Accounts payable workflow automation is really just about using smart software to take over the repetitive, manual tasks involved in paying your company's bills. It's about swapping out paper-shuffling and endless email chains for a clean, digital system that cuts down on mistakes, gets invoices approved faster, and ultimately saves money.

Think of it as the modern fix for a problem that’s been around as long as business itself.

Moving Beyond Manual Invoice Processing

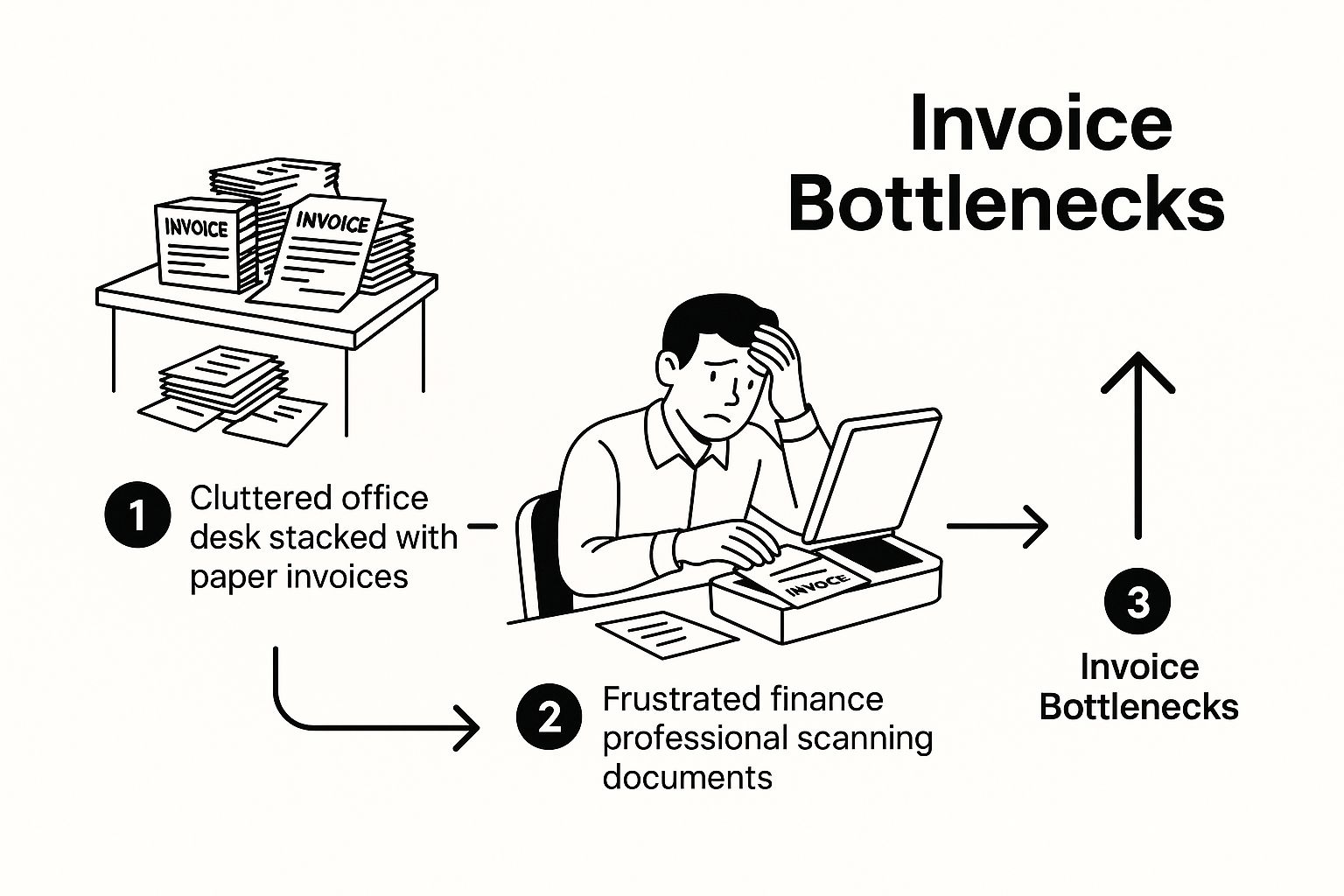

For anyone who's worked in a finance department, the sight of a desk piled high with invoices is all too familiar. The old-school, manual way of handling accounts payable is like being stuck in rush-hour traffic—it's slow, frustrating, and full of bottlenecks. For any business looking to grow, this just doesn't work anymore.

These manual processes are a huge time-sink. Tasks like printing out invoices, physically hunting down managers for a signature, and typing line items into a spreadsheet eat up hours every single day. Not only does this grind operations to a halt, but it also keeps your skilled finance team bogged down in grunt work instead of focusing on high-impact, strategic tasks.

The True Cost of Manual AP

The headaches of a manual system go way beyond just being annoying. They create very real financial and operational risks that can seriously stunt a company's growth.

- Costly Human Errors: When you're manually typing in data, mistakes are bound to happen. A misplaced decimal point or a wrong vendor number can easily lead to overpayments or paying the same bill twice, hitting your cash flow directly.

- Late Payment Penalties: Invoices get lost. They get buried under other paperwork or stuck waiting for an approval that never comes. This leads to missed deadlines, which means paying unnecessary late fees and, worse, damaging your reputation with important suppliers.

- Lack of Visibility: With paper trails and scattered spreadsheets, it’s almost impossible to get a clear, up-to-the-minute picture of your company's liabilities and cash flow. This turns financial planning and forecasting into a guessing game.

"The manual AP process isn't just inefficient; it's a strategic liability. Every misplaced invoice and delayed approval is a missed opportunity for early payment discounts and a potential strain on crucial vendor partnerships."

The proof is in the numbers. The global market for accounts payable automation was valued at around $3.08 billion USD in 2023 and is growing fast. This boom is driven by a simple fact: manual processing is expensive, costing an average of $15 per invoice. It's no wonder so many businesses are finally making the switch.

This infographic does a great job of showing exactly where the common bottlenecks pop up in a traditional AP department.

As you can see, every manual touchpoint adds another layer of friction, turning what should be a straightforward payment into a long, drawn-out ordeal. By using tools like data entry automation software, you can start clearing these roadblocks for good.

How AP Automation Actually Works

So, how does this all come together in the real world? It's not one giant piece of software doing everything at once. Instead, think of accounts payable workflow automation as a finely tuned digital assembly line. Each stage is designed to handle a specific task with speed and precision, moving invoices from arrival to payment with very little human intervention.

This approach replaces the old, chaotic method where one person juggled every step. If you're new to the concept, getting a handle on what is workflow automation in general can provide a great foundation.

Step 1: Digital Invoice Capture

It all starts the moment an invoice shows up. In a manual world, this means someone is physically opening mail, sorting through a crowded email inbox, and printing out PDFs. It's a recipe for lost paperwork and delays.

An automated system flips the script. Invoices that arrive via email are automatically identified and pulled into the system. The few paper invoices you still get can be scanned and digitized in seconds. Just like that, you have a single, organized queue for every bill, which immediately puts an end to misplaced or forgotten invoices.

Step 2: AI-Powered Data Extraction

Once the invoice is captured, the heavy lifting begins. Manually, an AP clerk has to stare at the document and painstakingly type every detail into the accounting system—vendor name, invoice number, line items, and totals. This is the #1 spot for human error and bottlenecks.

In fact, recent studies show that 63% of AP teams sink over 10 hours a week into manual processing, with a staggering 66% still relying on manual data entry.

This is where AI-powered data extraction comes in. It uses smart tech like Optical Character Recognition (OCR) to "read" the invoice, identify all the crucial information, and automatically fill in the required fields. The best part? The system gets smarter over time, learning the unique layouts of your vendors' invoices to become even more accurate. For a closer look at the technology behind this, our guide on financial data extraction tools is a great resource.

Step 3: Automated Three-Way Matching

With the data pulled, the system moves on to a crucial verification step: three-way matching. Think of this as your tireless internal auditor, working 24/7 to prevent mistakes and catch fraud before a payment ever goes out.

The software cross-references the invoice details against two other key documents:

- The Purchase Order (PO): Does the invoice match what your company actually ordered?

- The Goods Receipt Note (GRN): Does it match what your company physically received?

If the quantities, prices, and terms on all three documents are a perfect match, the invoice is green-lit for approval. If anything is off—even by a penny—the system flags the discrepancy and sends it to the right person for a closer look.

Step 4: Intelligent Approval Workflows

The final piece of the puzzle is getting the sign-off. The old way involved chasing managers down the hall with a stack of papers or sending endless follow-up emails that get buried in a crowded inbox.

Automation makes this entire process hands-off. You set the rules upfront—based on things like the department, vendor, or invoice amount—and the system takes care of the rest. The correct approver gets an instant notification, reviews all the matched documents on their phone or computer, and approves it with a simple click. The approval bottleneck is officially a thing of the past.

Comparing Manual vs Automated AP Workflows

To see the difference in black and white, it's helpful to place the two approaches side-by-side. The contrast highlights just how many slow, error-prone steps are completely eliminated or streamlined by automation.

| Process Step | The Manual Approach | The Automated Approach |

|---|---|---|

| Invoice Arrival | Physical mail sorting, printing emails, manual filing. High risk of lost invoices. | Invoices are captured automatically from emails or scans into a central digital queue. |

| Data Entry | A person must read and type every detail from the invoice into the system. Prone to typos. | AI with OCR reads and extracts all data automatically, with increasing accuracy over time. |

| Validation | Manually pulling up POs and receiving reports to compare line-by-line. Time-consuming. | The system performs a three-way match against the PO and GRN in seconds, flagging exceptions. |

| Approval Routing | Physically walking invoices to desks or sending emails and waiting for a response. | Invoices are routed to the correct approver instantly based on preset rules. |

| Payment | Manually scheduling individual payments and entering them into the banking portal. | Approved invoices are queued for batch payments and can be paid with a few clicks. |

| Archiving | Filing paper copies in bulky cabinets, making retrieval difficult and slow. | All documents are digitally archived and are fully searchable by any data point. |

As the table shows, automation doesn't just speed things up; it builds a more secure, accurate, and transparent process from start to finish. It frees your team from tedious administrative tasks to focus on more strategic financial work.

Unlocking Key Business Benefits with Automation

Bringing automation into your accounts payable workflow isn't just a minor tech upgrade for the finance team. It’s a smart business move that delivers real, measurable results that ripple through the entire company. When you ditch the old-school manual methods, you open the door to efficiencies that directly boost your bottom line.

The first thing you'll notice is a serious drop in operational costs. It's easy to underestimate, but manual invoice processing is incredibly expensive. Some studies show it can cost as much as $15 per invoice when you factor in all the manual labor. Automation takes a huge chunk out of that cost by cutting down the hours your team spends on mind-numbing tasks like data entry, shuffling papers, and chasing down approvals.

By automating routine AP tasks, businesses don’t just cut costs—they reallocate their most valuable resource, their people, to strategic financial analysis and vendor management, activities that actively drive growth.

This efficiency boost also means better accuracy. Let's be honest, manual data entry is a recipe for human error. A simple typo or a transposed number can lead to messy overpayments or paying the same bill twice. An automated system pulls data right from the invoice, practically getting rid of those mistakes and keeping your financial records clean.

Gaining Deeper Financial Control and Visibility

Beyond the cost savings, automation gives you a whole new level of control over your company's finances. Think of the system as a digital watchdog. It's constantly on the lookout for red flags—like duplicate invoice numbers or mismatched vendor information—which helps you catch potential fraud before it happens.

Visibility is another game-changer. With a manual system, figuring out what you owe and when can feel like a major investigation. Automation flips the script, giving you real-time dashboards where you can see everything at a glance:

- Invoice Status: Know exactly where every single invoice is in the approval process.

- Upcoming Payments: Get a crystal-clear forecast of your cash needs.

- Accrual Reporting: Close the books at the end of the month faster and with far more accuracy.

This instant access to data gives your finance leaders the insight they need to make smarter decisions about cash flow and budgeting. You can explore the full range of accounts payable automation benefits in our more detailed guide.

Strengthening Critical Vendor Relationships

The impact of AP automation goes well beyond your own four walls. Good relationships with your vendors are a huge asset; they can lead to better pricing, priority service, and more flexible payment terms. On the flip side, nothing sours a vendor relationship faster than late or incorrect payments.

An automated workflow ensures your suppliers get paid accurately and on time, every single time. That kind of reliability makes you a partner people want to do business with. Even better, it puts you in a great position to consistently snag early payment discounts, transforming your AP department from a cost center into a team that actively saves the company money.

Your Roadmap to a Smarter AP Process

Switching to an automated system isn't about flipping a switch; it's a deliberate journey. Think of it as a well-planned expedition, moving you from the chaos of manual processing to the calm of an automated workflow. Following a clear roadmap ensures your investment in accounts payable workflow automation actually pays off.

The first step? Taking a good, hard look at where you are right now.

Step 1: Map Out Your Current AP Workflow

Before you can build a better system, you need to understand the one you've got—warts and all. Get your team together and literally map out your current accounts payable process. Follow an invoice from the moment it lands on someone's desk (or in an inbox) to the second it’s paid and archived.

Where are the black holes? Does it take days just to get an invoice entered into the system? Are you constantly chasing department heads for approvals? This exercise will shine a bright light on the specific bottlenecks that are costing you time and money. You’re not just shopping for software; you're solving a real business problem.

A successful automation project starts with a crystal-clear picture of your current manual headaches. When you know exactly where the friction is, you can set sharp, targeted goals for what your new system needs to accomplish.

Step 2: Set Clear, Measurable Goals

Once you've identified the pain points, it's time to define what "better" actually looks like. Vague goals like "improving efficiency" are useless. You need concrete, measurable targets that will guide the entire project and, later, prove its value.

What do good goals look like? Something like this:

- Slash average invoice processing time from 15 days to 3 days.

- Crush the cost per invoice from $15 down to less than $5.

- Completely eliminate late payment fees within the first three months.

- Start capturing at least 80% of available early payment discounts.

These aren't just wishful thinking; they are the benchmarks you’ll measure success against.

Visual workflow builders are at the heart of making this happen. This screenshot from Zapier shows how you can connect different apps and tell them what to do, step-by-step.

This is the magic of integration in action. You can build a simple rule that says, "When an invoice email arrives, automatically pull the data and create a new bill in our accounting software." No more manual entry.

Step 3: Choose the Right Automation Software

Picking the right tool is a make-or-break decision. You need a solution that solves today's problems but is also flexible enough to grow with you. Key features to hunt for include smart data capture (often called OCR), automated three-way matching, and approval workflows you can easily customize.

But here’s the non-negotiable part: the software must integrate seamlessly with your existing accounting system or ERP. If it doesn’t, you're just trading one manual task for another. A solid integration ensures your financial data is always accurate and up-to-date, without anyone having to copy-paste information between systems.

Step 4: Get Your Team Ready for the Change

You can have the best technology in the world, but it’s the people who make it work. A smooth transition is all about change management. Start by explaining the "why" behind the new system—how it will free them from tedious, repetitive tasks and let them focus on more strategic work.

Get your AP team involved from the get-go. Let them help you vet vendors and test out the software. Their real-world experience is priceless, and having them on board early will make the final rollout a thousand times easier.

Finally, don't skimp on training. Set up hands-on sessions so everyone feels confident and comfortable with the new tools from day one. When your team truly embraces the new way of working, you know you’re on the path to success.

How AI Is Supercharging Accounts Payable

If basic automation is the engine of a modern AP department, then you can think of Artificial Intelligence (AI) as the turbocharger. It takes a process that’s already efficient and makes it truly intelligent. We're not talking about science fiction here—this is the very real next step in how smart companies manage their finances.

AI-powered tools don't just follow a set of pre-programmed rules. They actually learn, adapt, and even start to predict outcomes. This shift turns the AP team from a reactive department that just pays the bills into a proactive hub that provides valuable financial insight.

From Simple OCR to Intelligent Data Capture

Many automation systems use Optical Character Recognition (OCR) to pull information from invoices. It’s a good first step, but classic OCR can get tripped up by different invoice layouts, messy handwriting, or complicated tables. This is where AI makes a huge difference. For a deeper dive into this foundational tech, check out our article on OCR in banking.

AI-driven systems go way beyond old-school OCR, offering much higher accuracy at a better price point. By combining technologies like machine learning and robotic process automation, these tools can handle even the most complex invoice matching scenarios, cutting down on tedious manual work and costly payment errors.

Proactive Fraud Detection and Risk Management

One of the most valuable things AI brings to the table is its knack for spotting anomalies a human might overlook. Machine learning algorithms digest mountains of historical payment data to learn what “normal” looks like for your business.

When an invoice comes in that doesn't fit the pattern—maybe it's an unusually large amount, a vendor suddenly has a new bank account, or the invoice template looks just a little off—the system immediately flags it. This real-time monitoring adds a powerful layer of security against both external scams and internal mistakes.

With AI, fraud detection stops being a manual, after-the-fact audit. It becomes an automated, always-on safeguard protecting your company’s cash.

Predictive Analytics for Smarter Cash Flow

AI also gives your finance team a crystal ball of sorts. By analyzing payment cycles, vendor terms, and past cash flow trends, these systems can provide some seriously strategic advice.

- Optimal Payment Timing: The system can recommend the perfect time to pay an invoice, helping you hold onto your cash as long as possible while still snagging any early payment discounts.

- Cash Flow Forecasting: It delivers more reliable short-term cash flow predictions, which helps leadership make smarter, data-backed decisions about the budget.

This kind of insight allows the AP team to become a key player in the company's overall financial strategy. If you're interested in how this technology is being applied more broadly, you can find great information on UK business use cases for AI models such as ChatGPT-5.

Frequently Asked Questions About AP Automation

Switching to an automated system is a big move, and it's totally normal to have a lot of questions. This is a major change to how your business operates, so getting into the nitty-gritty details is essential before you can feel confident moving forward. We've pulled together the most common questions we hear about accounts payable workflow automation to give you clear, straight-up answers.

Think of this as a way to tackle the real-world concerns your team will likely bring up, from costs and job security to the practical side of getting a new system online.

How Much Does AP Automation Software Cost?

There's no single price tag for AP automation software; the cost really depends on what your company needs. The main things that will affect the price are your monthly invoice volume, how many people on your team will use the system, and which advanced features you want to include.

Most vendors offer a subscription plan, with monthly costs ranging from a few hundred dollars for smaller businesses to several thousand for large companies with more complex workflows. Some might even charge per invoice. But the initial price isn't the whole story—it's crucial to think about the return on your investment.

When you add up the savings from less manual work, avoiding late payment fees, and snagging early-payment discounts, you'll find the software often pays for itself much faster than you'd expect.

Will Automation Replace Our AP Team?

This is probably the biggest myth out there. The goal isn't to replace your talented AP staff; it's to give them superpowers. The software acts like a super-efficient assistant, taking over all the monotonous, repetitive tasks that people dread doing.

Imagine no more manual data entry, no more chasing down approvals, and no more physical filing. This frees up your team to concentrate on high-value work that actually requires a human brain. Your AP specialists can shift from being data-entry clerks to financial strategists, focusing on things like vendor negotiations, analyzing spending patterns, and improving cash flow—activities that directly boost the company's bottom line.

How Long Does Implementation Take?

How long it takes to get an AP automation system up and running really hinges on the software's complexity and how well it plays with your current technology. The good news is that modern cloud-based systems have made this process way faster than it used to be.

For most businesses, a standard setup can be wrapped up in just a few weeks. If your project is more involved—say, you need a deep, custom integration with an older ERP system—it might take closer to two or three months. The biggest factor in a quick and smooth rollout? Having a clear plan from the start with well-defined goals and a dedicated internal team to drive the project forward.

Does AP Automation Integrate With Our Accounting Software?

Yes, 100%. Solid integration is a non-negotiable feature for any AP automation solution worth its salt. The best platforms are built to connect effortlessly with all the major ERP and accounting systems, offering pre-built connectors for software like QuickBooks, NetSuite, SAP, and Oracle.

This seamless connection is what makes everything click. It ensures that as soon as an invoice gets the green light, all the data flows straight into your financial system of record without anyone having to type it in again. This completely removes the risk of data-entry mistakes and gives you a single, reliable source of financial truth. Before you sign on with any provider, always double-check that they have a proven, rock-solid integration for your specific accounting software.

Tired of drowning in paperwork and chasing down invoice approvals? Let Bank Statement Convert PDF help you take the first step toward a more efficient financial workflow. Our tools are designed to eliminate the manual data entry that slows your business down. Discover how our software can transform your process.