Let's break down a term you hear a lot in business finance: working capital management. What is it, really?

At its core, it's all about how a company manages its short-term finances to make sure there's always enough cash on hand to cover the day-to-day bills. Think of it as the financial engine of your business—keeping the lights on, paying employees, and settling up with suppliers without a hitch.

What Is Working Capital Management, Exactly?

Imagine your business is a car on a road trip. Working capital is the fuel in the tank. You don't want to carry so much that it weighs you down, but you absolutely can't afford to run out between gas stations. Managing it well means you always have just what you need to keep moving forward smoothly.

This isn't just about paying bills, though. It's a constant balancing act between two key parts of your company's balance sheet:

-

Current Assets: These are all the resources your company expects to convert into cash within a year. This includes the obvious stuff like cash in the bank, but also money your customers owe you (accounts receivable) and the products sitting on your shelves (inventory).

-

Current Liabilities: These are the debts you need to pay off within that same year. We're talking about money owed to your suppliers (accounts payable), short-term loans, and other immediate expenses.

The magic number here is your net working capital, which is simply your Current Assets minus your Current Liabilities. If that number is positive, you’re in good shape. A negative number, however, could be a red flag signaling potential trouble ahead.

Effective working capital management is about more than just survival; it’s about unlocking the cash trapped within your operations. By optimizing this cycle, a business can self-fund growth, reduce its reliance on external debt, and build resilience against unexpected market shifts.

The Core Components of Working Capital

To really get a handle on this, you need to know the players involved. Each component has a specific job to do in keeping your business financially healthy, and they all influence each other.

The table below gives a quick snapshot of the building blocks you’ll be working with.

The Core Components of Working Capital

| Component Type | Examples | Role in Working Capital |

|---|---|---|

| Current Assets | Cash & Equivalents, Accounts Receivable, Inventory | These represent the resources available to meet short-term obligations and fund daily operations. They are the "inflow" side of the equation. |

| Current Liabilities | Accounts Payable, Short-Term Debt, Accrued Expenses | These are the immediate financial obligations that drain cash from the business. They represent the "outflow" side. |

As you can see, it's a game of inflows and outflows. Your goal is to keep the inflows coming in faster than the outflows go out.

If you want to see how these elements fit into the bigger picture, our guide on what are the financial statements is a great resource for understanding balance sheets.

Why It’s More Than Just Accounting

Don't mistake this for a simple bookkeeping task. Working capital management is a strategic function that directly impacts your company's profitability and how efficiently you operate. Get it wrong, and you could face cash shortages, miss out on great growth opportunities, or even risk going out of business.

But when you get it right? The benefits are huge.

A company that masters this discipline can dramatically improve its cash flow, boost profits by cutting down on unnecessary costs, and build stronger relationships with suppliers by always paying on time. It's one of the most powerful tools a business has for securing its financial health and building a foundation for long-term success.

The Three Levers of Working Capital

Knowing what working capital is and actually managing it are two different things. To get practical, we need to zoom in on the three core levers you can pull to directly influence your company’s cash flow and day-to-day efficiency.

Think of these not as dry accounting terms, but as the control dials for your business’s financial engine. These three levers are Accounts Receivable (AR), Accounts Payable (AP), and Inventory. Even small, deliberate tweaks to any one of these can have a massive impact on your liquidity. The real magic happens when you master the interplay between all three.

Lever 1: Speed Up Your Cash with Accounts Receivable

Accounts Receivable is simply the money your customers owe you for products or services they've already received. The faster you can turn those outstanding invoices into actual cash in the bank, the better your working capital position will be.

When collections are slow, your cash is essentially trapped on someone else's books, unable to fuel your own growth. The primary goal here is to shorten your Days Sales Outstanding (DSO)—the average time it takes to get paid after making a sale. You need a proactive strategy for this, which is the cornerstone of solid accounts receivable management.

A few proven tactics include:

- Invoice Immediately and Accurately: Don't wait. Send invoices the moment a job is done or a product ships. Make sure they are crystal clear and error-free to avoid giving customers a reason to delay.

- Offer an Early Payment Discount: A small incentive, like a 1% or 2% discount for paying in 10 days, can work wonders to speed up payments.

- Automate Your Reminders: Let your accounting software do the nagging. Set up polite, automated reminders for upcoming and overdue payments to keep the cash flowing without tying up your team.

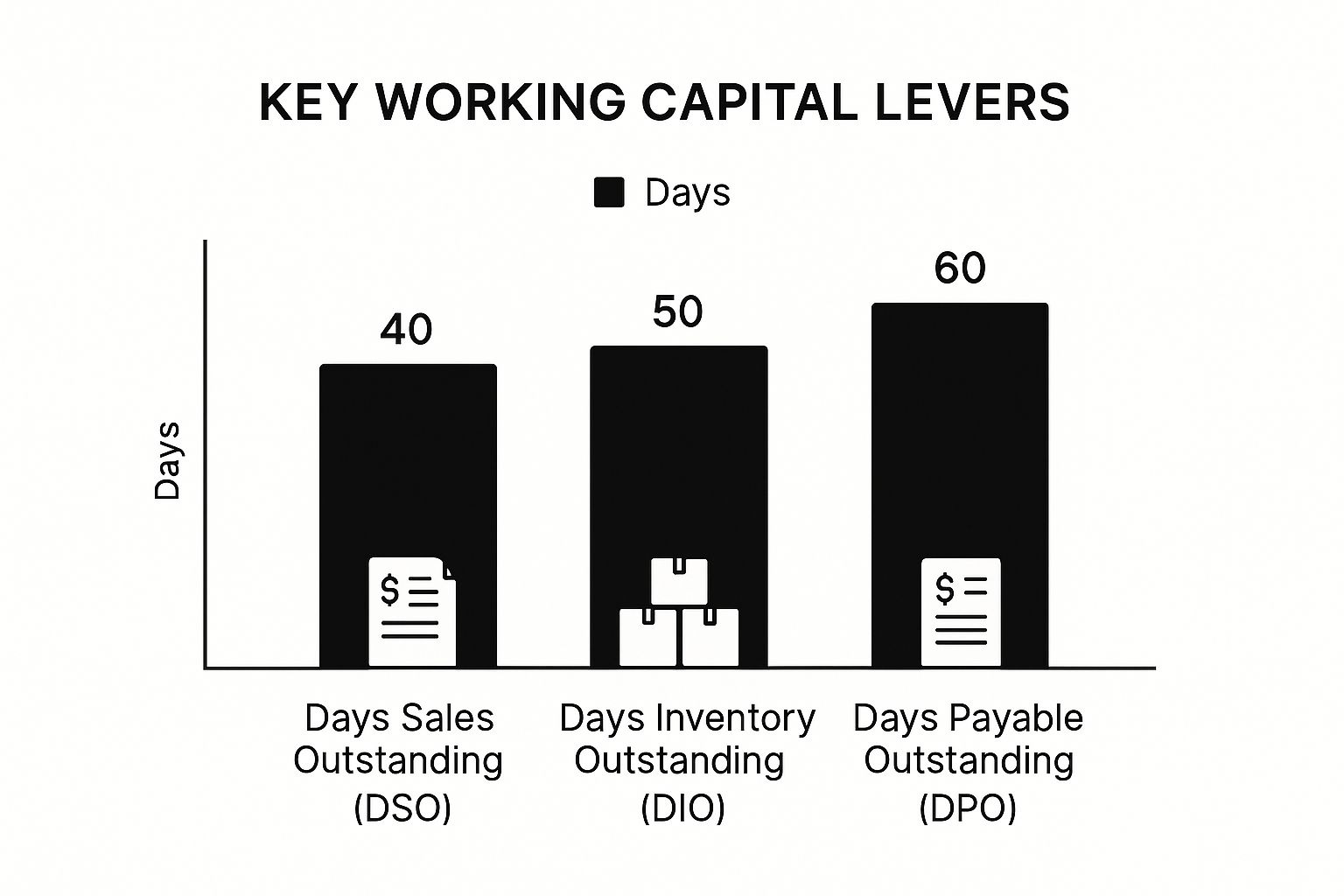

This infographic shows how DSO fits into the bigger picture with the other key metrics that drive your cash cycle.

As you can see, each lever plays a direct role in how long it takes for the cash you spend to make its way back into your business.

Lever 2: Control Your Cash Outflow with Accounts Payable

On the flip side, Accounts Payable is the money you owe your suppliers. Paying your bills on time is obviously important for maintaining good relationships, but paying them too early is like giving away an interest-free loan.

The art of AP management is all about stretching your payment terms just enough without souring those crucial partnerships. By strategically managing your Days Payable Outstanding (DPO), you get to hold onto your cash longer, giving you more flexibility to fund operations or jump on new opportunities. It's a fine line to walk—you’re using your suppliers' credit as a short-term financing tool, but you can't afford to damage your reputation.

Strategic AP management isn't about not paying your bills. It's about optimizing the timing of those payments to align with your own cash inflows, creating a natural financial buffer.

Lever 3: Fine-Tune Your Stock with Inventory Management

Inventory is a tricky one. For many businesses, it’s the biggest current asset on the books, but it’s also the most difficult to turn back into cash. Every item sitting on a shelf represents capital that's just sitting there, not working for you.

The challenge is to strike the perfect balance: hold just enough inventory to meet customer demand without tying up a fortune in unsold goods. Your goal is to shrink your Days Inventory Outstanding (DIO)—the average time it takes to sell through your stock. Poor inventory management leads to high carrying costs from storage, insurance, and the dreaded risk of products becoming obsolete.

Modern approaches like just-in-time (JIT) systems or using data analytics for smarter sales forecasting can slash these costs and unlock significant amounts of cash.

Across the board, smart companies are seeing working capital as more than just a defensive chore; it's a tool for growth. Research from Visa’s Corporate Working Capital Index found that savvy CFOs are twice as likely to use financial tech like virtual cards and are 32% more likely to use working capital strategies to fuel expansion. By getting a firm grip on AR, AP, and inventory, you can turn a financial necessity into a real competitive edge.

Measuring Your Working Capital Health

You can't fix what you can't see. Just knowing the parts of working capital isn't enough—you have to be able to check its pulse. This means taking key financial ratios and translating them into a clear story about your business's real-world efficiency and cash flow.

Think of these metrics as vital signs. They tell you exactly how quickly your company turns actions into cash, highlighting your strengths and, more importantly, flagging hidden risks before they spiral into full-blown problems. Let's walk through the essential tools for this financial check-up.

The Quick Liquidity Check: The Working Capital Ratio

The fastest way to get a bird's-eye view of your financial stability is the Working Capital Ratio, often called the Current Ratio. It’s a simple, powerful comparison of what you own versus what you owe in the short term.

Here's the formula:

Working Capital Ratio = Current Assets / Current Liabilities

A result below 1.0 is a serious warning light. It suggests you might not have enough cash or liquid assets on hand to cover your immediate bills. On the flip side, a ratio consistently above 2.0 could mean you’re playing it too safe—cash might be sitting idle instead of being put to work growing the business. For most healthy companies, the sweet spot is somewhere between 1.2 and 2.0.

Diving Deeper With The Cash Conversion Cycle

While the working capital ratio is a great snapshot, the Cash Conversion Cycle (CCC) is the full-length movie. It measures the exact time—in days—it takes for a dollar spent on inventory to travel through your operations and land back in your bank account as cash from a sale. The shorter the cycle, the healthier your business.

The CCC is the ultimate report card for your operational efficiency. It reveals precisely how long your cash is tied up in the process of running your business. A lower number means you have a self-funding, cash-generating machine.

The CCC is built on three pillars we've already discussed:

- Days Inventory Outstanding (DIO): How long your products sit on the shelf.

- Days Sales Outstanding (DSO): How fast you collect cash from your customers.

- Days Payable Outstanding (DPO): How long you take to pay your suppliers.

The formula is a simple sum of these moving parts: CCC = DIO + DSO – DPO. Let’s break down each one.

Days Inventory Outstanding (DIO)

DIO tells you the average number of days it takes to turn your inventory into sales. A high DIO is often a red flag for deeper issues like weak sales, poor purchasing decisions, or obsolete stock that’s tying up your precious cash. To get a true picture, calculating your inventory carrying costs is a crucial piece of the puzzle.

Days Sales Outstanding (DSO)

DSO tracks the average number of days it takes to get paid after you’ve made a sale. When your DSO is high, it means customers are treating you like a bank, which puts a direct strain on your cash flow. Sharp invoicing and a disciplined collections process are your best tools for keeping this number low.

Days Payable Outstanding (DPO)

Finally, DPO shows how long your company takes, on average, to pay its own bills. While a higher DPO can be a good thing—it means you hold onto your cash longer—you have to strike a delicate balance. Pushing it too far can easily damage hard-won supplier relationships and tarnish your company's reputation.

To see how these metrics play out in the real world, let's compare two fictional businesses.

Cash Conversion Cycle Impact Comparison

| Metric | Company A (Efficient) | Company B (Inefficient) | Impact Analysis |

|---|---|---|---|

| Days Inventory Outstanding (DIO) | 30 days | 90 days | Company B has 3x more cash tied up in slow-moving inventory. |

| Days Sales Outstanding (DSO) | 20 days | 60 days | Company A gets paid in under three weeks; Company B waits two months. |

| Days Payable Outstanding (DPO) | 40 days | 30 days | Company A strategically uses supplier credit to its advantage. |

| Cash Conversion Cycle (CCC) | 10 days (30+20-40) | 120 days (90+60-30) | Company A needs financing for only 10 days of operations, while Company B needs to cover a four-month gap. |

The difference is stark. Company A's operations are practically self-funding, while Company B constantly needs external cash just to stay afloat.

This isn't just a small business problem. According to a J.P. Morgan Working Capital Index, the S&P 1500 currently have an estimated $707 billion in trapped liquidity—a 40% jump since before the pandemic. Why? Longer cash conversion cycles. The report found 67% of firms are taking longer to collect payments (DSO) and 76% are holding inventory longer (DIO).

By truly understanding these numbers, you can shift from just doing accounting to making powerful, strategic decisions. For a closer look at evaluating your company’s performance, check out our complete guide on financial statement analysis techniques. Mastering these metrics is the first real step toward building a more profitable and resilient business.

Proven Strategies to Optimize Working Capital

https://www.youtube.com/embed/c5iigcEppZw

Once you’ve got a handle on your working capital health, it’s time to shift from diagnosis to action. Optimizing your working capital isn't about finding a magic bullet. It’s about choosing the right strategic playbook for your company's specific goals, industry pressures, and overall appetite for risk.

This really boils down to making deliberate choices about how you juggle your assets and liabilities. Most businesses fall into one of three primary philosophies, each with its own trade-offs between keeping the lights on (liquidity) and turning a healthy profit.

Three Core Working Capital Strategies

Think of these approaches as setting the rules of the game before you start messing with the individual pieces like accounts receivable or inventory.

-

The Conservative Strategy: This is the "safety first" approach. A company playing it conservatively will maintain high levels of current assets, like a big cash cushion and plenty of inventory. While this nearly eliminates the risk of coming up short on cash, it also means a lot of capital is just sitting there, not earning a return. It's safe, but it can drag down profitability.

-

The Aggressive Strategy: This is your classic high-risk, high-reward option. An aggressive strategy means keeping current assets lean and mean, often relying on short-term financing to cover bills as they come due. This frees up a ton of cash to invest back into the business for growth, but it leaves zero room for error. A slight delay in customer payments could trigger a major liquidity crisis.

-

The Moderate Strategy: This is the "Goldilocks" approach—not too risky, not too cautious. It's all about finding a happy medium by trying to match the maturity of assets and liabilities. Most businesses naturally find themselves in this balanced zone, making smart trade-offs to stay both efficient and secure.

Actionable Tactics for Optimization

No matter which high-level strategy you lean toward, the real work of optimization happens at the tactical level. The goal is to make specific, targeted improvements to the three main levers you can pull: receivables, payables, and inventory.

Streamlining Accounts Receivable

Getting paid faster is one of the quickest ways to pump cash directly into your business. The trick is to shorten your Days Sales Outstanding (DSO) without annoying your customers.

- Invoice Immediately and Clearly: Don't wait. Send accurate, easy-to-understand invoices the second a job is done or a product ships.

- Offer Early Payment Discounts: A small incentive, like 2% off for paying within 10 days, can work wonders in motivating customers to settle up quickly.

- Automate Your Collections: Use simple software to send out polite, automated reminders for upcoming and overdue payments. This ensures consistent follow-up without bogging down your team.

A huge part of this is also protecting your margins from unexpected hits. It's worth understanding the impact of chargeback fees and how to avoid them to stop these hidden costs from slowly draining your cash reserves.

Mastering Accounts Payable

Managing what you owe isn't about stiffing your suppliers—it's about holding onto your cash for as long as ethically possible without damaging those critical relationships. This is all about stretching your Days Payable Outstanding (DPO).

Strategic management of accounts payable is not about delaying payments indefinitely. It is about timing your outflows to align with your inflows, effectively using supplier credit as a short-term, interest-free source of financing.

Here’s how to do it right:

- Negotiate Better Payment Terms: Don't just accept the terms you're given. Proactively talk to your key suppliers about extending your payment deadlines. If you're a good, long-term customer, you have more leverage than you think.

- Schedule Payments Strategically: Instead of paying bills the moment they land on your desk, schedule them to be paid just before they're actually due.

- Use Technology for a Clear View: Modern procurement or accounting software gives you a bird's-eye view of all upcoming payments, helping you forecast cash needs and plan your outflows with precision.

Fine-Tuning Inventory Levels

For many businesses, inventory is the single largest asset—and the hardest one to turn back into cash. Driving down your Days Inventory Outstanding (DIO) can free up an enormous amount of capital.

- Adopt Just-in-Time (JIT) Inventory: This system is all about ordering materials from suppliers so they arrive exactly when needed for production. It drastically cuts down on the cash you have tied up in warehouse shelves.

- Get Better at Forecasting: Use your own sales data and market trends to get smarter about predicting future demand. This helps you avoid the twin problems of overstocking (which ties up cash) and stockouts (which loses sales).

- Liquidate Slow-Moving Stock: Be ruthless. Identify inventory that isn't selling and get rid of it—even if it means a steep discount. It's better to convert that dead weight back into cash you can actually use.

By blending a clear, overarching strategy with these focused, practical tactics, you can turn working capital from a dry accounting metric into a powerful engine for profitability and resilience.

Using Technology for Smarter Management

Trying to manage your working capital with spreadsheets is like driving with a paper map from 10 years ago. Sure, it might get you there eventually, but you're going to be slow, make mistakes, and miss all the better routes everyone else is taking. Today’s technology isn't just an upgrade; it’s a complete game-changer. It turns working capital management from a backward-looking chore into a forward-looking, data-driven strategy.

Modern tools don't just speed things up—they automate the tedious stuff, give you a live view of your cash position, and find insights you’d never spot manually. When you step away from manual processes, you can tighten your cash cycle, smooth out operational bumps, and free up your finance team to think strategically instead of just punching numbers.

Creating a Single Source of Truth

The first big win from technology is getting all your financial data in one place. Think of an Enterprise Resource Planning (ERP) system as your company's central nervous system. It connects the dots between accounting, procurement, inventory, and sales, making them all speak the same language.

This integration breaks down the classic information silos. Suddenly, the warehouse manager and the CFO are looking at the exact same figures. With this single source of truth, decisions get made faster and with more confidence. You can instantly see how a shipping delay hits your receivables or how a new supplier deal will affect your payment schedule.

The Power of Automation and AI

On top of a centralized system, specialized software can pull the core levers of working capital with incredible efficiency. These tools are built to handle the repetitive, detail-heavy tasks that eat up so much time.

-

Automated Invoicing Platforms: These systems fire off invoices the moment a sale is made, send out polite payment reminders on a schedule, and let customers pay with a click. This alone can seriously slash your Days Sales Outstanding (DSO) by getting rid of manual delays.

-

Supply Chain Financing Tools: This is a clever win-win. These platforms let your suppliers get paid early by a financing partner, which keeps them happy. Meanwhile, you can stick to your normal payment schedule, perfectly optimizing your Days Payable Outstanding (DPO).

Artificial intelligence is also stepping in to play a major role. AI algorithms can sift through your historical data and market trends to generate scarily accurate cash flow forecasts. They can also predict customer demand to fine-tune your inventory, preventing both the high cost of overstocking and the frustration of running out of a popular item.

Technology transforms working capital management from a historical reporting function into a forward-looking strategic advantage. It provides the visibility to not only see where your cash is but to direct it where it will have the greatest impact.

The amount of money tied up in inefficient systems is staggering. A recent U.S. Working Capital Survey by The Hackett Group found that $1.7 trillion in excess working capital is stuck on the balance sheets of the largest 1,000 U.S. public companies. The report points to generative AI as a key way for businesses to chip away at high receivables and inventory costs. You can explore more of their working capital trends on thehackettgroup.com.

Adopting this tech isn't just for the big players anymore. A whole ecosystem of accessible financial data extraction tools now exists to help businesses of all sizes automate how they gather and analyze data. Making this shift is no longer a choice—it’s a competitive necessity for building a resilient financial foundation.

Your Top Working Capital Questions, Answered

Even after you've got the strategies and metrics down, the real world has a way of throwing curveballs. When you start putting working capital principles into practice, specific questions always pop up.

Think of this section as your go-to cheat sheet. We'll tackle some of the most common head-scratchers that business owners and finance pros run into every day, turning theory into action you can use right now.

What Is a Good Working Capital Ratio?

There's no magic number here. The "right" working capital ratio is completely different depending on your industry. A software company with almost no physical inventory will have a wildly different financial picture than a retail business that needs to keep its shelves stocked.

That said, a good rule of thumb is to aim for a ratio between 1.2 and 2.0. This range usually means you have enough current assets to comfortably cover your short-term bills, but you aren't letting too much cash just sit around doing nothing.

A ratio that dips below 1.0 is a serious red flag. It signals negative working capital and means you could have trouble paying your bills. On the flip side, a ratio that's consistently over 2.0 might point to inefficiency—the company isn't investing its extra cash to fuel growth.

Your best bet is to benchmark your ratio against your direct competitors and the average for your industry. That context is far more telling than chasing an arbitrary number. The real goal is to maintain a healthy cushion for surprises while making sure every dollar is working hard for the business.

Can a Company Have Too Much Working Capital?

Absolutely. It might sound like a good problem to have, but holding onto excessive working capital can be a symptom of deeper operational issues. It’s a classic case of too much of a good thing.

When you have too much cash tied up in working capital, it often points to a few problems:

- Dusty Inventory: Products are sitting on shelves instead of being sold, locking up cash that could be put to better use. This also racks up storage costs and increases the risk of items becoming obsolete.

- Slow-Paying Customers: Your accounts receivable might be bloated because clients are taking too long to pay. In effect, they're using your business as an interest-free loan.

- Idle Cash: Huge cash reserves that aren't being reinvested into new projects, technology, or marketing are actually losing value over time to inflation.

Smart working capital management isn't about hoarding as much cash as possible. The real aim is to optimize it. You want to find that sweet spot where you have all the liquidity you need for smooth operations, with any extra cash quickly deployed to generate a return.

How Can a Small Business Improve Working Capital?

Small businesses can make a huge impact on their working capital without a big budget or a dedicated finance department. It’s all about focusing on simple, high-impact actions that directly shorten your cash conversion cycle.

Here are a few practical steps any small business can start with today:

- Invoice Immediately: Don't wait for the end of the month. Send that invoice the second the job is done or the product is delivered. The faster the bill goes out, the faster the money comes in.

- Reward Early Payments: Offer a small discount, like 1-2%, for customers who pay their bill within 10 days. The small hit you take on the margin is often a fantastic trade-off for a major cash flow boost.

- Get Smart with Inventory: Use your sales data. Know which products fly off the shelves and which ones don't. Avoid overstocking the slow-movers and think about liquidating old inventory to free up cash.

- Talk to Your Suppliers: If you have a good relationship, don't be afraid to ask for slightly longer payment terms. Even an extra 15 days can create a much-needed cash buffer for your business.

Building these simple habits can completely change a small business's financial footing, giving it the stability to weather any storm and the fuel to jump on new opportunities.

What Is the Difference Between Working Capital and Cash Flow?

This is a really common point of confusion, but getting the difference is crucial for truly understanding your company’s financial health. They're related, but they measure two completely different things.

Here’s a simple way to think about it:

- Working Capital is a snapshot in time. It's a figure on your balance sheet (Current Assets – Current Liabilities) that tells you about your company's liquidity right now. It's like checking the fuel gauge in your car.

- Cash Flow measures the movement of cash over a period. It's the story of all the cash coming into and going out of your business over a month, quarter, or year. It's like tracking your car's miles per gallon—it shows how efficiently you're using your fuel.

A company can have plenty of positive working capital but still face a cash flow crisis if all its customers are paying late. That’s exactly why managing working capital is so important—it’s the engine that keeps positive cash flow running smoothly.

Are you spending hours manually keying data from bank statements into spreadsheets? At Bank Statement Convert PDF, we provide powerful software that instantly converts your PDF bank statements into organized, usable Excel files. Stop wasting time and start making smarter financial decisions today.

Learn how you can automate your financial data entry with our tool