Verifying a bank statement is all about meticulously comparing the bank's record of your transactions against your own. It's a cross-referencing game where you hunt for discrepancies, confirm every charge is legitimate, and flag anything that looks out of place. Think of it less like a chore and more like a crucial financial health checkup.

Why Bother Verifying Your Bank Statements?

Before we jump into the "how," let's talk about the "why." This habit is one of the most fundamental defenses you can build for your financial stability. It's about catching the small leaks before they turn into major floods and making sure every single dollar is accounted for.

This simple routine is your best tool for spotting the kind of financial drains that often fly under the radar. I'm talking about forgotten subscriptions that quietly siphon off cash each month or simple clerical errors from a merchant. Getting into this rhythm is the difference between controlling your money and letting it control you.

Your First Line of Defense Against Errors and Fraud

Honestly, one of the most compelling reasons to do this is fraud prevention. A single unauthorized transaction is often the first red flag that your account has been compromised. For example, a small, weird-looking charge from a merchant you’ve never heard of could just be a test run by a scammer before they try to pull out a much larger amount.

And it’s not always about malicious activity. Banks and businesses are run by people, and people make mistakes. You might find things like:

- Duplicate Charges: Getting billed twice for the same coffee or online purchase.

- Incorrect Amounts: A simple typo at the register that results in an overcharge.

- Missing Deposits: A check or a direct deposit that just never showed up in your account.

Catching these issues quickly means you can dispute them while the trail is still warm, often with just a quick phone call. If you need a refresher on the details you'll be digging into, take a look at our guide on https://bankstatementconvertpdf.com/what-does-a-bank-statement-show/.

Gaining Real Financial Control and Insight

Beyond security, regularly checking your statements gives you a brutally honest look at your spending habits. You see exactly where your money is going, which is incredibly empowering when you're trying to make smarter financial decisions. It's a proactive way to maintain control and build a secure financial future, whether for yourself or your business.

This isn't just about catching mistakes; it's a core practice of financial literacy. When you actively review your statements, you shift from being a passive account holder to an active manager of your own wealth.

The broader financial world is doubling down on this, too. Driven by regulations aimed at stamping out fraud, the number of global digital identity verification checks is projected to jump by 15% in a single year, hitting 86 billion in 2025. This just underscores how critical verification has become in our economy. You can read more about these global verification trends to see the bigger picture.

Setting Up for a Smooth Verification Process

Before you even think about comparing a single number, a successful bank statement verification starts with getting organized. Taking a few minutes to set things up properly can turn a frustrating, messy job into a streamlined, almost routine task.

Think of it like being a detective. You wouldn't just rush to the crime scene; you'd gather your files, your tools, and your notes first. A clean, organized digital workspace is your secret weapon for catching discrepancies, minimizing errors, and saving a ton of time down the road.

Assembling Your Financial Toolkit

First things first, let's gather the evidence. You're basically comparing two sides of the same financial story, so you need both sets of documents in hand. Double-check that you have the correct statement period and that everything is clearly labeled.

- Digital Bank Statements: Hop into your bank's online portal and download the official PDF statements for the period you need to review.

- Internal Financial Records: This is your version of events. It might be a data export from your accounting software like QuickBooks or Xero, a simple spreadsheet where you log your income and expenses, or even just a folder of invoices.

Here’s a little tip from my own experience: I create a new folder for every single reconciliation period, named something like "May 2024 Reconciliation." Inside that folder, I drop the bank statement PDF, my exported sales data, and a subfolder for any receipts I might need to reference. This simple habit has saved me from so many headaches.

Choosing the Right Software

Okay, you’ve got your documents. Now, how do you get the transaction data out of that locked-down PDF and into a format you can actually work with? You’ve got a couple of solid options here, each with its own pros and cons.

A dedicated PDF-to-Excel converter is usually the most direct path. These tools are built for one purpose: pulling tables out of bank statements accurately. They do a great job of keeping the dates, descriptions, and amounts in the right columns, which is a lifesaver when you're dealing with multi-page statements full of tricky formatting.

The other route is using the data import features built right into spreadsheet programs like Microsoft Excel or Google Sheets. Excel's Power Query, for instance, is a seriously powerful tool that can connect to a PDF and transform the data. It definitely has a steeper learning curve, but it gives you incredible control for cleaning up messy data without needing another piece of software.

The most important thing is to pick a method you're comfortable with that keeps the data clean and accurate. For most small business owners, a specialized converter is the perfect balance of simplicity and power. It turns a potential tech nightmare into a quick, easy step.

No matter which tool you land on, the goal is the same: get that static, uneditable PDF data into a flexible spreadsheet. This conversion is the bedrock of the whole process. Once you have your documents and software sorted, you’re already halfway to a successful effort to verify bank statements.

Turning PDF Statements Into Usable Data

Getting your transaction data out of a locked PDF is often the biggest hurdle in the verification process. Honestly, this is where most people get stuck. But it's a crucial step—you have to turn that static document into a dynamic spreadsheet you can actually work with and analyze.

Let's break down the best ways to pull this off.

You've got a few solid options for converting PDFs, from simple online tools to more powerful features already built into programs like Excel. The real trick is finding a method that keeps your data structured correctly. You need dates to stay in the date column, descriptions in the description column, and so on. A sloppy conversion creates more headaches than it solves.

Choosing Your Conversion Method

The biggest mistake I see people make is using the first free online converter they find on Google. Sure, they're tempting, but they come with real risks. Uploading sensitive financial documents to an unknown server is a huge security gamble. Plus, these free tools often choke on the complex tables in bank statements, leaving you with jumbled columns and a bigger mess than you started with.

A much safer and more reliable path is to use dedicated software or built-in tools. For instance, Excel’s Power Query feature is a total game-changer for this kind of work. It lets you import data directly from a PDF and gives you incredible control to clean it up before it even hits your spreadsheet. This is exactly what you need for handling those tricky multi-page statements with inconsistent formatting.

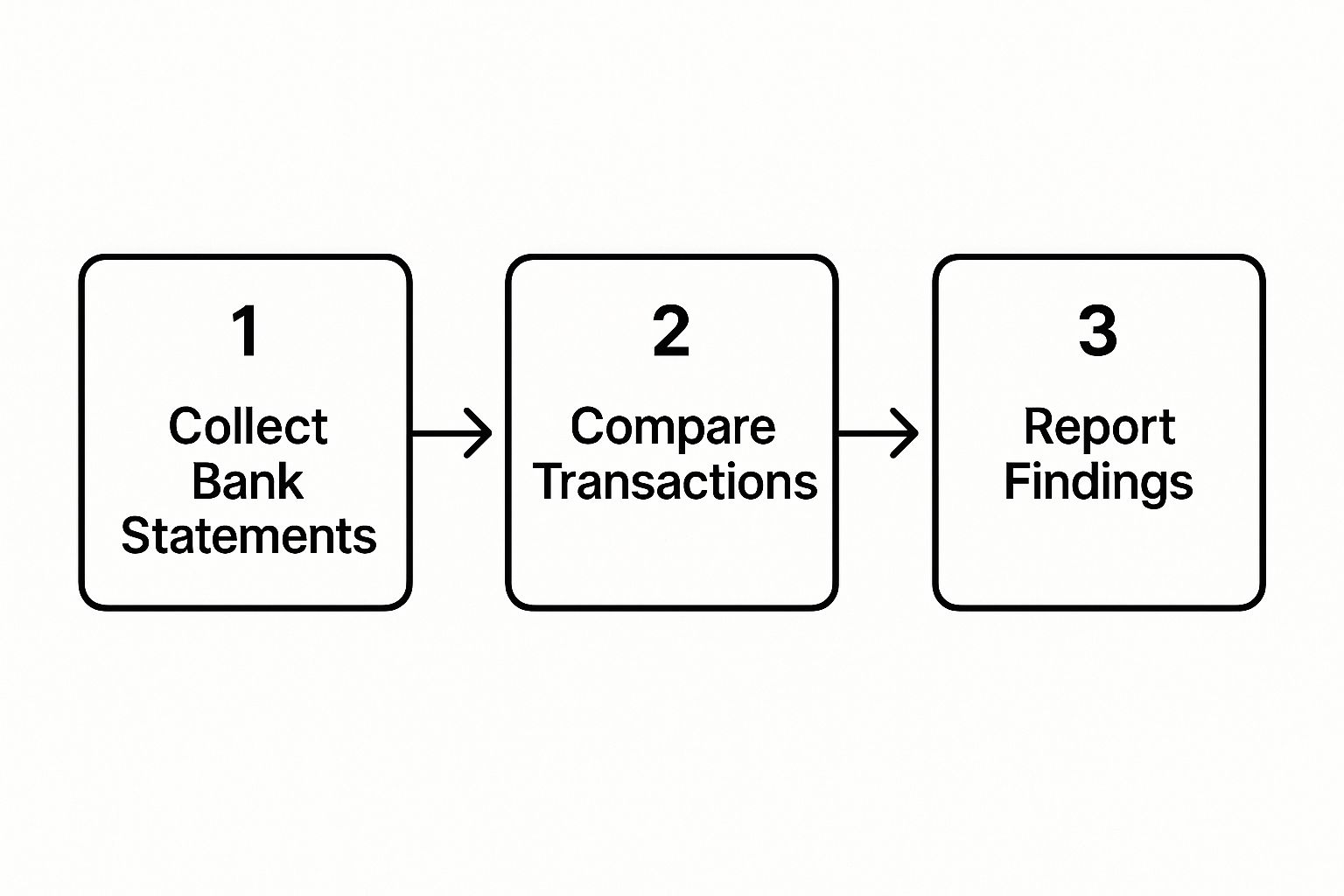

This infographic gives you a bird's-eye view of the entire workflow, starting from gathering your documents.

As you can see, getting your data ready is the foundation. Without clean data, you can't even begin to compare anything.

To help you decide, here’s a quick breakdown of the most common methods I've used over the years.

Comparison of PDF to Excel Conversion Methods

| Method | Pros | Cons | Best For |

|---|---|---|---|

| Online Converters | Quick, free, no software required. | Major security risks, poor accuracy with complex tables, often has ads or limitations. | Non-sensitive, simple, single-page PDFs where a few errors aren't a big deal. |

| Copy & Paste | Simple and free. | Almost never works cleanly. Results in a wall of unformatted text. | A last resort for grabbing just a few lines of data when all else fails. |

| Adobe Acrobat Pro | High-quality conversions, preserves formatting well. | Requires a paid subscription, which can be expensive. | Professionals who regularly work with PDFs and need the highest fidelity conversion. |

| Excel's Power Query | Free with Excel, highly powerful and customizable, secure (data stays local), can process entire folders of PDFs at once. | Has a bit of a learning curve for first-time users. | Anyone with Microsoft 365. It's the best all-around option for security, power, and cost. |

Ultimately, for anyone doing this regularly, learning to use Power Query is the clear winner. The initial time investment pays for itself almost immediately.

Handling Common Data Conversion Headaches

Even when you use a great tool, you'll probably hit a few snags. These issues are frustrating, but they're all fixable if you know what to look for.

- Incorrectly Split Columns: This is a classic. A transaction description and date get squished into a single cell. Excel's "Text to Columns" feature is your best friend here.

- Mangled Dates: Sometimes dates import as just text instead of a format Excel can work with. Just highlight the column and change the format to "Date" in the Home tab. That usually does the trick.

- Jumbled Text and Numbers: It’s common for debits and credits to end up mixed in the same column. You’ll have to sort the data and carefully move them into their proper Debit and Credit columns.

The whole point of this cleanup phase is to end up with a perfect, four-column table: Date, Description, Debits, and Credits. Once your data is neatly structured like this, the actual reconciliation part becomes a breeze.

After you've gathered your PDF statements, the next step is extracting that raw information. For a deeper look into the technical side of this, it's worth understanding how to extract data from PDF.

A Power Query Example for Bulk Conversions

Let's say you need to verify bank statements for an entire year. The thought of converting 12 separate PDFs one by one is enough to make anyone procrastinate. This is where a tool like Power Query really proves its worth by letting you import and combine data from an entire folder at once.

You can literally point Excel to a folder holding all your monthly PDFs, and it will merge them into a single, clean table for you.

For accountants, bookkeepers, or business owners who need to analyze finances across multiple periods, this isn't just a time-saver—it's essential.

If you're looking for a step-by-step tutorial on this, our guide on how to convert PDF bank statements to Excel walks you through the entire process. With your data finally clean and organized, you're ready to dive into the actual reconciliation.

How to Reconcile Transactions Like a Pro

Alright, you've successfully wrestled your PDF bank statement into a clean Excel file. Now for the real work: reconciliation. This is where you put on your detective hat and meticulously match the bank's records against your own.

Don't let the term "reconciliation" intimidate you. At its core, it’s a simple process of comparison to verify bank statements and ensure everything lines up.

My approach always boils down to a three-part mantra: Match, Flag, and Investigate. Your entire goal is to tick off every transaction that exists in both your books and the bank's, which naturally leaves you with a short, manageable list of discrepancies to dig into.

Mastering the Match Game with Excel

You don't need to be an Excel guru to pull this off. Honestly, simple sorting and filtering tools will get you most of the way there. A great starting point is to get your internal records and the bank statement data into two separate sheets within the same Excel workbook. This keeps everything tidy.

From there, I lean heavily on a few key formulas to do the heavy lifting. Functions like XLOOKUP (my personal favorite) or a classic INDEX/MATCH combo can automate the entire matching process. You can literally tell Excel to look for an exact transaction amount from your records over in the bank statement data.

Here’s how I usually set it up:

- Add a "Match" Column: Right next to your list of internal transactions, create a new, blank column.

- Write a Lookup Formula: In that new column, use

XLOOKUPto search for each transaction amount in the bank statement's amount column. - See What Shakes Out: The formula will return the amount if it finds a perfect match. If it doesn't, you'll get an error like #N/A. Just filter for the errors, and—voila—that's your list of discrepancies.

The real win here is speed and accuracy. Manually eyeballing hundreds of transactions is just asking for trouble and missed errors. Automating the initial match lets you spend your brainpower on the items that actually need your attention.

Before you get too deep in the weeds, it helps to understand the importance of bank reconciliation as a whole. Knowing why you're doing this makes the how a lot more intuitive.

A Real-World Reconciliation Scenario

Let's walk through a common example. Imagine you're reconciling sales for your e-commerce store. Your report from your payment processor shows 150 individual sales for the month. But when you look at the bank statement, you only see 148 deposits. There's your first red flag.

Using the XLOOKUP method, you'd instantly see which two sales from your ledger didn't have a matching deposit. Now, the investigation begins. More often than not, the culprit is one of these usual suspects:

- Timing Differences: Sales from the very last day of the month probably didn't clear and hit your account until the first or second day of the next month.

- Batch Deposits: The payment processor often bundles a handful of sales into one lump-sum deposit. You'll need to add up a few transactions in your records to see if they match that single deposit amount.

- Processor Fees: A customer paid $100, but the deposit that landed in your account was $97.50 after fees.

Flagging and Investigating Variances

Once you've isolated the odd ones out, the final piece is to investigate and make a note of what happened with each one. Common issues are unmatched amounts, transactions that are missing entirely (like an uncashed check), or deposits that have no corresponding sales record.

For a more detailed breakdown of this process, our guide on account reconciliation best practices is a great resource.

Your job isn't done until you've figured out the "why" behind every single variance. It might be a simple typo on your end or something that requires a phone call to the bank. Keeping a clear, documented trail of your findings is absolutely critical for a clean audit.

Investigating and Resolving Discrepancies

Finding a mismatch between your records and the bank statement is just the beginning. The real work—and the real value—is in digging into why it happened and getting it fixed. This is the final, crucial phase to properly verify bank statements.

This is where your inner detective comes out. Most discrepancies fall into a few common buckets, and knowing what to look for makes the whole process much faster. The first thing I always do is classify the problem; that tells me exactly who to call and what info I need to have ready.

Common Causes of Discrepancies

Let's be honest, more often than not, the problem is a simple clerical error or a timing issue, not some grand financial conspiracy. Before you jump to conclusions, check for these usual suspects:

- Unrecorded Bank Fees: It’s easy to forget about those monthly service charges or wire fees until they show up on the statement.

- Simple Data Entry Mistakes: A classic fat-finger error. You typed $54.20 in your books when the receipt clearly says $45.20. It happens.

- Duplicate Charges: A merchant's payment terminal glitches and accidentally bills you twice for your morning coffee.

- Timing Differences: This is a big one. You've written checks that haven't been cashed yet, or you made a deposit that's still pending.

Of course, sometimes the issue is more serious. For a deep dive into identifying potential fraud, take a look at our guide on how to spot fake bank statements.

Pro Tip: Keep a clear audit trail. For every single discrepancy, document what it was, the steps you took to investigate, and how it was resolved. This record is worth its weight in gold during an audit or even just for your own financial clarity.

Creating an Action Plan for Resolution

Once you've pinpointed the likely cause, it's time to act. Your next move could be a call to your bank's fraud department, an email to the merchant who overcharged you, or simply correcting an entry in your accounting software.

Whatever the path, go in prepared. Have all your documentation handy—dates, transaction amounts, reference numbers, and any receipts you have.

Responding quickly is essential. The financial world relies on shared data and quick analysis to fight fraud. A 2025 KPMG survey found that a whopping 79% of banks see centralized data on fraudulent accounts as a highly effective weapon. When you report an issue, you're not just protecting yourself; you're helping the system connect the dots and shut down scammers.

Even with a solid plan, a few questions always seem to come up once you get your hands dirty with bank statement verification. Let's walk through some of the most common ones I hear.

Think of this as a quick Q&A to iron out those last few details, so you can build a reconciliation process that works for you.

How Often Should I Be Doing This?

For any business, monthly reconciliation is non-negotiable. It just makes sense. Your bank sends you a statement every month, so you should check it every month. This cadence helps you spot discrepancies, potential fraud, or simple errors before they spiral out of control.

On the personal side, a monthly check-in is still the best practice for keeping a tight grip on your finances. But let's be realistic—life gets busy. If a monthly review feels overwhelming, a deep dive every quarter is a perfectly acceptable alternative. The real goal here is consistency, not chasing some unattainable idea of perfection.

Are Those Free Online PDF to Excel Converters Safe?

This is a big one, and you need to tread very carefully. Free online tools are tempting, but many of them come with a hidden cost: weak security. You're talking about uploading documents filled with your most sensitive financial data onto a stranger's server. It's a risk I'm never willing to take.

My rule of thumb: When it comes to financial data, security always trumps convenience. Stick to offline software or trusted tools like Microsoft Excel's built-in Power Query feature.

If you absolutely must use an online service, do your homework. Dig into their privacy policy. If they aren't crystal clear about how they encrypt your data and when they delete it, walk away. It's just not worth it.

What if My Own Records Are a Mess?

First off, don't panic. It happens. If you find your internal records are spotty, the first step is to become a detective. Go on a scavenger hunt for every receipt, invoice, and email confirmation you can find. Your goal is to piece together your financial story before you even glance at the bank statement.

Think of it as a learning experience. A messy reconciliation is the best motivation for getting organized. It’s a powerful reminder of why spending a few minutes each week to log your transactions will save you a massive headache down the line.

Ready to stop wrestling with PDFs and get straight to the numbers? The software from Bank Statement Convert PDF is built to give you a fast, secure, and accurate conversion every time. It creates the clean slate you need for a painless reconciliation. You can get started right here: https://bankstatementconvertpdf.com.