Earning your CPA license is a massive accomplishment, but the learning doesn't stop there. Think of your license less like a trophy to put on the shelf and more like a passport—it needs to be kept current to be valid. This ongoing professional development is what we call Continuing Professional Education (CPE), and it's the bedrock of a CPA's career.

The standard benchmark across most states is completing 40 hours of professional education every year, though many allow you to complete 80 hours over a two-year period. These rules are in place for a good reason: they ensure every CPA stays sharp on ever-changing tax laws, accounting principles, and critical ethical standards.

Why CPE is Non-Negotiable for CPAs

This commitment to lifelong learning is much more than just a bureaucratic box to check. It’s a promise to the public. The financial world doesn’t stand still—tax codes are constantly revised, new technologies disrupt old processes, and complex ethical dilemmas surface all the time. CPE ensures that the professional you trust with sensitive financial matters is armed with the most up-to-date knowledge and skills.

The Real Purpose Behind the Credit Hours

At its core, the primary goal of CPE is to protect the public interest. By making ongoing education mandatory, regulatory bodies like the National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA) maintain the integrity of the entire profession. It’s a system designed to ensure every licensed CPA meets a consistent, high standard of excellence, which is what builds public trust in the first place.

But beyond just compliance, CPE plays several other critical roles for the individual CPA:

- Keeps Your Skills Relevant: It ensures your hard-earned expertise doesn't become obsolete in a field that changes at lightning speed.

- Deepens Your Expertise: CPE allows you to dive into specialized niche areas, like forensic accounting, international tax, or data analytics.

- Reinforces Ethical Judgment: Dedicated ethics courses are a constant reminder of the high road accountants are expected to take.

- Minimizes Professional Risk: Staying current on the latest regulations and standards is your best defense against errors that could lead to liability.

A Look at the Standard CPE Framework

While the specific rules can differ from one state to another, most state boards build their requirements around a common framework. They all want to see a demonstrated commitment to professional growth, which can be enhanced by mastering essential skills like those found in these small business bookkeeping tips.

The bottom line is that CPE transforms your license from a static piece of paper into a living credential. It’s a tangible sign of your ongoing commitment to professional excellence.

Typical CPA CPE Requirements at a Glance

To give you a clearer picture, here’s a breakdown of the typical components you'll find in most state CPE requirements. Think of this as the universal blueprint that states adapt to their own needs.

| Requirement Component | Common Standard | Core Purpose |

|---|---|---|

| Total Credit Hours | 40 hours annually or 80 hours biennially | Ensures a consistent and substantial level of ongoing learning each reporting period. |

| Ethics Training | 2-4 hours per reporting period | Reinforces the importance of professional conduct, integrity, and objectivity. |

| Technical Subjects | A defined minimum (e.g., 50% of total hours) | Guarantees that CPAs maintain core competencies in accounting, auditing, and tax. |

| Reporting Period | 1, 2, or 3 years | Establishes the cycle for completing and reporting all required CPE credits to the state board. |

Ultimately, these requirements work together to ensure that every CPA, regardless of their location or specialty, is held to a high and consistent standard.

Decoding Your CPE Credit Requirements

Let's get one thing straight: not all continuing professional education (CPE) credits are the same. Hitting your CPA continuing education requirements is more than just a numbers game—it's about creating a smart, balanced, and compliant learning plan. To do that, you have to understand the specific categories of credits your state board requires.

I like to think of CPE credits like a well-managed investment portfolio. You wouldn’t dump all your money into one stock, right? The same logic applies here. Focusing all your learning in one narrow area is risky. A healthy mix of technical, non-technical, and ethics courses is what keeps your skills sharp and your career moving forward.

The Core Credit Categories Explained

State boards usually sort CPE into different buckets. This ensures you're not just deep in the weeds on one topic but are maintaining a broad, well-rounded professional competency. While the exact mix can differ from state to state, the main categories are pretty universal. Knowing what they are is the first step to getting your compliance plan in order.

Generally, you'll need to allocate your hours across these areas:

- Technical Subjects: This is the bedrock of your CPE. We're talking about the core accounting and finance topics—auditing, taxation, business law, and financial reporting. Expect a hefty chunk of your credits, often 50% or more, to come from this category.

- Non-Technical Subjects: These are the skills that make you a more effective and well-rounded professional. Think leadership, communication, project management, or even marketing. Most states allow these, but they often put a cap on how many non-technical hours you can count toward your total.

- Professional Ethics: This one is non-negotiable. Every single state has a specific ethics requirement, usually somewhere between 2 to 4 hours per cycle. It’s all about reinforcing the integrity and objectivity that are the foundation of the entire profession.

Ensuring Your Credits Count

Okay, so you know what kind of credits you need. The next big hurdle is making sure the courses you take will actually be accepted by your state board. There's nothing worse than spending time and money on a course, only to find out it doesn't count. It’s a completely avoidable headache.

The trick is to confirm your course provider is properly accredited. Your best bet is to stick with sponsors registered with the National Association of State Boards of Accountancy (NASBA) on its National Registry of CPE Sponsors. This is the gold standard. Courses from these providers are accepted by virtually every state board without issue.

Taking a course from a NASBA-registered sponsor just gives you peace of mind. You know the program has already been vetted for quality and relevance, so it’s a safe bet for meeting your requirements.

Some boards might have their own separate list of approved local providers, but you can't go wrong starting with the NASBA registry. Before you sign up for anything, take five minutes to double-check your own state board's rules.

When you thoughtfully choose accredited courses that fit into your state's required subject areas, compliance stops feeling like a chore. It becomes a genuine opportunity for professional growth. This approach ensures every hour you log not only keeps your license active but also makes you a more skilled and valuable CPA.

Navigating State-Specific CPE Mandates

This is where things get tricky when it comes to maintaining your CPA license. There's no single, nationwide standard for Continuing Professional Education (CPE), which means the CPA continuing education requirements in Texas can look completely different from those in New York or California. Honestly, this lack of a unified rulebook is the biggest headache for most CPAs.

Think of it this way: the federal government might set general highway safety guidelines, but it's up to each state to decide its own speed limits and traffic laws. In the same vein, while national bodies like the National Association of State Boards of Accountancy (NASBA) provide a framework, your state's Board of Accountancy has the final word. Their rules are the ones you absolutely have to follow to keep your license active.

Why Your State Board Is the Only Source of Truth

It's easy to fall into the trap of listening to generalized advice or assuming your requirements are the same as a colleague's in another state, but that's a risky move. State boards dictate every single detail, from the reporting deadlines to the specific course topics they'll accept for credit. It's these small details that can trip up even the most careful professional.

For instance, one state might let you roll over extra CPE hours to the next reporting period, while the state next door could have a strict "use it or lose it" policy. Some states even have unique mandates, like requiring courses on fraud detection or state-specific tax codes, that you simply won't find anywhere else.

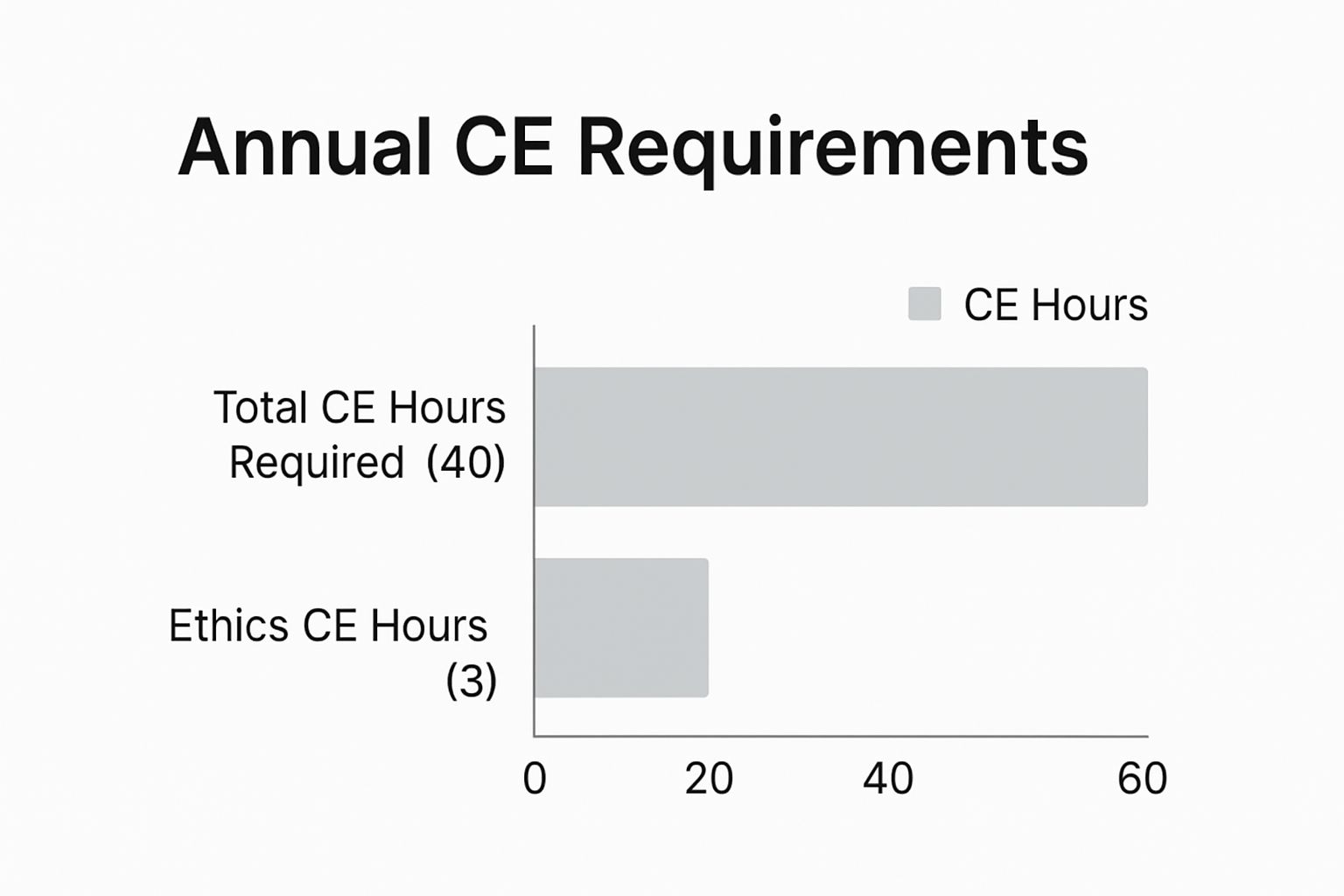

This chart gives a basic visual of a common annual breakdown, but it's crucial to remember that your state's specific formula might be completely different.

While the image shows a typical 40-hour total with a 3-hour ethics component, your state might require a different mix altogether.

Around the world, the U.S. approach to continuing education is often looked at as a benchmark because of how rigorous it is. On average, a CPA in the United States needs to complete at least 80 CPE hours every two years. But that average hides some big differences at the state level.

For example, California requires 80 hours every two years, while New York requires 40 hours annually. The math works out to be the same over a two-year period, but their distinct reporting cycles create very different compliance challenges. You can explore a more detailed guide to CPA education requirements to see more of these state-by-state variations.

How Key States Compare on CPE Requirements

To give you a real-world picture of how much the rules can differ, let's look at the requirements for a few major states. This table really drives home why you have to go straight to your own state board for the facts.

How Key States Compare on CPE Requirements

This comparative table highlights the key differences in continuing education rules for CPAs across several major U.S. states.

| State | Total Hours and Period | Annual Minimum | Ethics Rules | Unique State Mandates |

|---|---|---|---|---|

| California | 80 hours every 2 years | 20 hours per year | 4 hours of ethics every 2 years | Must complete 2 hours of Regulatory Review courses and 4 hours on Fraud Prevention. |

| New York | 40 hours annually OR 24 hours concentrated in one subject | None | 4 hours of ethics every 3 years | Concentration option allows focus on a single field like tax or auditing. |

| Texas | 120 hours every 3 years | 20 hours per year | 4 hours of board-approved ethics every 2 years | Must complete a course from a board-registered CPE sponsor. |

| Florida | 80 hours every 2 years | None | 4 hours of board-approved ethics every 2 years | At least 20 hours must be in Accounting & Auditing subjects. |

As you can see, everything from the total hours and reporting cycles to specific subject mandates can vary dramatically. There's no one-size-fits-all answer.

The most common mistake a CPA can make is assuming their state's rules are the same as a neighboring state's. Always, always verify every single requirement on your state board's official website before you sign up for any CPE course.

By making your state board's website your first and last stop for information, you take all the guesswork out of the equation. This simple, proactive step ensures every hour you spend on education counts toward renewing your license, letting you manage your professional growth with confidence.

Finding CPE Courses That Fit Your Life

Long gone are the days of sacrificing a full week to sit in a stuffy conference room just to check off your CPE credits. Thankfully, professional education for accountants has evolved. It's now more flexible and convenient, designed for busy professionals juggling work, life, and the constant need to stay sharp.

This shift turns compliance from a chore into a genuinely valuable part of your career. You no longer have to bend your schedule to fit a rigid course catalog; you can weave learning directly into your life.

Exploring Modern CPE Formats

Today, CPAs have a great mix of learning methods to choose from, each with its own perks. The real trick is finding the right combination that fits how you learn and what you need professionally, making it easier to meet your CPA continuing education requirements.

-

Live Webinars: These are fantastic if you want the feel of a traditional classroom without the commute. You get to interact with instructors and other CPAs in real-time, which is perfect for getting immediate answers to your questions.

-

On-Demand Online Courses: This is flexibility at its finest. These pre-recorded courses let you learn whenever you can find the time—early mornings, late nights, or even on your lunch break. You set the pace.

-

Self-Study Programs: Usually text-based, these programs are ideal for deep dives into complex subjects. You can really take your time to absorb the material on your own terms.

I’ve found the best strategy is to mix and match. I might use on-demand courses to get up to speed on core tax updates, but I'll sign up for a live webinar for a niche topic where I can pick an expert's brain.

This blended approach lets you customize your education to fit both your calendar and your learning style.

The Rise of Technology in CPE

Technology has completely changed the game for continuing education. Online platforms, interactive webinars, and even AI-powered learning tools are making the whole experience more engaging and accessible. This modernization means accountants can meet their required hours without being held back by geography or a packed schedule, which naturally helps boost compliance.

Many of these platforms do more than just stream videos. They simplify the administrative side of things, too. Imagine a dashboard with built-in credit trackers that automatically log your hours and spit out the certificates you need for reporting. It’s a huge time-saver that cuts down on manual record-keeping. Some even connect with other https://bankstatementconvertpdf.com/accounting-automation-tools/ you’re already using, creating a smoother workflow.

Finding Niche and Specialized Training

Your CPE shouldn't just be about hitting a credit number; it should align with where you want to take your career. As your role changes, you might need specialized knowledge in areas like data analytics, cybersecurity, or new industry-specific regulations. The great thing about online learning is that finding these niche courses is easier than ever.

For instance, if you're in audit or advisory, finding free SOC 2 training courses can be a smart way to meet a specialized requirement while adding a high-demand skill to your resume. When you embrace these modern learning methods, you can build a CPE plan that not only keeps you compliant but also becomes a real asset for your career growth.

Mastering CPE Tracking and Record-Keeping

Earning your Continuing Professional Education (CPE) credits is only half the battle. The other half—the part that really matters when an auditor comes calling—is proving you actually completed them. Think of it this way: meticulous record-keeping is what turns your hard work into indisputable, audit-proof compliance.

Your CPE documentation is essentially a compliance file for your entire career. It’s the official evidence that backs up your license renewal, and having it organized and ready at a moment’s notice saves a world of stress. A messy or incomplete system, on the other hand, can create massive headaches and potentially invalidate hours you rightfully earned.

What Your State Board Expects You to Keep

While the details can shift from one state to another, most boards of accountancy want to see a standard set of documents for every single course you complete. These records are the official proof of attendance and completion, forming the very backbone of your compliance strategy.

Be prepared to pull out the following for every credit hour you claim:

- Certificate of Completion: This is the non-negotiable, most crucial document. It needs to clearly show your name, the course provider, the course title, the completion date, and the number of CPE credits awarded.

- Course Materials or Outlines: Always keep a copy of the agenda, presentation slides, or any official course description. This is your proof that the subject matter actually qualifies under your state’s rules.

- Proof of Attendance: For live events, both in-person and virtual, this might be a physical sign-in sheet or a digital log confirming you were present and engaged.

- Evidence of Interaction (for self-study): If you're doing a self-study course, make sure you save records of completed exams or other interactive elements required to pass.

This collection of documents is what validates that you met all your CPA continuing education requirements for a given period.

Record Retention Policies

So, you have all the right documents. How long do you need to hang onto them? The general rule of thumb is at least five years after the end of the reporting period in which you earned the credits.

Always double-check your specific state's retention policy. Assuming a shorter timeframe can leave you exposed during an audit that looks back several years. It's best to treat five years as the absolute minimum.

This long-term requirement makes an old-school, paper-based system a real liability. Stacks of certificates stuffed in a folder can easily get lost, damaged, or misplaced over time. It’s exactly why a digital approach is so much more effective for today's accountants.

Automating Your Tracking with Technology

The absolute best way to stay organized and audit-proof is to let technology do the heavy lifting for you. Manually tracking everything in a spreadsheet is certainly better than nothing, but dedicated software can automate the entire process, saving you countless hours and minimizing the risk of human error.

Many accountants now rely on specialized solutions to handle this. Exploring the best document management software for accountants can give you a great overview of tools that do much more than just manage CPE records.

For anyone who offers or needs to track CPE credits, using modern platforms is key to accurate reporting. It's worth looking into effective tools to track attendance online to ensure every participant's time is logged correctly. By building a solid system for your records, you can eliminate the stress of a potential audit and feel confident that your credits are always documented and ready for inspection.

Common CPE Mistakes and How to Avoid Them

Even the most meticulous CPAs can get tripped up by compliance rules. Let's be honest, the world of CPA continuing education requirements is complicated, and a simple oversight can lead to fines, extra coursework, or even put your license in jeopardy. The key is to build a smart, stress-free system for staying on top of it.

The biggest mistake I see? Procrastination. Life and work get chaotic, and it’s all too easy to shove CPE to the bottom of the to-do list until the deadline is staring you in the face. This last-minute scramble almost always means you're stuck taking whatever course is available, not the one that actually helps your career.

Another classic blunder is not checking if a course provider is accredited. Imagine spending hours on a course, only to find out your state board won’t accept the credits. It’s a painful—and expensive—lesson. Always, always confirm that a provider is registered with NASBA or approved by your state board before you sign up.

Misinterpreting State-Specific Rules

Every state board has its own quirks, and it's easy to get them wrong. For instance, many states put a cap on how many credits you can get from self-study courses or from non-technical subjects. If you assume you can knock out all your hours with on-demand online courses, you might be in for a rude awakening when you find out your state has strict limits on that format.

It's not just about the format, either. Some states have specific subject requirements that go beyond the standard ethics course. California, for example, requires CPAs to take courses on fraud prevention. It’s these little details that often trip people up.

The only official source for your CPE requirements is your state board of accountancy's website. Don't rely on general advice or what your buddy in another state is doing. Their rules are not your rules.

Poor Record-Keeping Habits

Finally, a huge misstep is simply failing to keep good records. Earning the credits is only half the battle; you have to be able to prove it if you get audited. A messy folder of certificates—or worse, missing ones—can completely invalidate all your hard work.

Here are a few simple habits to keep you on track and out of trouble:

- Start Early: Don't wait until November to think about your CPE. Map out a rough plan for the year. Spreading your courses out makes the whole process less of a mad dash and gives you time to pick quality programs.

- Verify Everything: Before you pull out your credit card, take two minutes. Go to the NASBA registry or your state board's list of approved providers and double-check that the course counts.

- Create a Digital File: Set up a dedicated folder on your cloud drive for CPE. As soon as you finish a course, drop the certificate, outline, and proof of attendance in there. Staying organized is a cornerstone of solid financial reporting best practices, and it’s just as crucial for your own compliance.

- Review Your State's Rules Annually: Things change. Make it a yearly habit to spend a few minutes on your state board’s website to catch any new rules or updated requirements.

By turning these simple actions into habits, you can stop thinking of CPE as a burden. It just becomes a seamless part of your professional routine, keeping your license safe and your skills sharp.

Common Questions About CPA CPE

Even the most organized CPA can have questions about the finer points of continuing education. Let's clear up some of the most common ones that pop up when you're managing your CPA continuing education requirements.

How Are CPE Credits Calculated?

It's easy to think that one hour of learning equals one CPE credit, but it's a bit more specific than that. Most state boards, along with NASBA, follow the "50-minute hour" standard. This means that for every 50 minutes of uninterrupted learning, you earn one CPE credit.

Think of it this way: a four-hour live webinar might seem like a straightforward four credits. But if that session included 40 minutes of breaks, your actual instruction time is 200 minutes. When you divide that by 50, you land squarely on four CPE credits. Always double-check how a course provider calculates their credits, as self-study courses can sometimes have their own unique formulas.

What If I Miss My CPE Deadline?

Missing your CPE reporting deadline is a big deal. State boards treat this seriously, and the penalties can range from a simple fine to something that could impact your career.

If you miss the deadline, you could be facing:

- Late Fees: This is the most common penalty. Almost every state will charge you a fee for a late renewal.

- Penalty Hours: You'll likely have to make up the hours you missed plus complete extra penalty credits on top of that.

- License Suspension: For more serious lapses or if it's a repeat issue, your license could be suspended. You'd be unable to practice until you've met all the requirements to get back in good standing.

Boards might grant an extension for a major life event, like a severe illness, but don't count on it. It requires a formal request with solid proof and is never a guarantee.

Your best bet is to treat your CPE deadline like a major client's tax filing deadline. Plan ahead, and you'll avoid the stress and cost of falling behind.

Can I Carry Over Extra CPE Credits?

This is a classic question, and the answer is a classic "it depends." Every state board has its own rule on this. Some states are pretty flexible, allowing you to carry forward a certain number of extra credits—maybe 10 or 20 hours—into your next reporting cycle.

On the flip side, many states have a strict "use it or lose it" policy. Any hours you earn above the minimum requirement for the current period simply vanish. They don't count toward your next cycle. That's why it’s so important to know your state's rules before you rack up a ton of extra hours. You want to make sure all your hard work pays off.

At Bank Statement Convert PDF, we get how crucial accuracy and efficiency are for financial pros. Our software makes converting PDF bank statements into neat Excel files a breeze, giving you back precious time you can use for client work—or even finishing up that last CPE course.