At its heart, small business bookkeeping is about one simple habit: tracking every single financial transaction. This isn't just about getting ready for tax season. It’s about creating a living, breathing story of your company's financial health, giving you the power to make smarter decisions based on real data. Without this habit, you're essentially flying blind.

Why Bookkeeping Is Your Business’s Most Important Habit

A lot of entrepreneurs see bookkeeping as a chore—a headache they have to deal with when taxes are due. But that view misses the whole point. Think of your business as a ship on a vast ocean. Your bookkeeping records are your ship's logbook, carefully noting your position, speed, and how many supplies you have left.

Without that logbook, how would you know if you're actually heading toward your destination (profitability)? How could you spot a slow leak (like a creeping, unnecessary expense) before it becomes a serious problem? This is the essence of bookkeeping: it's not just about crunching numbers, but about gaining clarity and control over your business.

It's the Foundation for Smart Decisions

Good bookkeeping is the bedrock of every solid business decision. It tells you which products are actually making you money, whether it's the right time to invest in new equipment, or if you can really afford to hire that new team member. This data-first approach takes the guesswork and stress out of your strategic planning.

The truth is, millions of entrepreneurs are in the same position. In the United States, small businesses make up 99.9% of all companies, yet a whopping 60% of their owners feel like they don't know enough about accounting. That's a huge knowledge gap, especially when you learn that nearly 70% of small businesses are handling their finances without a dedicated accountant.

More Than Just Numbers on a Page

Ultimately, good financial management is about building a business that can last. Consistent bookkeeping gives you the insights you need to get through tough economic times, secure a loan when you need it, and plan for long-term growth. It turns your financial data from a source of anxiety into your most powerful tool.

Bookkeeping is the act of telling the financial story of your business. Each transaction is a sentence, each financial report is a chapter, and together, they narrate your journey toward success.

This guide is here to take the mystery out of the process, turning something that feels overwhelming into a manageable—and even empowering—habit. You’ll learn how to set up a simple, effective system that gives you real confidence in your numbers.

Digging into why bookkeeping is important for businesses can really drive home its role as a critical habit. For some actionable next steps, you might find our guide on https://bankstatementconvertpdf.com/small-business-bookkeeping-tips/ helpful.

Getting to Grips with the Language of Your Business Finances

To truly get a handle on your business's financial health, you have to learn to speak its language. Think of bookkeeping less as complex math and more as a new dialect where terms like "assets" and "liabilities" tell the real story of where your company stands. It all comes down to a few core ideas that explain how money moves through your business.

Let's use a small bakery as an example. Everything that happens financially in your bakery, from selling a croissant to paying your rent, fits into five basic categories. Getting these down is the first real step to mastering your books.

The Five Building Blocks of Bookkeeping

Every single transaction your business makes will fall into one of these five accounts. They’re the fundamental buckets you'll use to organize every dollar.

For a clearer picture, here’s a quick-reference table that breaks down these core terms.

Key Bookkeeping Terms Explained

| Term | Simple Definition | Small Business Example |

|---|---|---|

| Assets | Everything your business owns that has value. | Cash in the bank, your delivery van, kitchen equipment, and money customers owe you (Accounts Receivable). |

| Liabilities | Everything your business owes to others. | A bank loan for your oven, unpaid supplier invoices (Accounts Payable), or a credit card balance. |

| Equity | The net worth of your business; what's left for you. | The initial cash you invested to start the bakery, plus all the profits you've kept in the business. |

| Revenue | All the money your business earns from sales. | Income from selling coffee, cupcakes, and wedding cakes. |

| Expenses | All the money your business spends to operate. | Costs for ingredients, employee wages, rent, and utility bills. |

Getting comfortable with these terms is a game-changer. For a deeper dive, this owner's guide to financial jargon is an excellent resource to keep handy.

The Golden Rule: The Accounting Equation

Now, here’s where it all comes together. These five elements are all connected by a simple, unbreakable rule known as the accounting equation. It’s the one principle that ensures your books are always balanced.

Assets = Liabilities + Equity

Picture a perfectly balanced scale. On one side, you have everything your business owns (Assets). On the other, you have all the claims against those assets—what you owe to others (Liabilities) plus what you, the owner, have a claim to (Equity). Every transaction has to keep this scale level.

For instance, if you buy a $5,000 oven (an asset) using a bank loan (a liability), the scale stays perfectly even. Your assets go up by $5,000, and your liabilities go up by the exact same amount.

Single-Entry vs. Double-Entry Bookkeeping

So, how do you actually record all this? There are two main methods, and choosing the right one is crucial.

- Single-Entry Bookkeeping: This is the most basic approach, working a lot like a simple checkbook register. You log money when it comes in and when it goes out. While it's straightforward, it provides a very limited financial picture and is prone to errors. It really only works for the smallest of side hustles with very few transactions.

- Double-Entry Bookkeeping: This is the gold standard for virtually every business, big or small. It’s built on the accounting equation, meaning every transaction gets recorded in at least two accounts—as a debit in one and a credit in another. This system is the foundation of real accounting.

Imagine you sell a $100 birthday cake for cash. With a double-entry system, you don’t just note the sale. You track where that money came from and where it went.

Your Revenue account increases by $100, and your Cash (Asset) account also increases by $100.

This creates a self-checking system that ensures accuracy and gives you the detailed information needed for critical financial reports. It’s not just a best practice; for most businesses, it’s a requirement.

Choosing the Right Tools for Your Bookkeeping

Now that you've got the core concepts down, it's time to pick the tools that will make it all happen. Getting this right can mean the difference between bookkeeping being a dreaded chore and a smooth, almost effortless habit.

You've really got two main paths you can go down: the old-school manual route with spreadsheets or modern, dedicated bookkeeping software. While a simple spreadsheet might feel comfortable and familiar, it can quickly become a tangled mess as your business gets more complex.

That's precisely why most small business owners today lean on cloud-based software. These platforms are built from the ground up for managing money and come packed with features that spreadsheets just can't compete with.

Spreadsheets vs. Bookkeeping Software

If you're just starting out—maybe as a freelancer with only a handful of clients—a spreadsheet can work in a pinch. It’s a low-cost way to get your feet wet with tracking basic income and expenses. But you'll likely outgrow it fast.

Once you have more than a few transactions a month, spreadsheets get clunky. It's tough to spot errors, and creating the kind of professional financial reports you'll eventually need for loans or investors is a major headache. This is where dedicated software really shines.

Let's break down the real-world differences:

| Feature | Spreadsheets (e.g., Excel, Google Sheets) | Bookkeeping Software (e.g., QuickBooks, Xero) |

|---|---|---|

| Automation | Everything is manual. You type in every single transaction. | It connects to your bank and pulls in transactions for you automatically. |

| Reporting | You have to build reports from scratch with complicated formulas. | You can generate professional financial statements in a few clicks. |

| Accuracy | One typo or a broken formula can throw everything off. The risk is high. | It’s built on double-entry principles, which drastically reduces errors. |

| Scalability | Gets incredibly slow and hard to manage as your business grows. | Designed to grow with you, handling thousands of transactions easily. |

| Accessibility | Stuck on one computer unless you’re using a cloud version. | Log in from your phone, tablet, or any computer, anywhere. |

Think of software as an investment in your sanity and your business's accuracy. It's a cornerstone of solid bookkeeping basics for small business.

Key Features to Look for in Software

When you're shopping around for software, a few features are absolute game-changers. They save a ton of time and give you a crystal-clear picture of your finances.

Make sure any tool you consider has these core functions:

- Automatic Bank Feeds: This is a must-have. The software securely links to your bank accounts and credit cards, importing new transactions every day so you don't have to.

- Invoicing and Payments: You should be able to create, send, and track professional invoices right from the platform. The best ones also let clients pay you online, which gets cash in your pocket faster.

- Expense Tracking: Easily categorize your spending as you go. Many apps even let you snap a picture of a receipt with your phone, and it digitizes the information for you. No more shoeboxes full of paper!

- Financial Reporting: With the click of a button, you should be able to pull up an Income Statement, Balance Sheet, or Cash Flow Statement to see exactly how your business is doing.

These features turn bookkeeping from something you do to catch up into a tool you use to look ahead. Understanding your numbers is power, and you can learn more about putting them to work with our guide to cash flow management for small business.

The move to digital tools isn't just a trend; it's the new standard. By 2025, a staggering 64.4% of American small and medium-sized businesses will be using bookkeeping software. This massive shift is driven by the need for efficiency and real-time financial data. It's also fueling growth for the providers themselves—cloud bookkeeping platforms have seen an average 15% revenue increase, with giants like QuickBooks Online holding 62% of the global market. You can dive deeper into these trends and discover more insights about bookkeeping services provider statistics on llcbuddy.com.

Your Step-by-Step Bookkeeping Workflow

Now that we've covered the basic concepts and tools, it's time to put them into practice. A reliable bookkeeping workflow is what transforms that messy pile of receipts and invoices into financial data you can actually use. This isn't about complex accounting wizardry; it's about building a simple, repeatable routine to keep you in control.

Think of this workflow as your financial rhythm. The goal is to make these steps second nature, so you're never scrambling at tax time or left wondering where your cash went. This routine is the engine that drives all the powerful insights your financial reports will give you.

Start with a Chart of Accounts

Before you can track a single dollar, you need a system to organize everything. That's where your Chart of Accounts (CoA) comes in. Picture your CoA as a perfectly organized filing cabinet for your business finances. Each main drawer is labeled with a major account type—Assets, Liabilities, Equity, Revenue, and Expenses.

Inside each of those main drawers are specific folders for every type of transaction. For instance, inside your "Expenses" drawer, you might have folders labeled:

- Office Supplies: For all your paper, pens, and printer ink.

- Software Subscriptions: For tools like your accounting platform or project management apps.

- Rent or Lease: For your monthly office or storefront payment.

- Marketing and Advertising: To track costs from social media ads or flyer printing.

Setting up a detailed CoA from the get-go is one of the most crucial steps for any small business. Most accounting software provides a default CoA that you can—and should—customize. Taking a little time to tailor it to your specific business makes every subsequent step much easier and more accurate.

The Core Bookkeeping Cycle

With your "filing cabinet" ready, the day-to-day work can begin. The process really boils down to three core activities you'll repeat consistently: recording, categorizing, and reconciling.

1. Record Every Single Transaction

This is the bedrock of good bookkeeping. Every time money moves in or out of your business, it absolutely has to be recorded. If you're using modern software, this is a lot easier than it sounds. The bank feed feature automatically imports transactions directly from your business bank accounts and credit cards, doing most of the work for you.

Still, you’ll need to be diligent about manually tracking any cash transactions. Did you pay for parking in cash on the way to a client meeting? Record it. Did a customer pay you with cash at a local market? Log it right away. These small amounts can add up quickly and throw off your accuracy if you let them slip through the cracks.

2. Categorize Income and Expenses

Once all your transactions are in the system, the next step is to file them away in the right folders within your CoA. This is where that well-organized "filing cabinet" you set up earlier pays off. That $50 purchase from Staples gets filed under "Office Supplies." The $1,000 payment you received from a client goes into a "Sales Revenue" account.

Proper categorization is what turns raw data into real insight. It’s how you can see exactly where your money is coming from and where it’s going, helping you spot trends like a sudden jump in software spending or a dip in sales for a particular service.

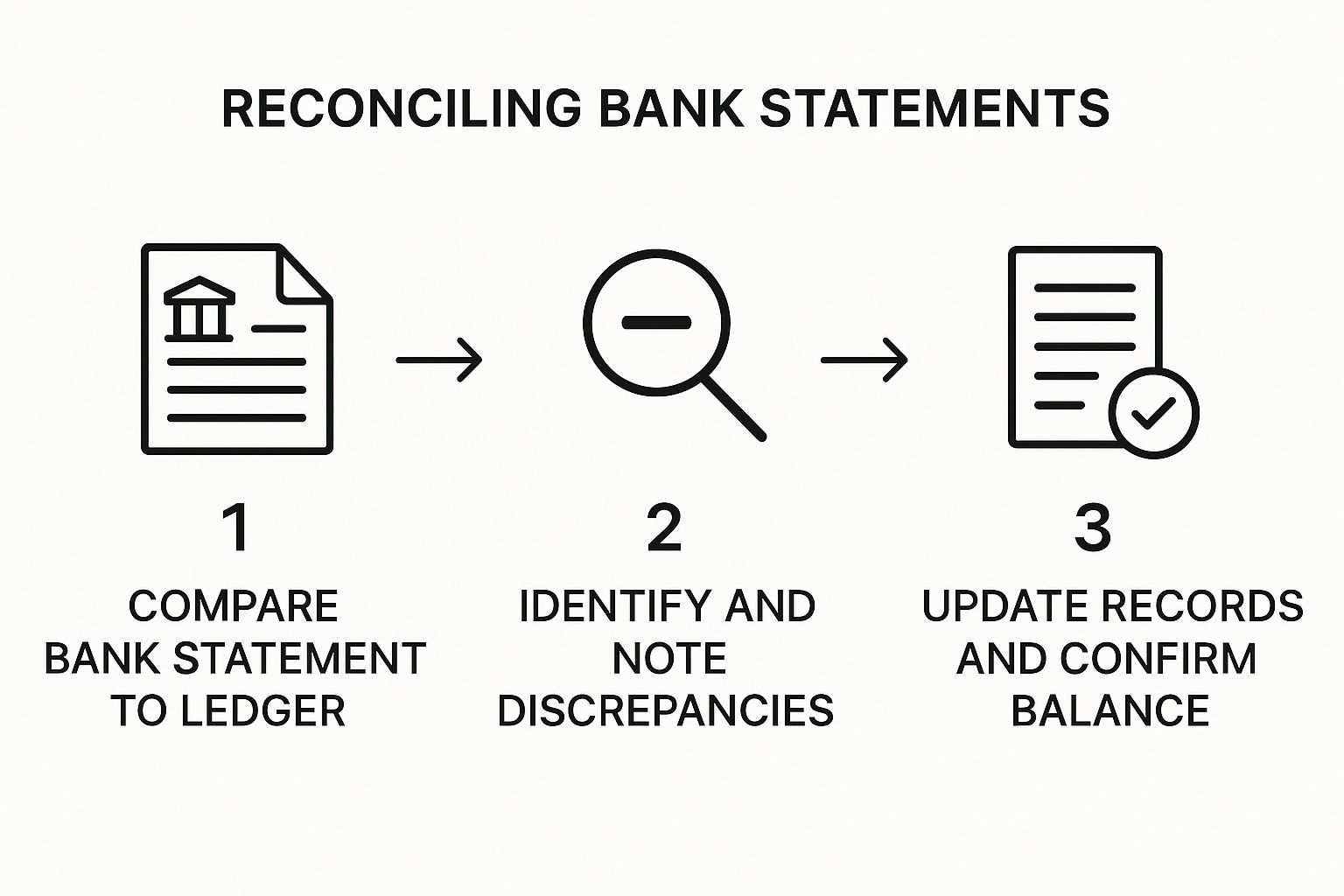

3. Reconcile Your Accounts Monthly

This final step is the one you can't afford to skip. Reconciling simply means comparing the transaction list in your bookkeeping software to your official bank and credit card statements at the end of each month. The goal is simple: make sure they match, down to the last penny.

Think of reconciliation as a quality control check for your finances. It's how you confirm that your books are a 100% accurate reflection of reality. This process helps you catch bank errors, find missing transactions, and even spot fraudulent charges before they snowball into bigger problems.

This simple process is the key to maintaining accurate records.

To ensure these tasks are done consistently and correctly, it helps to establish clear Standard Operating Procedures (SOPs) for an accounting department. And for business owners looking to make this entire process even smoother, our guide to the https://bankstatementconvertpdf.com/best-free-bookkeeping-software/ can point you toward some excellent tools.

How to Read Your Financial Statements

After all that diligent work of recording and categorizing transactions, this is where it all comes together. We get to create the financial statements. Think of these reports less as boring spreadsheets and more as your business's report card. They tell the real story of how you're doing.

Learning to read them is a core part of bookkeeping basics for small business. It's the skill that takes you from simply tracking numbers to making smart, confident decisions. Let's walk through the "big three" reports with some simple analogies to make them click.

The Balance Sheet: Your Financial Snapshot

Imagine taking a single, clear photograph of your business at a specific moment in time—say, midnight on December 31st. That's your Balance Sheet. It doesn't show you the action over a month or a year; it’s a static picture of what you own and what you owe on that one day.

It's built on that fundamental accounting equation: Assets = Liabilities + Equity.

- What should you look for? First, does it balance? It absolutely has to. More importantly, what’s the relationship between your assets and liabilities? A healthy company will have more in the asset column than the liability column, showing it’s on solid ground.

The Income Statement: Your Profitability Story

If the Balance Sheet is a photo, the Income Statement is a movie. You might hear it called a Profit and Loss or P&L statement, but it does one job: it tells the story of your business's performance over a period of time, like a month, a quarter, or a full year.

The formula here is straightforward: Revenue – Expenses = Net Income (Profit or Loss).

This is where you answer the most important question of all: "Am I actually making money?" It lays out every dollar you earned and every dollar you spent to get there, leaving you with the bottom line—your profit.

By digging into your Income Statement, you can spot your most profitable services, find areas where costs are creeping up, and see how your profitability changes over time. It’s the ultimate scoreboard for your business operations.

The Cash Flow Statement: The Journey of Your Cash

For a small business, the Cash Flow Statement might just be the most important report of all. Why? Because profit isn't the same as cash in the bank. The Income Statement can show a profit even if your clients haven't paid you yet, but the Cash Flow Statement tracks the actual hard currency moving in and out of your accounts.

You can’t pay your bills with profit on paper—you need cash. This report breaks down your cash movements into three areas:

- Operating Activities: Cash from your main business, like customer payments and vendor bills.

- Investing Activities: Cash spent on or received from selling long-term assets, like a new vehicle or computer equipment.

- Financing Activities: Cash from loans or investors, or money you pay back on a loan.

A strong business has a positive cash flow from its operations. That’s a fancy way of saying it brings in more cash from customers than it spends running the place. Getting comfortable with your bank statements is a huge part of this, and our guide on how to read a bank statement can help you master that skill.

Understanding these reports elevates you from a business owner to a strategic financial manager. And that skill is in high demand. In fact, 85% of accounting firms now offer financial strategy planning because business owners are hungry for this kind of insight. These firms are thriving, with 73% reporting higher profits, largely because they help people like you make sense of these very reports.

Common Bookkeeping Questions Answered

Once you get past the basic definitions, you'll find that actually doing the books brings up a whole new set of questions. It's one thing to know what a debit is, but it's another thing entirely to manage your finances week in and week out.

Think of this section as your field guide for those "now what?" moments. We'll tackle the real-world issues that trip up most new business owners, helping you build the confidence to manage your money well.

How Often Should I Do My Bookkeeping?

The short answer? More often than you think. Consistency is your best friend here.

For most small businesses, setting aside time to update and categorize your transactions weekly is the sweet spot. This keeps the task from snowballing into a monster project and gives you a real-time pulse on your cash flow. If you let it slide, you're flying blind.

At the absolute minimum, you need to reconcile your bank accounts and pull your main financial reports every single month. This closes out the period and makes sure your numbers are clean and ready for decision-making.

A great way to build this habit is to block out a specific time on your calendar, like Friday afternoons. Treat it like any other important meeting. It turns a dreaded chore into a manageable routine.

What Is the Difference Between a Bookkeeper and an Accountant?

This is a classic point of confusion, but the distinction is actually pretty simple.

Think of it like building a house. The bookkeeper is the one on-site every day, laying the foundation and putting up the walls. They’re handling the day-to-day construction—the nuts and bolts of your finances.

A bookkeeper’s work includes:

- Recording all your sales and expenses.

- Sending invoices and paying your bills.

- Running payroll.

- Making sure your bank statements match what's in your books (reconciliation).

The accountant is more like the architect. They designed the blueprint and pop in to make sure the structure is sound and up to code. They take the detailed data from the bookkeeper and use it for high-level analysis, tax strategy, and future planning.

In short, a bookkeeper records your financial history. An accountant uses that history to help you build a better financial future.

Can I Do My Own Bookkeeping, or Should I Hire Someone?

In the beginning, absolutely. Many founders handle their own books, and with today’s user-friendly software, it’s more manageable than ever. Doing it yourself forces you to get intimately familiar with the flow of money in your business, which is a huge advantage.

But as your business grows, so does the financial complexity. Eventually, the time you spend wrestling with spreadsheets is time you’re not spending on making sales, improving your product, or talking to customers.

A good rule of thumb is to start looking for help when you're spending more than a few hours a week on your books. If you’re starting to feel out of your depth with taxes or need deeper financial insights, that's another clear sign it's time to outsource.

You don't have to go all-in, either. A hybrid approach works wonders for many businesses. You can handle the daily data entry while hiring a pro to review your books quarterly and handle your year-end tax filing. It's a great way to balance cost control with expert oversight.

What Are the Most Common Bookkeeping Mistakes to Avoid?

Most bookkeeping errors aren't complex; they’re the result of small habits that spiral out of control. Knowing what to watch for is half the battle.

Here are the top mistakes that can cause major headaches down the road:

- Mixing Business and Personal Finances: This is the cardinal sin of small business finance. Open a separate business bank account and credit card from day one. Mixing funds is a nightmare for tracking profitability and a massive red flag in a tax audit. Just don't do it.

- Forgetting Small Cash Expenses: That coffee you bought for a client, the parking meter fee, the postage stamps—they all add up. If you don't track these little cash purchases, your profit numbers will be wrong, and you'll be leaving perfectly good tax deductions on the table.

- Falling Behind on Reconciliations: Pushing off your monthly bank reconciliation is a recipe for disaster. A tiny error in January can become an impossible-to-find mystery by June. Make it a non-negotiable monthly task to ensure your books actually reflect reality.

- Incorrectly Classifying Transactions: This is a sneaky one. Did you buy a new computer? That’s a long-term asset, not an "office supply." Classifying it wrong messes up your financial reports, giving you a warped view of your company's value and profitability.

Managing financial documents is a core part of accurate bookkeeping. At Bank Statement Convert PDF, we provide powerful software that simplifies this process by helping you convert bank statement PDFs into organized Excel spreadsheets. Take control of your data and streamline your workflow by visiting us at https://bankstatementconvertpdf.com to learn more.