Think of a bank statement as a financial story. It's a play-by-play of every dollar that came into and went out of your account over a certain period. Far from being just a jumble of numbers, it's a vital tool for budgeting, tracking your spending, catching fraud, or even getting a loan.

Why Your Bank Statement Is More Than Just a Piece of Paper

Let's face it, at first glance, a bank statement can look pretty intimidating. But this guide is here to help you crack the code, turning that confusing document into your secret weapon for financial clarity. Think of it as a monthly health check for your money—an essential record whether you get it in the mail or download it online.

The world has gone digital, and banking is no exception. A staggering 3.6 billion people now bank online, and in places like the UK, 87% of adults manage their money from a screen. This digital shift makes it more important than ever to be able to pull up your financial records and know exactly what you're looking at.

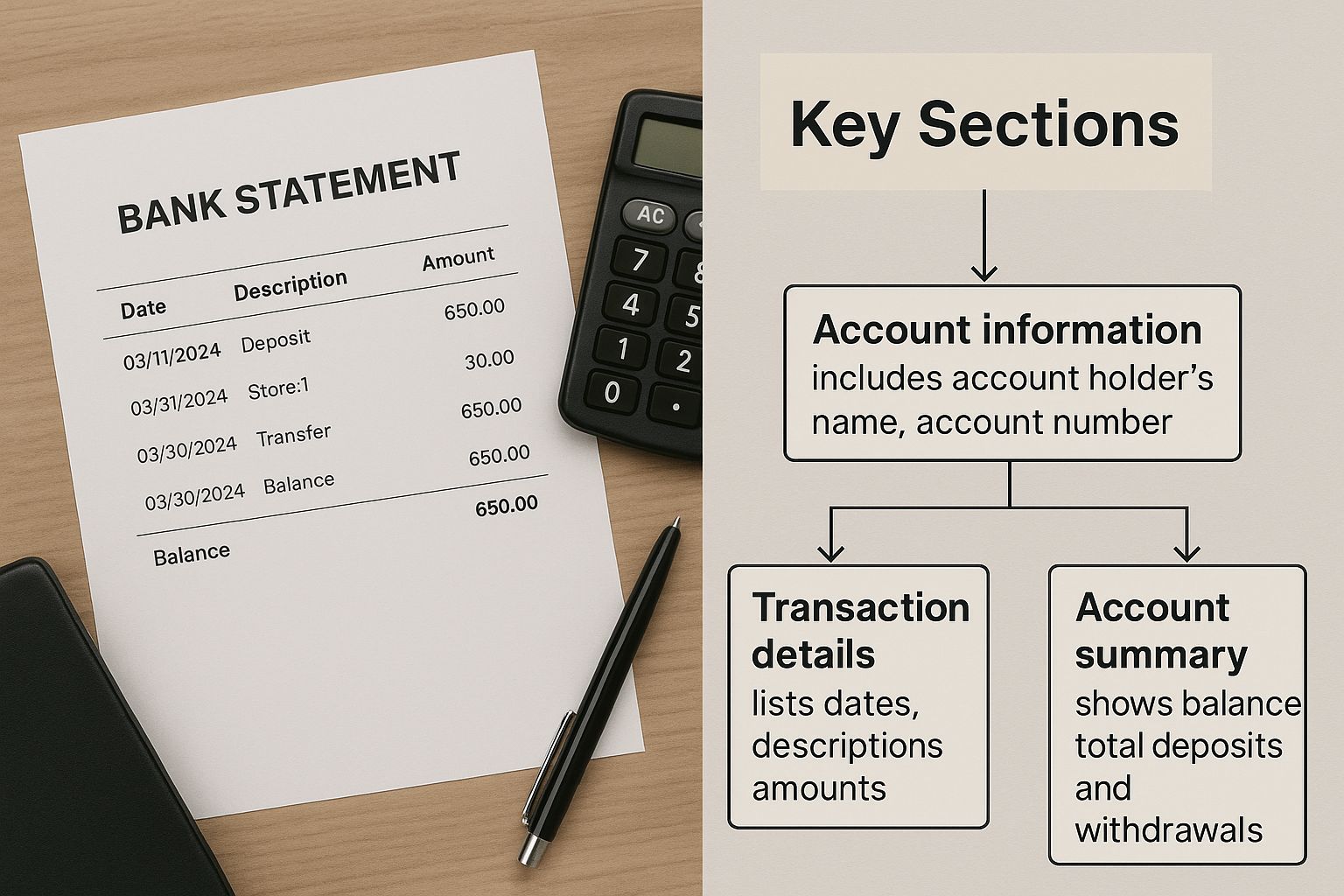

The Key Sections of a Bank Statement at a Glance

Here’s a quick summary of the most important parts of your statement and what they really mean for your money.

| Section Name | What It Tells You | Why It's Important |

|---|---|---|

| Account Holder Information | Your name, address, and account number. | Confirms the statement belongs to you and is the correct account. |

| Statement Period | The date range covered by the statement (e.g., April 1 – April 30). | Defines the specific timeframe for all listed transactions. |

| Account Summary | Opening balance, total deposits, total withdrawals, and closing balance. | Gives you a high-level overview of your account's activity for the month. |

| Transaction Details | A line-by-line list of every transaction, including date, description, and amount. | This is the core of the statement, showing exactly where your money went. |

| Bank Information | The bank's name, contact details, and customer service numbers. | Provides essential contact info if you spot an error or have questions. |

This table breaks down the essentials, but the real power comes from piecing them all together to see the full picture of your financial life.

Building a Strong Financial Foundation

Getting comfortable with your bank statement is one of the first and most important steps toward taking charge of your finances. When you know how to read it, you can:

- See Your Spending Habits: Finally figure out exactly where your money goes each month.

- Confirm Your Income: Make sure every paycheck and deposit landed correctly.

- Catch Fraud Early: Spot unauthorized charges or weird activity right away.

- Get Ready for Big Purchases: A solid history of statements is often a must-have for getting a mortgage or car loan.

Learning to master this one document is a game-changer. It allows you to move from guessing to knowing, making smarter financial decisions along the way. For a deeper dive, our guide on https://bankstatementconvertpdf.com/how-to-read-bank-statement/ breaks down every detail.

And if you’re a visual learner, looking at a Sample account statement from Stewart Accounting can help you see how these sections look in a real-world document. Once you cut through the jargon, you'll find that your statement isn't just a record—it's a roadmap.

Breaking Down the Header and Summary

Think of the top of your bank statement as its cover page or dashboard. It’s where you'll find all the big-picture information that puts the rest of the document into context. Before you get lost in the weeds of individual transactions, this is your starting point.

This is where you’ll see the essentials: your full name, mailing address, and account number. It might seem obvious, but getting these details right is incredibly important. A wrong address could mean you miss crucial mail from your bank, and confirming your account number ensures you're actually looking at your money.

This section sets the stage, giving you a quick, at-a-glance overview before you dive into the nitty-gritty of your spending.

Verifying Your Personal and Account Details

Your very first move should always be a quick sanity check of your personal info. Is your name spelled correctly? Is that your current address? Lenders, landlords, and anyone else who needs to verify your identity will be looking closely at this. A simple typo can create unnecessary headaches and delays.

It’s a small step, but it confirms the document is valid and belongs to you. After confirming your personal details, find the statement period. This tells you the exact date range the statement covers, like May 1, 2024 – May 31, 2024. Without this timeframe, the list of transactions that follows is just a jumble of meaningless numbers.

Understanding the Account Summary

Next up is the account summary, which is basically the highlight reel for your finances that month. It gives you a quick snapshot of your cash flow, boiling everything down to four key numbers.

- Beginning Balance: This is where your account stood financially on the first day of the statement period. It’s simply the carry-over amount from last month's statement.

- Total Deposits: This is the grand total of all the money that flowed into your account. Think paychecks, Venmo transfers from friends, or any other credits.

- Total Withdrawals: This lumps together all the money that went out. It covers everything from your morning coffee purchase to ATM cash-outs and automatic bill payments.

- Ending Balance: After all the additions and subtractions, this is what was left in your account on the last day of the period. This number will become the beginning balance for your next statement.

Think of your bank account like a bucket of water. The beginning balance is how much water was in it to start. Deposits are the rain you added, and withdrawals are the water you scooped out. The ending balance is what’s left in the bucket at the end of the day.

This summary tells a surprisingly powerful story in just a few lines. You can immediately see if you spent more than you earned, giving you a quick pulse check on your financial health before you even look at a single line item.

Decoding Your Transaction History

Think of the transaction history as the heart and soul of your bank statement. While the summary gives you the 30,000-foot view, this is where the real story of your financial life unfolds, one transaction at a time. It’s the detailed, line-by-line narrative of where your money comes from and where it goes.

At first glance, it can feel like you’re trying to crack a secret code. You’ll see a jumble of cryptic abbreviations like "POS DEBIT," "ACH CREDIT," and "ATM W/D" scattered everywhere. But each of those little codes represents a real-world action—from grabbing your morning coffee to your paycheck landing in your account. Learning to translate them is the key to truly understanding your finances.

This skill has become absolutely essential. We're all living in an increasingly digital financial world—in fact, global banking revenues from payments are growing at an estimated 9.5% annually. By 2027, transactions from digital wallets are expected to reach a staggering $25 trillion. This massive shift makes knowing how to read and verify an electronic bank statement sample a cornerstone of modern financial literacy. You can dive deeper into these global payments trends on Planergy.com.

Common Transaction Types and What They Mean

Let's break down the most common codes you'll bump into. Getting these down will make it a whole lot easier to categorize your spending and keep track of your income.

- POS DEBIT/PURCHASE: This means "Point of Sale." It’s the code for any time you use your debit card to buy something, whether you're at the grocery store or shopping online.

- ACH CREDIT/DEPOSIT: "Automated Clearing House" is a fancy way of saying an electronic deposit. This is how most people see their salary (direct deposit), government benefits, or even payments from services like PayPal.

- ATM W/D or WITHDRAWAL: A straightforward one—this just means you took cash out of an Automated Teller Machine. The bank usually includes the ATM's location in the description.

- TRF or TRANSFER: This signals money moved between your own accounts, like when you shift funds from your checking into your savings.

Each transaction line is like a sentence in your financial story. The date tells you when, the description tells you what, and the amount tells you how much.

Your transaction list is more than just a record; it's a powerful security tool. A quick, regular scan is one of the most effective ways to spot fraudulent charges and protect your account from unauthorized activity.

How to Spot and Investigate Suspicious Charges

Making a habit of scanning your transaction history turns a boring chore into a powerful security check. You’ll want to keep an eye out for anything that looks off, even tiny amounts. Fraudsters often test stolen card numbers with small "test" charges to see if they work before going on a shopping spree.

If you find a charge that doesn't look right, here’s what to do:

- Check the Details: Look closely at the date and merchant name. Keep in mind that sometimes the official business name on the statement is different from the store's name (for example, you might see the parent company's name instead).

- Jog Your Memory: Think back to what you were doing around that date. Could it be a recurring subscription you totally forgot about? It happens to the best of us.

- Contact Your Bank Immediately: If you're certain the charge is fraudulent, don't wait. Call your bank's customer service number right away. They can block any further charges, cancel your card, and start the dispute process to get your money back.

Understanding Fees and Interest

Your transaction history shows the flow of your money, but the fees and interest section reveals the cost of using the bank and how your money can grow. It’s where the hidden charges that can quietly eat away at your balance come to light. On the other hand, it’s also where you see your money working for you through interest.

Paying attention to these details is a game-changer because they hit your bottom line directly. A few bucks in fees might not feel like a big deal each month, but they can easily add up to hundreds of dollars over a year. At the same time, knowing how your interest is calculated helps you pick accounts that actually build your savings.

Common Bank Fees to Watch Out For

Banks have all sorts of fees for different services and situations. The first step to avoiding them is learning how to spot them on your bank statement sample. When you're scanning your statement, keep an eye out for various charges, including common transaction fees, to get a full picture of your banking costs.

Here are a few of the usual suspects you’ll likely encounter:

- Monthly Maintenance or Service Fee: This is a flat charge just for keeping the account open. A lot of banks will waive it if you meet certain conditions, like maintaining a minimum balance or setting up direct deposit.

- Overdraft Fee: This one stings. It's a hefty penalty for spending more money than you have in your account. These fees are often around $35 per transaction, so they can pile up fast.

- Out-of-Network ATM Fee: Using an ATM outside your bank's network can trigger a double-whammy—a fee from your bank and another one from the ATM owner.

- Insufficient Funds Fee (NSF): This is a close cousin to the overdraft fee. It happens when a payment you try to make (like a check) bounces because you don't have the funds. The payment gets rejected, but you still get stuck with a fee.

Think of checking the fees section as basic financial hygiene. It’s not just about seeing where your money went; it's about plugging unnecessary leaks and making sure your bank is helping, not hurting, your financial health.

How Interest Works on Your Statement

Now for the good part: interest. This is the money the bank pays you for keeping your cash in an interest-bearing account, like a high-yield savings account. It’s your money making more money, all on its own.

When you see an interest payment show up on your statement, it’s calculated using your account's Annual Percentage Yield (APY). The APY tells you the total interest you can expect to earn over a full year, and it includes the powerful effect of compounding.

Compounding is where the magic happens. It means you earn interest not just on your original deposit, but also on the interest that has already been added to your account. This is why starting to save early makes such a massive difference down the road. This whole process is a crucial piece of your financial puzzle, and tracking it properly is just good bookkeeping. If you want to dive deeper, you can learn more about what bank statement reconciliation is and see how it helps confirm every credit and debit.

By getting a handle on both sides of this coin—fees and interest—you can start making smarter moves to cut your costs and boost your account's growth.

Putting Your Bank Statement to Work

Think of your bank statement as more than just a piece of mail or a PDF download. It’s not just a backward-glance at what you've spent; it's a roadmap for your financial future. When you learn how to actively use the information it contains, you can take incredible control over your money, whether you're trying to build a personal budget, get a loan, or keep a business afloat.

The first step is turning that long list of transactions into a real-world budget. You get to play financial detective, following the trail of every dollar to see exactly where it ended up. By sorting each expense, you finally get a straight answer to that classic question, "Where is all my money going?"

From Transactions to a Real-World Budget

Building a budget straight from your bank statement is one of the most powerful things you can do for your finances because it’s based on hard facts, not wishful thinking.

Start by sorting your transactions into a few simple categories. And I mean all of them—every little coffee purchase or online order helps paint the full picture.

- Fixed Costs: These are the big, predictable bills that hit your account each month, like your rent or mortgage payment, car loan, and insurance premiums. They're the bedrock of your budget.

- Variable Necessities: This bucket is for the essentials that can change from month to month. Think groceries, gas for your car, and your electricity bill.

- Discretionary Spending: This is all the "fun stuff"—dining out, streaming subscriptions, shopping trips, and entertainment. It’s usually the first place you’ll find opportunities to save.

Once everything is categorized, you can instantly see what percentage of your income is going where. This clarity is a game-changer. It shines a light on spending leaks you never knew you had and helps you redirect that cash toward what really matters, like building savings or investing.

Your bank statement is the ultimate source of truth for your spending. It doesn't guess or estimate; it shows you the cold, hard data, holding you accountable to your actual habits.

Proving Your Financial Health for Major Goals

Your bank statements aren't just for you. They become critical documents for some of life's biggest milestones. When you apply for a mortgage, a car loan, or funding for a small business, lenders will pour over your statements to get a feel for your financial stability. Of course, before you can hand them over, you need to know how to get your bank statement directly from your bank in an official format.

Lenders are specifically looking for a few key things:

- Consistent Income: They want to see regular, predictable deposits that back up the income you claim on your application.

- Sufficient Funds: They'll check your balances to make sure you can comfortably handle your existing bills plus the new payment you're trying to take on.

- Responsible Account Management: Frequent overdrafts or non-sufficient funds (NSF) fees are huge red flags for lenders. They signal that you might be struggling to manage your cash flow.

Unlocking Deeper Insights with Spreadsheets

If you really want to level up your financial tracking, exporting your data is the way to go. Converting your bank statement PDF into a spreadsheet like Excel opens up a whole new world of analysis. You can sort, filter, and create charts to see your spending trends over several months or even years.

This makes it easy to spot patterns, track your progress toward goals, and even simplify tax prep by tagging all your deductible expenses throughout the year. A well-organized bank statement sample in a spreadsheet becomes your personal financial dashboard, making long-term planning more intuitive and effective than ever.

Common Questions About Bank Statements

Even after you get the hang of reading a bank statement sample, you'll probably still have a few practical questions. Let's walk through some of the most common ones I hear, so you can handle your financial documents like a pro and know exactly what to do when something comes up.

Probably the number one question is about how long to keep these things. It’s a great question, and the answer really depends on what you need them for.

How Long Should You Keep Bank Statements?

For day-to-day personal finance, holding onto your statements for one year is a pretty solid rule of thumb. That's long enough to review your spending habits and track your budget without drowning in paperwork.

But the moment taxes get involved, the timeline changes.

Tax experts will tell you to keep any statement that backs up your income or deductions for at least three years. The IRS can look back that far for a standard audit. To be on the safe side, though, many people just keep all tax-related documents for seven years. That covers you in nearly every scenario, like if the IRS claims you significantly underreported your income.

Here’s a quick guide:

- Personal Budgeting: One year is usually plenty.

- Tax Records: Keep them for at least three years, but seven is safer.

- Major Loans or Mortgages: Hold onto any related statements for the entire life of the loan.

Requesting Official Statements for Loans or Visas

Applying for a mortgage, a big loan, or even a travel visa? You'll almost certainly need to provide official bank statements. A quick printout from your online banking dashboard usually won't cut it. These organizations need to know the document is authentic, which means it needs to come directly from the bank.

Getting one is pretty straightforward. You can either:

- Pop into a local branch. A teller or banker can print official, stamped copies for you right there.

- Call your bank's customer service line. After verifying your identity, they can mail official copies to your address on file.

Pro tip: Before you request anything, ask the lender or agency for their specific requirements. Do they need a stamp? Do they need it sent directly to them? A quick question upfront can save you from major delays down the road.

What to Do If You Find an Error

It’s a heart-sinking moment: you’re scanning your statement and spot a charge you don't recognize. Don’t panic. There’s a process for this, and the most important thing is to act fast.

First, take a closer look. Sometimes a store's official business name is different from its public-facing one. If you’re positive it’s an error, call your bank's dispute department right away. Federal law gives you 60 days from the statement date to report a mistake.

Once you report it, the bank is required to investigate. They'll typically issue a provisional credit to your account for the disputed amount while they sort things out.

This is where having your transactions organized really helps. For instance, if you learn more about converting a bank statement to Excel, you can easily sort and flag transactions that look suspicious, making the whole process much less of a headache.

Managing and analyzing your financial records is crucial for personal and business success. At Bank Statement Convert PDF, we provide powerful tools to transform your PDF statements into organized, actionable Excel spreadsheets, saving you time and giving you a clearer view of your finances. Unlock deeper insights today by visiting https://bankstatementconvertpdf.com.