Let's be honest, nobody enjoys manually punching numbers from invoices, receipts, or bank statements into a spreadsheet. It’s slow, tedious, and a recipe for mistakes. Financial data extraction software is the tool that kills that entire process.

Think of it as a smart assistant that reads your financial documents for you. It automatically finds the important stuff—like invoice totals, due dates, and vendor names—and neatly organizes it into clean, usable data for your accounting or reporting software. It turns messy paperwork into organized information, instantly.

What Exactly Is Financial Data Extraction Software?

Picture a typical finance department. Invoices, bank statements, and purchase orders are flooding in as PDFs, scanned images, and email attachments. The old way of doing things involves someone painstakingly opening every single file, hunting for the key details, and then typing it all into another system. This isn't just a drag—it’s where costly errors creep in.

Financial data extraction software automates that entire workflow. It uses sophisticated tech to read and understand documents just like a human would, but it operates at a scale and speed we simply can't match. This frees up your finance pros to stop being data entry clerks and start focusing on high-value analysis and strategy.

The Core Technologies Driving Automation

So, how does this software actually work? It’s not magic, but it’s close. The heavy lifting is done by two key pieces of technology working in tandem.

- Optical Character Recognition (OCR): This is the foundation. OCR technology scans images of text—think of a PDF bank statement or a picture of a receipt—and converts it into text a computer can read. It’s the digital version of transcribing a document by hand.

- Artificial Intelligence (AI): OCR gets the text, but AI gives it meaning. The AI layer is what understands the context. It figures out that "ABC Corp" is the vendor's name, that "$1,250.75" is the total amount due, and that "10/31/2024" is the payment deadline.

Putting these two together is what allows the software to process a huge variety of documents with impressive accuracy. To see a real-world example, take a look at the role of OCR in banking, where it's used to process everything from checks to loan applications.

From Unstructured Chaos to Organized Clarity

The real goal here is to bring order to financial chaos. Most of our financial information arrives in "unstructured" formats—it's just text and numbers scattered across a page. This software’s job is to pull that information out and put it into a "structured" format, like the neat rows and columns of an Excel sheet or a database.

The real power of financial data extraction lies in its ability to translate diverse document formats into a single, unified language that your financial systems can understand and use for reporting, analysis, and decision-making.

Once the data is structured, it’s ready to be sent directly into your other essential business systems. This could include:

- Accounting platforms like QuickBooks or Xero

- Enterprise Resource Planning (ERP) systems

- Business Intelligence (BI) dashboards

In the end, this automation creates a solid, trustworthy foundation for all of your financial operations. It ensures the data you rely on to make critical business decisions is both accurate and available when you need it.

The Strategic Impact of Automated Data Extraction

Switching to automated financial data extraction is more than just a simple upgrade—it's a complete rethink of how a business manages its most critical information. It’s not about saving a few minutes here and there. It's about freeing your finance team from the grind of manual entry so they can become the strategic powerhouse they were meant to be.

Think about it. When skilled professionals are no longer bogged down by chasing invoices or fixing typos, they can finally focus on what really drives the business forward. We're talking about deep-dive financial analysis, accurate forecasting, and smart financial planning. This is how you shift your team from data clerks to genuine strategic advisors.

The market certainly sees the value. The global data extraction software market was already worth USD 2.5 billion in 2023 and is on track to hit USD 6.7 billion by 2032. That kind of growth tells you something big is happening.

From Costly Errors to Unwavering Accuracy

Let's be honest: manual data entry is a minefield of potential mistakes. One misplaced decimal or a couple of swapped digits can throw off entire financial reports, lead to bad forecasts, and create major compliance headaches. These aren't small slip-ups; they chip away at the trust you have in your own numbers.

Financial data extraction software all but eliminates this risk. Using sophisticated OCR and AI, these tools can reach accuracy rates well over 99%. The result? The data feeding your financial systems is clean, consistent, and completely reliable.

This newfound accuracy creates a positive ripple effect everywhere:

- Better Decision-Making: Leaders can act with confidence, knowing their decisions are based on solid ground.

- Stronger Compliance: Clean records make audits smoother and help you stay on the right side of regulations.

- Happier Vendors: When invoice data is right, payments are on time, which goes a long way in building good supplier relationships.

Accelerating Business Velocity and Agility

In today's market, speed is everything. Clunky, manual workflows are like an anchor dragging your business down. Just look at the accounts payable process—it can take days, sometimes weeks, to manually handle a single invoice. This slows down payments and gives you a blurry, outdated picture of your company's finances.

Automation shrinks that timeline from days down to mere minutes. This isn't just about being faster; it's about being more agile. It means you can close the books quicker, approve expenses in a snap, and manage your cash flow with real-time clarity.

The true strategic value emerges when real-time, accurate financial data becomes the standard. This allows a business to react swiftly to market changes, seize opportunities faster, and operate with a level of agility that manual processes simply cannot support.

This is a key piece of a much larger puzzle. To see how this fits into the big picture, it's worth exploring the many business process automation benefits that reach far beyond just the finance department.

Unlocking Significant Cost Savings and ROI

The return on investment you get from this kind of software is undeniable. The most immediate win is the reduction in labor costs, but the savings go much deeper than that.

To get a sense of just how valuable this is, look at how the big players are moving. The recent news of Salesforce's acquisition of Informatica shows the massive strategic importance top companies are placing on smart, efficient data management.

At the end of the day, automating data extraction isn't just a cost-cutting measure. It's about building a more resilient, intelligent, and forward-thinking financial operation that positions your company to lead, not just compete.

Manual vs Automated Financial Data Extraction

To truly grasp the difference, it helps to see a side-by-side comparison. The table below breaks down how automation stacks up against the old way of doing things.

| Aspect | Manual Data Entry | Automated Extraction Software |

|---|---|---|

| Speed | Slow; days or weeks per document | Fast; minutes or seconds per document |

| Accuracy | Prone to human error (typos, etc.) | High accuracy (often >99%) |

| Cost | High labor costs, plus costs of errors | Lower operational costs, subscription-based |

| Scalability | Difficult; requires hiring more people | Easily scalable to handle volume spikes |

| Employee Focus | Tedious, repetitive data entry | Strategic analysis and high-value tasks |

| Data Accessibility | Locked in physical or siloed files | Centralized, real-time, and accessible |

As you can see, the move to automation is less of an "if" and more of a "when." The advantages in speed, accuracy, and overall strategic focus are simply too significant to ignore for any business looking to stay competitive.

Essential Features of Top-Tier Extraction Software

When you start looking at financial data extraction software, you'll quickly notice they aren't all built the same. While lots of tools can pull data from a simple, clean PDF, the really powerful ones come packed with features designed for the messy, complex reality of business finance. Figuring out what those features are is the secret to choosing a tool that actually makes a difference to your bottom line.

Think of it like buying a car. Any basic model can get you from A to B. But a top-of-the-line vehicle has advanced safety features, a more powerful engine, and a navigation system that makes the whole trip faster, smoother, and far more reliable. It’s the same idea here—the right features turn data extraction from a chore into a genuine strategic advantage.

Let's break down the "must-haves" you should be looking for.

Foundational Technology: AI and OCR Accuracy

The engine driving any extraction software is its Optical Character Recognition (OCR), but it's the Artificial Intelligence (AI) that provides the horsepower. OCR is the technology that scans a document and turns the picture of the text into actual, usable characters. By itself, though, it's pretty limited.

That's where the AI and Machine Learning (ML) layer comes in. This is what gives the software the "smarts" to understand context—to know that "Total Due" is the invoice amount, no matter where it shows up on the page. The best platforms out there boast accuracy rates of 99% or more, which is absolutely vital for keeping your data clean. Anything less, and you're just swapping manual data entry for manual data correction.

A top-tier extraction tool doesn't just read documents; it understands them. The combination of high-fidelity OCR and contextual AI is what separates a basic text scraper from a true financial automation powerhouse.

Broad Document and Format Support

Financial information doesn't arrive in one neat, tidy format. It comes from all over the place. A truly capable software solution has to be flexible enough to handle this variety without a hiccup. We're not just talking about standard invoices, but the whole gamut of documents and file types you deal with every day.

A premier tool should handle all of these without breaking a sweat:

- Invoices and Receipts: The bread and butter of accounts payable.

- Bank and Credit Card Statements: Crucial for reconciliation and analysis.

- Purchase Orders: For matching and verifying every single transaction.

- Tax Forms: To keep compliance and reporting running smoothly.

- Contracts and Agreements: For pulling out key financial terms and dates.

It also needs to accept a wide range of file types, from PDFs and scanned images (like JPGs or PNGs) to attachments pulled straight from an email. This kind of flexibility ensures the software adapts to your workflow, not the other way around. This versatility is a key function, similar to what you'd look for when researching the best PDF to Excel converter software for more specific tasks.

Seamless and Smart Integrations

Let's be honest: extracted data is only useful if it ends up where you need it. This is where integrations become a deal-breaker. The leading extraction tools offer pre-built connectors or a solid Application Programming Interface (API) to sync up with the other software you're already using.

You should look for native integrations with the platforms that run your business, like:

- Accounting Software: QuickBooks, Xero, Sage

- ERP Systems: SAP, Oracle NetSuite, Microsoft Dynamics

- Cloud Storage: Google Drive, Dropbox, OneDrive

This connectivity gets rid of the soul-crushing task of downloading and uploading CSV files. It creates a smooth, automated workflow where data flows directly from a document into your general ledger, all without anyone having to lift a finger. That means more speed and better consistency across your entire tech stack.

Advanced Data Validation and Custom Rules

The final piece of the puzzle is making sure the data isn't just accurate, but that it also makes sense for your business. Top-tier software lets you build your own custom validation rules to automatically double-check the data before it goes anywhere.

For example, you could set up rules to:

- Flag Duplicate Invoices: Catch a repeat invoice number before you accidentally pay it twice.

- Verify Totals: Automatically confirm that the line items add up to the invoice total.

- Cross-Reference POs: Make sure the details on an invoice perfectly match the original purchase order.

Think of these rules as an automated safety net, catching mistakes before they become real problems. This proactive approach to data quality is a true hallmark of an enterprise-grade solution.

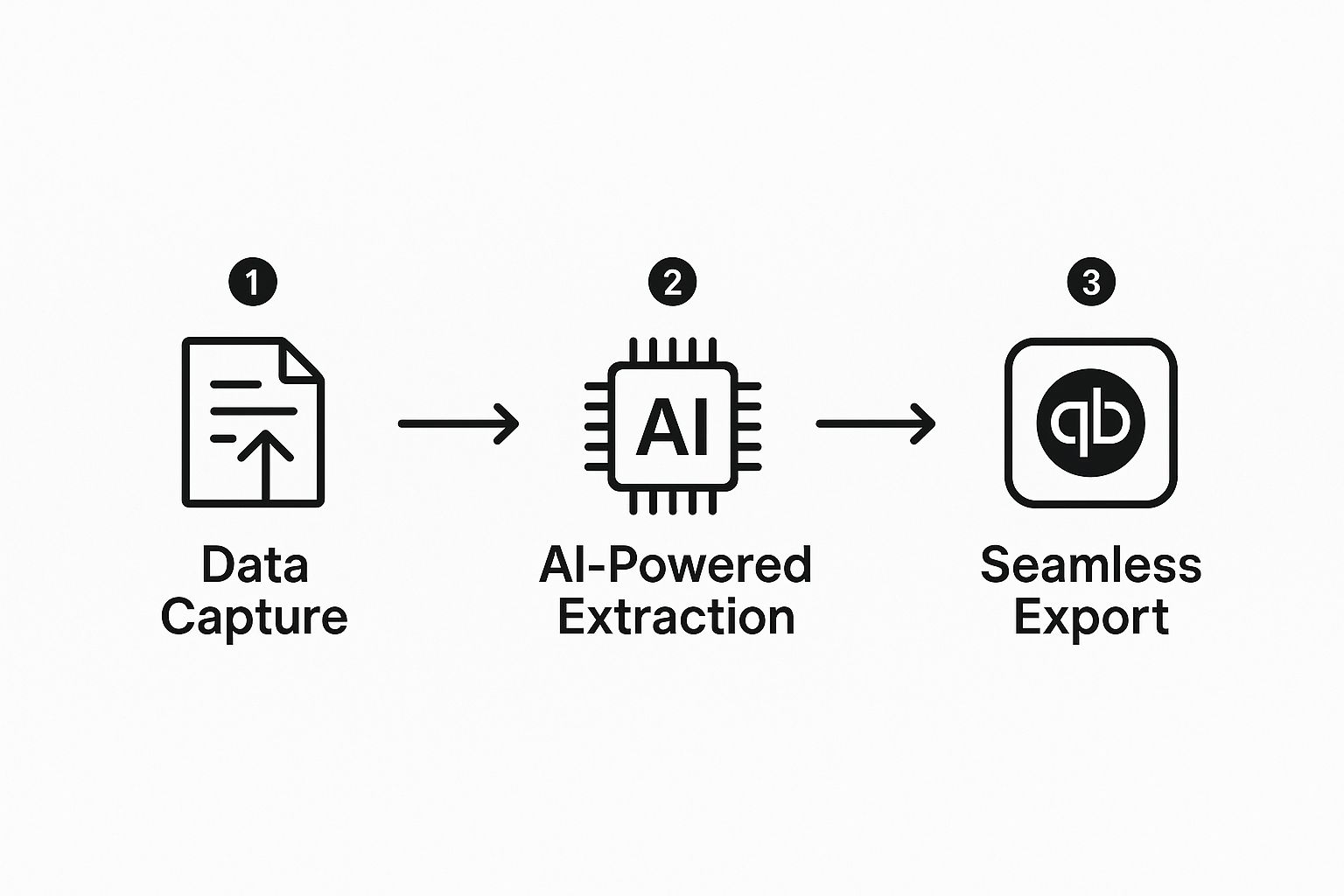

See How the Data Extraction Process Works

It's one thing to talk about financial data extraction in theory, but it’s much easier to grasp when you see it in action. So, let's walk through a common, everyday scenario: processing a vendor invoice. We'll follow it from the moment it lands in your inbox to the point where its data is neatly filed in your accounting system. This is the journey from a static document to active, usable information.

It all starts when a PDF invoice from a supplier arrives. Instead of the old routine—print, grab a ruler, and start punching numbers into a spreadsheet—you just feed the document into the software. That's the first step. Simple.

This infographic breaks down that journey from raw document to clean, structured data.

As you can see, it’s a clear path: capture the document, let the tech work its magic, and then export the results. Let's dig into what happens at each stage.

Step 1: Data Capture and Pre-Processing

First up is data capture. You can upload a PDF, forward an email with an attachment, or even scan a paper copy. The software isn't picky; it just ingests the document, whatever its starting format.

From there, the best tools kick off an intelligent pre-processing stage. Think of it as a digital cleanup crew. If you uploaded a photo of a receipt that was crooked or had a weird shadow, the software automatically straightens it out and boosts the contrast. This isn't just for looks—a clean image is absolutely critical for getting accurate results in the next step.

Step 2: AI-Powered Extraction

This is where the real intelligence comes into play. Using a powerful combination of Optical Character Recognition (OCR) and Artificial Intelligence (AI), the system doesn't just "read" the document—it understands it. It knows the difference between an invoice number and a phone number, even if they're right next to each other.

The software intelligently identifies and tags the key data fields it finds:

- Vendor Name: It spots "ABC Supplies Inc." and knows that's the supplier.

- Invoice Number: It pulls "INV-45892" and flags it as the unique ID.

- Invoice Date and Due Date: It finds both dates and formats them correctly.

- Line Items: It can even break down individual items, including their descriptions, quantities, and prices.

- Total Amount: The software zeroes in on the final amount due, ignoring any subtotals or taxes.

If you're curious about the nuts and bolts behind this, our guide on how to extract data from PDF files gets into the more technical details.

Step 3: Automated Validation and Verification

Getting the data out is only half the job. You also have to be sure it's correct. This is where automated validation comes in, acting as a tireless digital auditor. The system checks the extracted data against a set of rules that you define.

Think of the validation step as the system's built-in quality control. Its entire purpose is to catch common mistakes and red flags before bad data has a chance to mess up your financial records.

For example, the software can run multiple checks in a split second:

- It can look up the vendor's name to make sure it matches a supplier in your database.

- It can check if you’ve already processed an invoice with the same number to prevent duplicates.

- It can do the math to confirm that the sum of the line items actually equals the total amount.

If anything seems off, the system flags the invoice for a human to take a quick look. This "human-in-the-loop" approach gives you the best of both worlds: the incredible speed of automation and the confidence of human oversight. It's how these tools achieve accuracy rates that often top 99%.

Step 4: Seamless Export and Integration

Once the data has been captured, extracted, and triple-checked, the final step is to put it to work. The software exports all this information into a structured format, like a CSV file or an Excel spreadsheet.

But the most efficient systems go one step further with direct integrations. The validated invoice data can flow automatically into your accounting software, whether that’s QuickBooks, Xero, or another platform. A new bill payable is created instantly, no typing required. This final, seamless handoff is what closes the automation loop, freeing up your team to focus on work that actually requires their expertise.

How to Choose the Right Software for Your Business

Picking a financial data extraction tool isn’t just about ticking boxes on a feature list. It's a strategic move that directly impacts your team’s productivity, the integrity of your data, and your company's ability to grow. The right software should feel like a natural part of your finance department, not another clunky system that people have to wrestle with every day.

Think of it like hiring a key team member. You wouldn't just glance at a resume; you’d dig deeper. Can they grow with the company? Do they fit the culture? Do they have the specific skills to handle your unique challenges? You need to apply that same thoughtful approach when you invest in software.

Assess Your Current and Future Needs

Before you even glance at a product demo, you have to look inward. What, specifically, is broken right now? Are you drowning in a sea of vendor invoices? Is bank reconciliation a nightmare? Does expense reporting take weeks instead of days? Get crystal clear on your immediate pain points.

But don't just stop there. Picture your business in two, or even five, years. Will your document volume triple? Will you be dealing with new types of financial paperwork as you expand? A tool that works for your small team today might completely buckle under the pressure of your future enterprise needs.

Choosing a software solution is about balancing today's urgent needs with tomorrow's strategic goals. The best financial data extraction software is one that can solve your immediate problems while providing a clear path to handle future growth and complexity without requiring a complete overhaul.

Evaluate Core Functionality and Usability

Once you know what you need, you can start looking at software through the right lens. It’s easy to get distracted by slick dashboards and fancy reports, but the fundamentals are what will make or break your experience.

Here are the critical areas to focus on:

- Accuracy and Reliability: How good is it at actually reading the data? Ask for benchmark stats and look for providers who can consistently hit over 99% accuracy. Anything less just means you're trading one manual task for another.

- Document Scope: Can it handle everything you throw at it? Make sure you test it with your messiest invoices, your most complicated bank statements, and those long, multi-page contracts.

- Ease of Use: Is the interface actually intuitive? A powerful tool is worthless if your team finds it too confusing to use. The platform should be built for finance pros, not IT wizards.

- Implementation and Onboarding: How long will it take to get this thing up and running? A vendor with a clear, supportive onboarding process is worth its weight in gold.

The market for this technology is growing fast, with North America expected to lead the charge. This is happening because there's a high concentration of vendors in the region and a real appetite among businesses to adopt AI-driven tools. Plus, with so many small and mid-sized companies already on cloud platforms, the conditions are perfect for growth. You can read a full analysis of these market trends at dimensionmarketresearch.com.

Scrutinize Security and Compliance

When you're dealing with sensitive financial information, security isn't just a feature—it's everything. You're trusting a vendor with your company's most critical data, so you need absolute confidence in their security protocols. Don't be shy about asking tough questions.

Look for these key indicators that they take security seriously:

- SOC 2 Compliance: This is a rigorous audit proving a vendor manages data securely to protect your organization and your clients' privacy. It's a huge green flag.

- GDPR and CCPA Compliance: If you do business with people in Europe or California, the vendor absolutely must meet these strict data privacy regulations.

- Data Encryption: Make sure your data is encrypted both in transit (as it’s being sent) and at rest (while it's stored on their servers). This is non-negotiable.

Demand a Pilot Program

Finally, and this is crucial, never buy software like this without a proper pilot program. A slick demo shows you what a tool can do in a perfect world. A pilot shows you what it will do with your actual documents and your real-world workflows.

This is your chance for a proper test drive. Give the vendor a real sample of your documents—the good, the bad, and the ugly. This hands-on trial is the single best way to know if their accuracy claims hold up and if the software is truly a good fit for your team. A successful pilot gives you the hard evidence you need to make the final call with confidence.

The Future of Financial Data Automation

The world of financial data extraction isn't just evolving; it's accelerating towards a future that’s far more intelligent and connected. What we’re seeing now is really just the starting line. This technology is on a path to completely reshape financial operations, making them more predictive, autonomous, and central to a company's core strategy.

The demand for these smarter data tools is exploding. Market projections show the data extraction space is set to balloon from USD 6.16 billion in 2025 to a massive USD 24.43 billion by 2034. That’s a compound annual growth rate of 16.54%, which tells you one thing: businesses are all-in on using advanced analytics to make better decisions. You can dig into the details of this market expansion and its drivers.

The Rise of Hyperautomation and AI

The next big leap is something called hyperautomation. This isn't just about pulling data off a page anymore. It’s about seeing data extraction as the first domino in a fully automated, end-to-end business process.

Picture this: an invoice lands in an inbox. The software doesn't just read it. It instantly kicks off an approval workflow, schedules the payment, and updates your cash flow forecasts in real-time. No human hands required. That's the promise of hyperautomation.

AI and machine learning are what make this possible. The systems of tomorrow won't just see text; they’ll understand context and nuance in messy, unstructured data with incredible accuracy. They’ll learn from mistakes, adapt to new document formats instantly, and even flag potential errors before they become problems.

The future isn't about digitizing paper. It’s about building self-driving financial workflows that are smart, adaptable, and plugged into the entire business.

Integrated Systems and Enhanced Security

This vision hinges on everything working together. The evolution of financial automation is being heavily influenced by platforms like treasury management systems, which need clean, automated data feeds to do their job properly. The walls between different financial tools are coming down, paving the way for a unified ecosystem where data flows freely and intelligently.

Finally, new technologies are stepping up to lock down data security and integrity. Take blockchain, for example. It offers the potential for a transparent, unchangeable record of every financial transaction. When you pair that with financial data extraction software, you create an incredible level of trust and traceability. Every piece of data becomes secure and verifiable, from the moment it's captured to its final entry in your books. This blend of intelligence, integration, and security is painting a very clear picture of what’s ahead.

Your Top Questions About Financial Data Extraction, Answered

When you're looking into new software, especially for something as critical as your finances, you’re bound to have some questions. It’s only natural. Let's tackle some of the most common ones that come up when people explore financial data extraction tools.

One of the first things everyone asks is, "How accurate is it, really?" It's a fair question. The good news is that modern AI-powered tools are incredibly precise, often boasting accuracy rates north of 99%. These systems aren't just scanning documents; they're learning. Every time a user makes a correction, the AI gets smarter, ensuring the data flowing into your financial systems is something you can actually trust.

Another big one is integration. "Will this even work with my existing accounting software?" Nobody wants a tool that creates more work. That's why the best platforms are built with connectivity in mind. They use APIs and ready-made connectors to plug right into popular systems like QuickBooks, Xero, and other major ERPs. The goal is a smooth, automated pipeline for your data, no more clunky manual exports.

What About Security and the Bottom Line?

Handing over sensitive financial documents? Security is obviously a massive concern. Any reputable provider will treat this with the seriousness it deserves. Look for tools that use strong security measures like end-to-end data encryption and are compliant with rigorous standards like SOC 2. This means your data is protected from the moment it leaves your computer to the moment it's stored, giving you enterprise-level peace of mind.

In the end, it always comes down to one question: Is it worth it? What's the real return on investment (ROI)? The value here is crystal clear. You're looking at a massive drop in manual labor, the end of expensive data entry mistakes, and a much faster accounts payable cycle.

When you add it all up, the cost savings are substantial. But it's more than just saving money. It's about freeing up your finance team from mind-numbing data entry so they can focus on what they do best: strategic analysis that actually grows the business. The real ROI is building a smarter, more efficient financial engine for your company.

Ready to eliminate manual data entry and get perfectly clean financial data? Bank Statement Convert PDF provides the tools you need to convert bank statement PDFs into Excel spreadsheets effortlessly. Learn more and get started today at bankstatementconvertpdf.com.