Managing cash flow is all about a simple, crucial discipline: tracking the money coming in and the money going out of your business. It's the only way to make sure you have enough cash on hand to cover your obligations—things like payroll, rent, and supplier invoices—regardless of how profitable you look on paper.

Why Cash Flow Is Your Business Lifeline

It’s tempting to think of "cash flow" as just another accounting term, but it’s truly the heartbeat of your business. Here’s a hard-won lesson many entrepreneurs learn too late: Profit is a theory, but cash is a fact.

A business can look incredibly successful—landing big clients and posting impressive profits—yet still go under simply because it ran out of actual money to pay its bills. This is the single biggest trap for new business owners.

Don't just take my word for it. A staggering 82% of small business failures are a direct result of poor cash flow management. That’s not just a number; it’s a stark warning about why getting a handle on your cash is absolutely non-negotiable for survival.

Profit Isn't the Same as Cash

Let's break this down with a real-world scenario. Imagine you run a small graphic design agency. You just landed a fantastic $20,000 project. On your income statement, that's a huge win—you're profitable!

But there's a catch: the client's payment terms are 90 days.

That means you won't see a single dollar of that $20,000 for three whole months. In the meantime, you still have to pay your team, your software subscriptions, and your rent.

That lag between making the sale and getting the money is called the cash flow gap. It’s a dangerous place to be. After all, your landlord doesn't accept "accounts receivable" as payment. This is precisely why tracking your actual cash is more critical for day-to-day survival than tracking your profit.

To really get a grip on this, you need solid bookkeeping practices. Thankfully, you can get started with some of the best free bookkeeping software out there.

To make this distinction even clearer, here’s a quick comparison.

Profit vs Cash Flow at a Glance

| Concept | What It Measures | Why It Matters for You |

|---|---|---|

| Profit | The difference between your revenues and expenses over a period (e.g., a quarter). It's an accounting calculation. | Profit shows if your business model is theoretically sound and sustainable in the long run. |

| Cash Flow | The actual movement of money into and out of your bank account. It’s the real cash you can spend today. | Cash flow determines your ability to survive right now—to pay bills, make payroll, and seize opportunities. |

Thinking about both gives you the full picture. Profit is your long-term report card, but cash flow is your daily survival guide. You need both to thrive.

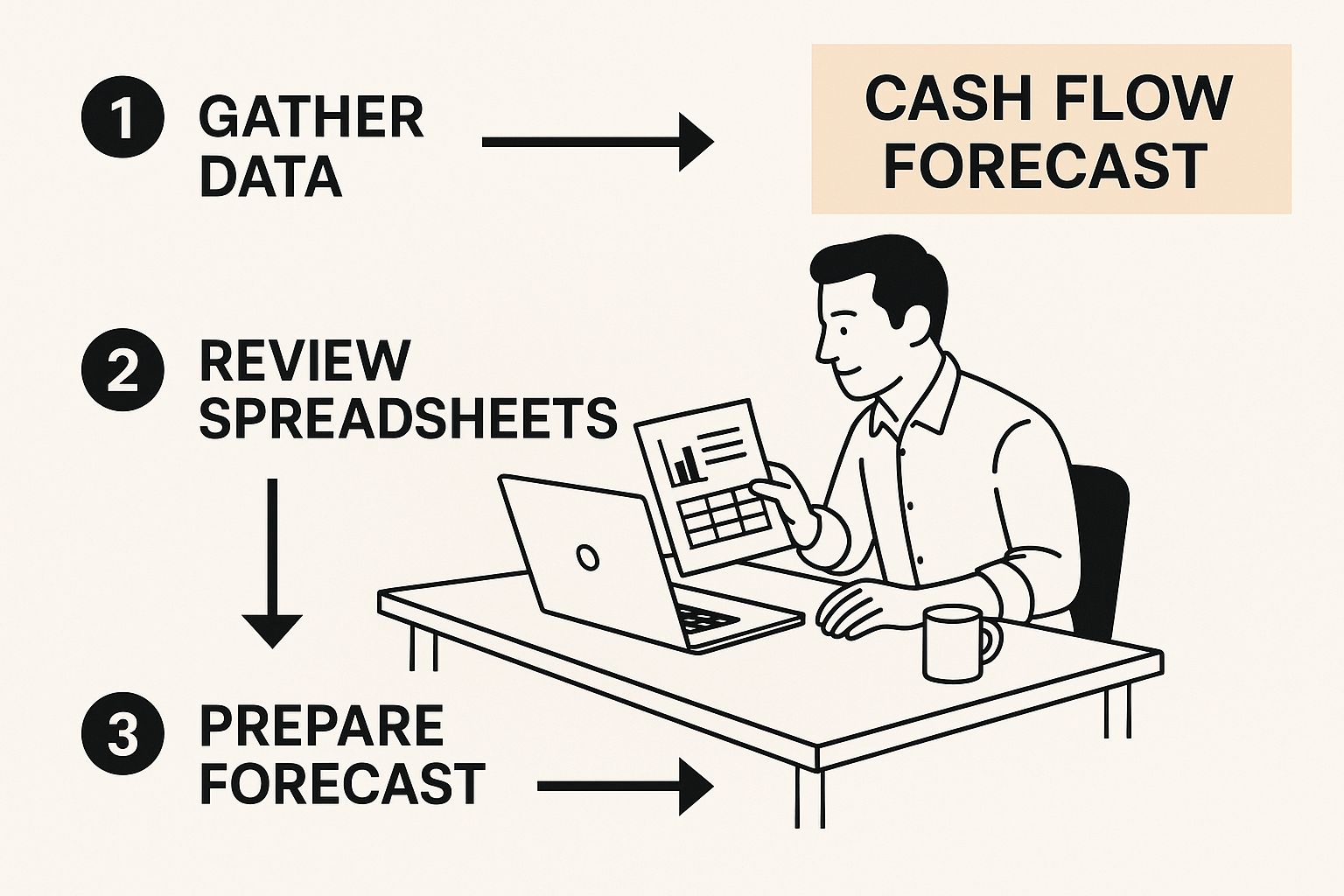

How to Build Your First Cash Flow Statement

Ready to build your first cash flow statement? The good news is you don't need a fancy accounting degree or expensive software. You already have all the raw materials you need sitting in your files: bank statements, paid invoices, and expense receipts. Your main task is to pull all this information together to create a clear, historical picture of your finances.

One of the biggest hurdles I see small business owners face is just getting the data out of their documents and into a usable format. Manually punching in numbers from dozens of PDF bank statements is a surefire way to waste a weekend and introduce costly mistakes. This is where a simple PDF-to-Excel converter becomes your best friend.

A good converter can pull all your transaction data directly into a spreadsheet, which is the perfect starting point for your analysis.

This simple step sidesteps the tedious manual entry, keeps your numbers accurate, and honestly, saves you a massive headache.

Start by Categorizing Your Cash Movements

Once your transaction history is neatly laid out in a spreadsheet, it’s time to bring some order to the numbers. The best way to start is by creating two main columns: Cash Inflows and Cash Outflows.

Now, go through your spreadsheet line by line and sort every single transaction into one of those two buckets.

- Cash Inflows: This is pretty straightforward—it’s all the money coming into your business. Think customer payments, any loans you’ve received, or cash you’ve personally invested.

- Cash Outflows: This is every dollar going out. This bucket will likely be more varied, including things like rent, payroll, inventory costs, software subscriptions, and marketing expenses.

Organizing your data this way immediately gives you a clearer picture of your financial health, making it much easier to build a reliable cash flow forecast.

Key Takeaway: Think of your cash flow statement as more than just an accounting chore. It's a diagnostic tool. It tells the real-world story of your business's finances over a specific period, whether that's a month or a quarter.

By getting this historical map of your money down on paper, you've created an essential foundation. To get a better sense of how this document fits into your bigger financial picture, it's helpful to understand what is a financial statement and its core components. This baseline is the first, most crucial step toward forecasting your future and making smarter decisions for your business.

Creating a Cash Flow Forecast You Can Trust

Alright, you've wrangled your past financial data. Now it's time to stop looking in the rearview mirror and start looking at the road ahead. Building a cash flow forecast isn't about getting a crystal ball; it's about making smart, educated guesses based on what you already know. Let's aim for a realistic projection for the next 30, 60, and 90 days.

First up, let's project the money coming in. Your past sales data is the foundation here, but the key is to be conservative. Just because you had a phenomenal month doesn't mean you should bank on a repeat performance. It's always better to be surprised by a surplus than blindsided by a shortfall.

This isn't just a numbers game, either. You have to layer in some real-world context. If you run a retail shop, you know to brace for the post-holiday slump in January. For a contractor, that means planning for the inevitable slowdown when winter hits. These patterns are predictable, so build them into your forecast from the start.

Accounting for Real-World Variables

Your forecast needs to be honest about all your expenses—the predictable ones and the curveballs. Regular outflows like rent, payroll, and software subscriptions are the easy part. It's the variables that can really throw a wrench in the works if you're not prepared.

Think about these common scenarios:

- One-Time Purchases: Planning to finally buy that new piece of equipment next month? That’s a major cash-out event that absolutely needs a line item in your forecast.

- Seasonal Inventory: A coffee shop doesn't buy pumpkin spice supplies in May. That big order hits in late summer, and your budget needs to reflect it.

- Quarterly Tax Payments: These are not a surprise. Tax deadlines are predictable, so make sure you're setting cash aside and including these payments in your plan.

When you map out these specific, time-sensitive expenses, your spreadsheet transforms from a boring document into a strategic roadmap for your business.

A cash flow forecast isn't a "set it and forget it" task. Think of it as a living document. You need to be in there, updating it weekly or bi-weekly. This constant review is the heart of effective cash flow management for small business.

By regularly comparing what you thought would happen to what actually happened, you'll start spotting potential cash crunches weeks away. That gives you the breathing room to chase down an overdue invoice, hold off on a non-essential purchase, or line up short-term financing if you need it. It’s how you stay in the driver's seat of your business's financial future.

Practical Ways to Improve Your Cash Flow—Starting Today

A forecast gives you a roadmap, but it doesn't drive the car. Now it’s time to get behind the wheel and take control. Managing your cash flow is less about watching numbers on a spreadsheet and more about actively making decisions that keep your bank account healthy.

Let's move from theory to action. Here are tangible steps you can take this week to make a real difference.

We'll look at this from both sides of the coin, starting with the best part: getting paid faster.

Speed Up Your Inbound Cash

The longer you wait for money, the more you hamstring your own business. It's a huge source of stress for small businesses in the U.S., who wait an average of 28 days to get paid. That's a month of expenses you have to cover while waiting on money you've already earned.

To shrink that waiting period, you need to get proactive.

- Offer early-bird discounts. A simple "2/10, net 30" term can be surprisingly effective. This gives clients a 2% discount if they pay within 10 days. That small hit is often well worth getting your cash three weeks sooner.

- Set tighter credit terms. For new clients, don't be afraid to ask for a deposit upfront or shorten your standard payment window from 30 days to 15. This establishes clear expectations right from the start.

- Make it easy to pay you. The fewer hoops a customer has to jump through, the faster you'll see the money. Accept online payments, credit cards, and ACH transfers. Yes, there are small processing fees, but they're a minor cost for immediate access to your cash.

Don't be shy about sending reminders. A friendly, automated email a few days before an invoice is due—and another the day it becomes overdue—can work wonders for reducing late payments without souring a good client relationship.

Smartly Manage Your Outbound Cash

Getting money in faster is only half the battle. You also need to be strategic about the cash going out. This isn't about being cheap; it's about being smart with your timing. Every dollar you can keep in your account a little longer is a dollar that can cover payroll or seize an opportunity.

Here are a few moves you can make right away:

- Talk to your vendors. Your suppliers are often more flexible than you think. Ask if you can extend your payment terms from net 30 to net 45 or even net 60. This one conversation can dramatically improve your cash position by aligning your payables more closely with your receivables.

- Lease, don't buy. Do you really need to own that expensive piece of equipment or that new company vehicle? Leasing often comes with a much smaller upfront cost and predictable monthly payments, freeing up a significant amount of cash.

- Audit your subscriptions. Take a hard look at your monthly bank statement. Are you still using all those software tools you signed up for last year? Cutting just one or two unused services can save you hundreds, if not thousands, over the course of a year.

Getting these habits down is a fundamental part of running a financially sound business. If you want to go deeper into organizing your finances, our guide on small business bookkeeping tips is a great place to start. When you master these strategies, cash flow management stops being a reactive chore and becomes one of your most powerful tools for growth.

Building a Cash Reserve for Peace of Mind

Trying to run a business without a cash reserve is like walking a tightrope with no safety net. It's a risky game that leaves you vulnerable to every little bump in the road, from a slow sales month to a critical piece of equipment suddenly dying. This financial safety net is what lets you breathe, giving you the confidence to handle whatever comes your way.

So, how much is enough? A great rule of thumb is to aim for a reserve that can cover three to six months of your non-negotiable operating expenses. We're talking about the essentials: rent, payroll, utilities, and crucial software subscriptions—everything you absolutely need to keep the lights on.

Setting Up Your Financial Cushion

I get it, building this cushion feels tough, especially when every dollar is already spoken for. The key is to start small and be consistent. Set up an automated weekly transfer to a separate business savings account. Seriously, even a small amount transferred regularly builds up surprisingly fast, creating that buffer that protects your core business.

Taking this step is more important than ever. The financial reality for many small businesses is precarious. A recent study found that nearly 70% of U.S. small businesses have less than four months' worth of cash on hand. This has led to 45% of owners skipping their own pay to keep the business running. You can dig into the numbers yourself in this detailed study on small business cash shortages.

Pro Tip: Don't wait until you're in a tough spot to apply for a business line of credit. The best time to establish one with your bank is when your finances are strong. It’s much easier to get approved, and it gives you a ready source of funds if you ever face a serious shortfall.

A healthy cash reserve turns cash flow management for small business from a purely defensive chore into a real strategic advantage. It gives you stability and the freedom to make smart decisions based on opportunity, not desperation. Keeping that reserve healthy means keeping your books accurate, which is why learning how to handle your bank reconciliation on Excel is such a powerful skill to have in your corner.

Answering Your Top Cash Flow Questions

Even with the best plan in place, you're bound to have questions as you get into the nitty-gritty of managing your money. Let's tackle some of the most common ones I hear from business owners.

How often should I actually check my cash flow?

I always tell my clients to aim for a quick, informal check-in every week. This isn’t about deep analysis; it’s about taking your business’s pulse. Is anything unexpected happening? A quick glance can help you catch a potential shortfall before it spirals.

Then, at the end of each month, sit down for a more formal review. This is where you pull out your forecast and compare it to what actually happened. This monthly habit is what really sharpens your financial instincts and helps you make smarter decisions for the next quarter.

What's the number one cash flow mistake small businesses make?

Hands down, the biggest trap is thinking profit equals cash. It's a classic mistake. Your income statement might show you're profitable because you've sent out a ton of invoices, but if that cash isn't in your bank account, you can't make payroll or pay your suppliers.

Profit is a long-term indicator of health, but cash is the oxygen your business needs to survive day-to-day. Never lose sight of the actual money flowing in and out.

The best tool for managing your cash flow is simply the one you'll use consistently. It doesn't matter if it's a basic spreadsheet or sophisticated software—consistency is what turns raw data into real insight.

Are there any cash flow tools that aren't overly complicated?

Absolutely. You don't need a degree in finance to get a handle on this. For most small businesses, the built-in reporting features in software like QuickBooks Online, Xero, or Wave are more than enough. They’re designed to be user-friendly and can generate cash flow reports with just a few clicks.

Honestly, even a well-organized spreadsheet can be a powerful tool when you're starting. The key is to start somewhere.

Ready to stop wrestling with financial documents? The Bank Statement Convert PDF tool is the perfect first step. It pulls transaction data directly from your PDF bank statements into Excel, saving you from hours of manual data entry. Get started for free today.