Learning how to track business expenses is really about getting a crystal-clear picture of where your money is going so you can make smarter decisions. It's a system of consistently grabbing every business-related expense, sorting it into the right bucket, and using that info to see how your business is really doing.

Get this right, and you'll not only dodge the usual tax-season panic but also spot hidden chances to fatten up your bottom line.

Why Smart Expense Tracking Is a Strategic Advantage

Too many business owners see expense tracking as a chore. It’s just another bookkeeping task you have to do to stay out of trouble with the tax man, right?

Wrong. Shifting your mindset from reactive record-keeping to proactive financial strategy is an absolute game-changer. Good expense tracking isn’t about stuffing receipts in a shoebox. It’s about gaining total control over your cash flow and making decisions backed by real data—the kind of decisions that actually grow your business.

Think about a small retail shop I worked with that was struggling with razor-thin margins. Once they started tracking everything meticulously, they noticed their "shipping supplies" costs were weirdly high. A little digging showed they were paying for premium packaging on even the most standard shipments. By switching to a more basic supplier for everyday orders, they saved thousands a year. That’s a simple win they never would have found without detailed expense data.

Beyond Bookkeeping: Uncovering Growth Opportunities

This isn't just about finding places to cut back. When you really know where your money goes, you unlock some serious advantages:

- Sharper Cash Flow Forecasting: Seeing your spending patterns clearly means you can predict future costs with way more accuracy. No more nasty surprises or cash shortfalls.

- Smarter Budgeting: When you know exactly what you spend on marketing, software, or supplies, you can build budgets that actually make sense and help you hit your goals.

- A Painless Tax Season: Having every expense already organized and categorized lets you maximize your deductions without that frantic, last-minute scramble. Mastering the fundamentals here is key. If you're new to this, getting a handle on the basics is your first move. Our guide on bookkeeping basics for small business is a great place to start.

Smart expense tracking transforms a boring administrative task into a powerful tool for financial intelligence. It’s the difference between guessing where your money went and knowing precisely how every dollar is working for you.

What Counts as a Business Expense?

From the moment you start, you have to be disciplined about categorizing everything. A business expense is simply any cost you rack up while running your company. This covers the big stuff like office rent and payroll, but also the smaller things like software subscriptions, client lunches, and digital ad campaigns.

As businesses grow, these costs can balloon. For example, global spending on business travel is expected to reach a staggering $1.57 trillion in 2025. That kind of number shows just how critical it is to manage these big-ticket items carefully.

Getting a handle on your expenses, much like efficiently tracking jobs and costs, frees up your time and money. Knowing how to track business expenses properly isn't just about staying compliant; it's about building a business that's resilient, profitable, and built to last.

Choosing Your Ideal Expense Tracking Method

Finding the right way to track business expenses is a lot like picking the right tool for a job. You wouldn't use a sledgehammer to hang a picture frame, and you shouldn't use a complex accounting suite when a simple app will do. Your tracking method needs to fit the scale and complexity of your business right now, but also be able to grow with you.

Most people start with what they know: a spreadsheet. It’s free, it’s familiar, and for a brand-new business, it seems like the path of least resistance. But I've seen it time and time again—that "easy" solution often creates a massive headache down the line. As your business picks up steam, the hours spent on manual data entry and hunting down formula errors start to add up, fast.

The Freelancer's Spreadsheet Story

I once worked with a freelance consultant who perfectly illustrates this journey. When she first hung out her shingle, her finances were simple—just a few clients and a couple of monthly software subscriptions. A basic spreadsheet worked beautifully. She could plug in her numbers and get a clear snapshot of her profitability. For her low transaction volume, it was totally manageable.

Fast forward a year, and her client list had tripled. She was now juggling project-specific material costs, travel receipts, and payments to subcontractors. That once-simple spreadsheet had become an unwieldy beast. She was losing hours every week just keying in receipts, and typos were throwing her numbers off. Tax season turned into a multi-day nightmare. This is the classic breaking point where a manual system starts to crack under pressure.

When to Upgrade From Manual Methods

So, how do you know when you've outgrown your spreadsheet? The signs are usually pretty clear. If any of these sound familiar, it’s probably time to look for a better way.

- It's a Time Sink: You're spending more than a few hours every month just on expense data entry.

- Constant Errors: You’re constantly finding typos, broken formulas, or miscategorized expenses that need fixing.

- You're Flying Blind: Your spreadsheet can’t give you an instant report on spending by category, client, or project.

- Receipt Chaos: You have a digital (or physical) shoebox full of receipts with no good way to attach them to the right transactions.

This is the point where dedicated software stops being a luxury and becomes a necessity. There's a reason 80% of employees report that automation frees them up for more important work—it's about buying back your most valuable asset: your time.

Your expense tracking method should be a tool that serves your business, not a task that drains it. If you spend more time managing the system than you do analyzing the data it provides, it's time for an upgrade.

Comparison of Expense Tracking Methods

Choosing the right tool is all about understanding the trade-offs. Let's break down the main contenders to see how they stack up against each other.

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Manual Spreadsheets | Solo freelancers or brand-new businesses with very few monthly transactions. | No cost to start; highly customizable. | Prone to human error; extremely time-consuming as business grows; no automation or real-time insights. |

| Expense Tracking Software | Growing small businesses, consultants, and teams needing efficient receipt capture and categorization. | Automates receipt scanning (OCR); syncs with bank accounts; generates reports; improves accuracy. | Monthly subscription fee; may have a slight learning curve. |

| Accounting Platforms | Established businesses needing a complete financial solution, including invoicing and payroll. | All-in-one financial management; provides a comprehensive view of business health; highly scalable. | More expensive; can be overly complex for those who only need expense tracking. |

Ultimately, the best way to track expenses comes down to your current reality and your future ambitions. A freelance graphic designer might be perfectly served by a dedicated expense tracking app. A small construction company with a crew and multiple active projects, on the other hand, will almost certainly need a full-blown accounting platform.

The goal is to pick a system that simplifies your life today while giving you room to grow tomorrow.

Your Modern Toolkit for Automated Expense Management

Let's be honest: stuffing receipts into a shoebox and wrestling with spreadsheets is a recipe for headaches and missed deductions. The good news is that we've moved far beyond that. The right set of tools can automate the grunt work of expense tracking, giving you back precious time to focus on what actually matters—analyzing your spending, not just inputting it.

This isn't about just another app; it's a completely different way of working, built on smart automation that captures, sorts, and reports on your expenses with very little effort from you.

The secret sauce here is Optical Character Recognition (OCR), which has gotten incredibly good thanks to AI. This is the tech that lets you snap a quick photo of a receipt. The software then "reads" the image, pulling out the merchant's name, the date, and the total amount, instantly converting a flimsy piece of paper into clean, digital data.

Think about it. No more trying to decipher faded ink or typing endless rows of numbers. That receipt from a coffee meeting or a last-minute supply run gets logged in seconds, right from your car. Nothing gets lost, and the task you used to put off for weeks is done before you've even left the parking lot.

Capture Expenses on the Go With Mobile Apps

This is where the real change happens. Mobile expense tracking apps put the entire process right in your pocket. Having that power on hand means you never miss a chance to log a legitimate business expense again.

This isn’t just a nice-to-have feature anymore; it’s quickly becoming how business is done. About 75% of businesses worldwide already rely on mobile apps for real-time expense reporting. It's a massive shift, fueling a global expense management market that's projected to hit $13.15 billion by 2030.

Here’s how this plays out in the real world:

- For the sales rep on the road: They can snap photos of fuel, meal, and hotel receipts as they go. No more digging through a messy envelope at the end of the month.

- For the busy consultant: The bill for a client lunch is logged and allocated to the correct project before they've even walked out of the restaurant.

- For the small business owner: A picture of an invoice for new inventory is taken the moment it arrives, keeping the books perfectly current.

Let the Software Do the Sorting

Once you've captured an expense, the next piece of magic kicks in. Modern software doesn’t just store a picture of your receipt; it actually understands what it is.

The system uses a mix of merchant data and your past habits to intelligently assign each expense to the right category—"Office Supplies," "Meals & Entertainment," or "Software Subscriptions." This doesn't just save a ton of time; it also keeps your bookkeeping consistent, which is a lifesaver when it comes to taxes and accurate reporting.

A modern expense tracking system does more than just record what you spent; it understands it. By automatically categorizing and syncing data, it builds a real-time, accurate picture of your company's financial health without the manual labor.

To make things even more airtight, these tools connect directly to your business bank accounts and credit cards. This bank feed synchronization automatically pulls in every transaction. The software then matches your snapped receipts to the corresponding bank transactions, turning a painful reconciliation process into a quick review-and-approve task.

If you're looking to build this kind of system, exploring the best cloud accounting software options is a great place to start. Many of them bundle all these automated features into one package.

Turn Your Data Into Decisions With Instant Reports

At the end of the day, the whole point of tracking expenses is to gain insight. This is where automation truly shines. Instead of spending hours exporting data and building reports in a spreadsheet, modern tools can generate them for you in seconds.

With just a couple of clicks, you can pull up reports that are crucial for running your business:

- Profit & Loss Statements: Get an instant snapshot of your profitability for any period.

- Expense by Category: Pinpoint exactly where your money is going and find opportunities to save.

- Spending by Vendor or Project: See how much you're spending on specific clients or initiatives to make sure they're profitable.

Suddenly, your expense data isn't just a historical record; it's a strategic tool you can use to plan for the future. The first step to unlocking these insights is to stop entering data by hand. You can find out more about getting this set up in our guide on https://bankstatementconvertpdf.com/how-to-automate-data-entry/. Embracing this modern toolkit helps you build a smarter, more data-driven business.

Building a System for Flawless Expense Capture

Knowing which tools to use is one thing; building a reliable system around them is another beast entirely. An effective method for tracking business expenses isn't just about software—it’s about creating a consistent, repeatable workflow that captures every single dollar without creating a ton of friction for you or your team.

This is where you graduate from simply recording transactions to building a genuinely bulletproof process.

The foundation of this whole system is clarity. Everyone involved needs to understand the rules of the game: what actually counts as a business expense, how it should be submitted, and who needs to sign off on it. Without this basic framework, even the slickest software will lead to messy, inconsistent books.

Start with a Clear Expense Policy

Before you even think about tracking a single receipt, you need an expense policy. This document becomes your single source of truth for all company spending. It’s designed to eliminate guesswork, prevent those questionable out-of-policy purchases, and make the whole process fair and transparent for everyone. To build a robust system, implementing strategies to automate data entry for business growth is a game-changer, slashing manual work and boosting accuracy right from the start.

Imagine a small construction company. Their team is constantly on the move—buying materials, fueling up trucks, and occasionally grabbing lunch. Without a policy, one crew member might expense a premium brand of lumber while another sticks to the budget, and a third just forgets to submit fuel receipts altogether. A clear policy puts an end to that chaos by setting firm guidelines.

Your expense policy should cover the basics:

- What is reimbursable? Get specific. Think travel, meals, software, client entertainment, and supplies.

- Spending limits: Set clear caps on things like daily meal allowances or hotel rates.

- The submission process: Detail how and when employees should submit expenses. For example, "All expenses must be submitted via the mobile app within 48 hours of purchase."

- Required documentation: Make it a hard rule: a digital receipt is required for every single purchase. No exceptions.

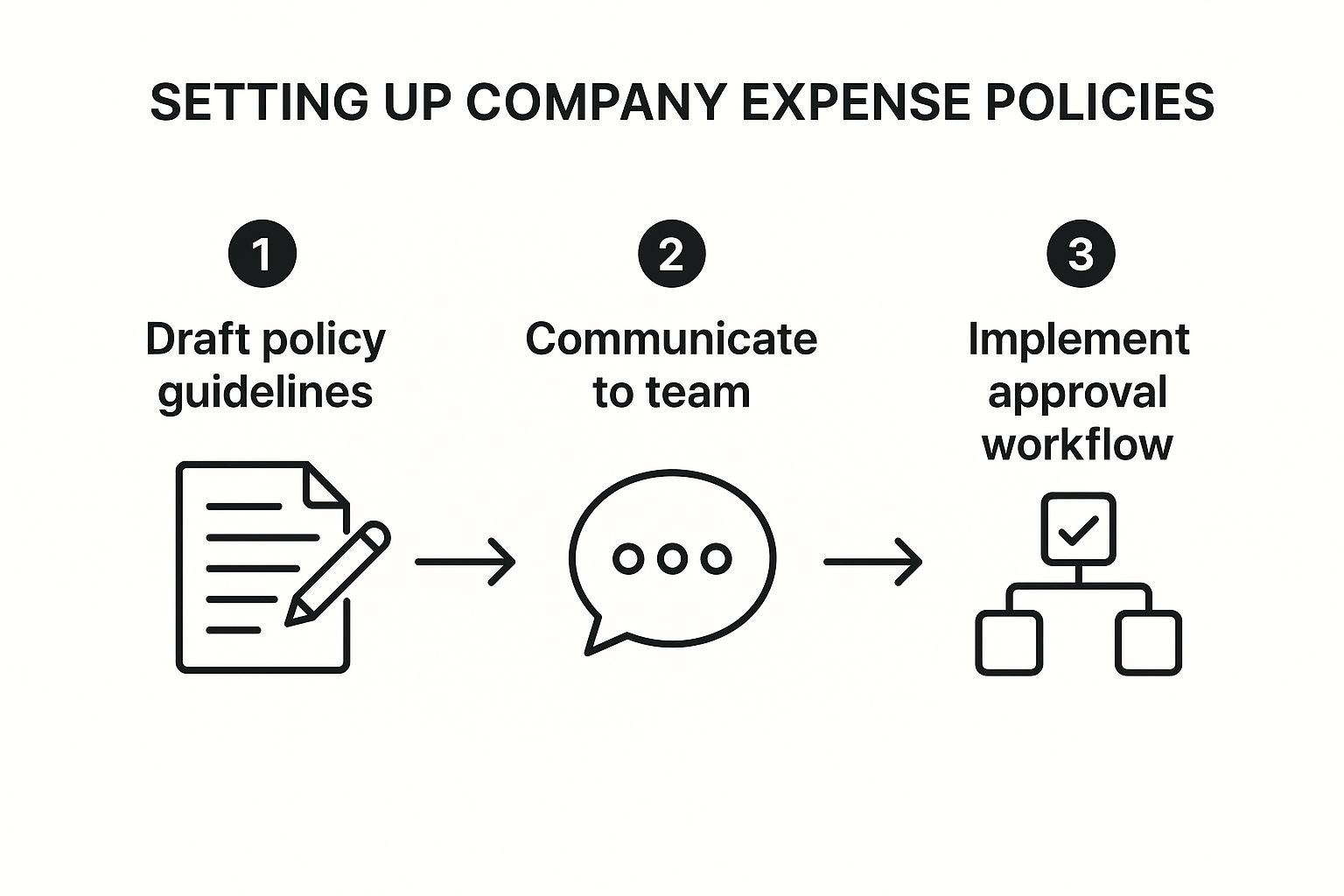

This infographic breaks down the key steps for getting a company expense policy up and running.

As you can see, a policy isn't just a document you write once and forget. It's a living part of your operations that needs clear communication and a solid approval structure to actually work.

Master the Art of Digital Receipt Capture

Paper receipts are the enemy of efficient expense tracking. They fade, get lost in the bottom of a toolbox, and create hours of tedious manual work. The core of any modern expense system is digitizing every receipt the moment the transaction happens.

This isn't just about snapping a picture; it's about building a habit. Get your team into a "snap and send" rhythm immediately. That purchase for job-site materials at the hardware store? The receipt should be captured before the employee even gets back in their truck. This real-time capture eliminates the dreaded end-of-month scramble and ensures 100% of expenses are recorded accurately.

The most common point of failure in any expense tracking system is the delay between the purchase and the capture. Closing that gap by making immediate digital capture a non-negotiable habit is the key to flawless accuracy.

For our construction company example, this means the site foreman snaps a photo of a subcontractor's invoice as soon as it's handed over. The driver captures the fuel receipt right at the pump. This simple, consistent action feeds clean, real-time data into their accounting software, giving them an up-to-the-minute view of project costs.

Create a Consistent Categorization Framework

Once an expense is captured, it needs to be sorted correctly. Messy, inconsistent categorization can make your financial reports almost useless and create massive headaches come tax season. Your categories should be logical, clear, and—most importantly—aligned with how you want to analyze your business performance.

A good starting point is to align your categories with standard tax-deductible expense types, but don't stop there. You need categories that give you real operational insights.

For instance, the construction company could break down a general "Materials" category into more granular subcategories:

- Lumber

- Concrete

- Electrical Supplies

- Plumbing Fixtures

This level of detail lets them see not just their total material costs, but also which specific areas are driving overages on a project. It transforms a simple expense report into a powerful project management tool.

Implement a Regular Review and Reconciliation Rhythm

A system is only as good as its upkeep. Don't let expenses pile up. The key is to set aside a specific, recurring time each week to review, approve, and reconcile all submitted expenses. A weekly 30-minute block on your calendar is far more effective than a frantic eight-hour marathon at the end of the month.

During this weekly review, you’ll want to:

- Verify all submissions: Check that every expense has a corresponding digital receipt and fits within the company policy.

- Ensure correct categorization: Quickly scan to make sure "Office Supplies" aren't getting mixed in with "Client Meals."

- Reconcile with bank feeds: Match the approved expenses against the transactions coming in from your business bank account or credit card. This is the final step that confirms everything is accounted for.

This regular rhythm keeps your books clean and provides a continuously accurate picture of your financial health. By establishing a clear policy, mandating immediate digital capture, creating a smart categorization framework, and sticking to a weekly review, you build a system that makes flawless expense tracking an achievable reality, not just a goal.

Turning Your Expense Data into Business Insights

Meticulously tracking every receipt is important, but it's only half the story. The real win isn't just knowing where your money went; it's understanding why it went there and what that means for your business. Raw expense data is just a pile of numbers until you transform it into insights that help you make smarter decisions.

This is where good bookkeeping evolves into sharp financial strategy. You're shifting from a tedious chore to a powerful tool for growth.

Think about a small marketing agency, for example. By analyzing their project expenses, they might find that their big-name clients, while bringing in impressive revenue, are barely profitable because of constant scope creep and high overhead. At the same time, their smaller, simpler projects could have much higher profit margins. That kind of insight is a game-changer, empowering them to adjust their pricing or even pivot their client focus.

Generating and Interpreting Key Financial Reports

Your expense tracking software is likely packed with reporting tools designed to give you this exact kind of clarity. Forget building charts from scratch; you can generate critical reports with just a few clicks. The two most powerful reports for getting a handle on your spending are the Profit & Loss statement and the Expense by Category breakdown.

- Profit & Loss (P&L) Statement: This is your business's ultimate scorecard. It subtracts your total expenses from your total revenue over a set period, telling you flat-out whether you made a profit or took a loss. Reviewing your P&L regularly helps you spot trends and see the big-picture impact of your spending.

- Expense by Category Report: This report is your magnifying glass. It takes your total spending and breaks it down into the specific categories you set up. You might be surprised to find that your "Software Subscriptions" have quietly crept into your top five expenses.

This detailed breakdown is where you find real opportunities to save. It helps you answer tough questions like, "Are we overspending on digital advertising?" or "Why have our utility costs jumped this quarter?" These reports are the bedrock of solid financial analysis.

Using Historical Data for Accurate Forecasting

Once you've got a few months of clean, categorized expense data under your belt, you can finally stop guessing about the future. Your past spending becomes a surprisingly reliable roadmap for creating accurate budgets and financial forecasts.

This is where learning to track your expenses properly really pays off. If you know you consistently spend around $500 per month on office supplies, you can confidently budget for it. If travel costs always spike in the third quarter, you can plan for that cash outflow well in advance and avoid any nasty surprises.

Your past spending is the most reliable predictor of your future financial needs. Use it to build budgets that are based on reality, not guesswork, turning a reactive process into a strategic advantage for your business.

This ability to forecast is crucial for managing your cash flow. It lets you anticipate major expenses and ensure you have the funds ready when you need them. This process goes hand-in-hand with making sure your books are balanced, which often involves reconciling your accounts. To nail this part, it helps to understand the fundamentals, like a clear explanation of the bank reconciliation formula and how it confirms your records match what the bank says.

By turning your expense data into these forward-looking insights, you arm yourself with the information you need to steer your business toward greater profitability and long-term stability.

Common Expense Tracking Pitfalls and How to Avoid Them

Knowing the steps to track business expenses is a great start, but the real trick is sidestepping the common traps that can completely derail your efforts. Trust me, learning from the mistakes of others is a lot less painful (and cheaper) than making them yourself. Let's build you a rock-solid financial system from day one.

One of the biggest blunders I see is mixing personal and business funds. It seems innocent enough—using your personal card for a quick business lunch because it's handy. But this habit creates an absolute nightmare for your bookkeeping. It muddies the waters for tax deductions and makes it nearly impossible to see how your business is actually doing financially.

The solution is non-negotiable: open a dedicated business bank account and credit card. Seriously. Use them for every single company-related purchase.

Dropping the Ball on Record-Keeping

Another classic mistake is putting off record-keeping. I once knew a freelancer who just tossed all her receipts into a shoebox, promising to "sort it out later." When tax time rolled around, half the ink had faded and a chunk of the receipts were missing. She lost out on hundreds of dollars in legitimate deductions.

This is where a simple routine becomes your best friend. Just set aside 15-20 minutes every Friday to scan your receipts and update your expense log. This tiny, consistent habit prevents the end-of-the-month (or end-of-the-year) panic that leads to costly errors. If you're looking for more ways to keep your books in order, you'll find some great advice in these small business bookkeeping tips.

The biggest threat to accurate expense tracking isn't complexity; it's inconsistency. A simple system you follow every week will always outperform a perfect system you only use once a month.

Sticking with Outdated, Manual Methods

It's surprising how many businesses still rely on manual data entry, not realizing the risks involved. Technology has made huge leaps in cutting down on errors and saving time, yet about 44% of businesses are still stuck with old-school systems.

This manual approach is slow and incredibly prone to error. Worse, a staggering 26% of companies using these methods aren't even sure if their expense reports comply with their own policies. You can find more stats on AI's impact on expense management on superagi.com. Using modern tools with features like receipt scanning isn't just a nice-to-have; it's about gaining accuracy and control over your finances.

So, how do you stay out of trouble? It really boils down to three simple, powerful actions:

- Separate your finances with dedicated business accounts. No exceptions.

- Build a weekly review habit to keep your records current and clean.

- Embrace modern tools to automate tedious tasks and minimize human error.

By getting ahead of these common pitfalls, you can turn expense tracking from a chaotic chore into a smooth, reliable process that actually supports your business's growth and stability.

Ready to stop manual data entry and take control of your financial records? Bank Statement Convert PDF offers a simple, powerful solution to convert your bank statement PDFs into organized Excel spreadsheets in seconds. Get started with our free converter today!