We've all been there. Staring at a stack of bank statements, knowing every single line item needs to be manually punched into a spreadsheet. It's a feeling of pure dread. This painstaking process isn't just slow; it's a genuine liability that costs businesses dearly in time, money, and financial accuracy. An online PDF to Excel converter is the answer, turning this tedious chore into a quick, automated task.

Why You Need to Ditch Manual Data Entry for Good

The case against manual data entry is much stronger than just "it's boring." The real damage is often hidden, quietly compromising your financial integrity and killing productivity. When you have skilled professionals burning hours on what is essentially transcription work, their expertise is completely wasted. It's not just inefficient—it's a direct hit to your bottom line.

Just think about your last account reconciliation. One misplaced decimal point or a couple of transposed numbers can send an entire financial report into a tailspin. Hunting down that tiny error can take hours, creating a frustrating domino effect of delays.

The Real-World Cost of Human Error

Let's be honest: manual entry is a recipe for mistakes. It doesn't matter how careful you are. In fact, studies show that even for professional data entry clerks, error rates can climb as high as 4%. That might not sound like much, but it means for every 100 transactions you enter, four could be wrong. If your business handles thousands of transactions, that's a massive, unacceptable risk.

These seemingly small errors snowball into huge problems:

- Inaccurate financial statements and unreliable forecasts.

- Incorrect tax filings, which can lead to audits and penalties.

- Bad business decisions made because they were based on faulty data.

The biggest risk with manual data entry isn't the time it burns, but the silent errors that corrupt your financial data from the inside out. Switching to an automated tool isn't a luxury; it's a necessary step to protect your company's financial health.

The Drain on Productivity and Focus

Giving this kind of tedious work to your accountants, bookkeepers, or even yourself as a small business owner is a terrible use of talent. It's a classic example of a high-value person stuck doing low-value work. This doesn't just crush motivation; it pulls them away from strategic tasks that actually move the needle, like financial analysis or building client relationships.

The repetitive, mind-numbing nature of the job also causes mental fatigue, which ironically makes errors even more likely.

This demand for better accuracy and efficiency has spurred a major shift in the market. We're seeing a rising demand for reliable PDF to Excel converters, with tools like Adobe Acrobat Pro setting a high bar with its powerful OCR and ability to preserve table structures. Other solutions, such as Nitro PDF Pro, are popular for how well they work with Microsoft Office. It's clear that professionals are moving toward powerful, subscription-based tools that promise better accuracy and security. If you want to see what's out there, you can explore some of the top Excel converter tools for business professionals in 2025 to see how the technology has evolved.

Ultimately, using a dependable online PDF to Excel converter is a strategic move, ensuring both financial integrity and operational efficiency.

How to Choose the Right PDF to Excel Converter

Picking the right converter can be the difference between a five-minute task and a five-hour headache. I’ve seen it happen time and time again: someone grabs the first free tool they find, only to end up with a jumbled mess of data that takes ages to fix. The secret isn't finding a converter with a million features; it's about finding one that does exactly what you need it to do.

Think about it. If you're a freelancer who just needs to convert one invoice a month, your needs are completely different from an accounting firm processing hundreds of bank statements. A simple, free online PDF to Excel converter might be perfect for that single, clean PDF. But once you start dealing with scanned documents or sensitive financial data, you need to be much more discerning.

Many online tools have a straightforward interface, often with a simple drag-and-drop area.

This clean design makes it incredibly easy for anyone to upload and convert a file without any technical know-how. That simplicity is fantastic for quick, one-off jobs. But for more serious work, you need to look under the hood.

Figure Out What You Really Need

Before you even start looking at tools, take a moment to think about the documents you work with most. Are they crystal-clear PDFs downloaded directly from your bank's website? Or are they scans of crumpled paper statements that have been sitting in a folder for months? This single question is the most important one you can ask.

- Does it have good OCR? If you’re working with scanned documents, Optical Character Recognition (OCR) is everything. This is the technology that reads the text and numbers from the image of the page. Bad OCR means your financial data turns into gibberish. My advice? Always test a tool with one of your trickiest scanned statements before committing.

- Can it handle weird tables? Bank statements are notorious for their complex layouts. You'll find merged cells, strange headers, and footnotes all over the place. A basic converter will choke on these, but a more advanced tool can intelligently figure out the structure and lay it out perfectly in Excel, saving you from a manual formatting nightmare.

The world of file conversion is huge. By 2025, the industry is expected to support over 25,600 different conversion types across more than 300 file formats. Some specialized services for bank statements can even handle documents from over 100 global banks. This just goes to show how specific—and powerful—the right tool can be.

To help you narrow it down, I've put together a quick comparison based on common scenarios I see.

Converter Feature Comparison for Different User Needs

This table breaks down which features matter most depending on who you are and what you're trying to accomplish. It's a simple way to match your needs to the right type of tool.

| Feature | Freelancer (Casual Use) | Small Business (Regular Use) | Accountant (Heavy Use) |

|---|---|---|---|

| OCR for Scans | Nice to have | Essential | Non-negotiable |

| Batch Processing | Not necessary | Highly recommended | Essential |

| Security (Encryption) | Recommended | Essential | Non-negotiable |

| Data Accuracy | Good is fine | High precision needed | Must be flawless |

| Cost | Free to low-cost | Low to mid-tier subscription | Worth a premium price |

| Customer Support | Self-service/FAQ | Email/Chat support | Priority phone/chat support |

As you can see, the requirements scale up pretty quickly. A freelancer can get by with a simple, free tool, but a professional accountant needs a robust, secure, and highly accurate solution.

Don't Overlook Security and Volume

When you're dealing with bank statements, security isn't just a feature; it's a requirement. This is where you have to be really careful with free, browser-based tools, as some have questionable data privacy policies.

My rule of thumb: Never use a converter that doesn't offer 256-bit SSL encryption. This is the standard for protecting your data as it travels to and from the server. For any kind of business use, this is the absolute minimum you should accept.

Finally, consider your workload. If you're converting just one or two statements, doing them one by one is fine. But if you have a stack of 50 to get through, you'll want a tool with batch processing. This feature lets you upload and convert all your files at once, turning what could be a full day of tedious work into a task you can finish in a few minutes.

Finding the right fit will make your workflow smoother and your data more reliable.

Turning Your Bank Statement PDFs into Usable Excel Files

Alright, let's get to the heart of the matter: converting that stubborn bank statement PDF into a dynamic, easy-to-use Excel spreadsheet. I've done this hundreds of times, and I can tell you that a little bit of prep work makes all the difference between a clean conversion and a frustrating mess. A great result always starts with a good-quality document.

Before you even think about uploading your file to an online PDF to Excel converter, take a moment to look at the PDF itself. You'll get the best, most accurate results from what we call "native" PDFs. These are the ones you download straight from your online banking portal. They're born digital, meaning the text and numbers are already data, which makes it a piece of cake for a converter to read.

If you're not sure how to grab one of these, we've put together a straightforward guide on how to download a bank statement from your bank.

Getting Your PDF Ready for Conversion

What if you only have a paper copy? In that case, the quality of your scan is everything. I've seen it all—blurry, crooked, poorly lit scans that would give even the most advanced tools a headache. To give the converter the best shot, make sure your paper statement is perfectly flat, evenly lit (no shadows!), and that the text is crisp and clear.

This prep work directly feeds the Optical Character Recognition (OCR) technology that reads the document. Think of it this way: giving the OCR a clean scan is like speaking clearly to a voice assistant. The better the input, the more accurate the output.

Walking Through the Conversion

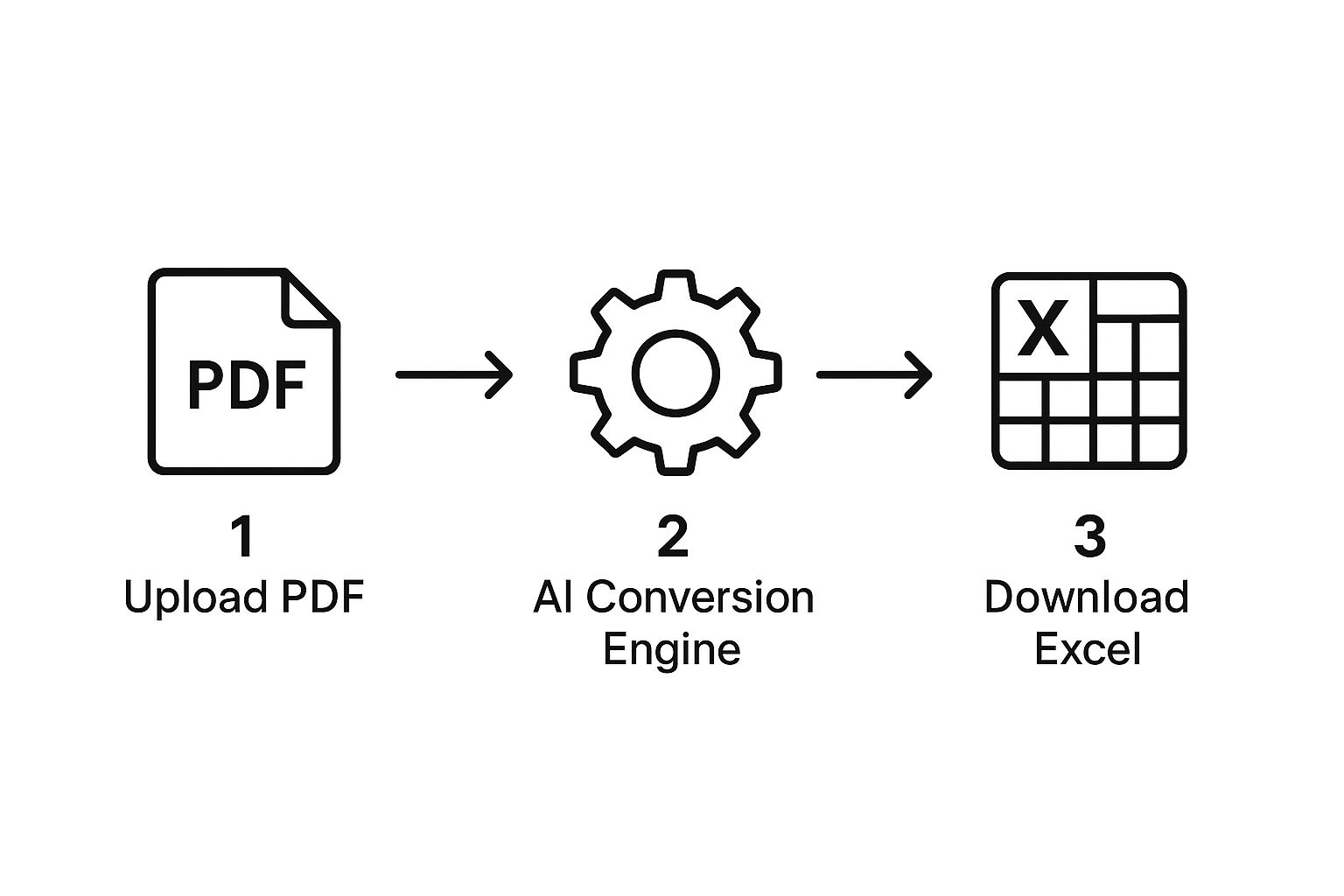

Once you have a quality PDF, the actual conversion is usually pretty simple. You’ll upload the document, let the online tool do its thing, and then download your shiny new spreadsheet.

The process is designed to be user-friendly, handling all the heavy lifting behind the scenes.

This workflow shows how a modern converter takes your PDF and, through some impressive AI processing, hands you back a file that's ready for work.

Most good converters will automatically see that you've uploaded a scanned image and switch on their OCR engine. But keep an eye out for a manual option. If you see a checkbox labeled "OCR" or "Scanned Document," make sure you tick it. For any non-native PDF, this is the most critical setting.

My Personal Tip: Converting a statement that's several pages long? Double-check that the tool is set to process all pages. It's a small detail, but I've learned the hard way that it's frustrating to download your file only to find you've got just the first page.

Fine-Tuning with Key Settings and Options

While most conversions are straightforward, some of the more advanced tools offer extra settings that can be a real lifesaver, especially with bank statements that have weird or complex layouts.

Here are a few common options you might run into:

- Table Detection Mode: Sometimes, a converter's automatic mode gets confused by an unusual table structure. Having the ability to try a different detection mode can often solve the problem instantly.

- Maintain Formatting: This tries to make your Excel sheet look just like the PDF, with the same fonts and colors. Honestly, for data analysis, I almost always turn this off. You want the raw, clean data, not the fancy styling.

- Header and Footer Removal: This is a fantastic feature. It intelligently strips out repeating information like page numbers, bank logos, or contact details, leaving you with nothing but your transaction data.

Think of these settings as you telling the tool what matters most. By guiding it, you ensure the spreadsheet you get back isn't just a jumble of data, but a perfectly organized dataset you can start analyzing right away.

Polishing Your Data in Excel After the Conversion

Alright, you've successfully pulled your data from a stubborn PDF into Excel. That’s a huge win. But if you’ve ever done this before, you know the job isn't quite finished. The raw data from an online pdf to excel converter often needs a bit of a tune-up before it’s ready for any serious analysis.

Think of the converted file as raw material. It's all there, but it needs to be shaped and cleaned to become a truly functional spreadsheet. This cleanup phase is a standard part of the process, and with a few Excel tricks up your sleeve, you can fly through it.

Tackling Common Formatting Headaches

The first things I always look for are merged cells and wonky formatting—they’re the most common culprits. Bank statements often use merged cells for headers or summary boxes, which looks clean in the PDF but completely breaks sorting and filtering in Excel.

Fixing this is straightforward. Just select the merged cells, head to the Home tab, and click the Merge & Center dropdown to unmerge them. You might have to manually copy the header text into the now-empty cells, but it’s a small price for a usable data table.

Date and number formatting is another classic problem. Excel might read dates as text or get the month and day mixed up, especially with different regional formats.

A quick tip: Select the entire date column, go to the Home tab, and in the Number group, choose Short Date or Long Date. If the data is still being difficult, it probably has sneaky extra spaces or non-printing characters.

Splitting and Sanitizing Transaction Details

Bank statements are notorious for cramming way too much information into a single cell. You’ll often see a transaction description that includes the vendor name, location, and a reference code all mashed together. This makes it impossible to, say, total up all your Starbucks purchases for the month.

This is where Excel’s Text to Columns feature is a lifesaver.

- First, highlight the column with the jumbled data.

- Next, navigate to the Data tab and click Text to Columns.

- Choose the Delimited option. This is perfect when a specific character—like a comma, a dash, or even a series of spaces—separates the data you want to split.

- Follow the simple on-screen wizard to break that one messy column into several clean, organized ones.

You’ll also run into numbers that Excel doesn’t recognize as numbers because they contain currency symbols ($) or commas. Formulas like SUM or AVERAGE won't work until you fix this. The Find and Replace tool (shortcut: Ctrl+H) is your best friend here. Just tell it to find all instances of "$" and replace them with nothing.

To get a great final layout, take a look at our guide on the ideal bank statement format in Excel for more advanced structuring ideas.

Sometimes, a quick-reference guide is the easiest way to handle these common cleanup tasks. Here’s a table of the issues I see most often and the Excel tools I use to fix them.

Common Post-Conversion Issues and Excel Fixes

| Common Issue | Excel Solution | Why It Happens |

|---|---|---|

| Merged Header Cells | Select cells -> Home tab -> Unmerge Cells | PDFs use merged cells for visual layout, which interferes with Excel's grid structure for sorting and filtering. |

| Dates Read as Text | Select column -> Data tab -> Text to Columns -> Finish | Extra spaces or non-standard date formats (e.g., "Jan-01-2024") can confuse Excel's auto-detection. |

| Numbers with "$" or "," | Find and Replace (Ctrl+H) to remove symbols | Currency symbols and thousand separators cause Excel to see the value as text instead of a calculable number. |

| Jumbled Transaction Data | Select column -> Data tab -> Text to Columns | Statements often combine descriptions, locations, and codes into one field for space-saving, not for data analysis. |

| Hidden Leading/Trailing Spaces | =TRIM() function in a helper column |

Copy-paste errors or formatting artifacts from the PDF converter can add invisible spaces that break formulas. |

Spending just a few minutes on these cleanup steps can make a world of difference. You'll transform a messy data dump into a pristine spreadsheet that's ready for budgeting, tax prep, or any financial analysis you need to do.

Advanced Tips for High-Volume Conversions

When you're dealing with more than just a handful of PDFs, the game changes. Converting hundreds of bank statements every month calls for a completely different strategy than just uploading one file at a time. This is where you really start to see the power of a modern online PDF to Excel converter, especially if you're a business trying to scale up your data processing without drowning in manual work.

One of the most immediate time-savers is batch processing. Forget the one-by-one drudgery. This feature lets you upload an entire folder of PDFs at once. The system then chugs through the queue, converting every document while you get back to more important things. It’s a simple concept that can easily reclaim hours of your day.

Automating with AI and Templates

For those recurring jobs—like processing monthly statements from the same dozen banks—you can take things even further. I've found that many of the more sophisticated tools now use AI to learn the specific layout of your documents. In practice, this means you can build a template-based workflow.

Once the converter understands the structure of a statement from, say, Chase Bank, it can apply that same logic to all future Chase statements you upload. This ensures the data extraction is consistent and accurate every single time, with zero manual setup. For anyone in accounting or finance, this is a massive win.

This kind of AI-driven automation has totally changed how we handle financial documents. In fact, some intelligent document processing platforms report over 98% accuracy on data extraction, even from tricky tables and scanned copies. With roughly 34% of Fortune 500 companies now using AI solutions like this, it's clear the technology is trusted for high-stakes financial work. You can discover more insights about AI-enabled data extraction on nanonets.com.

Integrating with APIs for Full Automation

For the most technically demanding workflows, nothing beats an Application Programming Interface (API). An API lets you plug the conversion service directly into your own business software, creating a seamless, automated process.

Imagine this: you could build a system where a bank statement PDF emailed to a specific address is automatically grabbed, sent to the conversion API, and the resulting Excel data is pushed directly into your accounting software. The entire process happens in the background, without a single click from you.

Sure, this method requires some technical setup, but it represents the absolute peak of efficiency for high-volume document processing. It's a core feature of what specialized bank statement extraction software delivers. By adopting these advanced strategies, you’re no longer just converting files; you’re building a truly efficient, scalable data management system.

Got Questions? Let's Talk About PDF to Excel Converters

Even with a straightforward tool, it's natural to have a few questions pop up, especially when you're handling sensitive documents like bank statements. I've worked with these converters for years, and I've seen the same concerns come up time and again. Let's walk through them so you can convert your files with confidence.

One of the first things people ask me about is security. And they're right to be cautious. You're about to upload a file filled with your private financial data to an online service. This is where you absolutely cannot compromise.

I only recommend using services that offer 256-bit SSL encryption. Think of it as an armored truck for your data; it scrambles the information as it travels from your computer to the converter's servers, making it completely unreadable to anyone who might try to intercept it. Good services also have a clear privacy policy that spells out how they handle your files—specifically, that they are automatically and permanently deleted after just a few hours.

"But Will the Numbers Be Right?" A Look at Accuracy

This is the million-dollar question, isn't it? What's the point of converting if the final Excel sheet is full of errors?

The good news is that if you're starting with a native PDF—the kind you download directly from your bank's website—the accuracy is incredibly high. We're talking over 99% accurate. The data in these files is already digitally structured, so the converter is just pulling it out and reorganizing it, not guessing.

Scanned documents, however, are a different story. Here, the quality of the scan is everything because the converter relies on Optical Character Recognition (OCR) to "read" the image.

- Got a clean, high-resolution scan? You can expect results that are nearly as perfect as a native PDF.

- Working with a blurry, skewed, or low-quality scan? This is where you might see some hiccups. The OCR could misinterpret a "3" as an "8" or a "5" as an "S." My rule of thumb is simple: if your source file was a scan, always give the final numbers a quick spot-check against the original PDF.

My Pro Tip: The best way to guarantee a perfect conversion is to start with the best source file. Whenever you have the choice, bypass the scanner entirely and download the digital PDF straight from your bank. It eliminates any chance of OCR-related errors from the get-go.

Can Any Type of PDF Be Converted?

For the most part, yes, but there are a few things to keep in mind. Modern converters are built to handle both native and scanned (image-based) PDFs. The difference is just how they do it. Native files are a direct data extraction, while scanned ones need that OCR process to transform a picture of text into real, workable data.

What about those password-protected statements? You can't just upload a locked file and hope for the best. You'll need to enter the password to unlock the PDF first. Most PDF readers, like Adobe Acrobat, let you save a new, unlocked version of the file once you've opened it with the password. That unlocked version is what you’ll upload to the converter.

Stop wasting hours on mind-numbing data entry. Bank Statement Convert PDF is the powerful, secure tool you need to turn your bank statements into clean, usable Excel files in just seconds. Try our converter today and see the difference for yourself!