In today's fast-paced financial landscape, manual data entry from bank statements is a major bottleneck. It's not just tedious; it's a drain on resources, prone to costly human errors, and a significant security risk. For accountants, lenders, and business owners, the time spent keying in transaction details is time lost on analysis, strategy, and growth.

The solution lies in automation. Modern bank statement extraction software leverages advanced technologies like Optical Character Recognition (OCR) and Artificial Intelligence (AI) to instantly and accurately pull data from PDF statements, even scanned ones, and convert it into structured, usable formats like Excel.

This guide moves beyond simple marketing claims to provide a detailed, practical review of the top 12 tools available today. We'll explore their specific strengths, potential limitations, and ideal use cases to help you find the perfect fit for your financial data challenges. Each entry includes screenshots, direct links, and an honest assessment to help you make an informed decision and eliminate manual data entry for good. We have personally evaluated each platform to give you real-world insights into what works best.

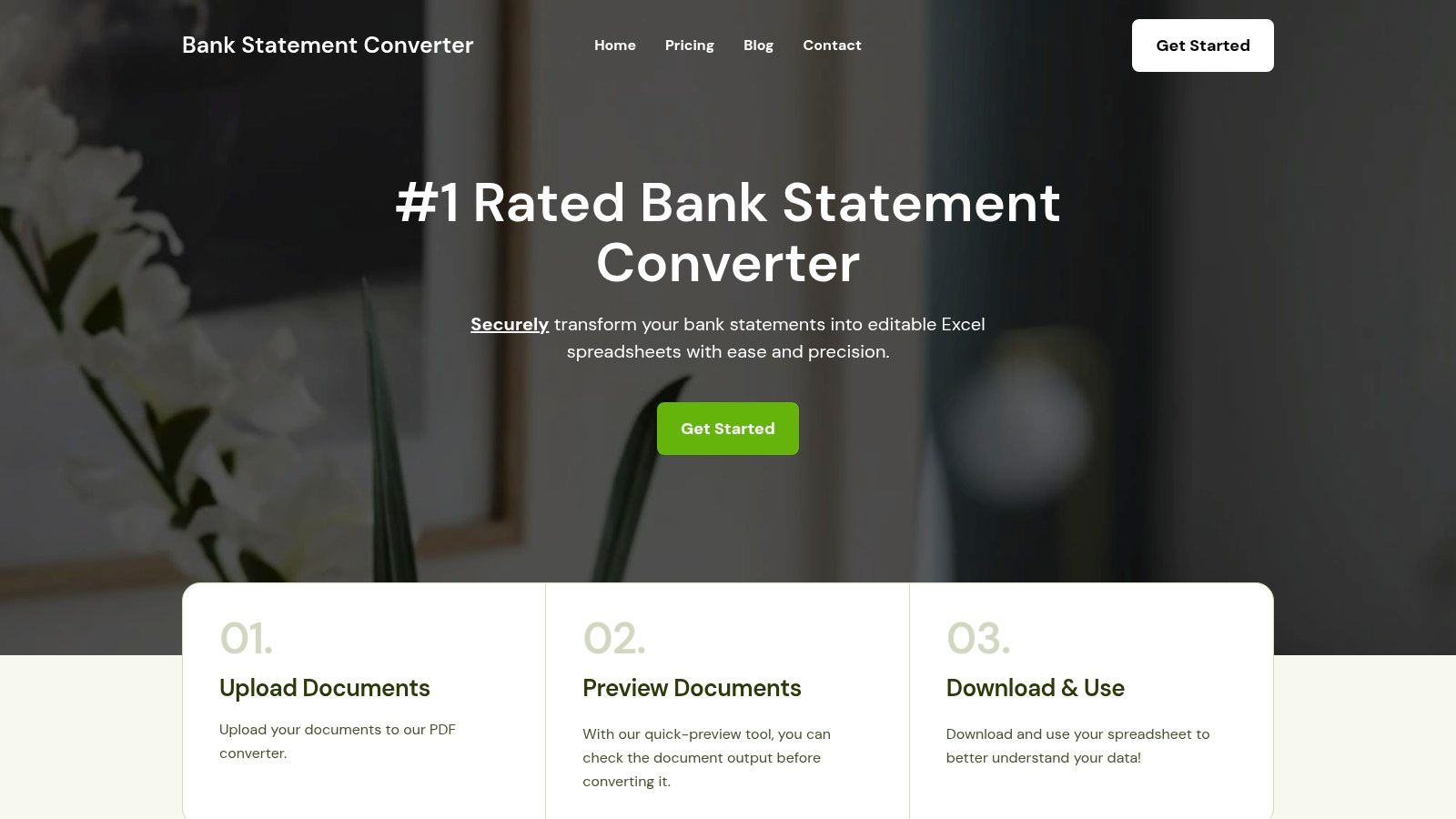

1. Bank Statement Convert PDF

Bank Statement Convert PDF establishes itself as a premier, highly specialized solution in the bank statement extraction software landscape. It excels by focusing on a singular, critical task: converting static bank statement PDFs into fully structured and editable Excel or CSV files. This laser-focus allows it to deliver exceptional accuracy and a streamlined user experience tailored specifically for financial professionals, including CPAs, accountants, and business owners who require pristine data for analysis, reconciliation, or bookkeeping.

What sets this platform apart is its powerful combination of advanced Optical Character Recognition (OCR) and AI-driven parsing. It reliably processes not only native, text-based PDFs but also challenging scanned or image-based statements, which often cause other tools to fail. The software intelligently identifies and isolates key data fields like transaction dates, descriptions, credits, debits, and running balances, organizing them into clean, usable columns.

Standout Features and Practical Use Cases

The platform is engineered for efficiency. Users follow a simple three-step workflow: upload a document, instantly preview the extracted data for accuracy, and download the formatted spreadsheet. This process drastically cuts down on manual data entry, minimizes human error, and accelerates financial workflows.

- Financial Reconciliation: Accountants can process months or years of statements from multiple clients in a fraction of the time, simplifying bank reconciliation in accounting software.

- Loan Application Analysis: Lenders and underwriters can quickly digitize applicant bank statements to analyze cash flow, identify recurring payments, and assess financial stability without tedious manual work.

- Business Expense Tracking: Entrepreneurs and small business owners can convert their monthly statements to track expenses, categorize spending, and prepare for tax season with greater accuracy.

The platform’s commitment to security is a significant advantage. It uses robust encryption for all file transfers and, critically, does not retain user data after the conversion process is complete, ensuring financial information remains confidential. For a deeper dive into structuring your data, you can learn more about how to format bank statements effectively in Excel.

Pricing and Plan Tiers

Bank Statement Convert PDF offers flexible, tiered pricing to suit different user volumes:

| Plan Level | Monthly Price | Page Limit | Key Features |

|---|---|---|---|

| Basic | $29/month | 300 pages | Core conversion features |

| Standard | $49/month | 1,000 pages | Increased page limit, batch processing |

| Premium | $99/month | 4,000 pages | High volume, batch processing, priority support |

While batch processing is reserved for higher-tier plans, the generous page limits and exceptional accuracy make it a strong contender for any professional who regularly handles bank statement data.

Website: https://bankstatementconvertpdf.com

2. DocuClipper

DocuClipper positions itself as a high-accuracy, user-friendly tool specifically for financial document processing, making it an excellent piece of bank statement extraction software for accountants, bookkeepers, and small business owners. It excels at converting both scanned and digital bank statements into clean, structured data formats like Excel, CSV, or QBO. The platform’s standout feature is its impressive 99.6% data accuracy rate, which significantly reduces the manual verification time often required with other tools.

Its direct integrations with accounting platforms like QuickBooks, Xero, and Sage are a major advantage, automating the reconciliation process. This makes it a powerful asset for professionals managing multiple client accounts. The interface is clean and intuitive, allowing users to quickly upload and process documents without a steep learning curve. DocuClipper's ability to detect and separate transactions from multiple bank accounts within a single PDF is a practical, time-saving feature.

Key Features & Considerations

- Best For: Accountants, CPAs, and businesses needing to process high volumes of financial documents with maximum accuracy and minimal manual input.

- Pricing: Offers tiered pricing, including a free plan for low-volume use (up to 30 pages per month), with paid plans starting at $25 per month for higher volumes.

- Pros: Very high accuracy, seamless accounting software integration, and a user-friendly interface. Strong security with SOC 2 compliance.

- Cons: The lack of a mobile app for on-the-go receipt or statement scanning can be a limitation. Pay-per-page or monthly subscription models may not be cost-effective for very occasional users.

Website: https://www.docuclipper.com/

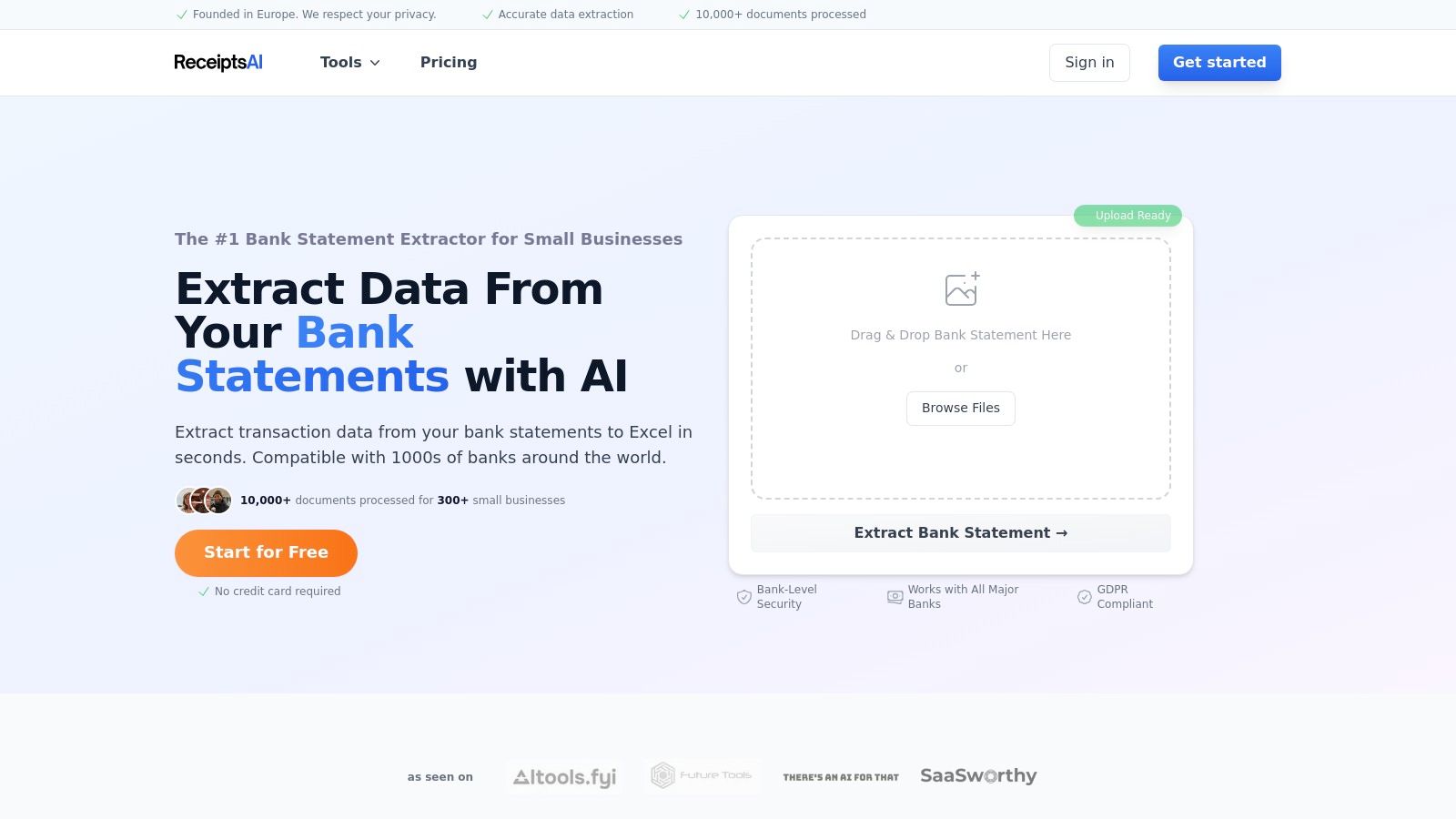

3. ReceiptsAI

ReceiptsAI offers a streamlined, AI-powered solution for converting bank statements into Excel, positioning itself as a highly accessible piece of bank statement extraction software. It emphasizes speed and simplicity, allowing users to upload a statement and receive structured transaction data within seconds. The platform supports a vast range of banks globally and goes beyond simple extraction by offering automated transaction categorization and basic cash flow forecasting tools, adding a layer of financial analysis to its core function.

The user experience is designed to be incredibly intuitive, catering to individuals and small businesses who may not have deep accounting expertise. Security is a key focus, with bank-level encryption and GDPR compliance ensuring that sensitive financial data is handled responsibly. By providing secure cloud storage and maintaining audit-ready records, ReceiptsAI serves as a reliable tool for both day-to-day bookkeeping and long-term financial management.

Key Features & Considerations

- Best For: Freelancers, solopreneurs, and small businesses looking for a fast, simple, and secure way to digitize bank statements without complex software.

- Pricing: A free plan is available for trial and very low-volume use (up to 30 pages per month). Paid subscriptions are required for higher volumes and advanced features.

- Pros: Very simple and intuitive interface, supports thousands of banks and multiple currencies, and includes a functional free plan for getting started.

- Cons: The free plan's 30-page limit is restrictive for regular business use. Advanced analytics and integration capabilities are less robust than some enterprise-focused competitors.

Website: https://receiptsai.com/tools/bank-statement-extractor?utm_source=openai

4. SparkReceipt

SparkReceipt is an AI-powered platform designed for both individuals and small businesses, making it a versatile piece of bank statement extraction software. It simplifies financial tracking by converting bank and credit card statements into organized, searchable transaction records. The platform's core strength lies in its user-friendly approach, offering instant data extraction from PDF, Excel, and CSV files without requiring technical expertise. This ease of use makes it highly accessible for freelancers, entrepreneurs, and those managing personal finances.

One of SparkReceipt's standout features is its ability to automatically match uploaded receipts with the corresponding transactions from extracted statements, streamlining expense management. It supports bulk processing, allowing users to upload multiple documents at once for efficient data handling. The platform also integrates with various accounting tools and offers a secure vault for long-term document storage, ensuring both connectivity and data safety. Its focus on affordability combined with robust functionality gives it a unique position in the market.

Key Features & Considerations

- Best For: Freelancers, small business owners, and individuals seeking an affordable, easy-to-use tool for managing expenses and bank statement data.

- Pricing: Known for its affordability, often featuring early-bird deals and straightforward pricing plans. It has a cap of 300 bank statement extraction credits per month.

- Pros: Very user-friendly for non-technical users, excellent customer satisfaction ratings, and a unique automatic receipt-matching feature.

- Cons: The monthly credit limit on bank statement extractions might be restrictive for high-volume users or larger businesses. Some advanced features may require extra setup.

Website: https://sparkreceipt.com/features/bank-statement-extractor/?utm_source=openai

5. Docsumo

Docsumo leverages powerful AI and intelligent OCR to offer a robust solution for automated data extraction. As a piece of bank statement extraction software, it is engineered to handle high volumes and complex document layouts, making it suitable for growing businesses and enterprises. The platform’s ability to accurately capture data from varied statement formats, including multi-currency documents, helps significantly reduce manual data entry and accelerates financial reconciliation workflows.

Its strength lies in its advanced data validation rules, which users can customize to flag discrepancies and ensure the integrity of the extracted information before it is exported. Docsumo provides seamless API integration with various ERP and accounting systems, positioning it as a scalable tool that can be embedded into existing financial processes. The platform is built to learn and improve, meaning its accuracy gets better over time as it processes more documents.

Key Features & Considerations

- Best For: Mid-sized to large enterprises looking for a scalable, AI-driven solution that can be customized and integrated into complex financial workflows.

- Pricing: Custom pricing based on document volume and specific needs. Users typically need to contact sales for a quote.

- Pros: High accuracy with intelligent OCR, excellent for handling complex and multi-currency statements, and highly scalable for business growth. Comprehensive security measures are in place.

- Cons: The initial setup and configuration can be complex and may require technical assistance. The pricing model may be a bit high for small businesses or individual users.

Website: https://www.docsumo.com/solutions/bank-statement-converter-software?utm_source=openai

6. InferIQ

InferIQ provides a specialized, AI-powered bank statement extraction software designed with a laser focus on U.S. bank statements. It excels at converting various unstructured formats, including PDFs and images, into clean, structured data through an exceptionally user-friendly web portal. The platform stands out by offering universal coverage for U.S. bank statements, aiming to eliminate the need for manual template creation and ensuring fast, accurate processing from the very first upload.

The interface is built for speed and simplicity, promising a zero learning curve for new users. A key differentiator is its human-in-the-loop verification process, which allows for manual correction of any potential errors, ensuring the final data output is visually precise and reliable. This makes it an effective tool for tasks like preparing a bank reconciliation statement. Its generous free tier is particularly attractive for freelancers or small businesses with moderate processing needs.

Key Features & Considerations

- Best For: Individuals and businesses in the U.S. seeking a straightforward, no-frills tool for quick and accurate bank statement conversion without complex setup.

- Pricing: Features a significant free plan allowing for the extraction of up to 100 pages per month, with custom enterprise plans available for higher volumes.

- Pros: Very generous free tier, high data accuracy with human-in-the-loop correction, and supports multiple file formats.

- Cons: Strictly limited to U.S. bank statements, which is a major drawback for international users. Complex or non-standard statements may still require some manual intervention.

Website: https://www.inferiq.ai/bank-statement-extractor/

7. BankStmtConverter

BankStmtConverter leverages AI to offer a specialized solution for converting financial data from bank statements into manageable formats. It stands out by adapting to numerous international bank formats and providing robust bulk processing capabilities, making it a viable piece of bank statement extraction software for users dealing with diverse financial documents. The platform places a strong emphasis on security, ensuring compliance with GDPR and CCPA and implementing automatic data deletion after processing to protect sensitive information.

A significant differentiator for BankStmtConverter is its one-time payment model, which grants perpetual use and avoids recurring subscription fees. This pricing structure is particularly appealing for small businesses or individual professionals who prefer a single, upfront investment. The software’s AI-driven extraction engine is designed to handle complex layouts, although its effectiveness can vary with certain non-standard bank statement designs.

Key Features & Considerations

- Best For: Freelancers, small business owners, and individuals seeking a non-subscription tool for occasional but varied bank statement conversions.

- Pricing: Features a one-time payment model for lifetime access, distinguishing it from the common subscription-based services.

- Pros: Cost-effective one-time purchase, strong security protocols with automatic data deletion, and support for a wide array of file formats.

- Cons: The user interface can feel complex for new users. Extraction accuracy may be limited for some unique or less common bank formats.

Website: https://www.softwareadvice.com/product/521042-BankstmtConverter/?utm_source=openai

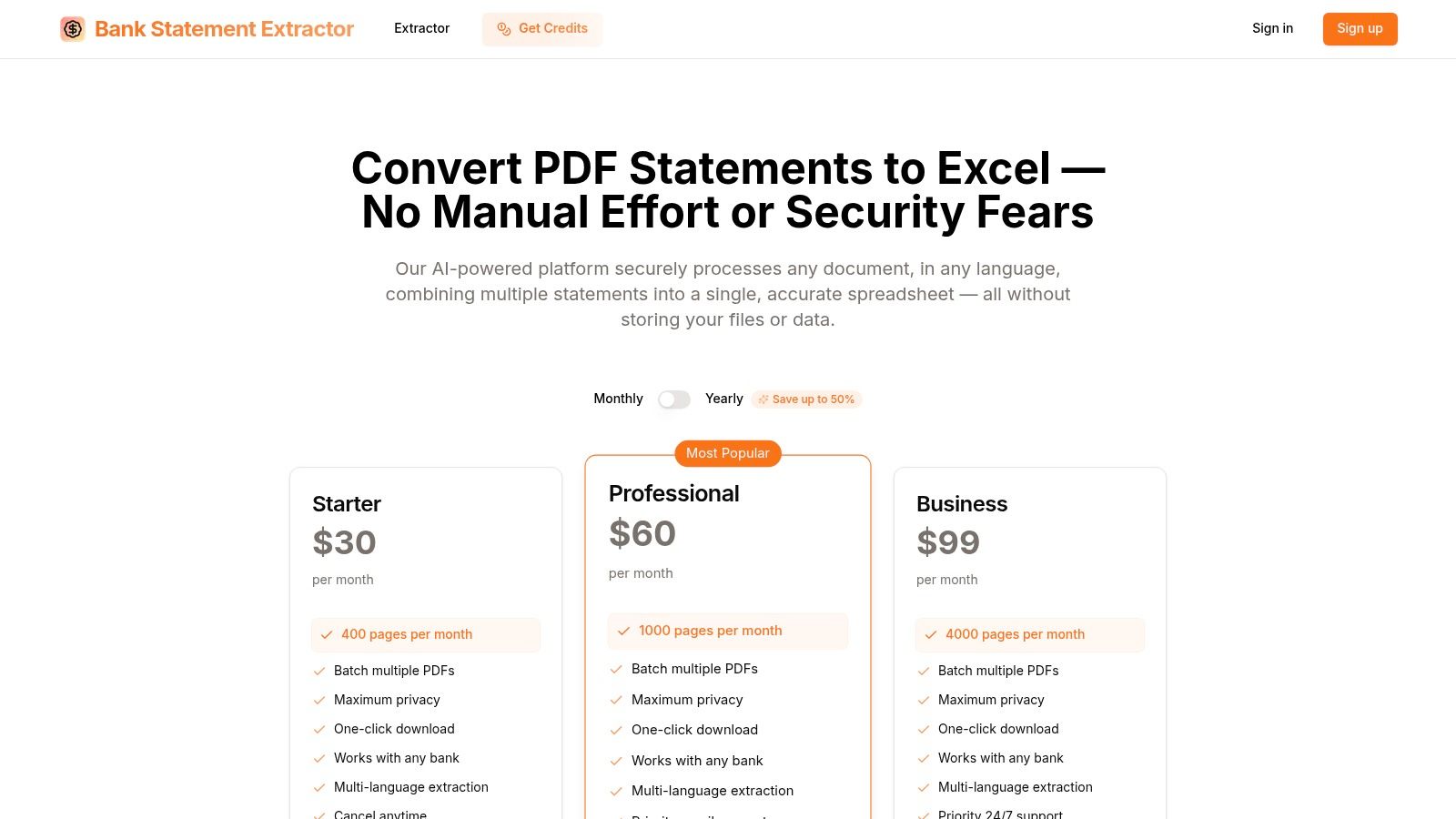

8. BankStatementExtract

BankStatementExtract offers a straightforward, AI-powered solution for professionals who need to convert PDF bank statements into Excel automatically. Its core strength lies in its simplicity and global reach, positioning itself as a reliable piece of bank statement extraction software for users dealing with documents from any bank worldwide. The platform's ability to handle multiple languages and perform batch processing makes it highly efficient for those managing diverse or international financial records.

A significant differentiator for BankStatementExtract is its strong commitment to user privacy; the service explicitly states it does not store any user data, which is a critical consideration for finance professionals handling sensitive information. While it automates the conversion process, it is important to note its capabilities are focused squarely on the PDF to Excel pipeline. Users looking for alternative formats might explore options like a dedicated PDF to CSV converter. The interface is designed for quick, no-fuss file uploads and processing.

Key Features & Considerations

- Best For: Freelance accountants, small businesses, and financial analysts who need a secure, fast, and globally compatible tool for one-off or batch conversions.

- Pricing: Flexible pricing plans are available based on usage, but there is no free plan for trial or very low-volume needs.

- Pros: Strong privacy focus with no data storage, supports statements from any bank and in multiple languages, and allows batch processing.

- Cons: Only processes PDF files, limiting its use for other document formats. The absence of a free plan may deter users who want to test the service first.

Website: https://www.bankstatementextract.com/pricing?utm_source=openai

9. Zenphi

Zenphi enters the market as a powerful, no-code Intelligent Document Processing (IDP) platform, offering a sophisticated solution for businesses deeply integrated into the Google Workspace ecosystem. It’s not just a standalone tool but a complete workflow automation engine, making it a unique piece of bank statement extraction software. Zenphi leverages advanced AI and OCR to extract data from bank statements and then uses that data to trigger complex, automated workflows, such as data matching, approvals, and entry into various business systems.

What sets Zenphi apart is its native integration with Google Drive, Sheets, and Gmail, allowing for seamless, end-to-end financial process automation without leaving the familiar Google environment. This makes it ideal for modern businesses that rely on cloud-based collaboration. The platform is designed for scalability, capable of handling everything from a small business’s monthly reconciliation to enterprise-level financial data processing with features like automated exception handling to manage discrepancies efficiently.

Key Features & Considerations

- Best For: Businesses of all sizes that are heavily invested in the Google Workspace and are looking for a highly customizable, no-code platform to automate their entire financial document lifecycle.

- Pricing: Custom pricing based on business needs; potential users must contact the sales team for a quote, as details are not publicly listed.

- Pros: Deep integration with Google Workspace, powerful no-code workflow automation capabilities, and highly scalable architecture.

- Cons: The lack of transparent pricing makes it difficult to evaluate costs upfront. Its powerful, feature-rich nature might present a steeper learning curve for users seeking a simple extraction tool.

Website: https://zenphi.com/bank-statement-processing-software/?utm_source=openai

10. Nanonets

Nanonets is a powerful AI-driven document automation platform that excels as bank statement extraction software for businesses that require high levels of customization and scalability. It uses advanced AI and machine learning to not only extract data but also to learn from new document layouts, continuously improving its accuracy over time. This makes it particularly effective for organizations dealing with a wide variety of statement formats from different banks, including complex or non-standard ones.

The platform's key differentiator is its ability to build and train custom extraction models. While it comes with pre-trained models for bank statements, users can fine-tune them or create new ones for unique requirements. Its robust API access allows for deep integration into existing enterprise workflows, CRMs, or accounting systems, enabling fully automated, end-to-end processing pipelines. This focus on customization and integration makes Nanonets a go-to choice for tech-savvy businesses and large-scale operations.

Key Features & Considerations

- Best For: Enterprises and tech-forward businesses needing a highly customizable and scalable solution that can be integrated directly into their workflows via API.

- Pricing: Provides a "Pro" plan starting at $499 per month for up to 5,000 pages, with custom enterprise pricing for higher volumes and advanced features.

- Pros: Highly accurate and customizable models, excellent scalability for processing large document volumes, and flexible API for seamless integration.

- Cons: The initial setup for custom models can require a learning curve and technical input. The pricing structure is geared more towards larger businesses than small firms or individual users.

Website: https://nanonets.com/

11. Docparser

Docparser is a powerful and highly flexible document data extraction tool that extends well beyond typical financial document processing. While not exclusively for finance, its robust parsing engine makes it a strong choice for businesses that need to extract structured data from a wide variety of documents, including bank statements. The platform's core strength lies in its customizable parsing rules, which allow users to create bespoke templates to pull specific data points from any PDF layout, making it an excellent piece of bank statement extraction software for custom workflows.

Unlike pre-trained tools, Docparser gives you complete control. Its advanced OCR technology can handle scanned documents, and its integration capabilities via webhooks, Zapier, or its native API mean you can send extracted data to virtually any cloud application. This makes it ideal for integrating transaction data into custom CRMs, databases, or business intelligence tools. By leveraging OCR for conversions, users can transform visual data into workable spreadsheet formats, which is a key process for data analysis.

Key Features & Considerations

- Best For: Tech-savvy businesses and developers needing a highly customizable solution to integrate bank statement data into custom applications or complex workflows.

- Pricing: Offers tiered monthly subscriptions based on document volume, starting from $39 per month for 100 documents, with custom pricing for enterprise needs.

- Pros: Highly flexible with custom parsing rules, supports a vast range of document types beyond just bank statements, and offers powerful integration options.

- Cons: The initial setup can be time-consuming as it requires manually defining rules for each new document layout. It has a steeper learning curve compared to plug-and-play tools.

Website: https://docparser.com

12. AutoEntry

AutoEntry, part of the Sage family, is a powerful cloud-based data entry automation tool designed to eliminate manual data input from financial documents. As a piece of bank statement extraction software, it excels at capturing and processing information from bank statements, credit card statements, receipts, and invoices. It automatically extracts key data points and categorizes them into the appropriate accounts, making it a valuable asset for bookkeepers and accounting firms aiming to streamline their workflows and improve efficiency.

The platform’s strength lies in its direct integration with major accounting packages like QuickBooks, Xero, and, naturally, Sage. This connection facilitates a seamless flow of data, reducing reconciliation times and minimizing errors. AutoEntry's mobile applications for both iOS and Android are a significant plus, allowing users to capture documents on the go. Its support for multi-currency transactions also makes it suitable for businesses with international operations.

Key Features & Considerations

- Best For: Accounting firms and businesses that are already part of the Sage ecosystem or need a robust, mobile-friendly solution for diverse document capture.

- Pricing: Operates on a credit-based subscription model. Plans start at around $13 per month, with credits used for each document processed. A free trial is available.

- Pros: Strong mobile apps for on-the-go data capture, seamless integration with top accounting software, and multi-currency support.

- Cons: The platform can have a steeper learning curve for users unfamiliar with accounting software. Document processing times can sometimes be inconsistent.

Website: https://www.autoentry.com

Bank Statement Extraction Software Comparison

| Software | Core Features ✨ | Accuracy & UX ★ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points 🏆 |

|---|---|---|---|---|---|

| Bank Statement Convert PDF 🏆 | Advanced OCR & AI, batch processing, multi-format support | ★★★★★ User-friendly, secure | $29-$99/mo flexible tiers 💰 | Financial pros, CPAs, entrepreneurs 👥 | Encrypted, no data retention, quick preview 🏆 |

| DocuClipper | Auto conversion to Excel/CSV/QBO, accounting integrations | ★★★★ 99.6% accuracy, fast | Higher cost, no mobile app | Accountants, SMBs 👥 | Automatic reconciliation, multi-account detect ✨ |

| ReceiptsAI | AI extraction, categorization, cash flow forecasting | ★★★★ Easy interface, multi-currency | Free plan limited, tiered subscriptions | SMEs, finance teams 👥 | Cash flow tools, GDPR compliant ✨ |

| SparkReceipt | PDF/Excel/CSV support, bulk processing, receipt matching | ★★★★ User-friendly, high satisfaction | Affordable, credit limits | Non-tech users, small businesses 👥 | Bulk processing, receipt matching ✨ |

| Docsumo | Intelligent OCR, advanced validation, multi-software support | ★★★★★ High accuracy | Higher pricing, training needed | Mid-large businesses 👥 | Complex layouts, multi-currency support ✨ |

| InferIQ | US bank focus, human-in-loop correction, fast extraction | ★★★★ High accuracy | Free 100 pages/mo, US only | US-based firms, finance teams 👥 | Free extraction limit, visual precision ✨ |

| BankStmtConverter | AI extraction, bulk processing, GDPR & CCPA compliance | ★★★ Good accuracy | One-time payment 🏆 | Businesses needing compliance 👥 | Perpetual license, strict privacy ✨ |

| BankStatementExtract | Multi-language, batch processing, privacy-focused | ★★★★ No manual effort | Flexible plans, no free option | Global users, privacy-conscious 👥 | No data storage, multi-language support ✨ |

| Zenphi | Automated workflows, OCR/AI powered, Google Workspace integ. | ★★★★ Scalable, no-code platform | Pricing not public | Enterprises, automation users 👥 | End-to-end workflow automation ✨ |

| Nanonets | AI OCR, customizable models, API access, bulk processing | ★★★★ High accuracy | Premium pricing for advanced features | Large volume users, developers 👥 | Custom models, API-first design ✨ |

| Docparser | Advanced OCR, customizable parsing, batch & integrations | ★★★★ Flexible, scalable | Varies, setup time needed | Developers, businesses 👥 | Custom templates, wide app integrations ✨ |

| AutoEntry | Data capture apps, multi-currency, auto categorization | ★★★★ Streamlines data entry | Subscription-based | SMBs, accountants 👥 | Mobile apps, multi-type document support ✨ |

Choosing the Right Automation Partner for Your Finances

The journey through the world of bank statement extraction software has revealed a landscape rich with specialized solutions. We've moved beyond the tedious era of manual data entry, where every line item was a potential error and every hour spent transcribing was an hour lost to strategic financial analysis. The tools we've explored, from straightforward converters like Bank Statement Convert PDF and BankStmtConverter to comprehensive platforms like Nanonets and AutoEntry, demonstrate that a solution exists for nearly every workflow, business size, and technical requirement.

The core takeaway is that there is no single "best" tool for everyone. The ideal choice is deeply personal to your operational needs. A solo CPA or a small business might find immense value in a dedicated, high-accuracy tool that focuses solely on converting statements without the complexity of a larger platform. Conversely, a large enterprise with an in-house development team may require the API-first approach of a solution like Docsumo or Zenphi to build custom, integrated financial workflows.

Making Your Decision: A Final Checklist

As you prepare to select and implement your chosen software, reflect on the critical factors discussed throughout this guide. Your decision should be a strategic one, aimed at maximizing efficiency and minimizing risk. Before you commit, consider these final points:

- Define Your Primary Use Case: Are you primarily focused on converting historical PDF bank statements for analysis, or do you need ongoing, real-time data capture for bookkeeping and reconciliation? A tool like DocuClipper excels at the latter, while dedicated converters are built for the former.

- Assess Your Transaction Volume: Your monthly transaction volume is a key determinant. Low-volume users might be well-served by a pay-as-you-go model, while high-volume firms will benefit from a subscription that offers a lower cost-per-page and batch processing capabilities.

- Prioritize Data Security: Handling financial data demands the highest level of security. Scrutinize each provider's security protocols, data handling policies, and compliance certifications. On-premise or desktop-based solutions offer an inherent security advantage by keeping your data off third-party servers entirely.

- Evaluate Integration Needs: How critical is seamless integration with your existing accounting software (like QuickBooks or Xero)? Tools like AutoEntry and ReceiptsAI are built around this functionality, whereas other platforms may require a more manual export-import process.

- Test Before You Invest: Never underestimate the value of a free trial. Use it to process a variety of your actual bank statements, including those with complex layouts or from different financial institutions. This real-world test is the ultimate measure of a tool's accuracy and suitability for your specific documents.

Ultimately, investing in the right bank statement extraction software is more than a simple software purchase. It is a strategic investment in accuracy, a commitment to efficiency, and a powerful step toward unlocking the insights buried within your financial data. By reclaiming countless hours and eliminating the persistent threat of human error, you empower yourself and your team to focus on what truly matters: driving financial growth and making informed, data-backed decisions.

Ready to eliminate manual data entry with unparalleled accuracy and security? Bank Statement Convert PDF is a desktop application specifically designed for professionals who demand precision and control. As the premier bank statement extraction software for converting PDF statements to Excel, it processes all your data locally on your computer, ensuring your sensitive financial information remains completely private. Experience the difference a dedicated, high-performance tool can make.