A good CPA exam study guide isn't just a book or a course; it's your personal roadmap. It's the strategic plan that breaks down this massive undertaking into something you can actually manage, day by day. Think of it less as a list of topics and more as a battle plan that helps you study smarter, not just longer.

Building Your Foundational CPA Exam Strategy

Looking at the CPA exam for the first time feels a lot like staring up at a mountain you're about to climb. The sheer amount of material can be paralyzing. But a solid strategy is what gets you from the base to the summit. Before you even crack open a textbook, you need a clear, actionable plan. This starts with understanding the exam's layout, getting through the administrative hoops, and making a smart choice about where to begin.

Your First Move: Applying for the NTS

You can't schedule a single exam section until you have your Notice to Schedule (NTS). This is a non-negotiable first step, and you'll get it by applying through your state's board of accountancy via the NASBA website. You'll need to submit your official transcripts and pay the application fees.

The NASBA portal is basically your command center for this whole process—applications, scores, important updates, you name it.

My advice? Start this process early. It can take weeks, and the last thing you want is a paperwork delay killing your study momentum. Once that NTS is in your hands, the clock starts ticking; you typically have a six-month window to schedule and sit for the sections you've been approved for.

Understanding the Exam Landscape

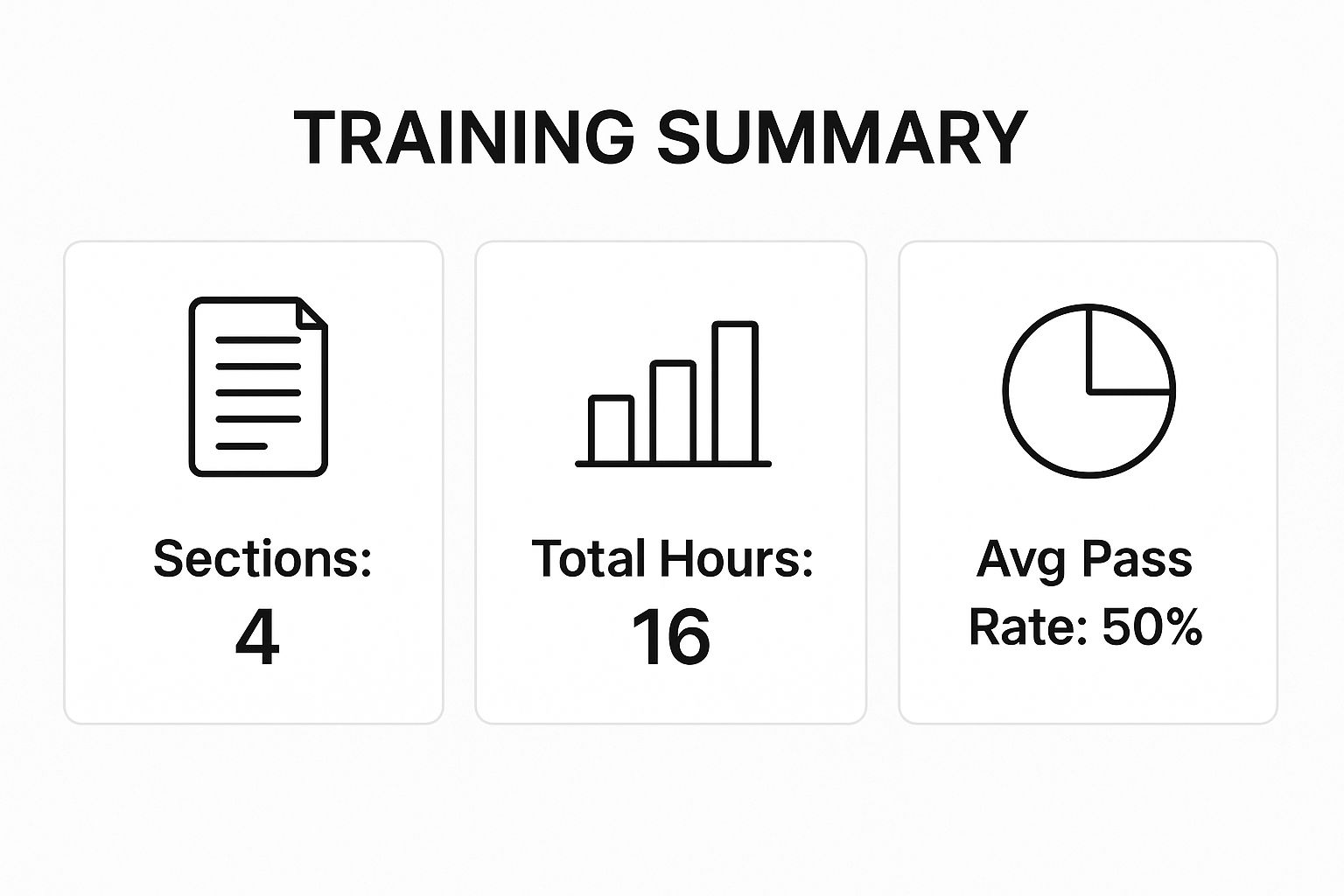

A winning study plan is built on knowing exactly what you're up against. The exam is structured with three core sections that everyone takes, plus one discipline section you get to choose based on your career interests.

Historically, CPA exam pass rates have hovered around 45-55%, which tells you right away that this isn't an exam you can cram for. The numbers really drive home the need for a disciplined approach.

Let's look at some recent data from 2024. The pass rates vary quite a bit by section:

- AUD: 44.3%

- FAR: 41.7%

- REG: 62%

- BAR (Discipline): 37.6%

- ISC (Discipline): 61.2%

- TCP (Discipline): 74.9%

Interestingly, the pass rate for BAR, which covers complex topics similar to those you'd encounter when you https://bankstatementconvertpdf.com/how-to-prepare-trial-balance/, jumped from 38% to 47% in the second quarter of 2024. This shows that candidates are getting the hang of the new exam structure as they adapt.

A huge part of your strategy needs to be setting clear, measurable goals. Just saying "I'll study FAR this week" is a recipe for falling behind. You need to be specific.

This is where the SMART goals framework comes in handy. Instead of a vague plan, a SMART goal sounds like this: "I will complete the governmental accounting module in my review course and score at least 80% on 100 practice multiple-choice questions by Sunday night." This creates real accountability and gives you a concrete way to measure your progress.

CPA Exam Section Study Order Strategy

One of the biggest questions candidates have is, "Which section should I take first?" There's no single right answer; it really depends on your background, confidence, and study style. Here’s a breakdown of the most common strategies to help you decide.

| Strategy | Description | Best For Candidates Who… |

|---|---|---|

| Eat the Frog First | Tackle Financial Accounting and Reporting (FAR) first, as it's widely considered the most comprehensive and difficult section. | …want to get the hardest part over with. A pass here can be a huge confidence booster. |

| Build Momentum | Start with a section you feel most comfortable with, like your chosen discipline or an area related to your work experience (e.g., REG for tax professionals). | …need an early win to build confidence and get into a rhythm. |

| The FAR-AUD Link | Take FAR and then Auditing and Attestation (AUD) back-to-back. The deep accounting knowledge from FAR provides a strong foundation for AUD concepts. | …are logical thinkers who want to build on conceptual knowledge from one section to the next. |

| The REG-TCP Link | Pair Regulation (REG) with the Tax Compliance and Planning (TCP) discipline. The significant content overlap makes studying for them consecutively very efficient. | …are planning a career in tax and want to maximize study efficiency. |

Ultimately, the best strategy is the one that keeps you motivated and moving forward. Take a look at your own strengths and weaknesses before locking in your exam order.

Designing a Study Calendar That Actually Works

Let's be honest: a generic, one-size-fits-all study plan is a recipe for disaster. I've seen too many promising candidates burn out because they tried to force a schedule that just didn't fit their life. Your CPA exam study guide needs to be built around you—your job, your family, and your natural energy rhythms.

Creating a calendar that sticks is less about filling in time slots and more about a bit of honest self-assessment.

First, figure out when you're at your best. Are you a morning person who can crush a tough chapter on government accounting before anyone else is awake? Or do you find your focus after dinner when the house is quiet? Working with your body clock instead of against it is the single biggest factor in long-term consistency.

Once you know your prime study windows, block out the non-negotiables. I'm talking about work, family commitments, sleep, and—this is crucial—actual downtime. The time that's left over is what you have to work with.

Budgeting Your Study Hours Realistically

A huge mistake I see people make is allocating the same amount of time to every exam section. They are not created equal. You have to budget your hours based on the sheer volume and difficulty of the material you're facing.

Getting this right from the start sets the foundation for your entire study plan. Based on years of seeing what works, here are the hour estimates I recommend as a starting point:

- FAR (Financial Accounting and Reporting): You need to plan for 120-150 hours. This section is an absolute beast, packed with a massive range of dense topics. Don't underestimate it.

- REG (Regulation): Budget around 100-120 hours. It's a tough mix of intricate tax rules and business law that demands a ton of memorization and application.

- AUD (Auditing and Attestation): Allocate 90-110 hours. The concepts can be tricky, but the total volume of material is more manageable than FAR or REG.

- Your Discipline (BAR, ISC, TCP): Aim for 90-100 hours here. These are specialized, deep dives, but they're not quite as broad as the Core sections.

Remember, these are just guidelines. If your day job is in tax, you might fly through REG but need to budget extra time for FAR. Be honest about your own background and adjust accordingly.

Structuring Your Week for Success

With your target hours in mind, it's time to map out your week. The goal is to create a rhythm that's structured enough to keep you on track but flexible enough for real life.

Let's look at how two different types of candidates might approach this.

Sample Weekly Calendar: The Full-Time Professional

If you're juggling a 9-to-5, every minute counts. You have to be strategic about using your mornings, evenings, and weekends.

| Day | Morning (6-7:30 AM) | Evening (6-8 PM) | Weekend (Sat/Sun) |

|---|---|---|---|

| Monday | 30 MCQs & Review | Lecture & Notes | N/A |

| Tuesday | 30 MCQs & Review | Task-Based Sims | N/A |

| Wednesday | 30 MCQs & Review | Lecture & Notes | N/A |

| Thursday | 30 MCQs & Review | Task-Based Sims | N/A |

| Friday | Review Weak Areas | OFF | N/A |

| Weekend | N/A | N/A | 4-6 hours per day (new material & cumulative review) |

This schedule gets you about 18-22 hours of quality study time per week without completely sacrificing your sanity. That Friday evening break is non-negotiable—it's your secret weapon against burnout.

Sample Weekly Calendar: The Full-Time Student

As a student, you have more flexibility, but that can be a double-edged sword. You absolutely must treat this like a full-time job to maintain momentum.

- Morning (9 AM – 12 PM): This is your class time. Get into new material, watch lectures, and take detailed notes while your mind is sharp.

- Afternoon (1 PM – 4 PM): Time to apply what you've learned. Hammer out Multiple-Choice Questions (MCQs) and wrestle with Task-Based Simulations (TBSs).

- Friday Afternoons: Make this your dedicated weekly review session. Go back over everything from the week. This kind of active recall is what cements the information in your brain for the long haul.

This approach gives you a solid 30 hours of focused study per week, which means you can get through the material much faster.

Think of your calendar as a living document, not something set in stone. If work throws a crazy project your way or a family event pops up, adjust. The real goal is consistency over the long run, not perfection on any given day.

Finally, put your key milestones on the calendar. I mean it—schedule them like appointments. Block out time for a full, timed mock exam two weeks before your real test, and another one a week out. These dress rehearsals are invaluable for building your stamina and nailing your time management.

Then, block off the final three to five days before exam day for nothing but an intensive final review. This is when you'll drill your weak areas and review high-level concepts until they're second nature.

Mastering the Core Exam Sections: AUD, FAR, and REG

Once you've got your schedule locked in, it's time to get into the weeds. Your success on the CPA exam really comes down to how you attack the content of the three Core sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Regulation (REG). Each one is its own unique beast and requires a specific game plan. A strategy that crushes AUD might completely backfire on the calculation-heavy world of REG.

This part of the guide is all about tactics. We're going to break down the high-risk topics, common stumbling blocks, and proven methods to master the material for each Core section.

Conquering the Beast Known as FAR

Financial Accounting and Reporting, or FAR, is legendary for one thing: the sheer volume of information. It covers a massive range, from the most basic journal entries all the way to the complexities of governmental and not-for-profit accounting. The real key to FAR isn't just memorizing rules; it’s about deeply understanding the "why" behind them.

For instance, when you're wading through governmental accounting, don't just try to cram fund types into your brain. Instead, focus on the different bases of accounting (modified accrual vs. full accrual) and figure out why a specific government fund uses one over the other. That conceptual understanding will be your lifeline when you're faced with a tricky task-based simulation.

A classic mistake is getting bogged down in niche topics. Pour your energy into the heavily tested areas like consolidations, leases, and revenue recognition. Mastering these will give you the biggest possible return on your study investment.

When you hit complex topics like consolidations and business combinations, grab a whiteboard or a piece of paper and draw it out. Visually mapping the parent-subsidiary relationship and seeing the flow of intercompany transactions can make abstract concepts click into place. You can get a solid primer by reading about https://bankstatementconvertpdf.com/what-is-a-financial-statement/ in our dedicated article, which is a great foundation before diving in.

Decoding the Nuances of AUD

Auditing and Attestation (AUD) is a different game entirely. It's less about calculation and much more about judgment and procedure. The entire exam really boils down to one central question: what would a reasonable auditor do in this situation? To pass, you have to start thinking like an auditor.

A major hurdle for many candidates is memorizing the different types of audit reports and opinions. Instead of trying to brute-force it with flashcards, create a simple decision tree.

- Start with a question: Are the financial statements materially misstated?

- If no: You're looking at an unmodified (clean) opinion.

- If yes: Ask yourself, is the misstatement pervasive?

- Yes and pervasive? That’s an adverse opinion.

- Yes but not pervasive? That’s a qualified opinion.

- If you can't get enough evidence (a scope limitation), it’s either a qualified opinion or a disclaimer of opinion.

This logical flow is so much easier to recall under pressure than a simple list. You can apply the same logic to understanding internal controls and risk assessment. Frame every concept within the context of the audit process, from planning and execution all the way through to the final report.

Navigating the Complexities of REG

Regulation (REG) is a two-for-one deal, combining the distinct fields of tax and business law. Success here demands a dual approach: meticulous memorization for law and precise application for tax. Tax basis calculations are a notoriously difficult area, but they become much more manageable when you break them down.

For any basis calculation—whether it’s for a partnership interest, S-corp stock, or a piece of property—use a consistent formula:

Initial Basis + Increases – Decreases = Ending Basis

The first thing you should do on exam day is write this formula at the top of your scratch paper. Then, for every single practice problem, consciously categorize each transaction into one of those three buckets. This systematic approach takes the guesswork out of it and helps prevent you from missing a critical step when the questions get complicated.

Interestingly, candidate performance isn't uniform. Data from the 2024 CPA Exam cycle reveals that younger candidates (under 22) had the highest pass rate at 64.1%, while those 30 or older saw a rate closer to 43.5%. This could be due to anything from different study habits to simply having more free time. There are even regional variations, with Nebraska leading the states at a 62.5% pass rate. This data just goes to show that personal circumstances can play a huge role in a candidate's journey, especially when tackling a tough section like REG.

Choosing Your Best Discipline Section: BAR, ISC, or TCP

With the CPA Evolution, you now face a big decision that helps shape your career path right from the start: picking your Discipline section. You've got three options—Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), or Tax Compliance and Planning (TCP). This isn't just about passing another part of the exam; it's your first real step toward specialization. Your choice should feel like a natural fit for where you see yourself in the accounting world.

Let's break down each of these sections so you can see exactly how the exam content connects to real-world jobs. We’ll look at what to expect from each, who they're really for, and how you can prepare effectively.

The Disciplines at a Glance

The first step is to get a clear picture of what you're signing up for. Think of the Disciplines as different branches on the same tree—none is harder than the other, they just lead to different places.

To help you get your bearings, here’s a quick overview of how the three Discipline sections compare.

CPA Discipline Section Overview

This table breaks down the three Discipline sections to help you connect the exam content to your career goals and current strengths.

| Discipline Section | Primary Focus | Ideal Career Path |

|---|---|---|

| BAR | Financial analysis, state/local government, technical accounting | Financial Analyst, Controller, FP&A roles |

| ISC | IT audit, data governance, cybersecurity, SOC engagements | IT Auditor, Systems Analyst, Risk Advisory |

| TCP | Complex tax for individuals, entities, and property transactions | Tax Accountant, Estate Planner, Tax Consultant |

While this gives you a high-level snapshot, the right choice ultimately comes down to what genuinely interests you and what you're already good at.

A Deep Dive into Each Discipline

Let’s really get into the weeds of each option. By the end of this, you should have a much clearer idea of which path feels like the right one for your skills and ambitions.

Business Analysis and Reporting (BAR)

Think of BAR as FAR on steroids. It’s tailor-made for anyone who actually enjoys the complex, technical side of financial accounting. If you're the person who gets excited about topics like lease accounting, business combinations, or revenue recognition, BAR is probably where you belong.

- Key Topics: You'll be tested heavily on state and local government accounting, deep technical accounting principles, and data analytics.

- Who Should Take It: This is the path for future financial reporting managers at public companies, controllers, or anyone aiming for a role in financial planning and analysis (FP&A). If you have a solid grasp of FAR, BAR will feel like the logical next step.

Pro Tip: Try to schedule your BAR exam shortly after you sit for FAR. The content overlap is huge, and you can ride that wave of knowledge to cut down on your total study time.

Information Systems and Controls (ISC)

For the more tech-minded candidates out there, ISC is your section. It sits at the intersection of accounting and technology, covering things like IT audits, data management, and cybersecurity. It’s a fantastic extension of the AUD Core section.

Success here isn't about crunching numbers; it's about understanding how information systems work and, more importantly, how to keep them secure. It’s very concept-heavy. One interesting quirk with ISC is the scoring: multiple-choice questions (MCQs) are worth 60% of your score, while task-based simulations (TBSs) make up the other 40%. This is a departure from the usual 50/50 split on the other exam sections.

- Key Topics: Expect to see a lot on SOC engagements, the data lifecycle, and various security frameworks.

- Who Should Take It: This is for the aspiring IT auditors, risk advisory consultants, and anyone whose future job involves managing financial systems and data. If the technology side of auditing clicked for you, you'll feel right at home in ISC.

Tax Compliance and Planning (TCP)

If you know for a fact that you want a career in tax, TCP is a no-brainer. This section takes everything you learned in the REG Core section and cranks up the complexity. You'll dive into specialized areas like personal financial planning and intricate entity tax compliance issues.

The TCP Discipline is all about application. You’ll be navigating messy, complex tax laws to solve detailed problems—the kind of stuff you’d actually do in a real tax job.

- Key Topics: Get ready for pass-through entity taxation, gift and estate tax rules, and advanced individual tax planning strategies.

- Who Should Take It: This is for anyone dead-set on working in public accounting tax, corporate tax departments, or wealth management. The synergy between REG and TCP is incredibly strong, making it a very efficient path for future tax pros.

Smart Study Techniques That Actually Work

Look, studying for the CPA exam is a marathon, not a sprint. The sheer amount of information you need to absorb is staggering, and trying to brute-force memorize it all will just lead to a serious case of burnout. It’s not about how many hours you put in; it's about making those hours count.

The entire game is built around a concept called active recall. This simply means pulling information out of your brain instead of just passively shoving it in. This is precisely why re-reading chapters or re-watching lectures over and over is one of the worst ways to study. You have to make your brain do the work.

Using Practice Questions to Your Advantage

Your best friends in this process are the multiple-choice questions (MCQs) and task-based simulations (TBSs). They are your primary tools for practicing active recall. The trick is to stop using them just to get a grade and start using them as diagnostic tools to find what you don't know.

Try doing rapid-fire sets of 20-30 MCQs on a single topic. After you finish a set, it's time for a deep-dive review.

- For the ones you got right: Take a second to confirm why you were right. Was it because you truly knew the concept, or did you just get lucky? Be honest with yourself.

- For the ones you got wrong: This is where the magic happens. Don’t just glance at the correct answer and move on. You need to dig into the explanation until you fully grasp the underlying concept you missed.

When you get to a TBS, don't just dive in and start clicking. Pause. Read the prompt carefully and look through all the exhibits. Ask yourself, "What are they really testing me on here?" Figuring out the core concept first helps you cut through the noise and focus on what’s actually being asked.

Think of practice questions this way: The goal isn't to get a perfect score. It's to find your blind spots. Every single question you get wrong now is a golden opportunity to fix a weakness before it costs you real points on exam day.

Choosing the Right CPA Review Course

A good CPA review course is a non-negotiable investment. It’s what provides the structure, the materials, and the thousands of practice questions you'll need. But with so many options out there, how do you pick one? It really boils down to your personal learning style and your budget.

Here’s what to think about when you're comparing them:

- Lectures: Are you someone who needs high-energy, engaging videos to stay focused, or do you prefer instructors who are straight and to the point?

- Question Bank: The course needs a massive, high-quality test bank that feels like the real exam. The questions should be tough and the format should be identical.

- Support: What happens when you get stuck? Does the course offer academic support from real people, mentoring, or at least an active community forum where you can get answers?

Don't just sign up for the biggest name. Almost all of them offer free trials. Use them. See which platform’s teaching style and software you can actually stand to look at for hundreds of hours.

And speaking of fundamentals, many candidates—especially those running their own side hustle or small business—find they need a quick refresher on the basics. If that's you, our guide on bookkeeping basics for small business can be a great place to get your feet back under you.

How to Stay Sane and Motivated

Let’s be real: the mental and physical grind of studying is intense. This journey tests your resilience just as much as your accounting knowledge. You have to go into this process with a plan to take care of yourself, or you won't make it to the finish line. Schedule your breaks, protect your sleep, and don't let your health take a backseat.

It's also worth remembering why you're doing this. The accounting world is facing a major talent shortage. There has been a 37% drop in CPA exam candidates since 2016 and an 18.2% decrease in accounting graduates. This means that earning your CPA license right now puts you in an incredibly valuable position. Your hard work will fill a critical need, giving you a serious advantage in the job market. You can read more about this professional shortage and its impact from the CPA Journal.

On days when you just don't feel like studying (and there will be plenty of them), having some external pressure can make all the difference. Seriously consider looking into the benefits of a study accountability partner. Having someone to report back to turns your private goal into a shared commitment, which makes you far more likely to follow through when your own motivation is running low.

Your CPA Exam Questions Answered

As you start laying out your study calendar, questions will inevitably bubble up. It's just part of the deal when you're taking on something this massive. But instead of letting those unknowns derail you, let's tackle the most common ones head-on. Getting a few clear answers now can save you a ton of stress later and keep you moving forward.

We'll dig into everything from realistic study hours and exam order to the real value of practice tests and, importantly, what to do if you hit a stumbling block.

How Long Should I Really Study for Each CPA Exam Section?

There’s no one-size-fits-all answer, but we have some solid data to work with. The key is to be brutally honest with yourself about the time you can commit.

Here’s a realistic breakdown of what to expect:

- FAR: You’ll want to block off 120-150 hours. This one is a beast, covering a huge amount of material. Underestimating it is probably the most common mistake candidates make.

- REG: Set aside 100-120 hours. You're dealing with a mix of tax and business law, which means a lot of memorization and a lot of application.

- AUD: Plan for 90-110 hours. The concepts can be tricky, but the total volume of information is more manageable than FAR or REG.

- Discipline (BAR, ISC, TCP): Aim for 90-100 hours for your chosen discipline. These sections go deep, but they don't go wide, focusing on one specialized area.

If you’re working a full-time job, spreading the hours for a single section over three or four months is a pretty sustainable pace. A full-time student, on the other hand, might knock one out in just six to eight weeks. It all comes down to building a schedule that fits your life, not the other way around.

What’s the Best Order to Take the CPA Exam Sections?

Honestly, the "best" order is the one that keeps you motivated and moving forward. This is more of a personal strategy decision than a right-or-wrong answer.

A few popular approaches have emerged over the years:

- Eat the Frog: Start with FAR. Get the biggest, most intimidating section out of the way first. Passing FAR is a massive confidence booster that can carry you through the rest of the exams.

- Build Momentum: Kick things off with a section you feel good about, maybe a Discipline that aligns with your day job. Scoring an early win can give you the psychological boost you need to tackle the tougher parts.

- Find the Overlap: Some people like to pair sections with related content. For example, taking AUD right after FAR makes a lot of sense, since your financial accounting knowledge will be fresh. Likewise, scheduling TCP right after REG can make for a smooth transition.

Think about your own personality. If you're someone who likes to run at the biggest challenge first, go for FAR. If you need a victory to get the engine started, begin with something more in your comfort zone.

What Happens If I Fail a Section?

First off, take a breath. It happens. Failing a section is incredibly common—way more than you think—and it says nothing about your ability to become a CPA. It’s a setback, not a career-ender.

Once you’ve shaken off the initial frustration, it's time to get strategic. Your score report is your best friend here; it literally shows you which areas you were weak in. Don't just reset and study everything again. Zero in on the topics where you scored lowest and hammer those hard. You can reschedule as soon as you get your new Notice to Schedule (NTS).

The most important thing to remember is that a failing score doesn't wipe out your other passes. Your passing scores are safe within a 30-month rolling window, which gives you plenty of time to regroup and get it done.

Once you've passed all four sections, your learning journey continues. To keep your license active, you'll need to complete ongoing professional education. We've put together a helpful resource explaining the details in our guide to CPA continuing education requirements.

Are Practice Exams Really That Important?

Yes. Full stop. They are absolutely essential. Mock exams are about so much more than just testing what you know; they are a core part of your training.

Think of it like a dress rehearsal. A full, four-hour mock exam simulates the real test-day pressure cooker. It builds your mental stamina, forces you to practice time management across both MCQs and TBSs, and gets you comfortable navigating the actual exam software.

If you do nothing else in your final review, make sure you complete at least two full-length, timed mock exams. It's one of the single best things you can do to prepare for what it feels like on game day.

At Bank Statement Convert PDF, we get the meticulous nature of the accounting world. Our tools are built to make your life easier by quickly converting bank statement PDFs into Excel. This frees you up to spend more time on what really matters—like high-level analysis and, of course, studying for your next exam. See how our software can streamline your workflow today.