To read a bank statement, you'll want to start with the big picture—the account summary—to see your opening and closing balances. After that, it’s about diving into the details. Go through the transaction history line by line, matching debits (money out) and credits (money in) against what you know you spent and earned. This is your chance to make sure everything adds up and is legitimate.

Why Reading Your Bank Statement Is a Critical Skill

Let's be honest—most of us just glance at the final balance and move on. It's easy to treat your bank statement like a junk mail receipt you just shove in a drawer. But doing that is a huge missed opportunity. This document is so much more than a number; it’s a detailed financial story of your last month, just waiting to be read.

Think of it as a monthly health check for your money. Knowing how to read a bank statement is fundamental for managing your finances, especially since banking has gone almost completely digital. In fact, digital banking now makes up about 77% of all banking interactions around the world. This makes it easier than ever to keep a close eye on your accounts, but you have to know what you're looking for.

Your Bank Statement Sections at a Glance

Before we dive deep, here’s a quick look at the key parts of your statement and what they mean for you.

| Section Name | What It Tells You | Why It Matters |

|---|---|---|

| Account Summary | A high-level overview of your account's activity for the period, including starting and ending balances. | Gives you a quick snapshot of your financial position without digging into every single transaction. |

| Transaction History | A detailed, chronological list of all debits (withdrawals, purchases, fees) and credits (deposits). | This is where you spot errors, unauthorized charges, and get a real sense of your spending habits. |

| Bank Fees & Charges | A specific breakdown of any fees charged by the bank, like monthly service fees or overdraft penalties. | Helps you identify and potentially eliminate costs that are quietly draining your account. |

| Interest Information | Details on any interest earned (for savings accounts) or charged (for credit lines) during the statement period. | Crucial for understanding how your money is (or isn't) working for you. |

This table is just the starting point. Now, let's get into what these sections really tell you and how to use them to your advantage.

Building Your Financial Foundation

Regularly reviewing your statement isn't just about spotting fraud—though that's a massive benefit. It’s about gaining total control over where your money is going. Making this a simple habit empowers you to do so much more.

- Track Your Spending: Finally see exactly where your money goes each month, from that forgotten recurring subscription to your daily coffee run.

- Identify Unnecessary Fees: Catch those sneaky monthly service charges, overdraft fees, or other bank costs that eat away at your balance.

- Confirm Your Income: Make sure your paychecks, client payments, and any other deposits have posted correctly and on time.

- Prepare for Financial Goals: Use the real data from your statement to build a budget that actually works, save for a down payment, or plan for retirement.

Of course, before you can do any of this, you need to have the document in front of you. If you're not sure where to find yours, our guide on https://bankstatementconvertpdf.com/how-to-get-your-bank-statement/ gives you clear, step-by-step instructions for most major banks.

A bank statement is the unfiltered truth about your financial habits. Learning to read it is like learning a new language—the language of your own money.

Beyond the Numbers

Mastering this skill goes way beyond simple math; it’s about building genuine financial literacy. Once you can confidently read your bank statement, you'll find it much easier to understand more complex financial documents down the road.

For instance, the same principles of careful review apply to other important papers. Developing your eye for detail here can even help you learn how to read legal contracts as a business owner. This guide will walk you through every section of your statement, turning what looks like a confusing jumble of numbers into a clear financial roadmap.

Understanding the Header and Account Summary

Think of the very top of your bank statement as your financial command center for the month. Before you get into the nitty-gritty of every single transaction, this section gives you the quick, high-level snapshot you need. It’s the first place you should look, and getting familiar with it sets the stage for understanding everything else.

Right away, you’ll see the basics: your bank’s name and contact info, your name and address, and, of course, your account number. Give this a quick glance every time. It’s a simple gut-check to make sure you're looking at the right statement for the right account.

You'll also spot the statement period—the specific date range this document covers, like October 1 through October 31. This is your timeframe; every deposit and withdrawal listed below happened between these two dates.

Decoding Your Balances

Okay, this is where the numbers start, and it’s where some confusion can creep in. The summary section throws a few different "balance" figures at you, and they each tell a slightly different part of your financial story. Knowing what each one means is the secret to avoiding those dreaded overdraft fees or thinking you have more cash than you actually do.

Here’s what you’re looking at:

- Starting Balance: This is where your account stood on day one of the statement period. It’s simply the money you had left over from the previous month.

- Total Deposits: This is a neat sum of all the money that flowed into your account. Think paychecks, Zelle payments from friends, or any cash you deposited.

- Total Withdrawals: And this is the sum of all the money that flowed out. This bucket includes everything from your morning coffee purchase to your rent check and ATM cash withdrawals.

- Ending Balance: This is the bottom line—what was left in your account on the very last day of the statement period. The math is straightforward: Starting Balance + Total Deposits – Total Withdrawals = Ending Balance.

Your ending balance is a historical snapshot. It's a factual record of where your account was on a specific day in the past, but it's not the number you should use to decide if you can afford that new pair of shoes today.

The Most Important Number: Available Balance

While the ending balance is great for record-keeping, your available balance is the number that matters for your real-life, in-the-moment spending decisions. You won't always see this on a paper statement's summary, but it's front and center in your online banking app for a reason.

Here’s a practical example. Let's say your statement's ending balance is $1,500. But you just swiped your debit card for $100 worth of groceries an hour ago. That transaction is likely still "pending" and hasn't officially been subtracted from your account yet.

In this scenario, your available balance is actually $1,400. That’s the true amount of money you have at your disposal. Getting in the habit of checking your available balance before you spend is one of the smartest, simplest ways to stay in control of your money and avoid any costly surprises.

Making Sense of Your Transaction History

This is the heart of your bank statement—where the story of your money unfolds, line by line. The transaction history takes the high-level numbers from the summary and breaks them down into a real narrative of your financial life. Honestly, it's the most powerful section for getting a true handle on your finances.

At first glance, it can look like a mess of dates, cryptic codes, and numbers. But once you know how to read it, it becomes an incredible tool. Every single line item represents one financial event, all logged in chronological order.

Your job here is to put on your detective hat and make sure every entry is legitimate. The two columns that matter most are debits (money going out) and credits (money coming in).

Deciphering Debits and Credits

Think of debits as everything you paid for—that morning coffee, your rent check, an ATM withdrawal, or the electric bill. Credits are the opposite; they're all the inflows, like your paycheck, a deposit from a client, or when a friend pays you back for dinner.

The best way to start is to simply scan down the list and mentally check off each transaction. "Yep, I remember that grocery run. Okay, there's that online purchase." This simple review is your first line of defense in confirming all the activity on your account is actually yours.

You'll quickly find that banks have their own language full of abbreviations. Learning to decode these is essential for understanding your spending at a glance.

- POS: This means Point of Sale. It's an in-person purchase you made with your debit card, like at a shop or restaurant.

- ACH: This stands for Automated Clearing House and usually signals an electronic bill payment or direct deposit. Your car payment or mortgage might show up as an ACH debit.

- TRF: Short for Transfer, this shows money moved between your own accounts, like from checking into savings.

- W/D: This is a Withdrawal, typically cash you took out from an ATM or a bank teller.

Don’t just skim the numbers. The transaction descriptions are gold. They often list the merchant's name and sometimes even a location, which can be a huge help in jogging your memory about a specific purchase.

A Practical Walkthrough of Your Transactions

Let's walk through a real-world example. Imagine you're reviewing your statement to see where you can trim your budget. You spot a $14.99 debit with the description "APL*ITUNES.COM/BILL." You instantly recognize it as your music streaming subscription.

A few lines down, you see a $55.40 POS debit at "TRADER JOE'S #123." That's last week's grocery trip. You keep going, mentally slotting each expense into a category: housing, food, entertainment, utilities. By the time you're done, you have a clear, data-backed picture of exactly where your money went.

This process is getting easier all the time. With 76% of major banks now working with tech companies, many online statements come with built-in budgeting tools that automatically categorize spending for you. This tech directly supports the data showing that people who actively monitor their statements cut their impulse spending by about 22%.

Once you've mastered the basics, you might want to explore how advanced AI-powered financial analysis tools can provide deeper insights. These platforms can automate much of the categorization and analysis, taking the manual work off your plate and offering a more sophisticated way to manage your finances.

How to Spot and Avoid Common Bank Fees

There’s nothing worse than seeing an unexpected fee pop up on your bank statement. It can feel like you're being penalized just for using your own money, and these little charges can quietly drain your account balance over time.

The good news? Most of these fees are completely avoidable once you know what you’re looking for.

Think of it as doing a quick 'fee audit' on your account. Take a close look at the "Fees" or "Service Charges" section on your statement. If there isn't a specific section, don't worry—they'll still be listed as debits right in your main transaction history. Spotting them is the first step to getting rid of them for good.

Uncovering the Most Common Fees

While fee schedules vary from bank to bank, a few usual suspects show up on statements everywhere. You have to be able to recognize them, because they’re easy to miss if you’re just skimming your balance.

Here are the top culprits to watch out for:

- Monthly Maintenance or Service Fees: Many checking accounts come with a flat fee, often $10-$15, just for existing. This is usually the easiest one to get waived.

- Overdraft Fees: This is the big one. It happens when you spend more than you have, and the bank covers the difference for a hefty price—averaging around $35 per transaction.

- ATM Fees: Using an out-of-network ATM can be a double-whammy. You might get hit with a fee from your own bank and another from the ATM's owner.

- Foreign Transaction Fees: If you use your debit card to buy something in a different currency, your bank will likely take a cut, typically 1% to 3% of the purchase.

Think of your bank statement as a receipt for your banking relationship. If you're being charged for services you don't use or need, it’s time to find a way to stop paying for them.

Actionable Strategies to Eliminate Fees

Once you’ve identified which fees are costing you money, you can take direct action. This rarely means you have to go through the hassle of switching banks. Usually, a simple tweak to your habits or account setup is all it takes.

1. Waive Monthly Service Fees

Most banks are happy to waive this fee if you meet certain conditions. Dig into your account terms and see if you can qualify by:

- Keeping a minimum daily or average balance in the account.

- Setting up a recurring direct deposit from your paycheck.

- Linking multiple accounts, like your checking and savings, at the same institution.

2. Prevent Overdrafts

This one is all about staying ahead of your spending.

- Set up low-balance alerts: This is a game-changer. Your bank can text or email you when your balance dips below a threshold you set, like $100.

- Opt out of overdraft protection: It sounds backward, but hear me out. Opting out means the bank will simply decline a debit card transaction you can't afford instead of approving it and slapping you with a huge fee.

For businesses or anyone juggling lots of transactions, getting a real-time view of your cash flow is critical. Learning how to automate data entry from your statements into a spreadsheet can make it much easier to see shortfalls coming and prevent them from happening.

Using Your Statement to Catch Fraud and Errors

Think of your bank statement as more than just a monthly summary—it’s your first line of defense. Moving from passively glancing at your balance to actively hunting for errors is a powerful shift in mindset. It’s all about training your eye to spot anything that looks even slightly out of place.

Fraudsters are sneaky. They rarely start with a big, obvious theft. Instead, they’ll often test the waters with a tiny charge, maybe a dollar or two, to see if you're paying attention. If that charge slips by unnoticed, they know they have a live account and can come back for a much bigger score.

Even honest mistakes, like a double charge at your local coffee shop, can bleed your account dry over time. That's why making a habit of reviewing your statement is so critical. You aren't just looking for huge, glaring fraud; you're also searching for that subscription you know you canceled or that one weird charge you just can't place.

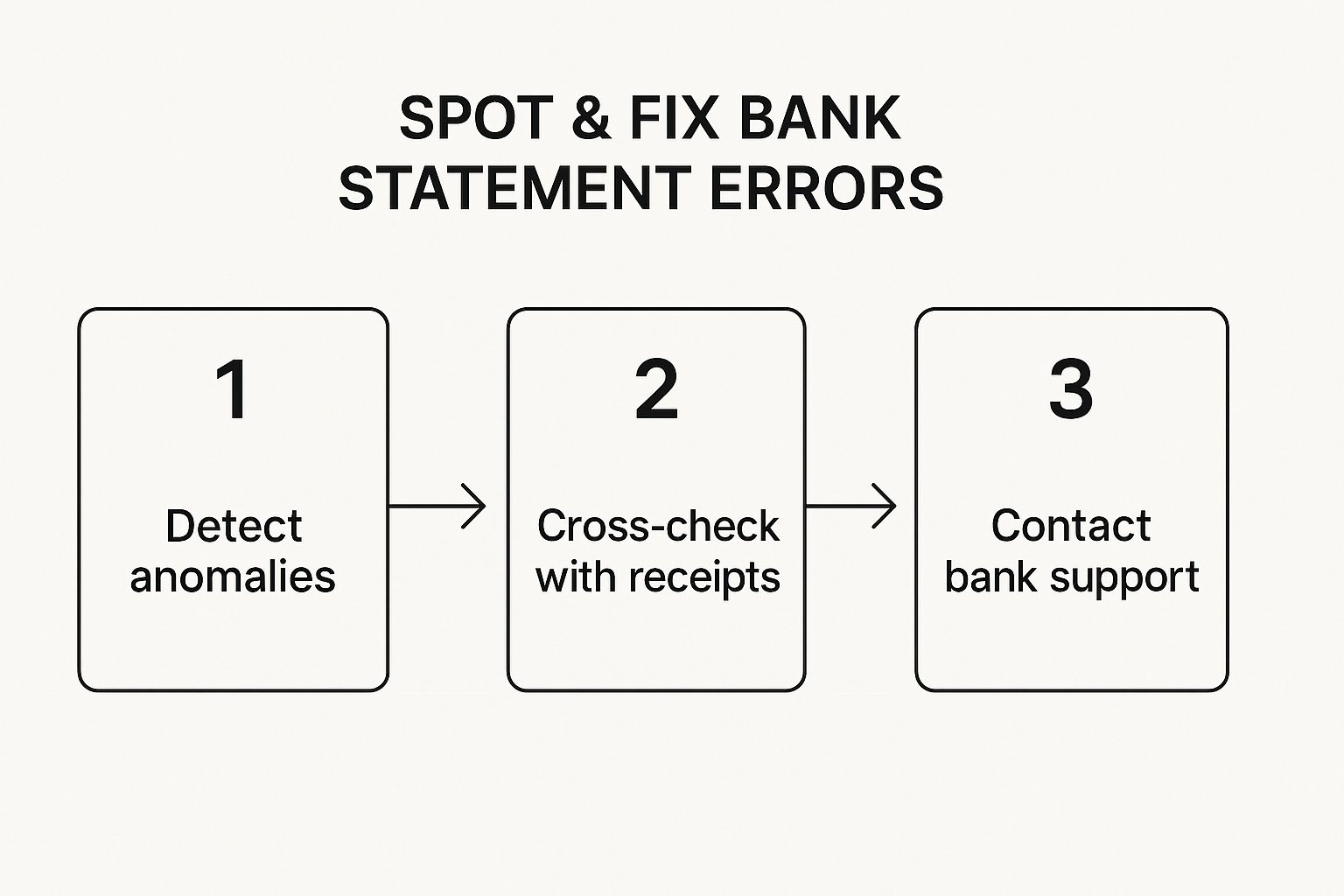

Identifying Red Flags and Taking Action

The sooner you catch a problem, the less headache you'll have to deal with. It’s about getting ahead of the issue before it spirals.

So, what should you be looking for?

- Scour for tiny, unfamiliar charges. Pay extra attention to any debits under $5 from a company you don't recognize.

- Look for duplicate transactions. Did that Amazon order from last week show up twice? Was your dinner bill accidentally run through again?

- Double-check your recurring payments. Make sure your Netflix subscription, gym membership, and car payment all match what you agreed to pay.

This isn't rocket science, but it does require a bit of discipline. A systematic check is the best way to keep your money safe.

As you can see, the process is straightforward: spot something weird, check it against your own receipts or records, and call your bank immediately. Following these steps can resolve most issues in a matter of minutes.

What to Do When You Find Something Suspicious

The second you spot something that doesn't look right, don't wait. Grab your statement, flip over your debit card, and call the customer service number.

When you get someone on the line, be ready to clearly explain the problem. Give them the date, the exact amount, and the merchant name for the transaction in question. The more specific you are, the faster they can help.

Your own diligence is the single most powerful tool against financial crime. Fraudsters count on you not paying attention. A carefully reviewed statement is their worst nightmare.

It's a two-way street, of course. Banks are spending a fortune to protect you. In 2025 alone, they invested a staggering $176 billion in IT, much of it to fight a nearly 20% year-over-year jump in cybercrime. And yet, 54% of fraud cases still start with small, sneaky charges that people overlook on their statements.

Beyond just checking your bank activity, another smart move is to regularly get all three of your credit reports for free, every single week. This gives you the full picture of your financial identity. It’s also wise to know what crooks are capable of; our guide on https://bankstatementconvertpdf.com/how-to-spot-fake-bank-statements/ can help you stay one step ahead.

Frequently Asked Questions About Bank Statements

Even after you've gotten the hang of reading your bank statement, a few practical questions almost always come up. I've heard these countless times, so let's clear up some of the most common ones to help you manage your financial documents with total confidence.

Think of this as your quick-reference guide for those little "what if" moments. We’ll cover how long you should be hanging onto your records and exactly what to do the moment you spot a mistake.

How Long Should I Keep My Bank Statements?

For day-to-day budgeting and personal finance, my go-to recommendation is to keep your statements for at least one full year. This gives you a great historical view of your annual spending habits and makes it easy to look up a transaction if you need to.

Now, things get a bit more serious if your finances are more complex. The IRS recommends keeping financial records for three to seven years, especially if you're self-employed, have business expenses, or need to prove major purchases. In those cases, your bank statements are your best evidence during a tax audit.

What's the Difference Between Available and Current Balance?

This is easily one of the most common points of confusion, and getting it wrong can lead to some nasty overdraft fees. It's actually pretty simple once you break it down.

- Current Balance: This number shows the total money in your account after all the transactions have been fully processed and have cleared. Think of it as what you had at the end of the last business day.

- Available Balance: This is the crucial number. It’s the amount of money you can actually spend right now. It reflects your current balance minus any pending debit card purchases or holds on deposits that haven't cleared yet.

Always, always, always make your spending decisions based on your available balance. It's the most accurate, real-time figure that will keep you from accidentally spending money that's already spoken for.

I Found an Error on My Statement. What’s the First Step?

Don't wait. The moment you see something that doesn’t look right, you need to act. Most banks give you a 60-day window from the statement date to report any errors or fraudulent charges. Your first move should be to call your bank’s customer service line immediately.

To make the call go smoothly, have these details handy:

- The exact date of the transaction

- The dollar amount

- The name of the merchant or the transaction description as it appears on the statement

Calmly explain why you believe the charge is a mistake. I also highly recommend following up your phone call with a quick email. This creates a written record of your dispute, which is always a smart move.

And of course, being able to spot an error means you need to be able to access your documents first. If you need a refresher, our simple guide on how to download a bank statement walks you through the process for most major banks.

At Bank Statement Convert PDF, we build tools to make your financial analysis faster and way more accurate. Why waste hours on manual data entry when you can convert your PDF statements into clean, organized Excel spreadsheets in just a few seconds?