If you've ever spent an evening manually punching in transactions from a bank statement PDF into a spreadsheet, you know the pain. It's a universal struggle, whether you're a freelancer trying to sort out business expenses for tax season or just trying to get a handle on your family's monthly budget. It’s a total time-drain.

But the real problem with doing it all by hand isn't just the lost hours. It's the small, inevitable mistakes that always seem to sneak in.

A single misplaced decimal point or a transposed number can completely wreck your financial analysis. This can lead to headaches like inaccurate budgets, incorrect tax filings, or skewed business reports.

The True Cost of Manual Data Entry

Switching to an automated converter isn't just about saving time; it's about making your financial data more reliable and useful. Sticking with the old copy-paste-and-pray method comes with some serious downsides.

- Human Error is Expensive: A simple typo can create a ripple effect, making it a nightmare to reconcile your accounts. Ironically, finding and fixing these mistakes often takes more time than entering the data in the first place.

- Productivity Takes a Hit: Every hour you spend on manual transcription is an hour you can't spend analyzing your numbers, planning your next move, or growing your business. For accountants, that's a direct hit to billable hours. Learn more about how to get that time back at https://bankstatementconvertpdf.com/how-to-automate-data-entry/.

- You Miss the Big Picture: When your data is stuck in a static PDF, you can't easily spot trends, sort transactions, or build custom reports. You're missing out on valuable insights into your financial health.

By taking this one tedious task off your plate, you start to tap into the wider business process automation benefits that save you mental energy for what really matters.

Ultimately, getting your financial data out of a PDF and into a flexible format like Excel is a fundamental need for anyone serious about managing their money. It's a critical step for everything from personal budgeting to securing a small business loan.

Choosing the Right PDF to Excel Conversion Tool

Trying to find the right conversion tool can feel overwhelming, but figuring out what you actually need is the most important first step. When you're converting a bank statement PDF to Excel, your options boil down to three main types, and each comes with its own set of trade-offs in security, accuracy, and sheer convenience.

You're essentially looking at dedicated desktop software, quick-and-dirty online converters, or the newer, smarter AI-powered platforms. For anyone who puts a premium on privacy, desktop software is usually the way to go. The entire conversion happens right on your machine, so your sensitive financial data never leaves your control.

This makes it the clear choice for accountants, CPAs, or any business owner handling confidential client information.

Desktop Software vs Online Converters

The biggest fork in the road here is data security. An online tool is undeniably easy for a quick, one-off conversion of something non-sensitive—you just drag a file onto a webpage and download the result a moment later. But uploading your bank statement to a free online service means sending your entire financial history to a server you know nothing about. That’s a risk most people aren’t, and shouldn't be, willing to take.

Desktop tools, on the other hand, give you airtight security but usually come with a price tag, either as a one-time purchase or a subscription. For that investment, you also get more powerful features, like the ability to batch process a whole year's worth of statements at once and far better accuracy with tricky layouts.

Key Takeaway: If security is your number one priority, always go with a reputable offline desktop application. The peace of mind alone is worth it, especially when you're working with multiple bank statements.

The Rise of AI Powered Platforms

This is where things get really interesting. The next wave of data extraction is all about AI. Unlike older tools that just scraped text and hoped for the best, these platforms actually understand the document's structure. They can intelligently tell the difference between a debit and a credit, parse dates correctly, and make sense of messy, multi-line transaction descriptions with incredible precision.

You can even find modern converters right in places like the Google Workspace Marketplace, which shows just how accessible this technology is becoming.

To help you decide which path is right for you, here’s a quick breakdown of the different approaches.

Comparing PDF to Excel Conversion Methods

This table helps you quickly compare the main features, benefits, and drawbacks of different conversion approaches.

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Online Converters | Quick, one-off tasks with non-sensitive data. | Free, fast, and no installation required. | Major security and privacy risks. Often struggles with complex layouts. |

| Desktop Software | Professionals handling sensitive financial data regularly. | High security (offline processing), batch conversion, advanced features. | Requires installation and usually comes with a cost. |

| AI-Powered Platforms | Users who need the highest accuracy for complex analysis or bookkeeping. | Superior accuracy, understands context (debits/credits), handles messy data. | Can be more expensive; may still have cloud-based security concerns. |

Ultimately, the right tool really hinges on what you value most. For a more in-depth look at specific tools on the market, you can check out our guide on the best PDF to Excel converter options available today.

Your final choice comes down to your primary use case:

- Occasional User: A free online converter might be fine for a document that isn't sensitive.

- Security-Conscious Professional: Desktop software is your most reliable and secure bet.

- Accuracy-Focused User: An AI-powered tool will give you the cleanest, most analysis-ready data.

How to Get a Clean Conversion Every Time

Getting your bank statement data from a PDF into a clean Excel file is where the rubber meets the road. It's one thing to know it's possible; it's another to do it without creating a mess you'll spend hours cleaning up. The secret is all in the setup.

First things first, you need the right kind of file. The absolute best-case scenario is a text-based PDF, which is the kind you download directly from your bank's website. This file type contains actual text that a converter can read and understand. If you're starting with a scan of a paper statement, you're dealing with an image, which is a whole different (and much tougher) ballgame.

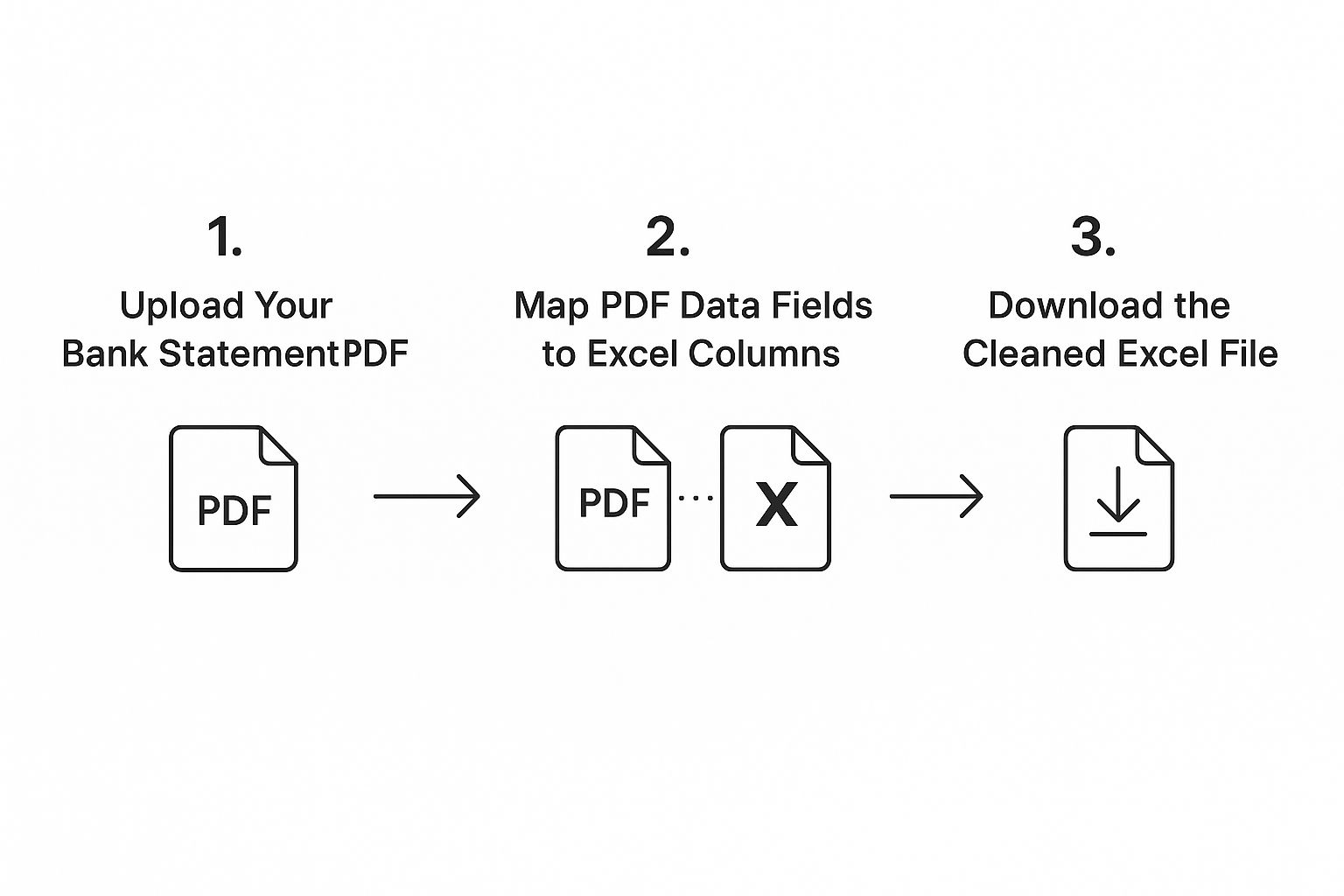

As you can see, a good tool simplifies this into a few key actions: upload, map, and download. This process is designed to sidestep the manual drudgery and the errors that come with it.

Preparing Your PDF for Conversion

Once you've got your hands on a good-quality PDF, a little prep work can make a world of difference. Most statements from major banks like Chase or Bank of America are pretty straightforward these days, but you can still run into quirks. I’ve seen transactions split across two lines or debits and credits crammed into a single column with just a minus sign to tell them apart.

A smart converter can often figure this stuff out on its own, but you can help it along.

- Ditch the Password: Is your PDF password-protected? You'll need to unlock it before most tools can even look at the data.

- Give it a Quick Scan: Flip through the pages to check for consistency. If the formatting suddenly changes halfway through, a basic converter might get confused.

- Focus on What Matters: The best tools let you zero in on just the transaction table. This is huge because it means you can tell the software to ignore all the extra fluff like headers, footers, and summary boxes.

I can't stress this enough: a clean input is the single biggest factor in getting a clean output. Taking 30 seconds to check your PDF can honestly save you 30 minutes of fixing a mangled spreadsheet later.

Mapping Data for Perfect Alignment

This is where the magic really happens. A top-tier conversion tool won't just guess where your data should go; it will let you tell it. This feature, often called data mapping, is your chance to line up the columns in the PDF with the columns you want in Excel.

You’ll see a preview of your statement and simply draw a line, so to speak, from the PDF's date column to your future "Date" column in Excel. You'll repeat this for the "Description," "Amount," and maybe even "Check Number." It’s a simple visual process that solves so many common headaches, like debits and credits getting mixed up. For a more technical look at this process, check out our guide on exporting data from PDF to Excel.

By taking a moment to map the data, you’re basically giving the software a blueprint. This guarantees a perfectly structured file every time, turning what could be a messy data dump into a precise, guided extraction.

Why Intelligent Data Extraction Beats Basic Conversion

Simply pulling numbers from a bank statement PDF to Excel is only half the battle. If you lose the context, you just end up with a jumbled mess of data. I’ve seen it countless times—you spend an hour fixing the spreadsheet, and you might as well have typed it all in by hand.

This is where you see the huge gap between basic text scraping and true intelligent data extraction.

A simple converter just sees characters on a page. It has no idea that one column is money coming in and another is money going out. This is exactly why they so often botch debit and credit columns, misread dates, or completely fall apart when a single transaction spills onto a second line.

Beyond Simple Text Scraping

Intelligent extraction tools are built differently. They’re designed from the ground up to actually recognize the structure of a financial document. Instead of just grabbing text, they analyze the layout and context to give you data that’s ready for analysis right away.

These smarter systems, which are often powered by AI, can do some impressive things:

- Automatically categorize transactions: They can tell the difference between deposits, withdrawals, bank fees, and interest payments on their own. No manual sorting is needed.

- Merge multi-page reports: Got a statement that runs 10 pages long? The software stitches it all together into one clean spreadsheet.

- Interpret complex layouts: It can make sense of those weird, non-standard statement formats that trip up simpler tools.

The Goal: You want a tool that produces a clean, organized, and accurate spreadsheet from the get-go. Intelligent extraction gets you there because it understands what the data means, not just what it says.

This shift is crucial for anyone who handles financial data regularly. For a bit more on understanding AI and its business benefits in this area, the concepts are pretty straightforward.

By choosing a smarter solution, you skip the soul-crushing task of fixing endless errors and can jump straight into analyzing your numbers. If you're ready to see what's out there, check out our list of top https://bankstatementconvertpdf.com/financial-data-extraction-tools/ that use this kind of advanced technology.

Troubleshooting Common Conversion Problems

Even with the best software, getting a bank statement PDF into Excel isn't always a smooth, one-click process. Hiccups are bound to happen, but the good news is that most of them are predictable and fairly easy to fix once you know what to look for.

The most common headache I see is dealing with a scanned, image-based PDF. If your converter spits out an error or just gives you a blank spreadsheet, this is almost always the reason why.

Think of it this way: a standard converter is looking for text it can copy and paste. A scanned PDF is just a picture of text, so the software sees nothing to grab. To get around this, you need a tool that has Optical Character Recognition (OCR) built-in. OCR technology is what allows the software to "read" the image, recognize the letters and numbers, and turn them into actual text that can be exported.

Handling Protected Files and Messy Data

Another frequent roadblock is a password-protected statement. For obvious security reasons, the converter can't just bypass a password and open a locked file. The fix is simple: you'll need to open the PDF yourself, enter the password, and then save a new, unlocked version of the file to your computer. That's the version you'll upload to the converter.

But what happens when the conversion technically works, but the resulting Excel file is a complete mess? You've probably seen it before—dates, descriptions, and dollar amounts all jumbled together in a single column.

This almost always happens when a bank uses a slightly weird or non-standard layout for its statements. A top-tier converter will have a "data mapping" or "table definition" feature. This lets you draw boxes around the data on the PDF preview and tell the software exactly which section belongs in the "Date" column, which belongs in the "Description" column, and so on.

Modern, AI-powered bank statement converters are getting incredibly good at handling these exact problems right out of the box. They use machine learning to recognize patterns and organize financial data with impressive accuracy, which really speeds things up. You can find some great examples of these AI-powered tools on the Google Workspace Marketplace.

Quick Fixes for Common Issues

Here are a few other little snags you might hit and how to deal with them:

-

Merged Columns: Sometimes, debit and credit amounts get dumped into the same column. The best way to fix this is to use the converter’s mapping tool to define separate columns for money in and money out before you finalize the export.

-

Split Transactions: A classic issue is when a long transaction description gets split across two lines in the PDF. Basic converters will often read this as two separate entries. A more intelligent extraction tool is smart enough to see it as one transaction.

-

Incorrect Date Formats: If your dates look wrong in Excel, check your software’s settings. Make sure you’ve selected the right regional format (e.g., MM/DD/YYYY for the U.S. vs. DD/MM/YYYY for Europe) so Excel doesn't get confused.

Knowing these issues might pop up ahead of time makes them far less frustrating. Instead of a roadblock, they just become a quick detour on your way to a perfectly organized spreadsheet.

Common Questions About PDF to Excel Conversion

When you're trying to pull data from a bank statement PDF into an Excel sheet, a few questions always seem to pop up. Let's walk through some of the most common ones I hear.

Can You Convert Scanned Statements?

This is probably the number one question. The short answer is yes, but there's a catch.

A standard converter won't work on a scanned PDF because it just sees a flat image. To handle these, you need a tool with built-in Optical Character Recognition (OCR). This technology is designed to scan the image, identify text and numbers, and then turn them into data you can actually use.

Just keep in mind that the quality of your scan is everything. A blurry, skewed, or low-resolution scan will give you messy results, no matter how good the OCR is.

How Secure is This Process?

Uploading your bank statements to a random, free online converter is a huge security risk. You have no idea where your sensitive financial data is going or who might have access to it.

For anything confidential—which a bank statement definitely is—the only safe bet is a dedicated desktop application. With an offline tool like Bank Statement Convert PDF, the entire process happens right on your computer. Your files never leave your machine.

What if the Columns Get Mixed Up?

It's a classic problem: you run the conversion, and your Excel sheet is a jumble. The description is in the date column, debits and credits are all over the place. This usually happens with bank statements that have complex or non-standard layouts.

A good converter solves this with a feature often called "data mapping" or "smart select." It lets you preview the statement and manually point to what goes where. You can tell the software, "This is the Date column, this is the Description," and so on, ensuring everything lands in the right place before you even export.

Ultimately, the best way to get a clean result is to start with the best source file. If you can, always download the "native" PDF directly from your online banking portal. These are text-based files, not images, and are far easier for software to read accurately.

Ready to stop wrestling with manual data entry for good? With Bank Statement Convert PDF, you get clean, accurate Excel files every time. Try our powerful software today!