Manually copying and pasting data from a PDF bank statement into a spreadsheet? It’s more than just tedious—it’s a silent killer of productivity and a major source of hidden costs. It seems simple enough on the surface, but this old-school method slowly drains time and, worse, invites expensive errors into your financial records. Thinking you can save a few bucks by manually handling the need to convert from pdf to csv is a classic false economy.

Why Manual PDF Data Entry Is Costing You

Let's be real—nobody gets excited about transcribing financial data line by line. It’s a mind-numbing task that feels outdated for a reason. But beyond the sheer boredom and time wasted, this manual process introduces real, tangible risks that can seriously impact your bottom line, leading to everything from bad business decisions to compliance nightmares.

Think about a small business owner knee-deep in tax prep. They might spend hours, or even full days, punching in transactions from a year's worth of PDF bank statements. A single misplaced decimal or one skipped line item is all it takes to throw off the entire tax filing. This could easily trigger a stressful audit or financial penalties. This isn't just a worst-case scenario; it's a common trap that turns a routine job into a high-stakes gamble.

The Snowball Effect of Small Errors

A tiny mistake in your financial data rarely stays tiny. One wrong number can contaminate an entire dataset, leading directly to skewed forecasts and poor strategic moves. When your team is stuck checking and re-checking manual entries, their focus shifts from sharp analysis to tedious data validation. That’s a huge waste of their expertise.

This is where automation stops being a "nice-to-have" and becomes a strategic necessity. The best converters are built specifically to solve this problem:

- Accuracy: Top-tier tools can hit over 99% accuracy, which all but eliminates human error.

- Efficiency: They can chew through documents in seconds, not hours.

- Security: Your sensitive financial data is handled securely, without the risks of manual handling.

The Real Price of Inaction

If you’re sticking with manual methods, you’re basically accepting these hidden costs as the price of doing business. All those hours spent on data entry could be invested in activities that actually grow your company, like nurturing client relationships or developing new strategies.

The constant risk of inaccurate data can damage your financial health, making it tougher to secure a loan or make confident investment decisions. To really get a handle on the damage outdated processes can cause, it's worth digging into the real cost of manual document filing. Looking into different data entry automation software options can show you a clear path to getting that time and accuracy back.

Key Takeaway: Moving from manual entry to an automated solution completely changes how you view the need to convert from pdf to csv. It's no longer just a technical chore; it's a fundamental business upgrade that boosts accuracy, frees up time, and shores up your entire financial operation.

Some services out there, like Rocket Statements, are already processing more than 2.5 million statements per month across 1,000 banks in 50 countries. That kind of scale shows just how massive the demand is for reliable, automated conversion. When major companies adopt this technology, it’s a clear signal that the days of costly manual errors are numbered. You can see more on how Fortune 500 companies are ditching manual entry in this piece from Rocket Statements' insights.

Choosing Your PDF to CSV Conversion Method

When you need to convert from pdf to csv, the sheer number of options can feel a bit overwhelming. The reality is, there's no single "best" way to do it—the right choice really hinges on what you're trying to accomplish. A freelancer converting one invoice a month has completely different needs than a finance team processing thousands of bank statements.

Let's walk through the main contenders: dedicated software, free online converters, and the built-in functions of your favorite spreadsheet program. Each one comes with its own unique trade-offs in accuracy, speed, security, and how well it scales up.

Dedicated Conversion Software

For anyone handling sensitive financial documents regularly, dedicated desktop software is almost always the way to go. I've found these tools are built from the ground up for high accuracy, especially with the kind of complex tables and weird layouts you see in bank statements.

A huge plus here is security. Since all the processing happens right on your computer, your data never gets uploaded to some random server. This approach is perfect for high-volume work or when you just can't afford mistakes. Yes, there's usually a cost involved, but the time saved and errors avoided make it a worthwhile investment.

Free Online Converters

The promise of a free, browser-based tool is tempting, I get it. For a quick, one-off conversion of a non-sensitive document, they can get the job done. You just drag, drop, click, and download. But that convenience comes with some serious risks, especially when you're talking about financial data.

Here's the catch: when you upload that PDF, you're sending it to a third-party server. At that point, you've lost control over your information. Privacy policies can be murky, and you have no real guarantee of how your data is being stored, used, or who has access to it. Accuracy is often hit-or-miss, too, with many free tools struggling to make sense of financial tables.

The decision to use an online converter really boils down to one question: Are you comfortable sending your private financial data to an unknown server just for a little convenience? For most businesses, the answer should be a hard no.

Built-in Spreadsheet Functions

Modern spreadsheet programs like Microsoft Excel and Google Sheets have gotten pretty smart, with features to import data directly from PDFs. Excel’s Power Query, for example, is a surprisingly powerful tool that can often recognize and pull tables right out of a document.

This method is a decent middle ground. It’s far more secure than an online converter because the file stays within your local software ecosystem. The downside? It can have a bit of a learning curve and often requires some manual cleanup to get the data formatted correctly. For a deeper look, you can explore some of the best PDF to Excel converter software to see how they stack up against these built-in options.

Comparing PDF to CSV Conversion Methods

To make the choice clearer, here’s a side-by-side comparison of the methods we've discussed. This should help you quickly pinpoint the best fit based on what matters most to you—whether that's airtight security, flawless accuracy, or pure speed.

| Method | Best For | Accuracy | Security Risk | Speed & Scalability |

|---|---|---|---|---|

| Dedicated Software | High-volume, sensitive data (e.g., bank statements, invoices) | Very High | Very Low | Excellent |

| Free Online Converters | One-off, non-sensitive documents | Inconsistent | High | Poor |

| Built-in Functions | Occasional conversions of simple PDFs; tech-savvy users | Moderate to High | Low | Moderate |

Ultimately, the right tool is the one that aligns with your specific workflow and security requirements. For serious or recurring tasks, investing in a dedicated tool is almost always the smarter long-term decision.

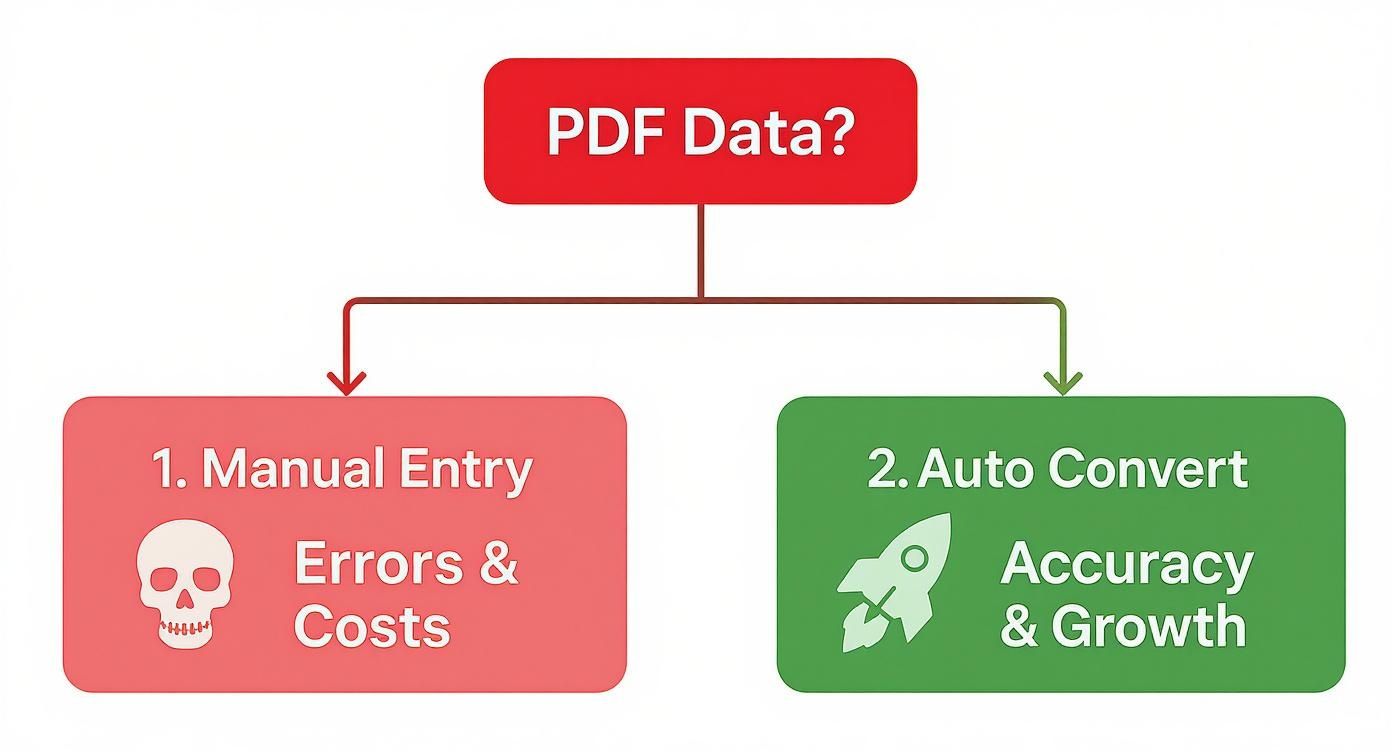

This decision tree gives you a great visual for the choice between manual entry and an automated approach, highlighting just how different the outcomes are.

The infographic lays it out perfectly: sticking with manual entry leads to errors and mounting costs, while embracing automation is your path to better accuracy and real business growth.

Using a Dedicated Converter: A Practical Guide

Moving on from manual data entry to a dedicated converter is a massive leap in efficiency. These tools aren't generic PDF editors; they're purpose-built to understand the often tricky and inconsistent layouts of bank statements. This is where you stop wrestling with your documents and let smart software do the heavy lifting for you.

Let's walk through what the process actually looks like. I'm not going to just list steps; I want you to understand the why behind each action. This way, you can get a perfect CSV on the first try, every time.

This kind of interface is typical for a good converter. It's clean, lets you upload your PDF, and immediately shows a preview of the extracted data. The most important feature here is the ability to visually map out the PDF's structure before you commit to the final conversion.

Prepping Your PDF for a Clean Conversion

You’ve probably heard the old saying, "garbage in, garbage out." Well, it couldn't be more true here. The quality of your original PDF has a direct, and significant, impact on the accuracy of your final CSV file. A quick check before you upload can save you a headache later.

First, figure out what kind of PDF you have. Is it a native PDF (digitally generated by your bank) or a scanned PDF (a picture of a paper statement)?

- Native PDFs: This is the gold standard. The text is already machine-readable, which means the data extraction will be nearly flawless.

- Scanned PDFs: These require an extra step called Optical Character Recognition (OCR) to turn the image into readable text. If the scan is blurry, crooked, or has shadows, you're going to get errors. If you can, rescan the document at a higher quality—at least 300 DPI—and make sure it's straight.

The Conversion Process: From Upload to Preview

With your PDF ready, the next step is to upload it into the converter. Most modern tools will immediately give you a preview of the extracted data, which is your chance to fine-tune the results before exporting. This interactive step is what separates a great tool from a mediocre one.

The software will take its best guess at identifying columns like Date, Description, Deposits, and Withdrawals. But let's be realistic—every bank formats its statements a little differently. Your job is to act as the human supervisor, verifying and, if needed, correcting what the software has done. You might need to click and tell the tool, "Hey, this is the transaction date column," or show it how to tell a credit from a debit.

A common pitfall I see all the time is with multi-page statements. Always, and I mean always, check if the converter correctly identified the table headers on the second, third, and subsequent pages. Sometimes the column mapping from page one doesn't carry over, and you end up with jumbled data from page two onward.

Fine-Tuning Your Extracted Data

This is the final, and arguably most important, part of the process. Before you eagerly hit that "Export to CSV" button, take a minute to scan the data preview for common slip-ups.

Look for things like:

- Merged Columns: Has a long transaction description spilled over into the withdrawal column?

- Weird Date Formats: Are all the dates in a consistent format that your spreadsheet software will understand?

- Split Rows: Has a single, long transaction been mistakenly broken into two separate lines?

Most dedicated converters give you simple, intuitive editing tools to fix these issues right in the preview. You can merge or split columns, correct a typo in a single cell, and delete extra rows that aren't transaction data (like those summary boxes or marketing blurbs banks love to add).

If you want to see what different software offers, you can explore our breakdown of various financial data extraction tools.

Trust me on this: spending an extra two minutes making these small adjustments inside the converter is infinitely faster than trying to clean up a messy CSV in Excel later. It ensures the data you export is accurate, properly structured, and ready for whatever analysis you have planned.

Navigating the Inevitable Conversion Glitches

https://www.youtube.com/embed/2k6NneSMYNc

Let's be realistic: even the best conversion software will stumble from time to time. You’re bound to hit a PDF that just refuses to play nice. At their core, PDFs are designed to look good on a screen, not to hand over their data in a neat, organized package. When you convert from pdf to csv, you're asking a tool to interpret a visual layout and turn it into a structured database. It's a bit of an art, and sometimes, things get messy.

But don't get discouraged. Most of these conversion headaches are surprisingly common and, more importantly, totally fixable. A little troubleshooting savvy is all you need to wrangle a jumbled mess into a pristine CSV.

Let’s walk through some of the classic problems you'll run into and how to sort them out.

Untangling Merged and Split Columns

This one is probably the most frequent frustration. You'll look at your data preview and see a long transaction description suddenly spilling over into the "Withdrawals" column, knocking your entire row out of whack. This is a classic symptom of a PDF with funky internal spacing or invisible boundaries that confuse the software.

The opposite can also happen. A single column in your bank statement, like "Transaction Details," might get chopped into two or three separate columns in the CSV. This tells you the converter is mistaking the spaces within the description for column dividers.

Luckily, the fix for both issues is usually right there in your converter's editing tools. Before you hit that final "Export" button:

- For split columns: Find the "Merge Columns" tool. Just select the columns that were incorrectly split and combine them back into one.

- For merged data: Look for a "Split Column" feature. Click on the header of the oversized column and draw a new line right where the data should be divided.

Taking a minute to make these adjustments in the preview stage is a thousand times easier than trying to clean up a mangled CSV in a spreadsheet program later.

Correcting Jumbled Rows and Data Errors

Ever converted a statement only to find a single purchase spread across two or three separate rows? It’s a common problem, especially when banks use multi-line descriptions or add extra details below the main transaction line. The software often misinterprets each new line of text as a completely new transaction, leaving you with fragmented, unusable rows.

Another related headache comes from character recognition errors, particularly with scanned documents. A low-quality scan can easily cause the software to mistake a "0" for an "O" or spit out random symbols.

Pro Tip: Your best bet is to prevent these issues from the start. Before you even upload the file, make sure your scans are crisp and clean. A straight, high-resolution scan at 300 DPI or more gives the Optical Character Recognition (OCR) engine the best possible shot at getting it right the first time.

If you’re already facing jumbled rows, look for a "Merge Rows" function in your converter. It lets you select the broken pieces of a single transaction and stitch them back together. For any OCR goofs, you can almost always click directly into the problematic cell in the preview window and manually correct the typo before you export. These quick, upfront edits are the key to getting a final dataset you can actually trust.

Alright, you've successfully wrestled your data out of that locked-down PDF and into a clean CSV file. That's a huge step, but the real work—and the real payoff—is about to begin. Now you get to turn that raw data into something genuinely useful.

This is where you go from just having a list of numbers to actually understanding what they mean for your finances or your business.

The great thing is, your new CSV file is ready to use in tools you probably already have open, like Microsoft Excel or Google Sheets. With just a few simple moves, you can start spotting spending patterns and building a much clearer financial picture.

A Little Housekeeping First: Essential Data Cleanup

Before you can slice and dice the data, it pays to do a quick cleanup. Even the best converter can't fix everything, and a few stray inconsistencies can throw off your entire analysis. I’ve learned this the hard way.

Here are a few things I always check first:

- Consistent Date Formats: Make sure all your dates look the same (e.g., MM/DD/YYYY). Inconsistent formats are a classic rookie mistake that will mess up any attempt to sort or filter by time. Just highlight the column and use the "Format Cells" function to get them all in line.

- Hunt for Duplicates: Duplicate entries are sneaky. They can easily creep in, especially if you're merging statements from different months or accounts. Thankfully, most spreadsheet programs have a one-click "Remove Duplicates" tool that makes short work of this.

- Split and Merge Columns: Sometimes, a single column contains too much information. For example, a transaction description might have both the vendor and the store number. Use the "Text to Columns" feature to break that out into separate, sortable fields. This makes filtering for specific vendors so much easier.

Find the Story in Your Data with Pivot Tables

Once your data is clean, you can start digging for insights. And for that, there's no better tool than a pivot table. Don't be intimidated if you've never used one—they are your best friend for summarizing massive datasets without needing to write a single formula.

Imagine you have an entire year's worth of transactions. A pivot table can instantly group everything by category—like "Utilities," "Travel," or "Supplies"—and give you a clean summary of what you spent in each. You can see the big picture in seconds.

Automating the switch to convert from pdf to csv is a massive time-saver. We're talking about an average of 8–12 hours per employee per week that's no longer spent on mind-numbing data entry. This not only frees people up for more strategic work but also slashes data entry errors from a startling 15% down to less than 1%. For more on how businesses are using this reclaimed time, check out this detailed report.

This is how you bridge the gap between having raw data and making smart decisions with it. By using these simple analysis techniques, you turn a static document into a powerful tool for financial insight.

And if you're feeling ready to take your analysis to the next level, our business intelligence tools comparison is a great place to see what's possible with more advanced software.

Got Questions About PDF to CSV Conversion?

If you're diving into converting your bank statements from PDF to CSV, you're bound to have a few questions. It’s a common task, but one that comes with its own set of quirks. Let's walk through some of the things people ask most often so you can sidestep the usual headaches.

Can I Convert a Scanned PDF to CSV?

Yes, you can, but it’s not as simple as a regular conversion. This is where a technology called Optical Character Recognition (OCR) becomes your best friend.

Think of a scanned PDF as just a flat picture of your statement. Your computer can't read the words and numbers on it any more than it can read a photograph. An OCR engine acts like a pair of digital eyes, scanning that image, recognizing the shapes of letters and numbers, and translating them into actual text. Once that's done, the data can be structured into a CSV file.

The key here is scan quality. A crisp, clear scan will give you fantastic results. A blurry, skewed, or low-resolution one? Not so much. The good news is that most modern, dedicated converters have a powerful OCR function built right in, so they handle this process for you automatically.

Are Online PDF to CSV Converters Safe?

This is a big one, and the answer is: it really depends on what you're converting. Many free online tools ask you to upload your file to their server. If it's a menu from your local pizza place, no big deal.

But we're talking about bank statements. These documents are packed with sensitive personal and financial information. Uploading that to a random website's server is a massive security gamble—you have no idea who sees it or where it's stored.

For anything confidential, your safest bet is desktop software that keeps everything on your own machine. The other secure option is a modern web-based tool that does all the processing locally in your browser, meaning your data never actually gets uploaded to a server.

Here's a simple rule I always follow: If I wouldn't email the document to a stranger, I'm not uploading it to a generic online converter. When it comes to financial data, you can never be too careful.

Why Does My Converted CSV Have Formatting Errors?

This is probably the most common frustration people face. Formatting errors happen because PDFs are designed to look good, not to be a neat database. Their priority is preserving the visual layout, which often makes pulling clean data a nightmare.

You'll run into all sorts of weird issues:

- Merged Cells: A single piece of information might be stretched across what should be multiple columns.

- Multi-line Rows: One transaction description could be split across two or three lines, confusing the converter.

- Weird Spacing: Inconsistent spaces can trick the software into creating extra, blank columns all over your spreadsheet.

This is precisely why a good conversion tool is more than just a "click-and-convert" button. The best ones give you a preview and let you step in to fix things. They have tools that let you manually split columns that got merged or join rows that were broken apart before you export the final CSV.

Tired of fighting with messy PDFs? If you want clean, usable data from your financial documents without the hassle, Bank Statement Convert PDF is built for exactly that. It's a secure and powerful tool designed to handle the unique challenges of bank statements. Try our converter today and see how easy it is to convert from pdf to csv.