In today's competitive business environment, relying on manual spreadsheets for financial analysis is a significant liability. Disjointed data, endless hours spent on manual reconciliation, and the constant risk of human error can obscure your company's true financial health, leading to flawed strategic decisions. The core problem is a lack of timely, accurate, and consolidated financial insight.

Effective financial reporting software directly addresses this challenge by automating data aggregation from various sources. It transforms raw numbers into clear, actionable reports and interactive dashboards. This automation not only guarantees data integrity but also frees up your finance team from tedious tasks, allowing them to focus on high-value analysis, forecasting, and strategic advisory.

This comprehensive guide is designed to help you navigate the crowded market and select the best financial reporting software for your unique situation. We'll move beyond marketing claims to provide a detailed breakdown of each platform's strengths, limitations, and ideal use cases. For each tool, you will find practical insights, screenshots, and direct links to help you make a well-informed decision. Whether you're a small business owner needing basic reporting, a CPA managing multiple clients, or an enterprise CFO requiring sophisticated consolidation, this resource will help you find the right solution to achieve financial clarity and drive growth.

1. Bank Statement Convert PDF

Bank Statement Convert PDF stands out as a powerful foundational tool for any organization aiming to streamline its financial data preparation. While not a full-suite reporting platform, its specialized function is a critical first step for accurate analysis, making it an essential component of the best financial reporting software ecosystem. It excels at a singular, vital task: transforming static, often unwieldy, bank statement PDFs into structured, analysis-ready Excel or CSV files with remarkable precision.

This platform leverages advanced OCR and AI-driven data extraction to accurately parse transaction details, dates, and amounts, even from scanned documents. The simple three-step process (upload, preview, download) significantly reduces manual data entry, minimizes human error, and accelerates the entire reporting and reconciliation workflow. This targeted efficiency is precisely why it’s a top choice for financial professionals who need clean, reliable data to feed into their broader reporting systems.

Key Features & Analysis

Bank Statement Convert PDF distinguishes itself with features designed for accuracy and efficiency. Its AI-powered engine is trained on a vast array of bank statement formats, ensuring high-quality data extraction. The preview function is a key differentiator, allowing users to verify the parsed data before downloading, which builds confidence in the final output.

For high-volume users like accounting firms, features such as batch processing and priority support are invaluable. The tool's commitment to security is also paramount; all file transfers are encrypted, and sensitive financial data is not stored on their servers post-conversion, addressing a major concern for financial professionals. Its role as a data-sourcing engine is crucial for processes like automated bank reconciliation, a topic they explore further on their blog. You can learn more about how this technology supports automated bank reconciliation software.

Practical Use Case

An accounting firm managing monthly bookkeeping for 50 small business clients can use this tool to instantly convert all incoming PDF bank statements into a uniform Excel format. This eliminates hours of tedious manual entry, standardizes the data for import into their primary accounting software, and allows accountants to focus on analysis and client advisory rather than data transcription.

Pros & Cons

| Pros | Cons |

|---|---|

| Highly Accurate OCR: Excels at extracting data, even from complex or scanned PDFs. | Single File Upload: Batch processing is a premium feature, not standard. |

| Simple User Interface: The three-step process is intuitive and requires minimal training. | Resolution Dependent: Very low-quality scans may require manual review. |

| Strong Security: Encrypted transfers and a no-data-storage policy ensure client privacy. | Specialized Tool: Focuses solely on conversion, requiring other reporting software. |

| Flexible Pricing: Tiers accommodate individual users and high-volume professional needs. |

Access and Pricing

Bank Statement Convert PDF is a web-based platform accessible on any modern browser, offering flexible pricing plans tailored to different usage levels. Plans range from options for individuals with occasional needs to enterprise-level subscriptions designed for high-volume processing with advanced features.

Website: bankstatementconvertpdf.com

2. QuickBooks Online

QuickBooks Online is a cornerstone of small to medium-sized business accounting, and its position as one of the best financial reporting software options is well-earned. While known primarily for bookkeeping, its reporting suite is robust, user-friendly, and highly effective for businesses needing clear, actionable financial insights without the complexity of enterprise-level systems. Its cloud-based nature ensures access from anywhere, which is critical for modern, flexible business operations.

The platform excels at generating standard reports like Profit & Loss, Balance Sheets, and Cash Flow Statements with just a few clicks. What sets it apart is the ability to easily customize these reports by filtering data, comparing periods, and saving templates for recurring use. This allows business owners to quickly drill down into specific performance metrics without needing a dedicated financial analyst.

Key Features & Considerations

QuickBooks Online offers tiered pricing plans, generally ranging from around $30 to $200 per month, making it accessible but potentially pricier than basic competitors.

- Customizable Dashboards: Visualize key performance indicators (KPIs) immediately upon login for a real-time health check of your business.

- Budgeting & Forecasting: The "Plus" and "Advanced" plans include tools to create budgets and compare them against actual performance, which is vital for strategic planning.

- Extensive Integrations: Its biggest strength is the vast ecosystem of third-party apps, allowing you to connect payroll, inventory, and CRM data for more comprehensive reporting.

While its reporting is powerful for SMEs, large enterprises may find it lacks the granular, multi-entity consolidation features of more specialized software. However, for most growing businesses, its combination of accessibility and capability is hard to beat.

Website: https://quickbooks.intuit.com/online/

3. Xero

Xero has carved out a significant niche as a cloud-based accounting platform, and its inclusion as one of the best financial reporting software options is due to its beautiful design and powerful automation. Particularly popular with small businesses, freelancers, and startups, Xero simplifies complex accounting tasks. Its core strength lies in providing real-time financial data in an accessible format, empowering business owners to make informed decisions quickly and without a steep learning curve.

The platform shines with its automated bank reconciliations and a clean reporting interface that makes generating P&L statements, balance sheets, and cash flow summaries straightforward. Xero’s standout feature is its vast integration library, allowing it to serve as a central hub connecting everything from payment gateways to project management tools. This creates a cohesive data ecosystem for more holistic and accurate reporting.

Key Features & Considerations

Xero's pricing is tiered, typically ranging from about $15 to $78 per month, making it a highly affordable and scalable choice for growing businesses.

- Robust Automation: Automates bank feeds, reconciliations, and invoicing reminders, freeing up significant administrative time for strategic analysis.

- Vast App Ecosystem: Connects with over 1,000 third-party business apps, enabling highly customized and comprehensive reporting workflows.

- AI-Powered Forecasting: The platform uses AI to provide short-term cash flow projections and invoice payment predictions, offering valuable foresight for financial planning.

While Xero is exceptionally user-friendly, some limitations exist. Its entry-level plans have limited reporting features, and crucial multi-currency support is reserved for the highest-tier plan. Nevertheless, for small businesses prioritizing ease of use, strong automation, and extensive integrations, Xero is an outstanding choice.

Website: https://www.xero.com/us/

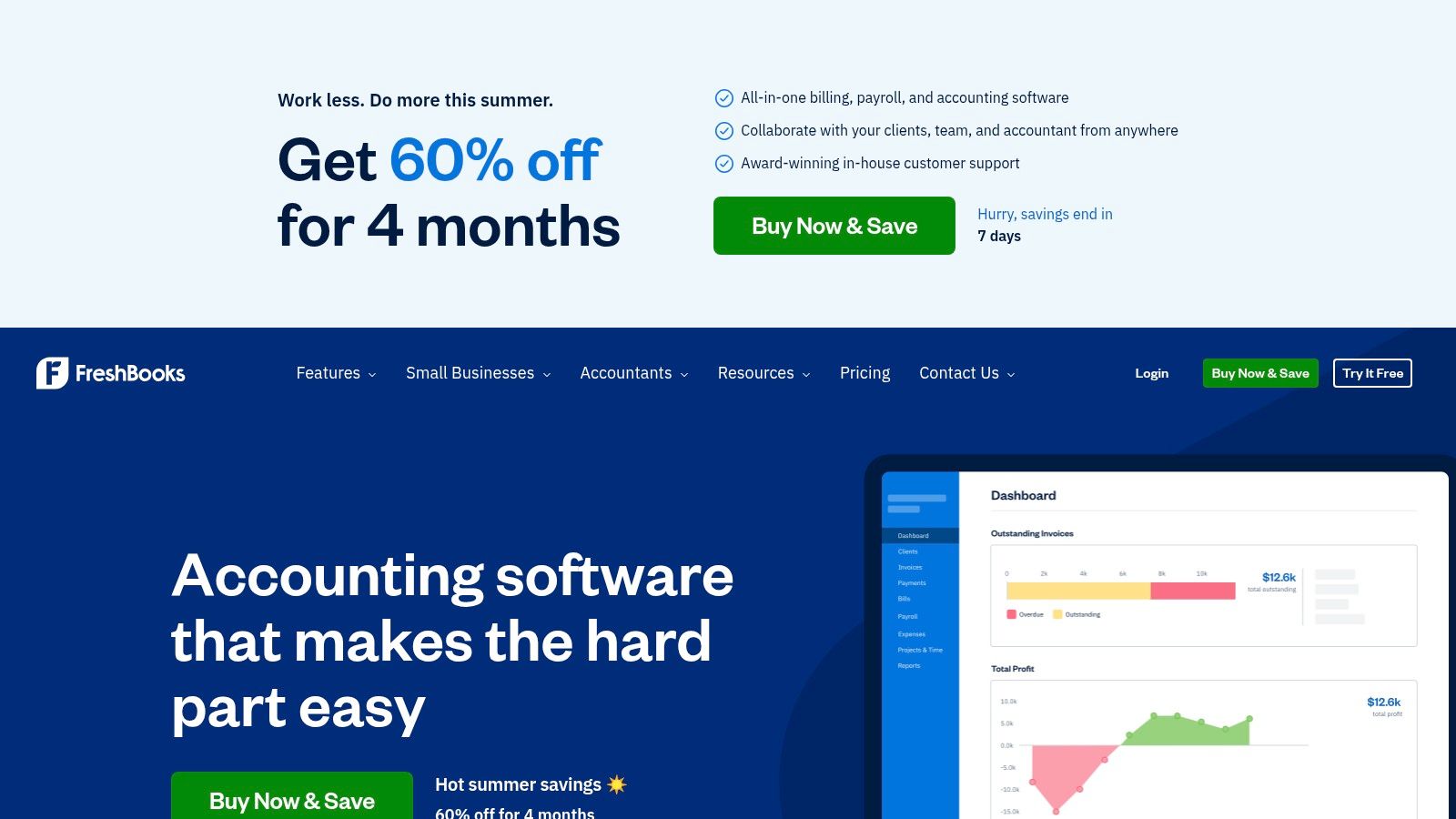

4. FreshBooks

FreshBooks has carved out a niche as an incredibly user-friendly accounting solution, particularly for freelancers and service-based small businesses. While its reputation is built on stellar invoicing and time-tracking, its reporting capabilities are straightforward and effective, earning it a spot among the best financial reporting software for those who prioritize simplicity over complexity. The platform is designed to make accounting less intimidating for non-accountants, translating financial data into clean, understandable reports.

The platform shines by focusing on core reports like the Profit & Loss statement, Expense reports, and Invoice Details. Its strength lies not in granular, multi-dimensional analysis, but in providing a clear, at-a-glance view of business health. This focus on core metrics is perfect for solopreneurs and small teams who need to quickly assess profitability and cash flow without getting lost in complicated financial jargon. For those interested in workflow efficiency, you can explore more about accounting automation tools.

Key Features & Considerations

FreshBooks offers several pricing tiers, typically ranging from about $19 to $60 per month, with custom pricing for businesses with more complex needs.

- Exceptional Invoicing Reports: Track outstanding revenue, see which clients are late to pay, and analyze sales tax collected with dedicated invoicing reports.

- Time Tracking Analysis: Service-based businesses can generate reports showing billable hours per project or client, providing crucial insights into project profitability.

- Simple P&L and Expense Reports: Easily generate a Profit & Loss statement or break down expenses by category to understand where your money is going.

While its reporting is ideal for freelancers and small service businesses, companies needing inventory management, advanced forecasting, or multi-entity reporting will find it limiting. However, for its target audience, FreshBooks offers an unbeatable combination of usability and essential reporting.

Website: https://www.freshbooks.com/

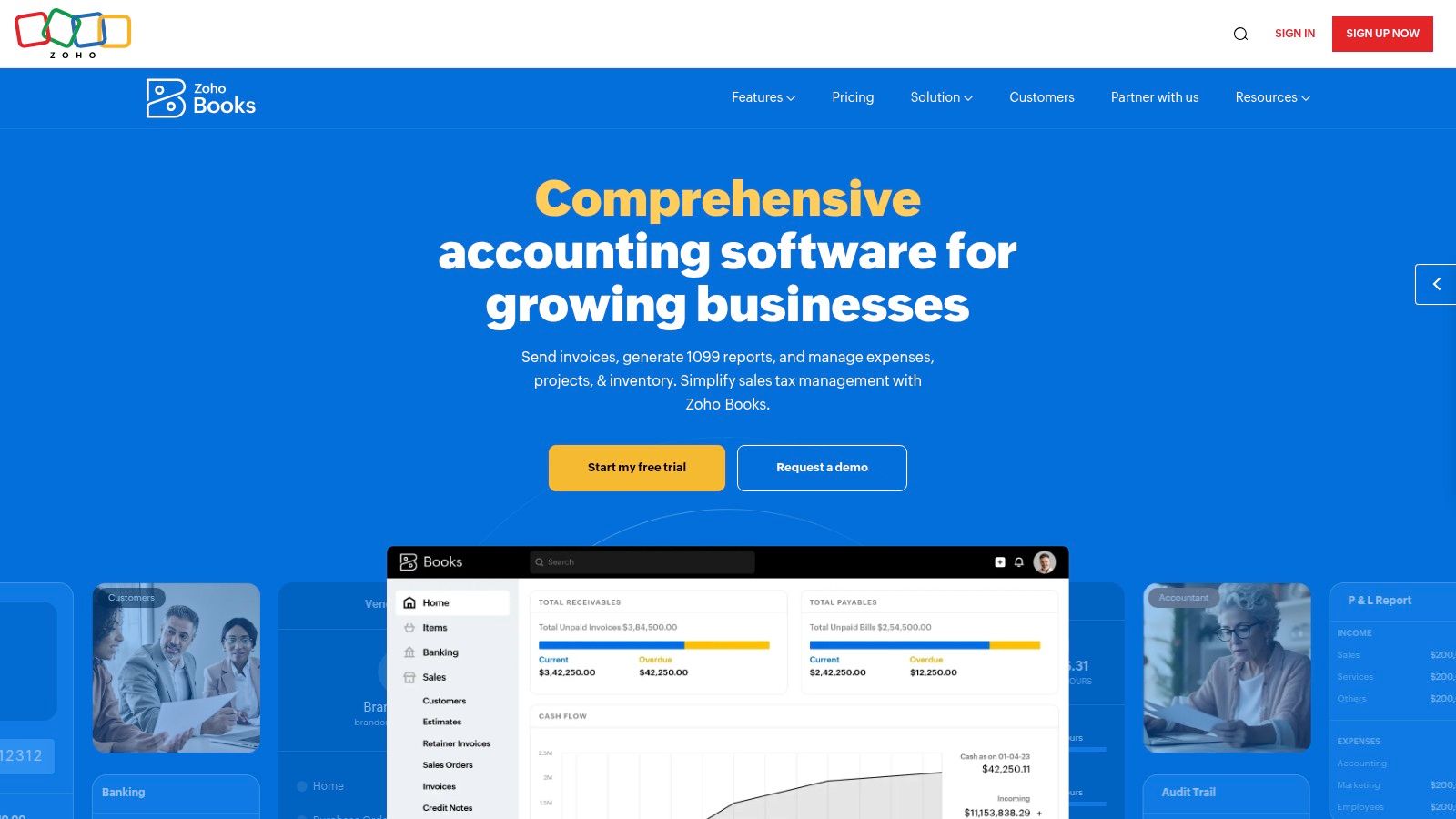

5. Zoho Books

Zoho Books carves out its space as one of the best financial reporting software options by offering a powerful, integrated, and remarkably affordable solution. It is a standout choice for small to medium-sized businesses already invested in or considering the extensive Zoho ecosystem. The platform seamlessly combines core accounting functions with robust, customizable reporting tools, allowing businesses to manage finances and derive insights from a single, unified interface. Its strength lies in making sophisticated features accessible without a steep learning curve or prohibitive cost.

The software excels in automating financial workflows, from invoicing to bank reconciliation, which feeds directly into its reporting engine. Users can generate over 50 business reports, including standard P&L and Balance Sheets, as well as more specific reports on sales, inventory, and project profitability. The ability to schedule reports and customize them with filters and new columns provides a high degree of flexibility for tailored business analysis.

Key Features & Considerations

Zoho Books offers a very competitive pricing structure, with plans starting from a free tier and paid plans ranging from approximately $15 to $275 per month, providing excellent value.

- Seamless Zoho Ecosystem Integration: Its biggest advantage is native integration with over 40 other Zoho apps, such as Zoho CRM and Zoho Inventory, creating a comprehensive business management suite.

- Strong Automation: Automate recurring tasks like invoicing, payment reminders, and report generation, saving significant administrative time and ensuring data accuracy.

- Multi-Currency Support: Essential for global businesses, it handles transactions and generates reports in multiple currencies with ease.

While its integration within the Zoho family is a major pro, its connections to third-party apps outside that ecosystem are more limited than competitors like QuickBooks. However, for businesses seeking an all-in-one, cost-effective solution, Zoho Books is an exceptional choice.

Website: https://www.zoho.com/books/

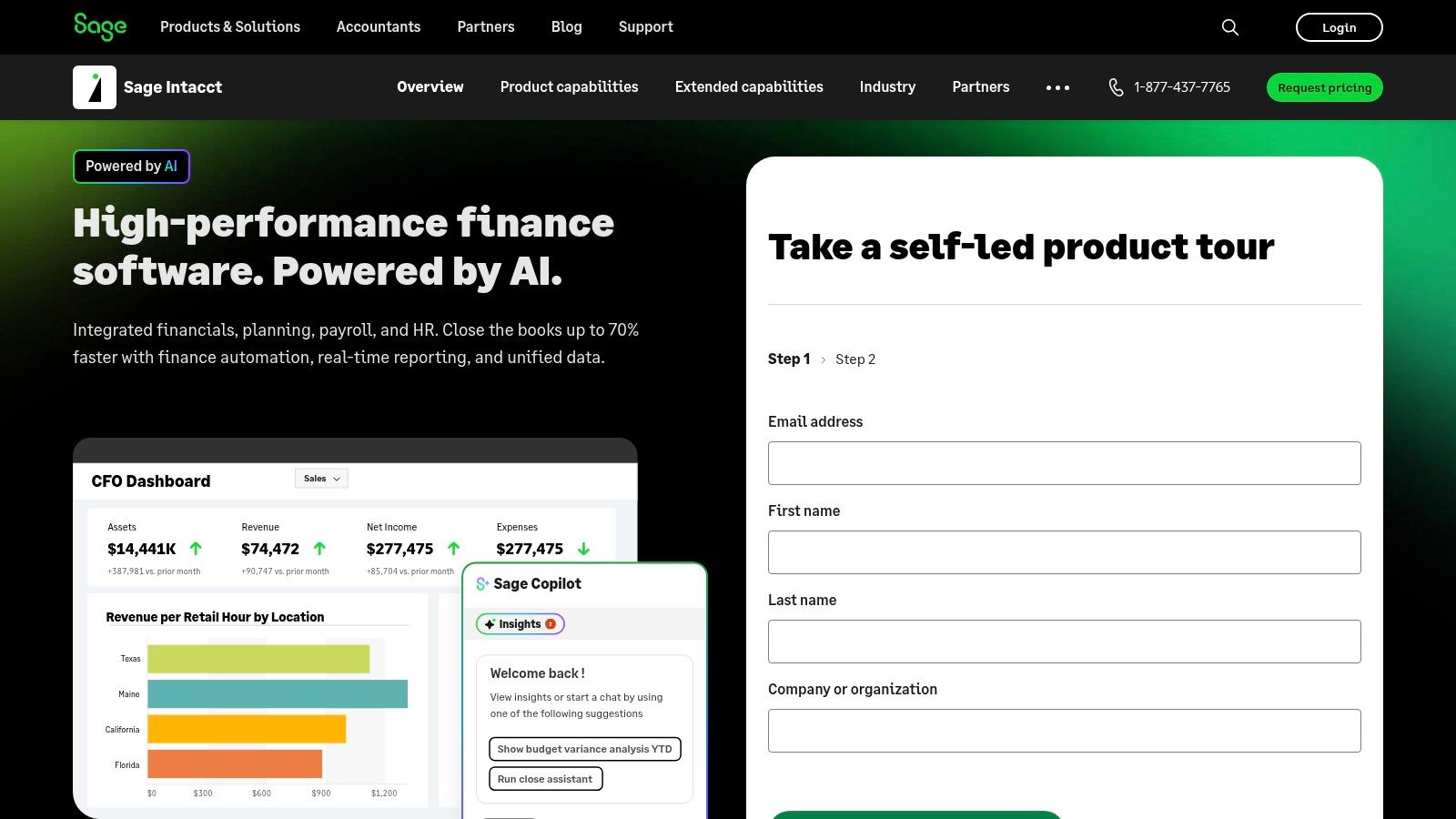

6. Sage Intacct

Sage Intacct is a powerful, cloud-based financial management platform built for scaling businesses that have outgrown introductory accounting software. It firmly establishes itself as one of the best financial reporting software choices by offering deep, multidimensional reporting capabilities that provide a granular view of company performance. Designed for finance professionals, it automates complex processes and provides the robust tools needed for detailed analysis, forecasting, and multi-entity consolidation.

The platform’s strength lies in its ability to handle complexity with ease, from managing multiple business units to navigating different currencies and regulatory requirements. Its reports and dashboards are not just canned summaries; they are interactive tools that allow users to slice and dice data across various dimensions like location, project, or department, providing insights that drive strategic decisions.

Key Features & Considerations

Sage Intacct uses a custom quote-based pricing model, as its services are tailored to each business's specific needs. This means it is a significant investment compared to entry-level software.

- Multi-Entity & Multi-Currency: Seamlessly manage financials for multiple locations or legal entities within a single, consolidated view, which is critical for growing or international companies.

- Dimensional Reporting: Go beyond standard reports by tagging transactions with dimensions to analyze performance from any business perspective you need.

- AI-Powered General Ledger: Features an intelligent general ledger that streamlines the close process and helps ensure compliance with robust audit trails.

- Strong Salesforce Integration: As the only financial management solution preferred by the AICPA, its seamless integration with Salesforce is a major advantage for service-based businesses.

While its feature set is extensive, the learning curve can be steep for those unfamiliar with enterprise-grade systems. It is best suited for mid-market companies needing sophisticated financial controls and reporting.

Website: https://www.sageintacct.com/

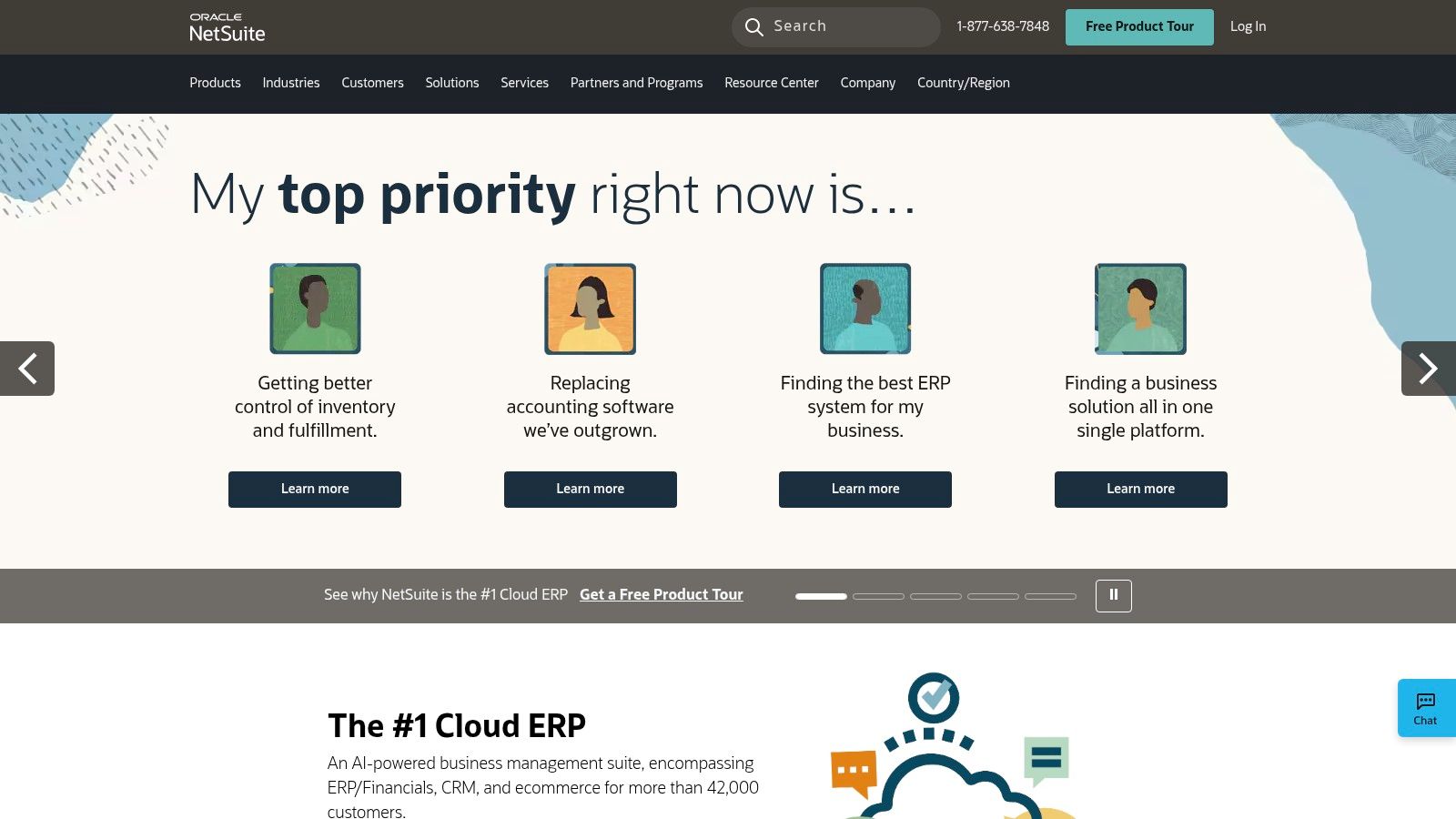

7. Oracle NetSuite

Oracle NetSuite moves beyond simple accounting into a full-scale cloud Enterprise Resource Planning (ERP) platform, making it one of the best financial reporting software choices for large, complex, and rapidly growing businesses. Its strength lies in unifying financial data with operational information from across the entire organization, providing a single source of truth. This integration allows for real-time visibility into financial performance, from a consolidated global view down to individual transactions.

The platform is engineered for scalability, handling multi-subsidiary, multi-currency, and multi-tax compliance with ease. Where other tools struggle with consolidation, NetSuite excels, automating complex processes and delivering role-based dashboards that give every stakeholder the specific insights they need. Adhering to the latest standards is easier when you follow our guide on financial reporting best practices.

Key Features & Considerations

NetSuite's pricing is customized based on company size, user count, and required modules, so costs are significantly higher than SME-focused tools.

- Multi-Dimensional Analysis: Slice and dice financial data across various business dimensions like department, location, or product line for deeply granular insights.

- Automated Reporting & Compliance: Streamlines the generation of compliant financial statements and disclosures for standards like ASC 606 and IFRS 15.

- Role-Based Dashboards: Provides pre-configured, yet customizable, dashboards for roles like CFO, controller, and accounting manager with relevant KPIs.

Due to its comprehensive nature, NetSuite has a steep learning curve and requires significant implementation resources. It is best suited for enterprises that have outgrown simpler systems and need a powerful, integrated financial management and reporting solution.

Website: https://www.netsuite.com/

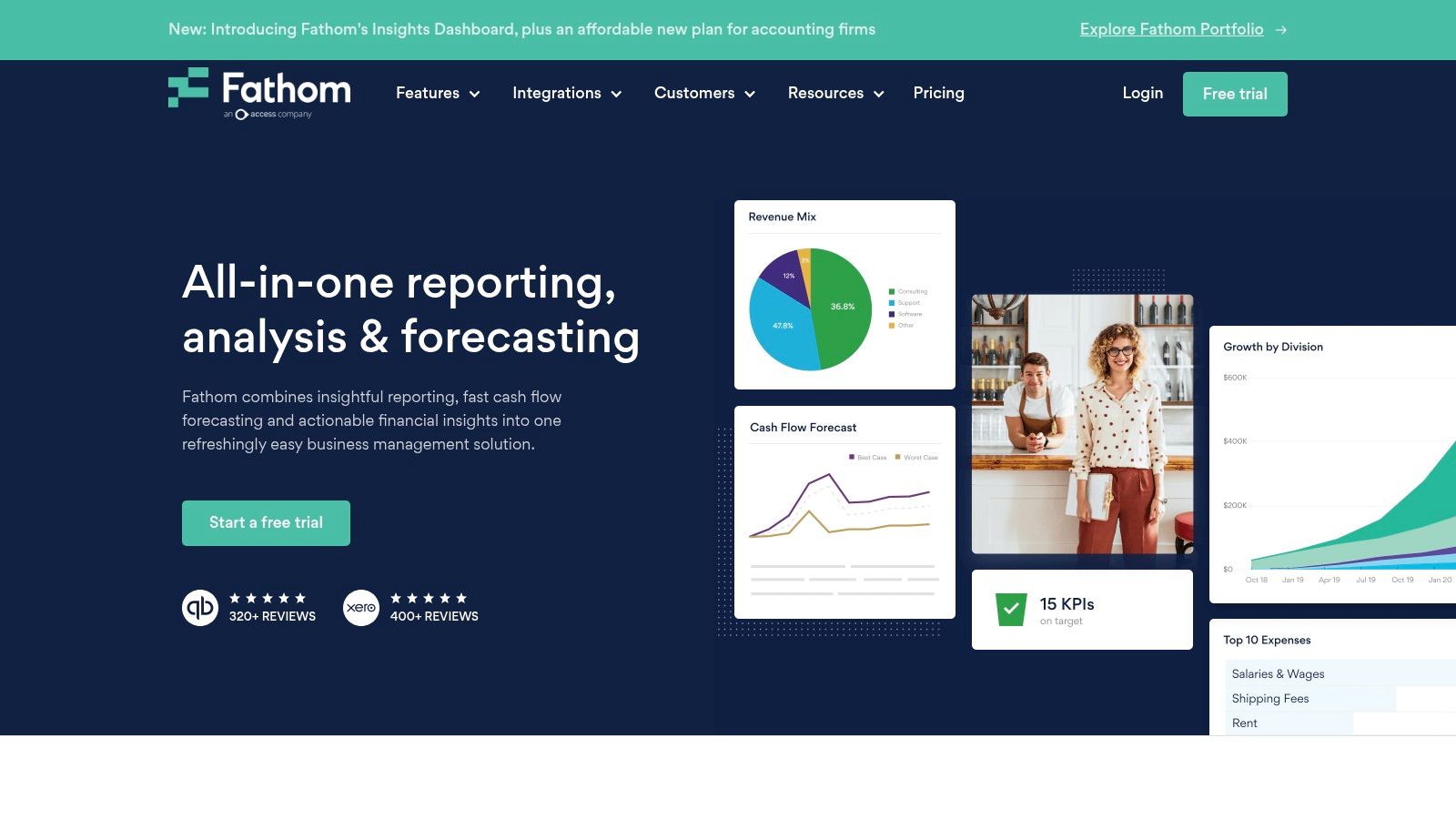

8. Fathom

Fathom excels as a specialized financial analysis and management reporting tool designed to transform standard accounting data into visually stunning, actionable insights. Rather than being a full-fledged accounting system, it integrates seamlessly with platforms like QuickBooks and Xero, making it one of the best financial reporting software choices for businesses and advisory firms wanting to elevate their reporting capabilities. Its core strength lies in its ability to automate the creation of beautiful, customized reports and dashboards that are easy for non-financial stakeholders to understand.

The platform is particularly powerful for multi-entity businesses or accounting firms managing multiple clients. Fathom’s consolidation feature allows you to effortlessly combine financials from different companies, even those using different currencies, into a single, cohesive report. This removes hours of manual spreadsheet work and provides a clear, consolidated view of group performance.

Key Features & Considerations

Fathom offers tiered pricing based on the number of companies you connect, with plans typically starting around $59 per month.

- Visual Management Reports: Create engaging and easy-to-digest reports with charts, graphs, and custom branding, perfect for board meetings and client presentations.

- Multi-Entity Consolidation: Seamlessly aggregate data from multiple entities, handling inter-company eliminations and multi-currency conversions automatically.

- KPI Dashboards: Monitor performance against key performance indicators in real-time with customizable dashboards that highlight critical business drivers.

While Fathom's reporting and analysis are top-tier, its forecasting tools are more basic compared to dedicated financial planning and analysis (FP&A) solutions. It also lacks deep compliance reporting features, focusing instead on management-level insights.

Website: https://www.fathomhq.com/

9. Vena Solutions

Vena Solutions uniquely positions itself as one of the best financial reporting software options by building its platform on a foundation finance teams already know and trust: Microsoft Excel. It enhances the familiar spreadsheet environment with a centralized database, sophisticated workflow automation, and robust permission controls. This approach bridges the gap between the flexibility of Excel and the structured integrity of enterprise-grade FP&A systems, allowing teams to leverage existing skills while gaining powerful new capabilities.

The platform excels by connecting directly to source systems like ERPs and CRMs, pulling live data into pre-built yet customizable templates for reporting, budgeting, and forecasting. This eliminates the manual, error-prone process of copying and pasting data, transforming Excel from a simple spreadsheet tool into a dynamic and collaborative reporting hub.

Key Features & Considerations

Vena Solutions provides custom pricing based on the specific needs, user count, and complexity of the implementation.

- Native Excel Interface: Reduces the learning curve significantly, as finance professionals can work within a familiar environment without sacrificing control.

- Centralized Database: Acts as a single source of truth, ensuring all reports and analyses are based on consistent, up-to-date information.

- Workflow Automation & Audit Trails: Streamlines the entire financial close and reporting cycle with clear task assignments and a detailed history of all changes.

While its Excel-based nature is a major advantage, the initial setup can be time-intensive. Businesses with massive datasets may also find it less performant than some pure database-driven alternatives. However, for organizations deeply invested in Excel, Vena offers a powerful path to modernizing financial processes.

Website: https://www.venasolutions.com/

10. Datarails

Datarails positions itself uniquely as a financial planning and analysis platform that enhances, rather than replaces, Microsoft Excel. For finance teams deeply embedded in spreadsheets, it provides a powerful layer of automation and real-time data consolidation, making it one of the best financial reporting software choices for those who love Excel's flexibility but need more robust capabilities. It bridges the gap between manual spreadsheet work and complex, expensive FP&A systems.

The platform’s core strength is its native Excel integration, which allows users to work in a familiar environment while benefiting from centralized data and automated workflows. This significantly reduces the manual effort involved in gathering data from various sources like your ERP or CRM. It's particularly useful for creating complex financial models and variance analyses that update in real-time without the risk of broken formulas or version control issues.

Key Features & Considerations

Datarails operates on a custom pricing model based on company size and needs, so you must request a quote for specific costs. Implementation is generally faster than traditional enterprise software since it builds on existing Excel skills.

- Excel-Native Interface: Continue working within Excel but with added power for data consolidation, automation, and real-time updates.

- Scenario Modeling & AI Insights: Build what-if scenarios and leverage AI to uncover trends and insights directly from your financial data.

- Drill-Down Analysis: Move from high-level summary reports to transaction-level detail with a few clicks, directly within your spreadsheet.

While its Excel-centric approach is a major pro for many, it's also a limitation for teams looking to move away from spreadsheets entirely. However, for SMEs needing to augment their current processes without a massive overhaul, Datarails offers a highly effective and innovative solution.

Website: https://www.datarails.com/

11. Workiva

Workiva is a powerful, cloud-based platform designed for large enterprises grappling with complex reporting and compliance demands. It firmly establishes itself as one of the best financial reporting software solutions for public companies and organizations needing auditable, collaborative, and secure financial data management. Its core strength lies in connecting data from disparate sources directly into reports, presentations, and regulatory filings, ensuring consistency and accuracy across all documents.

The platform excels at simplifying the "last mile" of financial reporting, a traditionally manual and error-prone process. It allows teams to work simultaneously within a single, live document, linking numbers, text, and data points. This means a change to a single figure in a spreadsheet automatically updates every instance of that figure in your annual report, SEC filing, and board presentation, drastically reducing risk and review time.

Key Features & Considerations

Workiva's pricing is customized based on the scale and specific needs of the enterprise, so it's a significant investment compared to SME tools.

- Connected Reporting: Link data from ERPs, spreadsheets, and other systems directly into reports, ensuring a single source of truth and eliminating copy-paste errors.

- Compliance & Audit Trails: Built-in support for XBRL, iXBRL, and ESMA/ESEF filings, with comprehensive audit trails that track every change, comment, and approval.

- Real-time Collaboration: Multiple users can edit, comment, and review documents simultaneously, with clear permission controls to manage access and workflow.

While its collaborative and compliance features are top-tier, the lack of a dedicated mobile app or live phone support can be a drawback for some teams. However, for large organizations prioritizing control and auditability in their financial reporting cycle, Workiva is an unparalleled solution.

Website: https://www.workiva.com/

12. Cube

Cube positions itself uniquely in the market by embracing, rather than replacing, the spreadsheets that finance teams already know and love. It stands out as one of the best financial reporting software options for businesses that want to enhance their existing Excel and Google Sheets workflows. By integrating directly into these familiar environments, Cube automates data collection, centralizes information, and adds powerful planning and analysis capabilities without forcing a complete process overhaul. This approach significantly lowers the adoption barrier for teams resistant to learning entirely new systems.

The platform is designed for agility, allowing finance professionals to build reports, run multiple scenarios, and drill down into data in real-time directly from their spreadsheets. This eliminates the tedious and error-prone process of manually copying and pasting data from various sources, freeing up teams to focus on strategic analysis rather than data wrangling. Its scalability makes it a strong contender for high-growth startups and mid-market companies.

Key Features & Considerations

Cube’s pricing is customized based on company size and needs, so you'll need to contact their sales team for a quote.

- Native Spreadsheet Integration: Works as an add-on for Excel and Google Sheets, preserving user familiarity while adding powerful FP&A functionality.

- Centralized Data Hub: Connects to your ERP, HRIS, and CRM systems to pull all financial and operational data into one single source of truth.

- Multi-Scenario Modeling: Easily create and compare different budget, forecast, and what-if scenarios to support strategic decision-making.

While Cube’s quick implementation is a major advantage, some users note potential performance lags with extremely large datasets. It’s an ideal solution for teams looking to supercharge their spreadsheet-based reporting without the steep learning curve of a traditional enterprise platform.

Website: https://www.cubesoftware.com/

Top 12 Financial Reporting Software Comparison

| Product | Core Features & Accuracy | User Experience & Quality ★ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Bank Statement Convert PDF 🏆 | Advanced OCR & AI, editable Excel/CSV | Simple 3-step with preview | Flexible plans, batch & priority | Financial pros, accountants, SMBs | Secure encrypted transfer, multi-device access |

| QuickBooks Online | Custom reports, budgeting, cash flow | User-friendly | Higher cost | SMBs, growing businesses | Extensive integrations |

| Xero | Automated bank reconciliation, AI forecasting | Intuitive, real-time insights | Affordable | Small businesses, startups | 1,000+ app integrations |

| FreshBooks | Invoicing, expense & time tracking | Intuitive | Moderate | Freelancers, service businesses | Strong invoicing features |

| Zoho Books | Automation, custom reports, multi-currency | Easy to use | Affordable | SMBs, Zoho ecosystem users | Deep Zoho app integration |

| Sage Intacct | 150+ reports, multi-entity, AI ledger | Comprehensive, scalable | Not publicly disclosed | Growing mid-market businesses | Compliance & audit focus |

| Oracle NetSuite | Customizable reports, real-time analysis | Powerful but complex | Higher cost | Large enterprises | ERP suite integration |

| Fathom | Visual reporting, KPI dashboards | Fast & visual | Moderate | Teams needing consolidated reporting | Multi-entity consolidation |

| Vena Solutions | Excel interface, templates, ERP/CRM integration | Familiar but complex setup | Mid to high | Excel-savvy businesses | Excel-based financial planning |

| Datarails | Scenario modeling, AI insights, Excel integration | Quick implementation | Mid | SMBs using Excel | Real-time data consolidation |

| Workiva | Automated workflows, compliance, collaboration | Advanced for compliance | Enterprise pricing | Large enterprises | Audit-ready reporting |

| Cube | Excel/Sheets integration, multi-scenario modeling | Quick & scalable | Mid | Growing businesses | Real-time reporting and automation |

Empowering Your Financial Strategy

Navigating the landscape of financial technology can feel overwhelming, but selecting the best financial reporting software is a foundational step toward achieving clarity, efficiency, and strategic foresight. As we've explored, the market offers a diverse array of solutions, each tailored to specific business sizes, industries, and operational complexities. Your journey begins not with a product, but with a deep understanding of your own needs.

From the essential data preparation facilitated by tools like Bank Statement Convert PDF to the all-in-one ERP power of Oracle NetSuite and Sage Intacct, the common thread is transformation. These platforms are designed to convert time-consuming manual processes into automated, streamlined workflows. They replace data silos and spreadsheet chaos with a single source of truth, empowering your team to deliver accurate, timely, and insightful reports that drive critical business decisions.

Key Takeaways and Your Next Steps

Choosing the right software is less about finding a universally "best" option and more about identifying the perfect fit for your unique circumstances. To move forward effectively, consider the following action plan:

- Define Your Core Requirements: Start by documenting your must-have features. Do you need advanced multi-entity consolidation like Sage Intacct? Is your primary goal creating stunning visual reports for stakeholders, pointing toward Fathom or Cube? Or is seamless integration with your existing accounting software, like QuickBooks Online or Xero, the top priority?

- Evaluate Scalability and Growth: Consider where your business will be in three to five years. A startup might thrive on FreshBooks or Zoho Books, but a rapidly scaling mid-market company may need the robust FP&A capabilities of Vena Solutions or Datarails to avoid a costly migration down the line.

- Assess Implementation and Usability: A powerful tool is useless if your team can't adopt it. Evaluate the implementation timeline, available support, and overall user experience. Does the software require dedicated IT resources, or is it designed for finance professionals to manage independently?

- Request Demos and Trials: Move beyond feature lists and marketing materials. Schedule live demonstrations with your top contenders. Use these sessions to ask pointed questions specific to your use cases and see the software in action with your own data, if possible. This is the most critical step in confirming that a platform truly meets your operational needs.

Ultimately, the best financial reporting software will do more than just generate statements. It will become an indispensable partner in your strategic planning, risk management, and growth initiatives. By investing in the right technology, you equip your finance team to transcend historical record-keeping and become proactive architects of your company's future success. Making an informed choice today will yield dividends in efficiency, accuracy, and strategic agility for years to come.

Ready to build a solid foundation for your financial reporting? It all starts with clean, usable data. Bank Statement Convert PDF is the essential first step, effortlessly converting complex PDF bank statements into organized Excel files, ready for any accounting or reporting system. Try Bank Statement Convert PDF today and see how simple data preparation can be.