When you get your bank statement, it’s best to break it down into four main parts: the summary, your deposits, your withdrawals, and the nitty-gritty transaction details. Think of it as your personal financial report card—it tells you exactly where your money is coming from and where it’s going.

Your First Look at a Bank Statement

Cracking open a bank statement for the first time can feel a bit like information overload. You're hit with a wall of numbers, dates, and fine print. But don't worry, once you know what to look for, it's pretty straightforward. The key is to see it as a simple story of your money over a specific period, which is almost always one month.

Right at the top, you'll find the header. This section is just for basic identification, so you can quickly confirm it's the right document.

Here’s what you’ll see:

- Your Personal Details: This is just your name and mailing address.

- Bank Information: Your bank's name and customer service contact info.

- Account Details: This includes your unique account number.

- Statement Period: The start and end dates for all the transactions listed on the statement.

The Account Summary

Right under the header is the account summary, and honestly, this is where you get the most bang for your buck. It’s your at-a-glance financial snapshot. If you only have 30 seconds, this is the part to check. For a deeper dive into what every line means, our full guide on how to read a bank statement is a great resource.

The account summary is your financial cheat sheet. It shows your starting balance, total money in, total money out, and what you were left with at the end. It's the fastest way to get a pulse on your account's health.

Let's look at a quick example. Say you started the month with $2,500. You deposited a total of $3,000 from paychecks or other sources, and you spent $1,800 on bills and other expenses. Your ending balance would be $3,700.

Getting comfortable with this summary section is the first real step to taking control of your finances. Once this makes sense, you're ready to dig into the individual transactions that led to those summary totals.

Getting to Grips with Deposits and Incoming Funds

Once you’ve got the bird's-eye view from the account summary, it’s time to zoom in on the money coming in. The deposits and credits section is where you can see your income story unfold, whether it's your regular paycheck, a refund for that shirt you returned, or a payment from a freelance client. This is where you play detective to make sure every dollar you were expecting actually landed in your account.

Your statement will lay out all these incoming transactions in chronological order. You'll quickly learn to spot the familiar ones, like a bi-weekly paycheck, which often shows up with a code like "DIR DEP" for Direct Deposit right next to your employer's name.

But it’s not just about your salary. This is the spot for all sorts of other credits:

- Peer-to-Peer Transfers: Money from a friend who paid you back for lunch might pop up with their name or the app they used (think Venmo or Zelle).

- Customer Payments: If you're running a side hustle, this is where you'll see payments from your clients.

- Interest Earned: For savings or some checking accounts, you'll see small but satisfying deposits labeled "INTEREST."

- Refunds: That return you made at Target last week? The credit from the store will show up right here.

Cracking the Code on Deposit Descriptions

Let's be honest, transaction descriptions can be a bit cryptic. Banks love to use abbreviations to save space. A mobile check deposit, for instance, might be coded as "MOBILE DEPOSIT" or something less obvious like "RDA," which stands for Remote Deposit Anywhere. Getting familiar with these little codes is crucial for knowing exactly what's going on with your money.

Don’t just scan the amounts; actually read the descriptions. It’s tempting to just check that the numbers look right, but verifying the source of each deposit is just as important. It’s a simple habit that helps you spot missing payments and truly understand your full financial picture.

This skill is more important than ever. According to the World Bank’s Global Findex Database 2025, 40% of adults in developing economies were saving in a financial account in 2024—a huge jump from past years. As more people around the globe engage with formal banking, the ability to clearly interpret a statement is a fundamental part of building financial literacy and tracking progress toward their goals.

Breaking Down Your Withdrawals and Outgoing Spending

Now let's get to the part of your statement that really tells the story of your spending habits: the withdrawals, or "debits." This is where every dollar that leaves your account gets listed, from your morning coffee run to that big mortgage payment. It can look like a long, intimidating list at first, but this is where you gain real control over your finances.

The bank lists all your outgoing transactions in chronological order. You'll see debit card purchases with some seriously cryptic merchant names, cash withdrawals from ATMs, and those automatic bill payments you set up months ago. The real trick is learning how to decipher these entries so you can connect a vague line item back to a specific purchase.

For example, you might see a charge like "SQ *OAKANDPINECAFE." That "SQ" usually means the purchase was processed through a Square payment terminal, which is common in small businesses like coffee shops. Spotting these little patterns is key to categorizing your spending accurately.

What to Look for in the Debits Column

Your debits column is going to be a mix of all sorts of spending. Once you know the common categories, you can quickly get a sense of where your money is actually going each month.

You'll typically find:

- Debit Card Purchases: These are your everyday point-of-sale (POS) transactions, whether you swiped your card in a store or typed the number in online.

- ATM Withdrawals: Any cash you've taken out will be listed here, often with the location of the ATM.

- Automatic Bill Payments: Think Netflix, your car payment, or your utility bills. These are recurring charges that hit your account automatically.

- Bank Fees: These are charges from the bank itself for things like monthly account maintenance, overdrafts, or using an out-of-network ATM.

Learning to spot these items is a fundamental financial skill. And it's becoming more important than ever—with 34% of consumers now checking their mobile banking apps daily, keeping a close eye on spending is the new norm. You can dig into more of these banking trends and statistics on driveresearch.com.

My biggest tip? Don't just scan for the big-ticket items. Those small, recurring charges are budget killers. A $15 monthly subscription you forgot about quietly drains $180 a year from your account. Your bank statement is the only tool that will catch these financial leaks.

When you carefully review every withdrawal, your statement stops being a boring old document and becomes a powerful roadmap of your financial life. It shows you exactly where your money goes, helps you find places to cut back, and ensures every single charge is legitimate. This is the bedrock of any solid financial plan.

Common Debit and Credit Transaction Codes Explained

Bank statements often use a lot of shorthand to describe transactions. Getting familiar with these common codes and abbreviations can make the whole process much less confusing.

Here’s a quick guide to some of the most frequent codes you’ll see for money coming in (credits) and money going out (debits).

| Code/Abbreviation | What It Means | Example |

|---|---|---|

| POS | Point of Sale | A debit card purchase at a physical store. |

| ATM | Automated Teller Machine | A cash withdrawal or deposit at an ATM. |

| ACH | Automated Clearing House | An electronic transfer, like a direct deposit or automatic bill payment. |

| TFR / TRF | Transfer | Money moved between your own accounts. |

| SVC CHG | Service Charge | A fee charged by the bank for account maintenance. |

| DD | Direct Deposit | Your salary or other regular payment deposited electronically. |

| W/D | Withdrawal | A general term for money taken out of the account. |

Knowing these basics will help you translate that bank jargon into a clear picture of your finances, so you can spend less time guessing and more time planning.

How to Spot Errors and Suspicious Activity

Think of your bank statement as more than just a piece of paper (or a digital file). It’s your front-line defense against costly mistakes and outright fraud. Getting into the habit of giving it a thorough once-over every month is one of the smartest financial moves you can make. You need to know what to look for.

Keep an eye out for these common red flags:

- Duplicate Charges: This happens more often than you'd think. A coffee shop or online store might accidentally bill you twice for the same purchase.

- "Zombie" Subscriptions: Remember that free trial you signed up for six months ago? Sometimes those cancellations don't stick, and you end up paying for services you no longer use.

- Small, Unrecognized Amounts: This is a classic fraudster tactic. They'll often test the waters with a tiny charge—say, $0.99—to see if the card is active before hitting you with a much larger, fraudulent purchase.

If you spot a transaction that makes you scratch your head, don't panic. The best course of action is to grab your records and call your bank's customer service line right away. Have the transaction date, the exact amount, and the merchant's name ready to go.

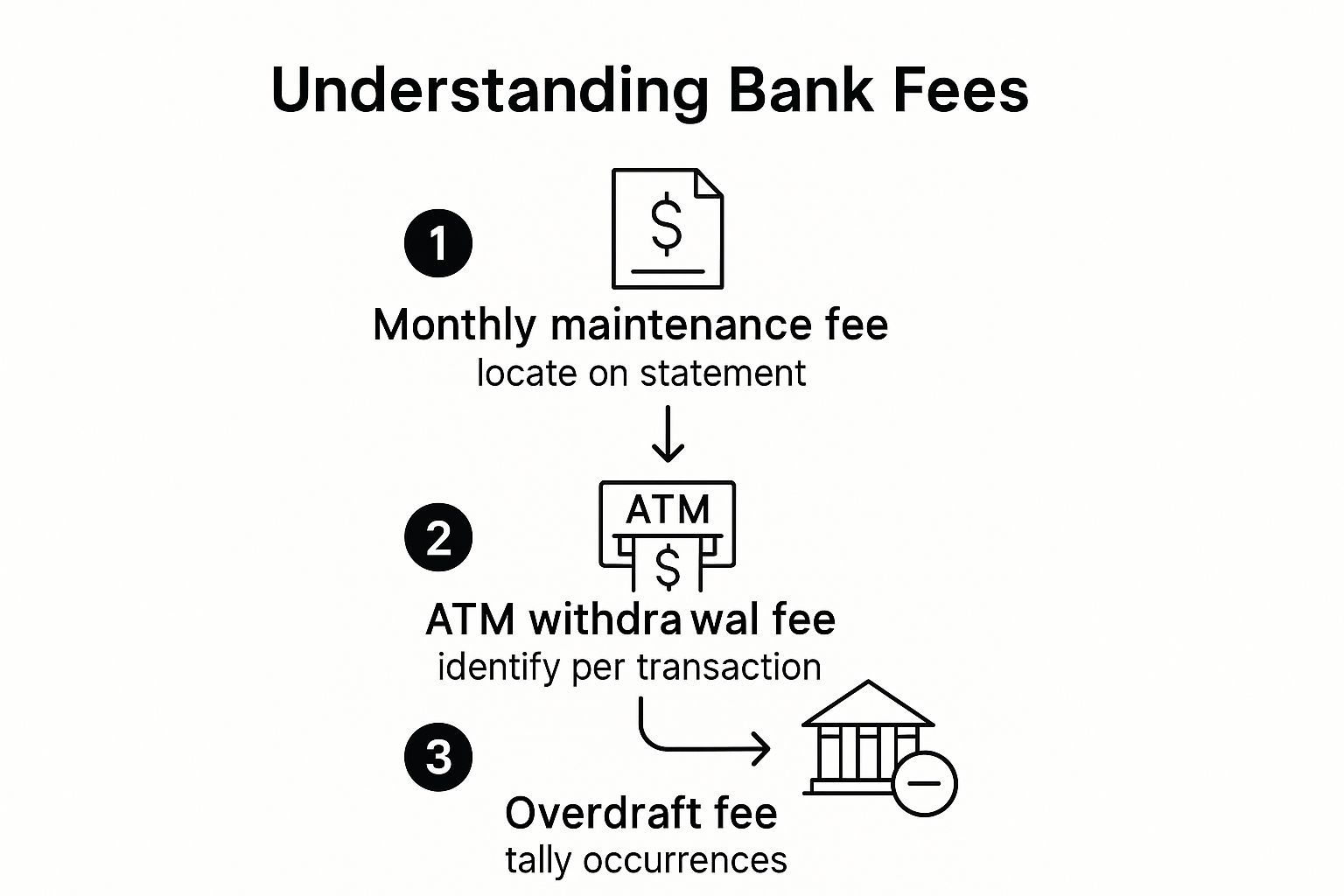

Uncovering Hidden Bank Fees

Bank fees are notorious for nibbling away at your balance without you even noticing. From monthly maintenance charges to out-of-network ATM fees, they can add up. The key is knowing where to find them on your statement so you can take action.

Once you can pinpoint these maintenance, ATM, and overdraft fees, you can start changing your habits to sidestep them in the future. Maybe that means finding a fee-free checking account or sticking to your own bank's ATMs.

Statements aren't always straightforward. For example, in North America, the average client holds about 17% more products with their main bank compared to other regions. This often translates into more complex statements, with extra line items for fees, interest, and transactions that can be a real headache to track.

Scrutinizing every line item is absolutely essential. It’s so easy to gloss over a small, incorrect fee or an unfamiliar charge. But these little discrepancies can be the first warning sign of bigger problems—or even a clue that a document might be fraudulent.

Developing this eagle eye for detail does more than just protect your cash; it sharpens your ability to tell if a statement is even real. If you want to take your skills to the next level, our guide on how to spot fake bank statements is a must-read.

Using Your Statement to Build a Better Budget

Think of your bank statement as more than just a list of what you’ve already spent. It's actually a blueprint for building a smarter financial future. Once you get the hang of reading it, you can stop just looking at the numbers and start actively planning with them. This is where the raw data becomes your secret weapon for creating a budget that actually works.

The first real step is to start sorting your spending. Comb through all your withdrawals and debits, then group them into simple categories: Housing, Groceries, Transportation, Entertainment, and so on. Realizing you spent $350 on dining out last month isn't about feeling guilty; it's a piece of information that gives you the power to make a change if you want to.

Turning Data Into Decisions

Once everything is categorized, you’ll start seeing exactly where your money is going and, more importantly, where you can save. You might spot a few subscriptions you forgot you were even paying for, or find out that your daily coffee run adds up to over $100 a month. That kind of insight is the foundation for taking control of your cash flow.

A few ways to tackle this analysis:

- A simple spreadsheet: Manually punching in the numbers can give you a really tangible sense of your spending habits.

- Budgeting apps: Many apps can sync with your bank to automatically categorize transactions and show you where your money is going with helpful charts and graphs.

- Conversion tools: If your statements are PDFs, a specialized tool can pull all that data into a clean Excel file, which is much easier to work with. If you need help getting the right file, our guide on https://bankstatementconvertpdf.com/how-to-get-your-bank-statement/ covers various options.

Analyzing your statement helps you find easy wins and bigger strategies to cut back, often covered in a comprehensive money-saving guide.

Your statement is the hard evidence of your financial habits. Use that evidence to set goals you can actually reach, watch your progress each month, and give yourself a pat on the back for the small victories along the way.

At the end of the day, learning how to use your bank statement for budgeting is a core financial skill. It gives you an honest look at where every dollar goes, which lets you make sure your spending lines up with your priorities. Making this a monthly habit is one of the most empowering things you can do for your finances.

Common Questions We Hear About Bank Statements

Even after you've gotten the hang of reading your bank statements, a few practical questions always seem to come up. Let's run through some of the most common ones I hear, so you can handle your financial documents like a pro.

How Long Should I Keep Bank Statements?

This is a big one. How long do you really need to hang onto those old statements? For most of your routine monthly statements, you can safely shred them after about one year.

But there are some crucial exceptions. If a statement shows proof of payment for something major—think a new roof, a car, or a big-ticket appliance—you’ll want to keep it longer. The same goes for any statements detailing tax-deductible expenses. For those, a good rule of thumb is to hold onto them for at least three to seven years, just in case you ever face an audit.

For anyone running a small business, organized record-keeping isn't just a good habit; it's essential. Getting these timelines right is a fundamental part of solid financial management. We actually dive deeper into this in our guide to bookkeeping basics for small business.

Current Balance vs. Available Balance

This little detail trips a lot of people up: the difference between your current balance and your available balance. It's a simple distinction, but an important one.

- Current Balance: This number reflects the total money in your account before any recent transactions have fully processed.

- Available Balance: This is the money you can actually access and spend right now. It’s your current balance minus any pending charges or holds.

Here’s a real-world example. Let's say your current balance is $500. You just swiped your debit card for $50 worth of groceries. That transaction will likely show as "pending" for a bit. Your available balance will immediately drop to $450, but your current balance might still read $500 until the bank officially settles the payment.

When you're trying to avoid an overdraft, always, always look at your available balance. That's your true spending power.

This detailed look at your cash flow is also why bank statements are so vital for freelancers or self-employed individuals seeking financing. Lenders often rely on them to verify income for specialized products. You can learn more about how that works in a comprehensive guide to bank statement loans.

Pro Tip: What if my statement doesn't show up?

If your paper statement is late, don't just sit and wait. First, check your online banking portal—the digital version is often available sooner. If it's not there or you really need the paper copy, call your bank's customer service line right away. You'll want to confirm they have your correct mailing address and ask them to send a replacement.

Ready to stop wrestling with manual data entry? Bank Statement Convert PDF turns your cluttered PDF statements into clean, usable Excel files in just a few clicks. Get started for free today and finally get a clear view of your finances.