Looking for a reliable bank reconciliation format in excel free download? You've come to the right place. A solid template is hands-down the fastest way to get your books in order, transforming what feels like a complex chore into a straightforward monthly check-in.

Your Secret Weapon: A Simple Excel Template

Before we jump into the download, let's talk about why a well-made Excel template is such a powerful tool. It's not just a blank spreadsheet; it's a pre-built framework designed to catch the small, costly mistakes that often go unnoticed—think hidden bank fees or even fraudulent charges quietly draining your account.

A good template does more than just hold your numbers. It uses formulas to automatically highlight any differences between what you have in your records and what the bank statement says. That simple feature immediately points you to the exact problem areas, slashing the risk of human error. Think of it as a foundational step for financial clarity, perfectly complementing other proven strategies for positive cash flow.

Catching Small Errors Before They Become Big Problems

When you don't have a consistent process, it's incredibly easy for minor issues to slip through the cracks and grow over time. A template brings much-needed structure, giving you dedicated spots to track all the moving parts.

- Outstanding Checks: These are the checks you've written and recorded, but they haven't been cashed yet.

- Deposits in Transit: Money you've logged as received, but it's still being processed by the bank.

- Bank Service Fees: Those little charges that are so easy to miss but can really add up.

Having this level of detail means your financial records are always accurate. You can feel confident during an audit and make smarter business decisions because you have a crystal-clear view of your actual cash situation. For those looking to take efficiency a step further, you can also learn how to automate data entry.

Even with all the fancy accounting software out there, Excel still holds its ground. Industry data shows that 65-75% of mid-sized businesses rely on Excel templates for their monthly bank reconciliations because of how flexible they are. A well-designed template can cut reconciliation errors by as much as 50%.

To help you get started, it's useful to know what goes into a great template.

A high-quality bank reconciliation template is more than just a grid of cells; it's an organized system with distinct sections, each playing a crucial role in ensuring your financial records are accurate and complete. Below is a breakdown of the key components you should look for.

Key Components in Your Bank Reconciliation Template

| Component | Purpose | Key Benefit |

|---|---|---|

| Header Information | Clearly identifies the reconciliation period and account being reviewed. | Prevents confusion and ensures you're working on the correct statement. |

| Bank Balance Section | Starts with the ending balance from the bank statement. | Provides a clear starting point for the entire reconciliation process. |

| Book Balance Section | Starts with the ending balance from your company's cash book or ledger. | Establishes your internal record's position before adjustments. |

| Adjustments to Bank Balance | Lists items recorded in your books but not yet on the bank statement. | Accounts for timing differences like outstanding checks and deposits in transit. |

| Adjustments to Book Balance | Lists items on the bank statement but not yet recorded in your books. | Captures missed transactions like bank fees, interest earned, or NSF checks. |

| Reconciled Balance | The final adjusted balance, which should match for both the bank and book sides. | Confirms that all discrepancies have been identified and accounted for. |

Understanding these components will help you not only fill out the template correctly but also appreciate how each part contributes to a clear and accurate financial picture.

How to Find and Download a Reliable Excel Template

Let’s be honest, a quick search for a "bank reconciliation format in excel free download" often leads you down a rabbit hole of spammy sites and clunky, poorly designed files. The whole point is to find a tool that actually saves you time, not one that makes you wish you'd just built it yourself from scratch.

So, where do you look? I always tell people to start with the most obvious but often overlooked source: Microsoft's own Office template library. You know these templates are clean, safe, and will work perfectly with your version of Excel. Another great place to find quality downloads are the resource pages of well-known accounting software companies. They often give away excellent templates as a way to show off their expertise.

What to Look For in a Good Template

Before you hit that download button, take a second to vet the template. A truly useful one will have a few tell-tale signs of quality.

First, look for a clean layout with crystal-clear labels. If you see vague headings or, worse, locked cells that hide the formulas, that's a major red flag. You want transparency to see how the numbers are being crunched. For a solid example of what to aim for, this bank statement excel template has the kind of professional structure you want.

Here's a quick mental checklist I run through when evaluating a new template:

- Is it compatible? Make sure it works with your Excel version, whether it's Office 365, Excel 2016, or something else.

- Are there instructions? A template with a dedicated "Instructions" tab or helpful notes is a godsend.

- Does it have the essentials? It absolutely must have dedicated columns for outstanding checks, deposits in transit, and bank fees. These are the core components of any real reconciliation.

- Can I tweak it? You should be able to add or remove a column without the whole spreadsheet imploding.

My Pro Tip: The first thing I look for is a "Reconciled Balance" or "Difference" cell that automatically updates. Its job is to calculate the difference between your adjusted bank balance and your company's book balance, and it should always equal zero when you're done. If that core formula is missing, just close the file and find another one. It's the whole reason you're using a template in the first place.

Getting Your Hands Dirty: A Practical Walkthrough of the Template

Alright, you've downloaded the file. Let's open it up and get to work. I find the best way to learn is by doing, so we'll walk through a common scenario together. Imagine we're running a small retail shop and need to reconcile last month's books.

First things first, we need our two starting points. Grab your official bank statement for the period and find the closing balance. Pop that number into the cell labeled "Bank Balance" in the template. Next, open your company’s cash book or accounting software and find the closing balance there. That figure goes into the "Book Balance" cell.

Don't panic if they don't match. In fact, they almost never do—that's precisely why we're doing this.

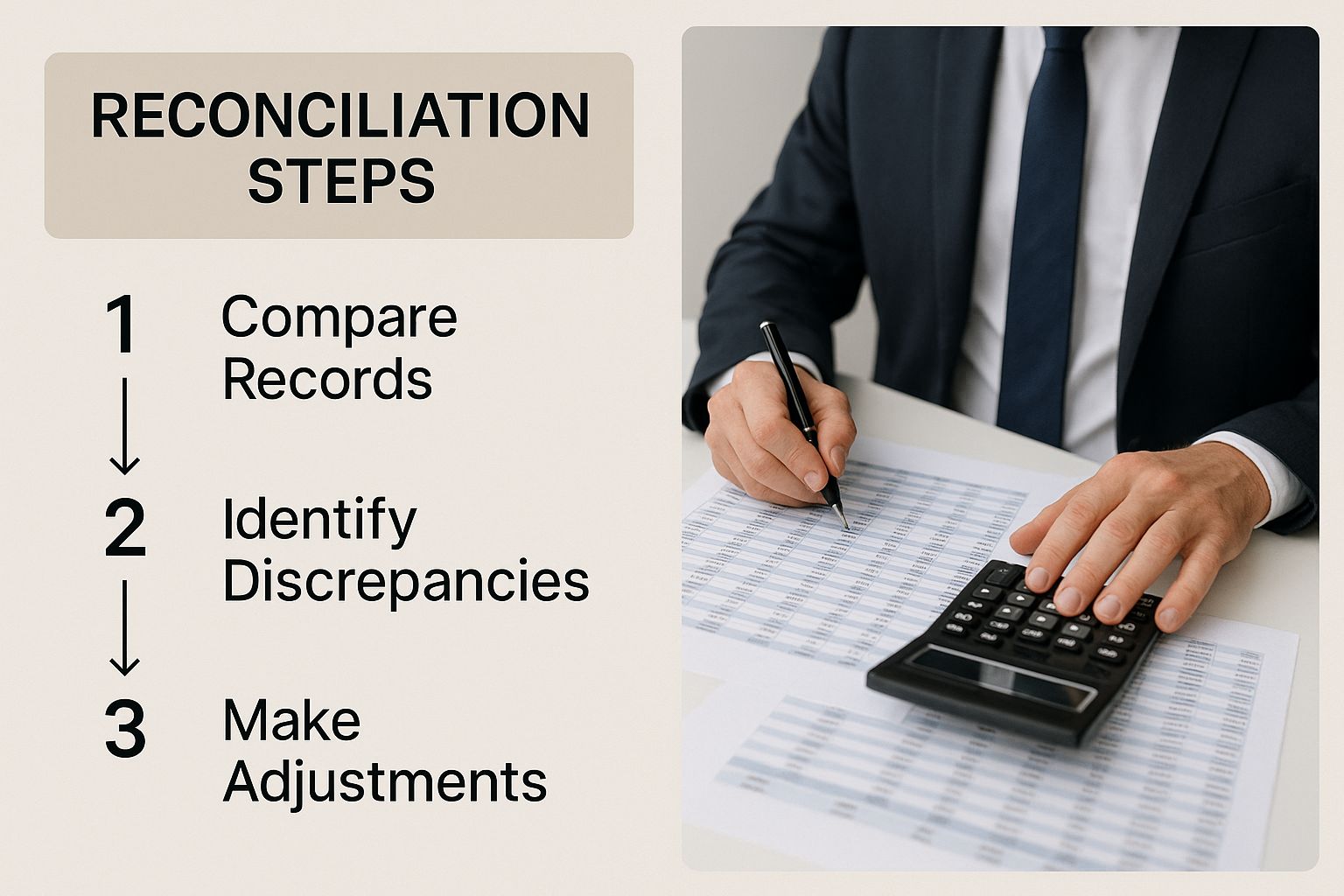

The whole point is to bridge the gap between what your bank says and what your books say. This process makes sure every dollar is accounted for.

As you can see, it’s a logical flow: start with your balances, add or subtract the items causing the differences, and arrive at an accurate, reconciled figure.

Time for Some Detective Work: Finding the Reconciling Items

Now comes the fun part—finding the discrepancies. Your goal is to hunt down every transaction that shows up in one record but is missing from the other. This is where a good template really proves its worth, giving you dedicated sections for the most common culprits.

You'll typically work on two sides of the reconciliation: adjusting the bank's balance and adjusting your own books.

Adjustments to the Bank Balance:

- Outstanding Checks: Did you write a check to a supplier on the 30th? You recorded it, but they haven't cashed it yet. It won't be on your bank statement. List it here.

- Deposits in Transit: Remember that batch of checks you deposited late on the last day of the month? It's in your books, but the bank is still processing it. Note it down.

Adjustments to Your Book Balance:

- Bank Service Charges: Your bank statement shows a $15 monthly fee. That’s a real expense you need to record in your books.

- Interest Earned: Hey, free money! If your account earned a few dollars in interest, you need to add that as income to your records.

As you plug in each of these items, you’ll see the magic happen. The template's formulas automatically update the adjusted balances in real-time. This is a massive time-saver and a huge step up from scribbling on a notepad. Honestly, using a properly structured template like this can slash reconciliation errors by up to 40%. If you want a more detailed breakdown of the mechanics, our complete guide on how to do bank reconciliation in Excel is a great resource.

Common Bank vs Book Reconciliation Items

To make it even clearer, here’s a quick-reference table showing where you’ll most likely need to make an adjustment.

| Reconciliation Item | Typical Adjustment Location | Example |

|---|---|---|

| Outstanding Checks | Bank Side | You wrote a check on June 28th, but it wasn't cashed until July 3rd. |

| Deposits in Transit | Bank Side | You deposited customer payments on June 30th that cleared on July 1st. |

| Bank Service Fees | Book Side | The bank charged a $10 monthly maintenance fee you hadn't recorded yet. |

| Interest Earned | Book Side | Your checking account earned $5.25 in interest for the month. |

| NSF Checks | Book Side | A customer's check bounced; the bank reversed the deposit. |

| Bank Errors | Bank Side | The bank accidentally processed a $100 deposit as $10. |

This table should help you quickly categorize items as you find them on your statements.

The moment of truth arrives when the "Adjusted Bank Balance" and "Adjusted Book Balance" finally match. Seeing that "Difference" cell hit zero is the goal—it’s the ultimate confirmation that your financial records are accurate and perfectly aligned with the bank's.

Getting Your Bank Statements into Excel the Easy Way

https://www.youtube.com/embed/Z2ryRCBL3vw

Let’s be honest: manually typing out every single transaction from a PDF bank statement into a spreadsheet is a soul-crushing task. It’s slow, tedious, and, worst of all, a perfect recipe for typos that can throw your entire reconciliation off balance. I’ve been there, and it’s no fun.

This is exactly why getting your PDF bank statements converted directly into Excel is such a lifesaver. You can skip the mind-numbing data entry and pull all the information you need in just a few clicks. It's a simple trick that can easily cut your prep time in half, letting you get straight to the important work of actually matching up the numbers.

Finding the Right Conversion Tool for the Job

You've got a couple of solid options for moving that data from a PDF into your bank reconciliation format in excel free download. The best one for you really depends on what version of Excel you’re using and how frequently you need to do this.

-

Excel's Own "Get Data" Feature: If you're running a newer version like Microsoft 365 or Excel 2021, you're in luck. There’s a fantastic built-in tool called "Get Data From PDF" right under the Data tab. It's surprisingly good at cleanly pulling data from most bank statements.

-

Dedicated Online Converters: There are also plenty of websites designed for this exact purpose. These are usually fast and super convenient, especially if you just need a quick conversion on the fly.

For a really detailed breakdown of these methods, including security tips and a full walkthrough, our guide on how to convert a bank statement PDF to Excel has everything you need to know.

A Quick Tip From Experience: Before you start converting anything, do a quick check to see if your bank lets you download statements directly as a CSV or Excel file. This is always the best-case scenario—it's the cleanest and most reliable data you can get. If the PDF is your only option, I always try Excel's built-in "Get Data From PDF" tool first. It’s often more accurate than other services and has the huge advantage of keeping your sensitive financial data on your own computer. This one habit has saved me from countless headaches.

Taking Your Template to the Next Level

A free template is a fantastic starting point, but the real magic happens when you start to tailor it to your own business. Once you've got the hang of the basic reconciliation process, a few small customizations can turn that generic spreadsheet into a powerhouse tool that gives you a much clearer picture of your cash flow.

One of the first things I always do is apply some conditional formatting. It’s incredibly useful. For instance, you can set up a rule that automatically highlights any discrepancies in bright red. Another great use is flagging any transactions over a specific amount—say, anything over $1,000—for a closer look. This simple visual trick saves a ton of time you'd otherwise spend hunting through rows of data.

Build a Quick Summary Dashboard

Here's another powerful trick: create a summary dashboard on a new tab. It doesn't need to be fancy. Just link a few key cells from your reconciliation tab—like the final reconciled balance—to the new sheet. Do this every month, and you'll have a running, at-a-glance view of your cash position over time.

You might also find these small upgrades make a big difference:

- Protect Key Cells: It's a good idea to lock the cells that contain your formulas. This simple step prevents you or someone else from accidentally deleting a formula and breaking the whole sheet.

- Add Drop-Down Lists: Use Excel's data validation feature to create drop-down menus for common transaction categories, like bank fees or specific vendor payments. This keeps your data clean and consistent.

It's worth noting how impactful structured templates can be. I've seen countless businesses benefit, and the data backs it up. Companies that use them tend to report 20% fewer month-end discrepancies than those relying on more informal methods. For small businesses that can't spring for pricey accounting software, these free tools are an absolute game-changer.

Ultimately, a well-organized template isn't just about balancing your books; it's a critical tool for preparing accurate financial statements and getting a true, comprehensive view of your company's financial health.

Answering Your Top Excel Reconciliation Questions

When you first start wrangling bank reconciliations in Excel, a few questions always seem to surface. Let's walk through the most common ones I hear, so you can keep the process moving smoothly.

How Often Should I Reconcile My Accounts?

For most businesses, tackling this once a month is the sweet spot. It lines up perfectly with your monthly bank statements, making it a natural part of your financial routine. This rhythm helps you spot and fix any discrepancies before they snowball.

But what if you run a business with a ton of daily transactions, like a busy coffee shop or an e-commerce store? In that case, you might find that reconciling weekly gives you a much better handle on your cash flow.

What if the Balances Don't Match?

Okay, so you've entered all your data, and the numbers just don't add up. First thing's first: don't panic. This happens to everyone, and the fix is usually something simple. It's often just a minor data entry mistake or a transposed number—think typing $83 when you meant $38.

My go-to troubleshooting method is to start with the basics. First, I double-check that the opening and closing balances I plugged in from the bank statement and my own books are 100% correct. If that doesn't solve it, I'll scan for easily missed items like bank service fees or interest earned. Those little details are often the culprits.

Can I Use This Template for Multiple Bank Accounts?

Absolutely. Using one workbook for all your accounts is a smart way to stay organized. Just duplicate the template's worksheet tab for each new account.

You can do this by right-clicking on the tab at the bottom of the Excel window and selecting "Move or Copy." Then, just rename the new tabs to keep things clear, like "Business Checking" and "Company Savings."

Tired of typing out every single line from your bank statements? Bank Statement Convert PDF can instantly turn those PDF statements into clean, ready-to-use Excel files. It's a massive time-saver. You can check it out at https://bankstatementconvertpdf.com.