Think of your bank statement as your account's monthly highlight reel. It’s a detailed summary that shows all the money that flowed in (credits) and out (debits) over a set period, usually a month. It’s basically the official story of your financial activity, kept by your bank.

What Your Bank Statement Reveals

At its heart, a bank statement is a chronological record of everything that happened in your account. You'll see every deposit, withdrawal, debit card swipe, bank fee, and any interest you might have earned. It provides a complete financial picture—a snapshot in time of your spending and saving habits.

The way we handle money has changed dramatically. With the global rise in digital payments, which accounted for over $3.1 trillion in digital wallet transactions in 2025, the bank statement has evolved right along with it. It now tracks a much wider range of financial activities than just old-school cash and checks. If you're curious, you can check out more banking statistics to see just how much financial behaviors are shifting.

Your statement isn't just a list of numbers; it's a narrative. It tells you where your money came from, where it went, and how your financial position changed from the start of the month to the end.

This simple document is actually a powerful tool that helps with some crucial tasks:

- Budgeting and Tracking: Seeing every single expense laid out in black and white is the best way to manage your budget and spot your spending patterns (hello, daily coffee runs!).

- Error Detection: It allows you to quickly catch any funny business, like unauthorized charges or bank errors, before they become bigger problems.

- Proof of Income: Lenders, landlords, and even some government agencies often require statements to verify your financial stability and income.

Once you know how to read your bank statement, you gain a massive amount of control over your financial life. It transforms from a simple piece of paper (or a PDF) into a roadmap for making smarter money decisions.

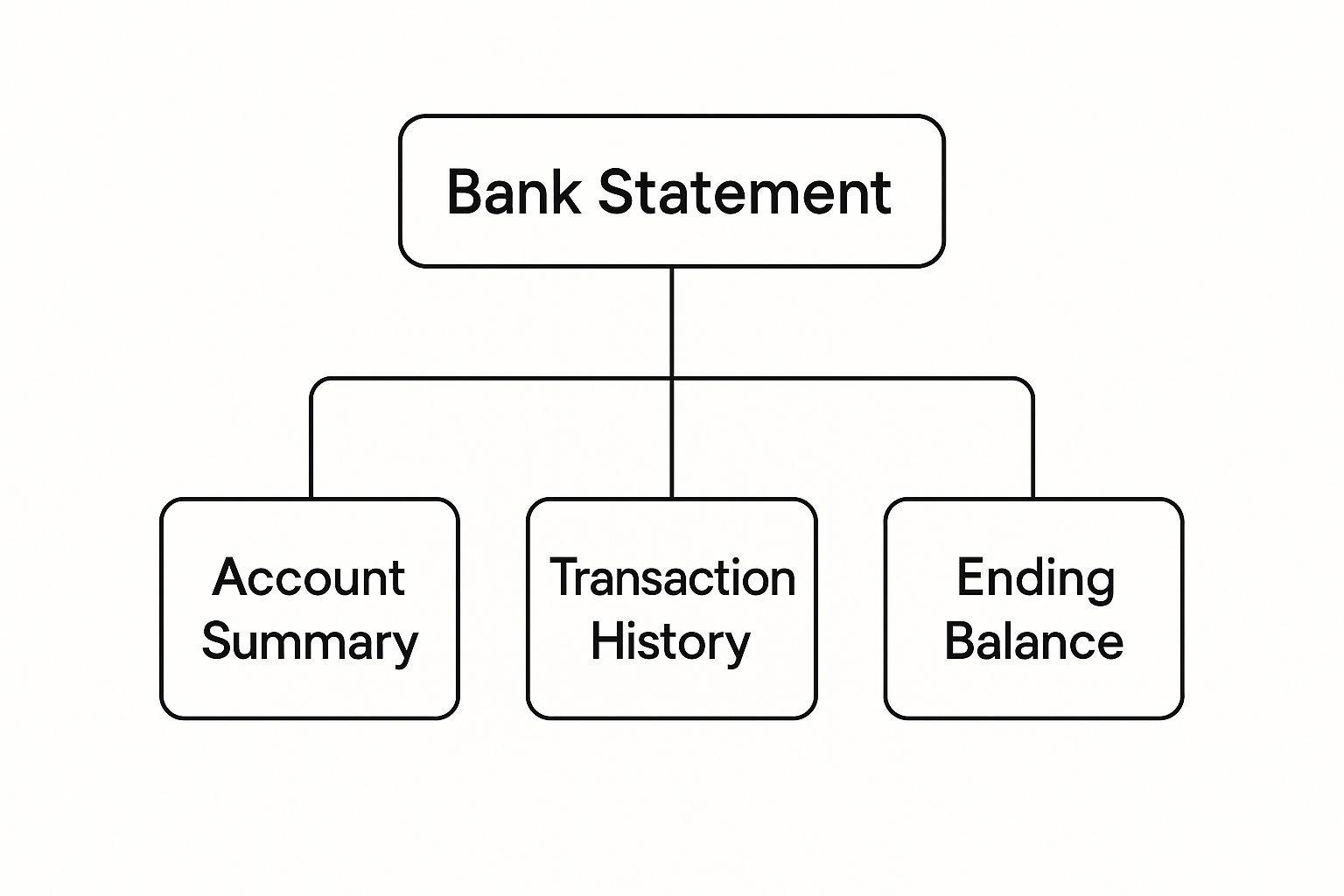

Key Components of Your Bank Statement at a Glance

To give you a quick overview, here’s a breakdown of the essential parts of a typical bank statement. Think of this as your cheat sheet for understanding where to find the information you need.

| Component | What It Shows |

|---|---|

| Account Holder Information | Your name, address, and account number. Always check this to ensure it's your statement. |

| Bank Information | The bank’s name, address, and customer service contact details. |

| Statement Period | The date range the statement covers, typically one month (e.g., March 1, 2024 – March 31, 2024). |

| Account Summary | A high-level overview, including your beginning balance, total deposits, total withdrawals, and ending balance. |

| Transaction Details | A chronological, line-by-line list of all activity: payments, withdrawals, deposits, and fees. |

| Ending Balance | The amount of money in your account at the end of the statement period. |

Knowing these key sections makes it much easier to navigate the document and quickly find what you're looking for, whether you're double-checking a transaction or pulling together documents for a loan application.

Deconstructing Your Statement Section by Section

Think of your bank statement as a story your money tells every month, broken down into a few key parts. Each section gives you a different piece of the puzzle, and together, they paint a complete picture of your financial life for that period. Learning how these pieces fit together is the first step to truly understanding what's going on with your cash.

The first thing you’ll probably see is the Account Summary. This is your 30,000-foot view—the "at-a-glance" highlights. It shows your opening balance, which is the amount of money you started with, and your closing balance, which is where you ended up after a month of activity.

But the real meat of the statement is what comes next.

The Transaction History Breakdown

This is where the story gets interesting. The Transaction History is a detailed, day-by-day log of every single thing that happened with your money. Every cup of coffee, every bill paid, and every paycheck deposited gets its own line item here.

When you're really trying to get a handle on your finances, this is where you'll spend most of your time. Every transaction falls into one of two simple categories:

- Credits (Deposits): This is all the money that came into your account. Think direct deposits from your job, a check you deposited, or even a Venmo transfer from a friend.

- Debits (Withdrawals): This covers every dollar that went out. This includes everything from using your debit card at the grocery store and pulling cash from an ATM to automatic payments for your car loan and any pesky bank fees.

This image gives a great visual overview of how a typical statement is laid out.

As you can see, the summary at the top and the detailed transaction list below all work together to explain that final number at the end of the month.

If you want to dive even deeper into reading the fine print, our full guide on how to read a bank statement has more examples and tips.

At its core, the math is straightforward. Your bank takes your starting balance, adds all your deposits, and subtracts all your withdrawals to get the final number. The formula is: Opening Balance + Total Deposits – Total Withdrawals = Closing Balance.

Getting comfortable with this flow—from the big-picture summary down to the individual transactions—is what it's all about. It helps you see not just where your money ended up, but the journey it took to get there. That kind of clarity is exactly what you need for smart budgeting, catching potential errors, and taking control of your financial health.

Decoding Common Transaction Codes and Abbreviations

Ever feel like your bank statement's transaction history is written in a secret code? You're not alone. It’s often a jumble of cryptic letters and abbreviations that can make it tough to figure out where your money is actually going.

The first step is getting a handle on the two most fundamental terms: debits and credits. Think of them as the two directions money can move. A debit is any money that leaves your account, like when you buy groceries or pay a bill. A credit, on the other hand, is any money coming into your account, such as your paycheck or a refund.

At its core, it's simple: Debits are subtractions that lower your balance, while credits are additions that raise it. Every single transaction falls into one of these categories.

Once you’ve got debits and credits down, the next layer to peel back is the alphabet soup of abbreviations that describe each transaction. Getting familiar with these codes is what truly unlocks the story behind the numbers.

Common Bank Statement Abbreviations and Their Meanings

To help you get up to speed, we've put together a quick reference table. These are the abbreviations you'll run into most often, and understanding them will make your next statement review a breeze.

| Abbreviation | Full Term | What It Means |

|---|---|---|

| POS | Point of Sale | A purchase you made in person using your debit card, like at a coffee shop or retail store. |

| DD | Direct Debit | This is a recurring, pre-authorized payment pulled from your account, such as a mortgage payment or subscription service. |

| ATM | Automated Teller Machine | Pretty straightforward—this marks a cash withdrawal or even a deposit you made at an ATM. |

| SVC CHG | Service Charge | This is simply a fee from your bank, which could be for account maintenance or another specific service. |

| TFR | Transfer | This shows that money was moved, either between your own accounts (like from checking to savings) or to someone else. |

Knowing what these common terms mean turns a confusing list of transactions into a clear, understandable record of your financial life. Suddenly, that cryptic document starts making a whole lot more sense.

Spotting Bank Fees and Interest Payments

Think of your bank statement as more than just a list of your own spending. It's a running dialogue about the financial relationship you have with your bank. This is where you'll find every fee they've charged you and every penny of interest you've earned, giving you a crystal-clear picture of what your account is costing—or earning—you.

Bank fees have a knack for showing up as small, sometimes sneaky, debits. You might expect a monthly maintenance charge, but then get hit with an unexpected overdraft fee. Simply learning to spot these charges is the first step toward keeping that money in your pocket.

Common Bank Fees to Keep an Eye On

The good news is that many bank fees are avoidable with a little planning. Here are some of the usual suspects you'll find on your statement:

- Monthly Maintenance Fee: This is the bank's standard charge just for having the account. You can often get this waived by keeping a minimum balance or setting up a direct deposit.

- Overdraft Fee: A costly penalty for spending more money than you have available. A simple fix is linking your checking account to a savings account for overdraft protection.

- ATM Fee: Using an ATM outside your bank's network can hit you with a double whammy—a fee from your bank and another from the ATM owner.

- Wire Transfer Fee: Banks charge for sending money electronically, and these fees can be especially steep for international transfers.

Take a moment to really scan your statement for these charges. A quick bank fee comparison might show you're paying way more than you need to. Paying close attention to these small costs is crucial, especially if you're managing business funds. For more on this, check out our guide on how to track business expenses.

Understanding Interest Payments

Now for the good part. Your statement also details any interest earned. This is the bank paying you for letting them hold onto your money, most often in a savings or interest-bearing checking account. It might not be a huge amount, but it’s a direct return on your deposits.

Keep in mind that broader economic trends play a big role here. For example, even with loan growth expected in 2025, forecasts pointed to a drop in net interest margins for banks. For customers, this often means that deposit costs stay high, translating to persistent fees and only modest interest payments on their statements.

How Your Statement Reflects Global Financial Activity

It’s easy to think of your bank statement as just a local affair—a simple record of what you’ve spent at the grocery store or the coffee shop down the street. But look a little closer, and you'll find it's actually a tiny window into the massive, interconnected world of global finance. Every time you buy something from an overseas website or get a payment from family abroad, that global activity shows up right in your transaction history.

These international transactions usually stand out from your everyday purchases. You'll often see the original amount in a foreign currency, the specific exchange rate used on that day, and the final cost that was deducted from your account in your own currency. You might also spot separate line items for things like cross-border transaction fees or foreign conversion charges. These details are a clear-cut example of how your personal finances are tied directly into the international marketplace.

So, what does a bank statement show in this context? It reveals your direct participation in the global economy, turning abstract ideas like currency exchange into real, tangible numbers that impact your balance.

This global financial connection is bigger than most people realize. In fact, by early 2025, the total amount of global cross-border bank credit soared to a record $34.7 trillion. That enormous flow of money is made up of countless individual transactions, including the international payments and foreign currency credits you see on your own statement.

If you want to dig into these details on your own documents, you can learn more about the different ways of getting a copy with our guide on how to get your bank statement. Understanding these entries gives you a much clearer picture of your own financial footprint in the world.

Common Questions About Your Bank Statement

Alright, so we've walked through all the different parts of a bank statement. But let's be honest, you probably still have a few practical questions rattling around. Let's tackle some of the most common ones so you can feel completely confident handling your finances.

One of the biggest things people ask is what they can do with a statement beyond just checking their balance. Think of it as your financial diary. By lining up a few months of statements, you get a brutally honest look at your spending habits and can finally see where all your money is really going. It’s the perfect tool for building a budget that actually works.

Handling Errors and Keeping Records

So, what happens if you spot a mistake? A weird charge you don't recognize? Don't wait. Call your bank the second you see it.

Most banks give you a specific timeframe, often 60 days, to report any errors. The faster you act, the easier it is for them to investigate and protect your money. This is why a quick scan of your statement each month is your best defense against fraud.

This brings up another great question: how long should you hang onto these things? For anything tax-related, the rule of thumb is to keep statements that show income or deductions for at least three years, though some experts recommend up to seven. For everything else, holding onto them for a year is a solid practice. You never know when you'll need proof of payment.

A big part of managing your finances is making sure your records match the bank's. This process is called bank statement reconciliation, and it's how you confirm that everything lines up perfectly. To really get the hang of it, check out our guide on what bank statement reconciliation is.

Finally, people often wonder if a digital statement is as "official" as a paper one. Absolutely. Whether you download a PDF from your online banking portal or get one in the mail, both are considered official documents for things like loan applications. Of course, many of these questions start at the very beginning, when you're figuring out how to open a business bank account and get access to these records in the first place.

At Bank Statement Convert PDF, we make it easy to turn your PDF statements into organized Excel spreadsheets for better analysis and record-keeping. Visit us at https://bankstatementconvertpdf.com to get started.