In today's volatile economic landscape, guessing about your company's financial future is a high-stakes gamble. Cash flow is the lifeblood of any business, and the ability to accurately predict its ebb and flow is the difference between strategic growth and constant crisis management. While many businesses track past performance, the most successful ones look forward, using sophisticated tools to anticipate cash surpluses and shortfalls. This guide moves beyond the basics, exploring eight distinct cash flow forecasting methods, each with unique strengths.

Effective forecasting is crucial for businesses of all sizes, from startups managing burn rates to large enterprises handling intricate financial ecosystems. Beyond small businesses, robust cash flow forecasting is vital for large-scale financial institutions, including those involved in strategic financial planning in the life reinsurance market, to ensure long-term stability and manage complex liabilities. The right method provides the clarity needed to make informed decisions about hiring, expansion, inventory, and debt management.

This article provides an in-depth roundup designed to equip financial professionals, entrepreneurs, and business owners with practical, actionable knowledge. We will dissect how each of these eight powerful methods works, detail their specific pros and cons, and identify the best-use scenarios for implementation. You will learn to move beyond simple projections and select the ideal forecasting approach to take decisive control over your financial destiny.

We will explore:

- The Direct and Indirect methods for short-term accuracy vs. long-term strategic insight.

- Rolling Forecasts for continuous, adaptive planning.

- Scenario-Based Forecasting to prepare for uncertainty.

- Advanced techniques like Statistical Analysis and Machine Learning for data-driven precision.

- Classic approaches such as the Percent of Sales and Judgmental methods.

1. Direct Method

The Direct Method of cash flow forecasting provides a granular, real-time view of a company's liquidity by tracking and projecting actual cash movements. Unlike other methods that start with net income and adjust for non-cash items, this approach directly forecasts cash receipts from customers and cash payments for expenses like payroll, supplier invoices, and taxes. It essentially builds a forecast from the ground up, focusing on the specific operational cash inflows and outflows.

This method is akin to managing a detailed checkbook register for your business. It requires meticulous tracking of all cash transactions, making it one of the most accurate, though labor-intensive, cash flow forecasting methods available. For businesses where daily liquidity is critical, the direct method offers unparalleled clarity.

How It Works in Practice

To implement the direct method, a business analyzes its accounts receivable aging reports to project cash from sales and its accounts payable schedules to forecast payments to vendors. It also incorporates fixed cash outflows like rent and payroll, and variable ones like utilities and marketing spend.

For example, a small retail shop would use this method by forecasting daily sales receipts based on historical data and upcoming promotions. It would then subtract anticipated payments for inventory, employee wages, and rent for that same period. This provides a clear, short-term picture of their cash position. Similarly, a large corporation like Walmart relies on direct forecasting to manage the immense daily cash flow across its thousands of stores, ensuring each location has sufficient cash for operations. While the direct method is a powerful tool for forecasting, it is also one of the two primary ways to prepare a cash flow statement. You can delve deeper into the fundamentals of the direct method and its application in financial reporting by reviewing how to create a cash flow statement.

Best Use Cases and Actionable Tips

The direct method is ideal for short-term forecasting (e.g., weekly or monthly) and is particularly valuable for small businesses, startups, and companies in industries with high transaction volumes or tight margins.

Actionable Implementation Tips:

- Prioritize Major Cash Flows: Apply the 80/20 rule. Start by forecasting your largest and most predictable cash sources and uses, such as top customer payments and major supplier invoices.

- Automate Data Collection: Manually compiling data is the biggest drawback. Integrate your accounting software with your accounts receivable (AR) and accounts payable (AP) systems to automate the collection of cash receipt and payment data.

- Leverage Historical Data: Maintain a clean historical record of cash flows. This data is invaluable for identifying seasonal trends, customer payment behaviors, and expense patterns that will make your forecasts more accurate.

- Update Frequently: For maximum benefit, direct forecasts should be living documents. Update them on a rolling basis, such as weekly, to reflect the most current information and maintain accuracy.

2. Indirect Method

The Indirect Method of cash flow forecasting begins with a company's net income and makes adjustments to reconcile it back to the actual cash flow. Instead of tracking individual cash transactions, this approach uses data from the income statement and balance sheet to estimate future cash positions. It adjusts for non-cash expenses like depreciation and amortization, and accounts for changes in working capital, such as accounts receivable and inventory.

This method is rooted in standard accounting practices and is widely used for financial reporting under both GAAP and IFRS. It provides a higher-level view, linking a company's reported profitability directly to its ability to generate cash. For stakeholders and investors, this connection is crucial for understanding the financial health and operational efficiency of a business.

How It Works in Practice

Implementing the indirect method involves taking the net income figure from a projected income statement and adding back non-cash expenses. Next, you adjust for the forecasted changes in working capital accounts. For example, an increase in accounts receivable would be subtracted, as it represents sales made but not yet collected in cash. Conversely, an increase in accounts payable would be added back, as it represents expenses incurred but not yet paid.

A SaaS company might use this method to forecast cash flow by starting with its projected net income. It would then add back depreciation on its servers and adjust for changes in deferred revenue, a significant non-cash item in subscription models. Similarly, a large manufacturing firm like Apple uses the indirect method in its financial guidance, starting with profit forecasts and adjusting for massive shifts in inventory and component payables to give investors a clear picture of its expected cash generation.

Best Use Cases and Actionable Tips

The indirect method is best suited for long-term strategic planning (e.g., quarterly or annually) and is particularly useful for businesses that already have robust financial reporting processes in place. It excels at showing how profitability translates into cash.

Actionable Implementation Tips:

- Forecast Working Capital Accurately: Your forecast is only as good as your working capital projections. Analyze historical trends to accurately predict changes in accounts receivable, accounts payable, and inventory.

- Model Collection and Payment Cycles: Pay close attention to customer payment behaviors and your own payment schedules. A small change in your average collection period can have a significant impact on your cash forecast.

- Account for Seasonal Swings: Many businesses have seasonal working capital needs. Ensure your model accounts for these variations, such as an inventory buildup before a busy holiday season.

- Validate Periodically: While the indirect method is excellent for strategic views, it can obscure short-term liquidity issues. Periodically cross-reference its results with a direct method forecast to ensure a complete and accurate picture.

3. Rolling Cash Flow Forecast

A Rolling Cash Flow Forecast is a dynamic and continuous approach that provides an always-current view of a company's financial future. Unlike static forecasts that are created once and reviewed periodically, a rolling forecast is constantly updated by adding a new period (like a month or a quarter) to the end as the most recent period concludes. This maintains a consistent forecast horizon, such as 12 or 18 months, at all times.

This method ensures that your financial projections never become outdated. By incorporating actual results from the period that just ended and adjusting future projections based on the latest business intelligence, market trends, and operational changes, it offers a more realistic and relevant financial roadmap. It's one of the most agile cash flow forecasting methods, allowing businesses to react quickly to change.

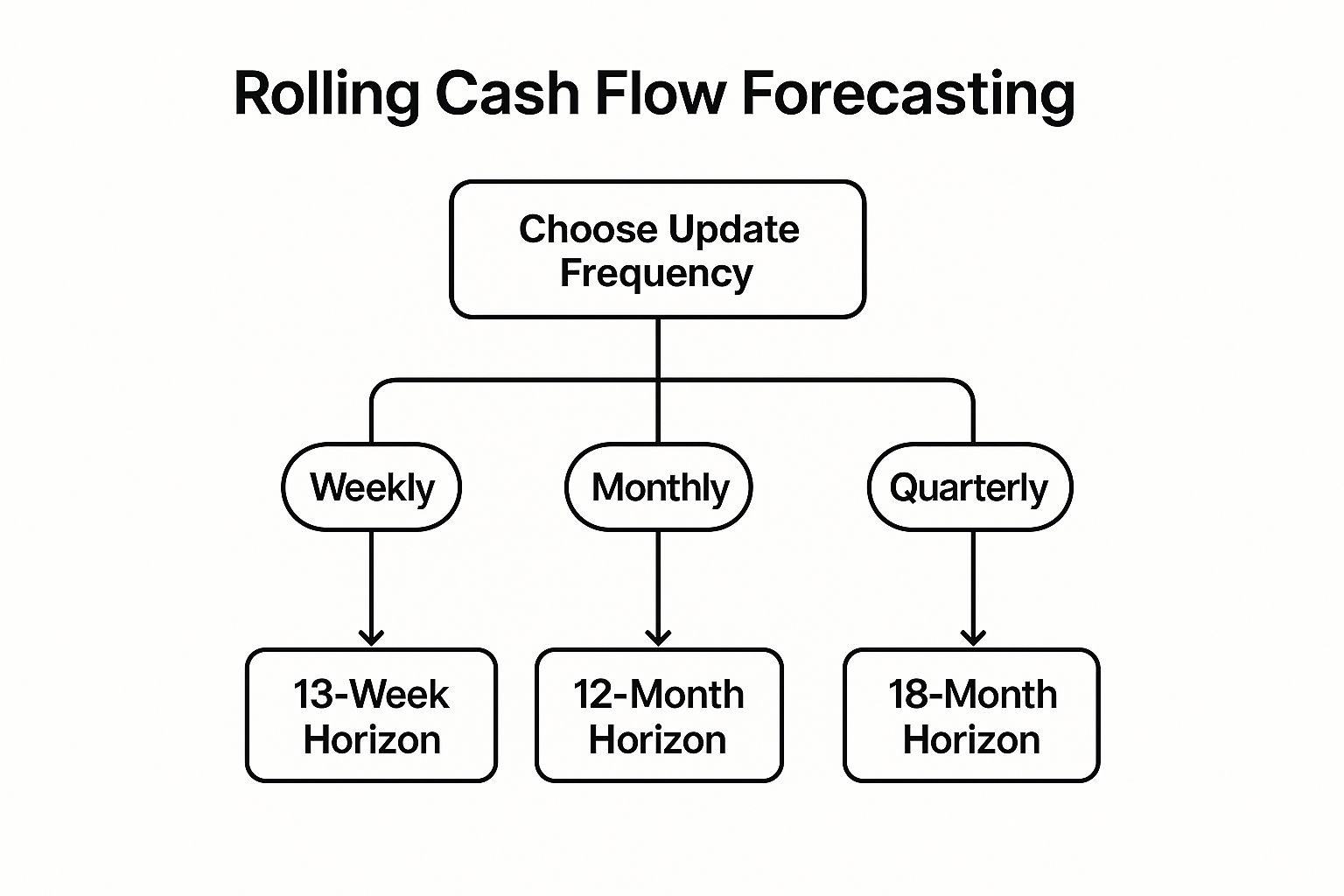

This decision tree illustrates how a company can structure its rolling forecast based on its operational tempo and strategic planning needs.

The visualization highlights that the update frequency directly influences the optimal forecast horizon, aligning short-term operational needs with long-term strategic visibility.

How It Works in Practice

Implementing a rolling forecast involves a cyclical process. At the end of each period (e.g., a month), the finance team replaces the forecasted numbers for that period with the actual financial results. They then add a new forecast period at the end of the forecast horizon. For instance, in a 12-month rolling forecast, as January ends, its forecast is replaced with actuals, and a forecast for the following January is added.

A construction company might use a rolling forecast to manage long-term project cash flows, updating projections monthly as milestones are met and material costs fluctuate. Similarly, Amazon famously uses a rolling 13-week forecast, updated weekly, to manage its complex inventory and supply chain logistics, ensuring cash is allocated efficiently to meet near-term demand. Effective cash flow management for small businesses often relies on this kind of adaptability to navigate market changes.

Best Use Cases and Actionable Tips

The rolling method is ideal for businesses in dynamic or unpredictable industries, as well as companies focused on proactive planning and growth. It helps avoid the "set it and forget it" trap of static annual budgets.

Actionable Implementation Tips:

- Establish a Clear Cadence: Define a consistent update schedule (e.g., the fifth business day of each month) and assign clear responsibilities to ensure the process runs smoothly and the forecast remains current.

- Automate Data Inputs: Manually updating a forecast is time-consuming. Integrate your accounting software, CRM, and ERP systems to automatically pull in actual results and key business drivers, freeing up your team for analysis.

- Focus on Key Drivers: Don't try to re-forecast every single line item with the same level of detail. Focus your efforts on the most significant and volatile drivers of your cash flow, such as sales pipelines, major expenses, and production costs.

- Conduct Variance Analysis: Regularly compare your forecasted numbers to actual results. Use this variance analysis to understand why differences occurred and refine the assumptions in your model to improve future forecast accuracy.

4. Scenario-Based Forecasting

Scenario-based forecasting is a strategic cash flow forecasting method that prepares a business for uncertainty by creating multiple forecast versions based on different assumptions. Instead of relying on a single projection, this approach develops best-case, worst-case, and most-likely scenarios, allowing organizations to understand the potential impact of various business conditions on their liquidity.

This method moves beyond a simple forecast to become a powerful strategic planning tool. By modeling different futures, a company can stress-test its financial resilience, identify potential cash shortfalls before they occur, and make more robust decisions. It answers the critical question: "What happens to our cash if…?" whether the variable is a sudden market downturn, a new competitor, or a spike in material costs.

How It Works in Practice

To implement scenario-based forecasting, a business first identifies the key drivers of its cash flow, such as sales volume, commodity prices, or interest rates. It then builds a baseline "most-likely" forecast. From there, it creates optimistic ("best-case") and pessimistic ("worst-case") versions by adjusting the assumptions for those key drivers.

For example, an airline would model cash flows under different fuel price scenarios to prepare for market volatility. Similarly, a retail company might create recession, stable growth, and rapid expansion scenarios to guide inventory and staffing decisions. This proactive planning helps companies like Shell, which pioneered scenario planning in the 1970s, navigate complex energy markets and make long-term investment decisions with greater confidence.

Best Use Cases and Actionable Tips

Scenario-based forecasting is ideal for businesses in volatile industries, those facing significant economic uncertainty, or companies making major strategic decisions like entering a new market or launching a new product. It provides the foresight needed to build contingency plans.

Actionable Implementation Tips:

- Limit Your Scenarios: Focus on a maximum of 3-5 distinct scenarios (e.g., optimistic, pessimistic, and expected) to avoid overcomplexity and ensure the analysis remains clear and actionable.

- Define Key Drivers: Clearly identify the critical variables that will differ across scenarios. These could be internal factors like production efficiency or external ones like market demand or regulatory changes.

- Assign Probabilities: Where possible, assign a realistic probability to each scenario based on historical data, market analysis, and expert judgment. This helps prioritize planning efforts. For more advanced techniques in scenario planning, explore how tools like Monte Carlo simulation can help model thousands of potential financial futures.

- Develop Action Plans: For each scenario, particularly the worst-case, create a corresponding action plan. This ensures you have a strategic response ready rather than reacting in a crisis.

5. Statistical/Regression Analysis Method

The Statistical Method, often employing regression analysis, leverages historical data and advanced mathematical models to forecast future cash flows. Unlike methods that rely on direct tracking or accounting adjustments, this approach identifies statistically significant relationships between a company's cash flow and various internal or external drivers. It builds a predictive model based on these identified correlations.

This quantitative technique transforms cash flow forecasting from an accounting exercise into a data science problem. It seeks to answer questions like, "How does a 5% increase in marketing spend affect our cash receipts in the next quarter?" or "What is the likely impact of a 1% rise in interest rates on our debt service payments?" By modeling these complex relationships, businesses can create more dynamic and nuanced forecasts that adapt to changing variables.

How It Works in Practice

To implement this method, a company first gathers extensive historical data on its cash flows and potential predictive variables. These variables could include sales volume, marketing expenses, economic indicators like GDP growth, or even industry-specific factors like weather patterns for a utility company. Using statistical software, analysts build a regression model that mathematically defines the relationship between these drivers (independent variables) and cash flow (the dependent variable).

For instance, Netflix can use regression models to predict subscription cash inflows. They might analyze historical data to find correlations between cash flow and variables like content spending, new subscriber acquisition costs, and market penetration rates in different regions. Similarly, credit card companies use sophisticated models that link their cash flows to macroeconomic indicators like unemployment rates and consumer spending habits, allowing them to predict default rates and payment behaviors with high accuracy.

Best Use Cases and Actionable Tips

The statistical method is best suited for mature companies with substantial historical data and the analytical resources to build and maintain complex models. It excels in stable industries where past trends are likely to predict future outcomes and is powerful for long-range strategic planning.

Actionable Implementation Tips:

- Start with Simple Models: Begin with a simple linear regression model involving one or two key business drivers (e.g., forecasting cash receipts based on sales revenue alone). Add complexity and more variables gradually as you gain confidence and understanding.

- Validate Your Model: Don't trust a model just because it fits past data well. Test its predictive power using "out-of-sample" data, a set of data it hasn't seen before, to ensure it can accurately forecast future events.

- Combine with Business Judgment: Statistical models are powerful but are not crystal balls. Always overlay the model's output with the qualitative insights of your finance and operational teams. They can account for unique future events the model doesn't know about, like a new product launch or a planned factory shutdown.

- Update Models Regularly: The relationships between variables can change over time. Revisit and update your models periodically, perhaps quarterly or annually, to ensure they reflect the current business environment and maintain their predictive accuracy.

6. Percent of Sales Method

The Percent of Sales Method is a cash flow forecasting method that hinges on the stable, historical relationship between sales revenue and other financial accounts. This approach assumes that many cash flow components, like operating expenses and accounts receivable, will change in direct proportion to sales. By establishing these relationships as a percentage of sales, businesses can project future cash flows based on their sales forecasts.

This technique simplifies forecasting by linking the entire cash flow statement to one key driver: revenue. It is particularly effective for businesses with predictable sales cycles and consistent operational patterns. Instead of forecasting each line item individually, you forecast sales and then use established percentages to estimate the corresponding cash inflows and outflows, making it a straightforward and efficient model.

How It Works in Practice

To implement this method, a company first analyzes its historical financial statements to determine the average percentage of sales for key cash flow items. For example, if a company's cost of goods sold (COGS) has historically been 40% of sales and supplier payments are made within 30 days, it can forecast cash outflows for inventory as 40% of the previous month's sales forecast.

A retail company might find that cash receipts from customers consistently equal 95% of the current month's sales. If they project $100,000 in sales for next month, they can forecast a cash inflow of $95,000. Similarly, a manufacturing business can link its payments to raw material suppliers directly to sales volumes, forecasting that cash outflows for materials will be 30% of projected sales for the upcoming quarter. This makes it one of the more accessible cash flow forecasting methods for businesses with stable operating histories.

Best Use Cases and Actionable Tips

This method is best suited for stable, mature businesses and for medium- to long-term forecasting where high-level accuracy is sufficient. It is also a valuable tool for scenario planning, allowing companies to quickly model the cash flow impact of different sales growth assumptions.

Actionable Implementation Tips:

- Analyze Historical Stability: Before applying this method, review several years of financial data. Ensure the percentage relationships you identify are stable and consistent over time; otherwise, your forecast will be unreliable.

- Adjust for Known Changes: Don't rely solely on historical averages. If you know about upcoming changes, such as a new supplier contract that alters your COGS percentage or a shift in credit terms for customers, adjust your percentages accordingly.

- Factor in Seasonality: If your business experiences seasonal fluctuations, calculate different percentages for different times of the year. For instance, your marketing spend as a percentage of sales might be higher in Q4 than in Q1.

- Regularly Review Ratios: The relationships between sales and other accounts can change over time. Review and update your percentage assumptions at least annually or whenever a significant operational change occurs to maintain forecast accuracy.

7. Judgmental/Qualitative Forecasting

Judgmental forecasting, also known as qualitative forecasting, relies on expert knowledge, experience, and intuition to predict future cash flows. This approach is particularly powerful when quantitative data is limited or when significant changes, like a market disruption or a new product launch, are expected that historical data cannot capture. It leverages human expertise and subjective insights rather than purely historical numerical data.

This method combines management insights, industry expertise, and market intelligence to develop comprehensive cash flow projections. Instead of plugging numbers into a formula, it involves a strategic discussion among key stakeholders. It's an essential tool for navigating uncertainty and making informed decisions when the past is not a reliable predictor of the future, making it one of the more adaptable cash flow forecasting methods.

How It Works in Practice

Implementing judgmental forecasting involves gathering a group of experts, such as senior management, sales heads, and financial analysts, to provide their informed opinions on future cash flows. These judgments are based on their understanding of the market, competitive landscape, planned business activities, and economic outlook. The process is often structured to consolidate these diverse opinions into a single, cohesive forecast.

For example, a startup launching a groundbreaking tech product has no sales history. The finance team would use judgmental forecasting by gathering insights from the marketing team on anticipated demand, the sales team on the pipeline, and the CEO on the overall strategic vision. Similarly, a company entering a new international market would rely on local market experts and consultants to project initial cash requirements and revenue potential, as its domestic historical data would be irrelevant.

Best Use Cases and Actionable Tips

This method is ideal for startups, businesses undergoing major strategic shifts, or any organization facing unprecedented market conditions. It’s most effective when used to complement, not completely replace, quantitative methods. A solid grasp of financial records is still crucial; even qualitative forecasts are grounded in foundational financial knowledge. You can strengthen this foundation by understanding the fundamentals of financial tracking and reporting, which is covered in more detail when exploring bookkeeping basics for small business.

Actionable Implementation Tips:

- Involve Multiple Experts: Reduce individual bias by creating a panel of experts from different departments (finance, sales, marketing, operations). Diverse perspectives lead to a more balanced and realistic forecast.

- Document All Assumptions: Rigorously document the reasoning and assumptions behind every judgment. This transparency allows you to track what went right or wrong and refine future forecasting processes.

- Use a Structured Approach: Employ techniques like the Delphi method, where experts submit anonymous forecasts, review a summary of the group's input, and then revise their predictions until a consensus is reached. This prevents groupthink.

- Combine with Quantitative Data: Whenever possible, use judgmental insights to adjust a baseline forecast created with quantitative methods. For example, use historical data as a starting point and then have experts adjust it based on upcoming promotions or expected economic changes.

8. Machine Learning and AI-Based Methods

Machine learning and AI-based methods represent the cutting edge of cash flow forecasting, applying advanced algorithms to analyze vast datasets and uncover complex patterns that traditional methods miss. Instead of relying on historical averages or simple regressions, these techniques can process hundreds of variables simultaneously, from sales data and macroeconomic indicators to customer behavior, to produce highly accurate predictions. They learn and adapt over time, continuously refining their forecasts as new data becomes available.

This approach transforms cash flow forecasting from a static calculation into a dynamic, intelligent process. It’s particularly powerful for businesses with complex operational dynamics, high transaction volumes, or those influenced by numerous external factors, offering a level of precision that was previously unattainable.

How It Works in Practice

Implementing AI-based forecasting involves feeding large amounts of historical financial and operational data into a machine learning model. The model is trained to identify correlations and causal relationships between different variables and cash flow outcomes. For highly accurate predictions, especially with complex sequential data, Long Short-Term Memory (LSTM) networks are a powerful tool; refer to an in-depth LSTM time series forecasting guide for practical implementation details.

For instance, a global e-commerce giant like Amazon uses AI to forecast cash needs by analyzing sales trends, supply chain logistics, and even regional weather patterns that might affect deliveries. Similarly, JPMorgan Chase has deployed machine learning to enhance its treasury cash forecasting, improving liquidity management across its global operations. These models can predict everything from transaction volumes to driver payment needs, as seen with companies like PayPal and Uber.

Best Use Cases and Actionable Tips

AI and machine learning are best suited for large enterprises or rapidly growing tech companies with access to substantial, high-quality data. They are invaluable in volatile industries where external factors can significantly impact cash flow with little warning.

Actionable Implementation Tips:

- Start with Clean Data: The adage "garbage in, garbage out" is paramount here. Ensure your historical data is clean, complete, and well-organized before you begin training any models.

- Begin with Simpler Models: Don't jump directly to complex neural networks. Start with simpler algorithms like linear regression or decision trees to establish a baseline before exploring more sophisticated methods.

- Maintain Human Oversight: AI is a tool, not a replacement for human expertise. Financial teams should always review, interpret, and validate AI-generated forecasts against their business knowledge and strategic goals.

- Invest in Proper Infrastructure: AI-driven forecasting requires robust data infrastructure and governance. Leveraging the best financial reporting software that offers AI capabilities can provide the necessary foundation for these advanced analytical methods.

Cash Flow Forecasting Methods Comparison

| Method | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Direct Method | High – detailed data collection, complex for large orgs | High – robust accounting systems needed | Accurate short-term operational cash flow insights | Daily cash management, retail, service companies | Granular cash flow visibility, easy to interpret |

| Indirect Method | Medium – uses existing financial data, less time intensive | Medium – relies on profit and working capital forecasts | Good long-term cash flow visibility | Public companies, financial reporting, strategic planning | Leverages available data, integrates with planning |

| Rolling Cash Flow Forecast | Medium to High – requires continuous updates and discipline | Medium to High – frequent data updates needed | Always current forecasts, early issue identification | Inventory planning, project management, seasonal businesses | Maintains forecast relevance, improves accuracy |

| Scenario-Based Forecasting | High – complex multiple scenarios modeling | High – sophisticated modeling and analysis | Comprehensive risk views, contingency planning | Uncertain environments, strategic decisions, risk management | Enables risk management, supports funding decisions |

| Statistical/Regression Analysis | High – requires statistical expertise and data volume | High – needs large historical datasets | Data-driven predictive models with confidence intervals | Data-rich environments, complex cash flow drivers | Identifies subtle patterns, objective and scalable |

| Percent of Sales Method | Low – simple ratio calculations | Low – minimal data and resources required | Basic cash flow estimates tied to sales forecasts | Stable, mature businesses, initial planning | Simple, quick, effective for stable sales patterns |

| Judgmental/Qualitative Forecasting | Low to Medium – expert input, less data dependent | Low to Medium – relies on expert availability | Flexible forecasts capturing market changes | New products, markets without historical data | Captures unprecedented changes, fast to implement |

| Machine Learning and AI-Based Methods | High – technical expertise and complex algorithms | High – large, quality datasets and infrastructure | Highly accurate, continuously improving forecasts | Complex organizations, large data volumes | Handles complexity, learns and improves over time |

Final Thoughts

Navigating the landscape of cash flow forecasting methods can seem complex, but as we've explored, the journey from uncertainty to financial clarity is achievable with the right tools and strategies. We’ve dissected eight distinct approaches, moving from the foundational Direct and Indirect methods to the dynamic Rolling Forecast and the forward-looking power of Scenario-Based planning. Each method offers a unique lens through which to view your company's financial future.

The key takeaway is that there is no single "best" method. Instead, the optimal approach is a tailored one, often a hybrid that borrows strengths from multiple techniques. A small startup might begin with a straightforward Percent of Sales model for its simplicity, while a more mature enterprise could leverage sophisticated Machine Learning algorithms to analyze vast datasets and uncover hidden trends. The true mastery lies in understanding your business's specific needs, operational complexity, and strategic goals to select and combine the most appropriate cash flow forecasting methods.

From Theory to Action: Your Next Steps

The ultimate goal of forecasting is not just to predict the future but to actively shape it. A reliable forecast is your strategic compass, empowering you to make informed decisions with confidence. It transforms financial management from a reactive, crisis-driven exercise into a proactive, opportunity-seeking discipline.

To put these insights into practice, consider the following actionable steps:

- Assess Your Current State: Which method are you currently using, if any? Evaluate its effectiveness. Are your forecasts consistently accurate? Do they provide the insights needed for strategic planning? Be honest about its limitations.

- Identify Your Primary Need: Are you focused on short-term liquidity management for the next 30-90 days? The Direct Method is likely your best starting point. Are you planning for long-term capital investments or seeking funding? A combination of the Indirect Method and Scenario-Based Forecasting will be more powerful.

- Experiment with a Hybrid Model: Don't be afraid to blend techniques. Use a Rolling Forecast framework to maintain a continuous 12-month outlook. Within that framework, apply the Direct Method for the first 1-3 months for granular accuracy and the Indirect or Percent of Sales method for the subsequent 4-12 months for a strategic overview.

- Incorporate Qualitative Insights: Remember the value of the Judgmental method. Your team's experience, knowledge of upcoming market shifts, and insights into customer behavior are invaluable data points that quantitative models can miss. Regularly integrate this human intelligence into your forecasting process.

Key Insight: Effective cash flow forecasting is a continuous cycle of prediction, measurement, and refinement. Your first forecast won't be perfect, but each iteration, informed by actual results and new information, will bring you closer to financial mastery.

By moving beyond simple guesswork and embracing a structured approach, you build a resilient business capable of navigating economic turbulence and seizing growth opportunities. You can anticipate cash shortfalls before they become critical, optimize your working capital, and allocate resources with precision. This financial foresight is no longer a luxury reserved for large corporations; it is an essential competency for any business dedicated to sustainable success. The various cash flow forecasting methods we've covered are your toolkit-it's time to start building.

Ready to streamline the most tedious part of cash flow analysis? Manually entering data from bank statements is a major bottleneck, but Bank Statement Convert PDF can automate the process. Our tool accurately extracts transaction data from PDF bank statements into Excel, giving you clean, analysis-ready information in seconds to fuel your direct cash flow forecasting. Visit Bank Statement Convert PDF to see how you can save time and improve accuracy today.