In the world of modern finance, manual bank reconciliation is an outdated bottleneck. Tedious data entry, the high risk of human error, and countless hours spent matching transactions are no longer sustainable for competitive businesses. This inefficiency directly impacts your bottom line, creating delays in financial reporting and obscuring your true cash position. The solution lies in dedicated automated bank reconciliation software, which transforms this painstaking process into a streamlined, strategic function.

This guide gets straight to the point. We’ve evaluated 12 of the top platforms to help you find the right tool for your specific needs, whether you are a small business owner, a CPA, or a financial controller in a large enterprise. Forget generic marketing copy; we provide an honest assessment of each product’s core strengths, practical limitations, and ideal use cases. You will find a detailed breakdown covering everything from implementation complexity to unique features that solve specific accounting challenges.

Each review includes screenshots for a clear visual reference and direct links to explore the software further. Our goal is simple: to equip you with the detailed, practical information needed to select the best automated bank reconciliation software and reclaim the time and accuracy your finance team deserves.

1. QuickBooks Online

QuickBooks Online (QBO) is a dominant force in the accounting software market, offering more than just basic bookkeeping. For businesses seeking a comprehensive financial hub, its automated bank reconciliation software capabilities are a core strength. By connecting directly to over 14,000 financial institutions, QBO automatically imports transactions daily, drastically reducing manual data entry and the potential for human error. This makes it an excellent choice for small to medium-sized businesses that need an all-in-one solution.

The platform uses AI-powered suggestions to categorize expenses and match them with existing invoices or bills, which significantly speeds up the reconciliation process. This smart matching learns from your past behavior, becoming more accurate over time.

Key Reconciliation Features & Use Case

QuickBooks Online excels for businesses that require a single platform for invoicing, payroll, and reporting alongside reconciliation. The user-friendly interface is a major plus, although new users may face a slight learning curve due to the sheer number of features. The mobile app is particularly useful for business owners who need to manage finances on the go, allowing them to approve matches and categorize transactions from anywhere.

- Best for: Small to medium-sized businesses needing a complete accounting ecosystem.

- Pricing: Plans range from Simple Start (around $30/month) to Advanced (around $200/month), with more advanced reconciliation and reporting features in higher tiers.

- Website: QuickBooks Online

2. Xero

Xero has carved out a strong reputation as a user-friendly and aesthetically pleasing accounting platform, making its automated bank reconciliation software a top choice for modern small businesses. By establishing direct bank feeds, Xero pulls in transactions daily, which dramatically minimizes manual data entry. Its standout feature is an incredibly intuitive reconciliation interface that presents bank transactions and suggested matches side-by-side, making the process feel less like a chore and more like a simple review.

The system's smart matching algorithm suggests connections between bank lines and invoices or bills, and it learns from your categorization habits to improve its accuracy. For businesses focused on collaboration and a clean user experience, Xero provides a refreshing alternative to more complex systems. You can learn more about how this works by viewing a bank reconciliation statement example.

Key Reconciliation Features & Use Case

Xero is ideal for service-based small businesses, startups, and creative agencies that value a modern interface and strong mobile capabilities. Its reconciliation screen allows for bulk matching, which is a significant time-saver for businesses with high transaction volumes. While its integration library is robust, it can be less extensive than some competitors, and U.S. users might find bank feed support is less comprehensive than for other regions.

- Best for: Small businesses and freelancers who prioritize a sleek design and collaborative features.

- Pricing: Plans start from Early (around $15/month) to Established (around $78/month), with reconciliation features available across all tiers.

- Website: Xero

3. Zoho Books

Zoho Books is a powerful cloud accounting platform known for its affordability and deep integration within the extensive Zoho business suite. Its automated bank reconciliation software features are particularly robust, making it a standout choice for businesses that want more than just basic bookkeeping. By automatically fetching bank and credit card transactions, it eliminates tedious manual data entry and sets the stage for a streamlined reconciliation process. The system is designed to handle high transaction volumes with ease.

The platform excels at automation, allowing users to create custom rules that automatically categorize transactions based on specific criteria. For instance, you can set a rule to always categorize payments to a specific vendor as "Office Supplies," which significantly reduces manual intervention and ensures consistency in your financial records.

Key Reconciliation Features & Use Case

Zoho Books is ideal for small to medium-sized businesses already using or planning to use other Zoho applications like Zoho CRM or Zoho Projects. This integration creates a seamless flow of information across the entire business. Its user-friendly interface and real-time dashboards provide a clear view of financial health, while its bulk reconciliation capabilities save significant time for businesses with numerous daily transactions. Although its U.S. market presence is smaller than some competitors, its feature set is highly competitive.

- Best for: Businesses invested in the Zoho ecosystem seeking powerful automation and affordability.

- Pricing: Offers a free plan for very small businesses. Paid plans range from Standard (around $20/month) to Ultimate (around $275/month), with more advanced automation in higher tiers.

- Website: Zoho Books

4. ReconArt

ReconArt positions itself as a specialized, enterprise-grade solution focused entirely on reconciliation. Unlike all-in-one accounting suites, ReconArt is a dedicated automated bank reconciliation software built to handle high-volume, complex matching scenarios. It’s highly scalable, serving businesses from mid-sized companies to large global corporations that need a powerful, standalone tool to manage intricate reconciliation processes across various account types, including bank accounts, vendor statements, and intercompany transactions.

The platform excels at managing the entire reconciliation lifecycle, from automated data import and normalization to sophisticated, rule-based matching. Its strength lies in its customization, allowing finance teams to configure rules and workflows specific to their operational needs, making it a powerful choice for organizations with unique or demanding reconciliation requirements. You can learn more about its capabilities in our guide to bank statement extraction software.

Key Reconciliation Features & Use Case

ReconArt is ideal for companies that have outgrown the reconciliation capabilities of their ERP or accounting system. Its exception management workflow is a standout feature, providing clear, actionable steps for resolving discrepancies, complete with audit trails and user assignments. The intuitive interface is often praised, which helps shorten the learning curve for a tool with such deep functionality.

- Best for: Medium to large enterprises needing a dedicated, high-volume reconciliation and exception management platform.

- Pricing: Custom quote-based pricing; not publicly disclosed. It is generally positioned as an enterprise solution.

- Website: ReconArt

5. BlackLine

BlackLine is an enterprise-grade, cloud-based platform designed to automate and control the entire financial close process. Its capabilities as an automated bank reconciliation software are particularly powerful for large organizations managing high transaction volumes across multiple entities and currencies. By centralizing reconciliation activities, BlackLine provides unmatched visibility and control, shifting finance teams from tedious manual work to strategic analysis. The system is engineered for complexity, handling intricate multi-way matching scenarios that go far beyond standard bookkeeping tools.

The platform uses a rules-based engine that users can configure to automate matching for even the most complex transactions. This ensures consistency and adherence to internal controls, which is critical for publicly traded companies and those facing stringent audits. Its robust workflow and task management features ensure every reconciliation is assigned, reviewed, and approved on schedule.

Key Reconciliation Features & Use Case

BlackLine excels in environments where compliance and auditability are paramount. It provides a complete, unalterable audit trail for every action taken within the system. While its comprehensive nature can mean a more involved implementation process, the payoff is a highly scalable and controlled reconciliation environment. For large enterprises aiming to standardize their closing procedures, BlackLine's structured approach is a significant advantage, supporting key financial reporting best practices.

- Best for: Large enterprises and corporations with complex, high-volume reconciliation needs and strict compliance requirements.

- Pricing: Pricing is customized based on the modules selected and the size of the organization. A direct quote is required.

- Website: BlackLine

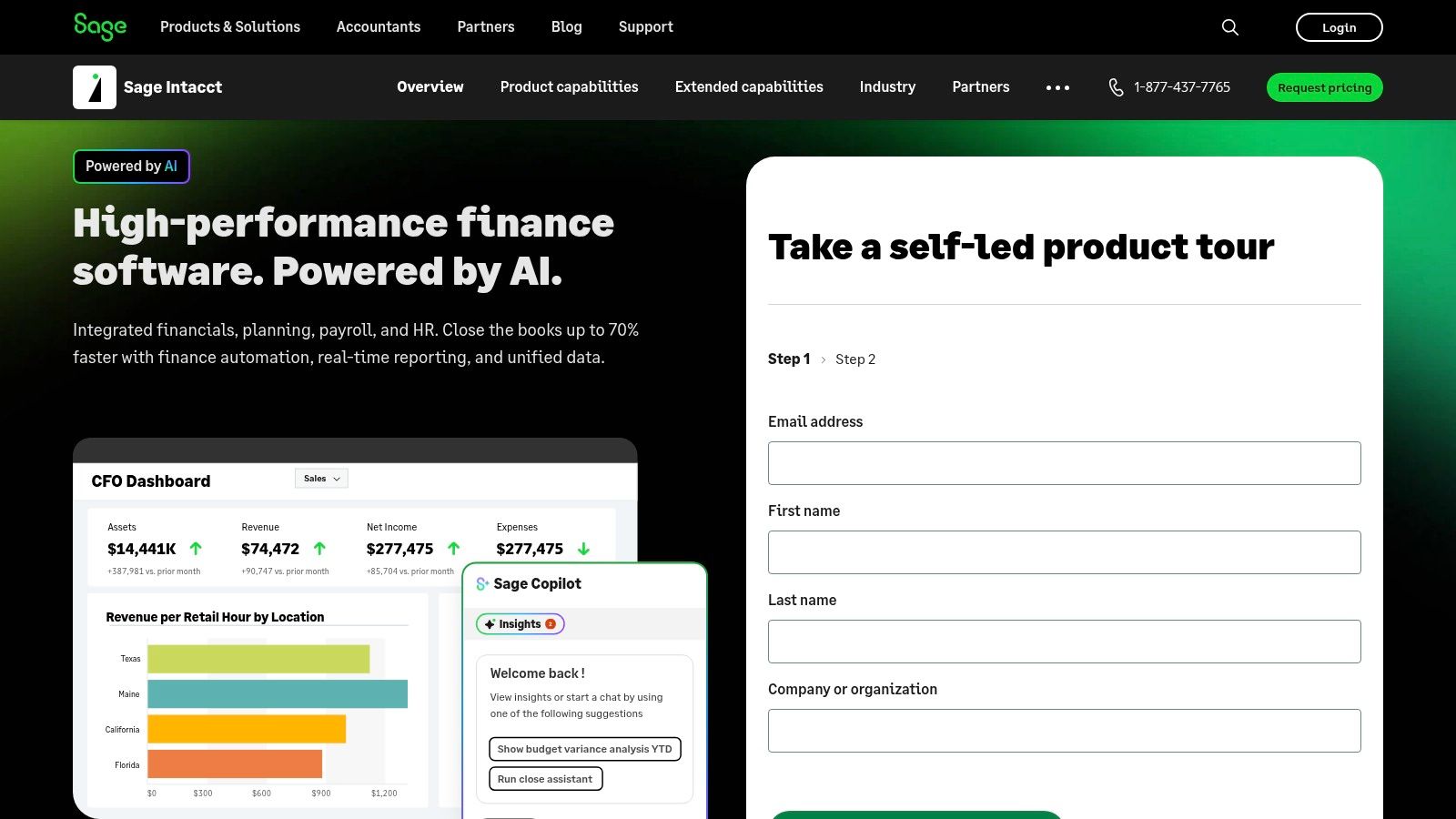

6. Sage Intacct

Sage Intacct is a powerful, cloud-based financial management platform designed for growing mid-market companies that have outgrown basic accounting software. Its automated bank reconciliation software features are built for complexity, offering robust automation that handles high transaction volumes and multi-entity consolidation with ease. By connecting directly to thousands of financial institutions, Sage Intacct automates the import of bank data, streamlining the reconciliation process for businesses with sophisticated financial structures.

The platform's key differentiator is its advanced dimensionality, which allows for detailed transaction tagging and reporting far beyond standard categorization. This provides deeper financial insights directly from the reconciliation workflow, making it ideal for data-driven organizations.

Key Reconciliation Features & Use Case

Sage Intacct excels for organizations managing multiple business units, currencies, or locations, as it can reconcile accounts across all entities from a single, consolidated view. The system’s flexible, API-driven architecture allows for extensive integration with other business applications like Salesforce and various payroll systems, creating a truly unified financial ecosystem. While its complexity can be a drawback for small businesses, its scalability is a major asset for companies on a rapid growth trajectory.

- Best for: Mid-sized businesses and enterprises with complex, multi-entity financial operations.

- Pricing: Custom pricing based on business needs; not publicly disclosed. A personalized quote is required.

- Website: Sage Intacct

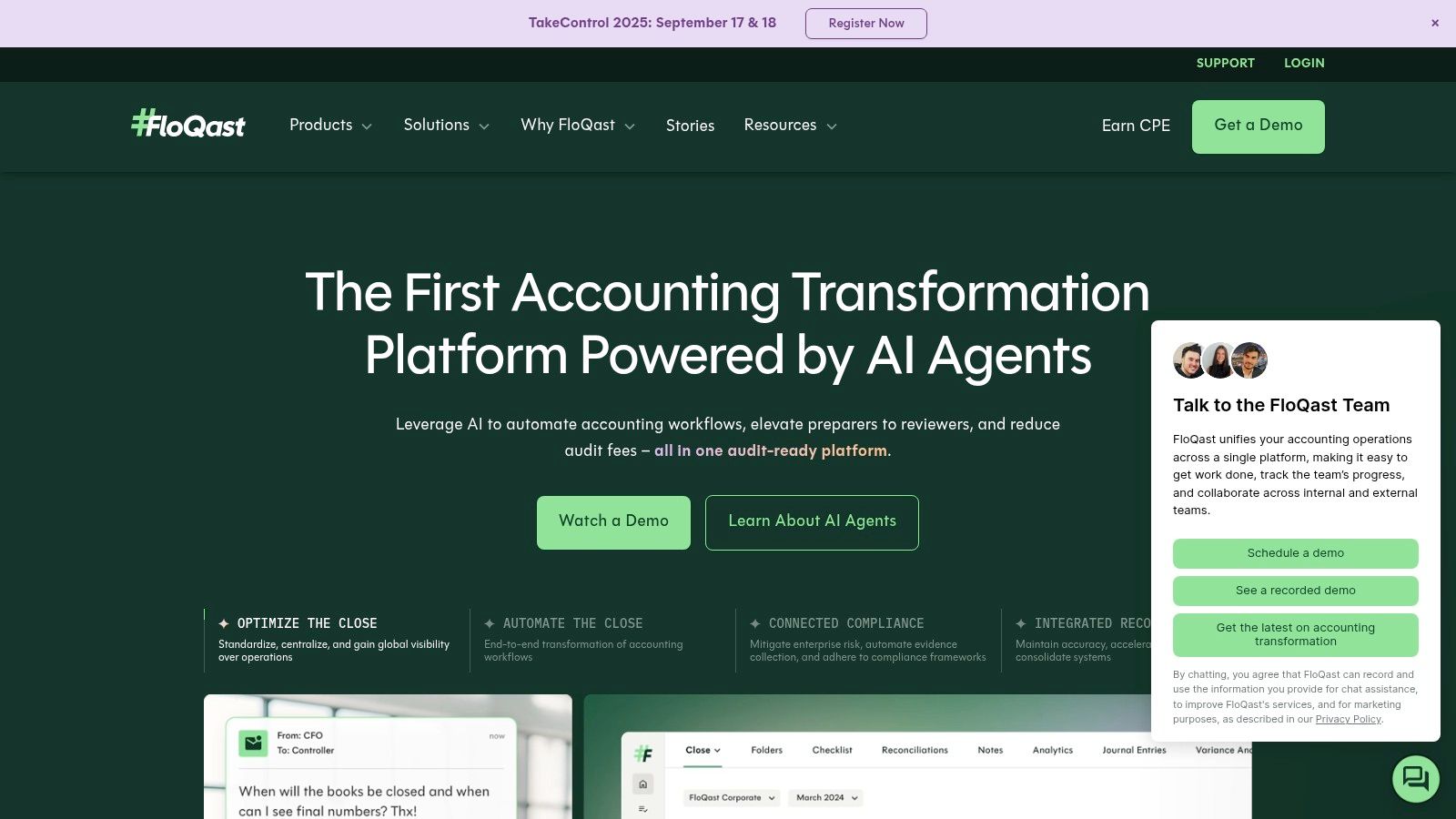

7. FloQast

FloQast is a cloud-based financial close management solution built by accountants, for accountants. While it offers a suite of tools for the entire close process, its automated bank reconciliation software capabilities are specifically designed for mid-sized to large enterprises. FloQast stands out by focusing on centralizing and streamlining complex reconciliation workflows, integrating directly with your existing ERP to pull data and automate matching, which dramatically accelerates month-end close.

The platform's AI-assisted intelligent matching, known as AutoRec, learns from user behavior to handle even complex reconciliations like amortization and depreciation schedules. This focus on high-volume, complex transactions and creating clear, audit-ready documentation makes it a powerful tool for scaling accounting teams.

Key Reconciliation Features & Use Case

FloQast is ideal for accounting departments that need to enhance their existing ERP rather than replace it. The platform provides a centralized management hub, offering clear visibility into the status of all reconciliations, which is crucial for controllers and CFOs. The customizable workflows and easy implementation process are significant advantages, allowing teams to get up and running quickly. However, its enterprise-grade features and pricing structure may not be suitable for smaller businesses.

- Best for: Mid-market and enterprise companies looking to streamline the financial close and improve audit readiness.

- Pricing: Custom pricing based on company size and needs. A demo is required to get a quote.

- Website: FloQast

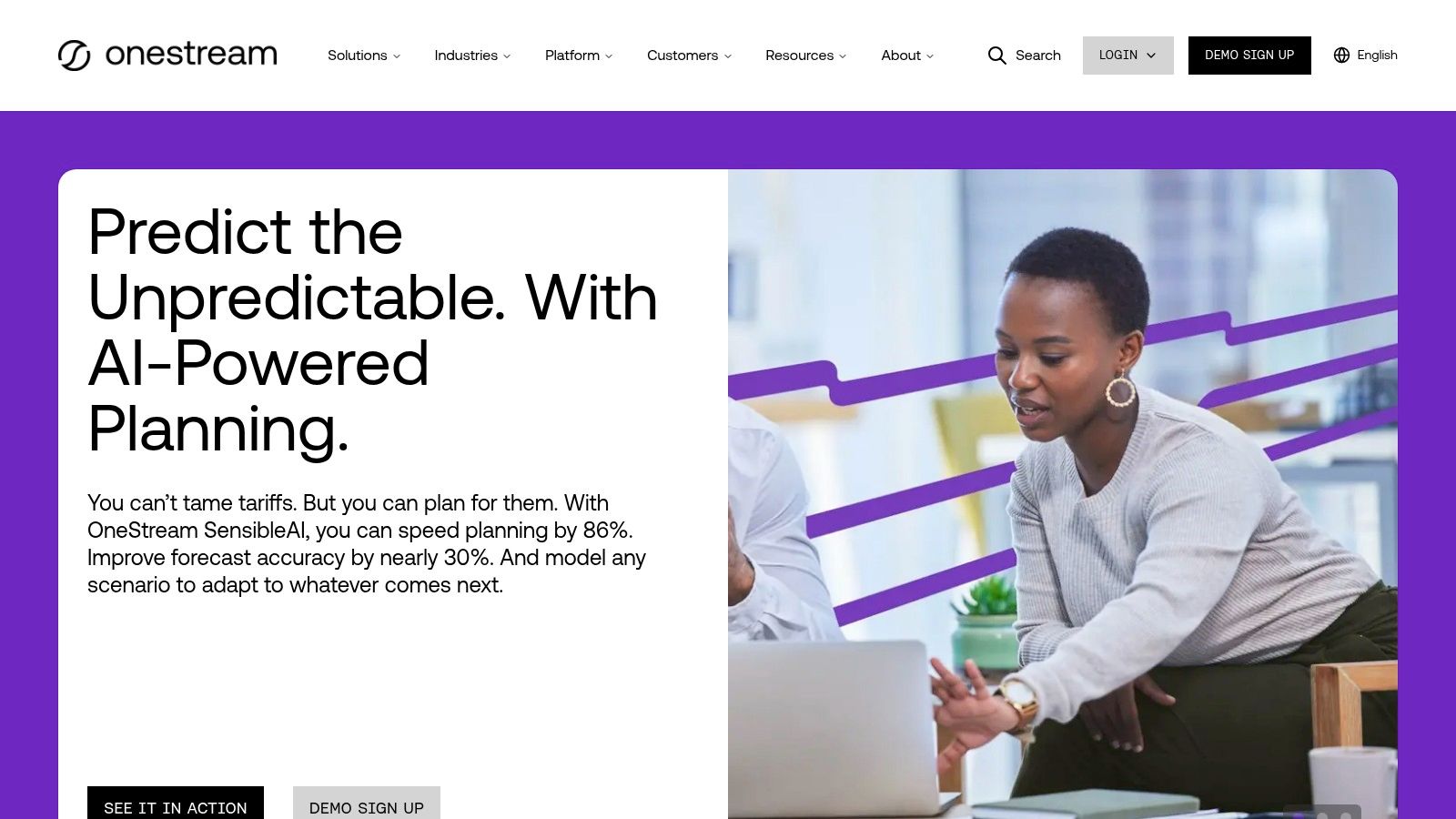

8. OneStream

OneStream delivers a powerful, unified platform that goes beyond standard bookkeeping, positioning its automated bank reconciliation software as a component of a larger corporate performance management (CPM) strategy. It is engineered for large, complex enterprises that require stringent internal controls and deep financial intelligence. The platform’s core strength lies in its single-source approach, pulling data directly from the trial balance to ensure consistency across reconciliation, reporting, and consolidation tasks.

This integrated design helps large finance teams eliminate data silos and reduce reconciliation times while enhancing compliance. OneStream’s ability to unify complex financial processes into one application makes it a standout choice for corporations managing multiple entities or facing rigorous audit requirements.

Key Reconciliation Features & Use Case

OneStream is ideal for large enterprises where reconciliation is tightly linked to financial close, planning, and regulatory reporting. Its built-in transaction matching and risk-based reporting allow teams to focus on high-risk accounts and exceptions, improving efficiency and control. While the platform’s extensive capabilities offer immense value, they also come with a significant learning curve and a potentially time-consuming implementation process. The powerful analytics provide proactive risk identification, a critical feature for maintaining financial integrity in a large-scale organization.

- Best for: Large, global enterprises needing a unified platform for financial close, reporting, and compliance.

- Pricing: Custom pricing based on the number of users, applications, and implementation needs. A significant investment is typically required.

- Website: OneStream

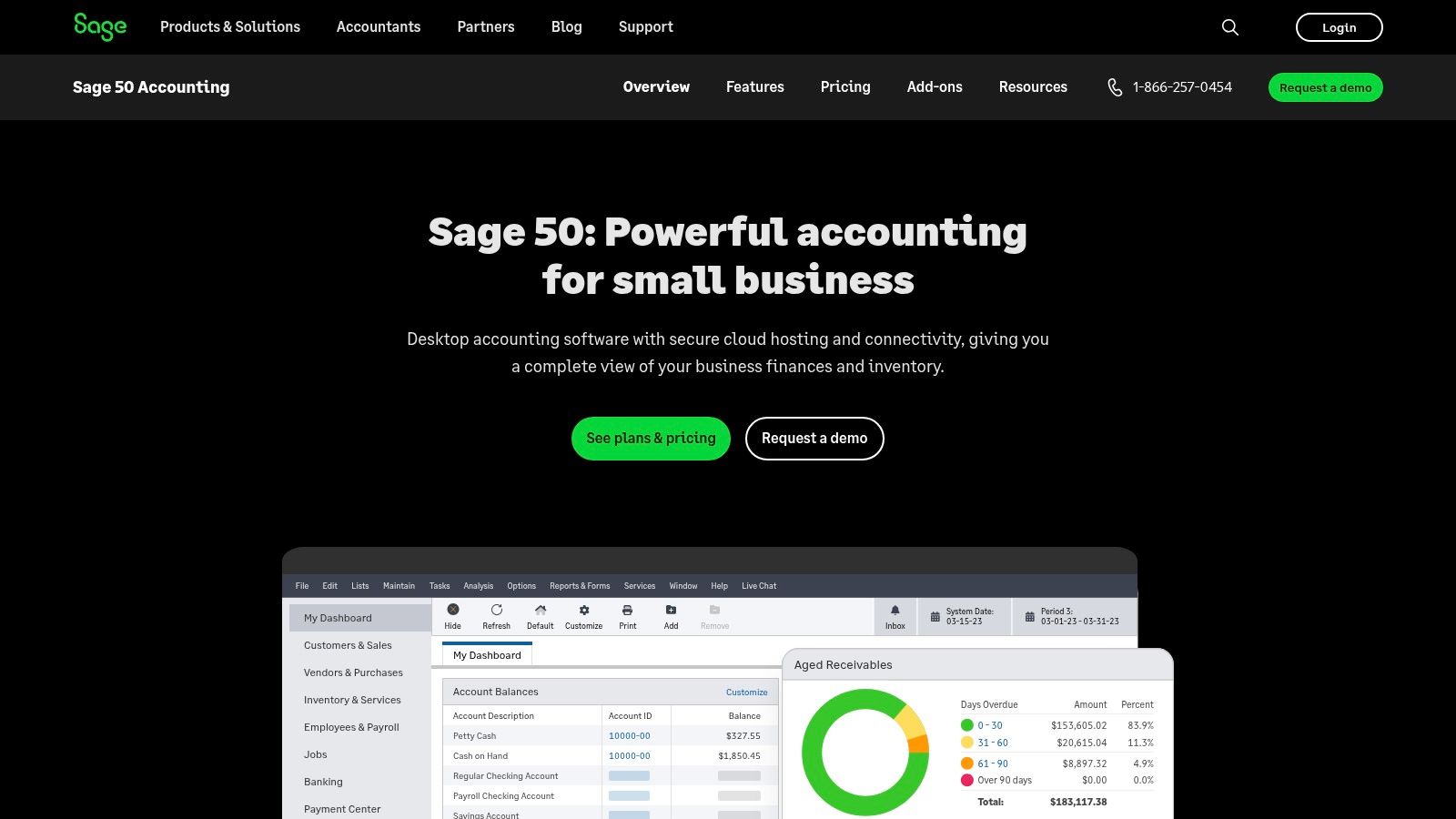

9. Sage 50 Accounting

Sage 50 Accounting is a robust desktop accounting solution with cloud capabilities, targeting small to medium-sized businesses that need detailed inventory management and job costing alongside financial tools. Its automated bank reconciliation software features are designed to simplify a traditionally tedious process. By connecting directly to your bank feeds, it automatically imports transactions, minimizing manual data entry and flagging potential discrepancies for review, which is a significant step up for businesses currently performing bank reconciliation on Excel.

The platform stands out for its strong audit trail and compliance reporting functionalities, making it a reliable choice for businesses in regulated industries or those preparing for audits. The system logs all changes, providing a clear and unalterable record of financial activities.

Key Reconciliation Features & Use Case

Sage 50 Accounting excels for businesses with complex inventory or project management needs that also require a comprehensive accounting package. While the interface is generally user-friendly, some users have noted that customer service can be inconsistent. It’s also important to note that certain advanced features may require purchasing add-ons, so businesses should carefully evaluate plan details. The one-click reconciliation reports are a major time-saver for generating month-end summaries.

- Best for: Small to medium-sized businesses with specific inventory, job costing, and compliance needs.

- Pricing: Plans typically start around $60/month, with tiered pricing for more advanced industry-specific features.

- Website: Sage 50 Accounting

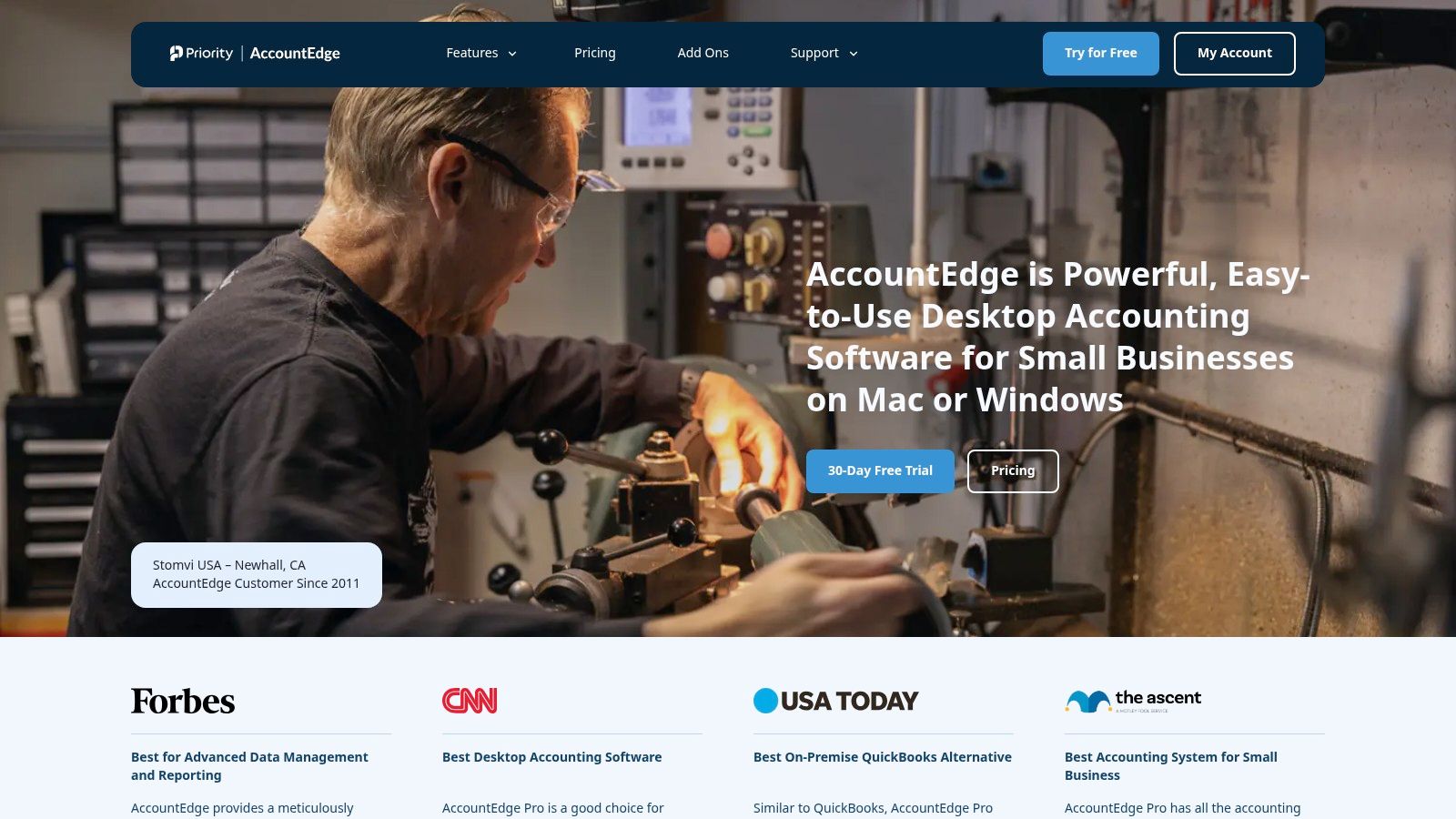

10. AccountEdge

AccountEdge stands out in the modern cloud-centric market by offering a robust desktop accounting solution. While many competitors are web-only, AccountEdge provides a locally installed software package that includes powerful automated bank reconciliation software capabilities. This design appeals to businesses that prefer to keep their financial data on-site or operate in areas with unreliable internet access. By connecting to bank feeds, it automates transaction imports, though this feature comes with an additional fee.

The platform is more than just a reconciliation tool; it integrates comprehensive inventory management, sales processing, and payroll features. This makes it a solid all-in-one option for product-based small businesses looking for an affordable, one-time purchase rather than a recurring subscription.

Key Reconciliation Features & Use Case

AccountEdge is ideal for small businesses that need deep inventory and job-costing features alongside their core accounting and do not want to rely on an internet connection for basic operations. Its centralized bank register allows you to view and manage all banking activities, while its detailed reconciliation reports provide clear audit trails. The user interface, however, can feel dated compared to newer, cloud-based alternatives, which might be a drawback for users accustomed to modern UX design.

- Best for: Small product-based businesses needing a desktop solution with strong inventory and payroll features.

- Pricing: A one-time license fee (around $499), with optional annual fees for upgrades, support, and bank feeds.

- Website: AccountEdge

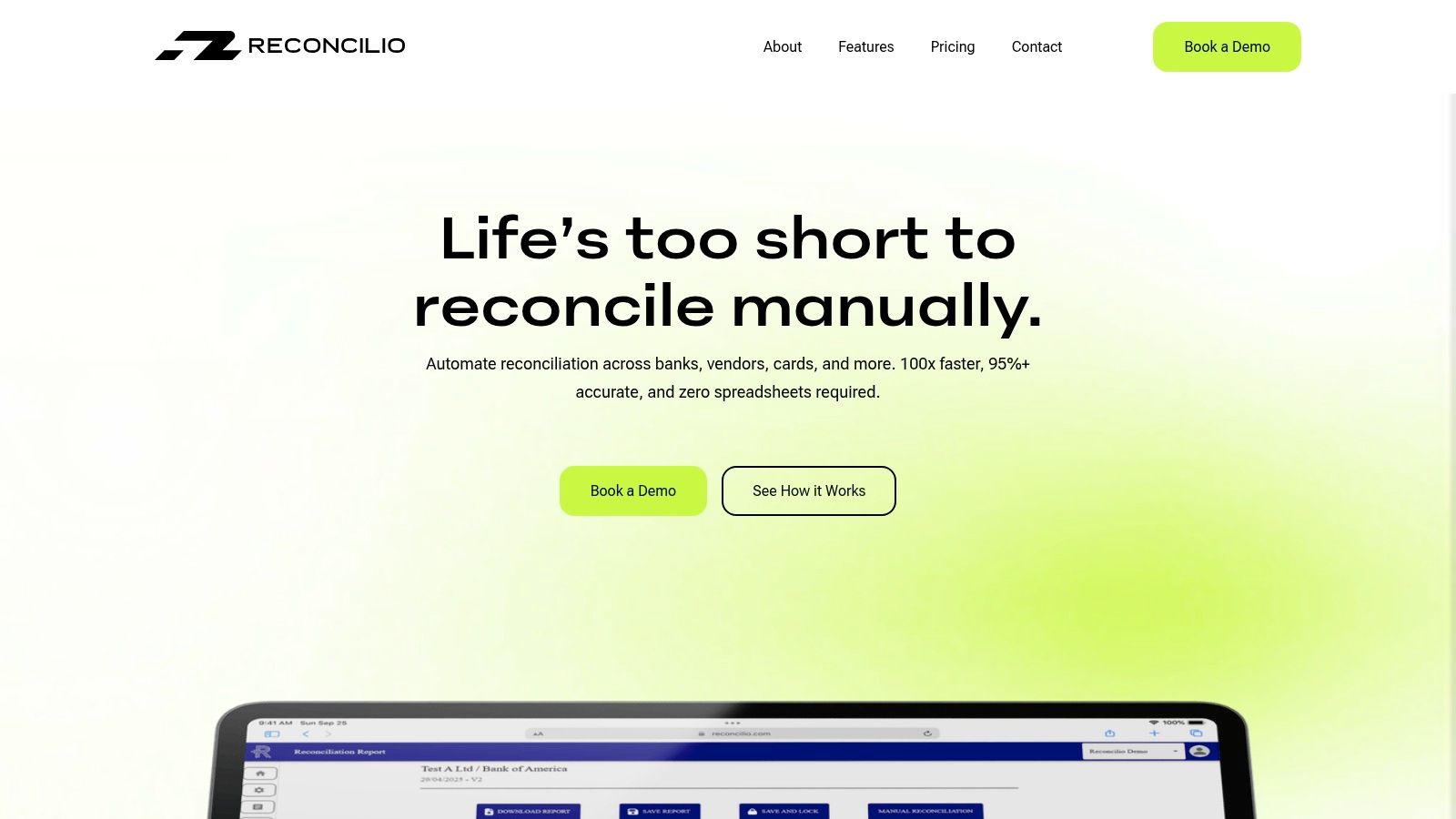

11. Reconcilio

Reconcilio is a specialized platform designed to automate complex reconciliation processes far beyond standard bank accounts. For businesses managing high transaction volumes across banks, payment gateways, vendors, and credit cards, its automated bank reconciliation software capabilities offer a powerful, dedicated solution. By focusing solely on reconciliation, it eliminates the manual effort tied to spreadsheets and provides real-time matching, validation, and exception handling. This makes it ideal for companies that have outgrown the reconciliation features of their primary accounting system.

The platform stands out by allowing users to create custom reconciliation types and rules, providing flexibility to handle unique and complex financial workflows. This adaptability ensures that as a business scales, its reconciliation processes can evolve without needing a complete system overhaul.

Key Reconciliation Features & Use Case

Reconcilio excels for mid-sized to enterprise-level businesses where reconciliation is a significant operational bottleneck. Its strength lies in its ability to integrate with various financial systems and centralize data for a single source of truth, producing audit-ready documentation automatically. While the initial setup and configuration may require some technical effort, the long-term benefits include enhanced accuracy, improved compliance, and a significant reduction in closing times. The lack of public pricing suggests a custom, quote-based model tailored to specific business needs.

- Best for: Growing businesses and enterprises needing a scalable, dedicated reconciliation tool for complex, multi-source transaction matching.

- Pricing: Not publicly disclosed; requires a consultation for a custom quote.

- Website: Reconcilio

12. NetSuite

NetSuite is a powerhouse in the world of cloud ERP (Enterprise Resource Planning), and its financial management suite includes robust automated bank reconciliation software designed for complexity and scale. Unlike standalone tools, NetSuite's reconciliation capabilities are deeply integrated into its entire business management platform. This means transaction matching is directly linked to order management, CRM, and inventory systems, providing a single source of truth for high-growth companies.

The system automates the process of matching bank data with transactions recorded in the general ledger, intelligently identifying discrepancies and flagging exceptions for manual review. Its strength lies in handling high volumes and complex multi-subsidiary environments, making it a go-to for mid-market and enterprise-level organizations that have outgrown simpler accounting packages.

Key Reconciliation Features & Use Case

NetSuite's reconciliation module is built for businesses that require more than just basic matching. It offers advanced rules-based matching and detailed exception handling workflows. The platform's powerful reporting tools allow finance teams to gain deep insights into cash flow and financial health across the entire organization, a crucial feature for strategic planning. However, the comprehensive nature of NetSuite means implementation can be complex and requires significant investment.

- Best for: Mid-sized to enterprise-level businesses and rapidly scaling companies needing a unified ERP solution.

- Pricing: Pricing is customized based on company size, user count, and required modules. It is a premium-priced solution generally starting in the thousands of dollars per year.

- Website: NetSuite

Automated Bank Reconciliation Software Comparison

| Software | Core Features ✨ | User Experience ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points 🏆 | Price Points 💰 |

|---|---|---|---|---|---|---|

| QuickBooks Online | Auto bank feed, AI matching, audit trails | User-friendly, robust support | Scalable for SMBs | Small to medium businesses | Extensive integrations, mobile app | Higher for advanced features |

| Xero | Automated feeds, bulk reconciliation | Modern, intuitive interface | Competitive pricing | Small to medium businesses | Real-time collaboration | Competitive |

| Zoho Books | Auto feeds, customizable rules | Affordable and integrated with Zoho ecosystem | Affordable, automation focused | SMBs in Zoho ecosystem | Deep Zoho integration | Affordable |

| ReconArt | Auto import, exception workflow | Intuitive UI, strong support | Scalable, standalone solution | Businesses of all sizes | Customizable reconciliation templates | Not publicly disclosed |

| BlackLine | Auto matching, workflow automation | User-friendly but complex implementation | Enterprise-grade compliance | Large enterprises | Comprehensive financial close solutions | Higher price point |

| Sage Intacct | Auto feeds, multi-entity, advanced analytics | Flexible, strong reporting | Scalable for complex needs | Growing businesses | Multi-entity consolidation | Not publicly disclosed |

| FloQast | AI matching, audit-ready docs | Clear documentation, easy implementation | Speeds up financial close | Mid-large enterprises | AI-enhanced automation | May be high for small biz |

| OneStream | Drill-to-reconciliation, risk reporting | Deep analytics, scalable but complex | Enterprise controls & compliance | Large enterprises | Unified close platform with risk focus | Not publicly disclosed |

| Sage 50 Accounting | Automated reports, mobile access | User-friendly with strong compliance tools | Comprehensive for SMB accounting | Small to medium businesses | Integration with Sage suite | May need add-ons |

| AccountEdge | Manual & auto reconciliation, payroll | Affordable, offline use, outdated UI | Affordable desktop solution | Small businesses | No internet needed | Affordable |

| Reconcilio | Automated reconciliation, real-time matching | Scalable, accuracy focus | Scalable and accuracy-enhancing | Growing businesses | Multi-type reconciliation | Not publicly disclosed |

| NetSuite | Auto matching, exception handling | Comprehensive ERP, scalable | Unified platform for scaling | Rapidly scaling businesses | Broad ERP with advanced reconciliation | Expensive for small biz |

Choosing Your Path to Financial Automation

Navigating the landscape of automated bank reconciliation software can feel complex, but the journey ends with significant rewards: reclaimed time, enhanced accuracy, and unparalleled financial clarity. We have explored a diverse range of solutions, from the accessible, all-in-one platforms like QuickBooks Online and Xero, which are ideal for small to medium-sized businesses, to powerful, enterprise-grade systems like BlackLine and NetSuite, engineered for high-volume transactions and complex financial operations.

Your ideal tool is not necessarily the one with the most features, but the one that aligns perfectly with your specific operational reality. A growing e-commerce business might prioritize a solution like Zoho Books for its seamless integration with payment gateways, while a large corporation will value the robust internal controls and compliance features of a platform like Sage Intacct or OneStream. The key is to move beyond marketing claims and focus on a strategic fit.

Key Takeaways for Selecting Your Software

The central theme emerging from our analysis is that a one-size-fits-all solution does not exist. Your decision-making process should be a deliberate evaluation of several core factors:

- Business Scale and Transaction Volume: Are you processing hundreds of transactions per month or hundreds of thousands? The answer will immediately narrow your choices. SMB-focused tools may struggle with enterprise-level volume, while enterprise solutions are often overkill for smaller operations.

- Integration Capabilities: Your chosen software must integrate smoothly with your existing technology stack. Consider your accounting system, ERP, payment processors, and banking institutions. A lack of native integration can create new manual workflows, defeating the purpose of automation.

- Complexity and Customization: Do you require simple matching rules, or do you need to manage complex multi-way reconciliations, intercompany transactions, and currency conversions? Specialized tools like ReconArt and FloQast excel where general accounting platforms may fall short.

- Implementation and Support: Assess the onboarding process and the level of technical support offered. A smooth implementation is critical for user adoption and realizing a fast return on investment. Consider the resources your team will need to dedicate to getting the system up and running.

Actionable Next Steps

Before you commit to a platform, create a detailed checklist of your non-negotiable requirements. Use the insights from this article to shortlist two or three top contenders that fit your business profile. Take advantage of free trials and schedule personalized demos to see the software in action with your own data sets. This hands-on experience is invaluable for understanding the user interface and confirming the platform can handle your unique reconciliation challenges.

Ultimately, the move to automated bank reconciliation software is a strategic investment in your organization's financial health. It transitions your finance team from tedious data entry clerks to strategic analysts, empowering them to focus on insights that drive business growth. By carefully considering your needs and evaluating the options, you can select a partner that not only eliminates manual reconciliation but also builds a foundation for a more efficient and resilient financial future.

Before you can leverage the power of automation, your data needs to be ready. If you're stuck with bank statements in locked PDF formats, Bank Statement Convert PDF is your essential first step. It effortlessly transforms your PDF statements into clean, usable Excel files, preparing your data for a seamless import into any automated bank reconciliation software you choose. Try Bank Statement Convert PDF today and bridge the gap between your data and your new automated workflow.