If you've ever tried to manually convert PDF bank statements to Excel, you already know the pain. It's a massive time-sink, and frankly, it opens up your financial data to a lot of unnecessary risks. This isn't just a slow, boring task—it's a direct route to costly mistakes and wasted hours that you could be using for actual analysis.

The Hidden Costs of Manual Data Entry

Manually keying in financial data is so much more than a simple headache. Every hour spent hunched over a keyboard, copying and pasting, is a real, tangible cost to your business. Think about it: that's time that could have gone into strategic planning, talking to clients, or finding new ways to grow. Instead, it creates a serious operational bottleneck.

Let's get real about the consequences of a single typo. One misplaced decimal point or a couple of transposed numbers can throw off an entire financial report. This can lead to bad business decisions, incorrect tax filings, or even damaged client relationships. These aren't just what-if scenarios; they happen all the time when businesses rely on outdated manual methods.

The Problem with Inconsistent Data

And what about those blurry scans or messy, inconsistent columns you get from different banks? Trying to make sense of it all adds hours of frustrating, non-productive work. It's no wonder that automating bank statement conversion has become so critical.

Modern tools now use AI-driven OCR to pull structured data directly from the PDF, which speeds up workflows and cuts down on operational costs. You can learn more about how to automate data entry at https://bankstatementconvertpdf.com/how-to-automate-data-entry/.

The true cost isn't just the salary you pay for data entry. It's the compounded price of all the errors, missed deadlines, and the important strategic work that never gets done because your team is stuck in spreadsheets.

This constant drain on resources is precisely why automated solutions are no longer a "nice-to-have." For any business serious about accuracy and efficiency, they're a fundamental need. To really get a handle on these inefficiencies, it's worth exploring the various business process automation tools available that can offer some powerful solutions.

Your First Conversion in Minutes

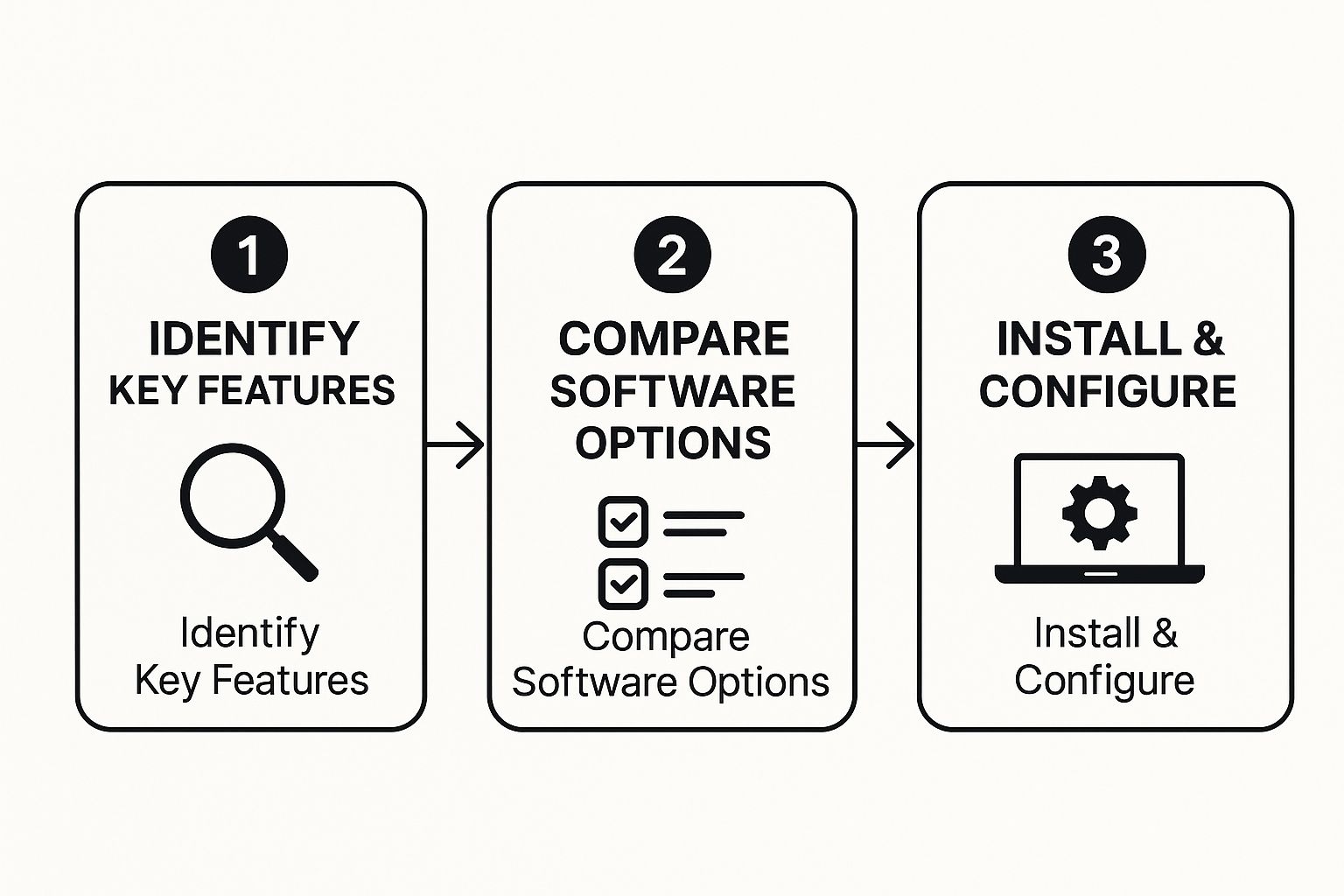

Jumping into your first PDF bank statement to Excel conversion is quicker than you might expect. Forget about clunky setups and confusing manuals. With the right software, you can get from a downloaded PDF to a ready-to-use spreadsheet in just a few minutes. The only thing you need to do beforehand is have your PDF statements saved and ready to go.

Once you launch the software, you'll see a pretty simple main screen. Look for a big, obvious button that says something like "Load PDF" or "Select File." That's where you'll start. A quick tip from experience: always use the original PDF downloaded directly from your bank's website. Scanned copies or photos can cause headaches later on.

This process is all about getting the setup right from the beginning, focusing on the features that matter most for clean data extraction.

Loading Your First Statement

Go ahead and select your PDF. The software will immediately get to work, using Optical Character Recognition (OCR) to find all the transaction data. You’ll be surprised at how well it reads standard bank statement layouts on the first try. A preview of the extracted data will pop up on your screen almost instantly.

Here's the most important part of the whole process: pause and look at that preview. Seriously. Take a few seconds to make sure the columns—date, description, debits, credits—are all lined up correctly. A quick glance now can save you a ton of time fixing things in Excel later.

This preview is your chance to see exactly what the software has pulled from the PDF before you commit to creating the final file.

If the columns look good and the numbers seem right, you're pretty much done. Just find the "Convert" or "Export to Excel" button and give it a click. The software will package everything up into a clean .xlsx file, ready for you to use.

And just like that, you've done your first conversion and skipped what could have been hours of mind-numbing data entry. For an even more in-depth look, we have a complete guide on how to convert your PDF into Excel with more advanced tips.

Getting Your Data Just Right: A Guide to Conversion Settings

Getting a conversion to work with one click is a great start, but the real magic happens when you dive into the settings. This is where you transform a good-enough spreadsheet into a perfect, analysis-ready document, saving you from tedious manual clean-up later.

Think of it this way: you're teaching the software how to read your bank's specific statement layout. The initial preview might get you 90% of the way there, but that last 10% is what makes all the difference. For instance, I’ve seen countless statements that cram debits and credits into one column, using a minus sign for withdrawals. Others keep them separate. A quick trip to the settings can sort that out instantly.

Mastering Column Mapping and Formats

The first place you'll want to look is column mapping. This is your command center for telling the software what's what. Did the tool mistake the "Description" column for "Transaction Type"? No problem. You can usually just click a dropdown menu to reassign it correctly.

Date formats are another common hang-up. Is your bank using DD/MM/YYYY or MM-DD-YY? Getting this right from the start means Excel will see those entries as actual dates, not just bits of text. This is absolutely crucial if you plan on sorting your transactions by date or creating timelines.

The real goal here isn't just to fix one statement. You're building a reusable template. Spend a few minutes configuring it now, and you'll save hours on all future statements from the same bank.

Dealing With Tricky Transactions and Layouts

What about those frustrating multi-line descriptions, where a single transaction takes up two or three rows? This is a classic problem that can throw off your entire spreadsheet. Most good converters have a setting for this, often called "Merge Multi-Line Rows" or something similar. Ticking that box tells the software to intelligently stitch those lines together into one clean entry. This is a fundamental part of learning how to extract data from a PDF accurately.

Bank statements aren't always straightforward, and running into formatting quirks is part of the process. Below is a quick guide I've put together to handle some of the most common issues I see.

Solving Common PDF Statement Issues

| Common Issue | Recommended Setting in Software | Why It Works |

|---|---|---|

| Debits and credits are in one column | Look for a "Split Debit/Credit" or "Separate Transaction Columns" option. | This automatically creates two columns, moving negative values to "Debits/Withdrawals" and positive ones to "Credits/Deposits." |

Dates are read as text (e.g., 01-Jan-23) |

Find the "Date Format" dropdown and match it to your statement's style (e.g., DD-MMM-YY). |

It tells the software how to interpret the date string, ensuring Excel recognizes it as a sortable date value, not plain text. |

| Transaction descriptions are cut off | Enable "Merge Multi-Line Rows" or a similar setting. | This intelligently combines text from subsequent rows into a single cell, preventing fragmented transaction details. |

| Running balance column is included | Use the "Ignore Column" or "Remove Column" feature during the mapping stage. | This prevents unnecessary data from cluttering your final spreadsheet, focusing only on the transactional data you need. |

Taking a moment to tweak these settings before you finalize the export is the key. It's how you make sure your process to convert pdf bank statements to excel is not just fast, but consistently accurate every single time.

Taking Your Conversions to the Next Level

Once you've got the hang of converting single bank statements, you're ready to unlock some serious time-saving features. This is where the software really starts to shine, letting you move past one-off conversions and build a truly efficient data workflow.

Batch processing is the first thing you should master. Why convert files one by one when you can do them all at once? Just point the software to a folder containing all your PDFs—it could be months' worth of statements from several different accounts—and let it run. It will chew through the entire batch, spitting out a perfectly organized set of Excel files for you. It’s a huge win.

Creating Custom Templates for Every Bank

If you’re juggling statements from multiple banks, you know the frustration. Every bank has its own quirky layout. This is where templates become your best friend.

Once you’ve nailed the settings for a statement from a specific bank—say, you've got all the columns, date formats, and transaction splits just right—find the "Save Template" or "Save Layout" option. Name it something logical, like "Chase Business Checking."

Next time a Chase statement lands on your desk, you just load that template. Boom. All your meticulous settings are applied instantly. No more repetitive tweaking. It's a genuine set-it-and-forget-it strategy that saves you from redoing the same work over and over.

A little tip from experience: create separate templates even for small variations from the same bank, like a credit card statement versus a checking account statement. Those subtle layout differences can trip up a conversion, so having a dedicated template for each ensures you get perfect results every single time.

Smart Integration and Keeping Your Data Safe

For anyone handling sensitive financial information, thinking about security isn't optional. Once your statements are converted, learning how to encrypt and securely share your converted files is a crucial next step.

Beyond security, look for tools that offer direct integrations with your accounting software. The best converters can send your data straight into platforms like QuickBooks or Xero, primed and ready for reconciliation. This eliminates the manual step of uploading CSVs and avoids potential errors.

This kind of direct integration is becoming more common. Some of the top bank statement extraction tools now claim an OCR accuracy of up to 95%. They don't just turn PDFs into spreadsheets; they can also categorize transactions on the fly, making your accounting work that much faster.

Troubleshooting Common Conversion Errors

Even with the best software, converting pdf bank statements to excel can sometimes throw you a curveball. It happens to everyone. The good news is that most of these common hiccups are surprisingly simple to fix without ever leaving the converter.

One of the biggest culprits I see is poor text recognition, especially with scanned documents. If your final Excel sheet is full of gibberish or missing data, the software’s OCR (Optical Character Recognition) is likely struggling with a blurry or low-quality scan.

Before you do anything else, try rescanning the statement. Aim for a resolution of at least 300 DPI and make sure the paper is perfectly flat on the scanner bed. Getting rid of shadows and skewed angles gives the OCR a clean slate to work with and often solves the problem instantly.

Correcting Data in the Wrong Columns

What about when the data is all there, but it's a total mess? You might see transaction dates sitting in the description column or withdrawal amounts mixed in with deposits. This is a classic sign that your bank uses a unique statement layout that the software hasn't seen before.

Resist the urge to start cutting and pasting in Excel! That’s a temporary fix for a recurring problem. Instead, jump back to the preview screen inside Bank Statement Convert PDF. This is where the real magic happens. You should find a layout editor or column mapping tool that lets you drag the columns back into their proper places.

The key is to fix the problem at the source. Correcting the column layout within the converter doesn't just fix the current file; it allows you to save that specific bank's layout as a template.

Taking a minute to do this means every statement you convert from that bank in the future will be perfect on the first try. If you're working with different file formats, this guide on PDF to CSV conversion has some great tips for getting your data structured just right.

Got Questions? We’ve Got Answers.

Even when you get the hang of the process, a few specific questions tend to pop up. Let's tackle some of the most common ones I hear about converting pdf bank statements to excel.

Can I Convert Scanned PDF Bank Statements to Excel?

Yes, you absolutely can. Modern converter tools are equipped with Optical Character Recognition (or OCR) which is designed to read text directly from images, like a scanned document. The accuracy is usually quite good, but it's almost entirely dependent on the quality of your scan.

For the best results, make sure you scan the document completely flat at a resolution of 300 DPI or higher. Shadows and skewed angles are the enemy here. If the software spits out errors, nine times out of ten, simply rescanning with a better quality setting solves the issue without needing to fiddle with anything else.

Here’s a quick tip from experience: Before running a conversion on a tricky scan, just open the image file and zoom way in. If you can't easily read the numbers and text, the software is going to struggle, too. A clear source file is everything.

Is It Safe to Upload My Bank Statements Online?

That's a smart question to ask. The safety of your data really comes down to the kind of tool you’re using. While plenty of online services have security protocols, a desktop application like Bank Statement Convert PDF is in a different league when it comes to privacy.

When you use desktop software, everything happens right there on your computer. Your financial data is never uploaded to a server somewhere on the internet. This setup completely removes the risk of your sensitive information being intercepted or stored by a third party, giving you total peace of mind.

What if My Bank Statement Has a Complex Layout?

Unusual layouts are a common headache but definitely manageable. Most high-quality converters come with a manual selection tool, which is a lifesaver. This feature lets you literally draw a box around the exact transaction table you want to extract.

By doing this, you're telling the software, "Hey, grab the data from here and ignore everything else"—all the logos, headers, footers, and marketing fluff. Even better, you can typically save that selection as a template. That means you only have to do the setup once for that bank's specific statement format, and you're good to go for the future.

How Do I Handle Statements Spanning Multiple Pages?

Good software should make this invisible. When you load a multi-page PDF, a solid tool will automatically find the transaction tables on every page and stitch them together into one continuous list.

The only real requirement is that the column structure needs to stay the same from page to page. The software is smart enough to see the repeated headers on page two (and beyond) and ignore them, leaving you with a single, clean data table in your Excel file without any manual cutting and pasting.

Ready to stop wasting time and eliminate costly data entry errors? Bank Statement Convert PDF gives you the power to convert any bank statement with speed and precision. Download your free trial today and experience the difference.