Think of your company's finances like a story. The general ledger (GL) is the book where this entire story is written, chronicling every single financial event, from a big sale to a small purchase of coffee for the office. But how do you know the story is true?

That's where general ledger reconciliation comes in. It's the process of fact-checking your financial story, ensuring that what's written in your general ledger perfectly matches up with outside proof. It’s the single most important step to confirm your financial records aren't just a work of fiction.

Understanding General Ledger Reconciliation

The general ledger acts as the master file for all your business transactions. Every penny that flows in or out is recorded and categorized here. But just writing it down doesn't make it right. Mistakes happen. Numbers get transposed. Transactions get missed.

Reconciliation is the systematic cross-check that brings these issues to light. It involves meticulously comparing the balances in your GL accounts against independent, third-party documents to prove their accuracy.

To help you get a quick sense of what's involved, here’s a breakdown of the core components you’ll be working with.

Key Components of General Ledger Reconciliation

| Component | Description | Example |

|---|---|---|

| General Ledger (GL) | The central, master record of all company financial transactions, summarized by account. | The cash account in your GL shows a balance of $10,500. |

| Source Documents | Independent records that provide external proof of the transactions recorded in the GL. | Your official bank statement for the same period. |

| Sub-Ledgers | Detailed logs for specific high-volume accounts, like accounts receivable or payable. | A detailed list of all outstanding customer invoices. |

| Reconciliation Process | The act of systematically comparing balances between the GL and source documents to find discrepancies. | Matching every deposit and withdrawal on the bank statement to entries in the GL's cash account. |

These components work together to create a verifiable and trustworthy financial picture.

Key Documents Used for Comparison

You need reliable sources to fact-check your general ledger. The most common and critical ones include:

- Bank Statements: This is the heavyweight champion of reconciliation. You match your GL’s cash account balance against what the bank says you have. It’s non-negotiable.

- Sub-Ledgers: Think of these as the detailed chapters for specific accounts. Your Accounts Receivable sub-ledger, for instance, lists every single customer invoice. The total must match the summary figure in your GL.

- Supplier Invoices and Receipts: These documents are your evidence for expenses. Cross-referencing them ensures you've accurately recorded what you owe and what you've paid.

You’re essentially playing detective with your own finances. The goal is to hunt down any discrepancies—whether they're simple typos or signs of something more serious—and fix them before they grow into massive problems.

This fundamental accounting practice is what creates a clear audit trail and ensures your financial reports are built on a foundation of truth. If you're looking to strengthen your understanding, brushing up on some bookkeeping basics for small business is a great place to start. Ultimately, regular reconciliation builds the confidence you need to make smart, data-driven decisions for your business.

Why Accurate Reconciliation Is Non-Negotiable

Knowing what general ledger reconciliation is only gets you halfway there. The real question is why this process is the absolute bedrock of financial integrity, not just another task on the accounting checklist. Skipping a reconciliation isn't like a typo in an email; it's like ignoring the check engine light on your car's dashboard. The consequences can be serious and ripple throughout the business.

Think of accurate reconciliation as your first line of defense against financial threats, both from the inside and out. It’s the process that shines a spotlight on strange or suspicious transactions, helping you catch potential fraud before it gets out of hand.

According to the Association of Certified Fraud Examiners (ACFE), businesses lose an estimated 5% of their annual revenue to fraud. Regular reconciliation is one of the most powerful tools you have to deter and detect it, protecting the assets you've worked so hard to build.

Without this constant cross-checking, a company could be slowly bleeding cash from unauthorized payments or doctored records, and no one would be the wiser until it's far too late. It’s a proactive way to guard your company’s financial health.

Driving Smart Business Decisions

Every big strategic move—from launching a new product to expanding into another city—is built on a foundation of trustworthy financial data. Can you imagine trying to get a business loan or attract investors when your financial statements are full of holes? Inaccurate numbers don't just look bad; they destroy credibility and can lead to truly disastrous decisions.

When you consistently reconcile your books, you ensure your financial reports paint a true picture of your company's performance. This gives leadership the confidence they need to:

- Set budgets effectively using real revenue and expense figures.

- Spot important trends in profitability or spending that need to be addressed.

- Secure financing by showing lenders and investors reliable, verifiable financial statements.

Making a big bet based on flawed data is a risk most businesses simply can't afford to take.

Ensuring Regulatory Compliance

Looking beyond your own boardroom, meticulous reconciliation is crucial for meeting your legal and regulatory duties. Tax agencies and auditors don't just hope for accurate financial records—they demand them. A clean, well-documented reconciliation trail proves you're doing your due diligence and operating with transparency, which makes audits a whole lot smoother.

On the flip side, failing to keep accurate books can lead to heavy fines, legal headaches, and a damaged reputation. This is where the output of your reconciliation work becomes so critical. The verified numbers from your general ledger flow directly into the key statements that tell your business’s official story. You can learn more about how to create these by reading our guide on how to prepare financial reports.

At the end of the day, general ledger reconciliation is non-negotiable because it creates a foundation of trust. It ensures the story your numbers tell—to your team, to your investors, and to regulators—is accurate, complete, and reliable. This isn't just about balancing the books; it's about building a stable and resilient future for your business.

A Practical Guide to the Reconciliation Process

Alright, we've covered why general ledger reconciliation is so important. Now, let’s get our hands dirty and walk through the "how." The whole process might sound a bit intimidating, but it's really just a methodical way of making sure your numbers tell the truth.

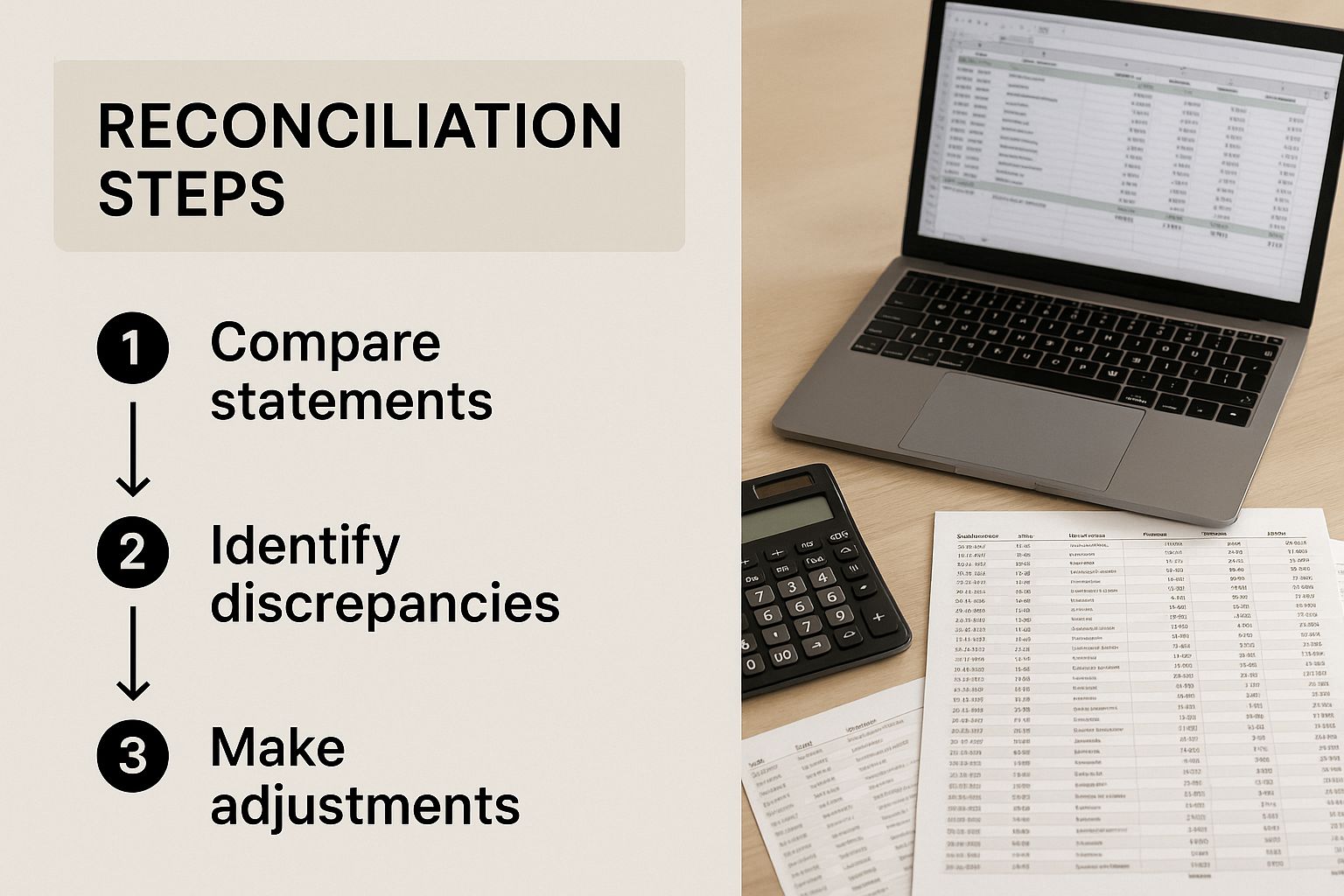

Think of it as transforming a jumble of financial data into a solid, verifiable record. This infographic gives a great high-level view of the key steps.

As you can see, reconciliation is a clear path—from gathering your documents all the way to making final corrections. It's designed to be auditable and straightforward.

Step 1: Gather Your Financial Documents

First things first, you can't compare anything without having all your documents in one place. This is your evidence. I always think of this step like a detective gathering clues before heading to the crime scene.

You’ll need two main sets of documents:

- The General Ledger Trial Balance: This is the master list from your accounting software, showing the final balance for every single account in that period.

- Source Documents: This is the external proof you'll be checking your ledger against. The big one is always the bank statement, but you'll also need sub-ledgers for things like accounts receivable, accounts payable, credit card statements, and loan agreements.

You absolutely cannot cut corners here. Having complete and accurate source documents is the foundation of a good reconciliation.

Step 2: Perform a Systematic Comparison

With all your paperwork in front of you, the real work begins. The goal is simple: match the balance of an account in your general ledger to the balance on its source document.

For example, you’ll take the ending cash balance from your ledger and compare it to the ending balance on your bank statement. You have to go line by line, ticking off every deposit, every withdrawal, and every check on both sides.

This is where you'll spot most of the problems. It takes patience and a keen eye for detail. Even a tiny transaction that doesn't match up needs to be flagged and investigated.

Step 3: Investigate and Identify Discrepancies

It’s almost a guarantee that the balances won’t match perfectly on your first pass. Don’t panic—that’s completely normal. Your job now is to play detective and figure out why they don't line up.

Discrepancies almost always fall into one of two buckets:

- Timing Differences: These are perfectly legitimate transactions that have been recorded in one system but not the other… yet. A classic example is an outstanding check you’ve recorded in your books, but it hasn’t been cashed and cleared by the bank.

- Errors or Omissions: These are straight-up mistakes. We’re talking about things like duplicate entries, posting a transaction to the wrong account, simple data entry typos, or, in rare cases, even fraud.

A timing difference will eventually sort itself out. An error, on the other hand, needs you to step in and fix it. The trick is to correctly identify which is which and document everything.

Keeping a worksheet to track these differences is a lifesaver. For bank reconciliations, using a bank reconciliation statement template gives you a pre-built structure to document and resolve everything cleanly.

Step 4: Make Adjusting Journal Entries

Once you've confirmed an actual error, you have to fix it in your general ledger. You do this by creating and posting what we call adjusting journal entries.

Let's say you spotted a bank service fee on your statement that was never entered into your books. You’d create an adjusting entry to debit your "Bank Fees Expense" account and credit your "Cash" account. Just like that, your ledger now reflects reality.

These entries need to be crystal clear and well-documented, with a note explaining exactly why the adjustment was made. This creates a clean audit trail that anyone—from your boss to an external auditor—can easily follow.

Navigating Common Reconciliation Roadblocks

Even with the most buttoned-up process, general ledger reconciliation can hit a few snags. Think of these roadblocks less as signs of failure and more as a normal part of wrestling with complex financial data. Once you know what they are, you can build a workflow that anticipates and solves these problems before they balloon into a full-blown crisis.

One of the most common—and frustrating—issues is simply hunting down missing documents. An invoice gets buried in an email chain, a receipt never makes it out of someone's wallet, or a bank statement just isn't there yet. Without that proof, you’re stuck. You can’t verify the transactions in your general ledger, and the whole process grinds to a halt.

Then there's the classic data entry mistake. We've all been there—a transposed number or a misplaced decimal point. It seems small, but that tiny error can create a discrepancy that takes hours of detective work to uncover, throwing your accounts completely out of balance.

Taming High Transaction Volumes

When your business grows, so does the mountain of transactions you have to sort through. It’s a good problem to have, but it puts incredible strain on your reconciliation process. Manually matching thousands of line items every month isn't just tedious; it's practically an invitation for errors and burnout.

When transaction volumes explode, the manual approach simply breaks. Teams get overwhelmed, deadlines get pushed, and inaccuracies creep in.

A study of accounting functions reveals significant variation in the average time taken to reconcile GL accounts. Firms in the 25th percentile complete their reconciliations in about five hours, while those in the 75th percentile can take up to ten hours or more.

Those longer reconciliation times have a real impact, slowing down your ability to close the books and make sharp, timely decisions. You can discover more insights on how reconciliation times affect business agility and see how a better process can shrink those cycles.

Dealing with Disconnected Systems

So many businesses run on a patchwork of software that doesn’t talk to each other. Your sales team uses one platform for invoicing, your e-commerce site has its own system, and accounting has its general ledger software. This creates data silos. To get everything in one place, you’re stuck manually exporting and importing files—a process that’s both time-consuming and a prime opportunity for errors.

So, how do you get past these hurdles? Smart finance teams focus on building better workflows and putting stronger controls in place. Here are a few strategies that actually work:

- Implement Stronger Internal Controls: Don’t leave documentation to chance. Create a clear, mandatory process for submitting and storing financial documents, like a centralized digital folder where every single invoice and receipt must go. No more chasing down paperwork.

- Use Batch Processing: For accounts with tons of activity, group similar transactions into batches. It's far quicker to reconcile a single batch total than to tick and tie hundreds of individual line items one by one.

- Standardize Your Chart of Accounts: Get everyone on the same page. When the whole company uses the same account codes for the same types of transactions, you prevent the kind of miscategorization errors that are a nightmare to track down later.

By tackling these common roadblocks head-on, you can turn your general ledger reconciliation from a dreaded monthly chore into a smooth, reliable, and even insightful process.

How Technology Changes the Reconciliation Game

If you've ever wrestled with the headaches of manual general ledger reconciliation—chasing down missing documents or drowning in high transaction volumes—you know there has to be a better way. And there is. Technology offers a powerful solution, turning a tedious, error-prone task into a genuinely efficient and accurate process.

This isn't just about working faster; it's about working smarter. Modern reconciliation software fundamentally changes how we approach this task by taking the most time-consuming manual steps off our plates. Instead of having skilled accountants spend hours just ticking and tying line items, these tools do the heavy lifting. This frees up your finance team to step away from clerical work and apply their expertise where it actually matters.

The Power of Automated Matching

The real magic behind this shift is automated transaction matching. Think of it as a super-powered assistant who can compare thousands of transactions in the blink of an eye.

Here’s a quick look at how it works in practice:

- Direct Bank Feeds: The software connects directly to your company’s bank accounts, pulling in statement data automatically and in real time. This single feature gets rid of the whole download-and-upload dance, which immediately cuts out a major source of human error.

- AI-Powered Matching Rules: Smart algorithms and AI learn your transaction patterns over time. The software can intelligently match a deposit in your bank feed to the corresponding invoice in your sub-ledger or spot recurring vendor payments, clearing the vast majority of items without anyone lifting a finger.

- Exception Flagging: For the handful of transactions that don't match up perfectly, the system flags them automatically. This directs your team's attention only to the items that truly need a closer look, turning a search for a needle in a haystack into a simple, manageable to-do list.

When technology handles the repetitive tasks, your finance team can shift from being data checkers to strategic analysts. They can finally focus on interpreting the financial story the data tells, which adds far more value to the business.

A Clear Return on Investment

Putting these tools in place delivers tangible benefits almost right away. Businesses that make the switch report huge reductions in the time it takes to close their books, a near-total elimination of data entry errors, and much clearer, real-time visibility into their cash flow. To see how this fits into the bigger picture, it's worth learning how to automate business processes across your entire organization.

The market is certainly taking notice. The global reconciliation software market was valued at roughly USD 2.01 billion in 2024 and is expected to more than triple to around USD 6.44 billion by 2032. This incredible growth shows just how essential these tools have become for companies that want to be both efficient and accurate.

For any business still stuck in the old way of doing things, looking into automated bank reconciliation software is the clear next step. It’s an investment that pays for itself over and over in time saved, mistakes avoided, and valuable insights gained.

Answering Your Reconciliation Questions

Once you get the hang of general ledger reconciliation, you’ll find a few practical questions always pop up. Getting straight answers to these common sticking points is key to building the confidence you need for a smooth, repeatable workflow.

Let's walk through some of the most frequent questions to give you the clarity you need to move forward.

How Often Should We Reconcile the General Ledger?

The most important thing here is consistency. While there isn't a single rule that fits every business, the most common—and highly recommended—practice is to perform general ledger reconciliation at the end of every month.

This monthly rhythm is a standard part of the month-end close for most companies. It helps you catch discrepancies quickly, before they snowball into much bigger problems that are a nightmare to untangle. If you wait until the end of the quarter or, even worse, the end of the year, you’re not just reconciling—you're conducting a massive forensic accounting project.

For really critical accounts with a ton of activity, like your main bank account, some teams even reconcile weekly or daily. This gives you almost real-time insight into your cash position and keeps the workload from piling up.

The goal is to find a good cadence. For most organizations, a monthly schedule hits that sweet spot between keeping your financial data fresh and accurate without completely overwhelming your accounting team.

Is General Ledger Reconciliation the Same as Bank Reconciliation?

This is a great question, and it’s one that trips a lot of people up. The simplest way to think about it is like this: all squares are rectangles, but not all rectangles are squares.

Bank reconciliation is a type of general ledger reconciliation, but it’s just one piece of the puzzle.

Here's the difference:

- Bank Reconciliation is a very specific task. You’re only comparing the cash balance in your general ledger to the cash balance on your bank statement. Its one and only job is to make sure your books and the bank agree on how much cash you have.

- General Ledger Reconciliation is the whole shebang. It covers all the important accounts on your balance sheet, not just cash. You’ll be reconciling accounts receivable against the sub-ledger of customer invoices, fixed assets against their detailed register, and accounts payable against your pile of supplier bills.

So, while bank reconciliation is probably the most important and frequent reconciliation you’ll do, it's just one chapter in the much bigger story of your company's financial health.

What Is a Good Starting Point for a New Business?

If you’re just getting your business off the ground, congratulations! Now is the perfect time to build good habits, because it's so much easier than trying to fix bad ones down the road. The best approach is to start small and build from there. Don't feel like you need to reconcile every single account right out of the gate.

Instead, focus your energy on the accounts that have the biggest day-to-day impact on your financial health. We often call these the "core accounts."

Here’s a simple checklist to get you started:

- Cash: Start here, always. Reconcile every bank account you have, every single month. This is absolutely non-negotiable.

- Accounts Receivable (AR): Make sure the total AR balance in your general ledger matches the detailed list of all your unpaid customer invoices.

- Accounts Payable (AP): Do the same for what you owe. The AP balance in your GL should match the total of all your unpaid supplier bills.

If you can master reconciling these three areas, you'll have a solid handle on the vast majority of your daily transactions. As your business grows and gets more complex, you can slowly add other accounts—like fixed assets, inventory, and payroll liabilities—to your monthly checklist. By starting with the essentials, you build a rock-solid foundation for financial accuracy.

Ready to stop manually typing data from bank statements into spreadsheets? Bank Statement Convert PDF offers a powerful tool that transforms your PDF bank statements into perfectly formatted Excel files in seconds, eliminating errors and saving you hours of tedious work. Start converting your bank statements today and streamline your reconciliation process.