The thought of a financial audit can be intimidating. I get it. But at its core, it’s really just a methodical look at your company's books. The whole point is to verify accuracy, assess risk, and confirm compliance with all the relevant legal standards.

Think of it less as a chore and more as a financial health check for your business. It's a chance to get an objective, independent pair of eyes on your financial statements.

Understanding the Financial Audit Process

An audit lends credibility to your numbers, giving stakeholders—investors, lenders, regulators—confidence that your financial picture is fair and accurate. It’s not just about ticking and tying numbers; it's an evaluation of the systems and controls that generate that financial data in the first place.

So, what are we trying to accomplish?

- Verify Financial Accuracy: Do the numbers on your balance sheet, income statement, and cash flow statement match the underlying transactions? Is there proof?

- Assess Internal Controls: How strong are your internal processes? Are there checks and balances in place to catch errors or prevent fraud?

- Ensure Regulatory Compliance: Are you following all the applicable laws and accounting standards, like GAAP or IFRS?

The Value Beyond Compliance

Sure, audits are often a regulatory requirement. But their real value comes from the insights they provide. I've seen audits uncover operational bottlenecks, flag hidden financial risks, and lead to concrete recommendations that strengthen a company's entire financial foundation. It's a powerful tool for improvement.

The growing demand for these services tells the story. With regulations getting tighter and fraud risks on the rise, the global financial auditing market is expanding, especially in banking and financial services. You can dig into more data on financial services compliance trends to see how this is playing out.

A well-executed audit turns a simple compliance task into a strategic asset. It gives you an unbiased view of your financial health, which is critical for making smarter business decisions and building trust.

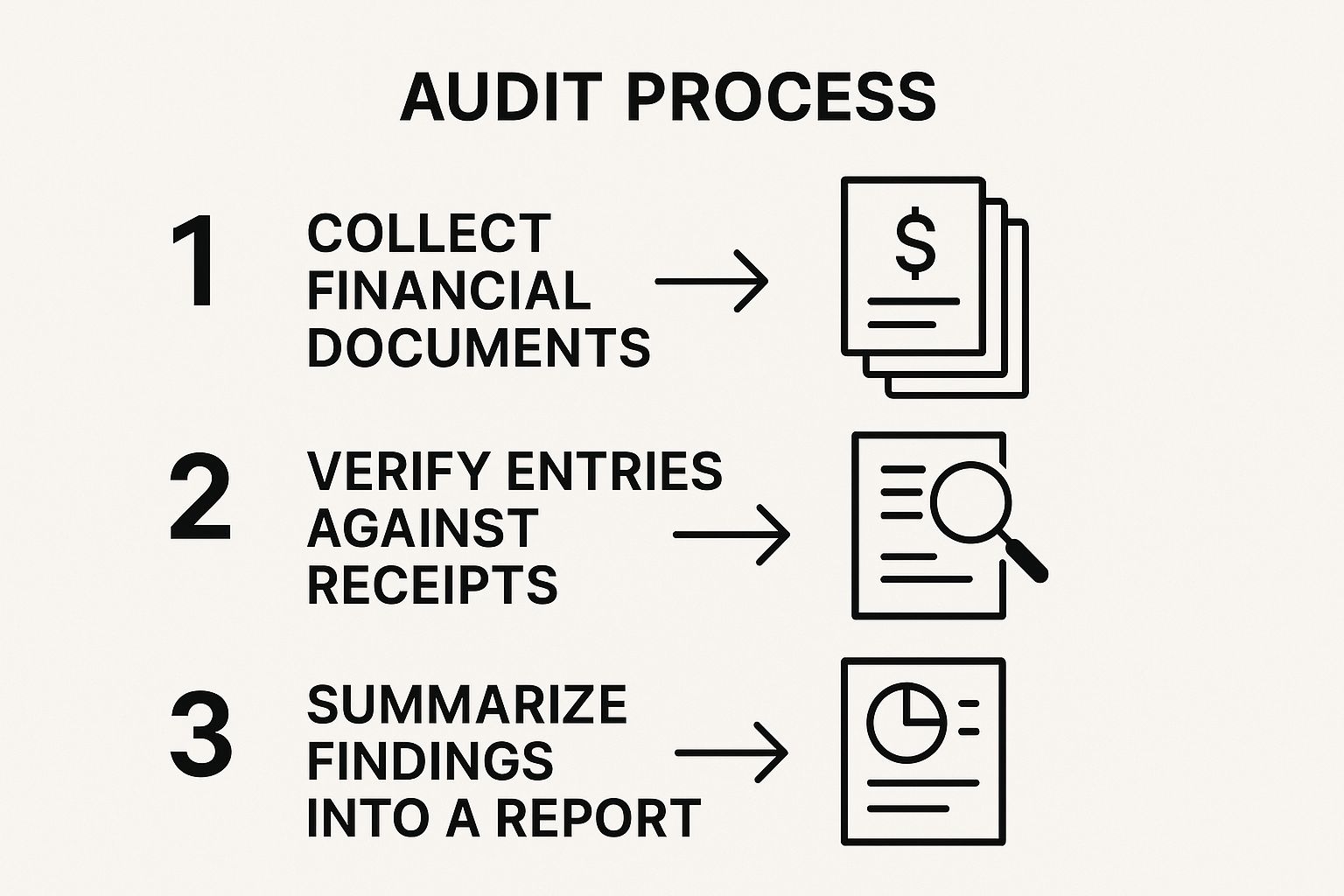

This simplified infographic gives you a bird's-eye view of the audit flow.

As you can see, it's a logical sequence. You start with gathering all the necessary information and move step-by-step toward a final report that helps guide what you do next.

To break it down even further, the entire audit process can be organized into four distinct phases. Each stage has its own clear purpose and set of activities that build on the last.

Key Phases of a Financial Records Audit

| Audit Phase | Primary Objective | Key Activities |

|---|---|---|

| 1. Planning | To establish the overall audit strategy and scope. | Risk assessment, defining audit objectives, creating an audit plan, assigning team roles. |

| 2. Fieldwork | To gather and analyze evidence supporting financial statements. | Testing internal controls, conducting substantive testing, interviewing personnel, reviewing documents. |

| 3. Reporting | To communicate the audit findings and opinion. | Drafting the audit report, discussing findings with management, issuing the final opinion. |

| 4. Follow-Up | To ensure corrective actions are implemented. | Monitoring management's response, verifying that recommendations have been addressed. |

Understanding these phases helps demystify the process. It's not a chaotic scramble for documents but a structured examination designed to produce reliable results.

Preparing for a Successful Financial Audit

I've seen it time and time again: the difference between a smooth audit and a painful one boils down to preparation. Rushing in with disorganized files and a panicked team is a surefire way to create friction, cause delays, and even invite unfavorable findings. The real work begins long before the auditor arrives.

Your first move is to clearly define the audit’s scope. What time period are they examining? Is this a full organizational review, or are they just focused on a specific department or grant? Nailing this down from the start prevents scope creep and keeps everyone on the same page.

Once you know the playing field, you need to assemble your internal team. This is absolutely not a one-person job. The person leading the audit will need backup from people who can provide context and pull documents at a moment's notice.

Assembling Your Internal Audit Team

You’ll want to build a small, core team with representatives who own different pieces of the financial puzzle. This way, when an auditor asks a detailed question about payroll or a specific vendor contract, you have an expert ready to give a clear, accurate answer.

A solid team usually includes:

- Finance Lead: Your CFO or Controller will typically oversee the entire process.

- Accounts Payable/Receivable Specialist: This is your go-to for anything related to invoices, payments, and collections.

- Payroll Administrator: They'll have all the documentation for employee compensation, benefits, and tax withholdings.

- Operations Manager: This person can provide critical context on big contracts, inventory, and operational spending.

With your team ready, it's time to start gathering the documents. Auditors will send over a request list, and having everything organized and ready to go shows competence and transparency right out of the gate.

An organized set of records does more than just make the auditor's job easier. It sends a powerful message about your company's commitment to good governance and financial integrity.

Key Documents to Prepare

Your goal here is to create a single source of truth for data. Centralizing your documents in one place avoids version control nightmares and ensures everyone is looking at the same information.

Auditors will ask for a lot, but you can get a head start by compiling the essentials:

- General Ledger: This is the complete record of every single financial transaction during the audit period.

- Bank and Credit Card Statements: You'll need every statement for every account, plus the corresponding reconciliations.

- Major Contracts and Agreements: Think leases, loan agreements, and any significant contracts with vendors or clients.

- Invoices and Receipts: Have supporting documentation handy for major sales and expenses.

Once you’ve gathered all this, the next crucial step is to reconcile every account. Make sure your internal books perfectly match up with external statements from banks and vendors. If you need a refresher, our guide on account reconciliation best practices provides a great walkthrough. This kind of meticulous prep work makes the actual audit process much smoother and builds instant credibility with your auditor.

Executing the Audit Fieldwork

Alright, the planning is done. Now comes the part everyone thinks of when they hear "audit": the fieldwork. This is where the rubber meets the road, where my team and I roll up our sleeves and really get into the nitty-gritty of your financial records. Our mission is to verify the numbers you’ve put on your financial statements. Think of us as investigators, gathering the evidence to support your financial story.

This isn't just a random spot-check. Every test we run is a direct result of the risk assessment we did earlier. If we flagged inventory as a potential high-risk area, you can bet we'll be spending a lot of time there during the fieldwork.

A classic example is when we test sales. We’ll pull a sample of transactions right from your general ledger and trace them all the way back to the beginning. We're talking about matching them to customer purchase orders, shipping documents, and the final sales invoice. It’s the only way to be sure a sale is real and recorded properly.

Testing Transactions and Internal Controls

The heart of fieldwork is something we call substantive testing. This is where we directly test the details behind your account balances and transactions. We're not just taking your numbers at face value; we need to see the proof. That means we'll be asking for everything from vendor invoices and employee expense reports to detailed payroll registers.

So, what are we actually looking for? It boils down to a few key things:

- Validity: Did this transaction really happen? Is there a legitimate invoice from a real company?

- Accuracy: Was the amount recorded correctly, down to the last cent?

- Completeness: Is anything missing? Are all the sales you made this year actually in the books?

- Cutoff: Were transactions posted in the right period? A sale from December 31st can't be pushed into the new year.

At the same time, we're sizing up your internal controls. We might do a "walk-through" where we follow a single purchase from the moment the invoice arrives until the check is cut. This shows us if the systems you have in place to prevent mistakes or fraud are actually working in the real world.

The point of all this isn't just to catch you out. It's to gain real confidence that your financial statements are solid and free from major errors. Being open and working with us during this phase makes a world of difference and smooths out the entire process.

Shifting Priorities in Modern Audits

The audit game is changing. While checking the core financials is still job number one, the scope of what we look at is getting much broader. We have to consider a whole new world of business risks.

A fascinating 2025 global internal audit survey shows that risks tied to digital disruption and AI are rocketing up the priority list, expected to become the second-highest concern for auditors. This is a huge shift. It shows that our role is moving beyond simple number-crunching into a more holistic advisory role. You can dive into the full report to see these shifting audit priorities and global risks.

What does this mean for you? During fieldwork, don't be surprised if we ask about your data security protocols or your plans for adopting new tech, right after we discuss your revenue recognition policy.

Of course, some things never change. The process of bank statement verification remains a cornerstone of any audit. It’s our independent, third-party confirmation of your cash position, and it’s critical for reconciling what your books say with what the bank says.

Fieldwork can feel intense. We’ll be in your space, asking for documents, and digging into the details. But if you understand why we’re doing it, the whole experience changes. It becomes less of an interrogation and more of a collaborative effort to strengthen the financial health of your company.

Leaning on Tech to Make Sense of the Numbers

The days of green-bar paper, ticking and tying, and mountains of binders are fading fast. Frankly, manual auditing is becoming a relic. We're now in an era where technology allows for a much deeper, smarter look into financial records. Instead of just spot-checking a few transactions, we can analyze the entire dataset, uncovering patterns and red flags that the human eye would almost certainly miss.

This isn't just about getting the audit done faster; it's about doing a better audit. When you can sift through a whole year's worth of expense reports in the time it takes to grab a coffee, you've suddenly freed yourself up to focus on the truly tricky stuff—the high-risk accounts and areas that require real judgment. This is where a few simple but powerful tools can make all the difference.

Turning Flat Files into Actionable Data

One of the first and most practical steps you can take is to get your data out of static PDFs and into a format you can actually work with, like Excel. Think about all those bank statements, vendor invoices, or credit card reports saved as PDFs. Typing all that information into a spreadsheet by hand is a surefire way to waste hours and, almost inevitably, introduce errors.

This is where good financial data extraction tools come in. They automate the grunt work, pulling the data from a locked-down PDF and neatly organizing it into a spreadsheet you can sort, filter, and analyze. That one simple move opens the door to running proper reconciliations, spotting trends, and flagging outliers in minutes.

Many of the online tools for this are incredibly straightforward.

You basically just upload the file, and it spits back an Excel document, ready for you to dig in.

Once your data is liberated in Excel, the real analysis can begin. You can start using pivot tables to summarize thousands of lines of data, run VLOOKUPs to cross-reference transactions against other records, and apply conditional formatting to make anomalies pop right off the screen.

How This Plays Out in the Real World

Let's walk through a common scenario: auditing a year's worth of employee expense reports. Imagine hundreds of employees submitting dozens of reports each, all as separate PDF files. Trying to manually check every single one for compliance would be an absolute nightmare.

But what if you converted them all into a single master Excel file? Suddenly, you have a powerful new perspective. You can instantly:

- Sort by vendor: Does one employee seem to love expensing meals at the same five-star restaurant every week?

- Filter by amount: Quickly pull up every single expense that falls just under the company's receipt threshold, like a suspicious number of claims for $24.99.

- Analyze by date: You might spot patterns that look off, like an employee expensing multiple "business lunches" on the same day.

This approach transforms a tedious compliance check into a sharp fraud detection tool. You're no longer just looking at individual transactions; you're seeing the big picture and the patterns within it.

This shift isn't just a nice-to-have; it's becoming an expectation. A KPMG report revealed that nearly 80% of financial leaders think auditors should be using advanced tech to deliver better quality and deeper insights. The pressure is on to move beyond old-school methods.

And data conversion is really just the beginning. The next level involves bringing in even smarter tools to review the data you've gathered. To get a better sense of where the industry is heading, it's worth learning more about using AI for Financial Analysis. These technologies build on these foundational steps to make the entire audit process more insightful and efficient.

Interpreting Audit Findings and Finalizing the Report

After all the fieldwork and analysis are done, everything boils down to one critical document: the audit report. This isn't just a summary of findings. It's the auditor's official, professional opinion on how accurately your financial statements reflect the health of your business. Getting a handle on what this opinion means is crucial for understanding where you truly stand.

When that report lands on your desk, it will contain one of four distinct types of opinions. Each one carries a different weight and has very different implications for your company, so it pays to know what they mean before you even open the file.

Decoding the Different Audit Opinions

The language in an audit report can feel a bit formal, but the message behind it is always clear. Think of each opinion as a grade on your financial reporting—a grade that shows how well your records line up with standard accounting principles and whether the auditors had any roadblocks during their work.

Here’s a quick rundown of what to expect:

- Unqualified Opinion: This is exactly what you want to see. It’s often called a “clean opinion” and signifies that the auditor is confident your financial statements are presented fairly and are free from any significant errors. It's a gold star.

- Qualified Opinion: This is a step down from perfect. It basically says that most of your financial statements are accurate, but the auditor ran into an issue in a specific, isolated area. Maybe a particular transaction wasn't recorded correctly, or they couldn't get enough evidence for one part of the business.

- Adverse Opinion: This one is a serious red flag. An adverse opinion means the auditor has found that your financial statements are full of major errors, are unreliable, and don't comply with Generally Accepted Accounting Principles (GAAP).

- Disclaimer of Opinion: The rarest of the bunch, this means the auditor couldn't form an opinion at all. This typically happens when they were prevented from gathering enough evidence to do their job, perhaps due to major limitations on the scope of their work.

Don’t underestimate the impact of these opinions. Anything other than an unqualified report can create real problems, making it harder to get loans, attract investors, or satisfy partners. It’s a clear signal to everyone that something might be wrong with your financial reporting.

Beyond the Opinion: The Management Letter

Alongside the formal report, you'll often receive what's called a management letter. This document is less about the final numbers and more about your internal systems and day-to-day processes. It's essentially constructive criticism from an expert.

In this letter, the auditor will point out any weaknesses they spotted in your internal controls and offer practical suggestions for shoring them up. For example, they might recommend better separation of duties in your payables department or suggest stronger security protocols for your accounting software. For a deeper look at creating the final documents, check out our guide on how to prepare financial reports post-audit.

The whole process usually wraps up with an exit meeting. This conversation is your chance to sit down with the auditor, discuss the findings face-to-face, ask questions, and make sure you understand their recommendations. Don't just see this final stage as a report card; it's a golden opportunity to learn from the experts and make your company’s financial operations stronger for the long haul.

Common Questions About Financial Audits

Even with the best plan in place, it's completely normal to have questions swirling around before a financial audit. Tackling these uncertainties upfront can take a lot of the stress out of the process and give you the confidence to move forward. Let’s dive into some of the questions I hear most often from business owners.

Do We Actually Need an Audit?

This is usually the very first question people ask. While some companies voluntarily go through an audit to build trust and transparency, for many, it’s not really a choice.

An independent financial audit often becomes mandatory when:

- Your own bylaws require it. Check your company's founding documents; you might have a built-in requirement for periodic audits.

- You get federal funding. Here in the U.S., if you receive more than $750,000 in federal awards, you'll almost certainly need to get an audit.

- State laws kick in. Many states have rules that trigger an audit requirement once a nonprofit or company hits a certain revenue level, often around $500,000.

- Lenders or grantmakers insist. It’s common for banks and grant providers to ask for audited financial statements to confirm you're on solid ground before they'll give you money.

What's the Difference Between an Internal and External Audit?

It’s easy to get these two mixed up. Think of an internal audit as a self-checkup. It’s done by people within your own organization to look at your internal controls and make sure everything is running smoothly. It’s a great proactive tool.

An external audit, on the other hand, is what this guide is all about. This is where an independent Certified Public Accountant (CPA) comes in. Their job is to give an impartial, unbiased opinion on your financial statements for people outside your company—like investors, banks, or regulators.

While both audits are valuable, the external one carries a lot more weight with third parties. That independent verification is what gives them confidence that your financial records are accurate and above board.

How Long Is This Going to Take?

I get it—nobody wants their daily operations turned upside down. The timeline for an audit really varies, but you can generally expect the whole process to take several weeks from start to finish.

A rough timeline often breaks down something like this:

- Finding and hiring an auditor: 4-12 weeks

- Getting your own house in order: 2-4 weeks

- The auditor's on-site "fieldwork": 2-4 weeks

- Putting the findings into action: Ongoing

Honestly, the biggest time sink is usually the internal prep work. The more organized you are before the auditors even walk in the door, the quicker and less painful their fieldwork will be. A good rule of thumb is to have your audit wrapped up before your annual tax filing deadline so you can make any necessary adjustments.

What If the Auditors Find a Mistake?

First, take a deep breath. Finding an error isn’t a catastrophe; in fact, it happens all the time. The point of an audit isn't to play "gotcha," but to help you strengthen your financial reporting.

If an auditor uncovers a misstatement, their first step is to figure out if it's a one-off mistake or a sign of a bigger, systemic problem. From there, they’ll work with you to get it corrected. They'll also likely suggest changes to your internal processes to make sure it doesn’t happen again. The best thing you can do is be open and cooperative. The real test isn't the error itself, but how you respond and improve your systems for the future.

Turning your financial records from locked-down PDFs into usable data is the key to a faster, less stressful audit. A tool like Bank Statement Convert PDF is designed for exactly this, letting you convert bank statements into Excel spreadsheets without the headache of manual data entry. You’ll save a ton of time and cut down on errors. Start your audit prep the smart way.