The month-end close: a recurring cycle of reconciliations, journal entries, and reporting deadlines that can feel like a high-stakes race against the clock. For accountants, bookkeepers, and business owners, a disorganized close process isn't just stressful-it's a direct route to inaccurate financial statements, compliance risks, and flawed business decisions. The secret to transforming this chaotic period into a streamlined, predictable process lies in a well-structured month end close checklist template.

But not all templates are created equal. Some are generic lists, while others are powerful frameworks built into sophisticated software. This guide cuts through the noise. We've rounded up the top resources available today, from practitioner-built Excel files to automated software solutions. Each option includes screenshots and direct links to help you evaluate which is best for your team.

We'll explore the specific features, pros, and cons of each, helping you find the perfect tool to bring order and efficiency to your financial close. A smoother close often starts with cleaner inputs, and for comprehensive insights into managing financial operations, consider practical strategies like these 8 Real-World Ways to Clean Up Your Accounts Receivable. Get ready to conquer your next month-end with confidence.

1. Bank Statement Convert PDF

Bank Statement Convert PDF is a specialized, web-based tool designed to tackle one of the most tedious and error-prone tasks in the month-end close process: manual data entry from bank statements. This platform directly addresses the critical first step of reconciliation by transforming static PDF bank statements into fully editable and analyzable Excel or CSV spreadsheets. Its focused utility and efficient performance make it an indispensable resource for accountants, CPAs, and business owners aiming to streamline their closing workflow.

The platform’s core strength lies in its powerful combination of Optical Character Recognition (OCR) and intelligent parsing algorithms. This technology accurately extracts key data points including dates, transaction descriptions, amounts, and running balances, even from scanned, image-based PDFs. The result is a clean, structured dataset ready for immediate use in any accounting software or spreadsheet program like Excel or Google Sheets, effectively eliminating hours of retyping and minimizing the risk of human error.

Key Features and Practical Applications

Bank Statement Convert PDF excels by focusing on features that deliver immediate value to financial professionals.

- High-Speed, Accurate Conversion: The primary function is converting bank statement PDFs to Excel or CSV in seconds. For anyone building a month end close checklist template, automating this data extraction step is a significant efficiency gain. Instead of budgeting hours for manual entry, your team can move directly to analysis.

- Intelligent Data Formatting: The tool doesn't just extract data; it formats it for usability. The output includes selectable columns and advanced Excel formatting, making the data ready for pivot tables, sorting, and reconciliation without additional cleanup.

- Security-First Approach: The service emphasizes security, a crucial factor when handling sensitive financial documents. It uses encryption for all file transfers and explicitly states that it does not retain user-uploaded PDFs or the extracted data, providing peace of mind.

- Broad Compatibility: Converted files are fully compatible with Microsoft Excel, Google Sheets, and LibreOffice, ensuring seamless integration into existing workflows regardless of your preferred software.

Pricing and Accessibility

The platform offers a tiered pricing structure designed to accommodate different user needs. A free/basic tier allows users to test the service with limited features. Paid plans, such as the Basic and Semi-Pro tiers (around $29/month), provide higher page allowances suitable for small to medium-sized businesses. A Pro plan (around $99/month for 4,000 pages) caters to professionals with higher volume needs. Before finalizing your reconciliation process, it's helpful to understand the fundamentals. For deeper insights, you can explore their guide on how to properly reconcile bank accounts.

Why It Stands Out

What makes Bank Statement Convert PDF a standout choice is its laser focus on solving a universal accounting problem with precision and speed. While larger accounting suites may offer data import tools, this platform provides a dedicated, best-in-class solution for handling the ubiquitous PDF bank statement. It empowers users to build a more efficient and accurate month-end close process from the ground up, starting with clean, reliable data.

Website: bankstatementconvertpdf.com

2. FloQast

FloQast offers a suite of practitioner-built Excel month end close checklist template downloads designed by accountants, for accountants. Unlike generic checklists, these templates are structured to mirror real-world accounting workflows, making them an excellent resource for teams looking to formalize their close process or upgrade an existing one.

The platform's key strength lies in its specificity and credibility. FloQast is a well-known leader in close management software, and their free templates reflect this expertise. The checklists are not just a simple list of tasks; they are role-based, assigning responsibilities to preparers and reviewers and providing timing guidance for each step. This structure is invaluable for ensuring accountability and clarity within the team.

Key Features and Offerings

FloQast provides several template variations to suit different needs:

- General Month-End Close Checklist: A comprehensive template applicable to most businesses.

- Microsoft ERP-Specific Checklists: Tailored versions for companies using Microsoft Dynamics 365, GP, or NAV, mapping tasks to system-specific functions.

- Role-Based Structure: Clearly delineates tasks for preparers and reviewers, including columns for due dates, completion dates, and sign-offs.

- Plug-and-Play Format: The Excel templates are ready to use immediately, allowing for easy customization to fit your company’s unique processes.

Expert Insight: The true value of FloQast's templates is their operational design. They are built to be actively used in a collaborative environment, not just referenced, which helps bridge the gap between a simple to-do list and a fully managed close process.

How to Access and Use the Templates

Accessing the templates is straightforward but requires providing contact information.

- Navigate to the FloQast templates page.

- Select the template that best fits your needs (e.g., General, Microsoft ERP).

- Fill out the download form with your business details.

- The Excel file will be sent to your email or made available for immediate download.

Once downloaded, you can customize the checklist by adding or removing tasks, assigning team members, and setting internal deadlines. For organizations looking to mature their financial operations, integrating this structured approach can be a critical step. A well-organized monthly close also sets the foundation for smoother annual processes; you can find more details in this guide to year-end closing procedures.

| Pros | Cons |

|---|---|

| Credibility: Built by accounting professionals. | Form-gated: Requires contact information, leading to marketing. |

| Detailed: Role-based structure with preparer/reviewer fields. | Over-engineered for small teams: May be too complex for simple needs. |

| ERP-Specific: Offers templates for common Microsoft ERPs. | Focus on structured close: Less suited for informal processes. |

Website: FloQast Templates

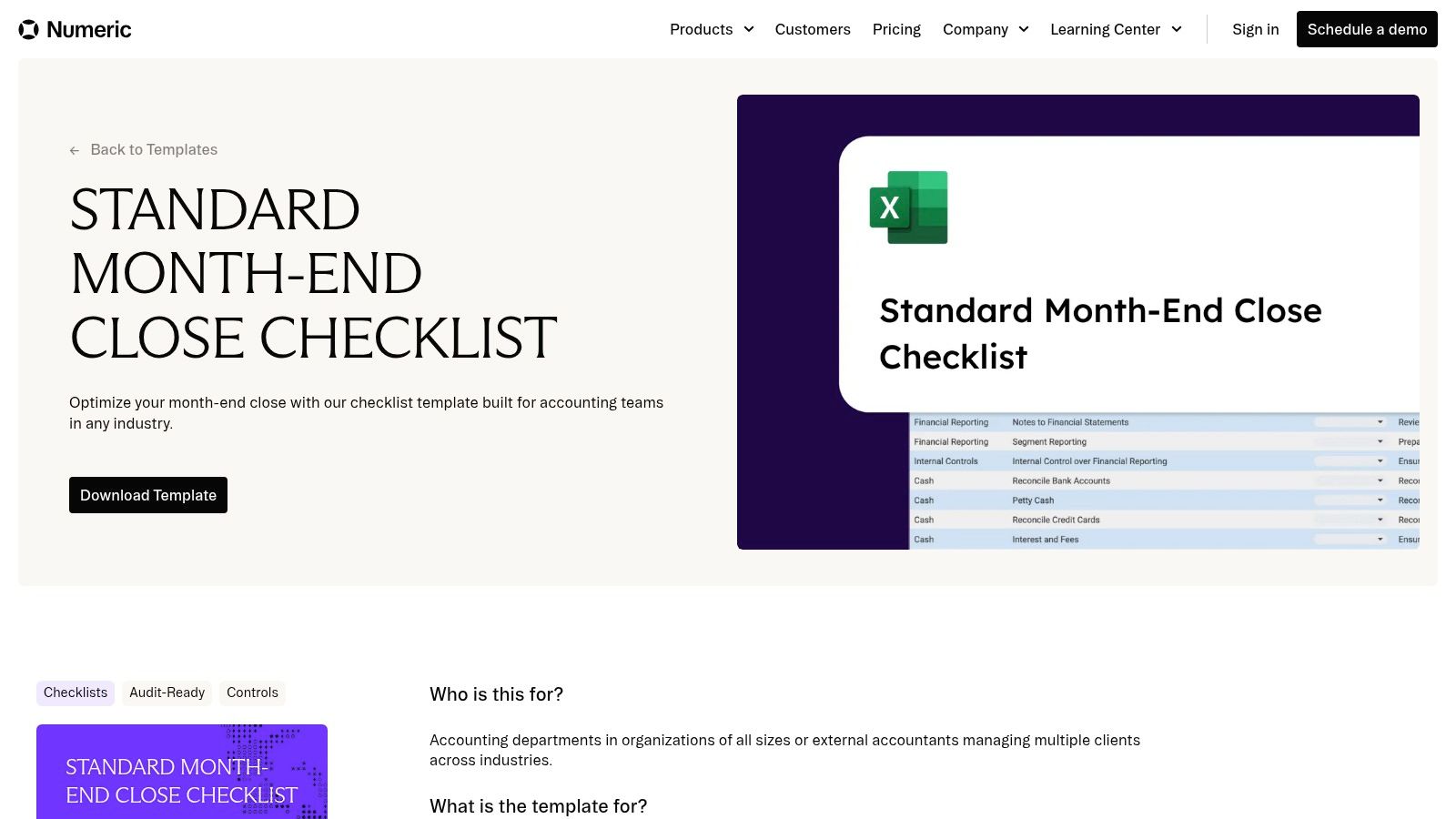

3. Numeric

Numeric offers a free and modern month end close checklist template designed as a launchpad for teams aiming to transition from static spreadsheets to a more dynamic, collaborative closing process. Their approach bridges the gap between a basic to-do list and a fully automated financial close, making it an ideal choice for growing teams that need a solid foundation with a clear path to future scalability.

The platform’s standout feature is its forward-looking design. The template itself is clean and comprehensive, but it is also built to seamlessly integrate with Numeric's paid close management software. This allows teams to start with a best-practice checklist and later leverage the platform’s advanced features like automation, real-time dashboards, and clear audit trails without having to reinvent their entire workflow. The content is current, reflecting the needs of today's fast-paced finance departments.

Key Features and Offerings

Numeric provides a template focused on core procedures with an eye toward automation:

- Comprehensive Checklist: Covers essential close tasks, including journal entry reviews, account reconciliations, accounts payable and receivable, payroll, and tax preparations.

- Actionable Guidance: Includes columns for timing, ownership, and notes on adapting the checklist to specific industry requirements.

- Path to Automation: The template is structured to align with Numeric’s software, providing a natural on-ramp to features like audit trails and collaborative dashboards.

- Modern Workflow Orientation: The content is up-to-date and built for contemporary accounting processes, moving beyond outdated, manual-only methods.

Expert Insight: Numeric's template is more than just a checklist; it's an entry point into a modern close ecosystem. It’s perfect for finance leaders who know they need a better system but want to start with a simple, effective tool before committing to a full software implementation.

How to Access and Use the Templates

Accessing the template is simple, though it requires providing your contact details.

- Visit the Numeric template download page.

- Fill out the form with your professional information.

- The Excel-based template will be sent to your email for download.

Once you have the file, you can immediately begin customizing it to your business. Assign owners, set deadlines, and add any company-specific tasks. The clear structure makes it a great tool for standardizing your process and preparing your team for the enhanced visibility and control offered by a dedicated close management platform.

| Pros | Cons |

|---|---|

| Good onramp to software: Bridges static templates and a full platform. | Form-gated: Requires submitting contact info to download. |

| Modern content: Aligned with current accounting best practices. | Paid platform: Full automation features are part of a paid product. |

| Clean and comprehensive: Easy to adopt and customize for any business. | Pricing not public: Software costs are not listed on the website. |

Website: Numeric Template

4. Template.net

Template.net serves as a broad digital marketplace offering a diverse range of business documents, including several variations of a month end close checklist template. Unlike platforms that are deeply rooted in accounting software, Template.net’s strength is its accessibility and format diversity, catering to users who prioritize speed and familiarity with common document editors like Microsoft Word and Google Docs.

The platform is ideal for small businesses, freelancers, or consultants who need a professionally formatted, brandable checklist without committing to a new software ecosystem. Its templates provide a solid starting point that can be quickly customized with a company logo and specific procedural tasks, making it a practical choice for teams that operate primarily within the Google or Microsoft Office suites.

Key Features and Offerings

Template.net provides flexibility through its wide array of formats and editing options:

- Multiple Formats: Templates are available for download as Word, Google Docs, and PDF files.

- Online Editor: Users can customize templates directly on the website before downloading, allowing for quick adjustments, branding, and printing.

- Broad Selection: The site offers various checklist styles, from simple monthly closing lists to more comprehensive month-end financial review templates.

- Plug-and-Play Design: The templates are designed for immediate use, requiring minimal setup to be integrated into an existing workflow.

Expert Insight: Template.net is best suited for those who view the month-end checklist as a guiding document rather than an integrated operational tool. Its value lies in providing a clean, professional-looking structure that can be adapted and shared easily without any specialized training.

How to Access and Use the Templates

Accessing templates on the site is straightforward, though some options may require a subscription.

- Navigate to the Template.net website and search for "monthly closing checklist."

- Browse the available designs and select the one that best fits your needs.

- Choose to either download the template in your preferred format (Word, Docs) or customize it using the online editor.

- If a subscription is required, follow the prompts to sign up for access to premium templates.

Once downloaded, the checklist can be fully customized. You can add specific line items for key tasks like bank reconciliations, which are foundational to the close. For a deeper dive into this specific task, explore this collection of bank reconciliation statement templates.

| Pros | Cons |

|---|---|

| Fast Access: Download and use immediately in familiar software. | Variable Quality: Content can be generic and may need significant edits. |

| Format Flexibility: Available in Word, Google Docs, and PDF. | Subscription-gated: The best templates often require a paid subscription. |

| No Learning Curve: Works with existing document editors. | Lacks Accounting Focus: Not designed by accountants for specific workflows. |

Website: Template.net

5. Etsy

For those seeking an immediate, affordable, and visually diverse solution, Etsy offers a marketplace of downloadable month end close checklist template options from independent creators. Unlike corporate or software-as-a-service (SaaS) providers, Etsy provides access to templates designed by a wide range of sellers, from fellow accountants to professional template designers, resulting in a unique variety of styles and formats.

The platform's key strength is its combination of low cost, instant access, and social proof. Shoppers can find templates in Excel, Google Sheets, and printable PDF formats, often for just a few dollars. The inclusion of user reviews and seller ratings provides a layer of quality control, allowing you to gauge the effectiveness and user-friendliness of a template before purchasing. This makes it an ideal source for small businesses, freelancers, or students who need a functional tool without a significant investment.

Key Features and Offerings

Etsy's marketplace model leads to a diverse set of features depending on the seller:

- Variety of Formats: Templates are available as Excel spreadsheets, Google Sheets links, and printable PDFs to suit different workflow preferences.

- Instant Digital Delivery: Once purchased, the files are available for immediate download, providing a quick solution.

- Customizable Layouts: Many sellers offer templates with progress-tracking columns, customizable task lists, and visually appealing dashboards.

- User Reviews and Seller Q&A: Public feedback and the ability to contact sellers directly help validate the quality and functionality of the templates.

Expert Insight: Etsy is a hidden gem for budget-conscious teams who value aesthetics and simplicity. The ability to filter by format and read real user reviews helps de-risk the purchase of a non-standardized asset, offering a practical starting point for formalizing a close process.

How to Access and Use the Templates

Acquiring a template from Etsy is a simple, direct-to-consumer process.

- Navigate to the Etsy marketplace and search for "month end close checklist."

- Browse the listings, paying close attention to product images, descriptions, and user reviews.

- Add your chosen template to your cart and complete the purchase.

- Access your digital files immediately through your Etsy account's "Purchases and Reviews" section.

Once downloaded, the template can be customized to fit your specific business needs. The direct, transactional nature of Etsy makes it one of the fastest ways to obtain a functional month end close checklist template without subscriptions or providing marketing information.

| Pros | Cons |

|---|---|

| Very affordable: Most templates are low-cost, one-time purchases. | Quality varies by seller: Requires careful vetting of reviews. |

| Instant access: Digital files are available immediately after purchase. | Limited support: Support is limited to seller messages. |

| Real user reviews: Helps assess template quality and usability. | Not standardized: Lacks the professional rigor of accounting software firms. |

Website: Etsy Month End Close Checklists

6. Graphite Financial

Graphite Financial, a fractional CFO and accounting firm, offers a specialized Excel month end close checklist template designed explicitly for startups. This resource is born from their direct experience working with early-stage companies, focusing on creating a lean, repeatable, and scalable closing process. Unlike enterprise-focused templates, Graphite’s version strips away complexity to prioritize what matters most for a growing business.

The template's key advantage is its practical, startup-centric sequencing. It guides users through essential tie-outs and reconciliations in a logical order that builds momentum and ensures foundational accuracy. This approach is invaluable for founders or small finance teams who need structure without the overwhelming detail found in corporate checklists, making it an excellent tool for establishing good financial habits early on.

Key Features and Offerings

Graphite Financial's template is built to be an educational and practical tool:

- Startup-Oriented Workflow: The checklist is sequenced to match the typical operational flow of a startup, from revenue recognition to cash reconciliation.

- Focus on Repeatability: Designed to help small teams establish a consistent monthly routine that can be easily managed and repeated.

- Expert Context: The template is based on the firm's direct work with its startup clients, embedding practical wisdom into the structure.

- Lean and Essential: It avoids overly complex steps, focusing only on the critical tasks needed for accurate and timely startup financials.

Expert Insight: For a startup, establishing a solid yet simple close process from day one is crucial. Graphite's template excels by providing a framework that is robust enough for accuracy but lean enough to not overwhelm a small team, perfectly balancing control with agility.

How to Access and Use the Templates

Accessing the template is simple, though it does require sharing your contact information.

- Visit the Graphite Financial free template landing page.

- Complete the short form with your name and business email.

- The Excel template will be sent directly to your inbox.

Once downloaded, the checklist is ready for immediate use. You can customize it by adding company-specific tasks or assigning responsibilities. A key part of the close involves validating account balances; you can learn more about effective methods in this guide to account reconciliation best practices.

| Pros | Cons |

|---|---|

| Tailored for Startups: Perfect for early-stage companies' needs. | Form-gated: Requires contact information to download. |

| Practical and Lean: Focuses on essential tasks without complexity. | May be too simple: Less suitable for larger or more complex enterprises. |

| Credible Source: Created by a firm specializing in startup finance. | Promotional: Serves as a lead magnet for their accounting services. |

Website: Graphite Financial Template

7. Rippling

Rippling offers a free and highly practical Excel month end close checklist template designed for teams seeking a robust yet straightforward tool. This resource focuses on accountability and progress tracking, providing a structured framework that can be implemented immediately without the need for new software. It strikes an excellent balance between detailed process management and the simplicity of a spreadsheet.

The template’s core strength is its emphasis on operational clarity. It moves beyond a simple task list by incorporating columns for owners, priorities, due dates, and even time estimates for each task. This multi-phase approach allows finance leaders to not only delegate responsibilities but also to monitor progress and manage workload distribution effectively, making it a powerful tool for growing teams that need to formalize their close process.

Key Features and Offerings

Rippling’s template is built for practical application and easy customization:

- Structured Columns: Includes fields for tasks, owners, priorities, due dates, and time estimates to provide a comprehensive overview.

- Built-in Status Tracking: The worksheet is designed for active progress monitoring, allowing managers to see the status of each item at a glance.

- Practical Guidance: The template comes with practical tips for streamlining the close, embedded within its structure.

- Ready-to-Customize Excel Format: As a downloadable Excel file, it is easy to adapt to any company’s specific chart of accounts, team structure, and closing timeline.

Expert Insight: Rippling's template excels at fostering accountability. By assigning owners and estimating time, it turns the close from a generic checklist into a manageable project plan. This is particularly useful for remote or hybrid teams where clear ownership is critical.

How to Access and Use the Templates

Getting the template is simple, though it requires providing your contact details.

- Visit the Rippling month-end close checklist resource page.

- Fill out the brief form with your name, company, and email address.

- The Excel template will be sent directly to your inbox for download.

Once you have the file, you can immediately begin populating it with your specific closing tasks, assigning them to team members, and setting deadlines. The pre-built structure makes it easy to get started, and its spreadsheet format ensures maximum flexibility for customization.

| Pros | Cons |

|---|---|

| Free and Detailed: Balances simplicity with process rigor. | Gated Download: Requires form submission, leading to marketing. |

| Focus on Accountability: Emphasizes owners and due dates. | Not Integrated Software: It is a manual Excel-based process. |

| Progress Monitoring: Built-in structure for tracking status. | Static Tool: Lacks the automation of dedicated close software. |

Website: Rippling Month-End Close Checklist

Month-End Close Checklist: 7-Tool Comparison

| Solution | Implementation Complexity 🔄 | Resources & Cost ⚡ | Expected Outcomes ⭐📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Bank Statement Convert PDF | Low–Moderate 🔄 — web-based, few setup steps; occasional preprocessing for unusual PDFs | Low ⚡ — browser upload; free/basic + paid tiers ($29–$99/mo) with page limits | High ⭐⭐⭐ — fast OCR → editable Excel/CSV; ready for reconciliation/reporting 📊 | Accountants/CPAs and small businesses needing rapid PDF→Excel conversion | OCR extraction; advanced Excel formatting; encrypted uploads; fast conversions |

| FloQast | Moderate 🔄 — Excel templates with role-based structure; some configuration | Low ⚡ — downloadable templates (form-gated); minimal tooling required | High ⭐ — improves close consistency and role clarity; enterprise-friendly 📊 | Accounting teams adopting structured month‑end close, MS ERP users | Practitioner-built templates; ERP-specific variants; role-based tasks |

| Numeric | Low–Moderate 🔄 — downloadable checklist + optional SaaS integration | Low ⚡ — free template (form-gated); paid product for automation/dashboarding | High ⭐ — modern close content; onramp to collaborative automation and audit trails 📊 | Teams that want a current template and a path to automated close software | Up-to-date checklist; integration hooks to automation and dashboards |

| Template.net | Very Low 🔄 — download and customize immediately, online editor available | Low ⚡ — free/paid templates; subscription or one-off purchase options | Medium ⭐ — fast branded checklists; quality varies by template 📊 | Small businesses or consultants needing quick, brandable templates | Multiple formats (Word/Google Docs/PDF); quick customization; online editor |

| Etsy | Very Low 🔄 — instant digital downloads from independent creators | Very Low ⚡ — inexpensive one-off purchases; instant delivery | Medium ⭐ — variety of styles and formats; depth depends on seller 📊 | Individuals seeking low-cost, styled checklists with social proof | Affordable options; diverse visual styles; user reviews for validation |

| Graphite Financial | Low 🔄 — free Excel template tailored for startups; form to download | Low ⚡ — free download; optional paid services from the firm | Good ⭐ — lean, repeatable monthly routine designed for startups 📊 | Startups and lean companies needing a CFO-backed checklist | Startup-focused sequencing; educational context; firm credibility |

| Rippling | Low–Moderate 🔄 — structured Excel sheet (tasks, owners, due dates); customizable | Low ⚡ — free worksheet (form-gated); no new software required unless desired | High ⭐ — strong accountability and progress tracking; practical for teams 📊 | Teams wanting a rigorous worksheet to track ownership without buying software | Detailed task/owner/due-date columns; built-in status and time estimates |

From Checklist to Competitive Advantage: Finalizing Your Choice

Navigating the landscape of month-end close tools and templates can feel overwhelming, but the right choice can transform a chaotic, stressful period into a streamlined, strategic asset. We've explored a diverse range of options, from dedicated platforms like FloQast and Numeric that offer robust automation and collaboration, to flexible resources from Template.net and Etsy that provide an excellent starting point for customization. Each tool presents a unique approach to conquering the close.

The ultimate goal is to move beyond simply ticking boxes. A truly effective month end close checklist template serves as the backbone of financial integrity and operational efficiency. It standardizes procedures, minimizes the risk of human error, and creates an audit trail that builds confidence among stakeholders. This structured approach frees up your finance team from manual data wrangling, allowing them to focus on higher-value activities like variance analysis and strategic forecasting.

Selecting Your Ideal Template

Choosing the right solution requires a clear understanding of your business's current stage and future ambitions. A solopreneur or a small startup might find a simple, customizable template from Graphite Financial or Template.net perfectly sufficient. In contrast, a rapidly scaling company with multiple entities and complex reconciliations will benefit immensely from the integrated systems offered by platforms like Rippling, which connect accounting with HR and IT from day one.

Consider these key factors before making your decision:

- Scalability: Will this template or tool grow with your company, or will you need to replace it in a year?

- Integration: How well does the solution connect with your existing accounting software and other financial tools? Making significant decisions about which financial systems to adopt requires careful evaluation. A comprehensive comparison, such as an Odoo vs Xero vs MYOB comparison, can be invaluable for selecting the right fit for your core accounting needs.

- Customization: Can you easily adapt the checklist to fit your specific chart of accounts, internal controls, and reporting requirements?

- Team Collaboration: Does the tool facilitate clear communication, task assignment, and real-time progress tracking for your entire team?

By evaluating your options through this lens, you can select a month end close checklist template that not only solves today’s challenges but also supports your long-term vision. The power lies not just in the document itself, but in the consistent, disciplined execution it enables. By implementing the right system, you turn a tedious monthly chore into a powerful competitive advantage, armed with accurate, timely data to drive your business forward.

Ready to streamline one of the most time-consuming steps in your close process? Bank Statement Convert PDF makes bank reconciliation faster and more accurate by effortlessly converting any bank or credit card statement from a PDF into a clean Excel or CSV file. Stop manual data entry and start your month-end close with pristine, ready-to-use data by trying Bank Statement Convert PDF today.