For many accounting firms, the best document management software isn't just one thing—it's a powerful combination of practice management, secure client portals, and smart workflow automation. All-in-one platforms like TaxDome and Karbon are popular for this very reason, while specialized tools such as SmartVault shine with their tight integrations into the tax software firms already use.

Why Your Firm Needs More Than a Digital Filing Cabinet

If your firm's "document management" is really just a bunch of folders on a shared drive, you're not just disorganized. You're leaving massive amounts of efficiency and security on the table. Think about the time wasted hunting down a single client email for a specific bank statement or trying to figure out which version of a tax form is the final one. That manual chaos is a quiet but constant drain on your resources and profitability.

A true Document Management System (DMS) is so much more than a digital filing cabinet; it’s the central nervous system for your entire firm. It acts as an intelligent hub, built to manage a document's entire journey—from the moment a client securely uploads it to its automated approval and compliant, long-term archiving. The goal here is to get past simple storage and build a streamlined, secure, and genuinely productive operation.

The Shift from Storage to Strategy

Making the jump to a dedicated DMS isn't just an upgrade; it's becoming a strategic necessity. You can see this shift happening across the industry, with the global DMS market valued at USD 8.7 billion in 2024 and projected to hit nearly USD 39 billion by 2034. That explosive growth shows just how many firms are ditching basic tools for sophisticated platforms that can truly handle their document-centric work.

To really get why these modern solutions are so powerful, it helps to understand the basics of What is a Document Management System (DMS). Having that foundation makes it clear how these systems offer so much more value than a simple cloud folder ever could.

Core Pillars of an Effective Accounting DMS

A modern DMS for accountants is really built on four critical pillars, each designed to solve the biggest headaches in the profession:

- Ironclad Security: This is non-negotiable. You need features like end-to-end encryption and precise access controls to protect sensitive client financial data.

- Automated Compliance: The system should take the guesswork out of complex regulations, like IRS retention policies, by using automated rules and creating clear audit trails.

- Seamless Integrations: It has to play nicely with your other tools. A great DMS connects effortlessly with your accounting software, CRM, and practice management platforms to create one unified system.

- Workflow Automation: This is where the magic really happens. Automation can handle repetitive tasks like client onboarding, document review cycles, and approval processes, freeing up your team for higher-value work.

The image below gives you a sense of how modern platforms bring all these functions together into a single, centralized dashboard.

This kind of centralized view helps your whole team track tasks and deadlines, making sure nothing slips through the cracks. It's a world away from the disjointed mess of managing files scattered across emails and local drives—a process that can easily lead to errors in critical tasks, like the ones we detail in our guide on the https://bankstatementconvertpdf.com/bank-reconciliation-formula/.

Fortifying Your Client Data with Unbreakable Security

As an accountant, you’re the guardian of your clients' most sensitive financial information. Protecting this data isn't just a best practice—it's your fundamental duty. A simple password on a shared drive is like putting a bicycle lock on a bank vault. It might stop a casual snooper, but it offers zero real defense against a determined threat. Real security demands a multi-layered approach that protects data at every turn.

Think of the best document management software as a digital fortress. It’s built not just to store information but to actively defend it from every possible angle. That means protecting data while it's just sitting on a server (at rest), while it's being sent to a client (in transit), and controlling exactly who can access it and when.

Locking Down Data with End-to-End Encryption

Your first line of defense is end-to-end encryption. This is the digital equivalent of an unbreakable code that only the sender and the intended recipient can decipher. When a client uploads a tax return or you send over a financial statement, encryption scrambles the data into a completely unreadable format.

Even if a hacker somehow managed to intercept the file on its journey, all they would see is a meaningless jumble of characters. The data is only unscrambled when it reaches its destination and is unlocked with a unique digital key. This simple process ensures sensitive information stays completely private, whether it’s being uploaded, downloaded, or just stored away.

Granting Access with Granular Controls

A digital vault needs more than just a big lock; it needs a smart security guard. That’s where granular access controls come in. Let's be honest, not everyone on your team needs access to every single client file. A junior associate handling bookkeeping has no business seeing the partner's M&A diligence files.

A proper document management system lets you set precise, role-based permissions. You can control exactly who can do what, on a document-by-document or folder-by-folder basis.

- View-Only Access: Lets team members see a document but not edit or download it. Perfect for review.

- Edit Access: Grants permission to make changes, with every version meticulously tracked.

- Upload/Download Rights: Controls who can add new files to a client’s folder or export them.

- Delete Permissions: Restricts the ability to permanently remove files—a power you’ll want to limit to senior staff or admins.

This level of control dramatically cuts down the risk of accidental data leaks or unauthorized changes. It ensures people only interact with the information they absolutely need to do their job.

A data breach isn't just a technical failure; it's a catastrophic breakdown of client trust. For accounting firms, the reputational damage can be far more costly and long-lasting than any initial financial loss.

Verifying Identity with Multi-Factor Authentication

A stolen password is one of the oldest tricks in the book—and it still works. Multi-factor authentication (MFA) is your firm’s best defense against it. Think of it as a second, powerful security checkpoint that goes way beyond a simple username and password.

When logging in, MFA demands a second form of verification. This could be:

- A code sent to a mobile phone via SMS.

- A prompt from an authenticator app (like Google Authenticator).

- A biometric scan, like a fingerprint or Face ID.

By requiring this extra step, you make sure that even if a team member's password falls into the wrong hands, your firm's data stays locked down. This simple feature isn't a "nice-to-have" anymore; it's a non-negotiable standard for modern security.

Maintaining a Digital Paper Trail

Finally, in a profession where accountability is everything, a detailed audit trail is non-negotiable. This feature acts as a complete, unchangeable log of every single action taken within the system. It records who accessed a file, when they viewed it, what changes they made, and if they downloaded or shared it.

This digital paper trail is invaluable for compliance, internal investigations, and proving due diligence. It gives you irrefutable evidence of your firm's security protocols in action. Software built specifically for accountants often goes a step further by emphasizing security measures like data encryption and controlled access to meet regulatory requirements like GDPR and HIPAA. You can see how these standards are applied by exploring some of the top financial process solutions available today.

Juggling the Complex Maze of Industry Compliance

For any accountant, compliance isn't just a box to tick—it's the foundation of your practice. We're all juggling a dizzying number of regulations, from GDPR and HIPAA to the very specific IRS document retention policies. It often feels like walking a tightrope; one slip-up, one misplaced file, and you’re facing steep penalties or, even worse, a complete loss of client trust. This is exactly where a solid document management system stops being a nice-to-have and becomes your firm's compliance backbone.

A modern DMS takes this heavy, complex burden and turns it into a manageable, automated process. Forget relying on sticky notes and calendar alerts to track document lifecycles. The right software acts as your firm's digital compliance officer, making sure every single file is handled by the book.

Automating Document Retention and Destruction

One of the biggest compliance headaches I see is simply knowing how long to keep what. The IRS, for example, has different retention periods for different types of records. If you hold onto documents for too long, you're creating unnecessary risk. But if you get rid of them too soon? That’s a recipe for legal disaster.

A dedicated DMS tackles this head-on with automated retention policies. You can create rules that tag documents with a specific "shelf life" from the moment they're uploaded.

- Set it and forget it: You can assign a 7-year retention policy to all client tax returns, and the system takes it from there.

- Automated purging: Once a document’s time is up, the system can flag it for secure destruction. This ensures you aren't hoarding sensitive data longer than legally required.

- Legal holds: What if a client is under audit? Easy. You can place an indefinite "legal hold" on all their files, which overrides any destruction rules until the issue is cleared.

This kind of automation pulls guesswork and human error right out of the equation. A risky manual chore becomes a reliable process humming along in the background.

Keeping Everyone on the Same Page with Version Control

Using an old W-9 or an outdated engagement letter isn't just sloppy—it's a compliance risk waiting to happen. Version control is a core feature in any good DMS that makes sure your team always works with the most current documents. Every time a file is changed, the system saves it as a new version but keeps a complete history of all the old drafts.

This creates a single source of truth for your entire firm. No more digging through emails to find "final_final_v3.docx." Everyone is working from the same approved document, which is absolutely critical for maintaining consistency across all your client work and official filings.

Compliance isn't a one-time setup; it's an ongoing process. The right software provides the framework to build, enforce, and prove your firm's adherence to industry standards, turning regulatory obligations into a competitive advantage.

Secure Client Portals Are a Compliance Must-Have

Let's be blunt: emailing sensitive financial documents back and forth is a huge security and compliance failure. A DMS with a built-in secure client portal gives you a compliant, encrypted channel for all communication and file sharing.

Clients can upload bank statements, sign forms, and get their final returns, all within a protected online space. Every single action—uploads, downloads, views—is logged in a detailed audit trail. This gives you undeniable proof of when a document was sent, received, and opened. Some solutions even offer a specialized AI finance compliance advisor to help navigate the tricky regulatory waters, which creates a defensible record that protects both you and your clients.

It's telling that while software products made up 76% of the global DMS market revenue in 2024, service-based segments like compliance consulting are growing even faster. This shows that true success comes from rethinking your processes for compliance, not just from buying a software license. By automating these core compliance tasks, a DMS frees you up to focus on high-level strategy instead of getting buried in administrative busywork.

Building a Connected Tech Stack With Seamless Integrations

Your document management software should never be a lonely island in your firm’s digital world. It’s better to think of it as the central gear in your entire technology engine. When it stands alone, it can only do so much. But when it connects smoothly with all your other tools, it drives the entire machine forward with incredible power.

A disconnected system creates what I call "digital friction." It forces your team into a maddening cycle of downloading, re-uploading, and manually keying in data from one platform to another. This isn't just slow—it's a breeding ground for expensive mistakes. The best document management software for accountants is built to kill this friction by plugging directly into the apps you already use every single day.

From Manual Data Entry to Automated Data Flow

Let's walk through a common scenario. A new client signs an engagement letter through your secure portal. In a disconnected world, this kicks off a flurry of manual tasks: someone has to create a new client profile in your practice management software, set up a corresponding folder in your cloud storage, and then create a new entry in QuickBooks. Each step is a chance for something to go wrong.

Now, imagine that same scenario in a connected workflow. The moment that signed letter hits your DMS, it automatically triggers a chain reaction:

- A new client account is instantly created in your practice management system.

- Their contact information is pushed to your CRM.

- A standardized folder structure for them is generated right inside the DMS.

- A task is assigned to the onboarding team to get started.

That’s the real power of an integrated system. It turns a series of disjointed, manual steps into one fluid motion, saving hours of work and ensuring data is consistent across every tool your firm uses.

A connected tech stack does more than just save time; it creates a single source of truth for your client data. When your DMS, accounting software, and practice management tools all speak the same language, you eliminate the confusion and risk that comes from conflicting information spread across different platforms.

Native Integrations vs. Third-Party Connectors

When you’re looking at how a DMS connects with your other software, you'll generally find two types of connections: native integrations and third-party connectors. Knowing the difference is crucial for building a tech stack you can actually rely on.

Native integrations are built directly into the software by the developers. They’re designed to work perfectly together, offering deep, reliable connections that just work. For instance, a DMS with a native QuickBooks Online integration can sync invoices and financial reports automatically without any fuss. These are almost always the most stable and feature-rich options.

Third-party connectors, like Zapier or Make, act as a bridge between applications that don't have a direct link. They are incredibly flexible and can connect thousands of different apps. While powerful, they can sometimes be less robust than native integrations and might need a bit more hands-on management to keep the connections running smoothly. To get a better handle on how all these pieces fit together, it's worth understanding how systems integration explained in more detail.

When you're vetting a new DMS, it’s smart to have a checklist of the core integrations your firm can't live without.

Core Integration Checklist for Accounting DMS

| Integration Category | Key Software Examples | Primary Benefit | Impact on Efficiency |

|---|---|---|---|

| Accounting Software | QuickBooks, Xero, Sage | Automates financial document syncing and data entry | High – Eliminates manual entry of invoices, receipts, and reports. |

| Practice Management | Karbon, Canopy, TaxDome | Creates a unified client view and centralizes task management | High – Links documents directly to client projects and deadlines. |

| E-Signature | DocuSign, Dropbox Sign | Secures and automates the signing process for official documents | Medium – Speeds up client approvals and finalization of returns. |

| Secure Portals | Citrix ShareFile, Client Portal | Provides a secure, branded channel for client communication | Medium – Simplifies secure file exchange and reduces email clutter. |

| CRM | HubSpot, Salesforce | Syncs client contact information and communication history | Low – Ensures client data is consistent across sales and service teams. |

This checklist helps you prioritize what matters most, ensuring your DMS becomes the hub that ties everything together, rather than just another app to manage.

Unlocking Firm-Wide Efficiency in the Real World

The practical benefits here are massive. Take a tax prep workflow: a client uploads their W-2s and 1099s to your secure portal. Your DMS uses Optical Character Recognition (OCR) to pull the data and, through an integration, pushes it straight into your tax software, pre-filling the return. This is just one of many powerful https://bankstatementconvertpdf.com/accounting-automation-tools/ that a connected system makes possible.

And it doesn't stop there. Once the return is done, the finalized document is sent from your tax software back to the DMS. It's then automatically routed to an e-signature platform like DocuSign. After the client signs, the executed copy is filed neatly back into the correct client folder, and a notification goes to your billing system to generate the invoice.

Think about that—not a single manual download or "please find attached" email was required. This is how the best document management software for accountants unlocks completely new levels of productivity.

Putting Your Firm on Autopilot with Workflow Automation

If security, compliance, and integrations are the engine of your document management system, then workflow automation is the self-driving feature. It's what gets you where you're going faster, with far less effort. This is where a good DMS stops being a cost center and starts generating a real return, turning all those repetitive, low-value administrative chores into hands-off processes that just… happen. It’s how you free your team from the daily grind of manual follow-ups and data entry.

Think of your typical manual process as a clumsy relay race. A document comes in, and someone has to physically (or digitally) pass it to the next person, who then passes it to another. Every handoff is a potential point of failure. Automation transforms that clunky relay into a high-speed conveyor belt, where documents glide from one stage to the next based on a set of rules you define.

The Anatomy of an Automated Workflow

Let's see this in action by tracing a document's journey through a process that causes headaches for nearly every accounting firm: client onboarding.

Imagine a new client is ready to sign on. Instead of a messy email chain clogged with attachments, they use your secure client portal to upload their signed engagement letter. The moment they hit "upload," a powerful chain reaction kicks off:

- Automatic Task Creation: The system sees the document is an "Engagement Letter" and immediately creates a task for a senior partner to review and countersign.

- Status Updates: In your practice management system, the client's status instantly flips from "Prospect" to "Onboarding." No one has to remember to do it.

- Approval and Filing: Once the partner signs off, the DMS automatically files the fully executed contract into the client's brand-new folder.

- Team Notification: At the same time, a message shoots over to your onboarding team's chat channel, letting them know a new client is ready to go and linking them directly to the files.

What used to be a five-step manual slog that could drag on for days is now done in minutes. And the best part? The administrative steps required zero human intervention. That’s the real power of workflow automation.

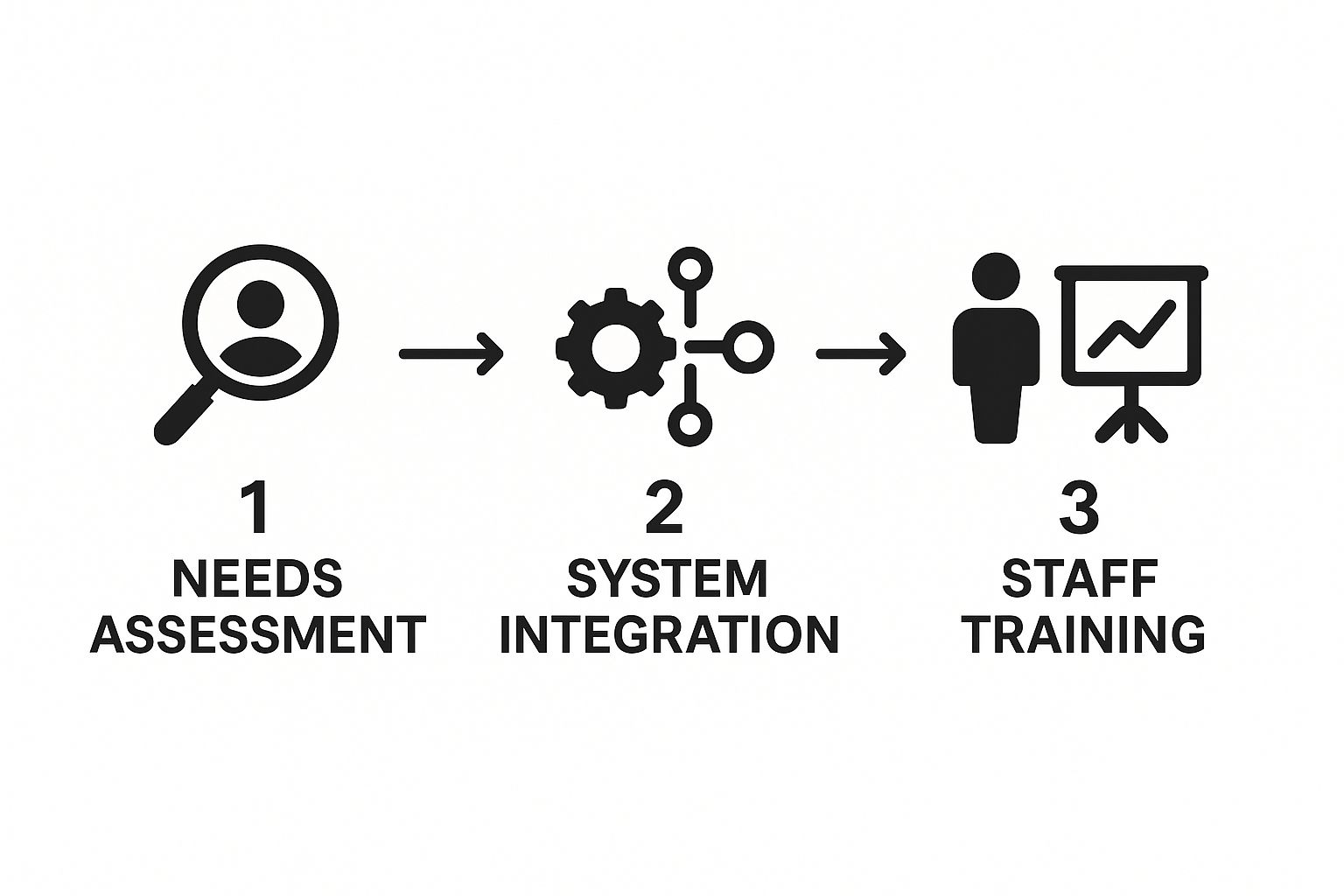

The infographic below highlights the core stages—needs assessment, system integration, and staff training—that are essential for getting this kind of effective automation off the ground.

As you can see, successful automation isn't about just flipping a switch. It’s a deliberate process that starts with a deep dive into your firm's actual needs before you even think about technology and training.

Expanding Automation Across Your Firm

The client onboarding example is really just the tip of the iceberg. The best document management software for accountants lets you build custom workflows for almost any repetitive process you can think of.

Here are a few other powerful examples I've seen firms implement:

- Tax Return Review Cycles: A staff accountant finishes a tax return and changes its status to "Ready for Review." This single click automatically moves the file into the manager's queue and pings them with a notification.

- Invoice Approvals: A vendor invoice comes in and is automatically routed to the right department head for approval. Once they approve it, it can be pushed directly to your accounting software to be queued for payment.

- Document Collection: For recurring bookkeeping work, you can set up automated reminders that email clients a few days before their documents are due, complete with a secure link to upload them.

Workflow automation isn’t about replacing accountants; it’s about empowering them. By taking over the tedious administrative work, a DMS frees up your team’s most valuable asset: their time. Time they can now spend on high-value client work and strategic advice.

This kind of automation even extends to data processing. For instance, advanced systems often include powerful bank statement extraction software that uses OCR to pull key figures from uploaded statements, literally saving hours of mind-numbing manual data entry.

Ultimately, putting your firm's routine processes on autopilot creates a more scalable, profitable, and less stressful place to work. Your team is happier because they get to focus on work that matters, and your clients are happier because they get faster, more reliable service. It’s a fundamental shift from being reactive to proactively running your firm.

How to Choose the Right Document Management Software

Knowing what features to look for is one thing, but actually picking the right document management platform for your firm? That's a different beast entirely. Getting it wrong can mean wasted money, a team that's pulling their hair out, and a system that just adds another layer of chaos. To sidestep that mess, you need a solid plan for how you’re going to evaluate your options.

Think of it less like online shopping and more like a home inspection. You have to know what you're looking for before you even start. A smart approach starts by looking inward at your firm's real, day-to-day needs, long before you get swayed by a flashy product website. This way, the software you land on will actually fit your specific goals and workflows like a glove.

Start With a Firm-Wide Needs Assessment

Before you get caught up in feature lists and polished sales demos, the first step is to create a blueprint of what your firm actually needs. Get your team together and start mapping out the current pain points in your document process. Where are the biggest jams? Is it the endless back-and-forth with clients for information, keeping track of document versions, or just staying on top of compliance?

Turn your findings into a simple checklist. This isn’t about features; it's about the problems you need to fix.

- Document Collection: Are you constantly chasing clients who send the wrong files or incomplete information? If so, a system with automated reminders and structured client requests should be at the top of your list.

- Workflow Inefficiency: Do approval processes move at a snail's pace because everything is manual? Look for platforms that excel at customizable workflow automation.

- Integration Gaps: Is your team tired of manually copying data from one app to another? Make sure any potential solution has native integrations with your accounting and practice management software.

- Security Concerns: Does your current way of storing files feel a bit exposed? Granular access controls and detailed audit trails should be non-negotiable.

Ask the Right Questions During Demos

Once you know exactly what you're looking for, you’re ready to talk to vendors. A product demo is your chance to see past the marketing fluff and watch the software in its natural habitat. Don't just sit back and let the salesperson run the show—come armed with specific questions tied directly to your needs assessment.

Instead of a generic question like, "Do you have an audit trail?" get specific. Ask them, "Show me exactly how your audit trail works. Can I see who accessed a specific client file last week and what they did?"

Your goal during a demo is to make them prove it. Force the vendor to connect their software's features directly to your firm's real-world problems, not just talk about them in theory.

Here are a few other critical questions to have in your back pocket:

- "Can you demonstrate the integration with QuickBooks Online? I want to see how data flows between the two platforms."

- "Walk me through setting up a retention policy for tax documents. How does the system handle the final, secure destruction of those files?"

- "Show me how your client portal handles different user permissions. For example, how can I give a CEO different access than their bookkeeper?"

The Pilot Program Is Non-Negotiable

Finally, whatever you do, never commit to a firm-wide rollout without running a pilot program first. Pick a small, tech-friendly group from your team and a few trusted clients to test-drive the software for 30 to 60 days. A pilot program is your ultimate reality check, uncovering the practical quirks and hidden benefits a demo could never reveal. You might even find that some helpful features from the best free bookkeeping software you're used to are surprisingly absent.

This trial period gives you invaluable feedback on everything from usability to client adoption before you sink significant time and money into a new system. It's the single best way to make sure the software you choose is genuinely the right fit for your firm.

Frequently Asked Questions

What’s the Real Difference Between Cloud Storage and a DMS?

It’s a common question. Think of cloud storage like Google Drive or Dropbox as a basic digital filing cabinet. It’s a fantastic place to park your files, but its job pretty much stops there.

A true document management system (DMS), on the other hand, is more like an intelligent, automated back office. It wraps that storage in layers of security, compliance protocols, automated workflows, and even client portals. It doesn't just hold your documents; it actively manages them as a core part of your firm's operations.

How Long Will It Actually Take to Get New Software Running?

This really depends on the size of your firm and how complex your current data situation is. That said, most modern, cloud-based systems can get you up and running in a matter of weeks, not the months-long sagas of the past.

A smart way to approach it is with a pilot program. Start with a small, tech-savvy team to test out the new workflows and iron out any kinks. Once they’re comfortable, you can roll it out to the rest of the firm. This staggered approach makes the learning curve much less steep for everyone.

The biggest roadblock to a successful software launch often isn't the technology—it's getting your team to buy in and actually use it. Make sure you choose a platform with a clean, intuitive interface and commit to solid training so everyone feels confident right from the start.

Will a DMS Play Nicely with My Existing Tax Software?

It absolutely should—in fact, this is non-negotiable. The best document management systems are built to connect with the tools you already rely on.

Look for native integrations with major tax and accounting software like QuickBooks, Xero, or Lacerte. This seamless link means data can flow between systems automatically, which cuts out the soul-crushing (and mistake-prone) task of entering the same information in multiple places.

Are you buried under a mountain of bank statements, manually keying in transaction after transaction? Let Bank Statement Convert PDF take that off your plate. Our tool converts messy PDF bank statements into clean, organized Excel files in seconds, giving you back precious time to focus on your clients. Give it a try at https://bankstatementconvertpdf.com.