Let's get one thing straight: verifying a bank statement is your best defense against getting burned by financial fraud. This isn't just about ticking a box; it's about digging into financial documents to make sure they're real, accurate, and haven't been messed with.

Whether you're a lender underwriting a loan, a landlord screening tenants, or a business owner vetting a new partner, you have to master bank statement verification. It’s your shield against risk.

Why You Absolutely Can't Skip Bank Statement Verification

Whenever someone's financial health is part of the deal, trust is everything. But in an age where anyone can download editing software, that trust has to be verified. You simply can't take a PDF statement at face value anymore.

Imagine you're a mortgage lender. You approve a six-figure loan because an applicant hands you a slick-looking statement showing an inflated income. If that document was doctored—and you didn't catch it—the fallout could be disastrous.

In this guide, we'll walk through the two main ways to validate statements: the old-school manual check and the newer, more powerful automated tools. You'll learn exactly what to look for and understand why this one process is so incredibly important.

The Rising Wave of Document Fraud

The stakes are higher than ever. As we all move more of our lives online, the criminals are right there with us, finding new ways to exploit the system.

Financial fraud is exploding. We've seen fraudulent activity in financial services jump by 21% recently, driven by sophisticated scams like synthetic identity fraud and account takeovers. If you're not actively hunting for signs of a forgery, you're leaving the door wide open for trouble. To get a sense of just how common this is, check out the latest fraud trends from Veriff.

The new reality is pretty sobering: 1 in every 20 verification attempts is flagged as fake. That’s a 5% fraud rate, and it’s still climbing. Robust verification isn't just a good idea; it's essential.

It's More Than Just a Formality

Good verification isn't just about catching crooks—it's about making smarter business decisions.

For a property manager, it’s concrete proof that a potential tenant can actually afford the rent. For a lender, it provides a much deeper look into an applicant's creditworthiness than a simple credit score ever could. For a company, it’s a crucial part of due diligence before a merger or big partnership.

This process goes hand-in-hand with another key financial task. To see how verifying statements fits into your broader financial health checks, take a look at our guide on what is bank statement reconciliation.

Ultimately, a properly verified statement gives you a clear, unfiltered snapshot of someone's financial reality. It’s what allows you to move forward with confidence. By the time you finish this guide, you’ll have the know-how to spot the fakes and protect your bottom line.

How to Manually Spot a Fake Bank Statement

When you're handling bank statement verification without software, you have to put on your detective hat. The truth is, forged documents almost always have subtle tells—tiny imperfections that give away the fraud. But you have to know what you’re looking for.

This isn't about just confirming the final balance. It's about a forensic-level review of the entire document.

Let's start with the most obvious element: the bank's branding. A common shortcut for fraudsters is to grab a logo from a quick Google search. Look closely at it. Is it pixelated, blurry, or a slightly different color than you'd expect? Official bank statements use crisp, high-resolution branding.

Then, give the contact details a once-over. Does the address listed actually correspond to a real branch? Is the phone number the bank’s official customer service line? A quick online search can immediately confirm if these details are legitimate or completely fabricated.

Examine Document Formatting and Consistency

This is where the majority of forgeries unravel. Banks are creatures of habit; they use rigid, standardized templates for their statements. Any deviation, no matter how small, is a massive red flag.

Pay close attention to the typography. Do you see different fonts or font sizes, especially around key numbers like deposits or balances? That's a classic sign of digital alteration. A genuine statement is going to look completely uniform from top to bottom.

Alignment is another dead giveaway.

- Column Alignment: Check the columns for deposits, withdrawals, and the running balance. Are the decimal points perfectly lined up? Even a slight misalignment suggests someone has manually edited the numbers.

- Spacing: Look for odd gaps between lines, words, or individual characters. Squeezing in a fake transaction can easily mess up the document's natural spacing.

- Margins: Are the margins around the page perfectly even and consistent? Shoddy editing often results in skewed or uneven margins.

I’ve seen countless fakes get exposed by something as simple as a misaligned decimal point. Forgers often focus on the big numbers and forget that the tiny formatting details are what make a document look authentic.

Scrutinize Transactional Details

Beyond the visual layout, the transactions themselves need to tell a coherent story. This is where you move from just looking at the document to actually analyzing it. If you need a refresher on the basics, our guide on how to read a bank statement is a great place to start.

Begin by looking for logical patterns. If the statement shows a bi-weekly salary deposit, it should land on or around the same two dates each month. A paycheck that’s supposed to hit on the 15th but suddenly appears on a Sunday is extremely suspicious, since payroll transactions don't typically process on weekends.

Don't trust the math. Grab a calculator and manually recalculate a few lines of transactions. Add the deposits and subtract the withdrawals from the running balance. A forger who alters one number might forget—or be too lazy—to update the entire balance column that follows. It happens more often than you'd think.

Check Document Properties and Authenticity

Finally, if you have a digital PDF, the file itself can hold clues. A PDF you download directly from a bank's secure portal often has specific metadata and security features that a homemade fake won't.

Here's a simple test: try to select and copy text from the document. Can you easily highlight just one number in a transaction and change it? If so, you're likely looking at an unsecured or edited file. Many official bank PDFs are essentially "flattened" images of text or have security settings that prevent this kind of easy editing, making text selection clunky or impossible.

These small technical checks can be the final piece of the puzzle in your manual verification process.

To help you keep these points in mind, I've put together a quick checklist of the most common red flags I've seen over the years.

Manual Verification Red Flag Detector

This table breaks down exactly what to look for when you're manually inspecting a statement. Think of it as your go-to cheat sheet for spotting potential forgeries.

| Area to Inspect | What to Look For | Example of a Red Flag |

|---|---|---|

| Bank Logo & Branding | Pixelation, blurriness, incorrect colors, or use of an outdated logo. | A grainy or fuzzy bank logo at the top of the statement. |

| Document Formatting | Inconsistent fonts, font sizes, or character spacing. Misaligned numbers in columns. Uneven margins. | The font used for a large deposit amount is slightly different from all other text. |

| Transactional Logic | Transactions occurring on non-business days (like holidays/weekends). Unrealistic patterns or missing regular payments. | A direct deposit for a salary payment is dated on a Sunday. |

| Mathematical Accuracy | Incorrect calculations in the running balance column. | Subtracting a $100 withdrawal from the balance, but the new balance is only $50 less. |

| Text & Numbers | Oddly thick or thin characters, suggesting digital editing. Discoloration around specific numbers. | A "3" that looks bolder or slightly darker than the other numbers in the same line. |

| PDF Properties | The ability to easily select, copy, and edit individual numbers or text within the PDF file. | You can click on the final balance, and a text cursor appears, allowing you to type. |

Keep this checklist handy. By systematically reviewing each of these areas, you dramatically increase your chances of catching a doctored statement before it causes any problems.

Using Automated Verification Tools for Speed and Accuracy

While a sharp eye for detail is invaluable, manual checks just don't scale. When you're dealing with a high volume of documents, you'll inevitably hit a wall. This is where technology steps in, offering a level of speed and precision that’s simply impossible to achieve by hand. Modern tools for bank statement verification can turn this tedious chore into a highly efficient, data-driven operation.

These platforms do more than just scan a document; they perform a deep forensic analysis in mere seconds. At their core, they rely on a powerful combination of technologies to dissect and validate every last piece of information.

The process usually kicks off with Optical Character Recognition (OCR), a smart technology that reads and digitizes the text from a PDF or image file. But it doesn't stop there. The best systems can actually understand the context of the data, recognizing the difference between a transaction line, an account balance, or a bank's official letterhead. To see how this works in practice, you can explore some of the top-tier financial data extraction tools available today.

How AI Uncovers Sophisticated Fraud

After the data is pulled from the document, the real magic happens. Sophisticated algorithms and AI models get to work, hunting for tiny red flags that are often invisible to the human eye. These systems are trained on millions of documents—both genuine and fraudulent—which allows them to spot patterns that scream digital manipulation.

For example, an AI can detect things like:

- Metadata Anomalies: It dives into the file’s history, looking for signs of editing software, multiple save dates, or other digital fingerprints left behind during tampering.

- Pixel-Level Inconsistencies: The software can analyze the individual pixels around numbers and text, identifying subtle changes in color or compression that happen when a figure is altered.

- Font and Template Verification: It cross-references the statement's layout and typography against a massive database of authentic bank templates to spot any deviations from the real thing.

This incredible attention to detail makes for a much more robust verification process, catching fraud that even a seasoned professional might otherwise miss.

The Power of Direct Data Verification

The most advanced automated solutions don't just stop at analyzing the document. They can actually verify the information directly with the financial institution itself. Using secure, permission-based connections (often through APIs), these tools pull transactional data straight from the source.

This direct line to the bank is the ultimate confirmation. It completely sidesteps the risk of a doctored PDF because you're looking at the raw, unaltered financial data as it exists in the bank's own records.

By comparing the provided statement against real-time bank data, you create a closed-loop verification system. This not only confirms the document's authenticity but also verifies the current account status and balance, providing a complete and trustworthy financial picture.

This shift toward direct, digital verification is part of a much larger trend. The global market for digital identity verification is booming, with an estimated 86 billion checks expected to be performed annually. According to a recent Juniper Research analysis, this 15% yearly growth is being driven by increasing regulatory pressure to clamp down on fraud.

When you bring these tools into your workflow, you’re not just saving time. You're building a much stronger defense against increasingly complex financial fraud and ensuring your decisions are based on data you can truly trust.

Choosing Your Verification Method: Manual vs. Automated

Deciding between manual and automated bank statement verification isn't just a technical choice—it's a strategic one. The right approach really comes down to your specific needs, like how many statements you're handling, your tolerance for risk, and the resources you have on hand. There’s no single right answer for everyone.

Think about a small landlord screening one tenant application a month. For them, a careful manual review makes perfect sense. It’s cost-effective, and they can afford to take the time to go over every detail when the volume is low.

Now, picture a busy lender processing hundreds of loan applications every single day. That same manual process would be a huge bottleneck. It’s slow, leaves the door wide open for human error, and just can't keep up. In this scenario, automation isn't just a nice-to-have; it's essential for survival.

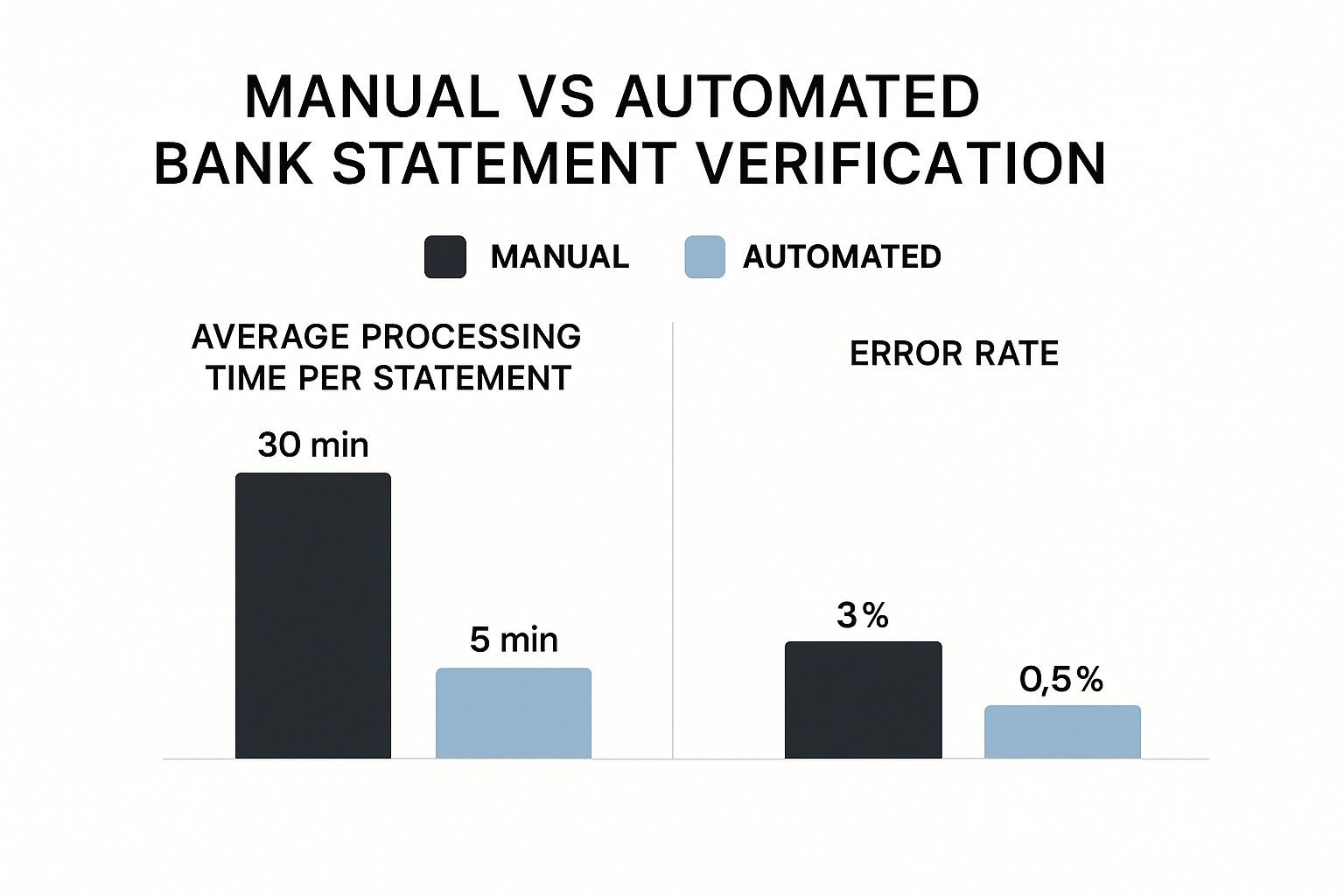

This image really drives home the difference, highlighting two of the most important metrics: how long it takes and how often mistakes are made.

As you can see, the numbers don't lie. Automated systems get the job done in a fraction of the time and with a much lower chance of error.

Key Factors for Your Decision

To make the right call, you need to weigh the pros and cons in a few areas that directly hit your bottom line and security posture. It's all about how each method stacks up in terms of accuracy, speed, and cost.

- Accuracy: Manual verification is only as good as the person doing it. A sharp analyst might catch a sophisticated fake, but fatigue is real, and it can cause even the best to miss a red flag. On the other hand, automated systems use machine precision to analyze thousands of data points, flagging tiny digital alterations that are completely invisible to the human eye.

- Speed: This one isn't even a fair fight. A manual review can easily take anywhere from 15 minutes to over an hour for a single document. An automated tool can give you a full fraud analysis and pull all the necessary data in less than a minute.

- Scalability: Trying to scale a manual process is a classic business headache. You have to hire more people, train them up, and manage them—all of which costs a lot of time and money. Automation lets you handle a nearly unlimited number of documents without having to grow your team.

At its core, the choice is between investing in technology upfront or dealing with the ongoing operational costs of labor. Automation might come with a subscription fee, but it often pays for itself by cutting down on labor hours and, more importantly, stopping expensive fraud in its tracks.

Verification Method Comparison: Manual vs. Automated

To make this even clearer, let's break down the key differences side-by-side. This table gives you a quick snapshot of how manual and automated methods perform across the metrics that matter most to any business.

| Feature | Manual Verification | Automated Verification |

|---|---|---|

| Speed | 15-60+ minutes per document | Under 60 seconds per document |

| Accuracy | Prone to human error and fatigue | High precision, detects digital alterations |

| Scalability | Difficult and costly to scale | Highly scalable with minimal overhead |

| Cost | High ongoing labor costs | Upfront/subscription cost, low per-unit cost |

| Fraud Detection | Dependent on analyst skill | Advanced, systematic detection |

| Consistency | Varies between individuals | Consistent and standardized results |

Ultimately, automated systems offer clear advantages in speed, accuracy, and scalability, making them a more reliable long-term solution for most businesses that handle any significant volume of statements.

Evaluating Risk and Cost

Don't underestimate the financial hit you can take from a single failed verification. For example, global losses from Authorised Push Payment (APP) fraud are projected to reach a jaw-dropping $331 billion. In these scams, confirming account authenticity is often the final defense against sending irreversible payments to criminals. For more on this, you can get the latest insights on combating APP fraud from LSEG.

In the end, your decision has to fit your business model. Are you in a high-risk industry where one fraudulent transaction could be devastating? Or are you operating on a smaller scale where an occasional manual check is enough? Answering that question will point you toward the verification method that makes the most sense for you.

Building a Secure and Compliant Verification Workflow

Picking your verification tools is just the beginning. A truly solid bank statement verification process is about building a structured, secure, and legally sound workflow around those tools. Let’s be clear: you’re handling highly sensitive financial data, and getting this wrong isn’t just bad practice—it’s a legal minefield.

An improvised process, with documents flying back and forth over insecure email and getting saved on random desktops, is simply asking for trouble. You need a rock-solid, standardized procedure that your entire team can follow every single time. This isn't just about consistency; it's about minimizing risk and creating an airtight audit trail for every verification you run.

Establishing Your Standard Operating Procedure

The bedrock of any dependable workflow is a clear Standard Operating Procedure, or SOP. Think of this document as the single source of truth for your verification process. It should cover everything from the moment you request a statement to its final archival or secure disposal. A good SOP leaves no room for guesswork.

Here’s what your SOP absolutely must outline:

- Secure Document Submission: First, define the only ways you’ll accept statements. A secure, encrypted client portal is the gold standard here. Make it a rule to steer clear of email attachments—they’re far too vulnerable.

- Initial Triage: Who lays the first eyes on a document? Decide if it’s an admin checking for completeness or if it goes straight to an underwriter. This needs to be defined.

- Verification Protocol: Get specific on the verification steps, whether they're manual, automated, or a mix. Crucially, specify which red flags automatically trigger a deeper dive.

- Data Handling and Storage: Pinpoint exactly how and where verified documents are stored. Access must be on a strict need-to-know basis, limited only to authorized staff.

If your team is dealing with a high volume of documents, specialized software isn't a luxury; it's a necessity. You can explore some great options in our guide on the https://bankstatementconvertpdf.com/best-document-management-software-for-accountants/ to help lock down this entire process.

Navigating Data Privacy and Compliance

Remember, you're not just looking at numbers on a page; you're the custodian of someone's private financial life. Regulations like GDPR in Europe or CCPA in California have teeth and come with strict rules about data management. Failing to comply can lead to staggering fines—we're talking up to 4% of your annual global turnover under GDPR.

A foundational principle of data privacy is "purpose limitation." In simple terms, this means you should only collect the data you absolutely need for the verification, and you shouldn't keep it any longer than necessary. Building automatic data purging policies into your workflow is a critical compliance move.

As you design your process, make sure it’s aligned with key industry regulations. Following stringent AML and KYC guidelines is non-negotiable for mitigating financial crime risks. This goes beyond just verifying an identity; it's about understanding the source of the funds themselves.

Creating an Escalation Pathway

So, what happens when a team member spots something that doesn't look right? Your workflow needs a clear, predefined path for escalating these red flags. The last thing you want is a junior analyst having to make the final call on a potentially fraudulent document.

A proper escalation protocol should define three key things:

- Who to Notify: A designated manager, a fraud specialist, or a senior underwriter.

- What Information to Provide: A concise summary of the suspicious findings.

- Next Steps: The specific actions the senior reviewer will take, whether it's requesting more documents or outright denying the application.

This kind of structured approach ensures that high-risk situations get the expert attention they demand. It not only protects your organization from potential losses but also reinforces the integrity of your entire verification system.

Answering Your Top Bank Statement Verification Questions

Even with a solid process in place, verifying bank statements can bring up some tricky questions. Let's walk through some of the most common ones I hear from clients to clear up any confusion and help you move forward.

Is It Really Okay to Ask Applicants for Their Bank Statements?

Absolutely. It’s completely legal and standard practice for lenders, landlords, and other businesses to request bank statements as part of their due diligence. You just need to have a legitimate reason and, most importantly, the applicant's clear consent.

The real catch isn't in the asking, but in the handling. Once you have that sensitive data, you're on the hook to protect it. Regulations like GDPR in Europe or CCPA in California have strict rules about how you collect, store, and eventually get rid of personal financial information. Be upfront about why you need the statements and make sure your security is airtight.

What Are the Dead Giveaways of a Fake Statement?

You don't have to be a forensic accountant to spot a fake. Many forgeries are surprisingly clumsy if you know what to look for.

Start with the basics:

- Mismatched Fonts: Look for different font styles or sizes, especially in the transaction lines.

- Poor Alignment: Numbers in the balance column that don't line up perfectly are a huge red flag.

- Fuzzy Logos: A blurry or pixelated bank logo often means it was copied and pasted.

My favorite trick is to check the dates. A payroll deposit that supposedly hit on a Sunday or a major national holiday? That’s almost always a sign of a fake. Forgers often forget that banks run on business days.

Here’s another simple check: try to highlight the text in the PDF. If you can easily select and edit individual numbers, the document has likely been tampered with. Authentic bank PDFs are usually locked down or are essentially a flat image, making that kind of editing impossible.

Can I Just Let the Software Handle Everything?

Automated tools are fantastic—they're fast, they're accurate, and they can spot digital alterations the human eye would miss. But relying on them 100% can be risky.

I always recommend a hybrid approach. Think of an automated tool like Bank Statement Convert PDF as your first line of defense. It can sift through dozens of statements in minutes, flagging the ones that look suspicious.

Then, your team can step in for a closer look at only the flagged documents. This way, you get the incredible efficiency of technology combined with the nuanced judgment of a human expert. It's the best way to catch sophisticated fraud without slowing down your entire operation.

Ready to stop guessing and start verifying with confidence? Bank Statement Convert PDF provides the tools you need to quickly and accurately extract data from financial documents, turning a tedious manual task into a streamlined, efficient process. Convert your first statement today.