Tax season often arrives with a wave of stress for small business owners, filled with a whirlwind of paperwork, deadlines, and complex regulations. The secret to a smooth and successful filing experience isn't found in a frantic, last-minute search for documents, but in a structured, methodical approach. This comprehensive small business tax preparation checklist serves as that essential roadmap, breaking down the entire process into clear, actionable steps. We will move beyond generic advice to provide a detailed guide for organizing your finances and maximizing your return.

This article is designed to help you confidently gather every necessary piece of information, from income statements and expense receipts to records for specific deductions like home office use and vehicle mileage. By following this guide, you will systematically prepare your documentation, identify potential tax savings, and ensure your final submission is both accurate and audit-ready. Forget the annual tax-time chaos. Instead, let's walk through the exact items you need to conquer tax season, ensuring you file efficiently and keep more of your hard-earned revenue. This checklist is your blueprint for a stress-free and financially optimized filing.

1. Organize and Categorize All Business Income Documentation

The foundation of any accurate tax return is a complete and meticulously organized record of your business income. Before you can even think about deductions, you must account for every dollar your business earned. This crucial first step in your small business tax preparation checklist involves systematically gathering, categorizing, and reconciling all revenue streams to ensure you report your gross income correctly and avoid potential IRS scrutiny.

The IRS receives copies of 1099s and other income reports, so any discrepancy between their records and your tax filing can trigger an audit. Therefore, your goal is to create an undeniable paper trail that matches your bank deposits and supports the total income figure on your tax forms. For more foundational knowledge on this topic, review these bookkeeping basics for small business.

Actionable Steps for Income Organization

To get started, create a system to track all revenue sources. A service-based business, for example, might collect 1099-NEC forms from various clients, while an e-commerce store aggregates sales data from multiple platforms like Shopify and Amazon.

- Gather All Documents: Collect every piece of income evidence, including issued 1099-NEC and 1099-K forms, merchant processing statements (from Stripe, Square, PayPal), bank deposit slips, and sales reports from your point-of-sale (POS) system.

- Reconcile with Bank Statements: Monthly, cross-reference your collected income documents against your business bank statements. This regular reconciliation catches errors early and makes year-end preparation much smoother.

- Create a Central Hub: To effectively track your earnings and prepare for tax season, creating a detailed business income worksheet is an invaluable step. This spreadsheet should itemize income by source, date, and amount.

- Document Non-Traditional Income: Don't forget to record non-cash income, such as bartered goods or services. You must document these transactions at their fair market value as they are considered taxable income by the IRS.

2. Compile and Classify All Business Expense Receipts

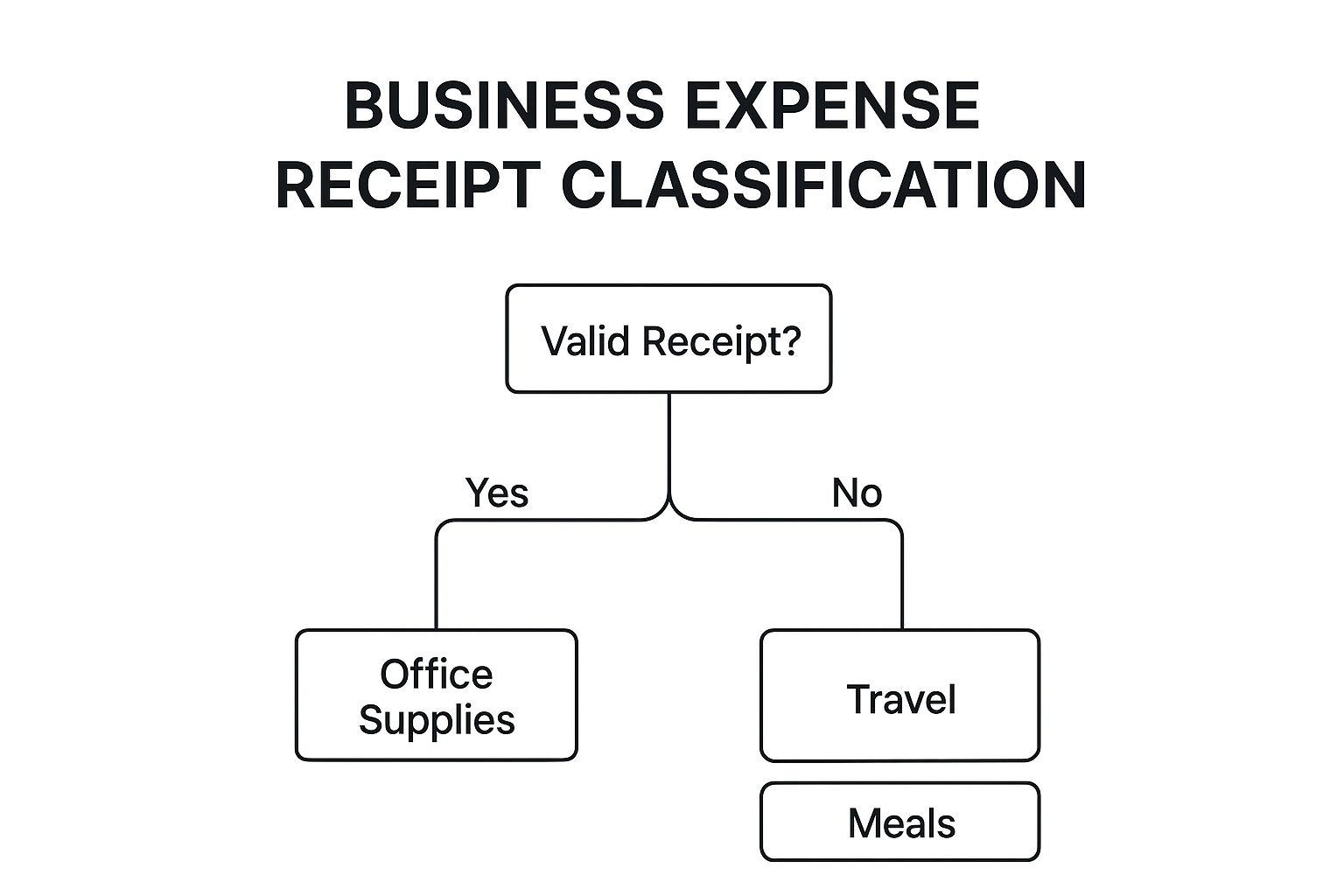

After accounting for your income, the next critical task in your small business tax preparation checklist is to meticulously document your expenses. Properly compiling and classifying every business-related cost is the key to maximizing your deductions and lowering your taxable income. The IRS requires contemporaneous, detailed records, meaning you must document expenses as they happen, not try to reconstruct them months later. Each receipt must clearly show the date, amount, vendor, and a specific business purpose to be considered valid.

This decision tree illustrates a simplified process for validating and categorizing common business expenses. Following this logical flow ensures that each expense you claim has a valid receipt and is sorted into the appropriate IRS category, a fundamental step for accurate tax filing. For a deeper dive into this process, explore these strategies on how to track business expenses.

Actionable Steps for Expense Organization

A disciplined approach to expense tracking prevents a last-minute scramble and ensures you claim every legitimate deduction. For example, a marketing agency might categorize $45,000 in annual expenses across software subscriptions ($12,000), contractor payments ($18,000), office rent ($9,600), and client meals ($5,400). Each category requires proper documentation.

- Use Digital Tools: Immediately capture receipts using mobile apps like Expensify or the QuickBooks mobile app. This creates a digital backup and automates data entry.

- Annotate Receipts Promptly: Get in the habit of writing the business purpose directly on each receipt before filing it away. For meals, note who attended and the business topics discussed.

- Maintain Separate Accounts: Use a dedicated business credit card and bank account for all business-related spending. This creates a clear line between personal and business finances and simplifies reconciliation.

- Calculate Mixed-Use Expenses: For costs that serve both personal and business purposes (like a cell phone or home internet), carefully calculate and document the business-use percentage. A sales representative logging 15,000 business miles can deduct $10,050 for 2024 (at 67 cents/mile), but this requires a detailed mileage log.

- Retain Records: Keep all expense receipts and supporting documentation for at least seven years in case of an IRS audit.

3. Calculate and Document Home Office Deduction (if applicable)

For many entrepreneurs and freelancers, the home office is the command center of their business. If you use a part of your home exclusively and regularly for business activities, the IRS allows you to deduct a portion of your home-related expenses, effectively reducing your taxable income. This deduction is a critical part of any comprehensive small business tax preparation checklist for those who qualify, helping to offset the costs of maintaining a dedicated workspace.

To qualify, the space must be your principal place of business or a place where you regularly meet clients. The key is that the area is used exclusively for your business; a dining room table that doubles for family meals won't qualify. You have two options for calculating this valuable deduction: the simplified method and the actual expense method, each with its own benefits.

Actionable Steps for the Home Office Deduction

Choosing the right method requires careful calculation and documentation. The simplified method is easier but may offer a smaller deduction, while the actual expense method requires meticulous record-keeping.

- Measure Your Space: The first step for either method is to accurately measure the square footage of your dedicated office space. Document this with a floor plan and photos for your records.

- Choose Your Method:

- Simplified Method: This is a straightforward calculation of $5 per square foot, capped at 300 square feet for a maximum deduction of $1,500. For an online store owner with a 250 sq ft office, this would result in a $1,250 deduction (250 x $5).

- Actual Expense Method: Calculate the percentage of your home used for business (e.g., a 200 sq ft office in a 2,000 sq ft home is 10%). You then apply this percentage to your actual home expenses like mortgage interest, rent, utilities, insurance, and repairs. A 10% deduction on $24,000 in annual housing costs yields a $2,400 deduction.

- Maintain Meticulous Records: If using the actual expense method, keep every receipt for home-related costs, including utility bills, insurance premiums, and repair invoices.

- Evaluate Annually: Your expenses and business use may change from year to year. It's wise to calculate the deduction using both methods each year to determine which one provides the greater tax benefit.

4. Review and Maximize Retirement Contribution Deductions

One of the most effective strategies for reducing taxable income involves leveraging retirement plans specifically designed for small business owners and the self-employed. This step in your small business tax preparation checklist requires you to review your annual contributions and, where possible, maximize them before the tax filing deadline. These contributions are typically tax-deductible, directly lowering your adjusted gross income (AGI) and, consequently, your overall tax bill.

Retirement plans like SEP-IRAs, Solo 401(k)s, and SIMPLE IRAs offer significantly higher contribution limits than traditional or Roth IRAs, providing a powerful tool for both wealth-building and tax reduction. The key is to understand which plan fits your business structure and to contribute as much as you can afford up to the legal limits. For more detail, the IRS offers comprehensive guidance in its Publication 560, Retirement Plans for Small Business.

Actionable Steps for Retirement Deductions

To strategically lower your tax liability, you must assess your options and act before the filing deadline. For example, a self-employed consultant with $100,000 in net earnings could establish a Solo 401(k), contribute as both the "employee" and "employer," and potentially deduct over $40,000 from their income.

- Assess Plan Options: Evaluate which plan best suits your needs. A Solo 401(k) is ideal for sole proprietors with no employees (other than a spouse), while a SEP-IRA offers simplicity and high contribution limits for businesses of any size. A SIMPLE IRA is a good option for small businesses with several employees.

- Know Your Deadlines: Deadlines are critical. A Solo 401(k) must be established by December 31st of the tax year, though you can fund it up until your tax filing deadline (including extensions). In contrast, you can establish and fund a SEP-IRA up until the tax filing deadline, offering more last-minute flexibility.

- Calculate Maximum Contribution: Use online calculators or consult with a financial advisor to determine your maximum allowable contribution based on your net business income. For a SEP-IRA, this is generally up to 25% of your net adjusted self-employment income, not to exceed the annual limit.

- Execute the Contribution: Before you file your taxes, make the actual contribution to your chosen retirement account. Ensure the transaction is designated for the correct tax year to secure the deduction.

5. Verify Quarterly Estimated Tax Payments and Calculate Any Balance Due

For small business owners and self-employed individuals, taxes are not a once-a-year event. A critical part of any small business tax preparation checklist is confirming you have met your quarterly estimated tax obligations throughout the year. This step involves reviewing all payments made and calculating if you've paid enough to cover your total tax liability, thereby avoiding potential underpayment penalties from the IRS.

Because income tax isn't automatically withheld from your business profits, you are responsible for paying it, along with self-employment taxes (Social Security and Medicare), in four installments. The IRS requires these payments to ensure you pay taxes as you earn income. Failing to properly calculate and remit these payments can result in a surprise tax bill and costly penalties when you file your annual return.

Actionable Steps for Estimated Tax Verification

Your goal is to ensure your total payments meet one of the IRS "safe harbor" rules: paying at least 90% of the tax you owe for the current year or 100% of the tax you owed for the previous year (110% if your adjusted gross income was over $150,000).

- Gather Payment Records: Collect documentation for every estimated tax payment made during the year. This includes bank statements showing withdrawals, confirmation emails from the IRS Direct Pay system, or records from the Electronic Federal Tax Payment System (EFTPS).

- Total Your Payments: Sum up all federal and state payments made for the tax year. The federal due dates are typically April 15, June 15, September 15, and January 15 of the following year.

- Project Your Total Tax Liability: Using your organized income and expense records, calculate your projected total tax for the year. This will determine if your payments meet the 90% threshold of your current-year tax liability.

- Compare to Prior Year's Tax: As a simpler alternative, locate your prior-year tax return (Form 1040). If your total estimated payments for the current year equal or exceed 100% (or 110%) of the "total tax" shown on that return, you are generally safe from underpayment penalties.

- Calculate the Final Balance: Once you determine your final tax liability, subtract the total of your quarterly payments. The result is the final amount you either owe or will receive as a refund. If you've underpaid, this amount will be due by the tax filing deadline.

6. Gather Documentation for Vehicle and Mileage Deductions

Vehicle expenses represent a significant and often overlooked deduction for many small businesses, but they are also one of the most scrutinized by the IRS. A crucial step in any small business tax preparation checklist is to meticulously compile all records related to your business vehicle usage. Failing to maintain detailed and contemporaneous logs can lead to a disallowed deduction during an audit, costing you thousands of dollars in taxes.

Whether you use the simpler standard mileage rate or the more complex actual expense method, the burden of proof is on you to justify every business mile claimed. For example, a real estate agent who drove 18,000 business miles in 2023 could deduct $12,060 (18,000 miles x $0.655) plus parking and tolls. Without proper logs, this entire deduction is at risk. For a deep dive into this topic, see this guide on how to track business mileage.

Actionable Steps for Vehicle Expense Documentation

To build an audit-proof record, you must choose a method and stick to consistent tracking throughout the year. The standard mileage rate requires a detailed log, while the actual expense method requires both a log and receipts for all vehicle-related costs.

- Implement a Tracking System: Use a dedicated app like MileIQ, Everlance, or a physical logbook. Record the odometer reading on January 1st and December 31st to establish your total annual mileage.

- Log Trips in Real-Time: Do not try to reconstruct your mileage from memory at year-end. For each business trip, contemporaneously log the date, starting point, destination, business purpose (e.g., "Meeting with client John Doe"), and total miles driven.

- Compile All Receipts: If using the actual expense method, gather all receipts for gas, oil changes, repairs, tires, insurance, registration fees, and lease payments. Total these expenses and multiply by your business-use percentage (business miles / total miles).

- Distinguish Business vs. Commuting: Remember that driving from your home to your primary place of work is non-deductible commuting. However, for a home-based business, travel from your home office to your first business stop (like a client visit) is deductible.

7. Collect Employee and Contractor Payment Records (W-2s, 1099-NEC forms)

Properly documenting payments to your workforce is a critical component of your small business tax preparation checklist, as labor is often a business's largest expense. This step involves compiling all records of compensation for both employees and independent contractors. Accurately reporting these payments on forms like W-2s and 1099-NECs not only substantiates your deductions but also ensures you comply with federal and state employment tax laws, avoiding severe penalties for misclassification.

The IRS pays close attention to how businesses classify their workers. Mistaking an employee for a contractor can lead to audits, back taxes, interest, and penalties. For instance, if a startup pays a developer as a contractor but the IRS reclassifies them as an employee, the business could face a bill for thousands in unpaid payroll taxes. Ensuring your records are pristine and your classifications are correct is non-negotiable for tax compliance.

Actionable Steps for Labor Payment Documentation

Your primary goal is to create a clear, compliant record of every dollar paid for labor, ensuring each payment is correctly categorized and reported. This process starts long before tax season by establishing proper onboarding and payment procedures for every person who works for you.

- Gather All Year-End Forms: Collect copies of all issued W-2 forms for employees and 1099-NEC forms for any contractor paid $600 or more during the year. Confirm that the totals on these forms match your payroll and bookkeeping records.

- Verify Payroll Tax Remittances: Compile records of all federal and state payroll taxes you withheld and remitted, including FICA (Social Security and Medicare) and unemployment taxes. Payroll service reports from providers like Gusto or ADP are excellent for this.

- Collect W-9s from Contractors: Before making any payments, always have independent contractors complete and sign a Form W-9. This provides their correct name, address, and Taxpayer Identification Number, which is required to issue a 1099-NEC.

- Review Worker Classification: Re-evaluate the status of your workers. Document the behavioral, financial, and relational factors that support your classification of someone as an independent contractor to defend your position if questioned. If you are ever unsure, consult a tax professional or attorney.

8. Review Available Tax Credits and Special Deductions for Your Business

Beyond standard expense write-offs, tax credits and special deductions offer some of the most powerful ways to lower your tax bill. Unlike deductions, which reduce your taxable income, tax credits provide a dollar-for-dollar reduction of the taxes you owe. This critical step in your small business tax preparation checklist involves proactively identifying and claiming these opportunities, many of which were introduced by legislation like the Tax Cuts and Jobs Act of 2017.

Failing to explore these options is like leaving money on the table, as many business owners are unaware they qualify. For example, a consulting firm with $150,000 in qualified business income (QBI) could claim a 20% QBI deduction, creating an additional $30,000 deduction. This requires meticulous tracking and is a key part of your financial reporting best practices.

Actionable Steps for Tax Credits and Deductions

To maximize savings, systematically evaluate which federal and state-level incentives apply to your industry and specific business activities. A tech startup might benefit from R&D credits, while a restaurant could leverage the Work Opportunity Tax Credit.

- Identify Major Opportunities: Start with the most common and impactful items. This includes the Qualified Business Income (QBI) deduction (IRS Form 8995), Research & Development credits, and the Work Opportunity Tax Credit for hiring employees from targeted groups.

- Evaluate Self-Employed Benefits: If you are self-employed, deductions for health insurance premiums are particularly valuable. When navigating this, it's essential to understand the specific rules for claiming your self-employed health insurance deduction to ensure you qualify.

- Screen New Hires: To claim the Work Opportunity Tax Credit, you must screen and certify new hires before their start date. Integrate Form 8850 into your onboarding process for all new employees.

- Document Everything: For credits like the R&D credit, maintain detailed records of expenses, payroll, and time logs related to development activities. For energy credits, keep receipts and documentation proving the property’s efficiency.

Small Business Tax Prep Checklist Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Organize and Categorize All Business Income Documentation | Medium – requires ongoing tracking and possible software | Time-intensive, possible software like QuickBooks/Xero | Accurate income reporting, audit preparedness | Businesses with multiple income streams and transaction types | Prevents IRS audit triggers; enables accurate tax payments |

| Compile and Classify All Business Expense Receipts | Medium to High – disciplined receipt collection & classification | Continuous receipt collection, apps like Expensify | Maximized deductions, audit protection | Businesses with diverse expenses needing categorization | Reduces taxable income; identifies spending patterns |

| Calculate and Document Home Office Deduction | Low to Medium – straightforward if qualifications met | Accurate measurements, minimal paperwork or detailed calculations | Tax savings on home expenses | Self-employed using dedicated home office space | Significant tax savings; simplified or actual method options |

| Review and Maximize Retirement Contribution Deductions | High – complex calculations and plan setup deadlines | Financial planning, possible professional advice required | Lowered current-year taxable income | Self-employed and small business owners planning retirement | High contribution limits; reduces income and self-employment tax |

| Verify Quarterly Estimated Tax Payments and Calculate Any Balance Due | Medium – requires ongoing calculation and cash flow management | Steady cash reserve needed, tax software or professional help | Avoid penalties, smooth tax payment schedule | Self-employed with no withholding needing quarterly payments | Avoids penalties; spreads tax burden throughout year |

| Gather Documentation for Vehicle and Mileage Deductions | High – meticulous trip logging and documentation required | Time-consuming daily logs, mileage apps recommended | Substantial business mileage deductions | Businesses with significant vehicle use for business | Large deductions possible; choice of simple or actual expense methods |

| Collect Employee and Contractor Payment Records | High – complex classification and compliance required | Payroll systems or services, legal consultation | Compliance with IRS, avoids penalties | Businesses with employees or contractors | Avoids misclassification penalties; ensures deductible labor costs |

| Review Available Tax Credits and Special Deductions for Your Business | High – complex qualifications and detailed documentation | Requires tax research and possible CPA consultation | Dollar-for-dollar tax reductions, additional savings | Businesses eligible for QBI, R&D, hiring credits, etc | Tax credits reduce tax liability directly; uncovers overlooked savings |

From Checklist to Action Plan: Final Steps for a Confident Tax Filing

Navigating the complexities of small business taxes can feel like a monumental task, but by following this comprehensive small business tax preparation checklist, you have systematically transformed a daunting process into a series of manageable steps. You've moved beyond simple record-keeping and into strategic financial management. From meticulously organizing income documents and categorizing every expense to identifying crucial deductions like the home office and vehicle mileage, you have laid the essential groundwork for an accurate and optimized tax return.

The power of this preparation extends far beyond just meeting a deadline. This process is an annual financial health check-up for your business. It provides a clear, data-driven picture of your operational efficiency, your spending habits, and your overall profitability. The effort you invest now in gathering W-2s, 1099s, and verifying estimated tax payments directly translates into financial clarity and strategic insight that can guide your business decisions for the entire year ahead.

Turning Preparation into Your Strategic Advantage

Think of this checklist not as a one-time chore, but as a blueprint for ongoing financial discipline. The habits you build during tax season, such as consistent expense tracking and proactive documentation, are the very habits that foster sustainable business growth. When you have a firm grasp on your numbers, you can make smarter decisions about budgeting, pricing, and investment.

Your completed checklist puts you in an empowered position. You now have everything needed to either confidently use tax software or to hand over a pristine, organized file to a CPA. This level of organization is invaluable, as it significantly reduces the time your accountant needs to spend on your return, which in turn lowers their fees and minimizes the risk of costly, time-consuming errors or IRS inquiries down the road.

From Year-End Scramble to Year-Round Success

Ultimately, mastering your small business tax preparation checklist is about taking control of your financial destiny. It's about shifting from a reactive, stressful scramble each spring to a proactive, year-round system of financial management. By integrating these steps into your regular bookkeeping, you are not just preparing for tax season; you are building a more resilient, transparent, and profitable business. You have the tools, the knowledge, and the plan. Now, you can file with confidence, knowing you have done your due diligence to secure every deduction and credit you rightfully deserve.

Ready to eliminate the most tedious part of tax prep? Stop manually entering data from bank statements and let Bank Statement Convert PDF transform your documents into clean, sortable Excel files in seconds. Streamline your expense categorization and make your tax preparation faster and more accurate by visiting Bank Statement Convert PDF to try it today.