Relying on manual accounts payable processes is like navigating with a paper map in the age of GPS. It's slow, prone to errors, and leaves your team buried in paperwork instead of focusing on strategic financial initiatives. From tedious data entry to chasing down approvals, the hidden costs of manual AP are substantial, encompassing wasted time, missed early payment discounts, and strained vendor relationships. The constant risk of duplicate payments and human error can silently drain your company’s resources and damage its reputation.

But what if you could reclaim that time, cut processing costs significantly, and gain unprecedented control over your cash flow? This isn't just a hypothetical scenario; it's the reality for businesses that embrace automation. The accounts payable automation benefits extend far beyond simple efficiency gains, transforming the entire function into a strategic asset.

In this comprehensive guide, we will move past the abstract and dive into the concrete advantages. We'll explore eight specific, high-impact benefits that modern finance teams are leveraging to drive accuracy, improve supplier partnerships, and support scalable growth. Forget the paper shuffle. Let's examine how you can turn your AP department from a reactive cost center into a proactive, value-driven powerhouse for your organization.

1. Turbocharge Processing Speed and Efficiency

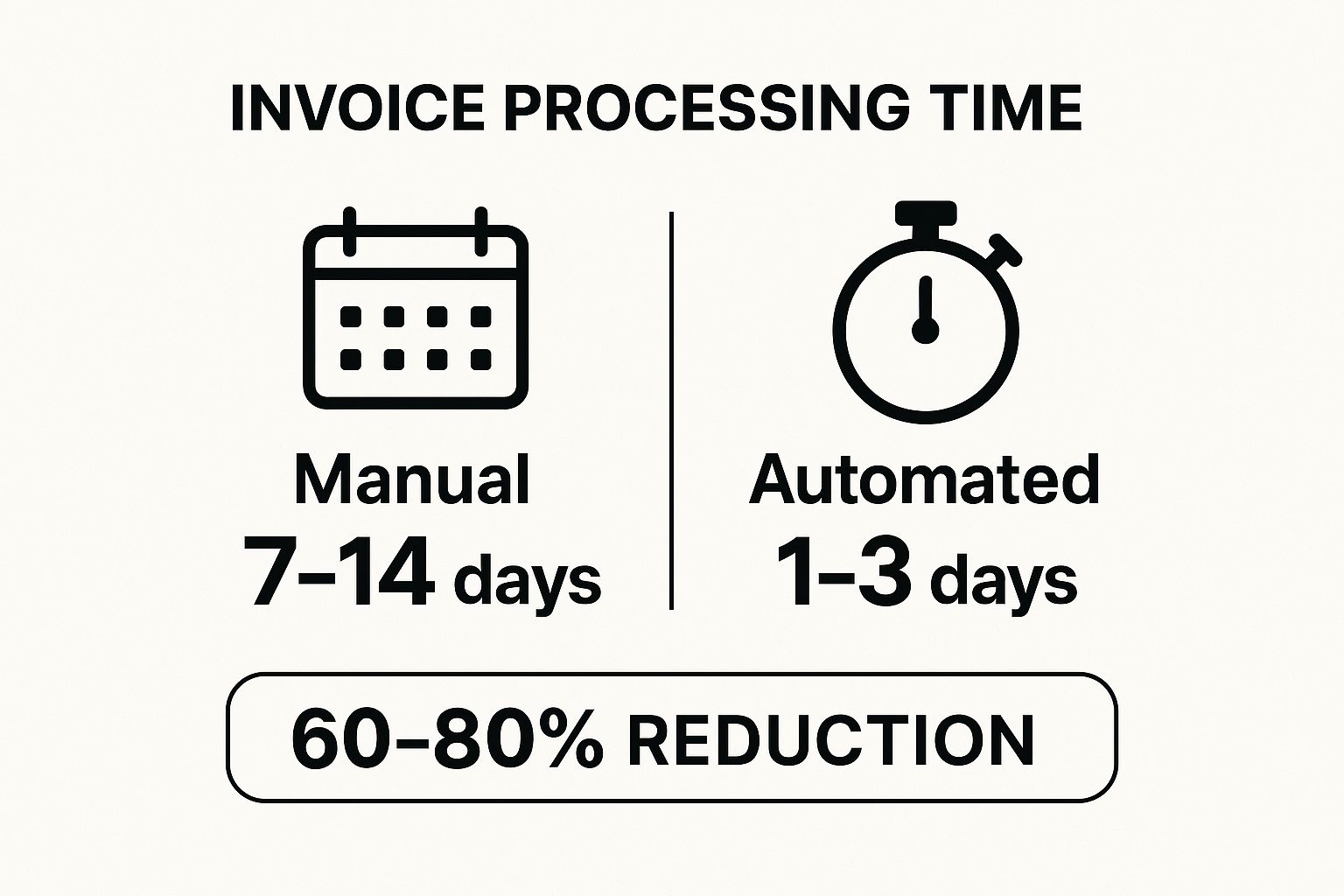

One of the most immediate and impactful accounts payable automation benefits is the dramatic acceleration of invoice processing. Manual accounts payable is a notoriously slow, multi-step process involving paper handling, data entry, physical routing for approvals, and manual payment scheduling. This traditional workflow often takes a sluggish 7 to 14 days per invoice.

Automation transforms this bottleneck into a high-speed, streamlined operation. By leveraging technologies like Optical Character Recognition (OCR) and intelligent data capture, the system instantly extracts and verifies invoice information, eliminating manual data entry. Pre-configured workflows then automatically route invoices to the correct approvers based on vendor, amount, or department, cutting down approval wait times. The entire cycle, from receipt to payment readiness, can be completed in just 1 to 3 days.

The following infographic visualizes the stark contrast in processing timelines between manual and automated systems.

This significant reduction in processing time is not just about speed; it empowers your AP team to focus on strategic, value-added activities instead of tedious administrative tasks. For a detailed look at how specific AP processes are transformed, explore the advantages of automated invoice processing.

Real-World Impact

Global companies have demonstrated the power of this efficiency. Siemens, for example, successfully cut their invoice processing time from 14 days down to just 3. Similarly, Coca-Cola European Partners achieved an impressive 75% faster processing speed after implementing automation, turning their AP department into a strategic asset.

How to Implement for Maximum Speed

- Start with Quick Wins: Begin by automating high-volume, standardized invoices from your key suppliers. This approach demonstrates value quickly and builds momentum for a wider rollout.

- Define Approval Hierarchies: Before implementation, map out and codify your approval workflows. Clear, pre-set rules are essential for the software to route invoices instantly and without ambiguity.

- Leverage Automated Notifications: Set up automated email or system alerts for approvers when an invoice requires their attention. This eliminates the need for manual follow-up and keeps the process moving.

2. Significant Cost Reduction

One of the most compelling accounts payable automation benefits is the drastic reduction in operational costs. Manual invoice processing is expensive, with industry estimates placing the cost per invoice between $12 and $15. These costs encompass labor hours for data entry, approval chasing, and payment execution, as well as physical expenses for paper, printing, postage, and document storage.

Automation directly targets and minimizes these expenditures. By digitizing the workflow, it eliminates the need for paper and its associated costs. More importantly, it dramatically reduces the manual labor required per invoice, cutting the processing cost down to as low as $2 to $5. This frees up significant financial resources that can be reallocated to more strategic business initiatives.

The following graphic illustrates the direct financial savings achieved by transitioning from a manual to an automated accounts payable system.

This cost efficiency is a core advantage that provides a clear and measurable return on investment. Organizations can better understand their financial health and make data-driven decisions by leveraging various accounting automation tools that provide visibility into these savings.

Real-World Impact

Major corporations have validated these savings at scale. Honeywell, for instance, slashed its per-invoice processing cost from $15 down to just $3. In the public sector, the City of Phoenix achieved a remarkable 70% cost reduction in its AP operations after implementing automation, proving the model's effectiveness across different industries.

How to Implement for Maximum Savings

- Calculate Total Cost of Ownership: Before starting, conduct a thorough analysis of your current manual processing costs, including often-overlooked expenses like error correction and storage. This creates a clear baseline to measure ROI against.

- Negotiate Volume-Based Pricing: When selecting a software vendor, inquire about tiered or volume-based pricing models. As your invoice volume grows, your per-invoice cost should decrease, maximizing long-term savings.

- Factor in Early Payment Discounts: The speed gained from automation allows you to consistently capture early payment discounts offered by suppliers. Include these potential savings in your ROI calculations to build a stronger business case.

3. Enhanced Accuracy and Error Reduction

Another core accounts payable automation benefit is the drastic improvement in data accuracy. Manual data entry is inherently prone to human error, with typical error rates ranging from 1% to 5%. These mistakes, such as incorrect amounts, duplicate payments, or wrong vendor details, can lead to costly overpayments, strained supplier relationships, and significant time wasted on reconciliation.

Automation all but eliminates these issues by replacing manual keying with advanced technology. Systems use validation rules, three-way matching (comparing purchase orders, invoices, and goods receipts), and duplicate invoice checks to ensure every detail is correct before processing. This systematic verification achieves an accuracy rate of 95-99%, safeguarding your company’s financial integrity and preventing costly, hard-to-detect errors.

This leap in accuracy translates directly to financial savings and operational stability. By preventing payment errors before they happen, automation protects your cash flow and frees up AP staff to focus on strategic analysis rather than firefighting preventable mistakes. This level of precision is a key reason why businesses see such a rapid return on their investment in AP solutions.

Real-World Impact

Leading companies provide compelling evidence of this benefit. Johnson & Johnson virtually eliminated duplicate payments, reducing them by 99% after implementing automation. Similarly, PepsiCo saw a dramatic drop in invoice exceptions from 25% down to just 5%, while Texas Instruments achieved an impressive 98% straight-through processing rate, meaning invoices pass through the system without any manual intervention.

How to Implement for Maximum Accuracy

- Implement Strong Vendor Governance: Maintain a clean and centralized vendor master file. This ensures that payments are always directed to the correct, verified supplier accounts and prevents fraudulent or duplicate entries.

- Configure Comprehensive Validation Rules: During setup, define strict rules for data fields. For example, mandate specific formats for PO numbers or set tolerance levels for price discrepancies to automatically flag potential issues.

- Audit Exception Reports: Regularly review reports on flagged exceptions. This helps identify recurring error patterns with specific vendors or invoice types, allowing you to address the root cause and further refine your automated workflows.

4. Better Cash Flow Management

One of the most strategic accounts payable automation benefits is the ability to achieve superior cash flow management. Manual AP processes often obscure financial visibility, making it difficult to track outstanding liabilities, predict future cash needs, and time payments effectively. This lack of real-time data can lead to missed discount opportunities, late payment penalties, and inefficient use of working capital.

Automation provides a centralized, real-time dashboard of all payable activities. With instant access to invoice statuses, payment due dates, and total outstanding obligations, finance leaders can forecast cash requirements with high accuracy. This visibility allows businesses to strategically decide when to pay suppliers, either taking advantage of every early payment discount or holding onto cash longer to optimize working capital without risking late fees.

This level of control transforms the AP department from a simple cost center into a strategic driver of financial health. It empowers businesses to make informed decisions that directly impact their liquidity and profitability. For a deeper understanding of these principles, explore the fundamentals of effective cash flow management for small business.

Real-World Impact

The impact on working capital is substantial. General Electric famously improved its working capital by $2 billion through better payment timing and supply chain finance initiatives powered by automation. Similarly, Walmart has captured millions in additional early payment discounts annually by using technology to identify and execute optimal payment schedules.

How to Implement for Maximum Control

- Establish Discount Capture Workflows: Configure your automation system to automatically flag all invoices with early payment discount opportunities. Set rules to prioritize and expedite these invoices through the approval and payment process.

- Create Payment Obligation Dashboards: Use the reporting tools within your AP software to build a real-time dashboard showing upcoming payment deadlines. Categorize payments by date, vendor, and amount to get a clear view of short-term cash needs.

- Leverage Data for Better Terms: Use your pristine payment history, enabled by automation, as a negotiating tool with suppliers. A track record of reliable, on-time payments can help you secure more favorable payment terms and discounts in the future.

5. Improved Vendor Relationships

Beyond internal efficiencies, one of the most valuable accounts payable automation benefits is the enhancement of supplier and vendor partnerships. Manual AP processes often cause friction due to delayed payments, lost invoices, and a lack of transparency into payment status. This uncertainty can strain relationships and even lead to less favorable contract terms.

Automation fundamentally changes this dynamic by creating a reliable, transparent, and consistent payment ecosystem. Automated systems provide vendors with self-service portals to track invoice status and payment schedules in real-time, drastically reducing the need for back-and-forth communication. By ensuring invoices are processed accurately and paid on time, you build a reputation as a dependable partner, which can lead to better pricing, preferential treatment, and a more resilient supply chain.

This shift transforms the AP function from a transactional cost center into a strategic relationship management hub, fostering trust and collaboration with key suppliers.

Real-World Impact

Leading organizations have leveraged automation to strengthen these critical partnerships. Kaiser Permanente achieved an impressive 95% vendor portal adoption, providing suppliers with unprecedented visibility. Similarly, Unilever successfully reduced vendor payment inquiries by 75%, freeing up both their AP team and their vendors' time. Home Depot saw a direct impact on satisfaction, with their vendor rating scores climbing from 6.5 to 8.2 after streamlining their AP processes.

How to Implement for Maximum Impact

- Provide Comprehensive Vendor Onboarding: Don't just launch a portal; create clear training materials, tutorials, and support channels to ensure vendors can easily adopt the new system.

- Offer Multiple Submission Methods: Initially, allow vendors to submit invoices through various channels (e.g., portal, email, EDI) to ease the transition before standardizing on your preferred method.

- Communicate Payment Schedules Clearly: Use the automated system to provide vendors with clear, predictable information on when they can expect payment, eliminating ambiguity and building trust.

6. Enhanced Compliance and Audit Trail

A critical, yet often overlooked, accounts payable automation benefit is the creation of a robust, transparent, and easily searchable audit trail. Manual processes, reliant on paper trails and email chains, create significant compliance risks. Documents can be lost, approvals can be undocumented, and reconstructing the history of a transaction for an audit can be a painstaking, resource-intensive ordeal.

Automation solves this by systematically capturing every touchpoint in the invoice lifecycle. From the moment an invoice is received to the final payment, the system creates a detailed, time-stamped log of every action, including data extraction, GL coding, approvals, and any modifications. This digital, tamper-proof record provides complete visibility and ensures adherence to internal policies and external regulations like the Sarbanes-Oxley Act (SOX).

This comprehensive documentation simplifies audit preparation from a multi-week fire drill into a routine, low-stress task. Instead of manually gathering documents, auditors can be given read-only access to the system to pull necessary records instantly, demonstrating strong internal controls and reducing compliance-related costs. For accountants seeking to manage these digital records effectively, exploring the best document management software for accountants can provide valuable insights.

Real-World Impact

Leading companies have leveraged automation to fortify their compliance frameworks. IBM, for instance, slashed its audit preparation time from several weeks down to just a few days. Similarly, Deutsche Bank successfully used automation to achieve full SOX compliance within their AP processes, while Johnson Controls now passes all AP-related audit requirements automatically, showcasing the power of a system-enforced control environment.

How to Implement for Maximum Compliance

- Involve Compliance Teams Early: Collaborate with your compliance and internal audit teams during the system design phase. Their input is crucial for configuring workflows and rules that meet all regulatory requirements.

- Implement Role-Based Access Controls: From day one, configure strict, role-based permissions. This ensures that employees can only view or act on invoices relevant to their specific job function, enforcing segregation of duties.

- Establish Automated Compliance Rules: Work with your vendor to build automated checks and balances directly into the workflow. For example, automatically flag invoices that exceed certain thresholds or lack a valid purchase order.

7. Superior Visibility and Reporting

A significant benefit of accounts payable automation is gaining unprecedented, real-time visibility into the entire AP lifecycle. Manual processes often create information silos, where invoice statuses, payment liabilities, and cash flow projections are fragmented across spreadsheets, emails, and filing cabinets. This lack of transparency makes it nearly impossible to get an accurate, up-to-the-minute financial picture.

Automation centralizes all AP data into a single, accessible platform. Comprehensive dashboards provide at-a-glance insights into key performance indicators (KPIs) like invoices processed, approval cycle times, and days payable outstanding. Finance teams can instantly track the status of any invoice, monitor accruals for month-end close, and generate customizable reports to analyze spend patterns, enabling data-driven decisions that optimize financial operations.

This enhanced visibility turns the AP department from a reactive cost center into a proactive, strategic unit. With clear data, leaders can identify bottlenecks, forecast cash requirements with greater accuracy, and contribute valuable insights to the wider organization. For more on leveraging this data, explore these financial reporting best practices.

Real-World Impact

Leading global companies leverage this visibility for strategic advantage. Nestlé, for instance, implemented real-time AP dashboards across more than 50 countries to standardize monitoring and improve process control. Similarly, Adobe used the superior reporting from its automated system to help reduce its month-end close time from a lengthy eight days down to just three.

How to Implement for Maximum Visibility

- Define Key Metrics First: Before implementation, identify the KPIs that matter most to your business, such as cost-per-invoice, on-time payment rate, and early payment discount capture rate. This ensures your dashboards are tailored to your strategic goals.

- Create Role-Based Dashboards: Customize views for different users. An AP manager might need to see team productivity metrics, while a CFO will want high-level cash flow and liability reports.

- Set Up Automated Alerts: Configure the system to send automatic notifications for critical events, such as a high-value invoice nearing its due date or an invoice stuck in approvals for too long. This enables proactive management of exceptions.

8. Scalability and Business Growth Support

A key strategic advantage of accounts payable automation is its ability to support and facilitate business growth. Manual AP departments are rigid; as invoice volume increases, so does the need for more staff, more office space, and more resources. This creates an operational drag that can stifle expansion, as scaling requires a linear and costly increase in headcount.

Automation breaks this restrictive link between volume and resources. An automated system can process ten thousand invoices with nearly the same efficiency as it processes one thousand, without demanding proportional staff increases. Cloud-based AP solutions, popularized by platforms like Sage Intacct and QuickBooks Online, are particularly adept at this, offering virtually limitless capacity. This inherent scalability ensures that your back-office functions can effortlessly keep pace with rapid expansion, mergers, or seasonal peaks.

This ability to handle increased volume efficiently is a core component of the long-term accounts payable automation benefits, transforming the AP function from a cost center into a strategic enabler of growth. It allows a business to expand its operations globally or enter new markets without being constrained by administrative capacity.

Real-World Impact

The power of scalable AP is evident in hyper-growth companies. Amazon, for instance, scaled its AP operations to process millions of vendor invoices globally, a feat impossible with manual methods. Similarly, Shopify automated its accounts payable to seamlessly support its explosive merchant growth, ensuring financial operations never became a bottleneck to its platform's expansion.

How to Implement for Maximum Scalability

- Choose Cloud-Based Solutions: Prioritize cloud-native or SaaS AP platforms. Their infrastructure is designed for elasticity, allowing you to scale up or down based on transaction volume without capital expenditure on servers.

- Plan for Future Integrations: Select a system with a robust API. As your business grows, you will likely add new software (e.g., ERPs, procurement systems), and a flexible AP solution will need to integrate seamlessly with them.

- Implement Modular Systems: Opt for solutions that allow you to add features and modules as you grow. You might start with basic invoice processing and later add features for international payments or advanced analytics as your business needs evolve.

Accounts Payable Automation Benefits Comparison

| Aspect | Improved Processing Speed and Efficiency | Significant Cost Reduction | Enhanced Accuracy and Error Reduction | Better Cash Flow Management | Improved Vendor Relationships | Enhanced Compliance and Audit Trail | Superior Visibility and Reporting | Scalability and Business Growth Support |

|---|---|---|---|---|---|---|---|---|

| Implementation Complexity 🔄 | Moderate; initial setup and configuration can be time-intensive | Moderate to high; significant upfront software and IT costs | Moderate; careful config of validation rules needed | High; requires integration with banking and treasury systems | Moderate; vendor onboarding and training required | High; requires careful system config and ongoing compliance maintenance | Moderate; training needed for effective use | Moderate; system upgrades and integrations may be needed |

| Resource Requirements | OCR tech, automated workflows, staff training | Software licenses, IT infrastructure, subscription fees | Strong data governance, validation rule setup | Integration with cash management systems, accurate payment data | Vendor self-service portals, communication resources | Security controls, compliance team involvement | Dashboard and reporting tools, data quality control | Cloud infrastructure, API integrations, performance monitoring |

| Expected Outcomes 📊 | 60–80% reduction in invoice processing time | 60–75% reduction in per-invoice processing cost | 90–95% error reduction, fewer duplicate payments | 80–90% increase in early payment discount capture | 30–40% increase in vendor satisfaction, 70% fewer inquiries | 60–70% reduced audit prep time, real-time compliance monitoring | 40–50% faster month-end close, proactive issue resolution | Supports volume growth without linear cost increases |

| Ideal Use Cases 💡 | High-volume invoice processing, urgent payment needs | Organizations seeking ROI via cost savings | Companies prioritizing payment accuracy and error prevention | Firms needing optimized working capital and payment timing | Businesses focusing on vendor satisfaction and retention | Entities with strict compliance requirements (e.g., SOX) | Teams needing real-time AP insights and KPI tracking | Fast-growing companies requiring scalable AP solutions |

| Key Advantages ⭐ | Automates data capture & workflow, frees staff for strategy | Significant operational cost savings, scalable cost structure | Prevents costly errors & duplicate payments, improves financial accuracy | Improves cash forecasting, reduces penalties, maximizes discounts | Boosts vendor relations, reduces disputes, improves payment predictability | Ensures tamper-proof audit trails, reduces compliance risk | Provides data-driven decision support, monitors bottlenecks | Handles volume spikes easily, supports global expansion |

Making the Leap: Your Next Step Towards AP Excellence

The evidence is clear and compelling. Transitioning from manual accounts payable processes to an automated system is no longer a luxury for large enterprises; it is a strategic necessity for businesses of all sizes aiming for resilience and growth. We've explored the multifaceted accounts payable automation benefits, moving far beyond simple efficiency gains to uncover a fundamental transformation of the finance function.

From the dramatic acceleration of invoice processing and the significant reduction in operational costs, to the near-elimination of costly human errors, the immediate ROI is undeniable. But the true value emerges as these initial gains compound. Enhanced accuracy and streamlined workflows lead directly to better cash flow management, empowering you to capitalize on early payment discounts and avoid late fees. This newfound reliability strengthens vendor relationships, turning transactional partnerships into strategic alliances.

From Tactical Fix to Strategic Asset

Ultimately, automation elevates the AP department from a reactive cost center to a proactive, strategic asset. The robust audit trails and enhanced compliance features mitigate risk and turn stressful audits into straightforward reviews. Furthermore, the superior visibility and reporting capabilities provide the real-time data needed for agile decision-making. You can finally move beyond asking "what did we spend?" to strategically analyzing "how can we spend smarter?" This shift is crucial for scaling your operations without proportionally increasing your back-office headcount.

As you consider this transformation, it's vital to grasp the core principles that drive these systems. To lay a solid foundation for your initiatives, delving into understanding business process automation is a crucial next step. This knowledge will empower you to better evaluate solutions and champion the project internally.

Your Action Plan for AP Modernization

The journey toward a fully automated AP department begins with a single, decisive step. Rather than being intimidated by a complete overhaul, focus on an incremental approach.

- Assess Your Current State: Document your existing AP workflow. Identify the most significant bottlenecks, a key step in pinpointing where automation will deliver the biggest impact.

- Define Your Goals: What do you want to achieve? Faster processing times? Lower costs? Better data? Set specific, measurable objectives.

- Explore Solutions: Research AP automation software that aligns with your goals and integrates with your existing accounting systems.

- Start Small: Begin with a pilot project, perhaps automating one part of the process, like invoice data capture, to demonstrate value and build momentum.

By embracing the powerful accounts payable automation benefits we've discussed, you are not just optimizing a single department. You are investing in the financial health, operational agility, and long-term competitive advantage of your entire organization. The future of finance is automated, and the time to make your leap is now.

Ready to take the first step in your automation journey? While full-scale AP systems are a big investment, you can start digitizing key documents today with Bank Statement Convert PDF. Our tool helps you instantly convert bank and credit card statements from PDF to Excel or CSV, streamlining reconciliation and data entry. Try Bank Statement Convert PDF to see how simple data automation can be.