To get your bank reconciliation done in Excel, the basic idea is to line up your bank's transaction list right next to your own company's records. Once you have them side-by-side, you'll use a few formulas and logical checks to match up every single entry. The whole point is to hunt down and explain any differences, like those pesky uncashed checks or bank fees you forgot to record.

Why Excel Still Works for Bank Reconciliation

Even with all the fancy accounting software out there, a simple Excel spreadsheet is still a go-to tool for this critical task. Its flexibility and the level of control it gives you make it a fantastic choice for small businesses, solopreneurs, or really anyone just getting their head around basic accounting principles. Before we jump into the Excel specifics, it's worth getting a clear picture of what is payment reconciliation is and why it’s so fundamental to your financial health.

For a lot of small and medium-sized businesses, Excel hits that sweet spot between having manual control and being efficient enough to get the job done. The process is straightforward: you dump your bank statement data into one worksheet, your company's cash book or ledger into another, and then let formulas do the heavy lifting of comparing them.

The key to a good Excel reconciliation is starting with clean, accurate data entry. Get that right, and you’ll save yourself a world of headaches later on. If you want to see what a finished report looks like, you can get a better idea by learning more about reconciliation report creation.

The Core Benefits of Using Excel

It might feel a bit old-school, but sticking with a spreadsheet has some real advantages that keep it relevant.

- Total Customization: You’re in the driver's seat. You can build a reconciliation template that fits your business perfectly—your chart of accounts, your reporting style—without being forced into a rigid software format.

- Cost-Effective: Let's be honest, for businesses watching every penny, Excel is usually already on the company computer. That makes it a powerful, and free, solution.

- Transparency and Control: You see every formula and every calculation. There's no "black box." This level of transparency helps you truly understand the nuts and bolts of the reconciliation process and gives you complete ownership of your financial data.

To help you get comfortable with the language we'll be using, here are a few common terms you'll run into.

Key Reconciliation Terms You Should Know

| Term | Definition |

|---|---|

| Book Balance | The cash balance according to your company's internal records (your cash book or ledger). |

| Bank Balance | The cash balance according to your bank statement. |

| Cleared Checks | Checks you've written that have been paid by your bank and deducted from your account. |

| Outstanding Checks | Checks you've written, but they haven't been presented to or paid by the bank yet. |

| Deposits in Transit | Deposits you've recorded in your books, but they haven't been processed by the bank yet. |

| Discrepancy | Any difference between your book balance and the bank balance that needs to be investigated. |

Knowing these terms will make the whole process much smoother as you start matching transactions.

The real power of using Excel for bank reconciliation lies in its simplicity and directness. You're not just clicking buttons; you are actively engaging with your financial data, which builds a much stronger understanding of your business's cash flow.

This hands-on approach is where the real value is, especially when your transaction volume is still manageable. It forces you to look closely at every entry, which is often how you spot irregularities or potential issues before they become big problems. As we move on, you'll see how this control helps you build a financial process you can truly rely on.

Setting Up Your Excel Workspace for Success

Before you even think about writing a formula, the secret to a smooth bank reconciliation is all in the prep work. Honestly, a clean and organized Excel file makes all the difference. Think of it like cooking: a tidy kitchen with all your ingredients laid out makes the whole process faster, easier, and a lot less frustrating.

First things first, you need to gather your source documents. Grab the bank statement for the period you're working on—say, the entire month of June—and your company's matching cash book or general ledger records. Having both on hand from the start is crucial for making sure you’re comparing apples to apples.

With your data ready, let's structure your Excel workbook. A classic mistake I see all the time is just dumping everything onto one giant, chaotic sheet. A far better way is to use separate tabs to keep things clean.

Here's the setup I recommend:

- Bank Data: This sheet is for pasting or importing the raw transaction data straight from your bank statement.

- Book Data: This one is for all the transactions from your company's internal cash ledger.

- Reconciliation Summary: This will be your command center—your final report where you’ll summarize the findings and prove the balances match.

This multi-tab approach is a lifesaver. It keeps your original data untouched and separate from your analysis, which makes it incredibly easy to find and fix an error later without messing anything up.

Preparing Your Data for Matching

Okay, now let's get into the nitty-gritty of the "Bank Data" and "Book Data" tabs. The number one reason reconciliations fail? Inconsistent formatting. Your bank statement and your internal records almost never present information the same way, so your job is to get them speaking the same language.

You need to make sure you have these key columns on both sheets:

- Date: Make sure every single date is in the exact same format (like MM/DD/YYYY).

- Description: A quick note on the transaction ("Office Depot" or "Payment from Client ABC").

- Debit: A dedicated column for money going out.

- Credit: A dedicated column for money coming in.

I can't stress this enough: separating debits and credits into their own columns is non-negotiable. Many bank statements lump them into a single column using positive and negative numbers. This will trip up your formulas later. Take a few minutes to split them out now; it will make the matching process far more reliable.

If you're unsure how to structure this, our article on the proper bank statement format in Excel has some great examples to guide you.

Pro Tip: I always add a "Unique ID" helper column to both my bank and book data sheets. You can easily create one by combining the date and the amount. For example, the formula

=TEXT(A2,"mm-dd-yyyy")&B2will do the trick. This is a game-changer for avoiding mix-ups when you have multiple transactions for the exact same amount on the same day.

Now that your workbook is neatly organized and your data is standardized, you’ve built a rock-solid foundation. This careful preparation is what separates a quick reconciliation from a headache-inducing one. You're now perfectly set up for the next phase, where we’ll dive into the formulas that automate the matching process.

Using Excel Formulas to Match Transactions

Now that your data is clean and organized, it's time to put Excel to work. Forget manually ticking off transactions one by one—that’s not just a headache, it's a surefire way to make mistakes. We're going to use a couple of powerful formulas to automate the entire matching process. What used to take hours can now be done in minutes.

The basic idea is to tell Excel to look at a transaction on your bank statement sheet and find its identical match on your company's book data sheet. The two functions I lean on most for this are VLOOKUP and COUNTIF. They are absolute workhorses for cross-referencing data and finding those perfect matches.

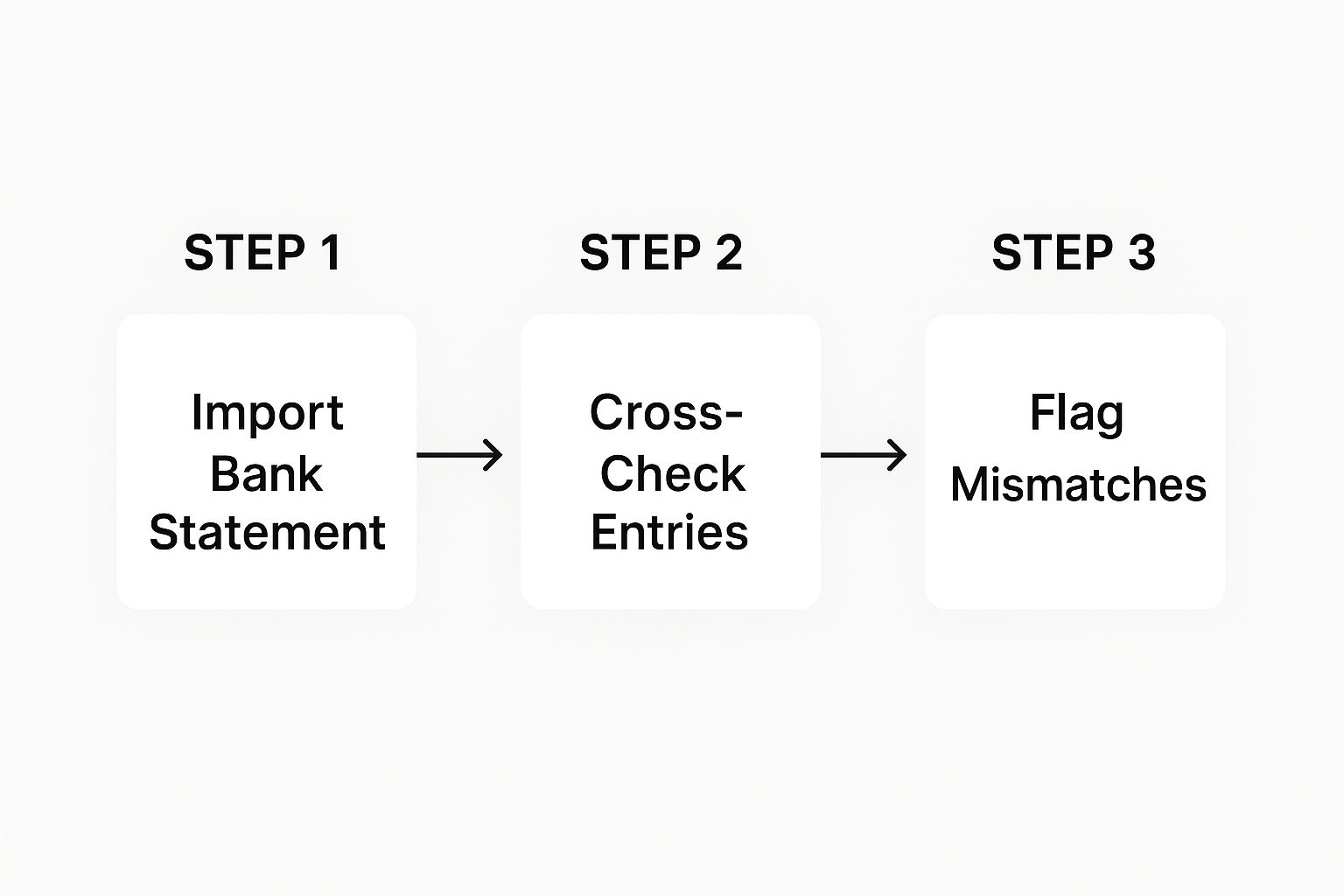

This visual guide shows the basic workflow for a successful reconciliation, from getting the data into Excel to identifying the mismatches that need your attention.

As you can see, the process flows from raw data to a final report of flagged differences. Our formulas are the engine that drives this whole process.

Crafting the VLOOKUP Formula for Reconciliation

The VLOOKUP function is your go-to tool for this job. In plain English, it searches for a specific value in one column and then returns a corresponding value from another column in the same row. For our reconciliation, it's going to look for a transaction amount from our bank data and see if it exists in our book data.

Let's say you're on your "Bank Data" sheet and want to see which transactions have a match in your "Book Data" sheet. First, add a new column and call it something like "Match Status." In the first cell of that column, you’ll type a formula like this one:

=VLOOKUP(D2, BookData!$D:$D, 1, FALSE)

Let's quickly break down what this tells Excel to do:

D2is the value we're looking for—in this case, the transaction amount in cell D2 of our bank sheet.BookData!$D:$Dis where Excel should look. It's searching the entire D column on the "BookData" sheet. The$signs are important; they lock the reference so it stays fixed as you drag the formula down.1tells Excel to return the value from the first column of our search area (which is just column D) if it finds a match.FALSEis crucial. It commands Excel to find an exact match only. No close guesses allowed.

Once you enter the formula, just drag the little square at the bottom-right corner of the cell all the way down your "Match Status" column. Excel will instantly populate the results.

What the VLOOKUP Results Are Telling You

At first glance, a column full of numbers and errors might seem messy, but it’s actually giving you a very clear answer.

If the formula finds a match, it will return the transaction amount itself. But if it doesn't find a match, it will return an #N/A error.

That

#N/Aerror isn't a mistake—it's exactly what you're looking for. It signals that a specific transaction on your bank statement is missing from your company's books. These are the items you need to investigate.

Any cell showing the transaction amount is a confirmed match. It exists in both datasets. Simple, right? This is the heart of an automated bank reconciliation. For more advanced situations, you can explore different takes on the ideal bank reconciliation formula to handle more complex matching criteria.

Using Conditional Formatting to Make Mismatches Stand Out

Staring at a wall of data can strain your eyes. To make your life easier, let's make those mismatches visually jump off the page using Conditional Formatting. This feature automatically highlights cells based on their content.

Here's how to quickly set it up:

- Click the header of your "Match Status" column to select the whole thing.

- Navigate to the Home tab and click Conditional Formatting > New Rule.

- A box will pop up. Select the option that says "Format only cells that contain."

- Under the rule description, change the first dropdown to "Errors."

- Click the "Format…" button and choose a fill color. A light red or yellow works great.

Now, every single #N/A cell will be highlighted. Your eyes will be drawn directly to the transactions that need your attention, turning your spreadsheet into a clear, actionable report.

Investigating Discrepancies and Finalizing Your Report

Alright, you've run your formulas, and now your spreadsheet is highlighting every single difference between your records and the bank statement. This is where the real detective work begins. The goal here is simple: investigate every highlighted mismatch until your adjusted balances are in perfect sync.

Don't panic if you see a lot of highlighted cells. Most of the time, discrepancies are just a matter of timing. A check you mailed out on the 30th won't clear the bank for a few days, or a deposit you made late Friday won't show up until Monday. Your job is to track down these items, confirm they’re legitimate, and make the right adjustments.

Pinpointing Common Reconciliation Items

After doing this for a while, you start to see the same culprits pop up again and again. Getting familiar with them makes the whole process go much smoother.

Here’s what you’re usually looking for:

- Outstanding Checks: These are the checks you’ve already recorded in your books but haven’t been cashed yet by the recipient. They’ve reduced your book balance, but the money is technically still sitting in your bank account.

- Deposits in Transit: You’ve recorded the cash or check, but it’s still being processed by the bank. This makes your internal records show a higher balance than the bank statement.

- Bank Service Fees: Those little monthly maintenance charges or transaction fees often hit your bank account before you have a chance to log them.

- Interest Earned: On the flip side, the bank might add interest to your account that you haven't recorded in your books yet.

For things like bank fees and interest, you'll need to make adjusting journal entries in your own accounting records. For outstanding checks and deposits in transit, you just need to account for them in your reconciliation summary—no journal entry is needed until they clear.

The whole point of this investigation is to get your adjusted book balance and your adjusted bank balance to match perfectly. Once they do, you have a solid, verifiable financial record that proves all your cash is accounted for.

Creating the Reconciliation Summary Report

Once you've hunted down all the reconciling items, it's time to pull everything together in a summary report. I usually create this on a separate, clean tab in the same Excel workbook. This report gives you a crystal-clear, at-a-glance view showing that your accounts are balanced.

This summary is the final checkpoint. You can find a helpful guide on its importance for proper https://bankstatementconvertpdf.com/bank-statement-verification/ to make sure you've covered all your bases.

When mismatches happen, they usually fall into a few predictable categories. Here's a quick look at the most common issues I've seen and what to do about them.

Common Reconciliation Discrepancies and How to Handle Them

| Type of Discrepancy | Common Cause | Required Action |

|---|---|---|

| Outstanding Check | You've sent a check, but it hasn't been cashed. | Subtract from the bank balance in your summary. No journal entry needed yet. |

| Deposit in Transit | A deposit was made but hasn't cleared the bank. | Add to the bank balance in your summary. It will resolve on its own. |

| Bank Service Fee | The bank charged a fee you haven't recorded. | Subtract from your book balance and record the expense in your ledger. |

| Interest Earned | The bank paid interest you haven't recorded. | Add to your book balance and record the interest income in your ledger. |

| Data Entry Error | A transaction was entered incorrectly (e.g., $54 instead of $45). | Find the error, correct it in your books, and adjust your book balance. |

| Duplicate Entry | A single transaction was accidentally recorded twice. | Delete the duplicate entry from your books and adjust your book balance. |

Knowing these common pitfalls makes troubleshooting much faster and less stressful.

Now, let's put it into a standard summary format.

| Bank Side Reconciliation | Amount | Book Side Reconciliation | Amount |

|---|---|---|---|

| Ending Bank Balance | $5,500 | Ending Book Balance | $5,150 |

| Add Deposits in Transit | $500 | Add Interest Earned | $10 |

| Less Outstanding Checks | ($800) | Less Bank Service Fees | ($20) |

| Adjusted Bank Balance | $5,200 | Adjusted Book Balance | $5,140 |

See that? The balances don't match. This summary immediately flags the problem—there's still a $60 discrepancy somewhere. The structured report makes it impossible to miss. Now you know you have to go back and find that $60 before you can finalize the month. Once resolved, those two bolded numbers will be identical.

Nailing this final report isn't just about finishing a task; it's a cornerstone of effective cash flow management and gives you true confidence in your financial numbers.

Pro Tips and Common Mistakes to Avoid

Once you've got the hang of the basic matching process, you can start layering in some more advanced techniques. A few simple tricks and knowing what not to do can make your bank reconciliation in Excel faster, more powerful, and far more reliable.

A fantastic tool for wrangling huge lists of transactions is the PivotTable. Instead of scrolling endlessly, a PivotTable can group and summarize everything in a snap. This is incredibly useful for spotting things that just don't look right, like way too many payments to one vendor or finding duplicate entries in seconds.

Common Data Entry and Formula Errors

Let's be honest: most reconciliation headaches don't come from some complex accounting principle. They come from simple human error. One tiny typo can have you chasing a phantom discrepancy for hours.

Here are the usual suspects I see all the time:

- Slipping Formula Ranges: Forgetting to lock your

VLOOKUPrange with dollar signs ($D:$D) is a classic mistake. When you drag that formula down, the range shifts with it, which causes a bunch of false#N/Aerrors that will send you on a wild goose chase. - Mismatched Date Formats: Excel is picky. It sees

06/20/2024and20-Jun-2024as completely different things. Before you even think about matching, make sure your date columns on both the bank and book sheets are formatted identically. - Transposed Numbers: It happens to the best of us. You meant to type $83 but your fingers typed $38. A quick tip: sort your unmatched items by amount. These little flip-flops often stick out like a sore thumb when the list is in order.

The real goal here is building a process that heads off these small mistakes from the start. If you standardize your data upfront and double-check your formulas before you copy them everywhere, you'll prevent most problems before they can even begin. That means less time hunting for errors and a more accurate financial picture.

Leveraging Automation for Greater Efficiency

As good as a well-built Excel template is, it has its limits, especially as your business grows and your transaction volume balloons. Manually entering data and checking formulas will always be time-consuming and, frankly, a bit risky.

This is where dedicated automation tools really shine. Modern reconciliation software just blows manual Excel processes out of the water. In fact, companies that switch to AI-based reconciliation often finish their month-end close up to 85% faster than teams still plugging away in spreadsheets. That's because the software does all the tedious line-by-line matching automatically, turning a multi-day slog into a much shorter task. You can find more stats on how automation slashes month-end close times in this breakdown.

For any growing business, knowing when to graduate from a manual process is a crucial step. Excel is the perfect place to learn the fundamentals of bank reconciliation, but automation gives you the accuracy and speed you need to really scale your financial operations.

When Your Business Should Move Beyond Excel

Look, Excel is a fantastic tool. It’s flexible, powerful, and for a lot of businesses starting out, it’s the perfect way to handle bank reconciliation. But there comes a time when what once was a strength becomes a weakness.

Recognizing that you're outgrowing your trusty spreadsheet isn't a failure—it’s actually a huge sign of success. It means you're growing, and your financial operations are getting more complex. The very things that make Excel great in the beginning, like its manual control, can start to hold you back.

A huge red flag is when your transaction volume starts to climb. Manually slogging through hundreds, or even thousands, of transactions a month is not just tedious; it's a breeding ground for human error. The time your team spends hunting and pecking to match line items becomes a serious resource drain.

Another clear sign is when you're juggling multiple bank accounts, especially if different currencies are involved. Trying to manage several spreadsheets while manually converting exchange rates adds a layer of complexity that can quickly spin out of control.

Recognizing the Tipping Point

The real shift happens when you need accurate, real-time financial data to make strategic decisions, not just to close out the books once a month. Good business decisions can't wait for a week-long reconciliation process to finish.

You've probably hit this tipping point if you're noticing a few key things:

- Growing Complexity: Your operations now involve multiple payment gateways, international sales, or a handful of different bank accounts.

- Time Constraints: Reconciliation is taking days, not hours. This pulls your team away from higher-value work like financial analysis and forecasting.

- Increased Error Rates: You're finding more and more small mistakes that take forever to track down and fix.

Outgrowing your Excel reconciliation process is a positive milestone. It means your business is scaling successfully and now requires more robust, automated systems to support its continued growth and maintain financial integrity.

This is a path many growing businesses walk. The global account reconciliation software market is on track to grow from USD 2.44 billion in 2025 to USD 6.15 billion by 2032. This isn't a coincidence; it's driven by companies just like yours looking to cut down on errors and speed up their financial close. You can see more details in these market growth insights on Coherent Market Insights.

Ultimately, knowing when to upgrade is key. If any of these challenges sound painfully familiar, it's probably time to start looking into automated bank reconciliation software to get your team's time back and support your next stage of growth.

Frequently Asked Questions

Even when you have a solid process, you're bound to hit a few snags during a bank reconciliation in Excel. Let's tackle some of the most common questions and sticky situations that I've seen trip people up.

What’s the Best Formula in Excel for Bank Reconciliation?

There isn't one single "best" formula, but a combination of VLOOKUP and COUNTIF is a real powerhouse for this kind of work. I typically use VLOOKUP to see if a transaction amount from the bank statement shows up anywhere in my company's books. It's a quick and dirty way to find potential matches.

But what about duplicates? That's where COUNTIF comes in. It's fantastic for spotting if the same amount appears more than once. For a truly robust check, I like to nest these inside a simple IF statement. This lets me create a status column with a clear result for each transaction.

For instance, a formula like =IF(COUNTIF(Bank_Transactions_Range, Ledger_Transaction_Cell)>0, "Matched", "Unmatched") will instantly tell you what's what. No more guesswork.

How Do I Handle Multiple Transactions With the Same Amount?

This is probably the most common headache in bank reconciliation. Just matching by the amount is a recipe for disaster because it can create false positives, and you'll waste time untangling the mess later.

The professional approach is to create a unique identifier for each transaction. I call this a concatenated key, and it's just a fancy term for joining a few pieces of data together in a helper column.

You'll want to add this key to both your bank data and your ledger. A simple formula like =TEXT(A2,"yyyy-mm-dd")&B2 can combine the date and the amount into one unique string. When you run your VLOOKUP on this column instead of just the amount, your accuracy skyrockets. It's a simple trick that dramatically cuts down on errors.

Your best defense against false positives is a unique identifier. By combining the date, amount, and maybe even part of the transaction description, you make your matching process nearly foolproof. This one step has saved me countless hours of investigation.

Can I Use a Template for Bank Reconciliation in Excel?

Of course! A good template is a fantastic way to hit the ground running and save a ton of setup time. You can find many online that already have the columns, formatting, and even the core formulas built right in.

The one major caveat is that you must understand how the template works. Don't just plug in your numbers and hope for the best. You need to know what the formulas are doing so you can troubleshoot when something inevitably goes wrong.

Think of a template as a starting point. You'll almost always need to tweak it to fit your bank's specific statement format or your own chart of accounts. The principles we've covered are what really guarantee an accurate reconciliation, not the template itself.

At Bank Statement Convert PDF, we know that getting clean, usable data is the most critical (and often most tedious) part of the process. Our software is designed to take your bank statement PDFs and turn them into perfectly structured Excel files in minutes. This means you can skip the manual data entry and get straight to the important work of analyzing your finances. Start converting your bank statements today!