Accounts receivable management is the process your company follows to make sure customers actually pay you for the products or services you've delivered. It’s more than just sending out an invoice; it's the entire system for establishing credit, billing customers, collecting payments, and managing the cash that comes in.

Understanding Accounts Receivable Beyond Just Invoices

Think of your company's cash flow like a river. Making a sale is like opening the floodgates, but accounts receivable management is the network of channels and dams that directs the water back to you. Without it, you're letting valuable resources flow away without ever getting them back.

When that happens, your business experiences a "cash flow drought." You might look profitable on paper, but you don't have the actual cash to pay your own bills, cover payroll, or jump on a new opportunity. A solid AR process prevents this by creating a reliable system for getting paid what you're owed.

The Core Purpose of AR Management

The fundamental goal here is simple: shrink the time it takes to turn a sale into cash in the bank. This requires a careful balancing act—you need to be firm about payment terms without damaging customer relationships. How well you do this directly impacts the numbers you see on a financial statement, which shows the true financial health of your business.

For a deeper dive into these critical reports, you can learn more about what is a financial statement in our detailed guide.

The objective is to optimize your billing, payments, and collections process to minimize the time it takes to get paid and eliminate the risk of bad debt.

To better understand this, let's break down the essential pieces of the puzzle.

Core Components of Accounts Receivable Management at a Glance

The table below offers a quick look at the fundamental pillars of AR management, what each one involves, and why it matters to your bottom line.

| Component | Description | Primary Goal |

|---|---|---|

| Credit Policy | Establishing clear terms for extending credit to customers, including limits and due dates. | Minimize risk by only extending credit to reliable customers. |

| Invoicing | Creating and sending accurate, timely, and easy-to-understand invoices. | Start the payment clock as soon as possible and avoid confusion. |

| Collections | The process of following up on overdue invoices, from gentle reminders to more formal actions. | Recover late payments and reduce the amount of outstanding debt. |

| Cash Application | Applying incoming payments to the correct customer accounts and invoices. | Maintain accurate financial records and a clear view of who has paid. |

Each of these components works together to create a system that protects your cash flow and keeps the business financially stable.

Why It Has Become a Strategic Focus

Lately, businesses have been zeroing in on their AR processes, and for good reason. Late payments are a massive headache for companies everywhere. In fact, a recent study showed that 75% of companies are putting a greater focus on AR.

Why the sudden urgency? A staggering 39% of invoices in the U.S. are paid late. This means that even if a business sets a 28-day payment term, the reality is that their average collection time can balloon to 67 days, leaving a huge chunk of their money tied up.

As you can discover more insights about these accounts receivable statistics, it becomes clear that smart AR management isn't just an administrative task anymore—it's absolutely essential for survival and growth.

The Four Pillars of an Effective AR Process

A solid accounts receivable strategy isn’t a single action—it’s a sequence of carefully executed steps. Think of it as building a bridge connecting your sale to your cash flow. Each pillar provides essential support, and if one is weak, the entire structure is at risk. A successful AR process is built on four of these pillars, guiding every invoice from creation all the way to collection.

This approach ensures nothing falls through the cracks, creating a reliable system for getting paid. Let’s break down each of these four critical stages.

1. Credit Policy and Customer Onboarding

This is where it all begins. Before you even think about sending an invoice, you need to establish the rules of engagement. A clear credit policy is your company's rulebook for extending credit. It defines who qualifies, how much credit they can receive, and the payment terms they need to follow.

This step isn't about being restrictive; it's about being smart. By assessing a new customer's creditworthiness upfront, you proactively lower the risk of late payments or, even worse, bad debt. It's like checking the weather before a long road trip—you prepare for potential challenges and avoid unnecessary risks.

Your onboarding process should lay these terms out clearly so every new customer understands their obligations from day one. That transparency goes a long way in preventing future disputes and setting a professional tone.

2. Invoicing and Billing

Once the terms are set, the next pillar is creating and delivering clear, accurate, and timely invoices. An invoice is more than just a request for money; it's a critical communication tool that kick-starts the payment cycle. If it’s confusing, incorrect, or late, it gives your customer a legitimate reason to delay payment.

A well-crafted invoice should always include:

- A unique invoice number for easy tracking.

- Clear descriptions of the products or services delivered.

- The agreed-upon payment terms and a prominent due date.

- Multiple, convenient ways for the customer to pay.

Did you know that more than 60% of late payments are due to incorrect invoicing? Automating this process can dramatically reduce human error, ensuring bills are sent out right after a sale is completed, which starts the payment clock immediately.

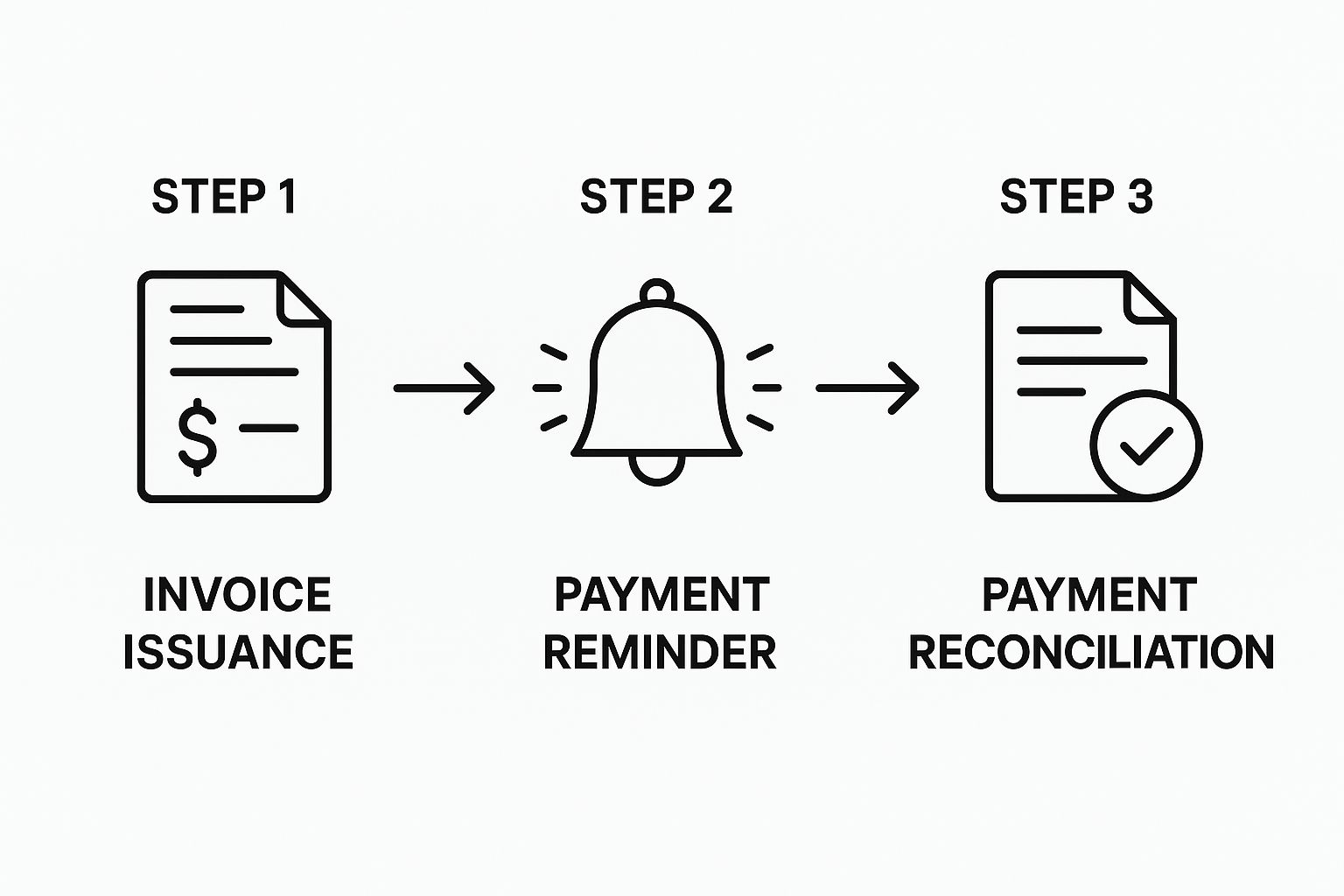

The process flow below simplifies the core lifecycle of an invoice.

This visual highlights how issuing an accurate invoice, sending timely reminders, and reconciling the final payment form a continuous, essential loop.

3. Collections Management

Let's be realistic—even with a perfect invoice, some payments will become overdue. The third pillar, collections management, is the systematic process of following up on these unpaid invoices. This is where many businesses stumble, often waiting too long to act or using an inconsistent approach.

Effective collections management is proactive, not reactive. It involves a structured communication plan that escalates over time.

- Gentle Reminders: Start with automated, friendly reminders sent just before or on the due date.

- Follow-Up Calls: If payment still hasn't arrived, a personal phone call can help uncover any issues and reinforce the payment expectation.

- Formal Notices: For seriously delinquent accounts, more formal written communication may be necessary.

The goal is not just to collect the money but to do so while preserving the customer relationship. A firm but professional approach maintains goodwill and encourages future business.

The key is consistency. Having a documented collections workflow ensures every overdue account is handled the same way, which makes the whole process more efficient and effective.

4. Cash Application and Reconciliation

The final pillar is often the most overlooked: accurately applying payments to the correct invoices and reconciling your accounts. This step, known as cash application, is what closes the loop on the transaction. When a customer pays, that money needs to be correctly recorded against their outstanding balance in your accounting system.

Without proper cash application, your financial records become a mess. You might mistakenly keep chasing a customer who has already paid, damaging the relationship. Or, you might fail to notice a short payment, leading to small losses that add up over time.

This stage is all about precision. Meticulously matching payments to invoices ensures your AR aging report is reliable, giving you a true picture of your company's financial health. For those looking to perfect this final step, mastering account reconciliation best practices is essential for maintaining accurate books and ensuring financial integrity.

How to Measure Your AR Performance

Managing accounts receivable effectively isn't about gut feelings or guesswork—it's driven by data. If you really want to sharpen your process and boost your cash flow, you have to measure what’s working and what isn’t.

By keeping a close eye on the right key performance indicators (KPIs), you can get a clear diagnosis of your AR health. These numbers act like a dashboard for your collections, pointing you directly to where you need to focus your energy. This is how you shift from just chasing invoices to strategically strengthening your company's financial footing.

Days Sales Outstanding (DSO)

One of the most telling metrics in your toolkit is Days Sales Outstanding (DSO). Put simply, DSO calculates the average number of days it takes for your company to get paid after you make a sale. The lower the number, the better.

Think of it as a report card for your collections speed. If your payment terms are 30 days but your DSO is hovering around 55, it means your customers are taking almost two months to pay you. That gap represents a serious chunk of cash that’s stuck in limbo instead of being put to work growing your business.

The formula is straightforward:

(Total Accounts Receivable / Total Credit Sales) x Number of Days in Period = DSO

A rising DSO is a major red flag, often signaling cash flow troubles ahead. For a deeper dive into how live data helps you spot and handle these issues, check out this piece on the importance of real-time data monitoring to manage receivables finance risk.

Accounts Receivable Turnover Ratio

Next up is the Accounts Receivable Turnover Ratio. This one shows you how efficiently your company is collecting its receivables over a set period, like a year. A higher ratio is a fantastic sign, suggesting you have solid credit policies and a well-oiled collections machine.

In essence, this ratio answers a critical question: "How quickly are we turning our credit sales into actual cash?" A low number might mean your credit terms are too generous, your collections team is hitting roadblocks, or your clients are facing financial strain.

A high AR turnover ratio is a positive indicator of liquidity. It shows your company can collect its debts effectively without needing to lean on outside financing, which is vital for long-term stability.

Watching this ratio helps you make smarter calls on everything from credit policies to customer screening. It’s also a key ingredient for solid financial planning, and you can see how it fits into the broader strategy by exploring these cash flow forecasting methods.

Collection Effectiveness Index (CEI)

Finally, there's the Collection Effectiveness Index (CEI). This metric gives you a laser-focused look at how well your team is doing at collecting money during a specific timeframe. Unlike other metrics that can be skewed by sales trends, CEI hones in purely on your team's performance.

It works by comparing the money you actually collected against the total amount that was available to be collected. A CEI that’s close to 100% means you have a highly effective collections team that’s bringing in the cash you're owed.

To see how these metrics work together, let's break them down side-by-side.

Comparing Key Accounts Receivable Metrics

Each metric offers a unique window into your financial health. Here’s a quick comparison of the three most important ones.

| Metric | Formula | What It Measures | Why It Matters |

|---|---|---|---|

| Days Sales Outstanding (DSO) | (AR / Credit Sales) x Days | The average time it takes to get paid after a sale. | Highlights collection speed and reveals potential cash flow gaps. |

| AR Turnover Ratio | Net Credit Sales / Average AR | How many times AR is turned into cash within a period. | Shows overall liquidity and the effectiveness of credit policies. |

| Collection Effectiveness Index (CEI) | (Beginning AR + Sales – Ending AR) / (Beginning AR + Sales) x 100 | The percentage of collectible receivables that were actually collected. | Directly measures the performance and efficiency of your collections team. |

By tracking these three KPIs regularly, you get a complete, multi-dimensional view of your AR performance. This data-driven approach empowers you to spot weaknesses, make targeted improvements, and ultimately transform your accounts receivable from a simple operational task into a powerful strategic advantage.

Best Practices for Modern AR Management

Knowing the theory behind accounts receivable is one thing, but putting it into practice is where you really start seeing results. Adopting the right habits can transform AR from a reactive chore into a proactive system that strengthens your company's financial health. It's all about preventing problems before they start, speeding up collections, and keeping your customers happy.

Think of the following strategies as a battle-tested roadmap. They offer a clear path to fine-tuning your AR process starting today.

Establish a Crystal-Clear Credit Policy

Your first line of defense, before you even make a sale, is a rock-solid credit policy. This is your rulebook. It lays out exactly who gets credit, how much you're willing to extend, and the payment terms they need to follow. Without one, you’re flying blind and leaving your business wide open to unnecessary risk.

A strong policy isn't about being overly strict—it's about being smart and consistent. It gets everyone, from sales to finance, on the same page when bringing on new clients. This simple clarity nips misunderstandings in the bud and sets a professional tone right from the start.

An effective policy should include:

- Credit Application Process: A standard form to gather all the necessary financial info from potential customers.

- Creditworthiness Criteria: The specific benchmarks a customer has to meet to get approved.

- Credit Limits: Clearly defined limits based on a customer's risk profile.

- Payment Terms: Explicit due dates (e.g., Net 30, Net 60) and any discounts for early payment or penalties for late ones.

Automate Your Invoicing and Billing

Manual invoicing is a breeding ground for expensive mistakes and frustrating delays. A simple typo, a forgotten attachment, or even just sending the bill a few days late gives customers a perfectly valid reason to hold off on paying you. In fact, studies show that over 60% of late payments are tied directly to invoicing errors.

Automating this process is one of the biggest levers you can pull. An automated system fires off an accurate, professional invoice the second a job is done or a product ships. This gets the payment clock ticking immediately and cuts out the human error that so often trips up collection efforts. Modern financial data extraction tools can take this even further by pulling data from different documents without any manual keying, ensuring everything is precise and fast.

When you automate tedious tasks like creating and sending invoices, you free up your team to focus on what really moves the needle: building customer relationships and handling the tough collection cases.

Diversify Your Payment Options

In today's world, convenience is everything. If you only accept paper checks or a single type of online payment, you're creating friction. Every little barrier you put in the way of payment makes a delay more likely. The easier you make it for people to pay you, the faster you get your money. Simple as that.

Offering a variety of payment options just makes sense. It caters to different preferences and removes common roadblocks. This customer-focused approach not only gets cash in the door faster but also makes for a much better customer experience.

Consider offering a mix of popular methods like:

- ACH bank transfers

- Credit and debit cards

- Online payment portals

- Digital wallets like PayPal or Stripe

This one adjustment can have a huge impact on your Days Sales Outstanding (DSO) by making the payment process painless for your clients.

Develop a Proactive Communication Plan

Waiting until an invoice is 30 days past due to pick up the phone is a reactive move that costs you. The smart play is to have a proactive communication plan for any overdue accounts. This means having a structured sequence of reminders that starts gently and escalates over time, preserving the relationship while still making it clear that payment is expected.

This approach keeps your invoices top-of-mind without being aggressive. Late payments have a massive global impact, costing businesses an estimated $600 billion every year. That staggering number underscores just how critical solid AR management is—this is the cash that keeps your business running.

A good communication cadence might look something like this:

- Friendly Reminder: An automated email sent a few days before the due date.

- Due Date Notification: A polite heads-up on the day payment is due.

- First Overdue Notice: A firm but professional follow-up about 7-10 days after the due date.

- Personal Phone Call: A direct call to discuss the balance and see if there are any issues holding up payment.

By putting these practices into place, you build an efficient and resilient AR system that doesn't just chase down payments but actively supports your company's growth.

How Technology Is Transforming AR Management

The days of dusty ledgers, manual data entry, and endless follow-up calls are officially over. Technology has completely changed the game for what is accounts receivable management, transforming it from a back-office chore into a strategic, data-rich function. This isn't just about speed; it's about gaining insights and efficiencies that were simply out of reach before.

Modern AR tools are doing far more than just sending reminder emails. They create intelligent, end-to-end workflows that manage everything from invoice creation and delivery to payment reminders and cash application. This shift lets your team step away from tedious, repetitive work and focus on what truly matters: analyzing payment behavior and strengthening customer relationships.

The Power of AR Automation

AR automation software is the engine driving this change. Think of it as the central command for your entire collections process. It standardizes every step, which cuts down on human error and gets cash in the door faster.

Instead of your team manually drafting invoices, stuffing envelopes, or making one-off phone calls, automation handles it all with perfect consistency. This systematic process directly clears some of the most common roadblocks in the AR cycle. By taking manual data entry out of the equation, you drastically reduce the risk of invoice errors—a primary reason for delayed payments.

An automated system can, for example:

- Generate and send an invoice the second a sale closes, getting the payment clock ticking right away.

- Schedule a sequence of reminders, starting with a gentle nudge before the due date and escalating as needed.

- Offer a customer portal where clients can easily view their invoices and pay online in just a few clicks.

AI and Machine Learning in Collections

Beyond basic automation, Artificial Intelligence (AI) and machine learning are adding a whole new layer of predictive intelligence. These sophisticated systems can comb through historical payment data, spot hidden patterns, and predict how customers are likely to behave in the future.

Imagine knowing ahead of time which clients are at high risk of paying late. AI can flag these accounts for you, empowering your team to reach out with a personalized message before an invoice becomes overdue. Your collections strategy instantly shifts from reactive chasing to proactive engagement.

AI-driven analytics don't just show you what already happened; they help you understand why it happened and predict what will happen next. This is a massive advantage for managing credit risk and fine-tuning your collections efforts.

To really get the most out of these capabilities, many businesses turn to dedicated accounting software. For instance, exploring options like Zoho Books implementation services can help bring all these processes under one roof.

Unlocking Smarter Financial Decisions

At the end of the day, this technological leap is about having better information. Automation in AR delivers real-time analytics and reporting, giving financial leaders a live, up-to-the-minute view of their collections performance and overall cash health. This clarity enables quicker, more confident decisions that protect the business from risk.

With detailed dashboards right at your fingertips, you can monitor key metrics like Days Sales Outstanding (DSO) and Collection Effectiveness Index (CEI) in real time. This visibility helps you spot trouble early, pivot your strategy, and maintain the kind of healthy, predictable cash flow that every growing business needs.

Common Questions About Accounts Receivable Management

Even when you think you have a handle on the basics, a few tricky questions about accounts receivable always seem to surface. These are the little details that can trip up even experienced business owners, creating bottlenecks where there should be smooth cash flow.

Let's clear the air and tackle these common points of confusion head-on.

What Is the Difference Between Accounts Receivable and Accounts Payable?

This is easily one of the most common mix-ups in business finance, but it's simple once you picture which way the money is moving.

Accounts Receivable (AR) is all the money owed to your business. Think of it as an asset on your balance sheet—it's cash that's on its way to your bank account. Every invoice you've sent out that hasn't been paid yet falls under AR.

Accounts Payable (AP) is the flip side. It's the money your business owes to others. This is a liability on your balance sheet because it represents cash that you will eventually have to pay out. Bills from your suppliers, rent, and software subscriptions all sit in your accounts payable.

A simple way to keep it straight:

- Receivable = Money you are waiting to receive.

- Payable = Money you have to pay.

Getting this right is the foundation of good cash flow management. A healthy AR process keeps money coming in, while a smart AP process controls the money going out. You absolutely need both to stay financially stable.

How Can Small Businesses Manage AR with Limited Resources?

If you're running a small business, you're likely wearing a lot of hats. The idea of adding "dedicated AR manager" to the pile can feel overwhelming, but you don't need a huge finance department to get it right. It’s all about working smarter, not harder.

Here are a few practical tips that work wonders for small teams:

- Create a Clear Credit Policy: Don't just give credit to anyone who asks. A simple application and a quick check can save you from a world of headaches down the road.

- Automate Your Invoicing: Use modern, affordable accounting software to send invoices automatically. This cuts out human error and ensures bills are sent the moment a project is complete or a product is delivered.

- Make Paying You Effortless: The easier you make it for customers to pay, the faster you’ll get your money. Offer online payment options like credit cards or bank transfers right on the invoice.

- Use Automated Reminders: Let your software do the nagging for you. Set up friendly, automated reminders for payments that are coming due or are just a few days late. This simple step keeps you top-of-mind without damaging customer relationships.

These tactics create a solid system that helps keep cash flowing without a massive investment of your time or money.

When Should You Send an Account to a Collections Agency?

This is a tough one. Bringing in a collections agency is a serious step and often means burning a bridge with a customer. It's a move you should only make when you've truly exhausted every other option.

Before you make that call, you need to be sure you've followed your own internal collections process to the letter. This should always include:

- A series of polite reminder emails.

- Several direct phone calls.

- A formal, final demand letter that clearly states your intention to escalate the matter.

So, when is it time? Generally, if an account is 90 to 120 days past due and the customer has gone completely silent, it’s time to consider it. At that point, your chances of collecting the debt on your own have dropped dramatically. You'll only get a portion of what you're owed, but something is almost always better than nothing.

Ready to stop chasing payments and start streamlining your finances? Bank Statement Convert PDF offers powerful tools to convert your financial documents into actionable data, giving you the clarity you need to manage your cash flow effectively. Visit us at https://bankstatementconvertpdf.com to learn how we can help.