In the fast-paced world of finance and accounting, manual data entry, tedious reconciliations, and endless paperwork are more than just daily frustrations; they are significant barriers to growth. Repetitive tasks drain valuable time, increase the risk of costly errors, and keep skilled professionals from focusing on high-impact strategic analysis. The solution lies in shifting from manual processes to intelligent automation. This article explores the top eight business process automation benefits that transform financial workflows, enabling teams to operate with unprecedented speed, accuracy, and efficiency.

We will move beyond theory and dive straight into the practical advantages that automation brings to accounting and finance departments. To truly grasp the shift from manual processes to strategic advantage, it's crucial to understand what business process automation is at its core. By automating routine operations like invoice processing, expense reporting, and financial closing, organizations can reallocate resources toward more strategic initiatives.

This guide details exactly how automation delivers tangible results, from significant cost reductions to improved regulatory compliance. You will learn how leveraging these technologies can not only streamline your current operations but also create a scalable foundation for future growth. Let’s explore the specific benefits your business can unlock.

1. Cost Reduction and Resource Optimization

One of the most compelling business process automation benefits is its direct and substantial impact on your bottom line. Automation significantly reduces operational costs by replacing manual, repetitive tasks with efficient, software-driven workflows. This shift minimizes the need for extensive human intervention in high-volume processes, which directly cuts down on labor expenses associated with data entry, document processing, and reconciliations.

The financial impact extends beyond payroll. By automating tasks, you drastically reduce the frequency of human error, which can lead to costly rework, compliance penalties, or incorrect financial reporting. Optimized resource allocation means your team is no longer bogged down by tedious administrative duties. Instead, their time and expertise can be redirected toward strategic initiatives like financial analysis, client relationship management, and business development, activities that generate far greater value.

How to Implement and Maximize Savings

Getting started doesn't require a complete operational overhaul. A phased approach ensures a manageable transition and quicker returns.

- Start Small: Identify high-volume, rule-based tasks like invoice processing or payroll administration. These "quick wins" provide a clear and immediate return on investment (ROI).

- Calculate ROI: Before implementation, project the potential savings. Factor in reduced labor hours, decreased error rates, and faster processing times to build a strong business case.

- Leverage Cloud Solutions: Cloud-based automation platforms like Microsoft Power Automate or UiPath eliminate the need for significant upfront investment in physical servers and infrastructure, lowering the barrier to entry.

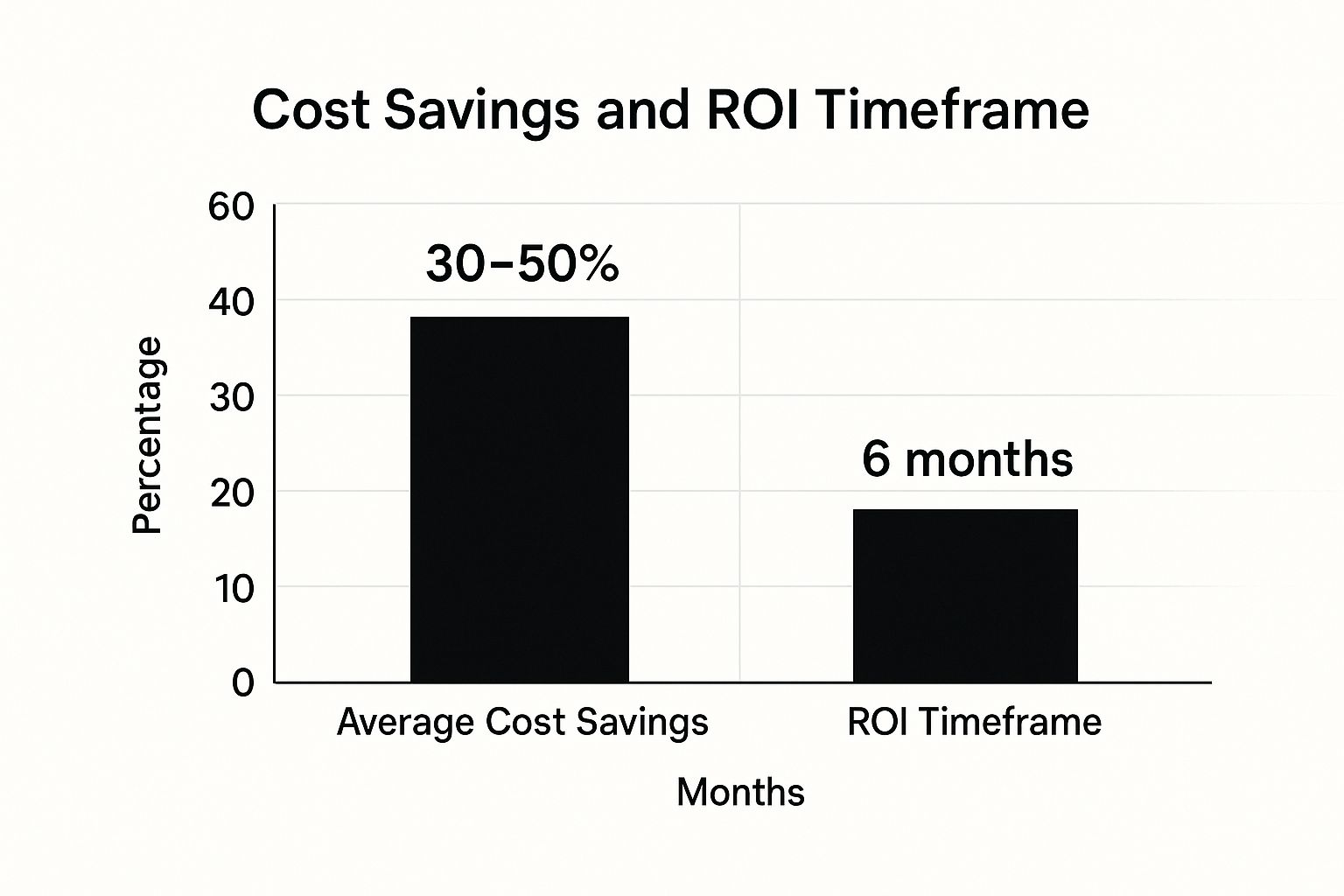

This bar chart illustrates the typical financial gains organizations can expect from a well-planned automation strategy.

The data clearly shows that businesses can not only achieve significant cost reductions but also realize a positive return on their investment in as little as six months. For functions like accounts payable, these savings are particularly pronounced due to the high volume of transactions. To explore this specific area further, you can learn more about the significant accounts payable automation benefits on bankstatementconvertpdf.com. By focusing on tangible outcomes, you can transform cost centers into models of efficiency.

2. Enhanced Accuracy and Error Reduction

Another core business process automation benefit is the dramatic improvement in data accuracy. Manual processes, especially those involving repetitive data entry and complex calculations, are inherently susceptible to human error. Automation mitigates this risk by executing tasks based on predefined rules with near-perfect consistency, achieving accuracy rates that manual efforts simply cannot match. This precision is critical in financial and accounting workflows where a single misplaced decimal can have significant consequences.

By removing human fallibility from the equation, businesses can trust their data more completely. This leads to more reliable financial reporting, better compliance with regulations, and a significant reduction in the time and resources spent on rework and error correction. For instance, automating expense tracking significantly reduces manual errors and improves financial accuracy, as highlighted by reviews of the best business expense tracking apps. Companies like Deutsche Bank have even eliminated up to 80% of trade reconciliation errors by implementing automation.

How to Implement and Maximize Accuracy

Achieving higher accuracy requires a thoughtful and systematic approach to implementation. The goal is to build robust, resilient automated workflows.

- Thoroughly Test Rules: Before deploying any automation, rigorously test its logic with a wide range of data sets, including edge cases, to ensure it performs as expected under all conditions.

- Implement Exception Handling: Design workflows that can identify and flag exceptions or anomalies for human review. This ensures that unusual transactions don't slip through the cracks.

- Establish Feedback Loops: Create a system for regularly monitoring automated outputs and collecting feedback from team members. This allows for continuous refinement and improvement of the automation rules.

This strategic implementation ensures that you not only reduce errors but also build a more resilient and trustworthy financial system. To explore the foundational step of eliminating manual input mistakes, you can learn more about how to automate data entry on bankstatementconvertpdf.com. By prioritizing accuracy, you fortify your operations against costly mistakes.

3. Improved Speed and Efficiency

Another of the most significant business process automation benefits is the dramatic acceleration of workflows. Automated systems operate 24/7 without fatigue, breaks, or human delays, enabling tasks that once took hours or days to be completed in mere minutes. This continuous operation ensures that critical financial processes, like month-end closing or payment approvals, are not bottlenecked by manual capacity or standard business hours.

The impact on business agility is profound. For instance, Vodafone successfully reduced its average invoice processing time from 30 minutes down to just three by implementing automation. This acceleration means faster payment cycles, improved cash flow, and stronger vendor relationships. By removing the latency inherent in manual handoffs, businesses can respond to market changes, customer demands, and internal requests with unprecedented speed, creating a distinct competitive advantage.

How to Implement and Maximize Speed

Achieving maximum efficiency requires a strategic approach that goes beyond simply installing software. A well-planned implementation ensures that speed gains are both substantial and sustainable.

- Identify Time-Critical Processes: Begin by targeting bottlenecks that directly impact revenue, customer satisfaction, or compliance deadlines. Loan application processing, customer onboarding, and order fulfillment are excellent starting points.

- Optimize Workflows First: Before automating, map out the existing process to identify and eliminate redundant steps. Automating an inefficient workflow only results in a faster inefficient workflow.

- Implement Performance Monitoring: Use analytics and dashboards to track key performance indicators (KPIs) like cycle time, throughput, and error rates. This data is crucial for continuous improvement and identifying areas for further optimization.

- Plan for Scalability: Design your automated workflows to handle peak volumes without performance degradation. This is especially important for seasonal businesses or functions like payroll that experience cyclical demand.

4. Enhanced Employee Satisfaction and Productivity

Another of the most significant business process automation benefits is its profound and positive effect on your workforce. By automating mundane, repetitive tasks like data entry, report generation, and transaction matching, you liberate employees from the drudgery that often leads to burnout and disengagement. This shift allows them to focus on more creative, strategic, and engaging work that leverages their unique human skills and expertise.

This empowerment directly translates to higher job satisfaction and morale. When team members feel their contributions are meaningful and value-driven, their productivity naturally increases. For example, a study by Accenture revealed that 73% of employees actually prefer working alongside intelligent automation. This leads to reduced employee turnover, saving the significant costs associated with recruiting and training new staff, while fostering a more innovative and collaborative work environment.

How to Implement and Maximize Engagement

Boosting team morale through automation requires a thoughtful, human-centric approach. The goal is to position automation as a supportive tool, not a replacement.

- Communicate Transparently: Clearly explain the "why" behind automation. Frame it as a way to eliminate tedious work and create opportunities for professional growth and more interesting projects.

- Provide Retraining Opportunities: Invest in upskilling your team. Offer training for the new automation software or in areas like data analysis, strategic planning, or client relations, which become more central to their roles.

- Involve Employees in Planning: Ask your team which tasks are most repetitive or frustrating. Involving them in the process of identifying automation candidates ensures you're solving real pain points and gives them a sense of ownership.

By championing automation as a tool for employee empowerment, you not only improve operational efficiency but also build a more resilient, skilled, and motivated workforce.

5. Improved Customer Experience and Service Quality

Beyond internal efficiencies, one of the most impactful business process automation benefits is its ability to radically enhance the customer experience. Automation provides faster response times, highly consistent service delivery, and 24/7 availability, all of which are critical in today's competitive landscape. Customers receive immediate answers to their inquiries, experience quicker order processing, and enjoy more reliable service, fostering greater satisfaction and long-term loyalty.

This operational upgrade allows your business to meet customer expectations at scale without compromising quality. For instance, Bank of America's chatbot, Erica, successfully handles over a billion client requests annually, providing instant support that would be impossible to achieve with human agents alone. By automating routine customer interactions, you free up your support team to handle complex, high-value issues that require a human touch, ensuring every customer feels heard and valued.

How to Implement and Maximize Service Quality

A customer-centric automation strategy is key to building lasting relationships and driving repeat business. The goal is to assist customers, not replace genuine connection.

- Design with the Customer Journey in Mind: Map out your customer's entire journey to identify key touchpoints where automation can reduce friction, such as onboarding, query resolution, or feedback collection.

- Ensure Seamless Handoffs: Program your automated systems, like chatbots, to recognize when a customer's query requires human intervention and ensure a smooth, context-aware transfer to a live agent.

- Personalize Automated Interactions: Leverage customer data to personalize automated communications. Simple touches, like using a customer's name or referencing their past purchase history, can make a significant difference.

By focusing on the customer, you can leverage automation to build a reputation for outstanding service. For example, modern financial institutions use sophisticated automation to streamline document processing and verification, leading to faster loan approvals and a better client experience. You can explore how automation is transforming client interactions and discover more about the role of OCR in the banking sector on bankstatementconvertpdf.com. This approach not only improves satisfaction but also solidifies your brand as a modern, efficient, and customer-first organization.

6. Better Compliance and Risk Management

Navigating the complex web of regulatory requirements is a critical challenge, and another of the key business process automation benefits is its ability to fortify compliance and mitigate risk. Automation embeds compliance rules directly into workflows, ensuring that every transaction and process step adheres to predefined internal policies and external regulations. This systematic approach minimizes the risk of non-compliance, which can lead to hefty fines, legal trouble, and reputational damage.

By creating standardized, repeatable processes, automation leaves no room for improvisation or accidental deviation from required protocols. For example, systems can automatically flag suspicious transactions for anti-money laundering (AML) checks or ensure that financial reports are generated in the precise format required by regulatory bodies like the SEC. Detailed, immutable logs of every automated action are created, providing a crystal-clear audit trail that simplifies compliance reporting and proves due diligence to auditors.

How to Implement and Maximize Compliance

Integrating compliance into automation requires a strategic, detail-oriented approach to ensure the system is both effective and resilient.

- Involve Compliance Experts: Collaborate with your compliance and legal teams from the very beginning. Their expertise is crucial for accurately defining the rules and logic that the automation system will follow.

- Automate Regulatory Updates: Design workflows that can be easily updated to reflect changes in regulations. Use systems that allow for flexible rule adjustments without requiring a complete process overhaul.

- Implement Validation Layers: Build in multiple checkpoints and validation rules within the automated workflow. This ensures data accuracy and process integrity before a task is completed, catching potential compliance issues early. For example, Johnson & Johnson successfully automated elements of its FDA compliance reporting to ensure consistency and accuracy.

This structured implementation transforms compliance from a manual, reactive effort into a proactive, integrated function of your daily operations. By codifying rules and maintaining perfect records, businesses can confidently meet their obligations and protect themselves from significant regulatory risks.

7. Scalability and Business Growth Support

A crucial benefit of business process automation is its ability to provide nearly unlimited scalability without a proportional increase in costs. As your business expands, automated systems can handle a surge in transaction volume, data processing, and customer inquiries seamlessly. This decouples business growth from linear increases in headcount and operational overhead, allowing you to scale efficiently and sustainably.

This capability is essential for ambitious companies. Instead of hiring new staff for every incremental increase in workload, automation handles the additional volume effortlessly, ensuring consistency and speed. For example, as an e-commerce business grows from 100 to 10,000 orders a day, an automated order processing system scales to meet demand without collapsing. This allows leaders to focus on market expansion and strategy rather than getting caught in operational bottlenecks.

How to Implement and Maximize Scalability

Designing for growth from the outset ensures your automated workflows can evolve with your business needs. This requires a forward-thinking approach to implementation.

- Design with Growth in Mind: When creating automated workflows, avoid hard-coded limits. Build processes that can dynamically handle variable loads, ensuring they won't break as transaction volumes increase.

- Leverage Cloud-Based Platforms: Cloud solutions, popularized by providers like AWS and Salesforce, offer inherent scalability. They allow you to increase capacity on demand without investing in physical servers, providing flexibility during periods of rapid growth.

- Monitor Performance Metrics: Continuously track key performance indicators (KPIs) like processing time and system load as your business grows. This helps you identify potential bottlenecks early and adjust your automation strategy proactively.

By building a scalable foundation, you ensure that your operational capabilities never hinder your growth potential. To support this, equipping your team with the right software is key. You can find out more by exploring the best accounting automation tools on bankstatementconvertpdf.com that are designed to grow with your business. This strategic approach transforms automation from a simple efficiency tool into a powerful engine for business expansion.

8. Data-Driven Decision Making and Analytics

A transformative benefit of business process automation is its ability to unlock powerful, data-driven decision-making. By systemizing and digitizing workflows, automation platforms capture vast amounts of clean, structured data in real time. This information provides unprecedented visibility into process performance, revealing bottlenecks, measuring cycle times, and identifying trends that are often hidden within manual operations.

This access to high-quality data shifts strategic planning from guesswork to an evidence-based discipline. Instead of relying on anecdotal feedback or outdated reports, leaders can make informed decisions based on live dashboards and comprehensive analytics. For example, Walmart uses automated demand forecasting to optimize inventory across thousands of stores, while Netflix leverages automated analytics to personalize content recommendations for over 200 million users. This capability turns operational data into a strategic asset, driving continuous improvement and competitive advantage.

How to Implement and Maximize Analytics

To effectively harness this benefit, you need a clear strategy for collecting, visualizing, and acting on the data generated by your automated processes.

- Define Key Metrics: Before implementation, identify the Key Performance Indicators (KPIs) that matter most, such as invoice processing time, error rates, or employee productivity. This ensures you track what truly drives business value.

- Invest in Visualization Tools: Integrate your automation platform with business intelligence (BI) tools like Tableau or Microsoft Power BI. These tools transform raw data into intuitive dashboards and reports, making complex information easy to understand.

- Train Your Team: Equip your staff with the skills to interpret data correctly. Training ensures they can identify meaningful insights and use them to refine processes, rather than just passively observing metrics.

By turning your processes into a source of intelligence, you create a feedback loop where automation not only executes tasks but also informs how to execute them better. This continuous cycle of improvement is one of the most powerful business process automation benefits for any organization seeking long-term growth.

Business Process Automation Benefits Comparison

| Aspect | Cost Reduction and Resource Optimization | Enhanced Accuracy and Error Reduction | Improved Speed and Efficiency | Enhanced Employee Satisfaction and Productivity | Improved Customer Experience and Service Quality | Better Compliance and Risk Management | Scalability and Business Growth Support | Data-Driven Decision Making and Analytics |

|---|---|---|---|---|---|---|---|---|

| Implementation Complexity 🔄 | High initial costs; requires IT support | Precise setup; handles exceptions with difficulty | System integration limits; potential workflow bottlenecks | Resistance to change; retraining required | Needs seamless handoff design; fallback systems needed | Complex setup; requires compliance expertise | Infrastructure upgrades for large scale possible | Data setup complexity; needs analytics expertise |

| Resource Requirements ⚡ | Specialized IT, training, ongoing maintenance | Strong validation mechanisms, monitoring | High processing power; 24/7 uptime | Employee retraining and change management | Multi-channel support systems; human agents backup | Compliance experts, regular system updates | Cloud solutions preferred; monitoring infrastructure | BI tools and data visualization; skilled analysts |

| Expected Outcomes 📊 | 30-50% cost savings; reallocates human resources | 99.9% accuracy; fewer errors and rework | 10-20x faster task completion | Higher engagement; reduced turnover | Faster response; 24/7 service; increased satisfaction | Reduced violations; improved audit readiness | Seamless workload handling; supports business growth | Real-time insights; optimized decisions |

| Ideal Use Cases 💡 | High-volume, repetitive processes | Data entry, compliance, audit-related tasks | Time-critical, high-throughput workflows | Tasks with repetitive manual labor | Customer service, support centers | Regulatory-heavy industries | Rapid growth scenarios; departments scaling simultaneously | Performance monitoring; process optimization |

| Key Advantages ⭐ | Measurable ROI in months; frees budget | Near-perfect consistency; reduces costly mistakes | Continuous operation; handles peak loads efficiently | Improves job satisfaction; promotes strategic work | Consistent, instant service; boosts loyalty | Enforces policies; real-time risk control | Scalable without proportional cost increase | Enables proactive management; uncovers bottlenecks |

Your Next Step Towards a Smarter Financial Future

The journey through the core business process automation benefits reveals a clear and compelling narrative: automation is no longer a futuristic concept but a present-day necessity for any forward-thinking finance or accounting department. Moving beyond manual, repetitive tasks isn't just about modernizing; it's about fundamentally transforming your operational capabilities and strategic potential.

We've explored how automation directly slashes operational costs by optimizing resource allocation and significantly boosts accuracy by removing the element of human error from rule-based workflows. The gains in speed and efficiency are tangible, compressing timelines for critical processes like financial closing and reporting from weeks to mere days. This newfound efficiency directly fuels higher employee satisfaction, liberating your skilled team from monotonous data entry and empowering them to focus on high-value analysis and strategic planning.

Ultimately, these internal improvements create powerful external results. Faster, more accurate financial operations lead to better customer service, while robust automation frameworks ensure stronger compliance and risk management. As your organization grows, these automated systems provide the critical scalability needed to handle increased transaction volumes without a proportional increase in headcount. This entire ecosystem is powered by clean, accessible data, paving the way for superior, data-driven decision-making that guides your business toward sustainable growth.

Turning Insight into Action

The evidence overwhelmingly supports adoption, but the pivotal question is, "Where do I start?" The most effective approach is to begin with a small, high-impact project that addresses a clear and persistent bottleneck. Identify a process that is:

- Repetitive: Performed frequently, such as daily or weekly.

- Rule-Based: Follows a consistent set of logical steps.

- Time-Consuming: Consumes a significant number of person-hours.

A perfect example within nearly every finance team is the manual processing of bank statements. The tedious task of extracting transaction data from countless PDF files is a prime candidate for automation. It's a universal pain point that directly hinders efficiency and introduces the risk of data entry errors.

By targeting such a process first, you create a quick win that demonstrates immediate value and builds momentum for broader automation initiatives. You're not just improving a single task; you are laying the foundation for a more agile, resilient, and intelligent financial future for your entire organization. Embracing the business process automation benefits today is an investment in long-term competitive advantage and operational excellence.

Ready to take your first, decisive step toward financial automation? Eliminate the bottleneck of manual data entry from PDF bank statements with Bank Statement Convert PDF. Our specialized tool is designed to instantly and accurately extract transaction data, directly delivering on the promise of speed, accuracy, and efficiency. Visit Bank Statement Convert PDF to see how you can transform your workflow in minutes.