Picture a digital assistant that can instantly read, understand, and organize every single line item on your bank statements. That, in a nutshell, is bank statement software. It takes chaotic PDF files and jumbled paper scans and turns them into clean, structured data you can actually use, making tedious manual entry a thing of the past.

What Is Bank Statement Software Anyway?

Think of bank statement software as a super-fast financial analyst who can process thousands of transactions in seconds—without ever making a typo. Instead of you or your team spending hours squinting at tiny numbers and painstakingly typing them into a spreadsheet, this tool automates the entire process of pulling that data out.

This technology isn't just a "nice-to-have" anymore; it's becoming a must-have for anyone who needs to move quickly and accurately. Manually processing statements is incredibly slow, but worse, it's a huge source of errors. Those little mistakes can snowball into incorrect financial reports, stalled loan applications, or even compliance headaches. The whole point of this software is to stop those problems before they even start.

The Core Problems It Solves

Anyone who's ever dealt with stacks of bank statements knows the common frustrations. These tools are built specifically to tackle those pain points head-on.

Manually entering financial data is riddled with challenges that many businesses just accept as the "cost of doing business." But automation provides a direct and powerful fix. The table below breaks down the everyday struggles and how bank statement software offers a clear solution.

Core Problems Solved by Bank Statement Software

| Manual Challenge | Software Solution |

|---|---|

| High Risk of Human Error | Automation extracts data with near-perfect accuracy, eliminating typos and misinterpretations. |

| Painfully Slow Reconciliation | Clean, organized data is ready for direct import into accounting systems, cutting reconciliation time dramatically. |

| Delayed Financial Reporting | Real-time data extraction means decision-makers get the insights they need instantly, not weeks later. |

| Massive Time Commitment | Hours or days of manual work are reduced to just a few minutes, freeing up staff for more valuable tasks. |

Essentially, this technology is more than just a convenience—it's a strategic move.

By automating the foundational, repetitive task of data extraction, you can free up your team to focus on what really matters: high-level analysis, strategy, and growing the business.

The demand for these tools is exploding, thanks in large part to big leaps in AI. The global market for bank statement analyzer software was valued at around USD 1.2 billion in 2024 and is expected to hit USD 3.5 billion by 2033. That growth tells you just how critical this technology is becoming.

Of course, before you can process a statement, you have to get your hands on it. If you need a hand with that first step, you might find our guide on how to download a bank statement from your financial institution helpful.

How the Technology Actually Works

Ever wonder how a static document like a bank statement gets turned into a goldmine of searchable, usable data? It’s not magic, but it is a pretty clever, multi-step process. Think of it like a digital assembly line: a raw PDF or scanned image goes in one end, and structured, actionable information comes out the other.

It all starts the moment you upload a statement. Whether it's a clean PDF straight from your online banking portal or a scanned copy of a paper document, the software's first job is to learn how to read it.

From Image to Text with OCR

The first piece of the puzzle is a technology called Optical Character Recognition (OCR). Put simply, OCR is the software’s set of eyes. It scans the document, recognizes the shapes of letters and numbers, and converts the whole thing into digital text. This single step eliminates the soul-crushing task of manual data entry and all the typos that come with it.

But just having the raw text isn't enough. At this stage, the software has a big block of words and numbers with zero context. It can't tell a transaction date from a closing balance.

Parsing and Structuring the Data

This is where intelligent parsing takes over. The software uses sophisticated rules and algorithms to make sense of the chaos. It’s trained to spot patterns and pull out specific pieces of information, sorting them into neat categories:

- Dates: Finding and correctly formatting every transaction date.

- Descriptions: Isolating the text that describes what the transaction was for.

- Amounts: Separating money going out (debits) from money coming in (credits).

- Balances: Pinpointing the opening, closing, and running balances on the statement.

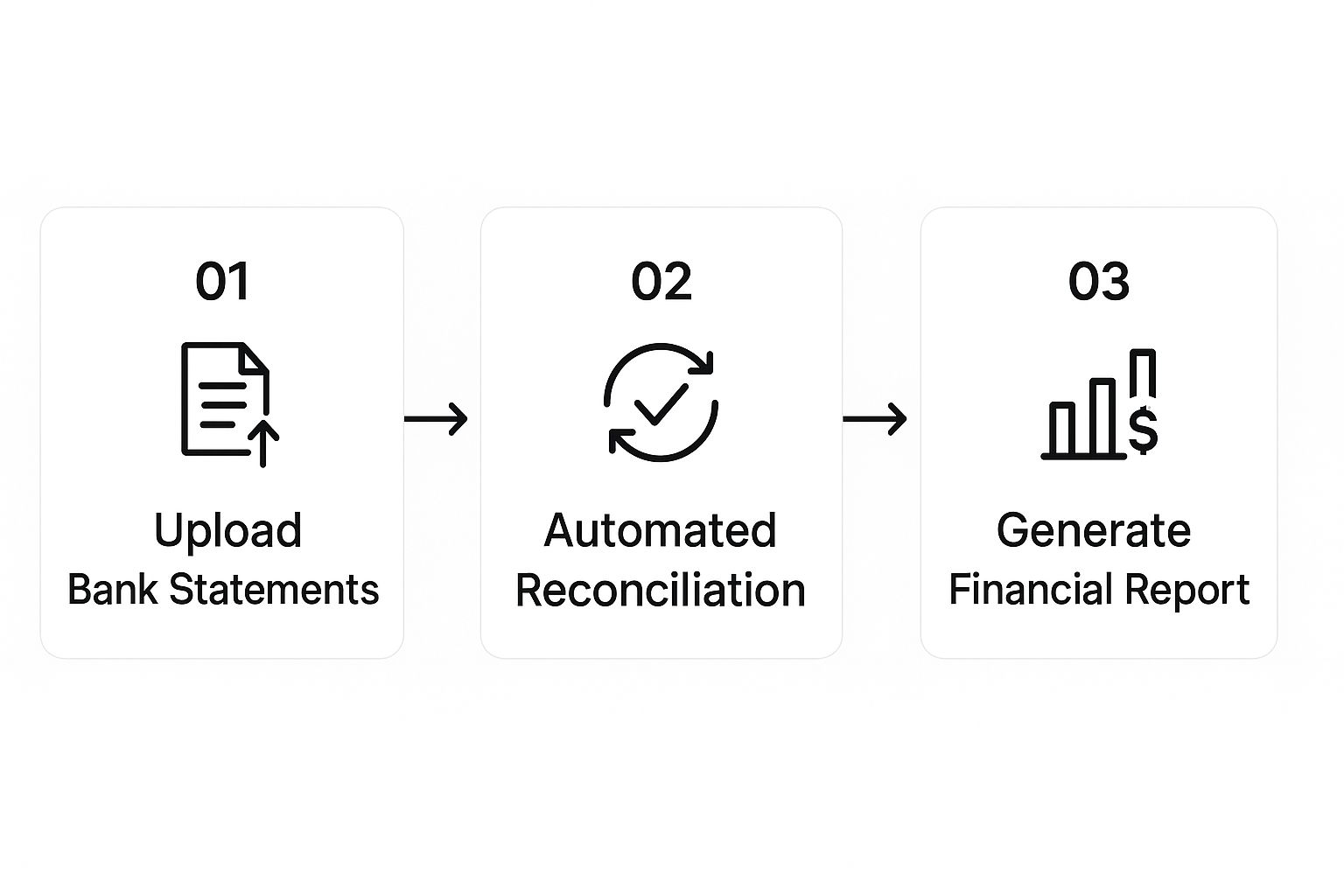

This high-level workflow shows how a document moves from initial upload to a final, polished report.

As you can see, the technology automates the entire journey, taking raw data and transforming it into a clean financial summary without you lifting a finger.

Adding Intelligence with AI

The last layer—and the most impressive—is where artificial intelligence (AI) and machine learning come into play. Once all the data is neatly structured, AI algorithms get to work analyzing it for insights that a human might miss.

This is where the software goes from being a simple data-entry tool to a genuine analytical partner. It learns to automatically categorize spending (like tagging a payment as "Utilities" or "Software Subscription"), flags unusual activity that might be fraudulent, and double-checks the numbers for accuracy.

Many modern bank statement tools rely on these advanced capabilities to make the process faster and smarter. To get a better sense of what’s possible, it’s worth looking into the broader applications of AI for financial analysis. This final step is what turns a pile of transactions into true business intelligence you can use for reporting, reconciliation, or planning your next move.

What to Look for in Bank Statement Software

Choosing the right bank statement software is a bit like picking the right tool for a job. You wouldn't use a sledgehammer to hang a picture frame, and you shouldn't pick a complex enterprise tool when all you need is simple data extraction. Not all software is created equal, and the best fit really hinges on what you need to get done.

Let's move past the marketing buzz and dig into the core features that actually make a difference in your day-to-day work. The most basic requirement? The software has to handle whatever you throw at it. Your financial data isn't always going to show up as a neat, clean PDF. A truly useful tool needs to be versatile enough to process everything from digital PDFs and CSVs to scanned paper statements without a hiccup.

Data Extraction and Accuracy

At its heart, this kind of software has one primary job: to pull data from a document accurately. This is the absolute deal-breaker. Look for tools that don't just grab the information but also double-check it for you.

- Optical Character Recognition (OCR) Quality: The software's ability to "read" a scanned document is its foundation. High-quality OCR is critical to ensure a "5" isn't misread as an "S," which can cause a whole chain of errors down the line.

- Data Validation Rules: Think of this as a built-in fact-checker. Good software will automatically compare the summary totals on a statement with the list of individual transactions to make sure the math adds up. If it doesn't, it flags the discrepancy for you.

These built-in accuracy checks are what separate a flimsy, basic tool from a reliable, professional-grade solution.

Automation and Intelligent Processing

Once the data is pulled out, the real magic should happen. The best software doesn't just hand you a pile of raw data; it helps you organize it and make sense of it. This is where automation and AI really shine as massive time-savers.

One of the most powerful features is automated transaction categorization. Imagine a digital assistant that intelligently sorts every transaction into categories like "Rent," "Utilities," or "Travel Expenses" based on who you paid. This one feature alone can shave dozens of hours off your bookkeeping and tax prep work.

When a platform can automatically categorize 80% or more of your transactions correctly on the first go, you're no longer stuck in the weeds of manual data entry. You can finally focus on analysis.

More advanced tools can even help with fraud detection. These systems learn your normal spending habits and flag anything that looks out of place—like a surprisingly large withdrawal or a payment from a new country—so you can review it. It’s an extra layer of security that provides some welcome peace of mind.

Essential vs. Advanced Software Features

Not everyone needs every bell and whistle. A sole proprietor's needs are very different from a large lending institution's. This table can help you figure out which features are "must-haves" for you versus "nice-to-haves."

| Feature | Essential For | Advanced For |

|---|---|---|

| High-Accuracy OCR | Everyone. If it can't read the document, nothing else matters. | Anyone dealing with old, faded, or low-quality scans. |

| Basic CSV/Excel Export | Sole proprietors, small businesses, and individuals doing their own books. | Most users will outgrow this and want direct integrations. |

| Automated Categorization | Accountants, bookkeepers, and businesses managing multiple accounts. | Lenders and auditors who need to analyze spending patterns across many clients. |

| Direct Accounting Software Integration | Anyone using QuickBooks, Xero, or Sage. This is a huge time-saver. | Firms that need custom API access to connect with proprietary or in-house systems. |

| Fraud Detection Alerts | Businesses with high transaction volumes or multiple employees with cards. | Banks, credit unions, and financial investigators monitoring for suspicious activity. |

| Multi-Format Support (PDF, Scans, CSV) | Pretty much everyone. You never know what format a client will send. | Forensic accountants who need to process a wide array of document evidence. |

Ultimately, use your own workflow as your guide. If a feature solves a major, recurring headache for you, it's probably essential.

Seamless Platform Integrations

Even the most powerful software is a pain to use if it's an island. Your bank statement tool has to play nicely with the other systems you rely on every day, especially your accounting software.

Look for direct, one-click integrations with the big players:

- QuickBooks Online and Desktop

- Xero

- Sage

A smooth integration means you can push structured, categorized data straight into your general ledger. No more messing with manual CSV uploads and trying to map data fields. This kind of connectivity is what makes for the best document management software for accountants. It turns a simple data tool into the hub of a highly efficient financial workflow, keeping your data consistent and saving you a ton of time.

The Real-World Benefits of Automation

Knowing the "how" of bank statement software is great, but the real magic is in the "why." What does it actually do for a business? When you stop processing statements by hand and start automating, the benefits are tangible and can be broken down into three key areas: massive efficiency gains, near-perfect accuracy, and much deeper financial insights.

The first and most obvious win is the sheer amount of time you get back. Forget about the days of being hunched over a desk, manually typing transaction details from a PDF into an Excel sheet. That entire, error-prone process gets condensed from hours down to just a few minutes. Your team is suddenly free to focus on work that actually requires a human brain, not just a pair of eyes and fast fingers.

It's no surprise that the demand for these tools is exploding. The global bank accounting software market was valued at around USD 3.4 billion in 2021 and is expected to climb to nearly USD 4.8 billion by 2025. This isn't just a trend; it's a fundamental shift in how businesses handle their finances.

Slashing Errors and Strengthening Compliance

Next up is accuracy. Let's be honest, humans make mistakes. A misplaced decimal point or a couple of swapped numbers might seem small, but they can create huge problems—leading to bad financial reports, stressful audits, and poor decisions based on faulty data.

Bank statement software all but eliminates this risk. By pulling the data directly from the document, it captures everything perfectly, every single time. This precision is critical for a few reasons:

- Error-Free Reporting: You can finally generate financial statements that you know are 100% correct.

- Compliance: It creates a clean, verifiable audit trail that keeps regulators happy.

- Risk Reduction: You sidestep the expensive consequences of simple human error.

This high level of accuracy is also the engine behind automated bank reconciliation. When transactions are matched flawlessly, closing the books at the end of the month becomes a much faster and more reliable process. If you want to dive deeper, you can explore more about automated bank reconciliation software.

Unlocking Deeper Financial Insights

Finally, and this might be the most powerful benefit of all, automation turns your raw transaction data into a strategic asset. Once all that information is organized and categorized, it stops being just a list of numbers and becomes a goldmine for analysis. You can instantly spot spending trends, see where your money is really going, and build far more accurate cash flow forecasts.

Instead of just looking at past transactions, you can start using that historical data to make smarter, forward-looking decisions for your business.

For instance, a lender can analyze an applicant's spending patterns in minutes to make a better risk assessment. A small business owner can get a real-time snapshot of their monthly cash burn. This is the ultimate goal: moving from reactive bookkeeping to proactive financial management. By learning to automate your bookkeeping processes, you can achieve this level of clarity and control.

How to Choose the Right Software

https://www.youtube.com/embed/SAy2tlmqT94

Picking the right bank statement software is less about finding the "best" tool on the market and more about finding the best tool for you. Before you even look at a single product page, it’s worth taking a moment to figure out exactly what you need. This quick self-assessment is the key to avoiding a common pitfall: overpaying for a dozen features you’ll never touch or, worse, choosing a tool that can't handle your workload.

Start by asking a few simple but crucial questions. Are you trying to maximize speed, guarantee near-perfect accuracy, or uncover deep analytical insights? How many statements are you processing each month? And what other software, like your accounting platform, does this new tool need to play nicely with? The answers will give you a clear roadmap to the perfect solution.

Define Your Core Requirements

Once you have a clear picture of your goals, you can start weighing the criteria that actually matter. An accounting firm processing client statements has a completely different set of priorities than a mortgage lender verifying income, so think about where your needs fall.

It's also smart to consider where these tools fit into the bigger picture. Specialized software like this is part of a massive, interconnected financial tech industry. The global core banking software market, which often includes statement processing, was valued at a huge USD 15.83 billion in 2024 and is expected to climb to USD 64.65 billion by 2034. According to data from custommarketinsights.com, this growth shows just how important it is to pick a solution that can integrate and grow with the technology around it.

Next up is security and compliance, and this part is absolutely non-negotiable. You're handling incredibly sensitive financial data, so your software has to be a fortress.

- Security Protocols: Make sure any tool you consider uses strong encryption for data, both when it's stored (at rest) and when it's being sent (in transit).

- Compliance Certifications: Look for official certifications like SOC 2. This is a clear sign that a provider has been audited and meets high standards for data security and privacy.

These two things are your best defense, ensuring that your financial data and your clients' information are locked down tight. For a closer look at the key features you should expect, our complete guide on bank statement extraction software breaks it all down.

The best software isn't the one with the most features; it's the one that most effectively solves your specific problem with the least amount of friction.

Finally, let's talk about money and growth. Think about how you’ll be paying for the service. Some companies offer a simple monthly subscription, while others charge based on how many statements you process. If your volume fluctuates, a pay-as-you-go model might save you a lot of money. The goal is to find a tool that not only fits your budget today but can also scale up without breaking the bank as your business grows.

Your Next Steps in Financial Automation

As we've seen, modern bank statement software isn't just a nice-to-have tool; it's a genuine strategic asset. It lets you swap out tedious, manual data entry for smart automation. That means your team can move faster, slash costly human errors, and finally tap into the financial insights that have been locked away in static documents.

So, where do you go from here? The first step is a practical one: take a close look at how you're doing things right now.

Assess Your Process

It’s time for an honest evaluation of your current financial workflow. Start by asking some key questions:

- Where are the biggest logjams when we process statements?

- How many work hours are we realistically losing each month to manual data entry and fixing mistakes?

- What crucial financial questions could we finally answer if all this data were instantly available?

This kind of internal audit is what builds a rock-solid business case for making a change. When you can pinpoint the exact time and money being wasted on old-school processes, you can clearly see the immediate return you'll get from adopting the right software.

Once you have that clarity, you can start exploring different solutions with confidence. A lot of platforms offer free trials, which are perfect for testing their tools with your own bank statements.

Making this move is an investment in a more efficient, accurate, and insightful financial future. Start exploring your options today and turn that mountain of data into your most powerful tool for growth.

Frequently Asked Questions

When you're looking into bank statement software, a few key questions always come up. It's smart to think about security, compatibility, and how a new tool will actually fit into the way you already work. Let's break down some of the most common ones.

Is This Software Secure for Sensitive Financial Data?

That's the big one, isn't it? The short answer is yes, but only if you go with a reputable provider. For any serious software in this space, security isn't just a feature; it's the entire foundation of their business.

Top-tier platforms build their systems with multiple layers of protection:

- End-to-End Encryption: This is non-negotiable. It means your data is scrambled the moment you upload it and stays that way while it's stored. Think of it like sending a message in a locked box that only the right system can open.

- Compliance Certifications: You'll want to see proof of their security chops. Look for certifications like SOC 2, which is a rigorous, independent audit that confirms a company has its security controls and privacy policies buttoned up tight.

- Access Controls: The software should ensure that only people you authorize can ever see or touch the financial data.

When a provider has these measures in place, you can feel confident that your financial information is in good hands.

Can It Handle Statements from Any Bank?

Pretty much, yes. A good piece of bank statement software is built to be "bank-agnostic." That’s a fancy way of saying it doesn't care if the statement is from a huge national bank, a local credit union, or an international institution.

The magic is in the technology.

The best tools use intelligent OCR and advanced parsing engines that can read and understand the layout of almost any statement you throw at it. They don't need to be trained on a specific bank's format; they’re smart enough to find the key information on their own.

This flexibility is what makes the software so powerful—it just works, no matter where the statements come from. That said, if you regularly deal with a very obscure or unique bank, it never hurts to double-check with the provider beforehand.

How Is This Different from My Accounting Software?

Great question. The two are designed to be teammates, not competitors. They each have a very specific job to do, and they make each other much more effective.

Think of it this way:

Bank statement software is the specialist. Its one and only job is to take a raw bank statement—usually a PDF or a scan—and pull all the transaction data out, converting it into a clean, structured digital file like Excel or CSV. It’s all about extraction and organization.

Accounting software, like QuickBooks or Xero, is the general manager. It takes that perfectly organized data and puts it to work for the big picture: reconciling accounts, running financial reports, tracking invoices, and managing your entire set of books.

So, the bank statement software does the tedious, manual work of data entry for you, feeding clean information directly into your accounting system. It saves you the headache so you can focus on the actual accounting.

Ready to stop typing out transactions and get your time back? Bank Statement Convert PDF is a powerful and secure tool built to turn your bank statements into perfectly organized Excel spreadsheets in seconds. Start your free trial today and see how easy it can be.