Getting your bank statement in Excel is about more than just changing a file format. It’s about transforming a static, unhelpful document into a dynamic tool for real financial clarity. You’re essentially shifting from a flat picture of your finances to a fully interactive dashboard. This simple move unlocks the ability to sort, filter, and analyze every single transaction without the headache.

Why Put Your Bank Statement in Excel

Pulling your financial data out of a rigid PDF and into a flexible spreadsheet is the first real step toward taking control of your money. A standard bank statement tells you what happened. An Excel sheet helps you understand why it happened and what you can do about it.

Think about it. If you're a freelancer, this means you can instantly tally up tax-deductible expenses or track quarterly income without reaching for a calculator. If you're managing family finances, it means you can finally see exactly where your money is going, making it much easier to stick to a budget.

Unlock Deeper Financial Insights

The real magic happens when you start organizing and playing with the data. You can finally spot those recurring subscription fees you forgot about, categorize every purchase to see your biggest spending black holes, and create simple charts that show your financial progress over time.

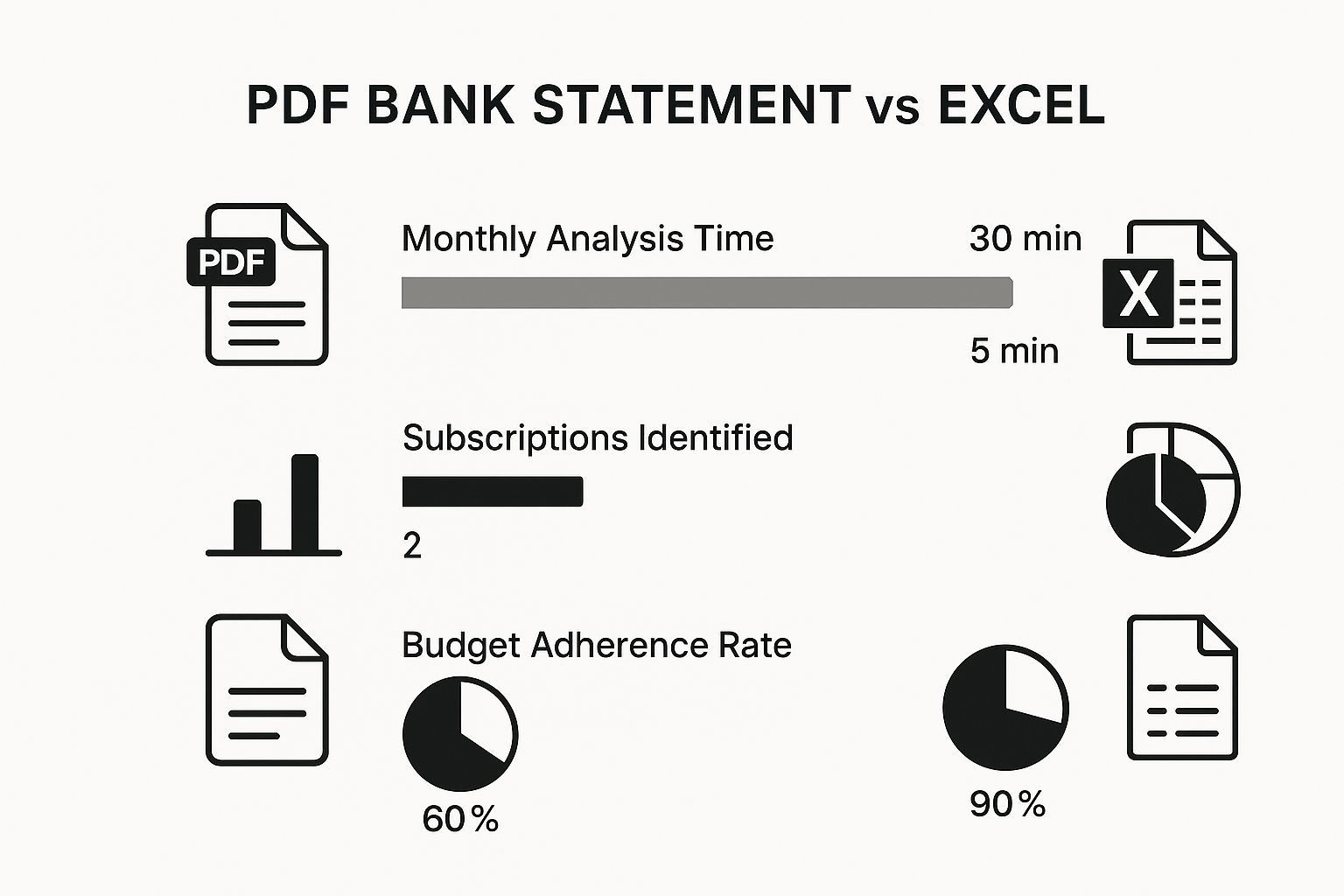

This infographic really highlights the efficiency you gain by ditching the static PDF for a spreadsheet when doing your monthly financial review.

The numbers speak for themselves. You can slash your analysis time and seriously improve your budget adherence just by making this one change.

The bottom line is this: analyzing your bank statement in Excel is about tracking your spending to finally master your money and achieve total financial clarity.

It’s no surprise that using Excel to manage bank statements has taken off. Both individuals and businesses are adopting templates designed specifically for this, allowing them to easily log transactions, calculate balances, and spot spending patterns. If you're looking for a pre-made solution, you can find great bank statement Excel templates on docparser.com.

The value of using Excel for personal finance is a lot like how serious traders rely on building a powerful trading journal Excel template to get a real edge. It’s all about turning raw data into intelligence you can actually use.

Choosing the Right Conversion Method

Getting your bank statement data into Excel isn't a one-size-fits-all task. The best way forward really depends on what you're working with—the complexity of your statement, your tech comfort level, and how much time you've got on your hands. Picking the right tool from the get-go can save you a world of frustration.

Let's walk through the three main ways you can tackle this. Each has its own sweet spot, from a quick personal finance check-in to a full-blown business audit.

Comparison of Bank Statement Conversion Methods

To make it easier to decide, here's a quick side-by-side look at the options. Think about what you need to accomplish, and the right choice should become clear.

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Manual Copy & Paste | A few transactions from a simple, one-page statement. | No special tools needed; it's fast for tiny jobs. | Terrible for most statements; data gets jumbled and requires heavy cleanup. |

| Excel's "Get Data" Tool | Most standard, digitally-generated bank PDFs. | Built right into Excel; surprisingly powerful and free. | Can struggle with scanned documents or unusual layouts. |

| Dedicated Software | Scanned statements, bulk conversions, and complex formats. | Highest accuracy (uses OCR); saves massive amounts of time. | Costs money; might be overkill for a one-off task. |

Ultimately, the goal is clean, usable data with the least amount of effort. Now, let's dive into the specifics of each approach.

H3: Manual Copy and Paste

I'll be honest—this is the "in a pinch" method. If you have a super short, clean statement with maybe 10-15 transactions, a quick copy and paste might just work. You highlight the data in the PDF, copy it, and drop it into a blank Excel sheet.

But here's the reality check: most of the time, this approach is a recipe for a formatting nightmare. Banks rarely design PDFs for easy copying. You’ll often end up with dates, descriptions, and dollar amounts all mashed into a single cell. I'd only recommend this for the absolute simplest scenarios.

H3: Excel's Built-In PDF Importer

Now we're talking. Newer versions of Microsoft 365 come with a fantastic feature called "Get Data From PDF." This tool is specifically designed to scan a PDF, identify tables, and import them cleanly. It’s a game-changer.

When you use it, Excel opens its Power Query editor, which shows you all the tables it found. You just have to pick the one that contains your transaction list and load it. It’s a huge leap from copy-pasting, though it can occasionally get tripped up by messy scans or really funky statement designs.

My Take: For most people working with a standard digital PDF from their bank, Excel's importer is the perfect starting point. It’s a great balance of power and simplicity, cutting down manual cleanup dramatically.

H3: Dedicated Conversion Software

When you need the highest level of accuracy, especially with scanned statements or large batches of documents, specialized software is the only way to go. These tools are built for one purpose: turning financial documents into perfect spreadsheets.

They use advanced Optical Character Recognition (OCR) technology that's been trained on thousands of bank formats. This means they can read scanned text, handle weird layouts, and export perfectly structured data with almost no errors.

If you're a bookkeeper, accountant, or small business owner who regularly needs to get a bank statement in excel, investing in one of the best PDF to Excel converter software options is a no-brainer. It's the professional’s choice for a reason—it just works.

Using Excel's Built-In PDF Importer

If you're running a modern version of Excel, you might be surprised to learn there's a powerful tool for this exact task built right in. You don't need any extra software or subscriptions. The most direct path is often the best, and in this case, it’s Excel’s own PDF import feature.

It's designed to sniff out tables within a PDF and pull them into a workable format. Let's walk through how it works.

To get started, head over to the Data tab in Excel’s main ribbon. From there, you'll navigate to Get Data > From File > From PDF. This will pop open a standard file browser, letting you track down and select the bank statement PDF you need to convert. It's a simple start to a surprisingly sophisticated process.

Navigating the Power Query Editor

Once you’ve picked your file, Excel gets to work. Instead of just dumping a mess of data into a new sheet, it launches the Power Query Navigator. This is where you get to guide the import process.

You'll see a preview window like this one:

Excel analyzes the PDF and presents you with every table and page it was able to identify. You can click on each item in the list on the left to see a preview on the right.

Your bank statement will likely show up as several different tables, especially if it’s more than one page long. Your job is to find the main table—the one with the actual transaction data like dates, descriptions, debits, and credits. Don’t be surprised if you also see smaller, irrelevant tables containing things like account summaries or page footers. You can just ignore those.

Pro Tip: See a folder icon in the Navigator list? That's a great sign. Clicking it usually combines all the related transaction tables from every page into one clean, unified list. This little trick can save you a huge amount of manual copy-and-pasting later.

After highlighting the right table, you’ll see two buttons at the bottom:

- Load: This button drops the data straight into a new worksheet. It’s a good choice if the PDF data looks perfect in the preview, but that's rarely the case.

- Transform Data: This is almost always the better choice. It opens the full-blown Power Query Editor, giving you a chance to clean everything up before it hits your spreadsheet.

Making Initial Data Transformations

Think of the Power Query Editor as your data-cleaning workshop. It’s here that you can fix all the little annoyances that come with PDF conversions. For instance, you can easily remove repetitive header rows that show up on every page or filter out blank rows that got pulled in by mistake.

A common issue I see is the date and transaction description getting squished into a single column. Power Query’s "Split Column" feature is perfect for fixing that.

The best part? Every adjustment you make—like removing a column or filtering rows—is logged as an "Applied Step" on the right side of the screen. This creates a repeatable recipe. Next month, when you get your new statement, you can just point the query to the new file, hit refresh, and Excel will automatically apply all the same cleaning steps for you.

This built-in method is incredibly effective, but it's not the only way to get the job done. For a different approach, check out our other guide on how to copy PDF data into Excel.

Time for a Little Data Janitor Work

Getting your bank statement data into Excel is a great start, but let's be honest—it's rarely a clean import. Now comes the part where we roll up our sleeves and turn that jumbled mess into something genuinely useful. This cleanup process is the make-or-break step for having an accurate bank statement in Excel.

You'll almost always notice some oddities right away. Things like leftover headers from the PDF, dates and descriptions crammed into one column, or—my personal favorite—numbers that Excel thinks are just plain text. We have to tackle these issues before we can do any real analysis.

For example, your statement might show a transaction as "01/15/2024 AMAZON PRIME." Good luck trying to sort or filter that column by date. This is where a couple of handy Excel functions come into play.

Splitting and Trimming Your Columns

The first order of business is usually breaking apart those combined columns. For this, Excel's TEXTSPLIT function is a game-changer. If your jumbled data is sitting in cell A2, you can use a formula like =TEXTSPLIT(A2, " ") to split it wherever there's a space. Just like that, the date and vendor are in their own separate cells.

You might also find pesky extra spaces lurking at the beginning or end of your text, which can throw off your formulas.

The

TRIMfunction is your best friend for this. It strips away all those sneaky leading and trailing spaces. A simple=TRIM(A2)will clean up the cell and make your data much more reliable.

With your columns separated and tidy, you can move on to making sure everything is in the right format.

Getting Your Data Types Right

It’s incredibly common for numbers from a PDF to land in Excel as text. This means you can't add them up, which defeats the whole purpose. The VALUE function is the perfect fix. If your withdrawal amount in cell C2 is stubbornly formatted as text, just use =VALUE(C2) to convert it back into a number Excel can work with.

Once converted, you can select the whole column and format it as Currency. While you're at it, double-check that your date column is formatted as Date. This small step is what allows you to sort your transactions by month, quarter, or year with just a few clicks.

While these manual cleanup methods are essential to know, it's worth noting that the financial industry relies on more advanced tools for this. Bank statement analysis is a crucial part of monitoring cash flow and evaluating creditworthiness. Today, AI-powered software often automates the heavy lifting, analyzing millions of transactions in seconds. You can discover more insights about automated bank statement analysis on nanonets.com.

For those who frequently work with different file formats, understanding how to handle them is key. You can learn more about working with a CSV file in Excel to make your entire process even smoother.

Categorizing Transactions to Find Spending Insights

Now that your data is clean and organized in Excel, this is where the magic happens. We're about to turn that raw list of transactions into a goldmine of financial information. After all, the whole point of putting your bank statement in Excel is to actually understand your finances and track your spending to master your money.

The first, and most important, move is to add a new column to your spreadsheet. Just label it "Category." This one small addition is the key that unlocks everything, letting you group your spending and see precisely where your money is flowing each month.

Building Your Category Framework

You don’t need to overcomplicate things at the start. In fact, it's better if you don't. Just create a handful of broad categories that reflect your life or business.

Here are a few common ones to get you started:

- Groceries: For all your food and supermarket runs.

- Utilities: Covers the essentials like electricity, water, and internet.

- Subscriptions: All those recurring charges for Netflix, Spotify, or software.

- Shopping: For general retail therapy and other non-essential purchases.

- Income: To tag any deposits, paychecks, or payments you receive.

With this simple structure, your transaction list instantly becomes an organized ledger. This is the foundation for creating budgets and spotting trends. For businesses, creating a dedicated business expense tracking spreadsheet is the logical next step.

Let Formulas Do the Heavy Lifting

Manually assigning a category to hundreds of transactions? No thank you. That's a surefire way to get bored and give up. The smarter approach is to let Excel do the tedious work for you.

You can set up a formula that automatically assigns a category based on keywords in the transaction description. It's surprisingly simple to implement.

For example, you can create a rule that says if a transaction description contains "Walmart," assign it the "Groceries" category. If it contains "Shell," it gets tagged as "Gas/Auto." This simple technique can often categorize 80-90% of your transactions in seconds.

By setting up a separate reference table with your keywords and corresponding categories, you can use formulas like VLOOKUP or even the newer XLOOKUP to automate the whole process. This is the secret to turning a static spreadsheet into a dynamic financial dashboard that gives you real, actionable insights.

Your Questions Answered

When you start pulling bank statements into Excel, a few common questions always pop up. Let's tackle some of the most frequent hurdles people run into.

Can I Automate This Process for Monthly Statements?

Yes, and honestly, you really should. The best way to do this is by setting up your import and cleanup steps in Excel's Power Query Editor. Think of it as creating a recipe that Excel can follow every single time.

Once you’ve configured that workflow, you just point the query to the new month's PDF and hit 'Refresh'. All your saved transformations—like getting rid of blank rows or splitting columns—are applied automatically. This is a huge timesaver and keeps your financial records perfectly consistent month after month.

How Do I Handle Debits and Credits in Separate Columns?

This is a classic bank statement headache. You'll often end up with withdrawals in one column and deposits in another, which isn't great for analysis. The goal is to merge them into a single ‘Amount’ column.

The trick is to create a new column with a simple formula. Something like =IF(ISNUMBER(DebitCell), -DebitCell, CreditCell) works perfectly. This formula checks for a number in the debit column, makes it negative if it finds one, and otherwise just pulls the positive value from the credit column.

This one change gives you a single, clean column of data. It’s so much easier to sum, sort, and use in charts or pivot tables, giving you a much clearer picture of your actual cash flow.

My Bank Lets Me Download a CSV File. Should I Use That?

If your bank offers a download in CSV (Comma-Separated Values) or any other spreadsheet format, you should use it 100% of the time. Seriously, don't even bother with the PDF.

A CSV file is already structured data, meaning you can open it directly in Excel without any of the messy conversion or cleanup steps. It's the most direct and accurate way to get your bank statement data into a spreadsheet, hands down.

Stop wrestling with messy PDFs. Bank Statement Convert PDF provides the specialized software you need to transform your bank statements into clean, organized Excel spreadsheets in just a few clicks. Take control of your financial data by visiting us at https://bankstatementconvertpdf.com.