When you’re handed a bank statement, you can't always take it at face value. The truth is, spotting a forgery requires a bit of detective work—a mix of old-school manual inspection and some clever digital verification.

It's about training your eye to catch visual inconsistencies, like fonts that just don't match or a logo that looks a little fuzzy. Then, you have to put on your accountant hat and check for mathematical errors. Do the balances actually add up? Finally, you need to think like a profiler and analyze the transaction patterns for anything that seems illogical or out of place.

The New Reality of Document Fraud

Let's be honest: the need to spot fake bank statements has become an essential skill for anyone in lending, property management, or business ownership. It used to be that creating a fake document took serious effort. Now, with powerful and user-friendly editing software everywhere, a convincing forgery can be whipped up in minutes.

What looks like a perfectly normal bank statement on the surface could be a complete fabrication designed to pull the wool over your eyes. This isn't just a minor inconvenience; it's a significant financial risk. The good news? You don't need to be a full-time forensic investigator to protect yourself. The key is to blend a sharp eye for detail with the right verification tools. It’s a surprisingly powerful defense.

The rise of sophisticated fakes is a real and growing problem. A 2024 report revealed that over 50% of financial institutions have seen a spike in business fraud, and a staggering 25% of them have faced losses exceeding $1 million. This just underscores how critical effective detection has become. You can dig into the latest fraud statistics and see how AI is helping institutions fight back on Klippa.com.

By learning what to look for, you can turn this complex threat into a manageable part of your due diligence. This guide will walk you through clear, actionable strategies to help you verify documents with confidence and keep costly deception from impacting your bottom line.

The Art of the Manual Review: Your First Line of Defense

Before you even think about running software, your own two eyes are the best tool for spotting a clumsy forgery. This first pass—a detailed visual and manual inspection—is where many fakes fall apart. You have to put on your detective hat and look for the small details that just feel off.

If you're dealing with a physical document, start with the paper itself. Does it have the weight and texture of an official bank document? Banks don't use cheap copy paper. A flimsy sheet is an immediate red flag.

From there, move on to the overall look and feel. Banks are meticulous about their branding. Every font, logo, and layout is standardized. Any deviation, no matter how small, is a potential clue.

A classic mistake I see all the time is a forger using a font that's almost right, but not quite. It might be a slightly different "A" or a "4" that doesn't match the bank's official typeface. One wrong character can give the whole game away.

Zeroing In on the Details

Once you've done a quick scan, it's time to get granular. Look closely at the bank's logo. Is it sharp and clear? Or does it look fuzzy and pixelated? A low-quality logo is a dead giveaway that it was likely lifted from a website and pasted onto a template.

Alignment is another area where forgers often slip up. Genuine bank statements are generated by sophisticated software that lines everything up perfectly. Manually edited documents rarely achieve this level of precision.

To help you know what to look for, here's a quick reference table of common red flags.

Common Red Flags in Forged Bank Statements

| Red Flag Category | What to Look For | Example |

|---|---|---|

| Document Layout | Inconsistent margins, crooked lines, or text that doesn't align properly in columns. | The "Date" and "Description" columns are perfectly straight, but the "Amount" column is slightly skewed to the right. |

| Typography | Mixed fonts, varying font sizes in similar sections, or unusual character spacing. | The headers are in Arial, but the transaction list is in Times New Roman. |

| Logo & Branding | Pixelated, blurry, or discolored bank logos. Outdated branding elements. | The logo looks fuzzy around the edges, as if it was a low-resolution image stretched to fit. |

| Numerical Data | Misaligned decimal points in financial columns. Obvious calculation errors. | In a column of figures, one number's decimal point is a fraction of a space off from the others. |

Paying attention to these details can help you quickly identify suspicious documents before investing more time in deeper analysis.

The Problem with Sophisticated Fakes

Of course, not all forgeries are so obvious. With today's powerful software, creating a visually convincing fake is easier than ever. These advanced forgeries can often pass a simple eye test, making purely manual checks less reliable.

That’s why understanding how these documents are created is so valuable. Knowing the techniques used to edit a bank statement PDF gives you insight into the potential weak points. Even with good software, forgers can leave behind subtle digital artifacts or create transaction histories that don't make logical sense. This is where combining your sharp-eyed inspection with more advanced digital tools becomes a powerful strategy for fraud detection.

Analyzing Transaction History Like an Investigator

Once you've given the statement a solid visual once-over, it's time to roll up your sleeves and dig into the numbers. This is where the real detective work begins, because a statement that looks perfect at first glance can completely unravel when you start checking the math. You’re no longer just looking; you're thinking like a forensic investigator.

The first and most powerful check is simple arithmetic. It sounds basic, I know, but you’d be surprised how often forgers slip up here. They get so focused on changing a few key numbers—like inflating a deposit—that they completely forget to update the summary totals.

So, grab a calculator. Start with the opening balance, add every single credit, and then subtract every single debit and fee. Does the number you get match the closing balance on the page? If it’s off, even by a few cents, you've likely caught a forgery.

Scrutinizing Transaction Patterns

Beyond just the math, the story the transactions tell is incredibly revealing. A real bank statement has a certain rhythm—it's a reflection of a person's actual life, which is rarely neat and tidy. A fake one often feels too clean or contains bizarre entries a forger wouldn't think to question.

Look at the dates. Are there transactions posting on a Sunday or a major bank holiday? While some digital payments might go through, a cluster of activity, especially anything that looks like an in-person teller transaction, is a huge red flag.

Also, think about what isn't there. A genuine account history shows a mix of everyday expenses—groceries, gas, a Netflix subscription, a random ATM withdrawal. If you see a statement with just a few big, tidy deposits and no signs of regular life, it's almost certainly been fabricated.

One of the most common giveaways I see is an over-reliance on round numbers. Real life isn't made up of perfect figures like $500.00 or $2,000.00. It’s messy, with transactions like $498.17 or $1,952.50. A history packed with perfectly rounded numbers just doesn't feel authentic, because it isn't.

Spotting Unnatural Financial Activity

Finally, take a step back and look at the big picture. Does the financial activity actually make sense for the person or business providing the document? Here are a few tell-tale signs of manipulation I've learned to watch for:

-

The Last-Minute Large Deposit: This is a classic. The account has a low balance all month, and then a massive deposit conveniently appears right before the statement date. It’s a common trick to make the closing balance look good enough to pass a requirement.

-

Inconsistent Cash Flow: Look for wild, unexplained swings from a very low to a very high balance. Without a clear source like a regular salary deposit, this kind of erratic activity is highly suspect.

-

Vague Descriptions: Be wary of generic transaction details. If you see large amounts labeled simply "Deposit" or "Transfer" where a genuine bank statement would usually provide more specific information, that's another reason to be suspicious.

By meticulously checking the math and questioning the logic behind every transaction, you can catch fakes that a quick visual check would easily miss.

Go Beyond the Visuals: Use Digital Tools for a Deeper Dive

Manual checks are a great starting point, but some of the most damning evidence of forgery is completely invisible to the naked eye. This is where you need to put on your digital forensics hat. Shifting from a simple visual review to a more technical analysis can give you the definitive proof you need.

One of the most effective tricks I've learned over the years is surprisingly simple: convert the PDF bank statement into an Excel spreadsheet. This single action can blow a fraudster's cover wide open. Genuine, bank-generated PDFs are built with structured data that converts cleanly. A manipulated document? It often turns into a chaotic mess of jumbled text and misaligned columns in Excel.

Once the data is in Excel, you can sort it in a snap. Try organizing transactions by date or amount. It’s a fantastic way to make duplicate entries or illogical transaction sequences—things that are easy to miss in a PDF—jump right off the page.

This process highlights how a layered approach, moving from initial visual checks to detailed data auditing, is your most reliable path to verifying a statement.

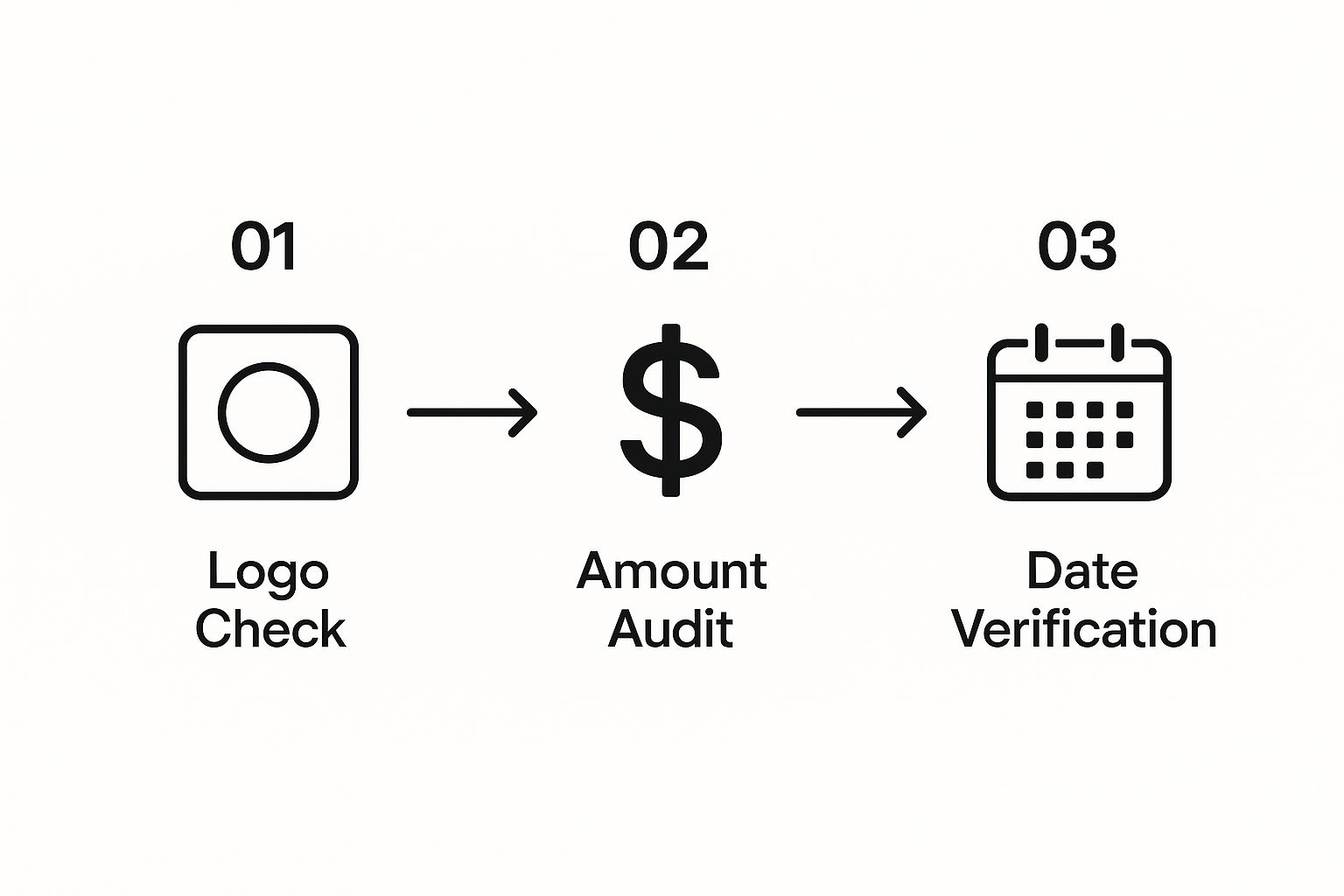

As you can see, combining logo and branding checks with a thorough audit of the numbers gives you a much clearer picture of the document's legitimacy.

Inspect the Document’s Digital Fingerprints

Every digital file has a backstory, and it’s stored in its metadata. Think of it as the file's DNA. Just right-click on the PDF file and look at its "Properties." You're hunting for clues in fields like "Author" or "Creator Application."

Does it say something like Adobe Photoshop, Canva, or a simple PDF editor? That's a massive red flag. A real bank statement should originate from the bank's own secure systems, not common design software.

For businesses that process dozens or hundreds of these documents, manual checks just don't scale. This is where automated solutions come in. Lenders and financial institutions are increasingly using AI-powered tools to catch subtle signs of fraud that even a trained human eye might miss.

These specialized platforms can run a whole battery of checks automatically, cutting down on manual labor and errors. If you're handling financial documents regularly, using dedicated bank statement extraction software is a game-changer. It rolls all these digital forensic checks into one efficient workflow, making it an indispensable asset for ensuring accuracy.

Securing Final Confirmation with Direct Verification

After you've done your due diligence with forensic checks and digital analysis, there’s one final, definitive step: go straight to the source. Nothing beats confirming the details directly with the financial institution that issued the statement. It's the only way to be 100% certain and completely remove any lingering doubt.

Of course, you can't just phone up a bank and start asking about someone's private account information. That's a huge privacy violation. The first, and most important, step is to get written authorization from the person whose statement you're trying to verify. This is non-negotiable, both legally and ethically. A simple, signed consent form usually does the trick.

Once you have that permission, you’re ready to contact the bank. Making the call or visit as smooth as possible means having all your ducks in a row beforehand.

What to Have Ready

To make the verification process quick and efficient, be prepared with these key details:

- The applicant’s full name and address exactly as they appear on the statement.

- The full account number.

- The specific statement period you need to confirm (e.g., March 1, 2024 – March 31, 2024).

- The exact closing balance you're verifying against.

When you get a bank representative on the line, explain that you have the customer's signed permission and just need to verify a few specific data points from a statement they provided. Instead of asking open-ended questions like "What was the balance?", frame it for a simple yes/no confirmation: "Can you confirm the closing balance for the March 2024 statement was $X,XXX.XX?"

A more modern and increasingly popular alternative is to use a third-party verification service like Plaid. With the applicant's consent, these platforms create a secure, direct link to their bank account to pull live, untampered financial data. This method completely bypasses the need for a PDF or paper statement, making it one of the most fraud-proof verification techniques available.

Whether you call the bank or use a digital service, this final confirmation is your ultimate safety net. Think of it like a final cross-reference, similar to how an accountant uses a bank reconciliation statement example to ensure every single figure matches up perfectly. It’s the step that provides total peace of mind.

Your Questions About Fake Bank Statements, Answered

Even with a detailed guide, you probably still have a few questions swirling around. Let's tackle some of the most common things people ask when trying to figure out if a bank statement is the real deal.

Should I Trust a Statement Just Because It Looks Professional?

Absolutely not. While a quick visual scan for things like blurry logos, weird fonts, or typos is a good starting point, it's a dangerously incomplete check.

Modern software makes it surprisingly easy to create a polished forgery that can fool almost anyone at first glance. Think of the visual check as the first filter, not the final word. The absence of obvious red flags doesn't mean the document is legitimate.

For any decision that carries real weight—like approving a big loan or handing over keys to a rental property—you need to dig deeper. Combining visual checks with a thorough data analysis is the only way to be sure, short of getting direct confirmation from the bank itself.

What's the Biggest Mistake People Make When Reviewing Statements?

Hands down, the most common and costly mistake is skipping the math. It's easy to get lost in the transaction descriptions and completely forget to check if the numbers actually add up.

A forger might skillfully alter a few key transactions to inflate their balance but overlook something as basic as recalculating the summary totals. It's a surprisingly frequent oversight. Always, always confirm that the opening balance + total deposits – total withdrawals = closing balance. If that simple equation fails, you've found a fake.

Are Those "Bank Statement Generator" Websites Illegal?

This is a tricky one. The websites themselves often exist in a legal gray area, but using the documents they produce to deceive someone is unequivocally illegal.

Submitting a fabricated statement to apply for a loan, get an apartment, or for any other official purpose is fraud. It’s a serious crime with severe consequences, including fines and potential jail time.

As a business owner, keeping your own records straight is just as important. Following good small business bookkeeping tips ensures your financial reporting is always accurate and above board. Always insist on official documents.

At Bank Statement Convert PDF, we get how critical accuracy and speed are. Our software is designed to help you pull data from PDF statements into Excel effortlessly. This makes it much faster to analyze the numbers, spot the red flags we've discussed, and verify financial information with confidence.