When you're searching for the best accounting software for small business, you'll quickly notice a few names pop up again and again: QuickBooks Online, Xero, and FreshBooks are always in the mix. QuickBooks has a reputation for being able to scale with you, Xero is loved for its clean design and massive list of integrations, and FreshBooks is the undisputed champ for service-based businesses that live and die by their invoices.

The right choice isn't about which one is "best" overall, but which one is the perfect fit for your business right now—and where you plan to go.

Finding Your Ideal Accounting Software

Choosing your accounting software is one of those foundational decisions that can make or break your efficiency down the road. It’s so much more than just keeping track of numbers; it’s about getting the financial clarity you need to make smart, strategic decisions. If you're still wrestling with spreadsheets or an old desktop program, making the switch to a modern, cloud-based platform is one of the most impactful upgrades you can make for your business.

This isn't just a small shift; it's a massive trend. The global accounting software market was valued at USD 19.38 billion in 2024 and is expected to hit USD 31.25 billion by 2030. What's driving that growth? It's small and medium-sized businesses just like yours, realizing these tools give them the kind of financial firepower once reserved for huge corporations. You can read more on this market growth at Grandview Research.

Top Accounting Software Picks for Small Businesses

To cut through the noise, I've put together a quick-glance table. Think of this as your starting point for figuring out which platforms are even worth a closer look. It highlights the top players and what they're really known for.

| Software Name | Best For | Key Standout Feature |

|---|---|---|

| QuickBooks Online | Overall Scalability | Comprehensive features that grow with your business, from solopreneur to mid-sized teams. |

| Xero | E-commerce & Inventory | Strong inventory management and over 1,000 app integrations for online stores. |

| FreshBooks | Freelancers & Service Businesses | Superior invoicing, time tracking, and project management tools tailored for client work. |

| Wave | Budget-Conscious Startups | Free accounting and invoicing features, making it ideal for new businesses with simple needs. |

This table gives you a bird's-eye view, but we'll dig much deeper into what makes each of these tools tick.

Here’s a look at the QuickBooks Online dashboard, which gives you a clean snapshot of all your key financial metrics in one place.

As you can see, the design is all about ease of use, getting you straight to common tasks like sending an invoice or checking on expenses without having to hunt through menus.

Why Your Choice Matters More Than Ever

Not too long ago, accounting was something you dealt with after the fact—a reactive chore you did once a year to get your taxes filed. Today, the right software turns it into a proactive, strategic tool. It takes over the tedious work of categorizing expenses and reconciling bank statements, which frees you up to actually focus on running and growing your business.

The goal isn't just to find software that keeps your books tidy. It's to find a platform that gives you insights you can actually use. Look for a tool that serves up clear financial reports, shows you your cash flow in real-time, and helps you understand the health of your business with just a quick look.

This guide is designed to walk you through that decision. We're going to move past the simple feature lists and give you a practical framework for comparing your options, looking at them through the lens of real-world business scenarios so you can find the perfect match.

Core Criteria for Evaluating Accounting Software

Picking the right accounting software for your small business is about more than just slick dashboards and marketing promises. To make a smart choice, you need a solid framework for evaluation—one that’s grounded in how your business actually runs. It’s about looking past the shiny features and sizing up each platform against a core set of practical needs.

Without a clear plan, it’s easy to get lost in the sea of options or, worse, end up with a tool that creates more headaches than it solves. Let’s break down the essential factors that will point you toward the right decision.

Essential Accounting and Bookkeeping Features

First things first, any accounting software worth its salt has to nail the fundamentals. These are the non-negotiable features that power your entire financial system and are absolutely critical for keeping accurate, compliant records.

Start with invoicing. Can the software create professional, branded invoices that reflect your business? Can you set up recurring billing for clients on a retainer or automatically send out payment reminders? A strong invoicing system is the lifeblood of your cash flow. A freelance designer, for instance, needs a tool that handles project-based billing and time tracking, while an e-commerce store needs one that can manage batch invoicing and comply with GST invoice requirements.

Next up is bank reconciliation. It has to be seamless. The software should securely connect to your business bank accounts and credit cards, pulling in transactions automatically. This feature alone can save you countless hours of manual data entry and dramatically cut down on human error. If your financial record-keeping skills are a bit rusty, our guide at https://bankstatementconvertpdf.com/bookkeeping-basics-for-small-business/ is a great place to brush up on the essentials.

Usability and Initial Learning Curve

Powerful features don't mean much if you and your team can't figure out how to use them. The software’s ease of use—or lack thereof—will directly affect whether it gets used properly and whether you see any real return on your investment.

Think about who's going to be in the software every day. If you’re not an accounting pro, you'll want an intuitive interface and a clean, easy-to-read dashboard. Platforms like FreshBooks are often praised for their simplicity, which makes them a fantastic choice for sole proprietors. On the other hand, a more comprehensive system like QuickBooks Online offers incredible depth but definitely comes with a steeper learning curve.

Key Insight: Don't just watch a demo video. Sign up for a free trial and put the software through its paces with real-world tasks. Try creating an invoice, running a profit and loss report, and reconciling a few bank transactions to get a genuine feel for the daily workflow.

Integrations and Scalability

Your accounting software can't operate in a silo. It has to play nicely with the other tools you depend on every day, whether that’s your payment processor, your e-commerce platform, or your CRM.

Check out the platform’s app marketplace. Does it connect smoothly with tools like Stripe, PayPal, or Shopify? Good integrations create a unified system, eliminating tedious double-data entry and ensuring you have a single, reliable source of financial truth. Xero, for example, is well-known for its massive library of over 1,000 third-party integrations.

Finally, think ahead. The best software for your business today should also be able to keep up as you grow over the next three to five years. Look for a platform that offers tiered plans, so you can easily add features like payroll, multi-currency support, or advanced inventory management when your company’s needs get more complex.

A Head-to-Head Comparison of Leading Platforms

Now that we have our evaluation criteria sorted, it's time to put the leading platforms under the microscope. This isn't about finding a single "best" option—it's about understanding the subtle but crucial differences that make each one a better fit for certain types of businesses. We’ll look at QuickBooks Online, Xero, and FreshBooks through the lens of real-world business scenarios, going far beyond a simple feature checklist.

There's a reason the global accounting software market is booming—it's projected to shoot past USD 20 billion by 2025. This explosion is primarily driven by small and medium-sized businesses in North America, which account for about 34% of the market, all hunting for better ways to manage their finances.

Scenario One: The Service-Based Freelancer

Let's say you're a freelance graphic designer. Your financial needs are straightforward but non-negotiable: creating sharp proposals and invoices, tracking your time with precision, and, most importantly, getting paid on time. You don't have physical inventory to worry about; your main concern is profitability per project and per client.

This is where FreshBooks was born to shine. It was built from the ground up for this exact situation. Its invoicing tools are simply best-in-class, offering easy customization, recurring billing, and automated reminders for late payments. The built-in time tracker is a game-changer, letting you log hours directly against a project and then pull that data into an invoice with a single click.

Key Differentiator: While QuickBooks and Xero can certainly handle invoicing and time tracking (often with add-ons), FreshBooks bakes these functions into its core workflow. This creates a seamless journey from proposal to payment that feels incredibly natural for service-based professionals.

QuickBooks Online is also a very capable choice, especially if you have ambitions of growing your freelance gig into a full-blown agency. Its project profitability tools are more powerful, giving you a much deeper look into the costs versus revenue for each job. The trade-off? The interface can feel a bit overwhelming for a solopreneur who just needs to send an invoice and get back to designing.

Xero lands somewhere in the middle. It handles invoicing perfectly well and has solid project management features, but they don't feel as central to the platform's DNA as they do in FreshBooks. It gets the job done but lacks that laser focus on the service provider's day-to-day reality.

Scenario Two: The E-commerce Retailer

Now, let's switch gears. Imagine you own a growing online store selling handmade candles. Your financial world is a whole lot more complex. You're juggling inventory levels, tracking the cost of goods sold (COGS), and need a rock-solid integration with your e-commerce platform, like Shopify or BigCommerce. If you sell internationally, multi-currency support is also a must.

This is where Xero truly excels. Its inventory management tools are built right in and are more advanced than what you'll find in its competitors' standard plans. You can track stock, set reorder points, and manage multiple product variations without breaking a sweat. Plus, its massive library of over 1,000 app integrations means connecting to your sales channels and payment gateways is about as easy as it gets.

QuickBooks Online, particularly its Plus and Advanced plans, puts up a good fight with strong inventory features. It provides a solid foundation for an e-commerce business, but many owners find they need to lean on third-party apps for more sophisticated inventory control, which can quickly add to the monthly cost.

FreshBooks, on the other hand, just isn't built for businesses that sell physical products. You can list items on an invoice, sure, but it completely lacks the dedicated inventory management system you need to run a retail operation without pulling your hair out.

Mobile App Usability and On-the-Go Management

As any small business owner knows, the workday doesn't end when you leave your desk. A powerful mobile app is essential for managing finances from anywhere—whether you're snapping a photo of a lunch receipt or sending an invoice from your phone the moment a meeting ends.

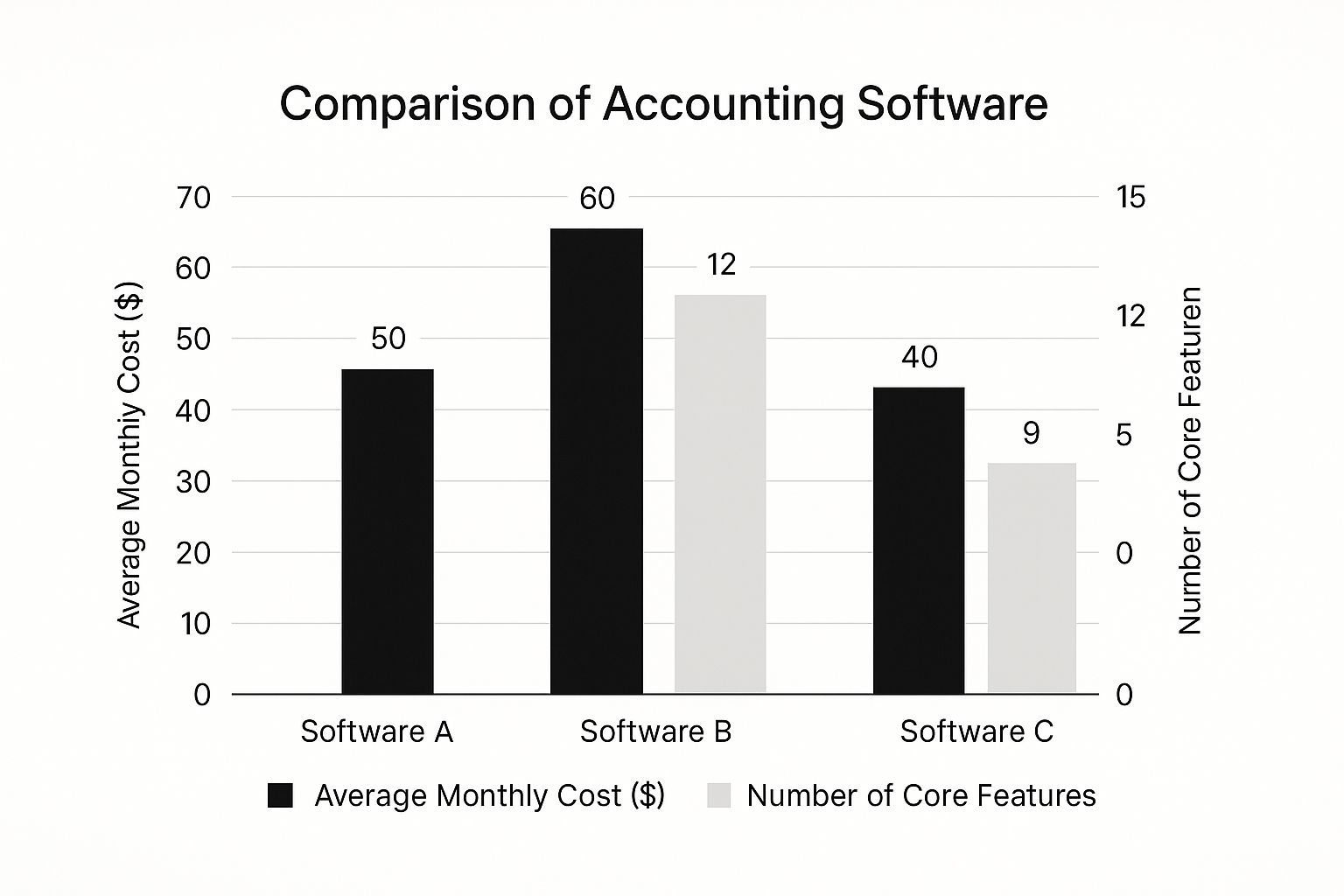

The chart below helps visualize the common trade-off between price and features. You can see how different platforms balance the number of tools they offer against their monthly cost.

This highlights that getting more functionality often means a bigger budget, forcing you to decide what's truly essential for your business.

-

QuickBooks Online's Mobile App: It’s arguably the most comprehensive out there. You can do almost anything on the app that you can on your desktop, from creating invoices and running reports to reconciling transactions. The receipt capture feature, in particular, is incredibly robust.

-

Xero's Mobile App: This app is clean, intuitive, and fantastic for the core tasks: invoicing, submitting expense claims, and handling bank reconciliation. It gives you a great snapshot of your cash flow, though its reporting capabilities are a bit lighter than what the QuickBooks app offers.

-

FreshBooks' Mobile App: Perfectly reflecting the platform's ethos, the app is a dream for invoicing, time tracking, and managing expenses on the move. It’s simple, fast, and exactly what a service provider needs to manage client work while out in the field.

Advanced Reporting and Financial Insights

Once your business starts to mature, basic profit and loss statements just don't cut it anymore. You need deeper insights to make smart strategic moves—things like cash flow trends, budget vs. actuals analysis, and other key performance indicators.

QuickBooks Online is the undisputed leader in this category. Its higher-tier plans unlock a massive library of customizable reports that you can schedule and automatically share with your team or accountant. For any business that's serious about data-driven growth, this depth is a huge advantage.

Xero also delivers excellent reporting, with a real knack for visual dashboards that make complex financial data easy to digest. It shines in cash flow forecasting and offers plenty of customizable templates, though it has slightly fewer out-of-the-box options than QuickBooks.

FreshBooks keeps its reporting simple and straight to the point. It gives you all the essentials a small service business needs—profit and loss, sales tax summaries, and expense reports. However, it doesn't offer the deep customization or advanced analytics you'll find in its bigger rivals. Streamlining these tasks is crucial for efficiency; you can learn more about the benefits with these essential accounting automation tools.

Feature Breakdown Across Top Accounting Software

To pull all these details together, here's a table that provides a quick, high-level comparison. It's not meant to be exhaustive, but it clearly highlights the core strengths and weaknesses we've discussed.

| Feature | QuickBooks Online | Xero | FreshBooks |

|---|---|---|---|

| Best For | Overall Scalability | E-commerce & Integrations | Freelancers & Services |

| Invoicing | Excellent | Excellent | Superior |

| Inventory Mgmt | Good (in higher plans) | Excellent (built-in) | Basic / Not Recommended |

| Reporting | Most Comprehensive | Very Good | Good (but basic) |

| Mobile App | Full-featured | Clean & Efficient | Simple & Fast |

| Integrations | Extensive | Industry-Leading | Good (focused on service tools) |

| Learning Curve | Moderate to High | Moderate | Low |

At the end of the day, the right choice comes down to the reality of your business. A freelancer trying to use QuickBooks might feel buried under features they'll never touch. An e-commerce store that picks FreshBooks will be critically hobbled by its lack of inventory tools. Use these scenarios as a mirror for your own operations to find the platform that truly fits.

Why Cloud-Based Accounting Is a Game Changer

The biggest leap forward in small business financial management isn't a single feature—it's the massive shift from desktop software to the cloud. This evolution has completely changed how business owners handle their finances, turning what was once a static, desk-bound chore into a live, interactive process. Getting a handle on this change is fundamental to choosing the right accounting tool for your business.

Remember the old days of being tethered to one specific computer in your office just to send an invoice or check your cash flow? Those are over. Cloud-based accounting software keeps your financial data on secure, remote servers. This means you can log in and manage your books from anywhere, on any device with an internet connection—be it your laptop at home, a tablet on the train, or your smartphone.

This might sound like a simple technical detail, but its real-world impact on running your company is huge.

Real-Time Access and Unmatched Flexibility

The most obvious perk is pure freedom. Picture this: you’re meeting with a client, and they agree to a new project on the spot. You can pull out your phone, create a professional invoice, and email it to them before you've even left their building. It’s that immediate.

Think about expense tracking, too. Instead of a shoebox overflowing with faded receipts, you can now snap a picture of a receipt right after a business lunch. The software instantly uploads it and even categorizes the expense for you. This one small habit can save you hours of painful data entry and all but eliminates the risk of losing important records.

This constant access also transforms how you monitor your business's financial health. You don't have to wait for your bookkeeper to close out the month to see where you stand. A live dashboard gives you a real-time snapshot of your finances, allowing you to make smarter, faster decisions based on what's happening right now, not what happened weeks ago.

Effortless Collaboration and Built-In Security

Cloud software also completely redefines how you work with your team and your accountant. Forget emailing massive, clunky data files back and forth—a nightmare for version control. Now, you can just grant your accountant secure, direct access to your live books.

Key Takeaway: Collaboration is fluid and error-free. When tax season rolls around, your accountant can simply log in, pull the reports they need, and make necessary adjustments without interrupting your work. This is a massive time-saver and ensures everyone is looking at the exact same numbers.

On top of that, with old desktop software, the responsibility for backups and data security was entirely on you. A stolen laptop or a crashed hard drive could mean your financial records were gone for good. Reputable cloud providers take care of all that, using bank-level encryption and running constant, automatic backups to shield your critical information from disaster.

This move to the cloud isn't just a fleeting trend; it’s the new normal. The market for cloud accounting is projected to hit USD 4.25 billion by 2025, and 67% of accountants are already using it to help their clients. This evolution is deeply rooted in the broader principles of cloud computing.

Matching the Right Software to Your Business Model

It’s easy to get lost searching for the single “best” accounting software for small businesses, but that search often misses the point. There isn’t one. The right platform isn’t a one-size-fits-all solution; it’s the one that clicks with your specific business model, your workflow, and the unique challenges you face every day. A feature-rich tool perfect for an e-commerce store would be a clumsy, over-engineered nightmare for a solo freelancer.

To make a confident choice, you have to look at these platforms through the lens of your own operations. Let's break down a few common business profiles to see how the leading software stacks up in the real world. This will help you pinpoint the solution that actually fits your needs.

For the Solo Freelancer and Consultant

If you’re a freelancer, your financial life is all about proposals, time tracking, and sending out clean, professional invoices. Your main goals are simple: bill clients correctly, get paid on time, and see how profitable each project is without getting bogged down in features you’ll never touch.

This is exactly where a tool like FreshBooks shines. It was literally built for service-based professionals. Its invoicing is best-in-class for this scenario—you can easily customize templates, set up automatic payment reminders, and turn your tracked hours directly into an invoice with just a few clicks.

Key Insight: For freelancers, the software should feel like a partner, not a chore. The path from logging billable hours to sending the final invoice needs to be as smooth as possible so you can spend more time on actual client work.

Sure, QuickBooks can do all of this, but it often feels like bringing a cannon to a knife fight. For a solopreneur, the goal is to find the most direct, uncomplicated way to manage client finances.

For the Growing E-commerce Store

An e-commerce business plays by a completely different set of financial rules. Your world is dominated by inventory levels, calculating the cost of goods sold (COGS), integrating with sales channels like Shopify, and wrestling with sales tax in different states or countries. Basic invoicing software just won't cut it.

This is where Xero often pulls ahead of the pack. Its inventory management, included right out of the box, is more capable than what you’ll find in competitors' standard plans. It lets you track stock levels and even set reorder points. On top of that, its massive marketplace of over 1,000 integrations means it will almost certainly connect to your entire e-commerce tech stack.

A retail business absolutely has to keep a close watch on its financial health, especially when it comes to inventory turns and sales cycles. Good tracking is essential for maintaining healthy cash flow, which you can read more about in our guide to cash flow management for small business. The software’s ability to connect the dots between your inventory and your bank balance is where it really earns its keep.

For the Agency or Service Business with a Team

Once a solo service business grows into an agency with a team, the financial complexity multiplies. Now you need project-based billing, time tracking for multiple employees, and much deeper reporting to figure out which projects and clients are actually making you money.

This is where a scalable platform like QuickBooks Online really shows its muscle. Its project profitability features are incredibly detailed, letting you assign expenses, payroll costs, and all billable hours to specific projects. This gives you a crystal-clear picture of which clients and services are fueling your growth and which are draining resources.

The biggest advantage here is that QuickBooks can grow right alongside you. You can start on a simpler plan and then upgrade to unlock more advanced tools like budgeting and class tracking as your agency gets bigger. It’s a system that supports you at every stage.

Here’s a quick-glance table to help you match your business type to the right software based on these scenarios.

| Business Model | Primary Need | Top Recommendation | Why It Fits |

|---|---|---|---|

| Freelancer | Simple Invoicing & Time Tracking | FreshBooks | Built from the ground up for a service provider's workflow. |

| E-commerce | Inventory & Integrations | Xero | Strong built-in inventory and a huge library of app connections. |

| Agency | Project Profitability & Scalability | QuickBooks Online | Powerful project tracking and tiered plans that grow with you. |

When you stop looking for the "best" software and start looking for the "right fit" for your business's DNA, you’ll find a platform that doesn’t just do your books—it actively helps you succeed.

Making Your Final Decision and Getting Started

You’ve done the hard work—weighing features, comparing the top contenders, and figuring out which platform truly fits your business. Now it’s time to pull the trigger. But before you commit, there's one final, practical step that will make all the difference.

Take full advantage of the free trials. This is non-negotiable. Don’t just poke around the dashboard for a few minutes. Dive in and use it like you would on a real workday. Create a test invoice, link a bank account to see how the reconciliation actually works, and pull a profit and loss report. This hands-on test drive tells you more about a system’s true usability than any review ever could.

Planning Your Transition

Once you’ve picked your winner, the real work begins: implementation. A messy transition can cause data headaches and disrupt your operations, so a little planning goes a long way.

First, map out your data migration. If you're coming from spreadsheets or another system, decide what historical data you absolutely need to transfer. Most software provides tools for importing customer lists, vendor info, and your chart of accounts. Getting this right from the start is the foundation for accurate financial reporting.

Expert Tip: Don't try to boil the ocean. Master one core task at a time, like invoicing or expense tracking. Once you have the basics down cold, you can start exploring the more advanced features like inventory management or detailed forecasting.

Finally, make training a priority. Block out time on the calendar for you and your team to go through the software’s tutorials or help docs. This upfront time investment will pay for itself by helping you get the most out of your new tool and avoiding bad habits from the get-go. A methodical approach is key, and you can find more great advice in these top small business bookkeeping tips to simplify finances.

Taking these deliberate steps ensures your new software becomes a powerful engine for financial clarity and growth, not just another subscription.

Frequently Asked Questions

Even after comparing features, a few lingering questions often pop up when you're about to pick an accounting platform. Let's tackle some of the most common ones to help you make that final decision with confidence.

Can I Switch Accounting Software Later?

The short answer is yes, but it’s not always pretty. Migrating your accounting data can be a real headache. While you can usually export things like customer lists or your chart of accounts, getting years of detailed transaction history from one system to another is often a messy, complicated process.

Your best bet is to choose a system that can grow with you from the get-go, like QuickBooks Online or Xero. If a switch is unavoidable, try to time it for the start of a fiscal year. It makes for a much cleaner break.

Do I Still Need an Accountant?

100% yes. Think of your accounting software as an incredibly smart assistant that handles the day-to-day grind, but it's not a strategist. It crunches the numbers, but it can't give you the nuanced advice a human expert can.

The software takes care of the 'what'—all your financial data. Your accountant delivers the 'so what?' and the 'now what?'—turning those numbers into smart business moves, tax planning, and future forecasts.

How Secure Is My Data in the Cloud?

It’s a valid concern, but reputable cloud accounting platforms are serious about security. They use the same kind of heavy-duty protection your bank does, like 256-bit SSL encryption and servers locked down in secure data centers. Honestly, your data is probably safer there than on a laptop in your office that could be lost, stolen, or damaged.

Just make sure you do your part: always turn on two-factor authentication (2FA). It adds a critical layer of security and is the single best thing you can do to protect your account.

To get a fuller picture of your finances, you’ll also want to get comfortable with specific accounting terms. For instance, understanding what a chargeback means in accounting is crucial for managing your revenue and expenses accurately.

A huge part of accounting is wrangling financial documents. Bank Statement Convert PDF is a simple but powerful tool that turns your PDF bank statements into clean Excel spreadsheets, saving you hours of manual entry and cutting down on errors. Learn how to streamline your financial data management today.