Think of the cash flow statement as the ultimate financial truth-teller. It cuts through the accounting jargon to show you one simple thing: where the actual money went. It's the story of cash moving in and out of a business, revealing its real-world ability to survive and thrive.

Profit is one thing, but cash is king. This statement is the reality check that shows if a company can actually pay its bills, fund its next big project, and keep the lights on.

Your Company's Financial Story Starts with Cash

Let's use a simple analogy. Imagine your personal bank account. You might get a big promotion and a higher salary (that's your "profit"), but if your spending outpaces your new paycheck, your bank balance will steadily drop. Sooner or later, you'll be in hot water.

A business is no different. The income statement can show a healthy profit, but the cash flow statement is what tracks the company's bank account. It's the lifeblood.

This is a critical distinction to grasp. A company can look incredibly profitable on paper but still go bankrupt from a lack of cash. How? Imagine a construction company that lands a massive project. They record the full contract value as revenue, making their profits look fantastic. But if the client doesn't pay for 90 days, the company has no cash from that huge sale to pay its workers and buy materials next week.

This is exactly why understanding the flow of cash is a non-negotiable skill for anyone serious about business.

The cash flow statement is often called the most honest financial report. It’s tough to fudge the numbers when you’re talking about actual cash in the bank. It gives you a clear, unfiltered look at a company’s liquidity and solvency.

Why This Statement Matters Most

For anyone trying to get a true picture of a company's financial state, this report answers questions that other documents just can't.

- For Investors: It shows if a company is generating enough real cash to pay dividends or fund growth without drowning in debt.

- For Managers: It's a vital tool for budgeting. It helps you plan for major expenses and spot a potential cash crunch before it becomes a crisis.

- For Entrepreneurs: Honestly, this is about survival. Good cash management is at the heart of bookkeeping basics for small business, ensuring you always have the funds to cover day-to-day operations.

Learning to read this statement is like gaining a superpower. You can see a company's real-time financial health, helping you make smarter, more confident decisions. If you're ready to dive deeper, this comprehensive guide to understanding cash flow statements is an excellent next step.

Decoding the Three Core Cash Flow Activities

Think of a cash flow statement as a storybook with three distinct chapters. Each chapter tells a different part of the story of how a company handles its money, and together, they paint a complete picture of its financial health. Nailing down what these three sections mean is the key to unlocking the insights hidden in the document.

At its heart, the statement is structured to answer three critical questions:

- How much cash is the business actually making from its day-to-day operations?

- Where is the company putting its money to grow for the future?

- How is the company funding itself—and is it paying that money back?

By splitting the cash flow into these three buckets—Operating, Investing, and Financing—we can easily track where the money came from and where it went. This gives us a clear window into the company's strategic decision-making.

Cash from Operating Activities: The Engine Room

This is the big one. Honestly, if you only look at one section, make it this one. Cash Flow from Operating Activities (CFO) shows you the cash generated (or spent) by the company's core business. We're talking about the cash that comes in from selling products or services, minus the cash that goes out for the everyday stuff like paying salaries, rent, and suppliers.

A consistently positive CFO is a fantastic sign. It tells you the company is healthy and self-sufficient, generating enough cash from its main business to keep the lights on and invest in growth. You don't want to see a company that has to constantly borrow money or sell off assets just to survive. If this number is in the red, it could be a warning that the fundamental business model is broken. To see how this fits into the bigger financial puzzle, take a look at our guide on what is a financial statement.

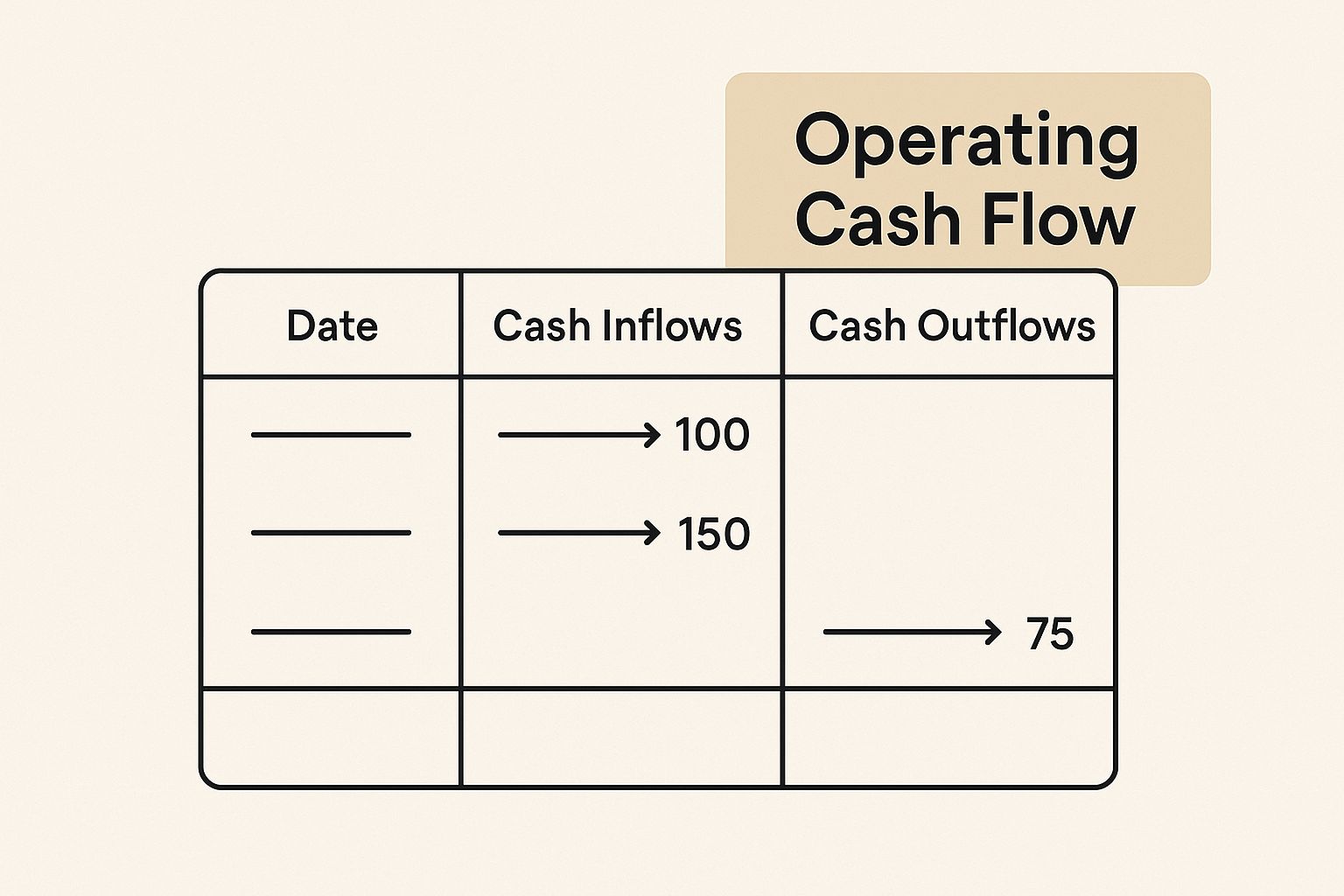

This infographic gives you a great visual breakdown of how operating cash flow works, showing the real-world inflows and outflows that power a business.

What this shows is simple but powerful: a healthy company's main cash source should always be its own operations, not loans or one-off asset sales.

Cash from Investing Activities: Building for the Future

The next chapter, Cash Flow from Investing Activities (CFI), is all about how a company is spending money to secure its long-term growth. This section tracks cash used to buy or sell long-term assets. Think big-ticket items like property, factories, and machinery (often called PP&E), but it also includes other investments, like buying another company or purchasing stocks.

Here’s a twist: a negative number in this section is often a good thing, especially for a company in growth mode. It means the business is reinvesting in its future—buying new equipment, upgrading technology, or expanding its footprint. On the flip side, a consistently positive CFI could be a red flag. It might mean the company is selling off its assets to raise cash, which could signal that it's in trouble.

Cash from Financing Activities: The Capital Structure

Last but not least, Cash Flow from Financing Activities (CFF) details the flow of money between a company and its owners, investors, and lenders. This includes cash coming in from actions like issuing stock or taking out a loan, and cash going out for things like paying back debt, buying back its own shares, or paying dividends to shareholders.

This section tells you a lot about a company's financial strategy and its stage of life. Is it a startup raising money to expand (positive CFF)? Or is it a mature, stable company focused on returning value to its investors through dividends and debt repayments (negative CFF)?

To tie it all together, let's break down these three pillars into a simple table.

The Three Pillars of a Cash Flow Statement

| Activity Type | What It Tells You | Example Inflows | Example Outflows |

|---|---|---|---|

| Operating | The cash generated by the core business operations. Is the company's main business profitable in cash terms? | Cash from sales of goods or services. | Payments to suppliers, employee salaries, rent, taxes. |

| Investing | How the company is investing in its long-term future. Is it buying or selling assets to grow? | Sale of property, equipment, or other businesses. | Purchase of new machinery, buildings, or other companies. |

| Financing | How the company raises and repays its capital. Where does its funding come from, and is it returning cash to investors? | Cash from issuing stock or taking on debt. | Repaying loans, paying dividends, buying back stock. |

Looking at these three sections together gives you a dynamic, multi-dimensional view of a company's financial health that you simply can't get from the income statement or balance sheet alone.

Direct vs. Indirect Methods: Two Roads to the Same Destination

When you look at the cash from operations section, you'll see companies take one of two paths to get to their final number: the direct method or the indirect method. Both will land you at the exact same figure for net cash from operations, but they tell a completely different story along the way.

Think of the direct method as an itemized receipt. It meticulously lists out every dollar that came in from customers and every dollar that went out to pay for things like inventory, salaries, and rent. It’s a straightforward, cash-in, cash-out report.

The indirect method, however, works more like a reconciliation. It starts with the net income number—the "profit" from the income statement—and then adjusts it. It adds back non-cash expenses and accounts for changes in working capital to figure out how much actual cash the operations generated.

Why You'll Almost Always See the Indirect Method

Go ahead, pull up a few annual reports. You'll quickly notice a trend. A staggering 98% of public companies use the indirect method. The biggest reason is practicality; it's just simpler to create from the accounting data they already have.

But more importantly, it builds a clear bridge between the profit shown on the income statement and the cash sitting in the bank. This is incredibly valuable for analysis.

It directly answers the classic question: "If we made a profit, where did the cash go?" By highlighting adjustments for things like depreciation and changes in accounts receivable, it shows exactly why net income and cash flow aren't the same.

The direct method is arguably more transparent about where cash came from and where it went. But the indirect method is powerful because it connects the dots between accrual accounting and cold, hard cash.

So, which one is better? It really depends on what you’re trying to figure out.

- Direct Method: Great for a granular view of specific cash inflows and outflows.

- Indirect Method: Perfect for understanding why reported earnings are different from actual cash flow.

Ultimately, both methods give you a clear picture of a company’s operational health. The indirect method is just the well-trodden path, and for most analysts, it offers a more insightful journey.

How to Analyze a Cash Flow Statement Like an Expert

Reading the numbers on a cash flow statement is one thing. Knowing what they mean is where the real power lies. This is the leap from just reading financial data to using it as a strategic tool to make smarter decisions. And don't worry, this isn't about memorizing complex formulas. It's about asking the right questions and connecting the dots.

When you look beyond the surface-level numbers, you start to get a feel for a company's financial stability, its strategic direction, and its real potential for growth. Think of it like being a financial detective—all the clues are right there in the statement, you just need to know where to find them.

This process reveals the story behind the figures. Is the company aggressively investing in its future? Is it struggling to stay afloat? Or is it mature enough to start rewarding its shareholders? Let's dig in.

Perform a Trend Analysis

One of the most valuable things you can do is a trend analysis. A single cash flow statement is just a snapshot in time. The real story emerges when you line up several of them side-by-side.

Pull the cash flow statements for the last three to five years. Are the numbers steady, all over the place, or following a clear pattern? Looking at a longer timeframe helps smooth out any weird one-off events and shows you the true underlying health of the business.

Here’s what you should be looking for:

- Growing Operating Cash Flow: This is the holy grail. It tells you the company's core business is getting better at turning profits into actual cash.

- Consistent Investing Patterns: Is the company regularly putting money into new assets (a negative CFI)? That’s a great sign they're committed to growth. But if they're constantly selling off assets (a positive CFI), it might be a red flag.

- Changes in Financing: Did the business suddenly take on a mountain of debt? Or did it issue a bunch of new stock? Tracking these financing activities over time reveals its strategy for funding its operations and growth.

Calculate Free Cash Flow

If there’s one metric to master, it’s Free Cash Flow (FCF). This is the cash a company has left over after paying for everything it needs to maintain or expand its asset base. Think of it as the "spare" cash that can be used to pay down debt, issue dividends, or jump on new opportunities.

Free Cash Flow (FCF) is the ultimate indicator of financial flexibility. It’s what’s left in the piggy bank after all the essential bills are paid, showing a company's true ability to create value.

The formula is refreshingly simple:

Free Cash Flow = Cash Flow from Operations – Capital Expenditures

You can find Capital Expenditures (often called CapEx) in the investing activities section. It’s usually listed as "purchase of property, plant, and equipment." A business with strong, growing FCF is in an incredibly powerful position.

Evaluate the Relationships Between Sections

The real magic happens when you see how the three sections—Operating, Investing, and Financing—talk to each other. Their relationship paints a vivid picture of the company's strategy and where it is in its lifecycle. For instance, a young, cash-hungry tech startup is going to have a completely different cash flow profile than a stable, mature utility company.

This kind of deep analysis is becoming a global standard. In fact, the cash flow management market is expected to hit $1.2 billion by 2025. This explosion shows a worldwide demand for better forecasting and planning to fuel business growth. You can explore the market research on cash flow management to see the data behind this trend.

By looking at how these pieces fit together, you can figure out a company's strategic focus without ever reading its business plan. This approach turns a simple financial report into a powerful diagnostic tool, giving you a clear window into where a company has been and where it's probably going next.

Common Cash Flow Patterns and What They Reveal

Think of the cash flow statement's three sections as a conversation. They don't just exist in isolation; the way they interact tells a compelling story about where a company has been and where it's headed. Learning to read these patterns is like learning financial body language—it helps you understand a company's real focus beyond the buzzwords.

Once you can spot these combinations of positive and negative flows, you move from just reading numbers to truly diagnosing a business's health and strategic direction.

The Healthy Grower Profile

This is the classic signature of a company that's firing on all cylinders and reinvesting for the future.

- Operating Cash Flow (CFO): Positive (+)

- Investing Cash Flow (CFI): Negative (-)

- Financing Cash Flow (CFF): Positive (+) or Neutral

A positive CFO is a great sign—it means the core business is profitable and generating real cash. But where is that cash going? The negative CFI tells us the company is plowing it right back into growth by buying new equipment, facilities, or technology. To fuel this expansion even further, you might see a positive CFF, indicating it's also taking on smart debt or raising investor capital.

The Emerging Startup Profile

A brand-new venture has a completely different—but often perfectly healthy—cash flow fingerprint. It's all about survival and scaling.

- Operating Cash Flow (CFO): Negative (-)

- Investing Cash Flow (CFI): Negative (-)

- Financing Cash Flow (CFF): Positive (+)

Don't be alarmed by the negative CFO. Startups are supposed to burn cash as they build their product and find their market. Likewise, a negative CFI is expected as they invest heavily in the assets needed to operate and grow. The key to this entire picture is a strongly positive CFF, which shows they are successfully raising money from investors or lenders to fund these early-stage deficits. For a startup, this is a sign of life; for a 50-year-old company, it would be a major red flag.

A company's cash flow pattern is like a fingerprint, uniquely identifying its current stage and strategy. A mature, stable company will look entirely different from a high-growth startup, and both can be financially sound.

The Mature Cash Cow Profile

Once a company has established its market dominance, the focus shifts from aggressive growth to rewarding the people who funded it.

- Operating Cash Flow (CFO): Positive (+)

- Investing Cash Flow (CFI): Neutral or Negative (-)

- Financing Cash Flow (CFF): Negative (-)

Here, a strong and steady positive CFO is the engine. The company is a cash-generating machine. You’ll see a small negative number in CFI, but this usually represents maintenance—just enough to keep the machine running, not build a new one. The real story is the negative CFF. The company is now using its massive cash pile to pay down debt, buy back its own shares, or pay dividends to its shareholders. It's giving cash back, not raising it.

Recognizing these archetypes is more than just an academic exercise. It gives you immediate, valuable context about a company's financial story. Let's break down a few common scenarios in a quick-reference table.

Interpreting Common Cash Flow Patterns

| Operating (CFO) | Investing (CFI) | Financing (CFF) | Likely Company Profile |

|---|---|---|---|

| + | – | + | Healthy Grower: Core business is profitable and all cash is being reinvested into aggressive growth. |

| – | – | + | Emerging Startup: Burning cash on operations and investing, funded by investors or loans. |

| + | – | – | Mature & Expanding: Strong operations fund both growth investments and returns to shareholders. |

| + | + | – | Transitioning/Restructuring: Selling off assets while paying down debt or rewarding shareholders. |

| – | + | + | Distressed Company: Operations are failing, forcing it to sell assets and raise debt to survive. |

This table isn't exhaustive, but it covers the most common patterns you'll encounter.

Spotting these scenarios quickly is a vital skill. It's a cornerstone of effective cash flow management for small business and a crucial tool for any savvy investor trying to understand a company’s choices.

Putting Your Cash Flow Knowledge into Action

So, you’ve got the theory down. You can read a cash flow statement. But this isn't just about passing an accounting quiz—it’s about using this knowledge to make smarter decisions in the real world. Think of it as the ultimate health check for a business, revealing far more than a simple profit and loss statement ever could.

The financial world is laser-focused on liquidity right now, and that’s driving some massive changes. The market for cash flow management tools was already worth USD 3.53 billion in 2023, but it’s expected to explode to USD 15.01 billion by 2032. North America is pushing the envelope with AI-powered forecasting, while a surge of small and medium-sized businesses in the Asia-Pacific region is fueling demand for better tools to simply get a grip on their daily cash. You can read more about this global market trend to see just how big this shift is.

From Analysis to Strategy

This is where the rubber meets the road. Being able to read the cash flow story is what separates good financial management from just guessing. It informs everything from your day-to-day budget to whether you can confidently seek a new round of funding.

A solid grasp of your cash flow is also the bedrock of good planning. For example, you can't build a healthy operating cash flow if you don't have a system for watching your spending. Our guide on how to track business expenses offers some great, practical starting points.

Plus, understanding how cash moves through a company is essential for other critical financial tasks, like getting an accurate sense of what it's worth with a business valuation estimator.

Ultimately, understanding cash flow statements gives you a clear lens to view a company's past performance, present stability, and future potential. It transforms complex data into a straightforward narrative about a business’s ability to survive and thrive.

With these skills, you're no longer just looking at numbers. You're reading the financial story of a business, empowering you to make far more informed decisions for your own company or investments.

Common Cash Flow Questions Answered

Even with a solid grasp of the basics, some practical questions always pop up when you start digging into a cash flow statement. Let's tackle a few of the most common ones to clear up any confusion.

How Does the Cash Flow Statement Relate to the Income Statement?

Think of it this way: the income statement tells you if the company is making money, but the cash flow statement tells you if the company is getting paid.

The income statement can be a bit misleading because it includes non-cash expenses like depreciation. This can make a business look profitable on paper even when its bank account is running on fumes. The cash flow statement bridges this gap, starting with net income and then making adjustments to reveal the actual cash that came in and went out. It’s the ultimate reality check on why profit doesn't always equal cash.

Why Is Cash Flow from Operations So Important?

Cash Flow from Operations (CFO) is the true engine room of a business. It reveals how much cash is being generated purely from the company's main line of work—selling its goods or services.

A consistently positive CFO is the clearest sign that a company's core business model is not just working, but is healthy and sustainable. It shows the business can pay its own bills, reinvest in growth, and handle its debts without constantly needing to borrow or find new investors.

Can a Profitable Company Go Bankrupt?

Yes, and it happens more often than you'd think. This is the classic "profitable but broke" scenario.

A company might report high profits because it's making a ton of sales on credit, but if it can't collect that money from customers fast enough, it runs out of cash. Without actual cash to pay for immediate needs like rent, payroll, or supplier invoices, even a profitable business can fail. The cash flow statement is your best tool for spotting this kind of danger before it’s too late.

Ready to take control of your financial data? Bank Statement Convert PDF makes it easy to turn complex PDF bank statements into organized, actionable Excel spreadsheets. Start converting your statements today