Bank statement analysis is the art of looking at a financial document and seeing the story behind the numbers. It's about meticulously reviewing every line item to understand someone's financial habits, confirm their income, and get a real sense of their risk profile. You're not just glancing at balances; you're digging into the narrative of spending patterns, cash flow, and potential red flags.

This kind of deep dive is absolutely essential in lending, business management, and even personal finance.

What Bank Statement Analysis Really Means

Imagine a bank statement as a financial diary. By itself, it’s a simple record of dates, descriptions, and amounts. But when you apply analysis, you step into the role of a financial detective. You start connecting the dots between transactions to build a complete picture of a person's or a business's financial wellbeing.

This is worlds away from just checking the opening and closing balances. It's about interpreting the story hidden in the data. For instance, a loan officer uses this process to see if an applicant's claimed income matches the deposits hitting their account. They're looking for consistency and trying to gauge whether the person's spending habits leave enough room for a new loan payment.

The Core Purpose of Analysis

The main goal here is to turn raw, messy transaction data into clear, actionable insights. By sorting transactions and spotting trends, you can get definitive answers to crucial questions about financial stability.

A solid analysis helps you:

- Verify Income Streams: You can confirm where money is coming from, how often it arrives, and how reliable it is.

- Assess Spending Habits: It becomes clear where money is actually going. You can separate essential spending from discretionary purchases and pinpoint areas of overspending.

- Identify Financial Red Flags: This is where you uncover the hidden problems—things like frequent overdraft fees, bounced checks, unusual large transfers, or payday loans.

This methodical approach is the bedrock of smart financial decision-making. For a business, it offers a crystal-clear view of cash flow, which is vital for managing expenses and fueling growth. For an individual, it's a fantastic tool for creating a budget that actually works. If you want a refresher, you can see our guide on what a bank statement shows to cover the basics.

Bank statement analysis isn't just about what happened in the past; it's about using that history to predict future financial reliability and behavior.

The table below breaks down the key goals of this process.

Key Objectives of Bank Statement Analysis

| Objective | Description | Primary Use Case |

|---|---|---|

| Income Verification | Confirming the amount, frequency, and source of all deposits to validate an individual's or business's stated income. | Mortgage lending, auto loans, personal loans |

| Cash Flow Assessment | Analyzing the movement of money in and out of an account to understand net cash flow and liquidity patterns. | Business lending, financial planning |

| Risk Identification | Spotting warning signs like overdrafts, insufficient funds (NSF) fees, payday loans, or irregular transactions. | Underwriting, fraud detection |

| Spending Behavior Analysis | Categorizing expenditures to understand financial habits, discretionary spending, and adherence to a budget. | Credit counseling, personal finance management |

| Debt Obligation Review | Identifying recurring payments to other lenders or creditors to calculate an accurate debt-to-income (DTI) ratio. | All forms of lending and credit assessment |

As you can see, each objective serves a distinct purpose, helping to build a comprehensive and reliable financial profile.

Adapting to a Digital World

This kind of analysis has become even more critical as finance has gone digital. With mobile banking now the norm, the sheer volume and speed of transactions have skyrocketed. Global digital wallet transactions have already surpassed $3.1 trillion, a figure that reflects a 24% jump largely driven by mobile-first banking habits.

This massive shift means that today’s bank statement analysis has to be faster, smarter, and capable of handling complex digital data streams with ease.

Ultimately, getting good at bank statement analysis gives you the ability to look past the raw numbers and see the real story. And with modern tools making this process quicker and more accurate than ever, it has moved from a tedious manual chore to a powerful strategic advantage.

How to Read a Bank Statement Like an Expert

Before you can really dig in and analyze a bank statement, you need to learn how to speak its language. A statement is so much more than a simple list of transactions; it's a financial story, packed with clues about a person's or a business's health. The first step is to move beyond just glancing at the beginning and ending balances.

Think of it like being a detective at a crime scene. You wouldn't just look at the door and leave; you'd examine every piece of evidence. Knowing what each section of a statement means is the key to turning that raw data into genuine insight.

Decoding the Statement Header and Summary

Right at the top of any bank statement, you'll find the high-level summary. This is your starting point—a quick snapshot of the account's status for the month. It’s tempting to skim past it, but this section sets the stage for everything else.

Here’s what you need to zero in on:

- Statement Period: The start and end dates for the statement. This is critical for making sure you have a complete, sequential set of documents for your analysis.

- Account Holder Information: The name and address tied to the account. Always double-check that this matches the person or business you’re looking into.

- Account Summary: This gives you the opening balance, total deposits, total withdrawals, and the all-important closing balance. It's the 30,000-foot view of the cash flow.

This summary quickly tells you if the account's balance grew or shrank, or if withdrawals outpaced deposits. Answering these basic questions right away helps direct where you'll focus your deeper investigation. If you want to get comfortable with different layouts, looking at a comprehensive bank statement sample is a great way to see how various banks present this info.

A common rookie mistake is taking the summary totals as gospel. A true expert uses the summary as a guide but knows the real story—the undeniable truth—is buried in the transaction details.

Navigating the Transaction Details

The transaction log is the heart and soul of the bank statement. This is where the real detective work happens, and where you'll spend most of your time during a bank statement analysis. Every single line item is a piece of the financial puzzle, revealing spending habits, income sources, and potential red flags.

The problem is, these entries are often packed with cryptic abbreviations and codes. Learning to decipher this financial shorthand isn't just helpful; it's absolutely essential for an accurate analysis.

Common Transaction Codes and Their Meanings

| Abbreviation | Full Term | Description |

|---|---|---|

| ACH | Automated Clearing House | An electronic transfer, usually for things like direct deposits or automatic bill payments. |

| POS | Point of Sale | A debit card purchase made in person at a store or restaurant. |

| NSF | Non-Sufficient Funds | A fee for a bounced check or rejected payment. This is a major red flag for financial distress. |

| W/D | Withdrawal | Cash taken out, typically from an ATM or with a teller. |

| SVC CHG | Service Charge | A fee the bank charges for account maintenance or other services. |

| Zelle/Venmo | P2P Payment | A person-to-person transfer, which can show informal money movement. |

Getting a handle on these codes helps you categorize transactions and spot patterns in a flash. For example, seeing multiple NSF fees in a single month might signal serious cash flow issues. On the other hand, consistent ACH deposits can help you confirm a stable source of income. Once you master these components, you're no longer just reading a statement—you're understanding the full financial story it has to tell.

Comparing Manual and Automated Analysis

When it's time to analyze a bank statement, you're essentially standing at a fork in the road. One path is the old-school, manual route—think highlighters, a calculator, and a carefully built spreadsheet. The other path is the modern, automated approach, where specialized software does all the heavy lifting for you.

For a long time, manual was the only way. An analyst would have to painstakingly review every single line item, identifying deposits, categorizing withdrawals, and typing it all into a separate system. It's a method that works, but it's slow and dangerously prone to human error.

A single misplaced decimal or a skipped transaction can completely skew the results, leading to bad financial decisions. In today's fast-paced world, where transactions are constant and complex, the cracks in this traditional method are really starting to show.

The Manual Method: A Necessary Grind

Doing a bank statement analysis by hand is a detail-oriented job that demands intense focus and a methodical workflow. Even with the best intentions, it's an incredibly time-consuming process. An analyst can easily spend hours, if not days, working through just one person's or business's statements.

Typically, the manual process goes something like this:

- Step 1: Get the Documents: The analyst starts with printed statements or PDF files.

- Step 2: Go Line by Line: Each transaction is read and interpreted, which often means trying to figure out cryptic descriptions.

- Step 3: Type It All Out: Key details for each transaction—date, amount, description—are manually entered into a spreadsheet.

- Step 4: Sort and Categorize: Every entry is then assigned a category, like "Income," "Rent," or "Business Expenses."

- Step 5: Do the Math: Finally, the analyst uses formulas to sum up the categories and look for red flags like overdrafts or unusual activity.

While this approach can be thorough, it just doesn't scale. Analyzing a year's worth of statements for a small business could tie up a single employee for an entire week. For lenders or accounting firms dealing with high volumes, that's just not practical.

The Automated Revolution: A Leap in Efficiency

Automated solutions completely change the game. These tools use powerful technology like Optical Character Recognition (OCR) and Artificial Intelligence (AI) to pull out, categorize, and make sense of months' worth of transaction data in minutes.

Instead of an analyst typing everything by hand, the software "reads" the bank statement—even a scanned PDF—and instantly converts it into a workable digital file. The process isn't just faster; it's also far more accurate. In fact, some studies show automated systems can be up to 100 times more accurate than a person doing the same task. Our guide on how to automate data entry dives deeper into how this tech eliminates those common mistakes.

The real magic of automation isn't just about speed. It's about finding the insights hidden in the data. Automated tools can spot subtle patterns, recurring payments, and financial behaviors that a human analyst could easily overlook.

To get a better sense of the technology driving this shift, you can explore resources on the potential of AI in automated data analysis. This is the core engine that allows software to learn and get smarter about recognizing different transaction types over time.

To really see the difference, let's put the two methods side-by-side.

Manual vs. Automated Analysis: A Head-to-Head Comparison

| Aspect | Manual Analysis | Automated Analysis |

|---|---|---|

| Speed | Extremely slow; hours or days per statement set. | Extremely fast; minutes for the same set. |

| Accuracy | Prone to human error (typos, omissions). | Highly accurate, with near-zero data entry errors. |

| Cost | High labor costs due to time spent per analysis. | Lower long-term cost; subscription-based. |

| Scalability | Very poor; difficult to handle high volumes. | Excellent; easily processes thousands of statements. |

| Insight | Limited to what an analyst can spot manually. | Uncovers deep patterns, trends, and anomalies. |

| Objectivity | Can be influenced by analyst bias or fatigue. | Completely objective and consistent. |

The takeaway is pretty clear. While the manual method was once the standard, automation has become the go-to for any serious financial analysis. The massive gains in speed, the virtual elimination of human error, and the power to find hidden financial stories give it a decisive edge.

A Step-By-Step Bank Statement Analysis Framework

Okay, let's move from theory to action. Knowing what's on a bank statement is one thing, but knowing how to systematically break it down is what truly matters. This isn't about just glancing at numbers; it's about having a repeatable process that guarantees you catch everything, every single time.

Think of it like being a financial detective. You need a standard operating procedure to sift through the evidence, connect the dots, and build a solid case. Without a framework, you risk missing crucial clues. With one, you can turn a stack of raw transaction data into a crystal-clear financial story.

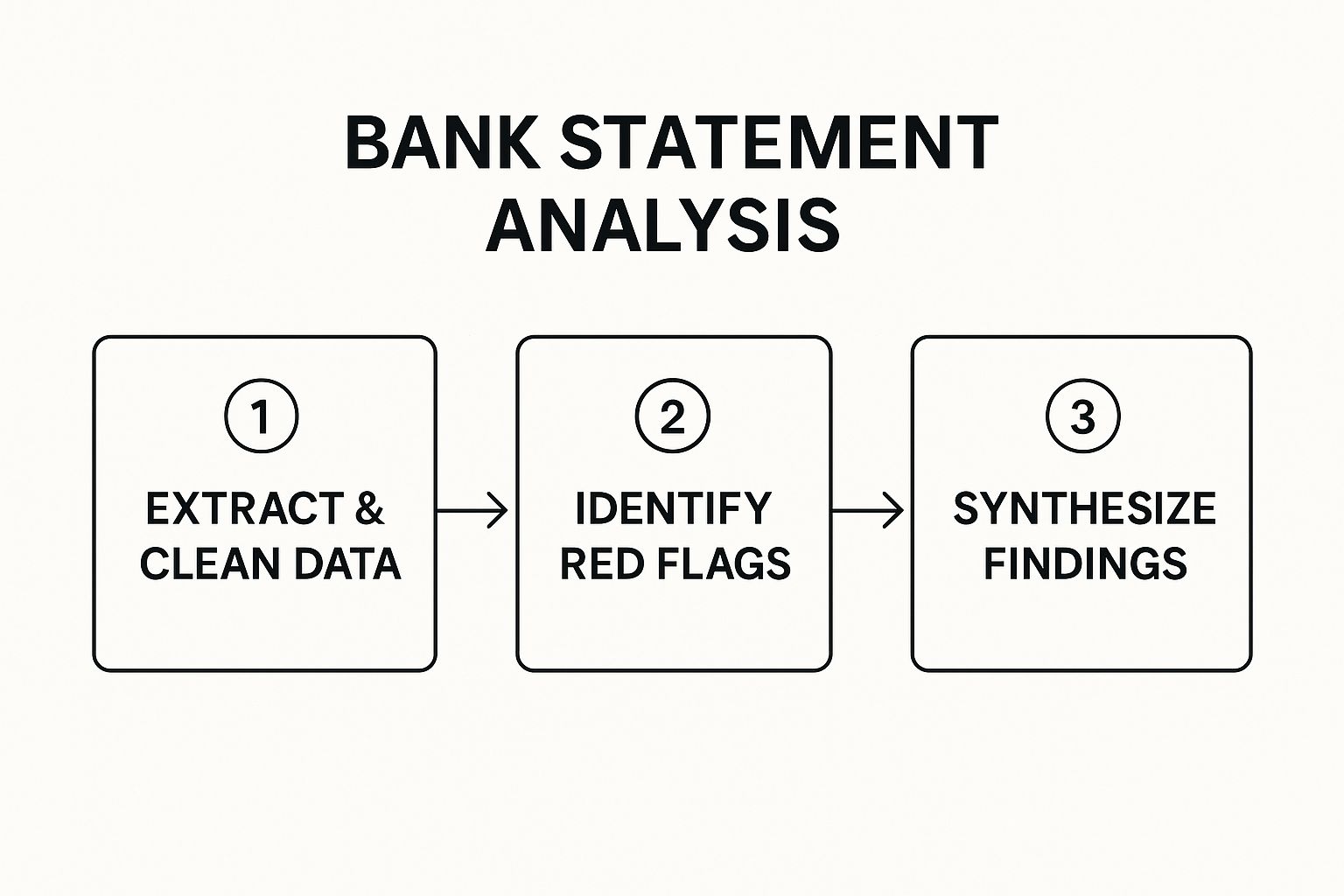

This practical framework breaks the whole process into four manageable stages. We'll walk through getting the documents, organizing the data, spotting the red flags, and finally, pulling it all together into a summary that makes sense.

Step 1: Gather and Verify Your Documents

This first step seems basic, but it’s the bedrock of the entire analysis. If you're working with incomplete or, worse, fake documents, your conclusions will be completely off-base and could lead to some seriously bad decisions.

Start by collecting all the bank statements for the period you need—for most lending decisions, that’s typically three to six months. Double-check that there are no gaps. A missing month isn't just an inconvenience; it could be a deliberate attempt to hide a major financial problem.

Once you have everything, it’s time to verify. You're looking for signs of digital tampering. Keep an eye out for:

- Weird Fonts or Spacing: If the text suddenly changes style or size, it's a huge red flag that someone has edited the document.

- Misaligned Columns: Genuine bank statements are clean and orderly. If numbers or dates don't line up perfectly, be suspicious.

- Vague Transaction Descriptions: Banks use standard formats for descriptions. If you see entries that are overly generic or lack detail, they might not be legitimate.

Step 2: Extract and Categorize Transaction Data

With your documents confirmed as authentic, the real work begins. The goal here is to pull every transaction off the page and organize it into a useful format. Done manually, this is by far the most grueling part of a bank statement analysis.

First, you have to extract every single transaction, making sure to capture the date, description, and amount. This is where automation is a lifesaver. Using software can turn hours of mind-numbing data entry into a task that takes just a few minutes.

Next comes categorization. Every deposit and withdrawal needs a label. This is more than just sorting debits and credits; it's about assigning meaningful tags like "Payroll Income," "Rent/Mortgage," "Utilities," "Groceries," or "Loan Repayment." This is the step that transforms a messy list of transactions into a structured picture of someone's financial habits.

This infographic shows a simplified, three-stage workflow for the process.

As you can see, the flow is logical: prepare the data, dig into the details, and then report your findings. Following this path ensures nothing important gets overlooked.

Step 3: Identify Red Flags and Calculate Key Metrics

Now that your data is organized, you can switch from bookkeeper to investigator. This is where you actively hunt for warning signs and calculate the numbers that tell the real story behind the transactions.

A red flag is any transaction or pattern that points to financial instability, high risk, or even potential dishonesty. Finding them is one of the main reasons we do this analysis in the first place.

Here are some of the most common red flags to look for:

- Overdrafts and NSF Fees: A pattern of non-sufficient funds (NSF) fees is a classic sign of someone living beyond their means.

- Payday Loans or Cash Advances: Relying on these high-interest loans suggests a person is struggling to cover their basic expenses.

- Unexplained Large Transfers: Big sums of money moving in or out without a clear reason could point to an undisclosed loan or an unstable source of income.

- Circular Transactions: Be wary of money moving in a loop between different accounts. It can be a tactic to artificially inflate an account balance.

Once you’ve noted these issues, you start calculating the key metrics. This means adding up the totals for your categories to get a clear picture of average monthly income, fixed costs, and debt payments. From there, you can calculate crucial figures like the debt-to-income (DTI) ratio, which is essential for any lending decision.

Step 4: Synthesize and Summarize Your Findings

The final step is to pull it all together. A jumble of notes and calculations isn't very helpful. What decision-makers need is a clear, concise summary that gets straight to the point.

Your report should give a high-level overview of the account holder's financial health. It needs to state the verified monthly income, break down the major spending habits, and clearly list any red flags you uncovered.

The conclusion should be direct and backed by the data you’ve gathered. It should provide a clear answer to whatever question prompted the analysis, whether that’s "Can this person afford a $2,000 monthly mortgage payment?" or "Is this business's cash flow stable enough to support expansion?" This final summary is where all your detailed work pays off, transforming a complex analysis into a simple, actionable tool for making smart decisions.

Uncovering the Insights That Matter Most

Having a solid framework is one thing, but the real magic happens when you start pulling meaningful insights from the data. Raw transaction lists are just noise. The goal of bank statement analysis is to connect the dots and tell the financial story hidden within those numbers.

Of course, the story you’re looking for depends entirely on who you are. A lender is hunting for signs of creditworthiness, while a business owner is diagnosing operational health. They both start with the same raw data, but they’re looking for completely different clues.

Insights for Lenders

For a loan officer, every analysis is an attempt to answer one fundamental question: “Can this person actually afford to pay us back?” Bank statements provide the unvarnished truth, often painting a much clearer picture than a loan application or tax return ever could.

Lenders zero in on a few key areas:

- Verifying Real Income: They look past the number an applicant writes down and search for the proof—consistent, recurring deposits from legitimate sources, like payroll ACH transfers. This is all about confirming that the claimed income is real and reliable.

- Gauging Repayment Ability: Income is only half the story. Analysts also track recurring debits for rent, car payments, and other loans to get a true sense of the borrower's existing financial commitments. This helps them calculate an accurate debt-to-income ratio.

- Spotting Financial Red Flags: A bank statement is also a behavioral report card. Lenders are on high alert for signs of financial distress, like frequent overdrafts, a pattern of using payday loans, or multiple non-sufficient funds (NSF) fees. These are all immediate warning signs that a borrower is stretched too thin.

By piecing these clues together, a lender can build a comprehensive view of a borrower's financial stability that goes far beyond a simple credit score.

Insights for Business Owners

For entrepreneurs, bank statement analysis is less about a single decision and more about ongoing financial health. Think of it as a regular check-up for your company's cash flow, helping you spot problems before they become full-blown crises.

For a business, analyzing bank statements is like getting a regular health check-up. It helps you catch small issues before they become chronic conditions and ensures your company’s financial vitals are strong.

A business owner can pull out several game-changing insights:

- Diagnosing Cash Flow Problems: By mapping out when money comes in versus when it goes out, you can spot dangerous cash flow gaps. For instance, if you notice that big client payments always land a week after payroll is due, you know you need to adjust your invoicing terms or look into a line of credit.

- Finding Hidden Spending Drains: When you categorize every single expense, you’ll be surprised at what you find. This is the best way to uncover things like "subscription creep" from software you no longer use or excessive bank fees that are quietly eating into your profits.

- Catching Early Warning Signs: A slow but steady decline in recurring customer payments? A sudden jump in late fees from your own vendors? These are the early tremors that signal bigger financial trouble is on the horizon, giving you time to act.

Insights for Fraud Detection

Beyond lending and internal audits, bank statement analysis is a crucial weapon in the fight against financial crime. Certain transaction patterns can scream "fraud," helping investigators and compliance teams flag suspicious accounts before major damage is done.

Analysts are trained to look for tell-tale signs, including:

- Unusual Transaction Volumes: A sudden, sharp increase in the number of transactions, especially many small, repetitive transfers, can be a classic sign of money laundering.

- Circular Money Movement: This happens when money is bounced between the same small group of accounts over and over with no clear business reason. It’s a common tactic used to hide the original source of the funds.

- Transactions with High-Risk Parties: Any payments to or from individuals or businesses with a known history of illegal activity is an obvious red flag that demands immediate investigation.

By learning to spot these patterns, you can transform a simple bank statement from a boring list of transactions into a powerful source of intelligence. That’s the end game: making smarter, more strategic decisions based on a financial picture you can actually trust.

Common Analysis Mistakes and How to Avoid Them

Bank statement analysis is part art, part science. Even seasoned pros can get tripped up by a few common mistakes that can completely throw off their conclusions. The good news is, once you know what to look for, these pitfalls are easy to sidestep.

One of the biggest traps is ignoring the context of transactions. It's easy to see a huge withdrawal and immediately wave a red flag. But was it a sign of trouble, or was it a one-time down payment for a car? Without the full story, the numbers don't mean much. A sudden dip in deposits might look like a job loss, but it could just be the end of a seasonal gig. You have to look for the narrative behind the data.

Another classic error is misinterpreting those frustratingly vague transaction descriptions. "ACH Debit" tells you almost nothing. Is it a car loan, a utility bill, or a subscription service? If you just guess or lump it into a generic category, your spending analysis will be skewed.

Overlooking Data Gaps and Anomalies

Working with an incomplete deck of cards is a recipe for disaster. A missing statement for April might not seem like a big deal, but what if that’s the exact month the account was hit with multiple overdraft fees or a suspicious transfer? People sometimes "forget" to include the statements that don't paint a pretty picture.

The integrity of your analysis depends entirely on the integrity of your data. A single missing statement can invalidate your entire conclusion, as it creates a blind spot where the most critical financial events might be hidden.

This is exactly why you can't skip the prep work. Before you even begin, it's critical to verify bank statements for signs of tampering or check for gaps. You have to build your analysis on solid ground.

Making Assumptions About Recurring Payments

Finally, here's a subtle mistake that can cause real headaches: making lazy assumptions about recurring payments. Just because you see three payments to "ABC Corp" doesn't mean they're all for the same thing. One could be for software, another for consulting, and a third for a one-off purchase. Lumping them together hides the real spending habits.

A sharp eye for detail here is invaluable, especially when it comes to things like detecting payroll overpayments or other financial leaks.

To keep your analysis clean and accurate, stick to a few simple rules:

- Question Everything: Don't just accept a transaction at face value. If a description is unclear, dig a little deeper.

- Confirm All Documents: Make sure you have a complete, consecutive set of statements before you start. Check for authenticity.

- Focus on Patterns, Not Single Events: Look for trends that repeat over several months. A single outlier is an anomaly; a consistent pattern is a behavior.

By actively watching out for these common blunders, you can turn a basic review into a powerful and trustworthy financial decision-making tool.

Frequently Asked Questions

When you start digging into bank statement analysis, a few questions always pop up. It's natural to wonder about the right tools for the job, how far back you need to look, or whether the documents you're holding are even real. Let's clear up some of the most common ones.

What Should I Look for in Analysis Software?

It’s easy to get bogged down by feature lists, but a few core capabilities really separate the great tools from the merely good ones. You need something that does more than just pull data; you need software that thinks.

Here’s what truly makes a difference:

- Smart Categorization: The system shouldn't just guess where money is going. It should intelligently categorize transactions—payroll, rent, supplier payments—and actually learn from your corrections to get sharper over time.

- Automatic Red Flagging: You want a tool that actively looks for trouble. It should instantly flag things like overdrafts, insufficient funds fees, payday loan cycles, or strange transfers that don't fit the usual pattern.

- Key Metric Dashboards: The software should do the heavy lifting by calculating critical metrics for you. Think average monthly income, cash flow trends, and debt-to-income ratios, all updated automatically.

How Far Back Should I Go When Analyzing Statements?

This is a classic "it depends" question, and the right answer hinges entirely on what you're trying to figure out. There’s no magic number.

For something like a mortgage application, lenders are typically happy with three to six months of statements. That's enough to get a reliable picture of current income and spending habits. But if you're doing a deep dive on a business's financial health or conducting a forensic audit, you'll want to see the bigger picture. In those cases, looking at 12 to 24 months of data is often necessary to spot seasonal cycles and long-term patterns.

Think of it this way: a shorter period confirms recent stability, while a longer one tells the complete financial story. Always match the timeframe to the question you're trying to answer.

Is It Possible for Bank Statements to Be Fake?

Absolutely, and it's more common than you might think. With today's powerful editing software, a fraudster can easily alter a PDF statement to inflate their income, hide problematic payments, or simply change dates to fit a narrative.

The good news is that fakes are rarely perfect. You can often spot clues like mismatched fonts, columns that don't quite line up, or blurry, pixelated text around numbers that have been edited. The best defense, though, is technology. Professional verification tools can analyze a document’s digital fingerprint to detect tampering, giving you confidence in your bank statement analysis.

Tired of spending hours manually keying in data? Bank Statement Convert PDF offers powerful, accurate software that turns your bank statement PDFs into analysis-ready Excel spreadsheets in minutes. Get to the insights faster and leave the manual work behind. Find out how it works at bankstatementconvertpdf.com.