Manual data entry is more than just a chore—it’s a high-risk activity that can quietly drain your resources. We all know how much time it burns, but the real cost often comes from those small, easy-to-miss mistakes that automated pdf to csv conversion is designed to catch.

Why Manual Data Entry Is Costing You More Than Time

Let's be real for a moment. You’ve got a stack of PDF bank statements or invoices, and you know what's coming: hours of soul-crushing transcription. It's a process loaded with hidden costs that go way beyond just the time you spend at the keyboard.

The biggest risk? Simple human error. I've seen it happen countless times. A single transposed number or a misplaced decimal in a bank statement can completely derail an entire month's reconciliation. For a small business owner staring down tax season, that tiny slip-up can lead to inaccurate filings, potential fines, and hours of frantic work trying to pinpoint the mistake.

The Real-World Impact of Inaccuracy

This isn't just theory; it’s the day-to-day reality for anyone who handles financial data. Picture yourself trying to build a sales forecast from dozens of separate PDF invoices. If you mistype a product code or a sales figure just once, your entire analysis is compromised. That can lead to bad inventory bets or a business strategy built on shaky ground.

The bottom line is that manual entry introduces a huge amount of risk into a process that absolutely demands precision. Your financial integrity shouldn’t depend on how much coffee you’ve had.

This is why we're seeing a massive shift in how businesses handle their documents. As operations go digital, the demand for accurate pdf to csv conversion has exploded, particularly in finance. A recent review of top PDF to CSV tools showed how specialized software can maintain table structures and correctly interpret financial data, saving companies hundreds of hours a year. This isn't a fad; it's a direct response to the high stakes of handling data by hand.

Making the switch from manual to automated isn't a luxury. It's a foundational step toward:

- Financial Accuracy: You can finally put an end to the typos and transposition errors that wreck your data.

- Operational Efficiency: This frees up your team to focus on meaningful analysis and strategy, not mindless data entry.

- Enhanced Scalability: As your document volume grows, your workload doesn't have to grow with it.

Ultimately, investing in a solid conversion process is an investment in your company's financial health and its ability to adapt and grow.

Picking the Best PDF to CSV Converter for Bank Statements

When it comes to converting bank statements, not just any tool will do the job. You can't grab a generic PDF converter and expect clean, usable data. I’ve seen it happen time and time again: you end up with a jumbled mess of numbers and text that takes more time to fix than if you’d typed it all out by hand.

The secret sauce is a tool with Optical Character Recognition (OCR) specifically designed for financial documents. This is the make-or-break feature.

Think of it this way: a standard OCR tool sees text, but a specialized one understands context. It knows that a bank statement has columns for dates, descriptions, deposits, and withdrawals, and it knows how to pull that data out accurately, even from a scanned, slightly crooked PDF.

Look for Smarter Features

A good converter goes beyond basic text recognition. One of the biggest headaches is when a tool can't figure out the table structure, mashing all the transaction details into a single, useless column. You need software that has intelligent layout recognition. It should be smart enough to identify the 'Date', 'Description', and 'Amount' columns, regardless of the bank's unique formatting.

Another must-have is the ability to handle multi-page statements seamlessly. A quality tool will process a 10-page PDF and give you one clean CSV file, not ten separate ones you have to merge manually. That alone is a massive time-saver.

Finally, let's talk about security. This is your financial data we're dealing with. It's incredibly sensitive.

A Note on Security: Never compromise on security. You're entrusting a piece of software with your private financial history. Always opt for a tool with a crystal-clear privacy policy and strong data protection measures. Your peace of mind is worth it.

Choosing a tool is an investment in your own efficiency. A freelancer managing their own books has different needs than a bookkeeper handling 20+ clients. Be realistic about your volume and the complexity of the statements you handle. If you're new to this, our guide on how to convert a PDF to a CSV file is a fantastic starting point.

When selecting a tool, it helps to separate the absolute must-haves from the nice-to-haves. I've put together a quick table to guide your decision.

Essential Features for a Bank Statement Converter

| Feature | Why It's Critical for Bank Statements | What to Look For |

|---|---|---|

| Financial OCR | Generic OCR fails on complex tables. This ensures dates, descriptions, and amounts are correctly identified and separated. | Mentions of "bank-grade," "financial document," or "table extraction" technology. |

| Multi-Page Processing | Avoids the manual work of converting each page and then merging multiple CSV files. A huge time-saver. | The ability to process entire PDF documents into a single, unified CSV output. |

| Data Security & Privacy | You're handling highly sensitive personal or client financial information. | A clear privacy policy, statements on data encryption, and options for offline processing. |

| Layout Recognition | Prevents data from different columns (like description and amount) from being merged into one cell. | Smart column detection that adapts to various bank statement layouts without manual setup. |

Ultimately, your choice of tool for PDF to CSV conversion will make or break your workflow. By prioritizing specialized OCR, smart layout detection, and robust security, you'll find a converter that genuinely makes your financial management easier and more accurate.

How to Prepare PDFs for Flawless Conversion

You know the old saying, "garbage in, garbage out"? It's the absolute golden rule of data conversion. A successful PDF to CSV conversion doesn't start when you upload the file; it starts with a little prep work that can save you a mountain of headaches later.

Think of it like a pre-flight checklist for your data. A few simple checks now will prevent a lot of cleanup and frustration down the road.

First things first, check for passwords. Many banks add password protection to their statements, which will completely block any converter from reading the file. You'll need to remove that lock before you can do anything else.

After that, take a look at where your PDF came from. Did you download it directly from your online banking portal, or is it a scan of a paper statement? The difference is huge.

Text-Based vs. Image-Based PDFs

A digitally generated PDF is what you want. The data inside is already text, so the software can simply read and pull it out. A scanned PDF, on the other hand, is basically just a picture of the document. This forces the software to use Optical Character Recognition (OCR) to guess what the text says, opening the door for all sorts of mistakes.

I once burned an entire afternoon trying to make sense of a batch of statements that were just low-quality smartphone photos. The OCR couldn't handle the blurry numbers, and the conversion failed every single time. It was a lesson learned the hard way.

A good scan is always better than a quick photo. If you absolutely have to scan a paper document, use a real scanner set to 300 DPI (dots per inch) or higher. This gives the software sharp, clear text to work with.

For the best results, just run through this quick mental checklist:

- Ditch the Password: Make sure the PDF isn't locked.

- Go Digital First: Always, always use the original digital PDF from your bank if you can get it.

- Scan Smart: If you must scan, use a flatbed scanner to avoid weird angles, shadows, and creases that confuse the software.

Following these simple rules drastically improves your odds of getting a clean, accurate conversion on the first try. For a deeper dive, check out our full guide on how to prepare PDFs for flawless conversion.

A Practical Walkthrough of the Conversion Process

Alright, theory is one thing, but let's roll up our sleeves and see how this works in practice. The best way to really get a feel for the pdf to csv conversion process is to walk through it with a real bank statement. I'll show you exactly how a dedicated tool can take a locked-down PDF and turn it into a flexible, usable spreadsheet.

So, you've just uploaded your bank statement. The first screen you see is the main interface—this is command central. It might look like there are a lot of buttons and options, but don't worry. We're just focused on getting to the preview and mapping stage, which is where the real work happens.

The Critical Data Mapping Stage

This is the most important step. You're basically teaching the software what each piece of information means. Most good converters do a pretty solid job of guessing what's what, but you always have the final say. You'll see a preview of the data the tool pulled from your statement, usually with dropdown menus above each column.

Your job here is to make sure every column is labeled correctly.

- The column with transaction dates? Make sure it's mapped as 'Date'.

- The one describing what you bought or where money came from? That's your 'Description'.

- And the money columns? They need to be correctly tagged as 'Debit' or 'Credit'. Simple.

Getting this mapping right is the key to the whole operation. It dictates how your final CSV will be structured, so a little attention here goes a long way.

Here's a pro-tip from experience: never just trust the automatic mapping. It's tempting, but taking 30 seconds to double-check that the 'Date' and 'Amount' columns are right can literally save you an hour of headaches trying to fix it all in Excel later.

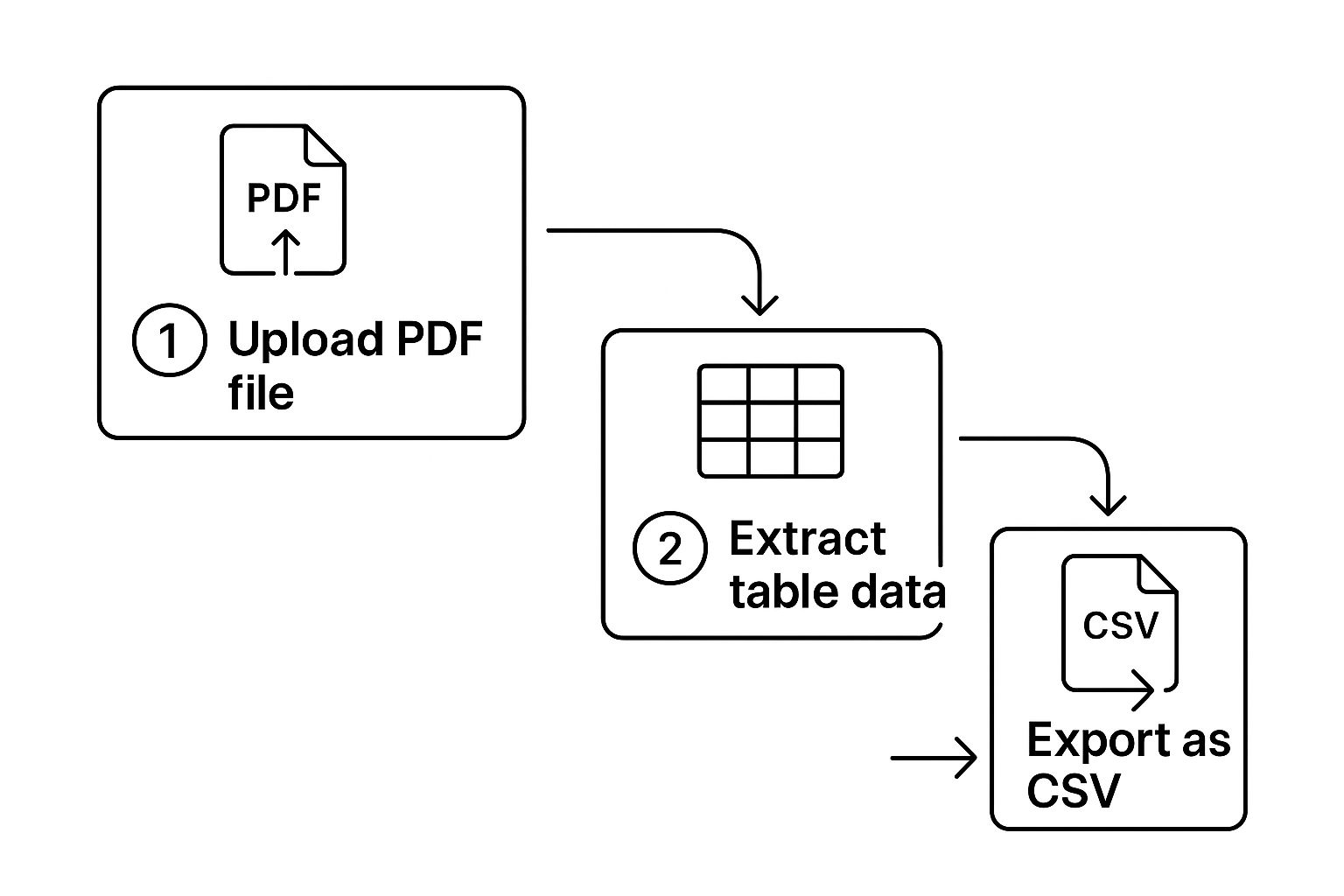

This quick visual breaks down the entire workflow into three simple stages.

As you can see, it's a direct path: upload your file, map the data, and export your structured CSV. No detours needed.

Finalizing Your Export Settings

Once you've given the column mapping your stamp of approval, you're almost done. But hold on—don't hit that download button just yet. The final settings are where you can really polish the output so it drops perfectly into your accounting software, whether that's QuickBooks or Xero.

Look for an option to set the date format, for instance. Does your accounting system use MM/DD/YYYY or DD/MM/YYYY? Matching that format now saves you from a world of frustrating import errors down the road.

After tweaking these final settings, you’re ready. You can now confidently export a clean, organized CSV file that’s ready for immediate use. Focusing on these key decision points, rather than just clicking buttons, makes the whole process faster and far more effective.

Navigating Common Conversion Hiccups

Even with a top-notch converter, turning a bank statement PDF into a clean CSV file can occasionally hit a snag. If you’ve ever opened a freshly converted file only to find a jumbled mess of data, you're definitely not alone. The good news? Most of these problems are common and surprisingly easy to fix.

One of the biggest culprits I see is when transaction descriptions and amounts get crammed into a single column. This is a classic issue with bank statements that use funky or non-standard table layouts. Instead of separate, usable columns for "Description" and "Amount," you end up with a single, useless cell that says something like "Coffee Shop Purchase $4.75." This pretty much defeats the whole point of converting the file in the first place.

Another frequent headache is misinterpreted data. The software might read a date as a plain piece of text instead of a proper date value, or it might get the format wrong—swapping DD/MM/YYYY for MM/DD/YYYY, for example. Currency symbols ($) or commas in large numbers (like 1,000.00) can also throw a wrench in the works when you try to import the file into Excel or Google Sheets.

Practical Fixes for Getting Clean Data

When you find yourself staring at merged columns, the first place you should look is your converter’s table editor or data mapping tools. Most dedicated software, including our own PDF to CSV converter, lets you manually fine-tune the column boundaries right in the preview screen. You can literally draw lines to show the software exactly where one column ends and the next begins.

Here’s a key takeaway: You are in control. Spending an extra minute to adjust the extraction settings before you export will always be faster than trying to untangle a messy CSV file later.

For those frustrating date and number formatting issues, dive into the export settings. A quality converter should give you granular control over the output. Look for options that let you:

- Standardize Date Formats: Choose the exact format your accounting software requires.

- Remove Currency Symbols: Strip out characters like '$' or '€' that can confuse spreadsheet programs.

- Handle Number Separators: Make sure numbers like "1,234.56" are recognized correctly.

This kind of detailed data extraction is becoming more widespread as the technology advances. In fact, industries from banking to healthcare now rely on sophisticated Vision Language Models (VLMs) to pull data accurately from all sorts of complex documents. This is a big reason why AI is improving data processing efficiency in major markets around the globe. By taking advantage of these built-in features, you can solve most conversion problems yourself and get a perfect, ready-to-use file every time.

Taking Your New Skills Beyond Bank Statements

Once you've gotten the hang of turning messy bank statements into clean, usable spreadsheets, you've actually picked up a seriously valuable data skill. This process isn't just a one-trick pony for financial docs. Knowing how to perform a solid PDF to CSV conversion is a versatile tool you can use in almost any professional field.

Start thinking beyond just your own finances. This skill opens up a ton of possibilities for solving data headaches across different business departments. When you understand the basic idea, you'll start spotting opportunities to digitize information everywhere.

Where Else Can You Apply This Skill?

Picture an HR department drowning in a mountain of paper expense reports. Instead of someone painstakingly typing every single line item into a spreadsheet, you could scan them as PDFs. Then, you could convert them all into one master CSV file, making it a breeze to track spending or spot claims that don't follow company policy.

Or think about a logistics team that gets buried in PDF invoices from suppliers every day. Each invoice is packed with useful data—product codes, quantities, prices, shipping dates. Turning those documents into a CSV means you can instantly upload the information into an inventory system. This helps forecast stock needs and analyze supplier costs without a single bit of manual data entry.

The core concept is simple: if the data is stuck in a table inside a PDF, you can set it free. This elevates you from being a data enterer to a data analyst, no matter what your job title is.

This is already common practice in the retail world. Retailers produce millions of PDF reports from their point-of-sale (POS) systems. Converting those sales and inventory reports to CSVs lets them update their databases in a flash, analyze sales trends, and make smarter stocking decisions. As you can see in this detailed retail analysis, automating this process is a huge win for efficiency.

Here are a few more real-world examples of where this comes in handy:

- Sales Teams: Pulling lead lists from PDF documents of conference attendees.

- Marketers: Turning campaign performance reports into raw data for a marketing dashboard.

- Researchers: Digitizing data tables from academic papers to perform a larger meta-analysis.

Every one of these situations uses the exact same PDF to CSV conversion workflow you've just learned for bank statements. It really shows just how valuable this skill can be.

Common Questions About PDF to CSV Conversion

As you start converting your own bank statements, you'll likely run into a few common questions. I've been there, and I’ve put together answers to the most frequent queries I hear from people just getting started. This should help you smooth out any bumps in the road.

What About Converting Scanned PDF Bank Statements?

Yes, you absolutely can, but this is where the right tool makes all the difference. To convert a scanned statement, your software needs a feature called Optical Character Recognition (OCR).

Think of OCR as a smart scanner that reads the image of your document, recognizes the letters and numbers, and figures out the table structure. Without it, a converter that only reads digital text won't see anything on a scanned page.

Just remember, the quality of your scan directly impacts the accuracy of the final CSV. A crisp, clear scan will give you clean data, while a blurry or crooked one is going to cause headaches.

Which CSV Format Works Best for QuickBooks or Xero?

Great question. Both QuickBooks and Xero are designed to import standard CSV files. The real key isn’t the file itself, but the column headers inside it.

Your accounting software has a specific template it's looking for. You need to make sure the columns in your exported CSV file—like ‘Date’, ‘Description’, ‘Debit’, and ‘Credit’—match what your software expects, word for word.

Pro Tip: Pay close attention to the date format. A simple mix-up between MM/DD/YYYY and DD/MM/YYYY is probably the #1 reason for import errors. Get this right in your converter settings from the start to avoid a lot of frustration.

How Do I Handle Statements with Multiple Pages?

Any good PDF to CSV converter worth its salt is built to handle multi-page documents without a fuss. It should be smart enough to recognize when a table of transactions spans across several pages and stitch it all together into one clean CSV file.

You shouldn't have to split the PDF yourself. When you're choosing a tool, check for features like 'multi-page processing' or 'batch conversion'. This is a sign the software is designed for real-world documents, not just single-page examples. If you want to see how a capable tool handles larger files, you can find options to convert PDF to CSV for free and test it out yourself.

Ready to stop wasting time on manual data entry? Bank Statement Convert PDF provides the specialized software you need to turn complex bank statements into clean, accurate Excel spreadsheets in minutes. Get started today at https://bankstatementconvertpdf.com.