Let's face it, staring at a mountain of bank statements when you need to get your finances in order is a universal headache. The best way to convert a bank statement to Excel really depends on your specific situation. A quick manual copy-paste might be fine for a single statement, while Excel's own Power Query tool is a lifesaver for recurring digital PDFs. For scanned or complex documents, specialized software is often the only way to go.

Each method solves a different piece of the puzzle, whether you're doing a quick one-off task or trying to build a reliable system for managing financial data.

Why You Need Your Bank Data in Excel

If you're a small business owner, freelancer, or just someone serious about budgeting, pulling your financial data out of a static PDF and into a flexible format like Excel is a total game-changer. It’s the first real step toward actively managing your finances instead of just watching them happen. You get to move beyond the soul-crushing, error-prone task of typing every single number by hand.

Manually keying in transactions isn't just boring; it’s a recipe for disaster. A single misplaced decimal or a couple of transposed numbers can throw off your entire financial picture, leading to hours of frustrating detective work to hunt down the mistake.

The Power of Organized Financial Data

Once your bank transactions are neatly lined up in an Excel spreadsheet, a whole new world of financial insight opens up. Suddenly, you can sort, filter, and analyze your spending patterns with just a few clicks. This clean, structured data becomes the bedrock of effective financial management.

For example, you can finally:

- Track Expenses Accurately: Categorize every transaction to see exactly where your money is going. This is how you spot those sneaky subscriptions or find real opportunities to cut costs.

- Simplify Tax Preparation: Forget digging through a year's worth of statements. Instead, just filter and sum your tax-deductible expenses in a matter of seconds.

- Build a Reliable Budget: Use your actual historical data to create a budget that reflects reality, then track how well you stick to it each month.

- Forecast Cash Flow: By analyzing past income and spending, you can make educated guesses about your future financial position—an absolute must for business planning.

The real win isn't just getting the numbers into a spreadsheet. It's about turning that raw data into actual intelligence that helps you make smarter financial decisions.

Moving Beyond Manual Entry

This guide is all about showing you practical, field-tested ways to get your transaction data into a clean spreadsheet, minus the headache. We'll walk through solutions for every kind of scenario, from the beginner who needs a quick fix to the bookkeeper processing hundreds of statements a month.

We’re going to cover everything from simple copy-and-paste tricks and some of Excel’s own hidden gems to powerful software that does all the heavy lifting for you. By learning how to convert a bank statement to Excel, you'll reclaim countless hours and gain the accuracy you need for confident financial planning.

The Manual Method: A Quick (But Messy) Copy and Paste

Sometimes, you just need to get the data from a single bank statement into Excel, and you need it done now. For a one-off job or a really simple, clean statement, the good old copy-and-paste method can feel like the most direct route. It’s not elegant, but it can work in a pinch.

Let's walk through how to do it and, more importantly, how to deal with the messy results you’re almost guaranteed to get.

The first part is easy. You pop open your PDF statement, highlight the transaction data, and hit Ctrl+C (or Cmd+C on a Mac). Then, you jump over to a blank Excel sheet and paste. What you see next is rarely a pretty, organized table. Instead, you'll likely be staring at a single, long column where dates, descriptions, deposits, and withdrawals are all smashed together. This is where the real work starts.

Untangling the Data with Text to Columns

Your best friend for sorting out this jumbled mess is a built-in Excel tool: Text to Columns. I've used this feature countless times to rescue data from ugly formats. It’s designed specifically to split a single column of text into multiple, usable columns.

Here’s how to put it to work:

- First, select the entire column that holds your pasted data.

- Head up to the Data tab on the Excel ribbon and find the Text to Columns button. Clicking it will launch a helpful wizard.

You'll be faced with two choices:

- Delimited: This works great if your data has a clear character separating each field, like a comma or a tab. Unfortunately, pasted PDF data is rarely that cooperative.

- Fixed width: This is almost always the better option for bank statements. It lets you tell Excel where the column breaks should be based on the spacing between the data.

Select Fixed width and click Next. Excel will make an educated guess, showing you vertical lines where it thinks the columns should be split. Now you get to play editor. You can click to add new lines, double-click to remove one, or just drag the existing lines to get the positioning right. The goal is to isolate the date, description, and amounts into their own columns.

Don't get hung up on making it perfect right away. Your main objective is to separate the big pieces. You can always tidy up things like extra spaces or merge columns later.

Once you’re happy with the breaks, click Finish. This single step takes your chaotic wall of text and gives it the basic structure of a table. It's a massive improvement, but there's still a bit of cleanup to do.

The Final Polish: Cleaning Up Common Frustrations

Even after the Text to Columns magic, your data will probably have a few quirks that need a human touch. This is the final polishing stage.

One of the most common issues I run into is inconsistent spacing that throws off the alignment. You also have to contend with date formats. Your bank might use "Feb 05, 2024" on one line and "02/20/2024" on another. The quick fix is to select the whole date column, right-click, choose Format Cells, and pick a single, consistent date format. This makes it possible to actually sort your transactions by date.

Numbers can be another headache. Amounts often paste as text, especially if they have currency symbols ($) or are negative (in parentheses). To make them usable for formulas, select the amount columns, look for the little error icon that pops up, and choose Convert to Number. For a deeper dive into these kinds of fixes, our guide on how to extract data from PDF files has some great advanced tips.

Lastly, you’ll definitely have to get rid of extra rows. The copy-paste will bring over all the junk from the PDF—headers, footers, page numbers, and summary totals. You’ll need to scroll through and manually delete these stray rows to ensure you're only left with clean transaction data. It's a tedious but necessary step for accurate analysis.

Knowing how to do this manually is a great skill to have for that rare, simple, one-time task. But you can see how its limitations become glaringly obvious when you’re dealing with multiple statements or complex layouts. It’s slow, incredibly prone to human error, and just doesn't scale. For anything more than a one-off conversion, you'll be much better off exploring more efficient and automated tools.

Automating Cleanup with Excel Power Query

What if you could clean up your bank statement data once and never have to do it again? It's not a pipe dream—it's what Excel's Power Query was built for. For anyone who regularly wrangles bank statements into Excel, Power Query is hands-down the best free tool for the job, especially if you're dealing with consistent, digitally-generated PDFs.

Think of it as a "set it and forget it" solution. You create a repeatable recipe of cleaning steps that you can apply to new statements with a single click. This one-time setup can save you countless hours of mind-numbing work down the road. Let's walk through how to build your own data-cleaning machine.

Getting Started with Get and Transform Data

Power Query is tucked away inside the Get & Transform Data section on Excel's Data tab. Instead of the old copy-and-paste routine, you'll be creating a live connection directly to your bank statement PDF. This is the key to the whole automation process.

To kick things off, head to the Data tab on the Excel ribbon. From there, you'll navigate to Get Data > From File > From PDF. A dialog box will pop up, asking you to find the bank statement PDF on your computer. Once you select it, Excel gets to work, analyzing the file and identifying any tables it can find.

Next, a "Navigator" window appears, showing a list of all the tables and pages Power Query found in the document. This is your first major checkpoint. Click through the different table options on the left to see a preview on the right. Your goal here is to pinpoint the table that actually holds your transaction data—dates, descriptions, and amounts.

Transforming Data in the Power Query Editor

Found the right table? Great. But hold off on clicking "Load." Instead, you'll want to click the Transform Data button. This is where the magic really begins.

Clicking that button opens the Power Query Editor, an incredibly powerful interface that records every single cleanup action you take. Your data appears in a familiar grid, but the crucial part is the Applied Steps panel on the right. Every change you make, whether it's deleting a column or filtering a row, gets recorded here as another step in your recipe. It's like recording a macro, but far more intuitive and without writing a single line of code.

Here are a few of the most common transformations you'll probably need to make right away:

- Removing Unnecessary Rows: Bank statements are notorious for extra headers and footers. The "Remove Rows" feature on the Home tab makes quick work of getting rid of them.

- Filtering Out Blank Rows: It's also common to see empty rows scattered throughout the imported data. Just use the filter dropdown on any column to uncheck "(null)" or "(blank)" and they'll vanish.

- Splitting Columns: Sometimes, debits and credits get lumped into one column. The "Split Column" tool is perfect for this, letting you separate them based on a space or another character.

Refining Data Types and Finishing the Query

Once the data's structure is looking good, there's one more critical step: setting the correct data types. Power Query often guesses wrong, importing numbers and dates as plain text. This makes them useless for any kind of math or sorting.

Fixing this is easy. Just click the little icon in each column header (it might look like "ABC," "123," or a calendar) and choose the right format. Make sure your date column is set to the Date type and your amount columns are set to Decimal Number or Currency. This small tweak is what makes your data actually usable back in Excel.

The most powerful moment is when you realize that every single click you've made in the editor has been saved as a repeatable step. You're not just cleaning one file; you're building an automated cleaning machine for all future files.

When you're happy with how the data looks, click the Close & Load button. Power Query will run through all your recorded steps and drop the perfectly clean data into a new Excel sheet, neatly formatted as a table.

The real payoff arrives next month. When you get your new bank statement, just save it in the same folder (or update the file path in the query), head to the Data tab, and hit Refresh All. In seconds, Power Query will perform all your saved steps on the new file, and your clean data will appear.

For those looking to go deeper, our complete guide on how to convert a PDF to Excel explores a variety of other techniques. But honestly, mastering this one process is a genuine game-changer for anyone tired of repetitive data entry.

Using Dedicated Bank Statement Converter Tools

Let's be honest, sometimes the manual copy-paste method is a disaster, and even Excel's Power Query throws its hands up in defeat. This is where dedicated bank statement converter tools really shine. They're built for one job and one job only: to wrestle messy bank statement PDFs into clean, usable Excel data.

Their biggest superpower? Handling scanned, image-based PDFs. If you've ever been handed a stack of paper statements that someone scanned, you know the pain. You can't copy the text, and Power Query can't read it. In this scenario, a dedicated tool isn't just a nice-to-have—it's the only way forward.

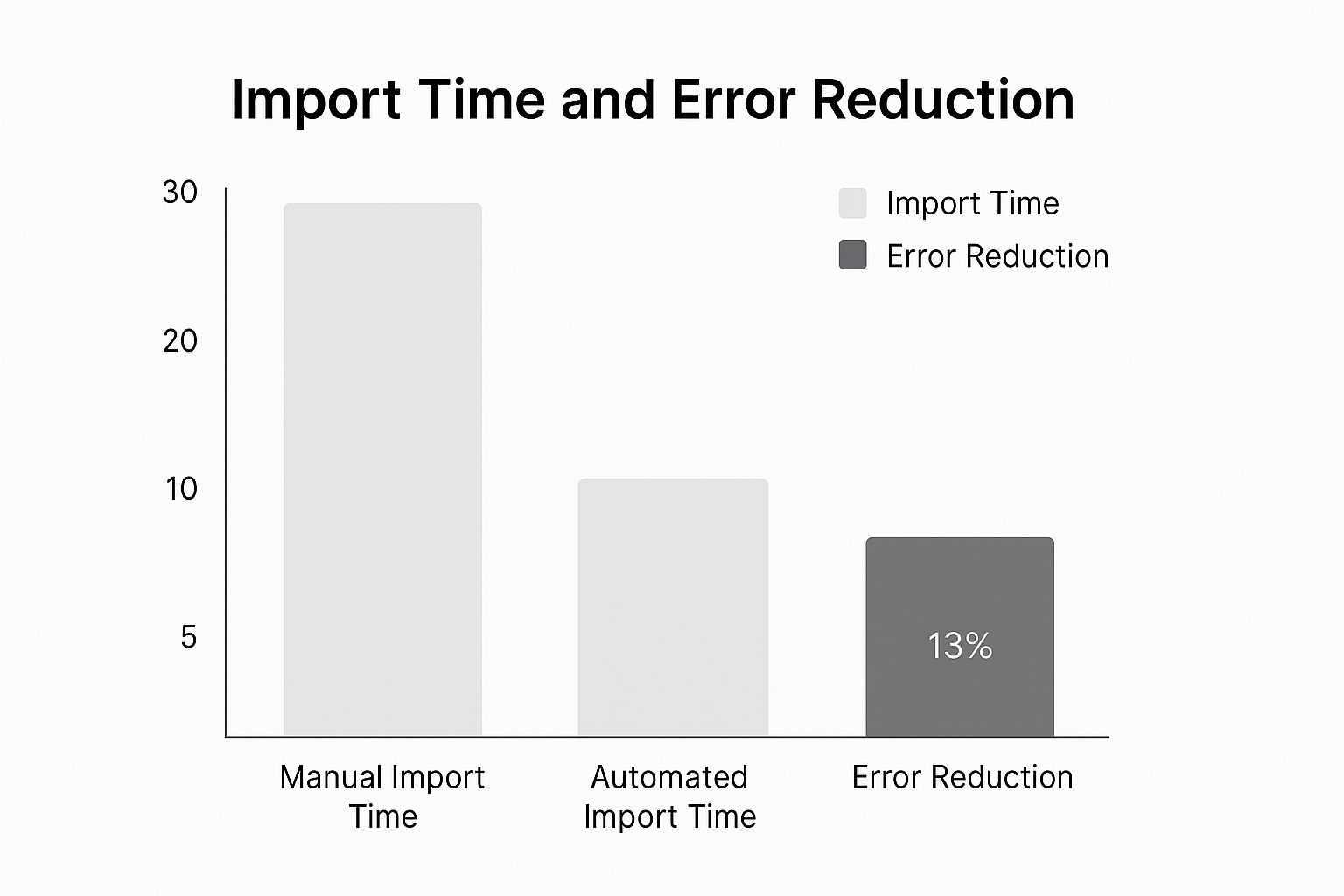

As you can see, the difference is night and day. Moving to an automated tool drastically reduces processing time while simultaneously boosting accuracy, which is exactly what you need when dealing with financial data.

The Magic is Optical Character Recognition (OCR)

The technology that makes this all possible is Optical Character Recognition, or OCR. In simple terms, OCR software scans an image of a document and "reads" the text, turning a picture of words and numbers into actual editable text. It’s like a digital translator for your paperwork.

But modern converters are smarter than that. They use AI-powered OCR that goes beyond just identifying characters. It actually understands the context of a bank statement. It can intelligently spot dates, transaction descriptions, debits, and credits, even if the statement layout is a bit strange or the scan quality is poor.

The real breakthrough with today's OCR is its ability to interpret the structure of a bank statement. It knows that a number in the far-right column is likely a withdrawal, and it can distinguish a running balance from a transaction amount, leading to far fewer errors.

This financial intelligence is what separates a generic PDF converter from a tool specifically built to convert a bank statement to Excel. The specialized tools are fine-tuned for the unique formatting and data types found only in these documents.

Key Features Professionals Rely On

If you're an accountant, bookkeeper, or business owner swimming in financial documents, certain features become absolute game-changers. These tools are designed with professional workflows in mind, saving countless hours and eliminating tedious manual entry.

Here's what makes a huge difference in the real world:

- Bulk Processing: Imagine getting a year's worth of statements for a new client. Instead of converting them one by one, you can upload all 12 PDFs at once. The software will process them as a batch and spit out a single, consolidated Excel file. This feature alone can turn an entire day's work into a 15-minute task.

- High Accuracy Rates: The best tools often boast accuracy rates of over 99%. This isn't just a marketing gimmick; it's a critical requirement. A single misplaced decimal can throw off your entire reconciliation. That level of reliability is essential for keeping the books clean and making sound financial decisions.

- Support for Thousands of Banks: Every bank seems to have its own unique statement format. A top-tier converter has been trained on thousands of different layouts from banks all over the world. This ensures that no matter where the statement came from, the tool can read it correctly.

It’s no surprise that a 2023 survey found that over 75% of accounting teams now use some form of automation for bank statement processing. As financial management becomes more complex, tools that improve efficiency and security are becoming indispensable. You can find additional information about financial automation tools on Microsoft AppSource to see how this trend is evolving.

Data Security and Compliance

Of course, uploading sensitive financial documents to any online service should make you think about security. Reputable converter services understand this and invest heavily in protecting your data. They don't take it lightly.

They build trust by implementing robust security measures from the moment you hit "upload."

- End-to-End Encryption: Your data is scrambled using protocols like SSL/TLS while it travels to their servers and while it's stored, making it unreadable to anyone who shouldn't see it.

- Strict Data Privacy Policies: Leading tools comply with major data protection laws like GDPR and CCPA. They are transparent about how your data is used and often have policies to automatically delete your files after a short period.

- Secure Infrastructure: Many of these services run on secure cloud platforms (like AWS or Azure) that have their own world-class layers of physical and digital security.

By choosing a tool with a clear commitment to security, you can take advantage of powerful automation without putting your financial information at risk. These dedicated tools offer a fast, secure, and incredibly efficient solution for anyone needing to get data out of a PDF bank statement and into a spreadsheet where it can actually be used.

How to Pick the Right Conversion Tool

Choosing the right software to get your bank statements into Excel can feel overwhelming. The market is crowded, and every tool promises to be the best. The secret is to ignore the marketing fluff and focus on what you actually need, whether you're a freelancer sorting your own finances or an accountant juggling dozens of client files.

Let's break it down into a practical framework. We’ll look at four make-or-break factors: accuracy, speed, security, and cost. Thinking through these pillars will help you find a solution that not only gets the job done but also gives you a real return on your time and money.

Data Accuracy is Non-Negotiable

When you're dealing with financial data, accuracy isn't just a nice-to-have—it's everything. One tiny error, like a misplaced decimal or a misread date, can spiral into hours of frustrating detective work trying to reconcile your books. The magic behind these tools is Optical Character Recognition (OCR), the technology that "reads" the text on your PDF.

But here’s the thing: not all OCR is created equal. A top-notch engine, especially one beefed up with AI, can do more than just read numbers. It intelligently understands different bank statement layouts, knows the difference between a debit and a credit, and gets dates right every time. Before you commit, hunt down reviews or case studies that specifically mention accuracy rates.

For instance, studies consistently show that specialized tools blow generic PDF converters out of the water. One 2025 report found a dedicated bank statement converter hit an impressive 99.6% accuracy rate—a world of difference from manual data entry. That level of precision is essential for any serious professional work. For a closer look, you can read the full analysis of bank statement converter performance on DocuClipper.com.

Think Speed and Workflow Efficiency

Let's be honest, the whole point of using a tool is to save time. So, look for features that slot right into your workflow and cut out mind-numbing, repetitive steps. If you're often staring at a pile of statements, batch processing is an absolute game-changer. It lets you upload an entire year's worth of PDFs and get them all converted into a single, organized Excel file in one go.

The time savings here are huge. Some tools can process statements roughly 80% faster than doing it by hand. For a busy accounting firm, that can easily add up to several hours saved every single week—time you can spend on analysis instead of data entry. The right tool should feel less like a simple utility and more like a productivity superpower.

Key Takeaway: A great tool doesn't just convert one file quickly. It smooths out your entire process, from upload to export, turning a tedious chore into a task you can knock out in two minutes.

Don't Skimp on Security and Compliance

You’re handling incredibly sensitive financial information, so the security of any tool you use is paramount. Never, ever upload a bank statement to a service without first checking out its security protocols. Good providers are completely transparent about how they protect your data.

Here's what to look for on their website:

- Encryption: The service must use strong, end-to-end encryption (like SSL/TLS) to shield your files during upload and processing.

- Data Privacy Policies: Make sure they comply with regulations like GDPR or CCPA. The best services also have clear policies about automatically deleting your files after a short period.

- Certifications: For business or enterprise use, look for certifications like SOC 2 or HIPAA. These show that the provider has passed rigorous, independent security audits.

Analyze the Cost vs. the Return

Finally, let's talk money. Conversion tools usually have a few different pricing models, and the best one for you hinges entirely on how often you'll use it.

- Pay-As-You-Go: This is perfect if you only need to convert a few statements here and there. You just pay per page or per document, no strings attached.

- Monthly/Annual Subscriptions: This is built for professionals and businesses with a steady workload. You get unlimited or high-volume conversions for a flat fee, which is far more economical for regular use.

But don't just stare at the price tag; think about the return on investment (ROI). If a $30 per month subscription saves you five hours of manual work, and your time is worth $50/hour, you're not spending $30—you're saving $250. Plus, you’re getting more accurate results. For a deeper dive into your options, our overview of bank statement extraction software compares several popular solutions. The right tool pays for itself almost immediately.

Common Questions Answered

Even with the right tools in hand, you'll likely have a few questions as you start converting bank statements. I've been there. Let's tackle some of the most common issues people run into, so you can get straight to the data without the headaches.

Can I Actually Convert a Scanned Statement?

Yes, you can, but it’s a different ballgame. If you have a scanned paper statement (an image PDF), your standard copy-paste or even Excel’s built-in PDF importer won't work. They simply can't "see" the text in an image.

This is where a tool with Optical Character Recognition (OCR) becomes essential. OCR technology scans the image, identifies the characters, and translates them into actual, usable text and numbers for your spreadsheet. Just be aware that the quality of your scan and the power of the OCR engine directly impact how accurate the final data is. A blurry scan will always cause problems.

Is It Safe to Upload My Bank Statements to a Website?

This is a perfectly valid and important question. Handing over financial data to any online service should make you pause. Reputable converters know this and take security very seriously. They use strong encryption (like SSL/TLS) to protect your files while they're being uploaded and processed.

Before you upload anything, do a quick check. Look for a clear privacy policy on the site. Do they mention security protocols or compliance with data protection laws like GDPR? Some services even highlight certifications like SOC 2, which means they've passed tough independent security audits. It's also a good sign if they automatically delete your files from their servers after a short time.

Trust is everything, and good services work hard to earn it.

What's the Best Free Way to Do This?

If you're working with a digital PDF that has a clean, simple table layout, your best bet is Excel’s Power Query. You'll find it on the Data tab, under the 'Get & Transform Data' section.

Forget manual copy-pasting—it's a recipe for disaster. Power Query is not only more accurate but also incredibly efficient. You can build a query to clean up your first statement, and then for all future statements from that same bank, you just point it to the new file and hit 'Refresh'. It’s a huge time-saver once you get the hang of it.

Will My Excel File Look Exactly Like the PDF?

No, and that’s a good thing! You’re going to lose the visual flair—the bank's logo, the specific fonts, and the color scheme won't carry over.

The whole point of this exercise is to strip away the design and pull out the raw, structured data. You want the clean columns of dates, descriptions, debits, and credits that you can actually work with. The goal is data integrity for your analysis or accounting software, not a pixel-perfect replica of the original statement.

Ready to stop wasting time on manual data entry and get perfectly clean data in seconds? Bank Statement Convert PDF uses advanced technology to accurately extract transactions from any bank statement PDF and organize them into a ready-to-use Excel spreadsheet. Try it today and see how much time you can save. Learn more at https://bankstatementconvertpdf.com.