If you've ever spent hours manually typing numbers from a PDF bank statement into a spreadsheet, you know the pain. It's tedious, slow, and one tiny mistake can throw everything off. A bank statement converter is the modern solution to this age-old problem. It’s a smart tool that uses AI and Optical Character Recognition (OCR) to automatically pull all the financial data from your PDFs and neatly organize it into an Excel or CSV file.

For accountants, business owners, and anyone managing finances, this isn't just a convenience—it's a game-changer. It frees you from the drudgery of manual data entry, saving a massive amount of time and, more importantly, eliminating the risk of human error.

Why We've Moved Past Manual Data Entry

Let's be honest: keying in transactions one by one from a PDF is a recipe for disaster. It’s not just boring; it’s a minefield of potential mistakes. A single misplaced decimal point or a transposed number can snowball into a major headache, forcing you to spend hours hunting down the error.

In today's fast-paced environment, we need speed and accuracy that manual methods just can't deliver. Your time is far too valuable to be wasted on such a repetitive task, whether you're a CPA juggling multiple client books, a small business owner prepping for tax time, or just trying to keep your personal budget on track.

The Smart Way to Handle Financial Data

This is where a dedicated bank statement converter comes in. These tools are built for one specific, crucial job: reading the often-complex layouts of bank statement PDFs and turning them into clean, usable data. It’s a lot more sophisticated than a simple copy-and-paste.

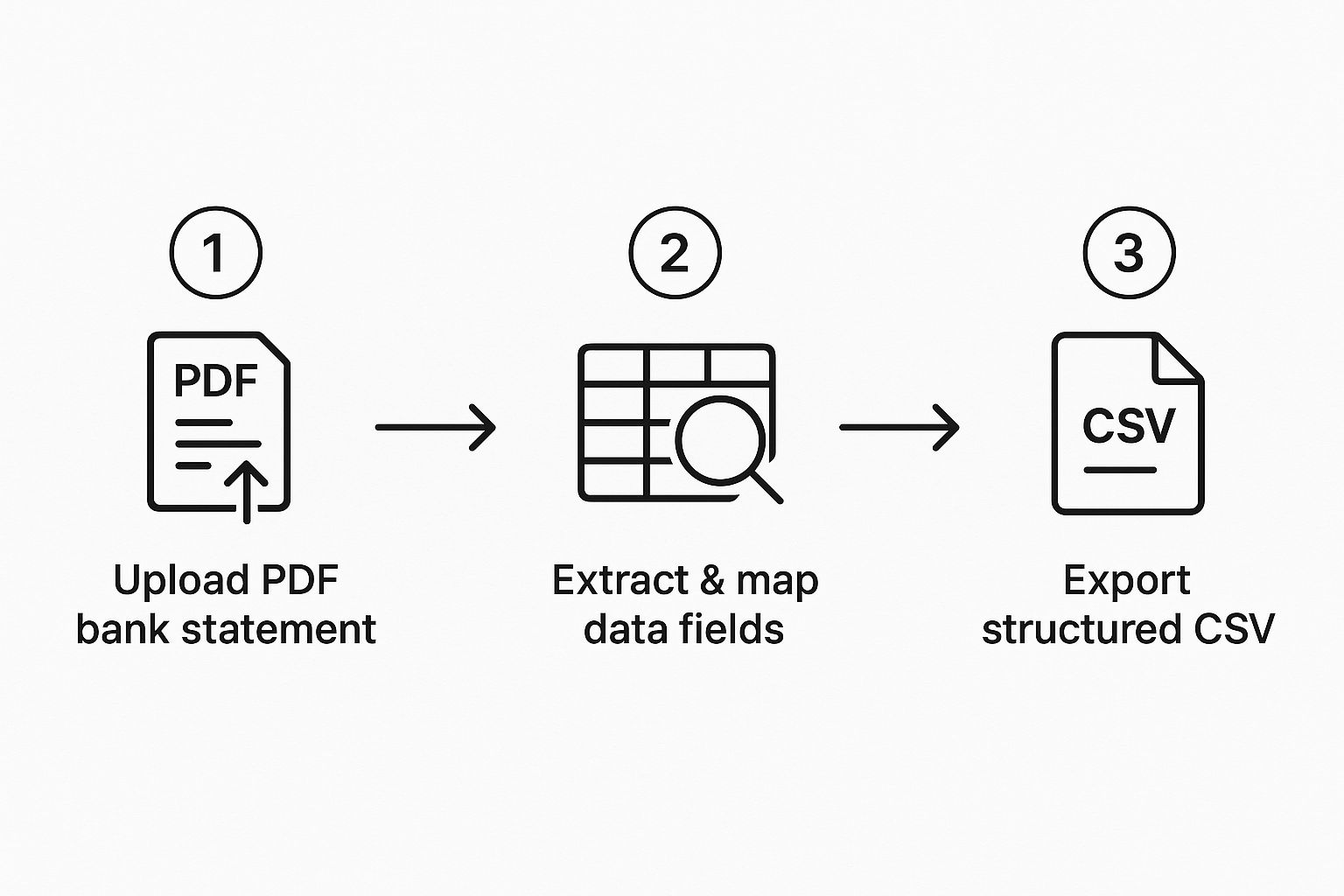

Here’s a quick look at how the technology works:

- Optical Character Recognition (OCR): The software first scans the document, intelligently recognizing all the text, numbers, and symbols on the page.

- AI-Powered Mapping: This is the really clever part. AI algorithms analyze the document's structure to identify what each column represents—Date, Description, Debits, Credits—even if the bank uses a unique or tricky format.

- Structured Output: Finally, it takes all that extracted information and organizes it into a perfectly structured spreadsheet, ready for you to analyze, import into accounting software, or use for budgeting.

This isn't just a niche tool; it represents a major shift in how we handle financial documents. The market for these tools is booming—the US bank statement analyzer API market, once valued around USD 250 million, is expected to hit an estimated USD 800 million by 2033. This surge shows just how much demand there is for turning messy documents into valuable data. You can dig deeper into this market trend in this comprehensive startup validation report.

To put it simply, the entire process boils down to a few straightforward steps. Here’s a quick overview of what that looks like.

Bank Statement Conversion At a Glance

| Phase | Action Required | Key Benefit |

|---|---|---|

| 1. Upload | Drag and drop your PDF bank statements into the converter. | Instantly starts the data extraction process without any setup. |

| 2. Verify | Quickly review the extracted data on-screen to ensure accuracy. | Gives you full control and confidence in the final data quality. |

| 3. Download | Export the clean data as a ready-to-use Excel or CSV file. | The data is immediately available for analysis or import. |

This simple workflow completely changes the game.

By automating data extraction, you’re not just saving time—you’re investing in data integrity. The accuracy gained from using a converter directly translates to more reliable financial reports and better business decisions.

Ultimately, a bank statement converter takes what was once a dreaded chore and turns it into a simple, three-step process: upload, verify, and download. It empowers you to get back to the work that actually matters—finding the insights hidden in your financial data, not just inputting it.

Prepping Your Bank Statements for a Perfect Conversion

The quality of your final spreadsheet all comes down to the quality of the document you start with. I've found that spending just a few minutes prepping the file beforehand can make a huge difference, saving you from a ton of manual cleanup later. It's really about setting the converter up for success.

First things first, always start with the best possible source file. If you can, grab the native digital PDF straight from your online banking portal. These are the gold standard because the text and data are already embedded, which means the converter can read everything perfectly.

Try to avoid using scanned paper statements whenever you can help it. While the OCR technology in modern converters is impressive, scans open the door to all sorts of little problems—things like a slightly skewed page, weird shadows, or just low-quality resolution. That’s how a "5" can get misread as an "S" or an "8" becomes a "B." Starting with a clean, digital-born PDF sidesteps these issues completely.

Handling Common Roadblocks

Even with perfect digital PDFs, you can still hit a couple of common snags. I see these all the time.

For instance, many banks add password protection to your statements for security. That's great for privacy, but a bank statement converter can't open a locked file. You'll need to remove the password before you can do anything else.

Here's an easy workaround: just open the protected statement on your computer, enter the password, and then use your system's "Print to PDF" function. This creates a brand new, identical PDF, but without the password. Simple.

Another thing that often trips people up is dealing with massive files, like a single PDF that has a full year of statements bundled together. Trying to upload and process a huge document like that can be really slow and sometimes cause the software to time out.

Pro Tip: Before you upload, take a minute to split large annual statements into separate monthly files. This makes the conversion much faster and, believe me, it makes organizing the data in Excel a whole lot easier afterward.

You can find plenty of free online PDF splitter tools that will break up the document for you in seconds. Taking these simple steps ensures the OCR engine can do its job without any hiccups, giving you a clean, accurate dataset ready for your analysis. A little bit of prep work upfront really does pay off.

From PDF Upload to Excel Download

Alright, you've got your PDF bank statements ready to go. Now comes the fun part—actually converting them. This is where a good converter tool really proves its worth, taking that locked-down PDF and turning it into a flexible Excel spreadsheet you can actually work with. The whole process is surprisingly simple, even if you've never done this before.

It all starts with a simple upload. Most tools just ask you to drag and drop your PDF file right into the application. The moment you do, the software's OCR (Optical Character Recognition) engine kicks into gear. It scans the entire document, hunting for all the key pieces of information: dates, descriptions, payments, and deposits. It’s a remarkably quick process.

As you can see, the goal is to get you from a messy document to clean, usable data with as few headaches as possible. But the real magic happens in the step between uploading and downloading.

Verify Your Extracted Data

After the initial scan, the software will show you a preview of the data it just pulled from your statement. Don't skip this part! This verification screen is the most important step in the entire process. It’s your opportunity to make sure everything is 100% accurate before you export it.

I've seen some incredibly accurate tools, but no OCR is perfect. A blurry scan or an unusual statement format can sometimes trip it up.

Here’s my personal checklist for what to look for on the verification screen:

- Classic OCR Goofs: Quickly scan the columns for silly mistakes. An "S" showing up instead of a "5" or an "l" where a "1" should be are common culprits. These are usually easy to spot and fix right on the screen.

- Columns Gone Wild: Sometimes the AI gets confused by a statement's layout and puts data in the wrong place. Double-check that your debits are actually in the debit column and credits haven't wandered off. Most converters let you re-assign an entire column with just a click.

- Split Transactions: Keep an eye out for single transactions that were split across two lines in the original PDF. The best converters catch and merge these automatically, but it's always smart to do a quick check and manually combine any that slipped through.

Taking a minute or two here ensures the raw data becomes a perfectly polished dataset. For a more detailed walkthrough, our complete guide on how to convert bank statements to Excel has a ton of extra tips for this stage.

The real goal here isn't just converting data; it's being confident in that data. A quick two-minute review means any financial report you build later will be completely reliable.

Once you’ve given everything a final once-over and you're happy that every number is in its right place, the last step is the easiest. Just find the "Download" or "Export" button, give it a click, and the software will hand you a pristine, perfectly formatted Excel or CSV file, ready for action.

Finding the Right Bank Statement Converter

With so many bank statement converters on the market, how do you pick the right one? The truth is, there's no single "best" tool. The best converter is the one that fits your specific needs, whether you're a freelancer tracking expenses or an accounting firm processing hundreds of statements a month.

These tools are a big deal in the fintech world, a market that's expected to hit a staggering USD 1.5 trillion by 2030. They solve a very real problem: getting transaction data out of locked PDFs and into a usable format. This is a massive headache for both banks and businesses.

Comparing Your Options

Let's break down the main types of converters you'll come across. Each is built for a different kind of user, and knowing the difference will save you a lot of time and frustration.

-

Free Online Tools: Perfect for a quick, one-off job. You just drag, drop, and download. The downside? They often have limits on file size or the number of pages, and the security of your financial data can be a real concern. They're convenient for non-sensitive, occasional use.

-

Dedicated Desktop Software: This is the sweet spot for most professionals—accountants, bookkeepers, and small business owners. You install it on your computer, so your sensitive financial data stays local and secure. These tools usually come with powerful features like batch processing and can handle tricky, non-standard statement layouts that free tools can't.

-

API Solutions: If you're building your own software or need to process a massive volume of statements automatically, an API is what you need. This is for enterprises and fintech companies that want to build conversion functionality directly into their own applications for seamless, high-volume workflows.

Making the right choice really boils down to your priorities. To help you weigh your options, I've put together a quick comparison.

Comparison of Bank Statement Converter Types

| Feature | Free Online Tools | Dedicated Software | API Solutions |

|---|---|---|---|

| Best For | Individuals, one-off tasks | Professionals, SMBs | Enterprises, developers |

| Security | Lower (uploads to servers) | High (data stays local) | Very High (custom integration) |

| Processing Volume | Low | Medium to High | Very High (automated) |

| Cost | Free (often with limits) | One-time fee or subscription | Subscription, usage-based |

| Key Advantage | Quick and easy, no install | Security, robust features | Full automation & integration |

Ultimately, the decision comes down to three key factors: accuracy, security, and volume. A free tool might seem great until it misreads a critical number. As you think about your workflow, this guide on how to convert bank statements to Excel can also help you pinpoint the features that will matter most to you.

Expert Tip: Before committing to any paid software, always run a few of your most complex or problematic bank statements through the trial version. It's the only way to know for sure if it can handle the specific formats your bank uses.

Taking It to the Next Level: Pro Tips and Fixes

Once you've got the hang of the basic conversion process, you're ready to tackle some of the more complex, real-world challenges. Honestly, this is where a good bank statement converter really starts to pay for itself. Let’s dive into a few techniques I use all the time to handle tricky statements and speed up my workflow.

Custom Templates for Oddball Statements

Ever get those bank statements from a small credit union or a niche financial institution with a completely bizarre layout? You know the ones—the columns are all over the place, and you have to manually fix them every single time. It's a huge pain.

Instead of reinventing the wheel with each new statement, you can create a custom parsing template. Think of it as teaching the software how to read that specific, weird format. You set the rules once, save the template, and from then on, any statement from that bank converts perfectly with a single click. It's a game-changer.

Batch Processing for High-Volume Work

Here's another massive time-saver, especially for accountants and bookkeepers drowning in documents at month-end. Don't waste your time converting PDFs one by one. If a client sends you 12 statements for the year, just drag the whole batch into the converter at once.

The software will chew through all of them simultaneously. What used to take a half-hour of tedious clicking can be done in a minute or two while you grab a coffee.

Solving Those Inevitable Conversion Headaches

No matter how smart the software is, you'll eventually run into a PDF that throws it for a loop. It happens. The key is knowing how to fix it quickly.

One of the most common hiccups? A statement where the table is a mess—no clear lines, weird spacing, or columns that bleed into each other. The OCR gets confused and spits out jumbled data.

The go-to fix for this is almost always to jump into the review interface and manually define the column boundaries. You literally draw lines on the document preview to show the software where each column begins and ends. This simple action trains the tool on that layout, ensuring every page gets extracted correctly.

Another classic problem is a statement with multiple currencies. For instance, if you have a credit card that mixes USD and CAD transactions, the software might get confused. Best practice here is to either process statements for each currency separately or, if your tool allows it, specify the currency before you export. This will save you a world of headaches when you try to import that data into your accounting system.

For a more detailed look at getting your data out in the right format, check out our guide on how to convert a PDF file to CSV format.

Got Questions? We've Got Answers

If you're new to using a bank statement converter, it's completely normal to have a few questions. I've been in this field for years, and I've heard them all. Let's tackle the most common concerns right now, especially around security and accuracy, so you can feel confident moving forward.

How Do I Know My Financial Data Is Safe?

This is usually the first question people ask, and for good reason. Your financial data is sensitive. The good news is that any reputable online converter takes this seriously, using end-to-end encryption the moment you upload your file.

Think of it this way: your data is never just sitting exposed. It's processed in a secure, temporary environment and then permanently deleted from the servers, usually within an hour. Always check for a clear data deletion policy on the service's website.

If you're someone who prefers your financial documents never leave your own computer—and many people are—then a dedicated desktop software tool is your best bet. This keeps everything on your local machine, giving you total control.

Just How Accurate Is the Conversion?

Accuracy is everything, and modern tools are incredibly precise—but there's a catch. The quality of your original PDF is the single biggest factor.

If you're starting with a crisp, digital PDF downloaded straight from your bank's website, you can expect an accuracy rate well over 99%. It just works.

However, if you're dealing with a scanned statement that's a bit blurry or skewed, the accuracy might dip a little. The best converters anticipate this. They'll flag any entries they're unsure about, letting you quickly double-check and fix them before you even think about exporting to Excel. It’s a huge time-saver.

Will This Actually Work With My Bank's Statements?

Most of the time, yes. Top-tier converters are built to be "bank-agnostic." They don't rely on a specific bank's template. Instead, smart AI has been trained on thousands of different statement layouts to recognize the core data—dates, descriptions, debits, credits—no matter how the columns are arranged.

That said, some banks have truly unique, complex formats. If you suspect your statements fall into that category, the smartest move is to take advantage of a free trial. Just run one statement through the process. It's a no-risk way to confirm it works perfectly for you. If you're curious about the technology behind this, you can learn more about how bank statement extraction software functions.

Ready to stop wasting time on manual data entry? Try Bank Statement Convert PDF today and transform your tedious PDF statements into organized Excel spreadsheets in minutes. Get started now!