Bank statement reconciliation is one of those fundamental accounting tasks that sounds more complicated than it really is. At its core, it's the simple act of matching the financial records you keep for your business with the ones your bank keeps for you. The goal? To make sure the cash balance in your books lines up perfectly with the amount shown on your bank statement.

Think of it as a financial health check-up for your company's cash. It's how you confirm that the money you think you have is actually the money you do have.

So, What Exactly Is Bank Reconciliation?

Let's use a simple analogy. Imagine you just finished a big grocery run. You'd likely glance at your receipt (your records) and compare it to the charge that pops up in your banking app (the bank's records) just to make sure they match. Bank reconciliation is the exact same idea, just scaled up for a business.

This isn't just about ticking boxes; it’s a crucial control for any business. By methodically comparing every single transaction, you can catch discrepancies that might otherwise fly under the radar. We're talking about everything from small data entry mistakes and missing transactions to something as serious as unauthorized charges.

Without this regular check-in, your financial statements could be painting a very misleading picture of your company's real-world cash position.

Why It's a Non-Negotiable Business Practice

When your accounts are properly reconciled, you can trust your financial data. It gives you the confidence that the numbers you’re using for budgeting, filing taxes, and making big strategic decisions are solid and reliable.

The primary goal here is to get to a point where your internal books are in perfect harmony with the bank's records. This creates a single, undisputed source of truth for your cash balance.

This process gives you the power to:

- Catch Errors Early: Spot and fix mistakes like duplicate charges or typos before they snowball into much larger headaches down the road.

- Uncover Fraudulent Activity: Quickly flag unauthorized withdrawals or other suspicious transactions, acting as a first line of defense against theft.

- Truly Understand Your Cash Flow: Get a crystal-clear picture of your available cash, which helps you make smarter, more informed decisions about day-to-day expenses and long-term investments.

The whole reconciliation process follows a clear set of steps and calculations. If you want to dive deeper into the mechanics, a great place to start is understanding the bank reconciliation formula that helps bring both sets of records into alignment.

To give you a quick snapshot, here's a simple breakdown of the key elements involved in any bank reconciliation.

Bank Reconciliation at a Glance

This table summarizes the fundamental components of the bank statement reconciliation process for a quick overview.

| Component | Description |

|---|---|

| Who | Typically performed by business owners, accountants, or bookkeepers. |

| What | The act of comparing your internal cash records (like your general ledger) against the official bank statement. |

| Why | The main goals are to ensure financial accuracy, detect potential fraud, and maintain tight control over cash flow. |

Ultimately, mastering this process is about maintaining the financial integrity of your business, one transaction at a time.

Why Bank Reconciliation Is a Business Lifeline

Knowing what bank statement reconciliation is is one thing. But the real game-changer is understanding why it's an absolute must for any healthy business. This isn't just about ticking a box in your accounting checklist; it’s a core practice that protects your company’s financial health and gives you the confidence to make smarter decisions.

Think of it as your primary financial defense system. When you regularly and meticulously compare your own records to what the bank says, you create a powerful check-and-balance that guards your business against threats from both the inside and out.

Your First Line of Defense Against Fraud

The most immediate benefit of staying on top of your reconciliation is catching fraud early. Unauthorized charges, shady withdrawals, or even signs of internal theft often pop up on a bank statement first. The problem is, if you aren't actively looking for them, these red flags are incredibly easy to miss.

By reconciling frequently, you dramatically shorten the timeframe for a fraudster to do real damage. A small, strange charge caught within a few days is just a minor headache. That same charge left to fester for months could snowball into a major financial crisis.

Reconciling your bank statement transforms it from a simple record of past transactions into a real-time security tool for your business's cash.

This kind of proactive monitoring is crucial. For instance, spotting a small, unfamiliar subscription fee during reconciliation could be the tip-off you need to realize a company debit card has been compromised—long before a truly massive fraudulent purchase hits your account.

Achieving True Cash Flow Clarity

Beyond just security, reconciliation gives you a brutally honest picture of your cash flow. Your own books might paint a rosy picture of your bank balance, but they don't always account for things like outstanding checks that a vendor hasn't cashed yet or bank service fees you forgot to log.

This gap between what you think you have and what you actually have can lead to some seriously bad business decisions. Knowing your precise cash position helps you answer the tough questions with confidence:

- Can we truly afford to hire a new team member right now?

- Do we have enough cash on hand to make that big inventory purchase?

- Is this the right moment to invest in that new piece of equipment?

Without reconciled books, you're flying blind and making educated guesses at best. With them, you’re operating from a position of financial reality. This clarity also pays dividends during tax season, making sure your reported income and expenses are spot-on and ready for any potential audit.

Of course, doing this by hand can be a slog. Manual bank statement reconciliation is notoriously time-consuming, with historical error rates hitting as high as 5-10%. This is why automation has become so important, shrinking reconciliation cycles from days down to just a few hours. You can explore more about how automation is transforming reconciliation to see its impact.

Your Step-by-Step Guide to the Reconciliation Process

Alright, now that you know what bank reconciliation is and why it's so important, it's time to get our hands dirty and dive into the "how." The process can feel a bit intimidating at first, but once you break it down, it’s really just a methodical, step-by-step routine. Let's walk through it together so you can tackle your next one with confidence.

At its core, the whole thing is just a big comparison game. You’re taking your company’s own financial records and holding them up against the bank’s official statement to make sure both are telling the same story.

Step 1: Gather Your Financial Documents

First things first, you can't compare what you don't have. Before you even think about matching numbers, you need to pull together the right paperwork. Getting this step right makes everything else run so much more smoothly.

For any given period—let's say for the month of June—you'll need two key documents:

- Your Bank Statement: This is the official report from your bank. It lists out every single transaction that hit your account during that period: deposits, withdrawals, bank fees, you name it.

- Your Business's Cash Records: This is your side of the story. It's your internal log of all cash movements, which for most businesses lives in the cash account of their accounting software or general ledger.

If you’re just starting out, it’s a great idea to get comfortable with the layout of a bank statement. Knowing how to read a bank statement will help you quickly find key info like dates, descriptions, and balances.

Step 2: Begin the Comparison Process

This is where the real matching begins. Start by comparing the deposits. Go line-by-line through your bank statement and tick off every deposit that you also have recorded in your business's books. Then, do the exact same thing for all the money going out—checks, debit card swipes, and electronic transfers.

As you check off the matching items, you’ll quickly see what has cleared on both ends. The goal here is to tick off as many transactions as you can, leaving you with a much shorter, more manageable list of things that don't quite line up. Those are the discrepancies we'll investigate next.

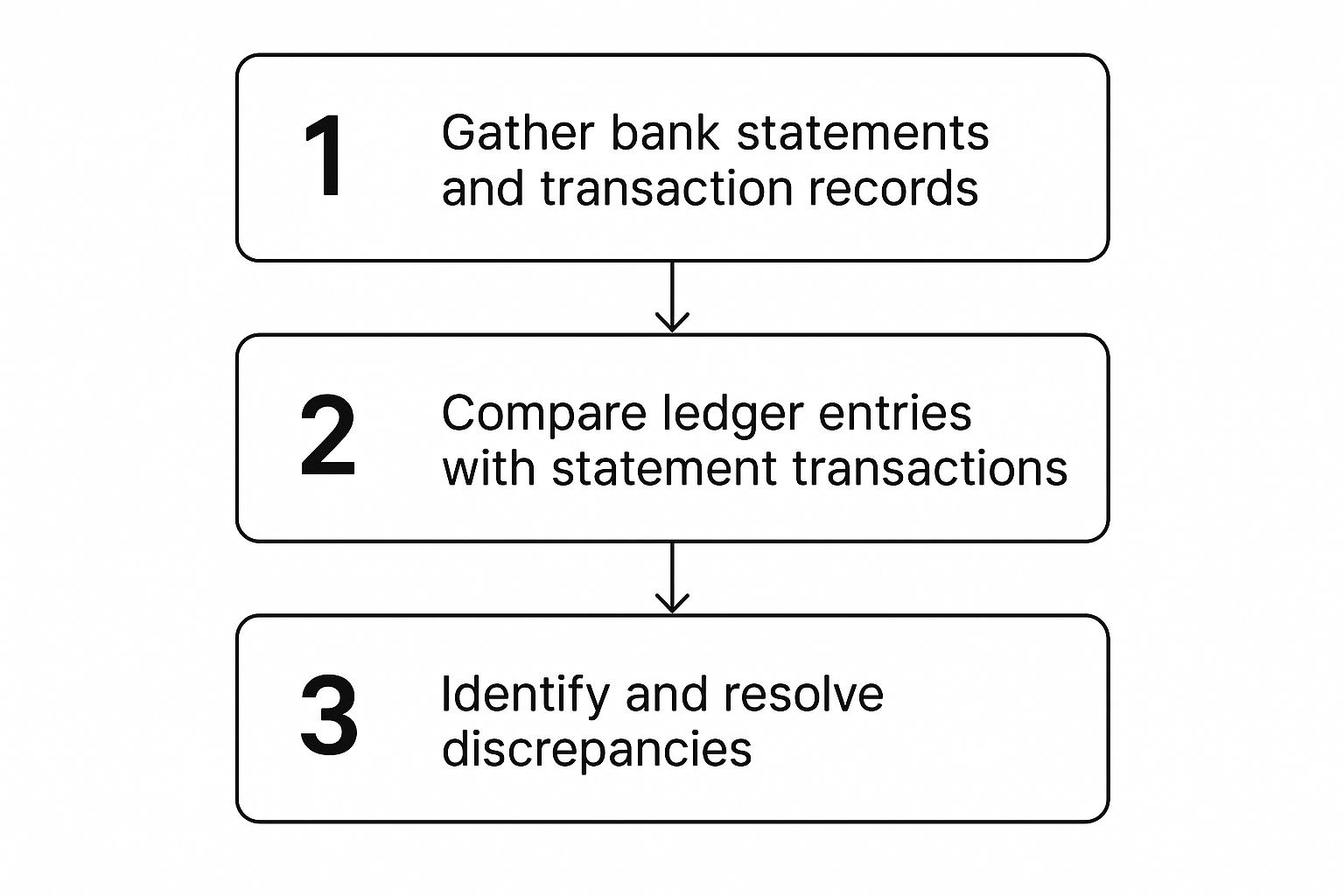

This handy visual shows the basic flow: gather your docs, compare them, and resolve any differences.

This simple three-part sequence is really the engine of the whole process, taking you from a pile of raw data to a perfectly balanced account.

Step 3: Identify and Adjust for Discrepancies

After you've matched everything you can, you'll almost always have a few leftover items on both lists. Don't panic! This is completely normal. Most of these aren't actual errors but are usually just a matter of timing or things you haven't recorded yet.

Now, you play detective. Your job is to figure out what these leftover items are and make the right adjustments in your company's cash book. Here are the usual suspects:

- Bank Service Fees: Those monthly account fees or transaction charges the bank takes out automatically. They're on the bank statement, but you probably haven't entered them into your books yet.

- Interest Earned: If your account earns interest, the bank adds it in. You'll need to record this as income on your end.

- Outstanding Checks: These are checks you've written and recorded, but the person you gave them to hasn't cashed them yet. They're out of your books, but not yet out of your bank account.

- Deposits in Transit: This happens when you record a deposit, but it was made too late to appear on that month's bank statement. Think of a deposit made on the last day of the month after the bank’s cutoff time.

By methodically identifying these common items and adjusting your internal records, you close the gap between your balance and the bank's balance until they perfectly match.

Once you’ve accounted for all these differences, you’ll put together a final bank reconciliation report. This report starts with the bank's ending balance, adjusts for those outstanding checks and deposits in transit, and should land on the exact same number as your adjusted cash book balance. When those two figures match to the penny, you’re done.

Solving Common Reconciliation Discrepancies

Finding a mismatch between your company’s books and the bank statement can feel like hitting a financial roadblock. But these discrepancies are rarely a cause for alarm. Most of the time, they’re simple, explainable issues you can resolve with a little methodical detective work.

Think of it as solving a small puzzle. All the pieces are there; you just need to find the ones that don't quite fit and figure out why. The most common culprits are usually timing differences, simple human error, or items that one side has recorded but the other hasn't yet.

Navigating Timing Differences

The most frequent source of discrepancies comes down to timing. Your business and the bank operate on slightly different schedules, which means some items will pop up in one record before the other. This is a perfectly normal part of the process.

Two classic examples of timing differences are:

- Outstanding Checks: These are checks you’ve written and recorded in your cash book, but the recipient hasn't cashed them yet. In your mind, that money is gone. But as far as the bank is concerned, it’s still sitting in your account.

- Deposits in Transit: This happens when you drop off a deposit late in the day or after the bank's cutoff time. You've already recorded the income, but it won't actually appear on the bank statement until the next business day.

These aren't errors, just temporary gaps that will close on their own. You just need to account for them on your reconciliation report to make everything line up.

Tackling Common Errors

While timing differences are expected, actual errors can also throw your numbers out of whack. These mistakes can come from your end or, less often, the bank's. The real key is to catch them early before they snowball into bigger headaches.

A small data entry error, like a transposed number (entering $97 instead of $79), is one of the most common yet easily overlooked mistakes. According to some studies, these simple human errors can contribute to a significant percentage of all accounting discrepancies.

Digging into these requires a careful side-by-side comparison. Look for transactions in your records that have no matching partner on the bank statement, and vice versa.

Here are the usual suspects:

- Data Entry Mistakes: A simple typo, like adding an extra zero or swapping digits when entering an expense.

- Duplicate Entries: Accidentally recording the same invoice payment or deposit twice in your accounting software.

- Bank Errors: It's rare, but banks can make mistakes. They might credit a deposit to the wrong account or process a withdrawal for the wrong amount.

If you think the bank made an error, get in touch with them right away with your documentation to get it fixed. For mistakes on your end, the solution is simple: just adjust the incorrect entry in your books.

Reviewing a detailed bank reconciliation statement example can help you see exactly how these adjustments are documented. When you methodically track down and correct each discrepancy, you turn a potentially stressful task into a routine financial check-up.

Troubleshooting Common Reconciliation Discrepancies

When your balances don't match, it almost always comes down to one of a handful of common issues. Instead of starting from scratch, you can usually pinpoint the problem by looking for specific patterns. The table below breaks down the most frequent discrepancies, their likely causes, and how to fix them.

| Discrepancy Type | Common Cause | How to Resolve |

|---|---|---|

| Outstanding Checks | Checks you've issued have not yet been cashed or cleared by the bank. | List these checks in your reconciliation. The balance will correct itself once they are cashed. |

| Deposits in Transit | Deposits made, especially near the end of a statement period, haven't been processed by the bank. | Note these as "deposits in transit" on your reconciliation. They will appear on the next statement. |

| Bank Service Fees | The bank charged monthly maintenance fees, overdraft fees, or other service charges you haven't recorded. | Add a new journal entry in your books to account for the bank fee expense. |

| Interest Earned | The bank paid interest on your account balance, which you haven't yet recorded as income. | Record the interest as income in your cash book. |

| Data Entry Error | A transaction was entered incorrectly (e.g., $54.32 entered as $45.32). | Find the incorrect entry in your records by comparing it to the bank statement and correct it. |

| Duplicate Transaction | A payment or deposit was accidentally recorded twice in your books. | Locate the duplicate entry and delete it from your accounting records. |

| Bank Error | The bank incorrectly processed a transaction (e.g., wrong amount, wrong account). | Contact the bank immediately with supporting documentation to request a correction. |

By using this as a checklist, you can quickly diagnose why your numbers are off. This turns reconciliation from a guessing game into a straightforward process of elimination, helping you maintain accurate and trustworthy financial records.

Moving from Manual Spreadsheets to Smart Automation

Let’s be honest, nobody enjoys manually ticking off transactions in a spreadsheet. For years, bank reconciliation was a grind—a tedious, after-the-fact chore that involved long hours and the constant risk of human error. It was a necessary evil.

This old-school method isn't just slow; it’s a massive resource hog. Every hour spent on manual matching is an hour you can't spend on what really matters: analyzing your financials and planning for the future. Thankfully, modern accounting tools are changing the game completely.

The Power of Automated Reconciliation

Smart software turns bank reconciliation from a month-end headache into a simple, ongoing check-in. Instead of being blindsided by discrepancies weeks later, you get a live, up-to-the-minute view of your financial standing. It’s a complete shift in how we handle our books.

So, how does it work? A few key features make all the difference:

- Direct Bank Feeds: Your accounting software pulls transactions straight from your bank. No more manual data entry.

- AI-Powered Matching: Smart algorithms learn your habits, recognizing recurring payments and vendor names to suggest matches automatically. It's a huge time-saver.

- Instant Discrepancy Flagging: The system instantly highlights any transaction that doesn’t line up, letting you solve mysteries in minutes, not days.

This isn't just a niche trend; it's a fundamental market shift. The global reconciliation software market was valued at USD 1.75 million in 2023 and is expected to rocket to USD 6.44 billion by 2032. That kind of growth tells you everything you need to know about where the industry is headed.

The real win with automation is clarity. It gives you a precise, real-time picture of your cash flow, taking the guesswork out of your financial decisions.

From Hours to Minutes

With the right tools, businesses are cutting down reconciliation time from days of work to just a few minutes a month. It’s about more than just accounting; it’s a lesson in how to automate repetitive tasks and save time across your entire operation.

The benefits are undeniable. You get better efficiency, pinpoint accuracy, and much tighter financial controls. If you're ready to explore your options, our guide on automated bank reconciliation software is a great place to start. Making this switch lets your finance team focus on strategy instead of spreadsheets, transforming a dreaded task into a powerful source of business insight.

Answering Your Top Bank Reconciliation Questions

Even after you've got a good handle on the "what" and "why" of bank reconciliations, the practical, day-to-day questions always seem to pop up. Let's tackle some of the most common ones I hear from business owners. The goal here is to clear up any lingering confusion so you can put this all into practice with confidence.

How Often Should I Reconcile My Accounts?

The best answer really depends on how much money is flowing in and out of your business every day. For most small businesses, doing a reconciliation once a month is a great rhythm to get into. It lines up neatly with when your bank statement arrives and keeps things manageable.

But what if you run a busy retail shop or an e-commerce store? If you have a high volume of transactions, waiting 30 days is like leaving the front door unlocked. A tiny error, a missed refund, or a fraudulent charge can snowball into a massive headache. For these types of businesses, reconciling weekly or even daily isn't overkill—it’s essential.

The rule of thumb is simple: the more you transact, the more you should reconcile. For a high-volume business, frequent reconciliations aren't just about good bookkeeping; they're a critical line of defense.

Is My Accounting Software Good Enough on Its Own?

Modern accounting software is fantastic, isn’t it? Those direct bank feeds that automatically pull in and suggest matches for your transactions are an incredible time-saver. But it's easy to fall into the trap of thinking the software does everything for you. It doesn't.

Think of your software as a brilliant assistant, not the boss. It can match a $50 payment to a $50 invoice, but it can't tell you if that vendor accidentally charged you twice. It won't question a new bank fee you've never seen before. That final, human review—the actual act of reconciling—is where your judgment comes in. It's your job to give it the final sign-off and confirm that everything truly makes sense.

What’s the Difference Between a Reconciliation and an Audit?

This is a great question because the terms are sometimes used loosely, but they mean very different things.

A bank reconciliation is an internal process. It's something you do regularly (monthly, weekly) to make sure your internal records match the bank's records. Think of it as part of your routine financial hygiene, like brushing your teeth.

An audit, however, is an external examination. This is when you bring in an independent third party, like a CPA firm, to formally inspect your financial statements to ensure they are fair and accurate. Your bank reconciliations will be one of the first things they ask to see, but they're just one small piece of a much bigger review.

What Do I Actually Do With the Final Reconciliation Report?

The finished bank reconciliation report is more than just a piece of paper that proves you did the work. It’s a vital internal document with a few key jobs.

This report is the official record explaining exactly why your books and the bank didn't match at first, and it shows the specific items (like outstanding checks) that bridge the gap.

Here’s why that matters:

- Proof for Auditors: When auditors show up, they will ask for these reports. They see them as proof that you have solid financial controls in place.

- A Historical Trail: If a question comes up months later about a weird transaction, this report is your go-to guide for figuring out what happened.

- Real-Time Cash Insight: It gives you the most accurate picture of your true cash position by clearly listing all the money that hasn't cleared the bank yet.

This report is the final, tangible result of all your hard work, and it's a cornerstone of smart financial management. Its importance is a big reason why the global market for account reconciliation software is expected to hit USD 10.38 billion by 2033. Businesses are investing heavily because they know managing huge transaction volumes and ensuring accuracy is non-negotiable. You can learn more about the growth of reconciliation technology and its impact on modern business.

At Bank Statement Convert PDF, we help you nail the very first step of your reconciliation. Our tool takes your PDF bank statements and turns them into clean, organized Excel files in a snap, saving you from tedious data entry and the errors that come with it. Start your journey to faster, more accurate reconciliations today!