In the world of business, accurate financial reporting is not just a regulatory chore; it is the bedrock of strategic decision-making and sustainable growth. When stakeholders, from investors to internal leadership, can trust your numbers, they can make informed choices that propel the company forward. Inaccurate or delayed reports, however, create uncertainty, obscure risks, and undermine credibility, potentially leading to poor capital allocation, missed opportunities, and severe compliance penalties. Think of it as the company's central nervous system-without reliable signals, every other function operates at a disadvantage.

This guide moves beyond generic advice to provide a concrete, actionable framework of financial reporting best practices. We will break down seven critical pillars that transform your reporting from a simple compliance task into a powerful strategic asset. You will learn how to implement a standardized chart of accounts for ultimate clarity, execute a disciplined monthly close process, and establish robust reconciliation workflows that guarantee data integrity. We will also cover essential strategies for documentation, management review, internal controls, and ensuring the timely delivery of accurate reports. By adopting these practices, you can build a reporting foundation that supports operational excellence, enhances investor confidence, and provides a clear view of your financial health.

1. Standardized Chart of Accounts

A standardized chart of accounts (CoA) is the bedrock of reliable financial reporting. It provides a systematic, hierarchical framework for organizing all financial accounts, ensuring every transaction is classified consistently across the organization. This uniformity is crucial for generating accurate, comparable, and meaningful financial statements, making it an essential component of financial reporting best practices.

Without a standardized CoA, different departments or subsidiaries might record similar transactions under varying account names, leading to a chaotic and error-prone close process. For example, one team might log software subscriptions under "IT Expenses," while another uses "Software Licenses." This discrepancy creates confusion and requires manual, time-consuming reconciliation. A unified CoA eliminates this ambiguity, ensuring that everyone speaks the same financial language.

Why It Works and How to Implement It

A standardized CoA establishes a single source of truth for all financial data. This structure simplifies consolidation, improves analytical accuracy, and enhances internal controls by providing clear audit trails.

Key Insight: Global enterprises like Coca-Cola and Microsoft leverage a standardized CoA to maintain consistency across hundreds of countries and diverse business segments, enabling them to compare performance and consolidate financials seamlessly.

When implementing a standardized CoA, consider these actionable steps:

- Start with an Industry Template: Begin with a CoA template specific to your industry (e.g., manufacturing, SaaS, retail) and customize it to fit your unique operational needs.

- Plan for Growth: Design the account structure with future expansion in mind. Incorporate placeholders for potential new business lines, geographic regions, or product categories to avoid a complete overhaul later.

- Document Everything: Create a comprehensive guide that defines each account, explains its purpose, and provides clear examples of what should be posted to it. This documentation is vital for training and maintaining consistency.

- Ensure System Integration: Verify that your chosen CoA structure is fully compatible with your ERP, accounting software, and other financial systems to facilitate smooth data flow.

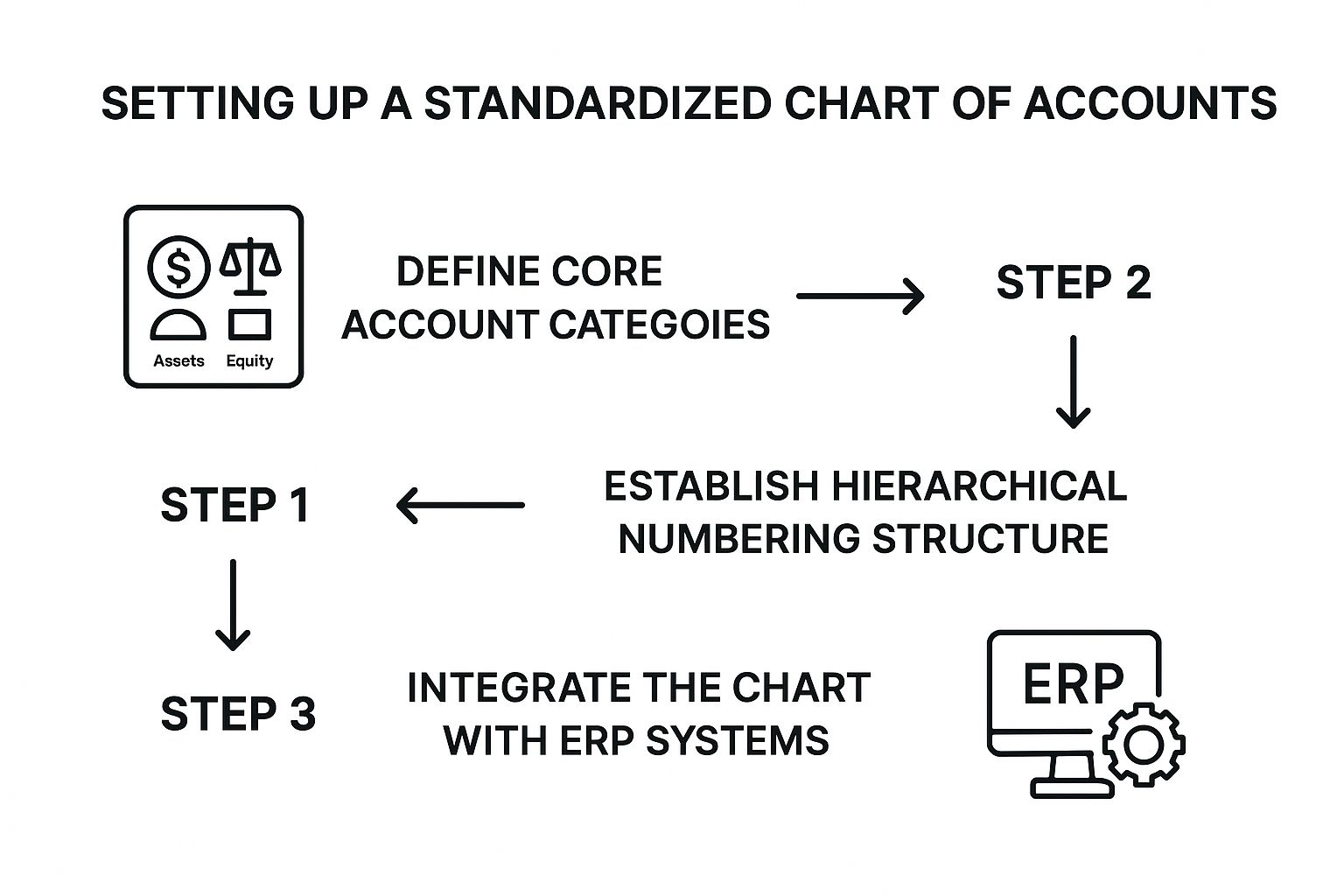

The following infographic illustrates the fundamental steps for establishing a standardized chart of accounts.

This process flow highlights how a logical, step-by-step approach-from high-level categorization to system integration-creates a robust and scalable financial architecture.

2. Monthly Financial Close Process

A disciplined monthly financial close process is a non-negotiable component of modern finance operations. It represents a systematic, time-bound procedure for completing all accounting activities at month-end to produce accurate and timely financial statements. This routine involves reconciling accounts, recording accruals, reviewing transactions, and generating reports within a strict timeframe, ensuring consistent and reliable outcomes.

Without a structured close, the accounting cycle can devolve into a chaotic, last-minute rush, introducing a high risk of errors and delaying critical business insights. A well-defined process transforms the month-end from a stressful bottleneck into a predictable and efficient function. This systematic approach is a cornerstone of effective financial reporting best practices, providing stakeholders with the timely data needed for strategic decision-making.

Why It Works and How to Implement It

A standardized monthly close process creates rhythm and predictability in the finance function. It reduces the likelihood of manual errors, accelerates reporting timelines, and strengthens internal controls by ensuring all necessary checks and balances are performed consistently. This allows the finance team to shift its focus from data wrangling to strategic analysis.

Key Insight: Leading companies demonstrate the power of an optimized close. Oracle closes its books globally in just four business days, while Cisco Systems has achieved a "virtual close" with daily reporting capabilities, and Johnson & Johnson maintains a five-day close across more than 250 worldwide subsidiaries.

To implement an effective monthly financial close process, consider these actionable steps:

- Create a Standardized Checklist: Develop a detailed, step-by-step checklist that outlines every task, responsible party, and deadline. This eliminates ambiguity and ensures no critical steps are missed.

- Leverage Automation: Use accounting software and specialized tools to automate routine and repetitive tasks like bank reconciliations, accrual entries, and intercompany transactions to reduce manual effort and errors.

- Establish Clear Roles: Assign specific responsibilities for each task in the close process. Clear ownership ensures accountability and helps identify and resolve bottlenecks quickly.

- Implement Continuous Accounting: Shift from a month-end crunch to a continuous model by performing reconciliations and data validation throughout the month. This distributes the workload and allows for early issue detection. For more details on this approach, explore these small business bookkeeping tips.

The following video provides a deeper dive into optimizing the month-end close.

By transforming the month-end close from a reactive scramble into a proactive, streamlined process, organizations can unlock faster, more accurate financial insights that drive better business performance.

3. Regular Account Reconciliations

Regular account reconciliation is the systematic process of comparing internal financial records against external statements-like those from banks, credit card companies, or vendors-to ensure they match. This fundamental control procedure is a cornerstone of financial reporting best practices because it verifies data accuracy, detects fraud, and identifies errors before they compound. By meticulously matching transactions and investigating discrepancies, companies maintain the integrity of their financial data.

Without regular reconciliations, errors like unrecorded payments, bank errors, or fraudulent withdrawals can go unnoticed, leading to inaccurate financial statements and poor business decisions. For instance, a missed invoice payment could result in damaged vendor relationships, while an undetected fraudulent transaction directly impacts cash flow. This process transforms accounting from a historical record-keeping function into a proactive tool for financial health and risk management. For a practical illustration, you can review a detailed bank reconciliation statement example.

Why It Works and How to Implement It

Routine reconciliations provide assurance that the cash balances, accounts receivable, and accounts payable reported on the balance sheet are correct and reliable. This builds trust with stakeholders and strengthens internal controls by creating a clear, documented trail of verification for every significant account.

Key Insight: Global financial institutions like JPMorgan Chase must reconcile millions of transactions daily to manage risk and comply with stringent regulations. Similarly, retail giants like Walmart perform real-time cash reconciliations across thousands of stores to optimize cash management and prevent loss.

To implement an effective reconciliation process, consider these actionable steps:

- Establish a Timely Cadence: Perform reconciliations promptly after a period closes, such as monthly for bank accounts and quarterly for less volatile balance sheet accounts. The sooner you reconcile, the easier it is to resolve issues.

- Utilize Three-Way Matching: For critical accounts like accounts payable, implement a three-way match that compares the purchase order, goods receipt note, and the vendor's invoice to verify transaction validity before payment.

- Automate Where Possible: Leverage electronic bank feeds and automated matching rules within your accounting software to handle high-volume, standard transactions, freeing up your team to focus on complex discrepancies.

- Document and Resolve: Maintain a clear log of all reconciling items, including their nature, amount, and the steps taken to resolve them. This documentation is essential for audits and internal review.

- Set Materiality Thresholds: Define a clear threshold for which discrepancies require immediate investigation. This helps prioritize efforts on significant issues rather than minor, inconsequential differences.

4. Comprehensive Documentation and Audit Trails

Comprehensive documentation and clear audit trails are the backbone of trustworthy financial reporting. This practice involves systematically creating and preserving detailed records that support every financial transaction and reporting decision, ensuring transparency and accountability. A complete audit trail provides a step-by-step history of all changes, approvals, and supporting evidence, making it one of the most critical financial reporting best practices.

In the absence of rigorous documentation, financial data lacks credibility and becomes difficult to verify. The infamous collapse of Enron serves as a stark warning, where a deliberate lack of proper documentation concealed massive fraud. Today, robust documentation is not just a best practice; it is a regulatory necessity. It provides historical context, justifies accounting treatments, and demonstrates compliance with standards like Sarbanes-Oxley (SOX).

Why It Works and How to Implement It

An unshakeable audit trail builds stakeholder confidence by proving the integrity of financial figures. It allows both internal and external auditors to trace transactions from the financial statements back to their source documents, confirming their validity. This level of transparency is essential for mitigating risk and preventing fraudulent activities.

Key Insight: To meet stringent regulatory demands, firms like Goldman Sachs maintain meticulous digital transaction records, while companies like Salesforce implement comprehensive documentation for every revenue recognition decision, ensuring complete transparency and compliance.

When implementing a documentation strategy, consider these actionable steps:

- Implement a Document Management System (DMS): Use a centralized, cloud-based DMS with robust search capabilities and version control to store and manage all financial documents securely.

- Establish Clear Retention Policies: Define and enforce document retention policies that align with legal, regulatory, and operational requirements for different types of records, such as bank statements.

- Automate Approval Workflows: Leverage your accounting or ERP system to create electronic workflows that automatically capture and timestamp approvals for journal entries, purchase orders, and expense reports.

- Standardize Documentation Requirements: Train staff on what constitutes complete documentation for various transaction types. For example, specify that every vendor payment must include an invoice, a purchase order, and proof of receipt.

- Test Retrieval Processes Regularly: Periodically conduct drills to test how quickly and accurately your team can retrieve specific documents for an audit request, identifying and fixing any process gaps. You can learn more about standardizing document formats on bankstatementconvertpdf.com.

5. Management Review and Analysis

A formal Management Review and Analysis process transforms raw financial data into strategic business intelligence. It is a structured practice where senior leadership systematically reviews financial results, scrutinizes variances against budgets and forecasts, and provides written commentary explaining performance drivers. This ensures high-level oversight and adds a crucial narrative layer to the numbers, making it one of the most impactful financial reporting best practices.

Without this critical review, financial reports are just tables of figures, leaving stakeholders to guess the story behind the data. A structured analysis provides the "why" behind the "what," identifying emerging trends, highlighting operational issues, and giving investors, lenders, and internal teams meaningful context. It bridges the gap between accounting outputs and strategic decision-making, ensuring that the entire organization is aligned on performance realities.

Why It Works and How to Implement It

This practice fosters accountability and transparency by forcing leadership to confront and explain performance, both good and bad. It builds stakeholder trust by providing a clear, honest assessment of the business's health and trajectory, moving beyond mere compliance to deliver genuine insight.

Key Insight: Warren Buffett's annual letters to Berkshire Hathaway shareholders are a masterclass in management analysis. He provides detailed, candid commentary on business performance, successes, and failures, offering unparalleled context that has become a gold standard for transparent corporate communication.

To implement a robust Management Review and Analysis process, consider these steps:

- Focus on Key Drivers: Center the analysis on the key performance indicators (KPIs) and business drivers that truly matter to your operational success, rather than getting lost in minor account fluctuations.

- Balance Quantitative and Qualitative: Support every number with a narrative. Use quantitative data to identify a variance, then provide qualitative insights to explain its root cause and business implications.

- Benchmark Your Performance: Compare results not only to internal budgets but also to industry benchmarks and competitor performance. This provides crucial external context and highlights areas of competitive advantage or weakness.

- Address Variances Transparently: Discuss both positive and negative variances with equal candor. Explaining challenges openly builds credibility and demonstrates that management has a clear-eyed view of the business.

- Include Forward-Looking Commentary: Where appropriate and permissible, provide thoughtful commentary on future outlook, potential risks, and strategic initiatives. This helps stakeholders understand the company's direction and management's plan for navigating the future.

6. Internal Controls and Segregation of Duties

A robust framework of internal controls, with segregation of duties at its core, is a non-negotiable component of trustworthy financial reporting. This system involves a set of policies and procedures designed to prevent errors and deter fraud by ensuring no single individual has control over all aspects of a financial transaction. This principle is fundamental to maintaining the integrity of financial data and is a cornerstone of financial reporting best practices.

Without proper segregation of duties, a single employee could potentially authorize a payment, record it in the ledger, and reconcile the bank account, creating significant opportunities for misappropriation or concealment of errors. For example, an employee could create a fictitious vendor, approve an invoice, and issue payment to themselves. By separating these responsibilities among different people, you create a system of checks and balances that significantly reduces this risk.

Why It Works and How to Implement It

Segregation of duties mitigates the risk of both intentional fraud and unintentional error by requiring collaboration and creating inherent oversight. This structure builds confidence among stakeholders, including investors and auditors, that financial statements are reliable and assets are protected.

Key Insight: In the wake of major accounting scandals, public companies subject to the Sarbanes-Oxley Act (SOX) were mandated to implement and document stringent internal controls. This led to widespread adoption of detailed segregation of duties, with companies like IBM and Bank of America meticulously separating functions like transaction authorization, custody of assets, and record-keeping across their global operations.

When implementing internal controls and segregation of duties, consider these actionable steps:

- Document All Procedures: Clearly map out key financial processes (e.g., accounts payable, payroll) and define the distinct roles and responsibilities within each workflow. This documentation serves as a guide for employees and a reference for auditors.

- Leverage Technology for Enforcement: Use your ERP or accounting software to enforce controls systemically. Configure user permissions to restrict access so that individuals can only perform their assigned functions, preventing unauthorized overrides.

- Regularly Test Control Effectiveness: Periodically conduct internal audits or walk-throughs to test whether controls are operating as designed. This proactive approach helps identify and remediate weaknesses before they can be exploited.

- Balance Control with Efficiency: In smaller organizations where extensive segregation is difficult, implement compensating controls like mandatory management review of transaction reports or outsourcing specific functions like payroll to a third-party provider.

7. Timely and Accurate Reporting

Delivering financial reports that are both punctual and precise is a cornerstone of effective financial management. This practice ensures that stakeholders receive reliable information within established deadlines, empowering them to make informed, strategic decisions. Adhering to this dual mandate of speed and accuracy is a critical component of financial reporting best practices.

Without a commitment to timeliness and accuracy, financial reporting loses its value. Delayed reports can render data obsolete, leading to missed opportunities or poor decisions based on outdated information. Similarly, inaccurate reports erode trust and can have severe consequences, from flawed operational planning to regulatory penalties. The goal is to create a rhythm where dependability is the standard.

Why It Works and How to Implement It

A disciplined approach to timely and accurate reporting builds credibility with investors, lenders, and internal leadership. It fosters a culture of accountability and high performance within the finance team, transforming reporting from a reactive, chaotic scramble into a predictable, value-added process.

Key Insight: Public companies operate under strict SEC deadlines for 10-K and 10-Q filings, a regulatory requirement that forces a high level of process efficiency. Similarly, leading tech firms like Microsoft provide detailed business segment reports to internal management within five days of the month's end, enabling swift strategic adjustments.

When implementing a framework for timely and accurate reporting, consider these actionable steps:

- Establish Realistic Deadlines: Set a clear reporting calendar with challenging but achievable deadlines for each stage of the closing process. Communicate these timelines across the organization to ensure all stakeholders provide necessary data on time.

- Invest in Automation: Use technology to automate repetitive tasks like data entry, reconciliations, and report generation. Tools that can quickly convert financial documents, such as a PDF to CSV converter, are invaluable for speeding up data preparation.

- Implement Review Stages: Build multiple layers of review into your process. A preliminary review can catch obvious errors early, while a final management review ensures the narrative aligns with the data before distribution.

- Cross-Train Your Team: Avoid bottlenecks by cross-training staff on critical reporting functions. This ensures that the absence of one person does not derail the entire closing schedule.

- Monitor Performance: Track key performance indicators (KPIs) like "days to close" and "number of post-close adjustments." Use this data to identify inefficiencies and continuously refine your reporting workflow.

Financial Reporting Best Practices Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Standardized Chart of Accounts | High – requires detailed planning and setup | Moderate – needs trained accounting staff | Consistent financial reporting and accurate consolidation | Large/multi-entity organizations needing uniformity | Ensures consistency and reduces recording errors |

| Monthly Financial Close Process | Medium to High – tight timelines and coordination | High – cross-department effort and overtime possible | Timely, accurate financial reports within deadlines | Companies with strict month-end reporting cycles | Improves accuracy and cash flow management |

| Regular Account Reconciliations | Medium – repetitive and detailed manual work | Moderate to High – skilled personnel needed | Early error/fraud detection and accurate financial data | Organizations requiring strong audit controls | Detects discrepancies and strengthens controls |

| Comprehensive Documentation & Audit Trails | Medium – requires systematic record keeping | Moderate – investment in storage and tech | Transparent, auditable financial processes | Highly regulated industries and audit-heavy firms | Facilitates audits and regulatory compliance |

| Management Review and Analysis | Medium – requires managerial time and coordination | Moderate – involves senior management effort | Better strategic insight and stakeholder communication | Firms emphasizing performance analysis and oversight | Enhances credibility and decision-making |

| Internal Controls & Segregation of Duties | High – complex policies and role definitions | High – may increase staffing and tech needs | Minimized fraud risk and improved accuracy | All sizes, especially public companies and high-risk environments | Significantly reduces fraud and errors |

| Timely and Accurate Reporting | Medium – process optimization and quality control | Moderate – needs coordination and tech | Reliable financial info delivered on schedule | Organizations needing dependable, frequent reporting | Builds trust and supports strategic planning |

Transforming Your Reporting from a Task to a Strategic Advantage

Navigating the landscape of financial reporting can often feel like a complex, obligatory task. However, as we have explored, embracing a structured approach built on proven best practices transforms this function from a simple necessity into a powerful strategic asset. The journey from raw data to insightful reports is not just about compliance; it is about building a foundation of trust, clarity, and control that empowers confident decision-making across your entire organization.

The key takeaways from this guide are not isolated tactics but interconnected pillars supporting a robust financial framework. From a Standardized Chart of Accounts that creates a universal language for your transactions to a disciplined Monthly Financial Close Process that ensures timeliness, each practice builds upon the last. Consistent Account Reconciliations act as your financial immune system, detecting errors early, while comprehensive Documentation provides the transparent audit trail necessary for verification and accountability.

From Compliance to Competitive Edge

Ultimately, implementing these financial reporting best practices is about shifting your perspective. It’s about moving beyond the historical view of what happened and toward a forward-looking analysis of what is possible. When Management Review becomes a deep, analytical dive rather than a cursory glance, and strong Internal Controls protect your assets from risk, your financial reports evolve. They become predictive tools that highlight opportunities, reveal inefficiencies, and guide strategic pivots.

This transformation requires commitment, but the return on investment is immense. Accurate, timely, and insightful reporting builds credibility with stakeholders, from investors and lenders to internal leadership. It provides the reliable data needed to optimize cash flow, manage expenses, and capitalize on growth opportunities with precision.

Your Actionable Next Steps

To begin this transformation, do not try to implement everything at once. Instead, focus on a phased approach:

- Assess Your Current State: Use the practices outlined in this article as a benchmark. Where are your biggest gaps? Is it a lack of standardized accounts, an inconsistent close process, or weak documentation?

- Prioritize for Impact: Identify the one or two practices that will deliver the most significant improvement to your operations. For many, formalizing the monthly close or automating reconciliations provides the quickest and most substantial win.

- Create a Roadmap: Develop a clear, step-by-step plan for implementation. Assign responsibilities, set realistic timelines, and define what success looks like for each new process.

By systematically embedding these principles into your daily operations, you do more than just clean up your books. You cultivate a culture of financial discipline and strategic foresight, turning your finance function into a true engine for sustainable growth.

Ready to streamline one of the most tedious parts of financial reporting? Start by eliminating manual data entry from bank statements. With Bank Statement Convert PDF, you can instantly convert any PDF bank statement into an Excel spreadsheet, making reconciliations and data analysis faster and more accurate. Visit Bank Statement Convert PDF to see how our tool can support your financial reporting best practices today.