Knowing how to get your hands on your bank statement is a must for keeping your finances in order. The short version? Just log into your bank’s website or mobile app, find the ‘Statements’ or ‘Documents’ section, choose the dates you need, and download the PDF. It’s a straightforward process that’s become a modern necessity.

Why Grabbing Your Bank Statements Online is a Game-Changer

Remember waiting for paper statements to show up in the mail? Thankfully, those days are mostly behind us. Digital banking puts your financial history right at your fingertips, giving you an up-to-the-minute picture of your financial health. This isn’t just a small convenience; it’s a huge shift in how we manage our money.

This instant access is critical for a bunch of real-world situations:

- Applying for a Loan: Lenders will almost always ask for your most recent bank statements to confirm your income and see how you handle your money.

- Doing Your Taxes: Statements are your official paper trail, making it easy to track down deductible expenses and verify sources of income.

- Budgeting and Spending Analysis: Downloading your statements is the first step to really digging into your spending habits and building a budget that actually works.

- Handling Discrepancies: If you ever need to dispute a charge, having the official statement is your best evidence.

The Worldwide Move to Digital Banking

The expectation for easy access to documents like bank statements is part of a much bigger global trend. According to the World Bank’s Global Findex Database, an incredible 76% of adults around the world now have an account with a financial institution or a mobile money provider. This growth is directly linked to the digital tools that make things like downloading a statement in seconds possible.

This chart from the World Bank report really drives the point home, showing just how much account ownership has grown, largely thanks to mobile technology.

As you can see, the more people get bank accounts, the more they expect—and need—on-demand digital services.

To give you a quick overview, here are the common ways you can get your statements and what each method is best for.

Bank Statement Download Methods at a Glance

| Method | Where to Find It | Best For | Typical Format |

|---|---|---|---|

| Online Banking Portal | Your bank’s main website (e.g., chase.com) under an “Accounts” or “Statements & Documents” tab. | Accessing a wide range of historical statements; downloading multiple months at once. | PDF is standard, but some offer CSV. |

| Mobile Banking App | Your bank’s official app (iOS/Android) in a “Documents” or “eStatements” section. | Quickly downloading a recent statement on your phone; convenience on the go. | Almost always PDF. |

| In-Person at a Branch | Visiting a local branch and speaking to a teller or personal banker. | Getting an officially stamped or notarized copy for legal or official purposes. | Printed paper, sometimes with an official seal. |

| By Mail (Paper Statements) | Sent automatically to your mailing address if you haven’t opted out for eStatements. | Keeping physical records; for those who prefer not to use digital banking. | Printed paper. |

While digital is the go-to for speed and convenience, it’s good to know that other options exist for those specific situations where you might need an official, physical copy.

A Quick Word on Document Legitimacy

With the ease of downloading comes the need for a little caution. Whether you’re a landlord, lender, or business owner reviewing documents, you have to be sure they’re legitimate. Digital files can be tampered with, so knowing the tell-tale signs of a fake is crucial. If you handle other people’s financial paperwork, it’s worth learning how to spot fake bank statements to protect yourself from potential fraud.

Being able to pull up your bank statement in a few clicks is more than just a neat feature—it’s a cornerstone of modern financial independence. It empowers you to make smart decisions, prove your financial standing, and manage your money with clarity and confidence.

Downloading Your Statement From a Computer

Grabbing your bank statements from your computer is usually the most straightforward way to do it. You get a full-screen view of your account dashboard, and honestly, the process is pretty similar no matter who you bank with. Once you get the hang of it for one bank, you’ll be able to find what you need just about anywhere.

First things first: the login. Always start by going directly to your bank’s official website. It’s a good habit to double-check the URL to make sure you’re on the legitimate site, not a look-alike. Pop in your username and password, and you’ll land on your main account summary page.

Finding Your Statements Hub

From your dashboard, you’re looking for the digital equivalent of a filing cabinet. Banks can be a bit creative with the naming, but they all mean the same thing. Keep an eye out for menu items or tabs with labels like:

- Statements & Documents

- eDocuments or eStatements

- Account Documents

- Online Statements

You’ll often find this link tucked under a main menu like “Account Services” or “Account Details.” With banks like Chase or Bank of America, it’s usually a pretty obvious link right on the main account overview. If you don’t spot it right away, try clicking into your specific checking or savings account—the link is often waiting for you there.

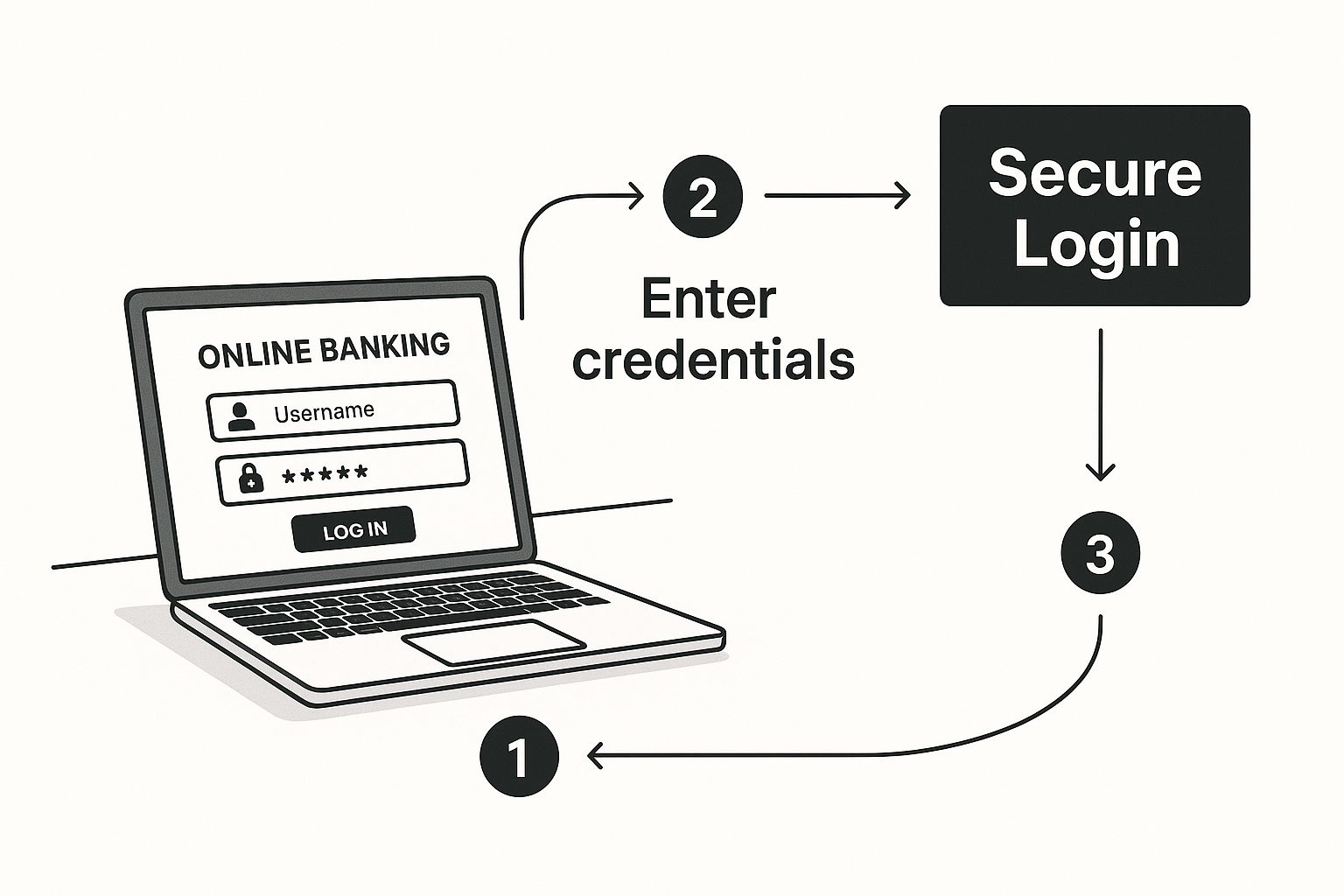

This is what that initial secure login process generally looks like on a computer.

As you can see, it all starts with that secure login, which is the most critical step for keeping your financial information safe.

Filtering and Downloading the Right File

Once you’re in the statements area, you’ll typically see a list of your most recent documents. To find the specific statement you need, you’ll want to use the filtering tools. These are your best friend for sifting through what could be years of financial records.

You can almost always filter by:

- Account: This lets you pick the right account, like “Primary Checking” or “Business Savings.”

- Date or Year: You can narrow it down by a specific month, quarter, or year. Most banks will keep statements available online for up to 7 years.

After you’ve set your filters, the system will pull up the exact statement you’re looking for, usually as a clickable link. Clicking it will either open the statement as a PDF file in a new browser tab or prompt you to save it directly to your computer.

Pro Tip: When the download box pops up, take a second to give the file a clear, descriptive name. Instead of the generic “statement_0524.pdf,” try something like “ChaseChecking_May2024_Statement.pdf.” This little habit will save you a massive headache later, especially when you’re scrambling to find documents for taxes or a loan application.

Sometimes a downloaded PDF isn’t quite right for what you need to do, or maybe you just want to add a few notes for your own records. In those cases, knowing how to edit a bank statement PDF is a handy skill for highlighting key transactions or adding annotations before you archive it.

Accessing Your Bank Statement on Your Mobile Device

It’s no secret that banks have poured a ton of money into their mobile apps. This chart from McKinsey’s annual banking review paints a clear picture: retail banking is a massive revenue driver for the industry. That financial reality is exactly why our banking apps have gotten so good—they have to be.

For most of us managing our finances from our phones, knowing how to quickly pull up a bank statement is a must. Mobile apps are built for convenience, and I’ve often found it’s a much faster process to grab a document on my phone than firing up the laptop. The whole experience is designed for quick taps and getting the job done.

This shift to mobile-first banking isn’t just some passing fad; it’s a direct result of our own behavior. Retail banking makes up around 33% of global banking revenue, and with over 70% of us in developed markets using digital banking regularly, the pressure is on for banks to deliver a seamless mobile experience. You can dive deeper into these trends in the McKinsey Global Banking Annual Review.

Because of this intense focus on the app experience, finding your statements is usually just a few taps away.

Navigating Your Bank’s App

Every bank’s app looks a little different, but once you’ve used a few, you start to see the patterns. After you log in (with your password, face, or fingerprint), your mission is to find where they keep the documents. The exact path can vary, but here are the most common places I’ve found them hidden:

- Tucked into a ‘More’ or ‘Menu’ Tab: Many apps keep things tidy by putting less-used features like statements behind a menu icon—think three dots or horizontal lines.

- Inside a Specific Account: This is my first stop. I just tap on the checking or savings account I need the statement for. More often than not, there’s a link for “Statements” or “Documents” right on that account’s screen.

- In a Central ‘Documents’ Hub: Some banks have a dedicated “Documents” or “eStatements” section right on the main dashboard. This is handy because it gathers all your official paperwork in one spot.

Once you find the statements area, the rest is pretty intuitive and works just like the desktop version. You’ll simply pick the account and the specific month or year you’re looking for.

A Quick Security Tip: Always make sure you’re on a secure network when downloading sensitive documents. Public Wi-Fi at a coffee shop or airport is a bad idea for financial tasks. Stick to your home network or cellular data to keep your information safe.

Saving and Sharing From Your Phone

After you’ve selected a statement, it will usually open as a PDF right on your phone. From there, your phone’s built-in sharing tools take over. Look for the Share icon—it’s usually a little box with an arrow pointing up on an iPhone or three connected dots on an Android device.

Tapping that icon opens up a menu of possibilities. You can:

- Save the PDF directly to your phone’s “Files” app or “Downloads” folder.

- Email it to yourself for your records or send it straight to your accountant.

- Upload it to a cloud service like Google Drive, Dropbox, or iCloud.

- AirPrint it wirelessly if you have a printer set up.

This kind of flexibility is what makes managing finances on the go so powerful. Whether you’re applying for a loan and need a statement on the spot or just getting organized on your couch, it’s all right there in your pocket.

How to Convert Your PDF Bank Statement to Excel

So you’ve successfully downloaded your bank statement, and now you have a PDF file sitting on your computer. That’s great for record-keeping, but let’s be honest—a PDF isn’t exactly helpful when you want to get your hands dirty with the data. For serious budgeting, tax prep, or any real financial analysis, you need that information in a spreadsheet.

This is where the magic happens. We’re going to turn that static document into a dynamic Excel file you can actually work with. Forget manually typing out every single transaction; that’s a tedious process just begging for typos and mistakes. A much better way is to use a tool to pull the data out for you, transforming those lines of text into clean, usable columns in a spreadsheet.

Choosing Your Conversion Method

When it comes to getting data out of a PDF, you have a few good options. The right choice really depends on the tools you already have and the type of PDF your bank provides. Some are crisp “true” PDFs where you can select the text, while others are essentially just images of a paper document.

Here are the main ways to tackle this:

- Adobe Acrobat Pro: If you’re already paying for an Acrobat Pro subscription, it has a built-in “Export PDF” feature. This can convert your statement directly into an Excel workbook (XLSX) and is often the simplest path for clean, text-based PDFs.

- Online Conversion Tools: A quick search reveals tons of free websites that promise PDF-to-Excel conversion. They can be convenient in a pinch, but be very careful. You’re uploading documents with sensitive financial information, so stick to well-known services and read their privacy policies first.

- Specialized Software: For the most reliable and accurate results, especially if you’re dealing with tricky formatting or scanned statements, dedicated software is the way to go. These tools are designed specifically for this job and can handle the messy layouts that often confuse generic converters.

The real value of your financial data isn’t unlocked until you can actually interact with it. Converting your PDF statement to Excel is the key step that turns a static report into a powerful tool for making smart financial decisions.

For accountants, bookkeepers, or small business owners who do this regularly, the accuracy from a purpose-built tool is a must-have. If you’re frequently processing statements, looking into specialized bank statement extraction software can save you a massive amount of time and give you confidence that your data is 100% accurate.

A Walkthrough Using a Converter

Let’s walk through the typical process of using a dedicated converter, since this approach is built to handle the most common issues you’ll run into. The exact steps might vary slightly, but the core idea is the same across different tools.

First, you’ll fire up the software and upload your PDF bank statement. The program gets to work, scanning the document to find the transaction table. If your PDF is just an image (a scan), it will use Optical Character Recognition (OCR) to “read” the text. A good tool will automatically identify the columns you care about, like Date, Description, Deposits, and Withdrawals.

Before you export anything, you’ll get a chance to review the extracted data. Don’t skip this step! This is where you can catch and correct any little errors. Maybe a long transaction description got split into two lines, or a column was misidentified. This preview screen is your opportunity to clean things up and make sure every transaction was captured correctly.

Once you’re happy with the preview, you just hit the export button. You can typically choose between Excel (XLSX) or CSV formats. Open the new file, and you’ll see all your financial data perfectly organized in rows and columns, ready for you to sort, filter, and analyze. You’ve just turned a locked-down document into a fully editable and incredibly useful financial asset.

Troubleshooting Common Download Issues

Even with today’s sophisticated banking apps, hitting a snag while trying to download a simple bank statement happens more often than you’d think. It’s a common frustration, but the fix is usually straightforward.

Before diving into solutions, it helps to know how we got here. The instant, on-demand statement download is a fairly new convenience. It wasn’t that long ago, before the mid-2000s, that getting a statement copy meant a trip to the bank or a long wait for the mail. The rise of high-speed internet pushed banks to build out their online portals, and the adoption has been massive. By 2020, over 85% of retail banking customers in developed countries were regularly using these platforms. You can dig into more data on this trend at the Bank for International Settlements.

This history lesson is important because it explains why you might run into certain limitations, especially when trying to pull very old records.

Can’t Find the Statements Section?

This is probably the most common issue. You log in, and the “Statements” link you used last month is just… gone. Banks are notorious for redesigning their websites and apps, often moving key features without any warning.

If you’re stuck, don’t give up. Try these moves first:

- Look Under ‘Account Services’ or ‘More’. This is often a catch-all menu for things like ordering checks, setting up alerts, and, you guessed it, accessing your eStatements.

- Click into the Specific Account. Instead of hunting around on the main dashboard, go directly to the checking or savings account you need. The statement link is frequently hidden on that specific account’s detail page.

- Use the Search Bar. This is your best friend. Nearly every banking site has one. Just type in “statements,” “documents,” or “eStatements,” and it will usually point you in the right direction.

Dealing With Missing or Grayed-Out Downloads

Another real headache is finding the list of statements, but the one you need is missing, or the download link is grayed-out and unclickable. This almost always comes down to one of two things.

First, your bank might have moved the document to an archive.

Expert Tip: Banks aren’t required to keep your statements online forever. Most institutions only offer instant access to the last 2 to 7 years of statements. Anything older is typically archived.

If you need a statement from 10 years ago, you’ll likely have to contact customer service directly and formally request it. Just be prepared; they sometimes charge a small fee for digging up and sending these older records.

Second, a grayed-out button could be an issue with your account settings. If you’re still receiving paper statements by mail, the bank might disable online PDF downloads. The fix is to go into your account settings and switch your preference to “eStatements” or “paperless.”

Once you finally get that PDF downloaded, the next step is to make that data useful. Our guide on using a PDF to CSV converter walks you through how to turn that static document into a flexible spreadsheet, perfect for budgeting or analysis.

A Few Final Questions About Bank Statements

Even with the best instructions, you probably still have a couple of lingering questions. Let’s tackle some of the most common ones that pop up when it’s time to grab your bank statements.

How Far Back Can I Get Bank Statements Online?

This is a big one, and the answer really depends on your bank. Generally, you can expect to find between two and seven years of statements available for immediate download right from your online portal.

What about documents older than that? They aren’t gone forever, but they are usually moved into a long-term archive. Getting your hands on these requires a special request. You’ll likely need to call customer service or send a secure message. Just be prepared, as some banks may charge a small fee for digging up and sending you these older, archived records.

Is It Safe to Download Bank Statements?

Absolutely, as long as you’re smart about it. Banks use heavy-duty encryption—the same kind that protects your account when you’re just checking your balance—to secure the download process on their official website and mobile app. The risk isn’t the download itself, but how and where you do it.

To keep your financial data locked down, always follow a few simple security best practices:

- Double-check that you’re on your bank’s real website (look for the little padlock and correct URL).

- Steer clear of public Wi-Fi at coffee shops or airports for banking. Your home network or your phone’s cellular data is a much safer bet.

- When you’re done, always log out completely. Don’t just close the tab.

Can I Get a Statement for a Closed Account?

Yes, you can. Banks are legally required to hold onto your financial records for several years even after an account is closed. The main difference is you won’t have the convenience of online access anymore.

Once an account is shut down, your login credentials for it usually stop working. This means you can’t just hop online and download what you need. Instead, you’ll have to reach out directly to the bank’s customer support. They’ll guide you through the process, which will involve verifying your identity to confirm you were the account holder.

It’s crucial to understand the difference between a bank statement and a transaction history. A statement is an official, static record of a specific period (like May 1st to May 31st). A transaction history is the live, scrolling list of recent debits and credits you see on your dashboard.

This isn’t just a technicality. If a mortgage lender asks for a bank statement, a screenshot of your recent activity just won’t cut it. They need that official PDF document.

Once you have those official PDF statements, the next step is often getting that data into a spreadsheet. That’s where Bank Statement Convert PDF comes in. Our software is designed to pull all the transaction data from your PDF and neatly organize it into a clean Excel file, saving you hours of tedious manual entry. Get started with our converter today!