An Excel bank reconciliation is where you systematically line up your company’s cash records with your bank statement to hunt down and resolve any differences. It's a foundational skill that gives you direct control and a much deeper understanding of your cash flow than automated software can provide on its own.

Why Excel Still Has a Place in Bank Reconciliation

With all the sophisticated accounting software out there, it’s fair to ask if doing a bank reconciliation in Excel is a thing of the past. The answer is a firm no. While automated tools are fantastic for matching a high volume of transactions, they often miss the subtleties that a manual, hands-on review in Excel can catch. This process is your financial safety net, giving you a clear, unfiltered view of your company's cash health.

Think of it like this: automation is like a self-driving car. It gets you to your destination, but reconciling in Excel is like taking the wheel yourself. You feel every turn, notice every stop, and understand the unexpected detours in your cash flow. For any business owner or accountant, that level of control is invaluable.

Finding the Story Behind the Numbers

A good reconciliation does more than just tick and tie numbers—it tells a story. I once worked with a small business owner who, through this exact process, spotted a series of tiny, recurring fraudulent charges that their automated system had completely missed. Another time, a startup founder got a crystal-clear picture of their burn rate simply by analyzing the timing gaps between when they recorded payments and when the cash actually landed in their account.

These kinds of insights come from the deliberate, focused act of comparison. The benefits go way beyond simple accuracy:

- Catching Fraud: It’s often your first line of defense against unauthorized charges or even internal theft.

- Fixing Errors: It brings bank errors or internal bookkeeping mistakes to light before they snowball.

- Managing Cash Flow: You get a true picture of your cash position, not just what your accounting software thinks you have.

- Staying Audit-Ready: A well-documented reconciliation is a must-have for a smooth audit and shows you have strong financial controls.

A regular, detailed bank reconciliation isn't just a bookkeeping chore; it's a vital business health check. It turns raw transaction data into actionable financial intelligence, giving you the clarity to make smarter decisions.

To really get the most out of this process, it helps to start with a solid foundation by understanding the core concepts of bank reconciliations. For a more detailed look at the steps involved, check out our guide on what is bank statement reconciliation.

Bank reconciliation in Excel is still a cornerstone of financial accuracy for businesses everywhere. A typical mid-sized company might process anywhere from 500 to 2,000 transactions a month, and every single one needs to be reconciled. This blend of smart automation and careful manual oversight is key for maintaining tight internal controls and staying compliant.

Setting Up Your Workspace for a Flawless Reconciliation

Before we even think about matching a single transaction, we need to get our workspace in order. A clean, well-structured Excel workbook is the bedrock of a smooth bank reconciliation. Trust me, spending a little time on setup now will save you from a world of headaches later. This isn't just about making a pretty spreadsheet; it's about building a functional tool that makes the entire process clear and efficient.

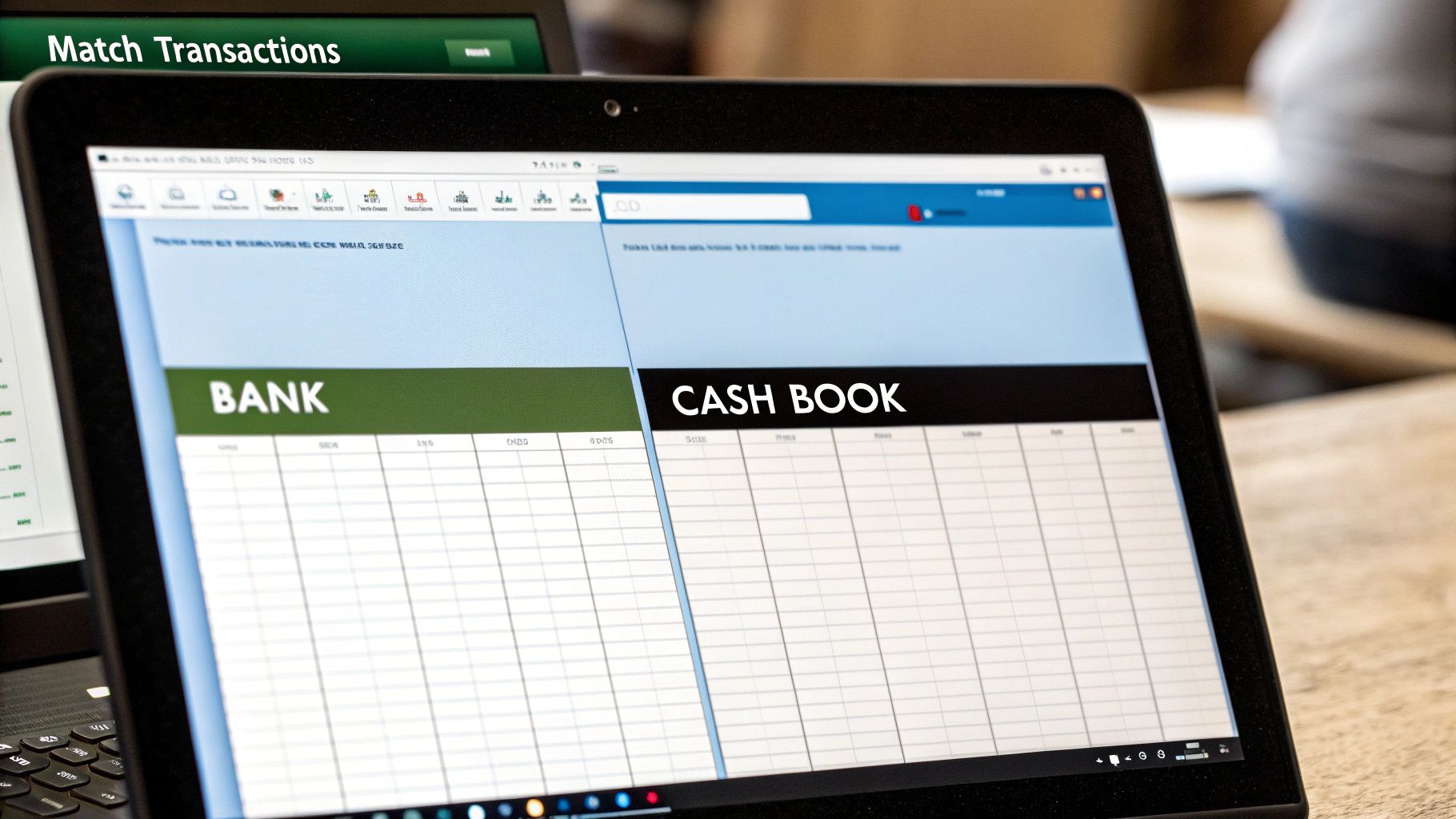

The first thing I always do is create a fresh Excel workbook with two separate tabs. I name one "Bank Data" and the other "Cash Book." This simple separation is non-negotiable—it keeps your two sources of truth distinct and prevents any accidental mix-ups as you start comparing transactions.

This visual guide lays out the fundamental workflow we're about to build: gathering the data, comparing it, and ironing out any discrepancies.

Think of it as turning a pile of raw, messy data into a perfectly balanced financial record, one logical step at a time.

Importing and Cleaning Your Data

Let's be honest, the biggest initial hurdle is getting data out of a bank statement PDF and into Excel. Manually keying in hundreds of transactions is not only mind-numbingly slow, but it's also a surefire way to introduce typos. There’s a much better way.

Meet your new best friend: Power Query. It's built right into Excel, and you can find it under the "Data" tab. Instead of copying and pasting, Power Query lets you connect directly to a PDF file and pull the transaction tables automatically. For anyone doing an excel bank reconciliation, this feature is a total game-changer.

The whole point of data prep is simple: end up with two clean, standardized lists of transactions that can be easily compared. I've seen it time and again—rushing this step almost always leads to reconciliation errors that are a nightmare to track down later.

Once you’ve imported the data, Power Query acts as your data cleaning station. Before the numbers even hit your spreadsheet, you can:

- Standardize Date Formats: Make sure every date follows the same format (e.g., MM/DD/YYYY).

- Clean Up Vendor Names: Get rid of extra junk characters or standardize names like "AMZN Mktp" to "Amazon."

- Split Columns: Easily separate transaction descriptions from reference numbers if they're crammed into one column.

Using a tool like Power Query eliminates the risk of manual errors and ensures your starting data is accurate and consistent from the get-go.

Structuring Your Data for Easy Comparison

Now that your data is clean, the next step is to make sure your "Bank Data" and "Cash Book" tabs are structured identically. This consistency is absolutely critical for the formulas we’ll be using later to match everything up. If you're looking for a great starting point, you can download a pre-built bank reconciliation format in Excel and just adapt it to fit your needs.

A solid, reliable structure usually includes these columns:

| Column Header | Purpose |

|---|---|

| Transaction Date | The date the transaction occurred or posted. |

| Description | Details about the transaction (vendor, customer name). |

| Reference No. | Check number or transaction ID. |

| Withdrawal/Debit | Money leaving the account. |

| Deposit/Credit | Money entering the account. |

This organized layout makes applying formulas and spotting differences a breeze. It's worth noting how much technology has improved this process. Modern systems like Microsoft Dynamics 365 now use AI-assisted reconciliation to automatically match 85%-90% of transactions. That's a huge leap from the 65%-70% we saw with older automated methods. With a well-prepared workspace like this, you're perfectly positioned to start the core task: matching your transactions.

Now for the Real Work: Matching Your Transactions

Alright, you've done the prep work. Your data is clean, organized, and sitting nicely in two separate tabs. This is where the excel bank reconciliation process really begins. We’re about to dive into the matching phase, where we’ll pair up every transaction from your bank statement with its counterpart in your cash book.

Forget printing out statements and ticking off lines with a pen and ruler. We're going to make Excel handle the heavy lifting. The idea here is to build a smart, repeatable system that’s not just fast but also incredibly accurate. We'll use a mix of powerful formulas and simple visual tricks to turn this chore into a more satisfying puzzle.

Using XLOOKUP to Find Your Matches

Our go-to tool for this job is the XLOOKUP function. If you're still using VLOOKUP, this is a major upgrade—it's more powerful and way more flexible. In simple terms, we’re going to tell Excel to take a transaction from the "Bank Data" tab and hunt for a match on the "Cash Book" tab, using the amount as the unique identifier.

Think about it this way: you see a withdrawal for $150.55 on your bank statement. XLOOKUP can scan the entire withdrawal column in your cash book, find that exact $150.55, and then return a related piece of info, like the date or description.

If it finds a match, great—that item is reconciled. If it comes back with an error, you've instantly flagged a problem that needs a closer look.

For a more detailed breakdown of how to build the formula, we’ve put together a guide covering the essential bank reconciliation formula with plenty of examples you can copy and paste. Using a formula like this is what separates a professional, scalable process from a simple manual check-up. It saves a ton of time and cuts down on human error.

Making Matches Pop with Conditional Formatting

Formulas are the engine, but our eyes are drawn to colors and patterns. That’s where Conditional Formatting becomes your secret weapon. Once you’ve used a formula to identify matched items (I usually add a new column and just put the word "Matched"), you can create a rule that automatically changes how those rows look.

Here’s how I typically do it:

- Select the entire data range on both your bank and cash book sheets.

- Go to Conditional Formatting and create a new rule. The rule should be based on a formula that checks if your status column says "Matched".

- Set the format. I like to either change the background to a light green or just use a strikethrough on the text.

The result is instant. As you work, all the matched transactions will visually fade away, letting you focus only on the lines that aren't green or struck through. These are the discrepancies that actually need your attention.

The true power of an Excel bank reconciliation is its ability to make problems impossible to miss. By using visual cues like Conditional Formatting, you force the unresolved items to stand out, so nothing ever gets overlooked.

Tackling the Tricky Stuff

Of course, it’s never a perfect one-to-one match. The real world is messy, and you’ll always run into a few common headaches.

- Lump-Sum Deposits: Your bank statement shows a single deposit for $1,000. But in your cash book, that deposit is actually three separate sales invoices for $400, $350, and $250. A simple formula won't catch this. You'll need to manually highlight the three cash book entries and the single bank deposit and mark them all as reconciled.

- Bank Fees: You spot a $15 monthly service charge on the bank statement that’s nowhere in your cash book. This isn’t a mistake; it's just an unrecorded transaction. You’ll need to add it to your cash book to get things to balance.

- Timing Differences: This is a classic. You wrote check #123 on March 30th, so it’s in your cash book for March. But the vendor didn’t cash it until April 5th, so it won’t appear on your March bank statement. This is what we call an outstanding check, and it’s a standard reconciling item.

The beauty of this system is that by letting formulas knock out all the easy, straightforward matches first, you dramatically shrink the list of items that require this kind of hands-on investigation. It makes the whole process feel much less overwhelming.

Using PivotTables for High-Volume Reconciliations

When you move past reconciling a few dozen transactions and start staring down a list of hundreds—or even thousands—the classic XLOOKUP and Conditional Formatting combo can really start to drag. This is where you bring in the heavy artillery: the PivotTable. For a high-volume excel bank reconciliation, this isn't just another function; it's a completely different way of thinking that summarizes huge datasets in a flash.

Think about a bustling e-commerce store or a consulting firm juggling payments from all over. A PivotTable can shrink what used to be a multi-day reconciliation nightmare into a task you can knock out in a couple of hours. The magic is in the approach: instead of matching individual lines, we summarize both sets of data and let the differences pop out on their own.

Combining Your Data for Analysis

First things first, you can't build the PivotTable until you get your bank and book data into a single, master list. The trick here is to add a "Source" column so you can tell them apart.

Your combined table should be structured something like this:

- Source: Mark each entry as either "Bank" or "Book"

- Date: The date of the transaction

- Description: Details of the transaction

- Amount: The value (I always use positive for deposits and negative for withdrawals to make the math work)

This unified list is the foundation for everything that follows. It's the critical first step that lets you compare both sources inside one powerful tool. If you're looking to speed this part up, you can find great tips on how to automate data entry to make this prep work fly by.

Building a Reconciliation PivotTable

Once your data is combined, creating the PivotTable itself is surprisingly simple. It’s all about dragging and dropping fields to build a summary that practically screams where the problems are.

Here’s a setup I use all the time because it’s so effective:

- Drag the Description and Amount fields over to the "Rows" area.

- Next, pull the Source field into the "Columns" area.

- Finally, drag the Amount field into the "Values" box, making sure it’s set to "Sum."

What you get is a table showing every unique transaction. If an item appears in both your bank statement and your internal books, the "Grand Total" column for that row will equal zero. Bingo! Any row with a non-zero total is your to-do list—it's either a missing transaction, a duplicate entry, or a simple amount mismatch.

A well-structured PivotTable does more than just find discrepancies; it neatly sorts them for you. You can instantly see which transactions only exist on the bank side, which ones are only in your books, and which ones have amounts that just don't cancel each other out.

PivotTables have become my go-to for simplifying reconciliations when the transaction volume gets serious. Anyone with intermediate Excel skills can get this up and running, comparing thousands of rows without breaking a sweat. In my experience, teams that adopt this method often see their reconciliation accuracy jump by over 30% because it makes duplicates and other errors so obvious. This technique really elevates your skills, getting you ready to tackle even the most complex reconciliations with confidence and speed.

Digging into Discrepancies and Getting Them Sorted

So, your numbers don't match. Don't panic. Finding a mismatch during your excel bank reconciliation doesn't mean you've failed; it's literally the whole point of doing it. This is where the real work begins—think of it as putting on your detective hat.

The trick is to have a system for tracking down these rogue items so you can sort them out without pulling your hair out. Nine times out of ten, these discrepancies fall into a handful of predictable categories.

The most frequent culprit is a simple timing difference. This is when you record a transaction in your books, but it hits the bank in a different period. There's no real "error" here; it's just a lag in processing that you need to account for.

- Outstanding Checks: You cut and recorded a check on the 28th, but your supplier didn't cash it until the 3rd of next month. Your books are right, but the bank statement is a few days behind.

- Deposits in Transit: On the flip side, you might deposit a stack of customer checks on the last day of the month. You’ve logged the income, but it won’t actually appear on the bank statement for another day or two.

Errors vs. Unposted Items: What’s the Difference?

Once you've ruled out timing, discrepancies are usually one of two things: a genuine error or something you just haven't recorded yet. Getting to the bottom of these issues is crucial, as they often highlight common bookkeeping mistakes that a good reconciliation process will bring to the surface.

For instance, you might spot a monthly bank service fee on the statement that you forgot to log in your cash book.

That's not an error, it's an omission. The fix is simple: make an adjusting journal entry in your records to account for the expense. The same goes for any interest earned—that's income, and you need to record it.

Your main goal when investigating is to figure out what each discrepancy is. Is it a timing issue that will clear up on its own next month, or is it an error or omission that needs a journal entry to get your books straight?

Actual errors need a different kind of fix. Let's say the bank accidentally cleared a check for $250 when it was written for $25.00. That's on them, and you'll need to contact the bank to get it corrected.

But if you find you entered an invoice payment as $98 instead of the correct $89, that one's on you. You'll have to create a correcting entry in your cash book. A well-organized reconciliation makes it crystal clear who needs to fix what.

Common Questions I Hear About Excel Bank Reconciliations

Even with a great system in place, you’re going to run into a few tricky spots during an Excel bank reconciliation. I see the same questions pop up time and time again. Let's walk through some of the most common hurdles and how to clear them.

Think of this as your go-to troubleshooting guide, full of practical answers from years of doing this stuff.

How Can I Match Transactions Faster?

This is the big one. Everyone wants to speed up the matching process.

If you're only dealing with a small number of transactions, the quickest trick in the book is using Conditional Formatting. Just select the columns with your dollar amounts, tell Excel to highlight duplicate values, and boom—your matches light up instantly. It's a simple and effective visual check.

But when you need something more powerful and scalable, XLOOKUP is your best friend. It's far superior to just highlighting cells because it doesn't just find a match; it can pull back a corresponding value from another column. You can use it to automatically mark items as "Reconciled" or pull in a transaction ID, which is a game-changer for larger datasets.

What's the Best Way to Handle PDF Bank Statements?

Dealing with PDFs is a massive headache for so many people. Let me be clear: the absolute worst thing you can do is manually retype the data into Excel. It’s slow, tedious, and a surefire way to introduce errors.

The best tool for the job is already built right into Excel: Power Query. You'll find it on the "Data" tab under the "Get & Transform Data" section.

With Power Query, you can point Excel directly at your PDF file, and it will intelligently find and extract the transaction tables for you. Once the data is in the Power Query editor, you have an incredible amount of control to clean it up before it ever hits your worksheet. You can fix date formats, split text into different columns, or remove unnecessary rows.

Your goal should be to never manually type transaction data from a bank statement. Using a tool like Power Query not only makes you faster but also dramatically reduces the risk of human error, which is the number one cause of reconciliation headaches.

Can This Whole Process Be Fully Automated in Excel?

Realistically, the goal is mostly automated, not 100% automated. And that's perfectly okay. Using a combination of Power Query, formulas like XLOOKUP, and PivotTables, you can get to a point where 80-90% of your transactions are matched without you lifting a finger. That’s where you’ll see a massive return on your time.

You'll almost always have a few outliers that need a human brain to sort out. These are things like:

- A single lump-sum deposit that needs to be split and matched against several smaller invoices.

- Transactions with weird, unhelpful descriptions that a formula just can't interpret.

- Surprise bank fees or other one-off charges that don't have a corresponding entry in your books.

The strategy here is simple: automate the routine, predictable work. Doing so frees you up to put your expertise where it really counts—investigating and resolving those tricky discrepancies. That’s where your true value lies.

Ready to stop manually typing and start reconciling faster? Bank Statement Convert PDF provides the software you need to instantly convert your bank statement PDFs into clean, ready-to-use Excel spreadsheets. See how Bank Statement Convert PDF works and take the pain out of data entry.